Global Assembly Line Solutions Market Size, Share, Growth Analysis By Automation Level (Semi-automated Assembly Lines, Manual Assembly Lines, Fully-automated Assembly Lines), By Component (Robotics & End-effectors, Conveyors & Transfer Systems, Sensors & Vision Systems, Controllers & Software, Safety & Ergonomic Modules, Others), By End-user (Automotive, Electronics & Semiconductors, Consumer Goods, Pharmaceuticals & Healthcare, Food & Beverage, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176489

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

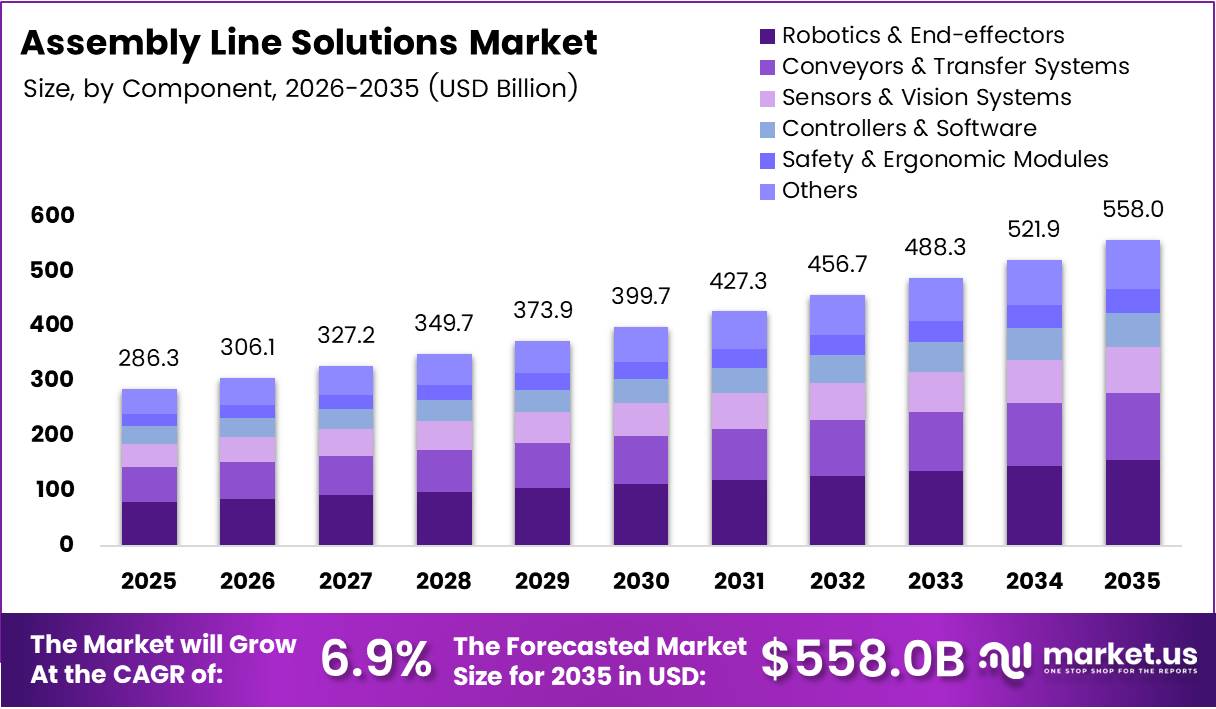

Global Assembly Line Solutions Market size is expected to be worth around USD 558.0 Billion by 2035 from USD 286.3 Billion in 2025, growing at a CAGR of 6.9% during the forecast period 2026 to 2035.

Assembly line solutions enable manufacturers to automate production workflows through integrated systems. These solutions combine robotics, conveyors, sensors, and control software to streamline component assembly. Moreover, they reduce manual intervention while improving precision and output consistency across manufacturing facilities.

Manufacturers deploy assembly line solutions to achieve higher throughput rates and operational efficiency. These systems support standardized production processes across automotive, electronics, and consumer goods sectors. Additionally, they enable scalable manufacturing operations that meet growing global demand for mass-produced products.

Market expansion reflects increasing factory automation adoption driven by labor cost pressures. Companies invest in semi-automated and fully-automated assembly lines to enhance competitiveness. Furthermore, Industry 4.0 initiatives accelerate integration of smart sensors and AI-powered quality inspection capabilities within assembly environments.

Growth opportunities emerge from modular assembly line designs supporting flexible production volumes. Rising industrialization in emerging economies creates demand for greenfield manufacturing projects. Consequently, manufacturers prioritize automated assembly systems for battery and electric vehicle component production to support electrification trends.

According to Hisparob, approximately 542,000 new industrial robots were installed globally in 2024, marking sustained factory automation demand. This adoption reflects manufacturers’ commitment to improving assembly efficiency and reducing human error. Moreover, investments span across automotive, electronics, and pharmaceutical sectors seeking competitive production advantages.

According to IFR, the total operational industrial robots worldwide reached 4,664,000 units in 2024, representing 9% year-over-year growth. This demonstrates broad manufacturing automation adoption across assembly line applications. Additionally, this expansion indicates sustained confidence in robotics-driven productivity improvements and quality enhancement capabilities.

In February 2025, Apptronik raised $350 million in Series A funding to scale AI-powered humanoid robot production for manufacturing tasks. This investment signals growing interest in advanced robotics for assembly operations. Therefore, collaborative robotics integration represents a significant technological evolution within modern assembly line solutions.

Key Takeaways

- Global Assembly Line Solutions Market projected to grow from USD 286.3 Billion in 2025 to USD 558.0 Billion by 2035

- Market expected to grow at a CAGR of 6.9% during the forecast period 2026-2035

- Semi-automated Assembly Lines segment holds 44.1% market share in 2025

- Robotics & End-effectors component segment dominates with 27.8% market share

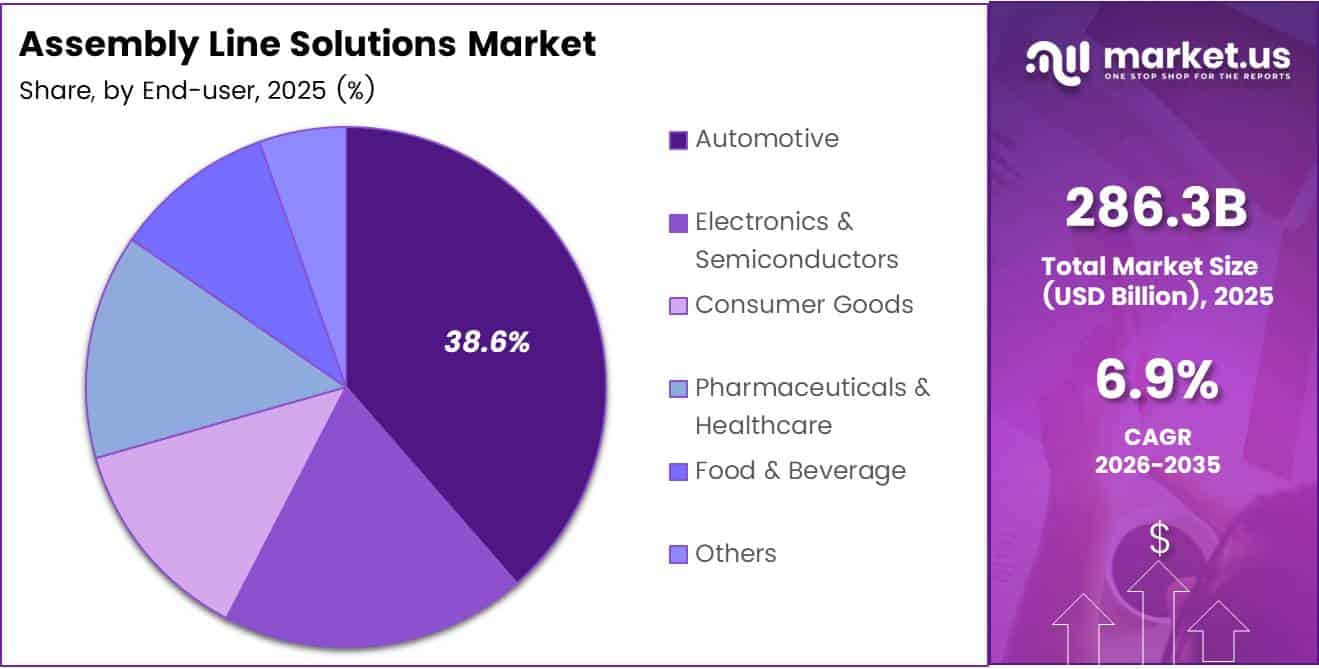

- Automotive end-user segment leads with 38.6% market share in 2025

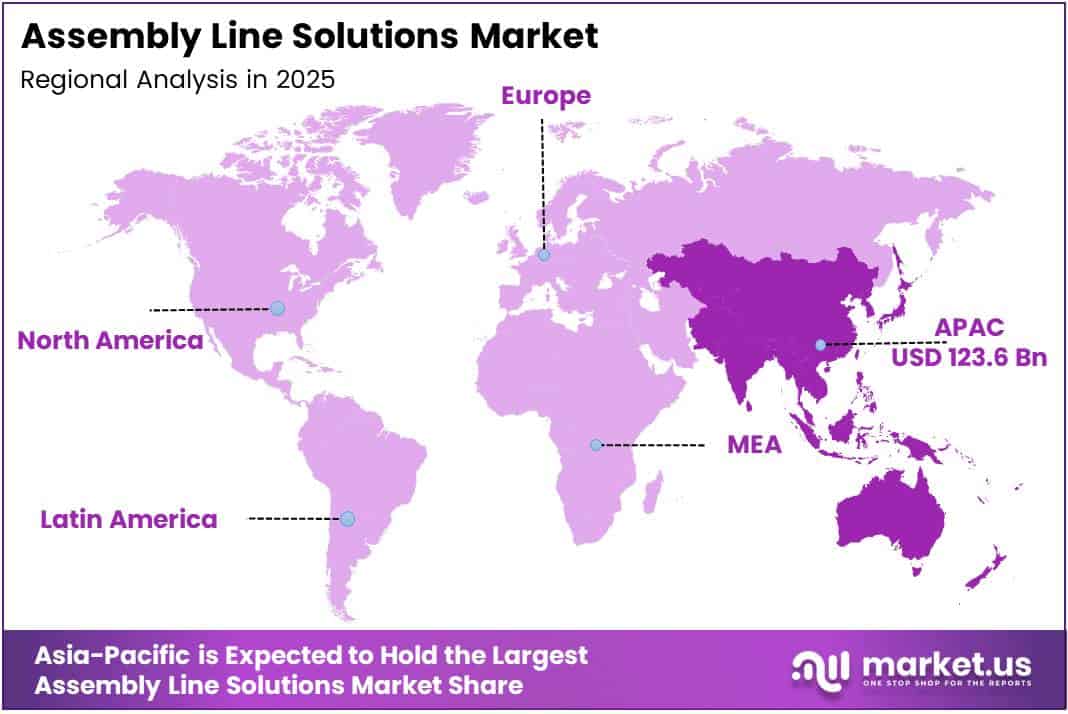

- Asia-Pacific region dominates with 43.20% market share, valued at USD 123.6 Billion

Automation Level Analysis

Semi-automated Assembly Lines dominates with 44.1% due to balanced cost-efficiency and operational flexibility.

In 2025, Semi-automated Assembly Lines held a dominant market position in the By Automation Level segment of Assembly Line Solutions Market, with a 44.1% share. These systems combine manual operations with automated components to optimize production workflows. Manufacturers prefer semi-automated solutions for applications requiring human oversight alongside mechanical precision. Therefore, this approach delivers cost-effective automation without complete workforce displacement.

Manual Assembly Lines continue serving specialized manufacturing applications requiring human dexterity and judgment. These systems support low-volume production and customized product assembly operations. Moreover, they provide flexibility for product variations and complex assembly tasks. However, rising labor costs drive gradual transition toward automated alternatives.

Fully-automated Assembly Lines represent advanced manufacturing solutions with minimal human intervention requirements. These systems integrate robotics, sensors, and AI-driven quality control for high-volume production. Additionally, they deliver consistent output quality and reduced operational errors. Consequently, automotive and electronics sectors increasingly adopt fully-automated configurations for standardized component assembly.

Component Analysis

Robotics & End-effectors dominates with 27.8% due to critical role in automation and precision handling.

In 2025, Robotics & End-effectors held a dominant market position in the By Component segment of Assembly Line Solutions Market, with a 27.8% share. These components perform precise material handling, welding, and assembly tasks across production lines. Manufacturers invest heavily in robotic systems to improve throughput and reduce defect rates. Moreover, collaborative robots enable safer human-machine interaction within assembly environments.

Conveyors & Transfer Systems facilitate material movement between assembly stations and production stages. These components ensure continuous workflow and minimize production bottlenecks across manufacturing facilities. Additionally, modular conveyor designs support flexible line configurations for varying product specifications. Therefore, they represent essential infrastructure for efficient assembly operations.

Sensors & Vision Systems provide real-time quality inspection and defect detection capabilities within assembly processes. These technologies enable automated verification of component placement and assembly accuracy. Furthermore, AI-powered vision systems enhance defect identification rates compared to manual inspection methods. Consequently, manufacturers prioritize sensor integration to maintain quality standards.

Controllers & Software manage assembly line operations through centralized control and data analytics capabilities. These systems coordinate robotics, conveyors, and sensors for optimized production workflows. Moreover, they enable predictive maintenance and performance monitoring across assembly equipment. Additionally, integration with enterprise systems supports Industry 4.0 manufacturing initiatives.

Safety & Ergonomic Modules protect workers and ensure compliance with industrial safety regulations. These components include emergency stops, protective barriers, and ergonomic workstations supporting operator wellbeing. Furthermore, they reduce workplace injury risks while maintaining production efficiency. Therefore, manufacturers prioritize safety investments alongside automation deployments.

Others category encompasses specialized components including pneumatic systems, lighting, and power distribution equipment. These supporting elements ensure comprehensive assembly line functionality and operational reliability. Additionally, they provide customization options for specific manufacturing requirements. Consequently, they complement core automation components within integrated assembly solutions.

End-user Analysis

Automotive dominates with 38.6% due to high-volume production requirements and automation adoption.

In 2025, Automotive held a dominant market position in the By End-user segment of Assembly Line Solutions Market, with a 38.6% share. This sector demands high-precision assembly for vehicle components and sub-assemblies across global production facilities. Automotive manufacturers deploy advanced robotics for welding, painting, and final assembly operations. Moreover, electric vehicle production drives additional automation investments for battery and powertrain assembly.

Electronics & Semiconductors sector requires precision assembly solutions for circuit boards and microelectronic components. These applications demand high-speed automation with micron-level accuracy for component placement. Additionally, growing semiconductor demand accelerates assembly line investments supporting chip packaging operations. Therefore, this sector represents significant growth potential for advanced assembly technologies.

Consumer Goods manufacturers utilize assembly lines for packaging, labeling, and product assembly operations. These systems support high-volume production of household items, appliances, and packaged products. Furthermore, they enable rapid production line changeovers for seasonal product variations. Consequently, flexibility remains a critical requirement for consumer goods assembly solutions.

Pharmaceuticals & Healthcare sector deploys assembly lines for medical device assembly and pharmaceutical packaging. These applications require stringent quality control and regulatory compliance throughout assembly processes. Moreover, sterile environment requirements drive specialized assembly line configurations. Additionally, growing healthcare demand supports continued automation investments within this sector.

Food & Beverage industry implements assembly lines for packaging, bottling, and product processing operations. These systems must accommodate hygiene standards and temperature-controlled production environments. Furthermore, they support diverse product formats requiring flexible assembly configurations. Therefore, modular designs serve varying production requirements across food manufacturing facilities.

Others category includes aerospace, defense, and industrial equipment manufacturing applications. These sectors require specialized assembly solutions for complex product configurations. Additionally, they prioritize quality assurance and traceability throughout assembly operations. Consequently, they adopt customized assembly line technologies meeting specific industry requirements.

Key Market Segments

By Automation Level

- Semi-automated Assembly Lines

- Manual Assembly Lines

- Fully-automated Assembly Lines

By Component

- Robotics & End-effectors

- Conveyors & Transfer Systems

- Sensors & Vision Systems

- Controllers & Software

- Safety & Ergonomic Modules

- Others

By End-user

- Automotive

- Electronics & Semiconductors

- Consumer Goods

- Pharmaceuticals & Healthcare

- Food & Beverage

- Others

Drivers

Accelerating Factory Automation Adoption Drives Market Expansion

Manufacturers accelerate factory automation investments to improve production throughput and reduce assembly errors. Assembly line solutions deliver consistent quality while minimizing human intervention in repetitive tasks. Moreover, automation enables 24/7 production capabilities supporting growing demand across global markets. Therefore, companies prioritize robotics integration to maintain competitive manufacturing advantages.

Rising demand for standardized manufacturing spans automotive and electronics sectors requiring high-volume production. Assembly lines enable economies of scale through continuous production workflows and optimized resource utilization. According to IFR, Asia accounted for 74% of all industrial robot installations in 2024, demonstrating regional automation leadership. Additionally, standardized processes reduce per-unit costs while improving output predictability across manufacturing operations.

Labor cost pressures force manufacturers to optimize assembly efficiency through automated solutions. Companies face increasing wage expenses and workforce availability challenges in traditional manufacturing regions. Consequently, assembly line investments offset labor dependencies while improving operational margins. Furthermore, Industry 4.0 initiatives backed by substantial capital investments accelerate smart manufacturing technology adoption across production facilities.

Restraints

High Capital Investment Requirements Limit Market Adoption

Assembly line solutions require substantial initial capital expenditure for equipment procurement and system integration. Manufacturers must invest in robotics, sensors, conveyors, and control systems before realizing productivity benefits. Moreover, smaller enterprises face financing challenges accessing advanced automation technologies. Therefore, high upfront costs create adoption barriers particularly for low-to-medium volume manufacturers.

System integration complexity increases project costs through engineering, installation, and commissioning requirements. Companies must allocate resources for equipment customization matching specific production workflows. Additionally, workforce training programs represent ongoing investments supporting automated system operations. Consequently, total ownership costs extend beyond initial equipment purchases.

Operational disruptions during assembly line retrofit projects create production downtime and revenue losses. Manufacturers must carefully plan installation schedules minimizing impact on existing production commitments. Furthermore, legacy equipment integration challenges complicate modernization efforts within established facilities. Therefore, retrofit risks discourage some companies from pursuing automation upgrades despite long-term efficiency benefits.

Growth Factors

Technological Advancements Accelerate Market Expansion

Growing demand for flexible and modular assembly lines supports low-to-medium volume production requirements. Manufacturers seek configurable solutions adapting to changing product specifications without complete line redesigns. Moreover, modular approaches reduce implementation costs while enabling incremental automation investments. Therefore, scalable assembly technologies attract diverse manufacturing sectors beyond traditional high-volume applications.

Rapid industrialization and greenfield manufacturing projects in emerging economies create substantial assembly line demand. According to Assembly Magazine, Japan installed 44,500 industrial robots in 2024, maintaining high adoption levels. Developing markets invest in modern production facilities supporting economic growth and export capabilities. Additionally, government manufacturing incentives accelerate factory construction and automation technology deployments across Asia-Pacific and Latin American regions.

Integration of AI-based quality inspection within assembly line solutions enhances defect detection capabilities. Machine learning algorithms analyze production data identifying quality issues faster than manual inspection methods. In March 2025, Apptronik closed an oversubscribed Series A round totaling $403 million to accelerate humanoid robotics commercialization. Furthermore, rising adoption of automated assembly systems in battery and electric vehicle component manufacturing supports electrification transitions across automotive supply chains.

Emerging Trends

Digital Transformation Reshapes Assembly Line Operations

Increasing deployment of collaborative robots alongside human assembly workers transforms manufacturing floor operations. Cobots provide flexible automation supporting variable production tasks without extensive safety barriers. Moreover, they enable smaller manufacturers to access robotics benefits previously limited to large-scale operations. Therefore, collaborative technologies democratize assembly automation across diverse industrial applications.

Shift toward digital twin technology enables assembly line simulation and optimization before physical implementation. Manufacturers create virtual replicas testing production scenarios and identifying bottlenecks without operational disruptions. According to Assembly Magazine, Korea installed 30,600 industrial robots in 2024, demonstrating advanced automation adoption. Additionally, digital twins support predictive maintenance through real-time equipment monitoring and performance analytics.

Growing use of vision systems provides real-time defect detection capabilities throughout assembly processes. Advanced imaging technologies identify component placement errors and quality deviations during production cycles. Furthermore, AI-powered vision inspection replaces manual quality control improving detection accuracy and throughput speeds. Consequently, manufacturers integrate vision systems across critical assembly stations ensuring consistent output quality and reduced waste rates.

Regional Analysis

Asia-Pacific Dominates the Assembly Line Solutions Market with a Market Share of 43.20%, Valued at USD 123.6 Billion

Asia-Pacific dominates the Assembly Line Solutions Market with 43.20% market share, valued at USD 123.6 Billion, driven by extensive manufacturing infrastructure and electronics production. China, Japan, and South Korea lead regional automation adoption across automotive and semiconductor sectors. Moreover, favorable government policies and industrial development initiatives accelerate assembly line investments. Therefore, Asia-Pacific maintains global leadership in factory automation and robotics integration.

North America Assembly Line Solutions Market Trends

North America demonstrates strong assembly line adoption across automotive, aerospace, and electronics manufacturing sectors. United States manufacturers invest heavily in Industry 4.0 technologies and smart factory initiatives. Moreover, reshoring trends drive domestic production capacity expansion supporting automation demand. Additionally, established automotive production infrastructure supports continuous assembly line modernization investments.

Europe Assembly Line Solutions Market Trends

Europe maintains advanced manufacturing capabilities with significant assembly line deployments across automotive and industrial sectors. Germany leads regional automation adoption through precision engineering and robotics excellence. Moreover, stringent labor regulations and sustainability requirements drive automated assembly solutions. Furthermore, Industry 4.0 standards and digital manufacturing initiatives accelerate technology integration across European production facilities.

Latin America Assembly Line Solutions Market Trends

Latin America experiences growing assembly line adoption supporting automotive and consumer goods manufacturing expansion. Brazil and Mexico attract foreign manufacturing investments requiring modern production infrastructure. Moreover, automotive assembly operations drive regional demand for robotics and automation technologies. Additionally, economic development initiatives support manufacturing sector modernization across the region.

Middle East & Africa Assembly Line Solutions Market Trends

Middle East & Africa shows emerging assembly line adoption driven by industrial diversification strategies. GCC countries invest in manufacturing infrastructure reducing petroleum sector dependencies. Moreover, automotive assembly operations expand across South Africa and Morocco supporting regional production capabilities. Therefore, government-led industrialization programs create opportunities for assembly line technology providers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

ABB maintains global leadership in industrial automation and robotics solutions serving assembly line applications. The company provides comprehensive automation portfolios including robotics, control systems, and sensors for manufacturing operations. Moreover, ABB’s technologies support automotive, electronics, and consumer goods assembly across worldwide production facilities. Therefore, their integrated solutions enable manufacturers to achieve operational excellence and production efficiency.

Siemens AG delivers advanced automation technologies and digital manufacturing solutions for assembly line optimization. The company offers industrial software, robotics, and control systems supporting Industry 4.0 implementations. Additionally, Siemens provides comprehensive digital twin capabilities enabling virtual assembly line simulation and optimization. Consequently, manufacturers leverage Siemens technologies for smart factory transformations and productivity improvements.

KUKA AG specializes in industrial robotics and automated assembly solutions across diverse manufacturing sectors. The company provides flexible robotic systems supporting welding, material handling, and precision assembly applications. In early 2025, Apptronik engaged in strategic collaborations with Mercedes-Benz and GXO Logistics piloting humanoid robots. Moreover, KUKA’s collaborative robotics enable safe human-machine interaction within assembly environments supporting operational flexibility.

Bosch Rexroth AG offers comprehensive assembly line technologies including automation components and control systems. The company provides modular solutions supporting flexible manufacturing and lean production methodologies. Furthermore, Bosch Rexroth’s expertise spans hydraulics, pneumatics, and electric drives serving assembly automation requirements. Additionally, their Industry 4.0 solutions integrate connectivity and data analytics for optimized assembly operations.

Key players

- ABB

- Siemens AG

- KUKA AG

- Bosch Rexroth AG

- JR Automation

- BBS Automation

- Mondragon Assembly

- ACRO Automation Systems

- Central Machines Inc.

- Fusion Systems Group

Recent Developments

- May 2025 – DiFACTO Robotics and Automation acquired intellectual property rights for RoboFinish division from Grind Master, strengthening its robotics portfolio in grinding, finishing, deburring, and machining technologies for advanced assembly applications.

- July 2025 – Doosan Robotics acquired an 89.59% stake in U.S.-based automation engineering firm ONExia Inc. for approximately $25.9 million, bolstering its AI-driven and collaborative robotics capabilities for assembly line solutions.

- October 2025 – SoftBank Group agreed to acquire the robotics division of Swiss engineering firm ABB in a deal valued at approximately $5.4 billion, marking one of the largest transactions in industrial robotics sector history.

Report Scope

Report Features Description Market Value (2025) USD 286.3 Billion Forecast Revenue (2035) USD 558.0 Billion CAGR (2026-2035) 6.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Automation Level (Semi-automated Assembly Lines, Manual Assembly Lines, Fully-automated Assembly Lines), By Component (Robotics & End-effectors, Conveyors & Transfer Systems, Sensors & Vision Systems, Controllers & Software, Safety & Ergonomic Modules, Others), By End-user (Automotive, Electronics & Semiconductors, Consumer Goods, Pharmaceuticals & Healthcare, Food & Beverage, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB, Siemens AG, KUKA AG, Bosch Rexroth AG, JR Automation, BBS Automation, Mondragon Assembly, ACRO Automation Systems, Central Machines Inc., Fusion Systems Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Assembly Line Solutions MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Assembly Line Solutions MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Siemens AG

- KUKA AG

- Bosch Rexroth AG

- JR Automation

- BBS Automation

- Mondragon Assembly

- ACRO Automation Systems

- Central Machines Inc.

- Fusion Systems Group