Global At-Home Pregnancy Testing Market By Product Type (Line Indicator (Cassettes, Dip Cards, Midstreams and Strips) and Digital Devices (Private Label Test Kits and Branded Test Kits)), By Detection Type (hCG Urine Test, LH Urine Test, FSH Urine Test and hCG Blood), By Distribution Channel (Retail Sales (Drug Stores, Hypermarkets & Supermarkets, Online Sales and Retail Pharmacies) and Institutional Sales (Gynecology Clinics, Hospital Pharmacies, IVF Clinics and Maternity Care Centers)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173179

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

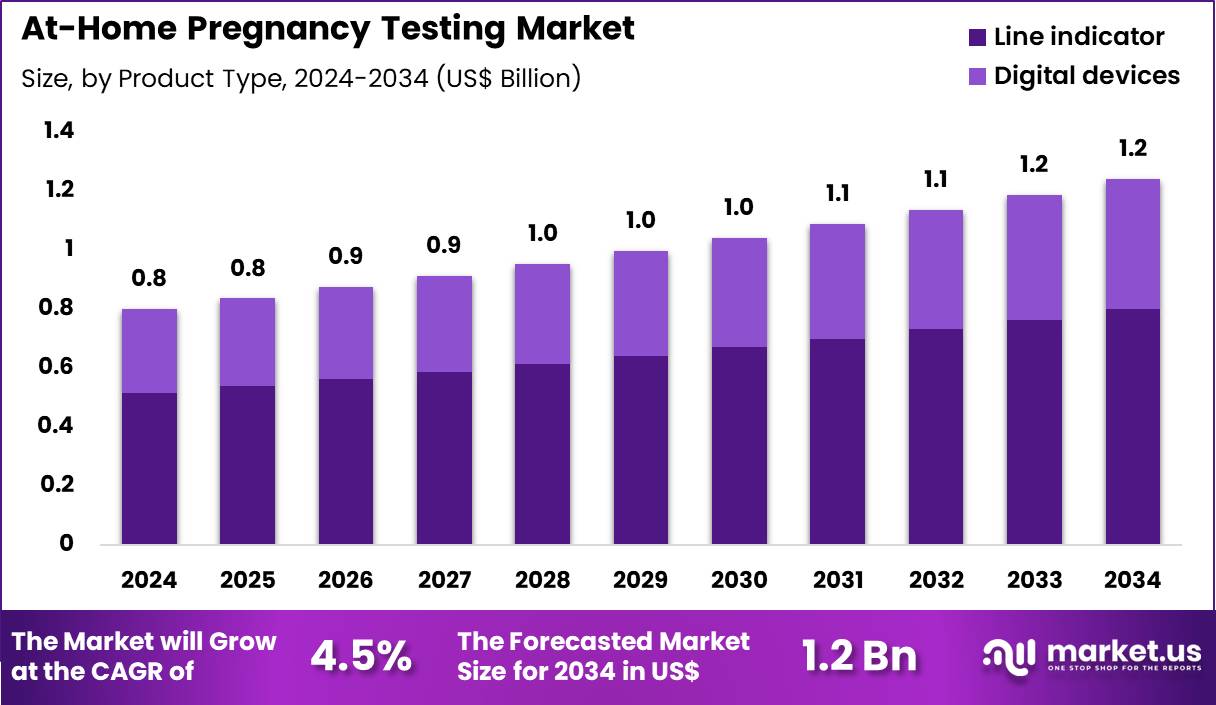

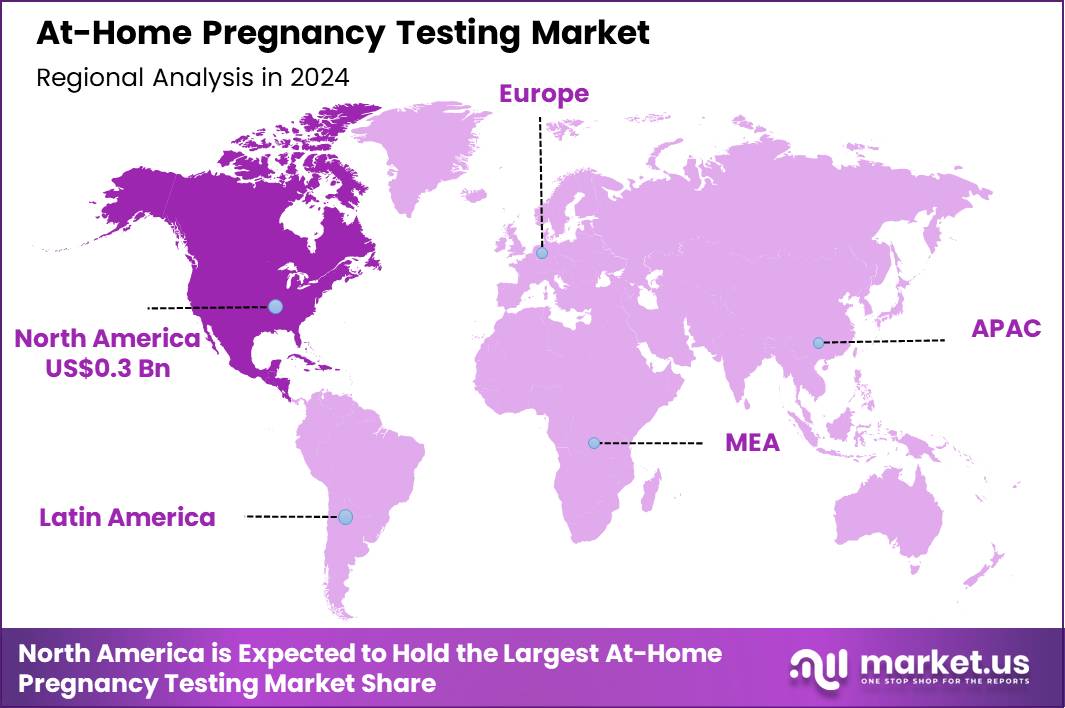

Global At-Home Pregnancy Testing Market size is expected to be worth around US$ 1.2 Billion by 2034 from US$ 0.8 Billion in 2024, growing at a CAGR of 4.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 0.3 Billion.

Growing emphasis on reproductive autonomy and early detection empowers individuals to utilize at-home pregnancy testing kits that deliver rapid, reliable confirmation of conception in privacy. Women frequently apply these devices to verify pregnancy status shortly after a missed menstrual period, enabling timely initiation of prenatal care and lifestyle adjustments. These tests support family planning decisions by identifying early pregnancy in cases of contraceptive failure or intentional conception attempts.

Users employ them for repeated monitoring during fertility treatments, tracking hCG fluctuations to assess implantation success. These kits facilitate confirmation of early miscarriage through declining hormone levels, providing emotional closure and guidance for subsequent cycles. Between 2024 and 2025, Thermo Fisher Scientific broadened the clinical adoption of its PlGF plus and sFlt-1 assays across hospitals in the United States following regulatory clearance.

The assays are being incorporated into routine care for pregnant individuals at elevated risk of preeclampsia and are increasingly paired with digital home-monitoring applications. This approach supports closer tracking between hospital visits, helping clinicians identify early warning signs sooner and connect home-based monitoring with timely clinical intervention for a condition that remains a major contributor to maternal complications.

Manufacturers seize opportunities to develop digital pregnancy tests that integrate smartphone connectivity, allowing users to track quantitative hCG trends and receive personalized insights for ongoing pregnancy management. Developers engineer eco-friendly test formats with biodegradable components, addressing consumer demand for sustainable options in routine reproductive health monitoring. These advancements expand applications in preconception planning, where serial testing detects ovulation-related hormone patterns to optimize conception timing.

Opportunities emerge in combining at-home tests with telehealth platforms, enabling seamless consultation upon positive results for immediate professional guidance. Companies advance multi-hormone detection capabilities that assess broader fertility markers alongside pregnancy confirmation. Firms invest in user-friendly designs with enhanced sensitivity for earlier detection, broadening accessibility for individuals pursuing assisted reproduction methods.

Industry innovators introduce advanced immunoassay technologies in at-home kits that provide clearer result interpretation through digital readouts, minimizing user error in early pregnancy verification. Developers refine strip-based formats with improved wicking mechanisms, ensuring consistent performance across varying urine concentrations for reliable daily monitoring. Market participants prioritize multilingual instructions and app integration to support diverse populations in family planning initiatives.

Companies emphasize high-accuracy thresholds that align with clinical standards, building trust for confirmatory use before medical appointments. Ongoing enhancements focus on compact, discreet packaging that facilitates discreet testing in professional or travel settings. These developments reinforce the role of at-home pregnancy testing as a foundational tool in proactive reproductive health management.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.8 Billion, with a CAGR of 4.5%, and is expected to reach US$ 1.2 Billion by the year 2034.

- The product type segment is divided into line indicator and digital devices, with line indicator taking the lead in 2024 with a market share of 64.3%.

- Considering detection type, the market is divided into hCG urine test, LH urine test, FSH urine test and hCG blood. Among these, hCG urine test held a significant share of 71.6%.

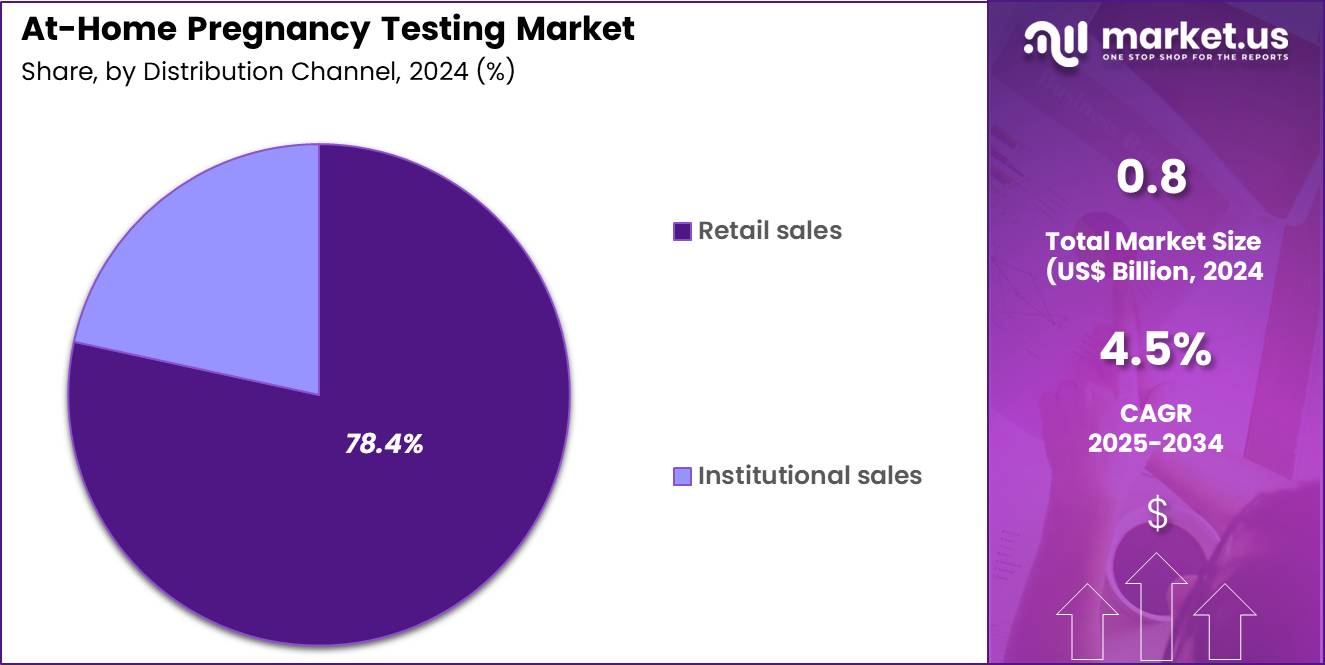

- Furthermore, concerning the distribution channel segment, the market is segregated into retail sales and institutional sales. The retail sales sector stands out as the dominant player, holding the largest revenue share of 78.4% in the market.

- North America led the market by securing a market share of 40.3% in 2024.

Product Type Analysis

The line indicator segment accounted for the largest share of growth within product type at 64.3% and continues to anchor the At Home Pregnancy Testing market. Consumers increasingly prefer line indicator tests due to their affordability, simplicity, and wide availability across retail channels. Manufacturers focus on improving strip sensitivity and result clarity, which strengthens user confidence and repeat purchases. The segment benefits from strong penetration in emerging economies where price sensitivity remains high.

Pharmacies and supermarkets actively promote line indicator kits as entry level diagnostic tools, expanding first time usage. The segment is expected to grow steadily due to minimal learning requirements and quick result interpretation. Rising awareness of early pregnancy detection further supports demand. Healthcare providers frequently recommend line indicator tests as preliminary screening options, reinforcing credibility.

The segment also benefits from private label expansion by retail chains, improving shelf visibility. Advances in reagent stability enhance shelf life, which improves distribution efficiency. Urbanization and rising female workforce participation increase demand for discreet and fast testing solutions. Line indicator products align well with these lifestyle needs.

The segment is anticipated to maintain dominance due to low manufacturing complexity and scalable production. E commerce platforms also contribute to volume growth by bundling multi pack offerings. Overall, the line indicator segment remains the backbone of market expansion due to accessibility, cost efficiency, and consumer familiarity.

Detection Type Analysis

The hCG urine test segment contributed 71.6% of growth within detection type and represents the most widely adopted testing method. This segment benefits from high clinical reliability and early detection capability, which supports consumer trust. hCG urine tests align with standard medical guidance for pregnancy confirmation, reinforcing widespread acceptance. Manufacturers continuously optimize antibody sensitivity to detect lower hCG concentrations, improving early stage accuracy.

The segment is projected to expand due to increasing awareness of reproductive health and planned parenthood. Consumers favor urine based tests because they require no specialized equipment and deliver rapid results. Regulatory approvals and standardized validation protocols further strengthen adoption. The segment also benefits from compatibility with both line indicator and digital formats, broadening its application base.

Retail pharmacists frequently recommend hCG urine tests as first line solutions, boosting sales volumes. Rising access to health information through digital platforms encourages informed purchasing decisions. The segment is expected to sustain strong growth in both developed and developing regions.

Increasing disposable income among urban populations supports higher testing frequency. Subscription based test kit offerings also contribute to recurring demand. Overall, the hCG urine test segment remains the most reliable growth driver due to accuracy, convenience, and strong alignment with clinical practice.

Distribution Channel Analysis

The retail sales segment captured 78.4% of growth within distribution channels and continues to dominate market expansion. Pharmacies, supermarkets, and online retail platforms provide unmatched accessibility and convenience for consumers. Retail channels support discreet purchasing, which strongly influences consumer behavior in reproductive health products. The segment benefits from extensive shelf space allocation and promotional strategies by large retail chains.

Online retail further amplifies reach through home delivery and subscription models. Retail sales are expected to grow due to increasing consumer preference for self directed healthcare solutions. Brand visibility and point of sale education enhance trust and drive impulse purchases. Retail platforms also facilitate rapid introduction of new product variants, supporting innovation driven growth.

The segment benefits from strong private label participation, which expands price tier options. Urban retail expansion and digital commerce adoption further strengthen distribution efficiency. Consumer reliance on retail pharmacists for guidance reinforces credibility. The segment is anticipated to remain dominant due to convenience, product variety, and pricing transparency. Overall, retail sales continue to shape market growth by aligning accessibility with evolving consumer purchasing behavior.

Key Market Segments

By Product Type

- Line Indicator

- Cassettes

- Dip Cards

- Midstreams

- Strips

- Digital Devices

- Private Label Test Kits

- Branded Test Kits

By Detection Type

- hCG Urine Test

- LH Urine Test

- FSH Urine Test

- hCG Blood

By Distribution Channel

- Retail Sales

- Drug Stores

- Hypermarkets & Supermarkets

- Online Sales

- Retail Pharmacies

- Institutional Sales

- Gynecology Clinics

- Hospital Pharmacies

- IVF Clinics

- Maternity Care Centers

Drivers

Increasing use of fertility services is driving the market

The at-home pregnancy testing market is substantially driven by the increasing use of fertility services, which encourages women to monitor their reproductive health more closely through accessible testing options. Healthcare professionals recommend at-home tests as a preliminary step for individuals undergoing fertility evaluations, fostering market demand. Government data indicate a notable portion of women engaging in infertility testing, highlighting the need for reliable home-based tools.

Pharmaceutical advancements in reproductive medicine complement this trend by promoting early detection practices. Regulatory support for fertility care enhances consumer confidence in using at-home tests for initial assessments. Clinical guidelines emphasize the role of self-testing in empowering women to take proactive steps in family planning.

Academic research on reproductive health contributes to greater awareness, sustaining market growth. Patient education initiatives by health organizations promote the integration of at-home testing into fertility journeys. Economic factors, such as the cost-effectiveness of home tests compared to clinical visits, further propel adoption. According to the Centers for Disease Control and Prevention’s Data Brief Number 542 published in December 2025, 6.9% of women ages 20–49 had infertility testing on themselves or their partner based on 2022–2023 data.

Restraints

Product recalls due to quality issues are restraining the market

The at-home pregnancy testing market is restrained by product recalls due to quality issues, which undermine consumer trust and lead to heightened regulatory scrutiny. Manufacturers must address defects such as inaccurate results or labeling errors, disrupting supply chains and market availability. Healthcare providers caution patients about potential risks, reducing reliance on certain brands.

Regulatory agencies enforce strict compliance, imposing financial burdens on companies through corrective actions. Clinical practices shift toward verified alternatives, limiting market penetration for affected products. Academic evaluations of recall impacts highlight safety concerns in self-testing devices. Patient safety priorities result in decreased sales during recall periods.

Global variations in recall management complicate recovery efforts for international brands. Economic repercussions include increased liability insurance and reputational damage. According to the U.S. Food and Drug Administration’s recall database, a Class 2 recall was initiated for the VERIQUICK PREGNANCY TEST on November 7, 2023, due to storage issues affecting product performance.

Opportunities

Growing focus on reproductive health is creating growth opportunities

The at-home pregnancy testing market presents growth opportunities through the growing focus on reproductive health, which expands the consumer base for innovative testing solutions. Healthcare initiatives promote early pregnancy confirmation to support maternal well-being and family planning. Government surveys reveal trends in medical help for pregnancy, opening avenues for integrated testing products.

Pharmaceutical collaborations can develop complementary tools for fertility monitoring alongside at-home tests. Regulatory advancements facilitate market entry for enhanced devices targeting reproductive care. Clinical research on women’s health drives demand for user-friendly testing options. Academic partnerships explore digital integrations to broaden accessibility in underserved populations. Patient-centered approaches emphasize convenience, fostering innovation in test formats.

Economic incentives from health programs encourage investment in reproductive testing technologies. According to the Centers for Disease Control and Prevention’s Data Brief Number 542 published in December 2025, 10.4% of women ages 20–49 had ever used any medical help to get pregnant based on 2022–2023 data.

Impact of Macroeconomic / Geopolitical Factors

Rising healthcare spending and demographic patterns that favor family planning are driving steady growth in the at-home pregnancy testing market, as consumers seek convenient and easy-to-use options for early confirmation. Manufacturers are expanding their offerings with digitally enhanced tests and leveraging the rapid growth of online retail to reach wider customer bases, particularly in emerging regions.

At the same time, inflation has increased the cost of plastics, reagents, and packaging, pushing producers to optimize operations and, in some cases, transfer higher costs to consumers, which can affect demand during periods of economic strain. Ongoing geopolitical tensions, including trade disputes between major economies and instability in key manufacturing regions, continue to disrupt supply chains and delay the delivery of critical components.

In the United States, tariffs applied to certain imported diagnostic products through 2025 have raised procurement costs and reduced margins for distributors. Retaliatory measures have also constrained exports and slowed cross-border research collaboration. In response, companies are shifting production closer to end markets and investing in domestic facilities, strengthening supply resilience. These strategic adjustments are helping the industry build long-term stability while supporting innovation and sustainable growth.

Latest Trends

Introduction of innovative multi-check test kits is a recent trend

In 2024, the at-home pregnancy testing market has observed a prominent trend toward the introduction of innovative multi-check test kits, which offer multiple testing options for enhanced user convenience and accuracy. Manufacturers prioritize designs that simplify the testing process, addressing common challenges in home use. Healthcare experts endorse these kits for providing rapid results and additional verification steps. Regulatory clearances support the launch of advanced features in consumer health products.

Clinical feedback informs refinements in kit components to improve reliability across diverse users. Academic studies evaluate the impact of multi-format testing on consumer satisfaction. Global distribution expands access to these kits in retail and online channels. Patient preferences shift toward comprehensive solutions that minimize testing errors.

Ethical considerations ensure inclusive design for varying user needs. According to a BusinessWire press release from Church & Dwight dated October 7, 2024, First Response unveiled the Multi Check Pregnancy Test Kit featuring the EasyCup innovation for seamless testing.

Regional Analysis

North America is leading the At-Home Pregnancy Testing Market

In 2024, North America commanded a 40.3% share of the global at-home pregnancy testing market, sustained by growing consumer preference for convenient, private, and rapid diagnostic options that enable early confirmation of pregnancy without immediate medical consultation. Women increasingly select digital and early-detection kits available through pharmacies and online channels, driven by heightened health awareness and the desire to plan family or career decisions promptly.

Manufacturers enhance product accessibility with user-friendly interfaces and improved sensitivity, allowing detection at lower hCG levels to support timely follow-up care. Rising emphasis on reproductive health education amplifies demand among younger demographics, who favor discreet testing amid busy lifestyles. Telehealth integrations further encourage self-testing as an initial step before virtual provider visits, streamlining pathways to prenatal services.

E-commerce platforms expand availability of premium brands with app connectivity for result tracking, catering to tech-savvy users. Retail expansions in convenience stores and supermarkets bolster impulse purchases, ensuring broad geographic coverage. The Centers for Disease Control and Prevention reported that 3,596,017 births were registered in the United States in 2023, reflecting the ongoing need for reliable early pregnancy confirmation tools.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders anticipate sustained advancement in at-home pregnancy detection solutions across Asia Pacific over the forecast period, as rising disposable incomes and expanding e-commerce infrastructure enhance consumer access to convenient reproductive health products. Young women in urban centers adopt sensitive digital kits for prompt results, integrating them into family planning routines amid evolving social norms.

Governments promote reproductive awareness campaigns, encouraging discreet testing to support timely prenatal engagement in densely populated regions. Local manufacturers introduce affordable strip variants tailored to regional preferences, boosting penetration in semi-urban and rural markets. Pharmaceutical chains expand shelf space for early-detection options, addressing increasing interest among working professionals.

Digital platforms facilitate direct-to-consumer sales with educational resources, empowering informed usage in diverse cultural contexts. Regulatory harmonization accelerates availability of high-accuracy models, fostering trust in self-administered diagnostics. The World Health Organization estimates that infertility affects approximately 1 in 6 people of reproductive age globally, with substantial prevalence in the region driving proactive testing behaviors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the At-Home Pregnancy Testing market drive growth by improving test sensitivity, result clarity, and speed to meet consumer expectations for early and reliable detection. Companies expand demand through user-friendly formats, digital-read integrations, and mobile app connectivity that enhance confidence and engagement during early pregnancy decisions.

Commercial strategies focus on broad retail and e-commerce distribution, subscription replenishment, and discreet packaging that supports repeat purchases and brand loyalty. Innovation priorities include hormone-detection accuracy across varying cycles and formats that reduce user error without clinical intervention.

Market expansion targets emerging economies with rising reproductive health awareness and increasing access to OTC diagnostics. Church & Dwight, through its Clearblue brand, operates as a leading participant with strong consumer trust, global retail reach, and continuous product innovation that anchors its position in convenient and accurate home pregnancy testing solutions.

Top Key Players

- Swiss Precision Diagnostics GmbH

- Quidel Corporation

- Procter & Gamble Co.

- Prestige Brands Holdings, Inc.

- Geratherm Medical AG

- DCC Plc.

- Church & Dwight Co., Inc.

- bioMérieux SA

- Alere Inc.

- Abbott Laboratories

Recent Developments

- On April 23, 2025, Prega News expanded its product portfolio by launching a newly developed pregnancy testing kit in India. The updated offering focuses on improved detection performance and ease of use, reflecting ongoing innovation in consumer-focused diagnostic products for early pregnancy confirmation.

- On June 10, 2025, Mylab Discovery Solutions entered the women’s health segment with the introduction of its PregaScreen home pregnancy test. The launch marks the company’s move into at-home reproductive health diagnostics, aiming to provide accessible and reliable pregnancy testing options for consumers.

Report Scope

Report Features Description Market Value (2024) US$ 0.8 Billion Forecast Revenue (2034) US$ 1.2 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Line Indicator (Cassettes, Dip Cards, Midstreams and Strips) and Digital Devices (Private Label Test Kits and Branded Test Kits)), By Detection Type (hCG Urine Test, LH Urine Test, FSH Urine Test and hCG Blood), By Distribution Channel (Retail Sales (Drug Stores, Hypermarkets & Supermarkets, Online Sales and Retail Pharmacies) and Institutional Sales (Gynecology Clinics, Hospital Pharmacies, IVF Clinics and Maternity Care Centers)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Swiss Precision Diagnostics GmbH, Quidel Corporation, Procter & Gamble Co., Prestige Brands Holdings, Inc., Geratherm Medical AG, DCC Plc., Church & Dwight Co., Inc., bioMérieux SA, Alere Inc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  At-Home Pregnancy Testing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

At-Home Pregnancy Testing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Swiss Precision Diagnostics GmbH

- Quidel Corporation

- Procter & Gamble Co.

- Prestige Brands Holdings, Inc.

- Geratherm Medical AG

- DCC Plc.

- Church & Dwight Co., Inc.

- bioMérieux SA

- Alere Inc.

- Abbott Laboratories