Asia-Pacific Electric Scooters Market Size, Share, Growth Analysis By Battery Type (Lead-acid, Lithium-ion, Lithium-ion Polymer, Sodium-ion & Emerging), By Power Output (Less than 3.6 kW, 3.6–7.2 kW, Above 7.2 kW), By Motor / Drive Type (Hub Motor, Belt Drive, Chain Drive, Mid-drive Motor), By End-Use (Personal / Individual, Commercial & Corporate, Micromobility Service, Delivery & Logistics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174812

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

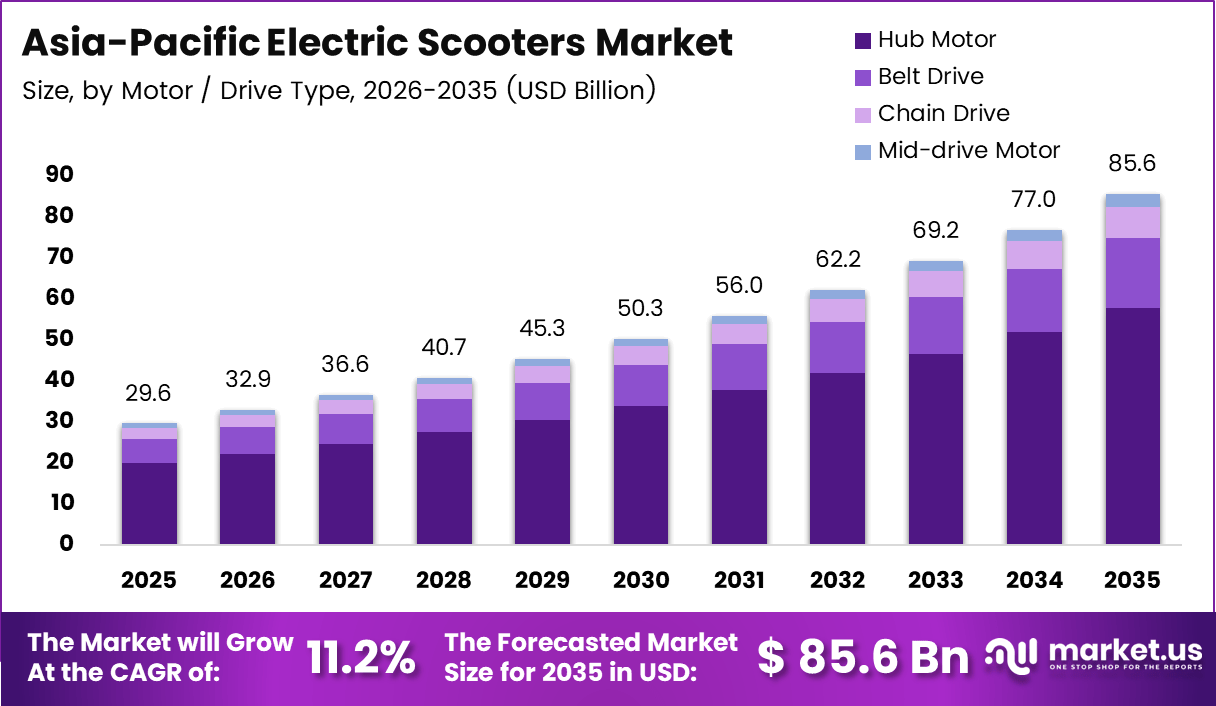

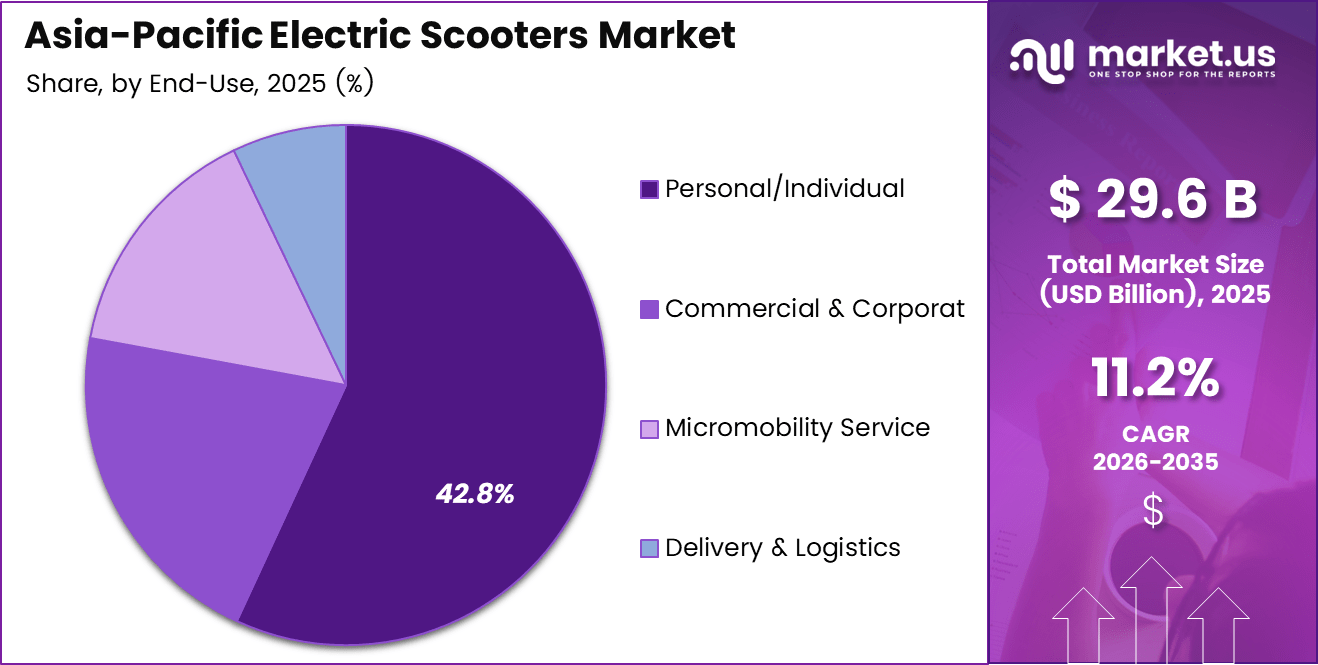

The Asia-Pacific Electric Scooters Market size is expected to be worth around USD 85.6 billion by 2035, from USD 29.6 Billion in 2025, growing at a CAGR of 11.2% during the forecast period from 2026 to 2035.

The Asia-Pacific Electric Scooters Market refers to the ecosystem covering electric two-wheelers, supporting infrastructure, and mobility services across urban and semi-urban regions. It addresses daily commuting, last-mile delivery, and shared mobility needs. Rising fuel costs, dense city populations, and sustainability goals continue driving adoption across Asia-Pacific economies.

The Asia-Pacific Electric Scooters Market is experiencing steady expansion supported by rapid urbanization and changing commuter behavior. Consumers increasingly prefer compact, low-maintenance electric mobility solutions for short-distance travel. As a result, electric scooters are gaining traction across personal ownership and fleet-based deployment models.

Growth opportunities are strengthening due to government investment in clean transportation programs and charging infrastructure. Many regional authorities continue offering purchase incentives, registration benefits, and tax relief to accelerate electric scooter penetration. At the same time, stricter emission regulations are encouraging faster replacement of internal combustion scooters across major metropolitan areas.

Technology advancements further improve market attractiveness by extending battery life, improving safety, and lowering lifetime ownership costs. Manufacturers are focusing on higher energy density lithium batteries and modular designs. Consequently, electric scooters now align better with reliability expectations for daily commuting and light commercial applications.

According to company disclosures, modern electric scooters use rear in-wheel motors powered by removable 48-volt/40-Ah e-bike lithium battery packs. These batteries achieve full charging within 4.5 hours and deliver around 65 km range per charge, depending on riding conditions and usage patterns.

Based on operational data shared by manufacturers, battery lifespan reaches approximately 50,000 km before replacement, nearly five times longer than typical e-scooter batteries. Performance benchmarks show maximum speeds of 65 km/h and vehicle weights near 118 kg, improving stability without sacrificing efficiency.

According to study, global deployments target nearly 100,000 electric scooters across 100 cities, supporting scalable shared mobility models. Operational cost comparisons indicate commuting expenses decline significantly, from about €12 on petrol to nearly €2 using electricity, reinforcing strong economic incentives across Asia-Pacific markets.

Key Takeaways

- The Asia-Pacific Electric Scooters Market is valued at USD 29.6 Billion in 2025 and is projected to expand at a CAGR of 11.2% through 2035.

- Lithium-ion batteries dominate the battery segment with a 72.1% share, reflecting strong demand for higher energy density and longer lifecycle performance.

- Scooters with power output below 3.6 kW lead the market at 51.8%, driven by suitability for daily urban commuting needs.

- Hub motor technology holds a 67.4% share, supported by its low maintenance requirements and cost-effective manufacturing advantages.

- Personal and individual usage represents the largest end-use segment with a 56.9% share, highlighting strong adoption for everyday mobility.

- Asia Pacific remains the leading region, supported by high urban density, favorable government policies, and large-scale electric mobility adoption.

By Battery Type Analysis

Lithium-ion dominates with 72.1% due to its balance of energy density, lifecycle efficiency, and charging performance.

In 2025, Lithium-ion held a dominant market position in the By Battery Type Analysis segment of the Asia-Pacific Electric Scooters Market, with a 72.1% share. This dominance is supported by its lighter weight, faster charging capability, and longer lifecycle, which align well with urban commuting needs and rising consumer expectations across Asia-Pacific cities.

Lead-acid batteries continue to remain relevant in price-sensitive markets. They are commonly adopted in entry-level electric scooters due to their low upfront cost and established recycling ecosystem. However, their heavier weight and shorter lifespan limit their appeal compared to advanced battery chemistries.

Lithium-ion polymer batteries serve niche applications where flexible form factors and compact design are required. These batteries support slimmer scooter designs and improved thermal management, though their higher cost restricts widespread adoption across mass-market electric scooter models.

Sodium-ion and emerging battery technologies are gradually gaining attention. These alternatives offer potential advantages in cost stability and raw material availability. Adoption remains limited, but pilot deployments and regional research initiatives indicate long-term interest within the Asia-Pacific electric mobility ecosystem.

By Power Output Analysis

Less than 3.6 kW dominates with 51.8% due to suitability for daily urban commuting.

In 2025, Less than 3.6 kW held a dominant market position in the By Power Output Analysis segment of the Asia-Pacific Electric Scooters Market, with a 51.8% share. This category benefits from regulatory compatibility, lower energy consumption, and ease of handling, making it ideal for dense urban environments.

The 3.6–7.2 kW segment addresses users seeking better acceleration and moderate highway capability. These scooters are increasingly preferred in suburban regions, offering a balance between performance and efficiency without significantly increasing operating or charging costs.

Above 7.2 kW power output scooters cater to performance-focused users and premium segments. These models support higher speeds and heavier loads, yet their adoption remains limited due to higher costs, stricter regulations, and the need for advanced charging infrastructure.

By Motor / Drive Type Analysis

Hub Motor dominates with 67.4% due to its simple design and low maintenance.

In 2025, Hub Motor held a dominant market position in the By Motor / Drive Type Analysis segment of the Asia-Pacific Electric Scooters Market, with a 67.4% share. Its integrated design improves efficiency, reduces mechanical complexity, and supports cost-effective mass production across regional manufacturers.

Belt drive systems are gaining traction in premium and lifestyle electric scooters. They offer quieter operation and smoother power delivery, enhancing ride comfort. However, higher costs and limited torque capacity constrain broader adoption.

Chain drive systems remain relevant in higher torque applications. They provide durability and better load-handling capability, especially in commercial usage, though regular maintenance requirements reduce appeal for personal users.

Mid-drive motors are used in specialized performance scooters. They enable better weight distribution and climbing efficiency, yet higher system complexity and cost limit their penetration in the mainstream Asia-Pacific market.

By End-Use Analysis

Personal/Individual dominates with 56.9% driven by daily commuting demand.

In 2025, Personal/Individual held a dominant market position in the By End-Use Analysis segment of the Asia-Pacific Electric Scooters Market, with a 56.9% share. Rising fuel costs, urban congestion, and supportive policies continue to encourage personal ownership across major regional economies.

Commercial and corporate usage is expanding steadily. Businesses adopt electric scooters for campus mobility and employee transport, driven by sustainability goals and operating cost optimization across corporate and industrial zones.

Micro-mobility service providers rely on electric scooters for shared urban transportation. Fleet electrification supports emission reduction targets, although high utilization rates demand robust designs and efficient maintenance strategies.

Delivery and logistics applications are growing with the expansion of last-mile services. Electric scooters offer cost efficiency and maneuverability in congested cities, making them suitable for short-distance, high-frequency delivery operations.

Key Market Segments

By Battery Type

- Lead-acid

- Lithium-ion

- Lithium-ion Polymer

- Sodium-ion & Emerging

By Power Output

- Less than 3.6 kW

- 3.6–7.2 kW

- Above 7.2 kW

By Motor / Drive Type

- Hub Motor

- Belt Drive

- Chain Drive

- Mid-drive Motor

By End-Use

- Personal / Individual

- Commercial & Corporate

- Micromobility Service

- Delivery & Logistics

Drivers

Rapid Urban Population Density Driving Demand for Compact Personal Mobility Solutions

Asia-Pacific cities are becoming more crowded each year, which increases daily travel challenges for residents. As urban population density rises, people look for compact and flexible mobility options. Electric scooters fit well into this need because they require less space, are easy to park, and move smoothly through congested streets.

Government incentives play a major role in accelerating adoption. Many countries across Asia-Pacific offer purchase subsidies, tax benefits, and registration advantages for electric two wheelers. These policies reduce upfront costs and encourage first-time buyers to shift away from petrol-based scooters.

Fuel price volatility further strengthens demand for electric scooters. Frequent fuel price fluctuations create uncertainty for household transportation budgets. Electric scooters offer predictable and lower running costs, making them attractive for daily commuting, especially for middle-income urban users.

Charging and battery swapping infrastructure is expanding across major Asian cities. Public chargers, workplace charging points, and battery swapping stations reduce range anxiety. This infrastructure growth improves user confidence and supports wider adoption of electric scooters in both residential and commercial use.

Restraints

Limited Driving Range and Battery Performance Concerns Restrain Market Adoption

Limited driving range remains a key restraint, especially in low cost electric scooter models. Budget scooters often use smaller batteries, which restrict travel distance per charge. This creates hesitation among users who rely on longer daily commutes or unpredictable travel patterns.

Battery performance issues also affect consumer trust. Lower priced models may experience faster battery degradation, reduced charging efficiency, and performance drops in extreme weather. These concerns increase maintenance costs over time and reduce perceived value for price-sensitive buyers.

Inconsistent safety regulations across Asia-Pacific further slow adoption. Different countries and cities follow varied standards for speed limits, helmet use, and vehicle certification. This regulatory fragmentation creates confusion for manufacturers and limits cross-border product standardization.

Road infrastructure quality also varies widely in emerging markets. Poor road conditions increase wear on electric scooters and raise safety risks. These factors discourage adoption in semi-urban and rural areas where infrastructure upgrades progress more slowly.

Growth Factors

Large Scale Electrification of Last Mile Delivery Fleets Creates New Growth Paths

Last mile delivery electrification offers strong growth opportunities. E commerce and food delivery platforms increasingly adopt electric scooters to reduce fuel expenses and meet sustainability targets. High daily usage makes electric scooters financially attractive for fleet operators.

Expansion into tier 2 and tier 3 cities presents another opportunity. Manufacturers introduce affordable, localized scooter models designed for regional road conditions. Growing urbanization and rising disposable incomes in smaller cities support steady demand growth.

Smart connectivity integration adds value to electric scooters. Features such as IoT diagnostics, remote monitoring, and predictive maintenance improve vehicle reliability. Fleet operators benefit from data driven insights that reduce downtime and optimize operational efficiency.

Shared mobility and subscription based services are also expanding. Urban users increasingly prefer access over ownership. Electric scooter sharing models support short trips, reduce traffic congestion, and create recurring revenue streams for service providers.

Emerging Trends

Increasing Adoption of Removable Battery and Battery Swapping Enabled Scooters

Removable battery and battery swapping scooters are gaining popularity. These designs allow users to charge batteries at home or swap them quickly, reducing downtime. This trend directly addresses charging accessibility challenges in high density residential areas.

There is a noticeable shift toward higher power output scooters for premium urban commuters. Consumers seek better acceleration and smoother rides for longer urban travel. Premium models cater to professionals who prioritize performance and comfort.

Manufacturers increasingly use lightweight materials to improve efficiency. Lighter frames enhance riding comfort, extend battery range, and improve handling. This trend also supports better durability on uneven urban roads.

Collaboration between scooter OEMs and energy companies is strengthening charging ecosystems. Joint initiatives support faster charger deployment and battery swapping networks. These partnerships improve infrastructure reliability and support long-term market scalability.

Key Asia-Pacific Electric Scooters Company Insights

In 2025, the Asia-Pacific electric scooters market is shaped by a mix of legacy manufacturers and innovative challengers, each contributing uniquely to regional dynamics and consumer adoption.

Yadea Technology Group continues to leverage its extensive distribution network and product breadth to maintain leadership across key Asia-Pacific markets. The company’s focus on affordable, reliable models positions it well amid growing urban mobility demand.

NIU Technologies has differentiated through smart connectivity and battery technology, appealing to tech-savvy consumers in urban centers. Its digital ecosystem and recurring revenue streams from connected services strengthen long-term engagement and brand loyalty.

Gogoro Inc. brings a distinctive approach with its battery-swapping infrastructure, enabling fast turnaround and reduced downtime for riders. This model has catalyzed partnerships and local deployments, particularly in cities prioritizing sustainability and reduced emissions.

Segway-Ninebot benefits from global brand recognition and diversified product lines, balancing performance with competitive pricing. Its investments in R&D and expansion into ancillary markets support incremental growth and resilience against localized competition.

Collectively, these four players exemplify key competitive strategies in the Asia-Pacific arena. Yadea’s scale and distribution strength address mass-market needs, while NIU’s digital integration caters to evolving customer expectations. Gogoro’s infrastructure-centric model introduces new service paradigms, and Segway-Ninebot’s balanced portfolio underscores adaptability across segments.

Top Key Players in the Market

- Yadea Technology Group

- NIU Technologies

- Gogoro Inc.

- Segway-Ninebot

- Sunra Electric Vehicle (Xinri)

- AIMA Technology Group

- TAILG Group

- Luyuan Electric Vehicle

- LIMA Electric

- Vmoto / Super Soco

Recent Developments

- In July 2025, leading international e-scooter operators Beam Mobility and Neuron Mobility signed a preliminary merger agreement aimed at strengthening micromobility leadership across the Asia Pacific region. The proposed consolidation is expected to enhance operational scale, fleet efficiency, and regional market presence for shared e-scooter services.

Report Scope

Report Features Description Market Value (2025) USD 29.6 billion Forecast Revenue (2035) USD 85.6 billion CAGR (2026-2035) 11.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Type (Lead-acid, Lithium-ion, Lithium-ion Polymer, Sodium-ion & Emerging), By Power Output (Less than 3.6 kW, 3.6–7.2 kW, Above 7.2 kW), By Motor / Drive Type (Hub Motor, Belt Drive, Chain Drive, Mid-drive Motor), By End-Use (Personal / Individual, Commercial & Corporate, Micromobility Service, Delivery & Logistics) Competitive Landscape Yadea Technology Group, NIU Technologies, Gogoro Inc., Segway-Ninebot, Sunra Electric Vehicle (Xinri), AIMA Technology Group, TAILG Group, Luyuan Electric Vehicle, LIMA Electric, Vmoto / Super Soco Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asia-Pacific Electric Scooters MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Asia-Pacific Electric Scooters MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Yadea Technology Group

- NIU Technologies

- Gogoro Inc.

- Segway-Ninebot

- Sunra Electric Vehicle (Xinri)

- AIMA Technology Group

- TAILG Group

- Luyuan Electric Vehicle

- LIMA Electric

- Vmoto / Super Soco