Asia Pacific Direct Selling Market Size, Share, Growth Analysis By Product (Health & Wellness, Household Goods & Durables, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 152372

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

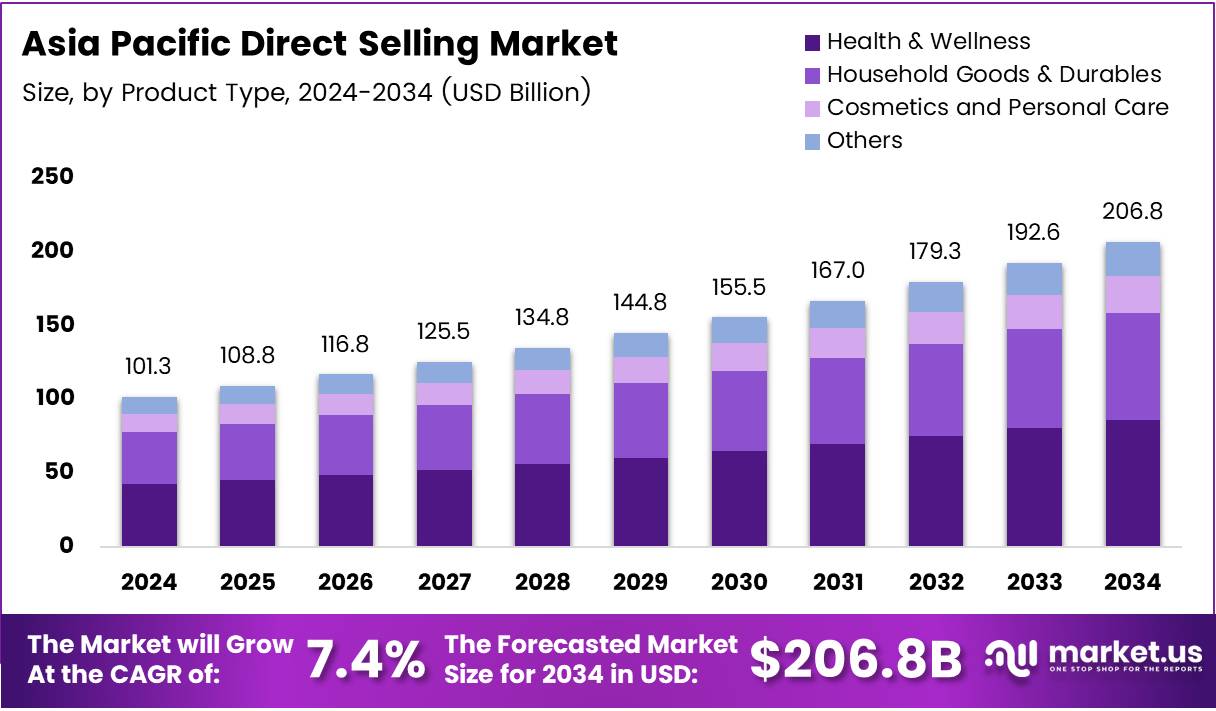

The Asia Pacific Direct Selling Market size is expected to be worth around USD 206.8 Billion by 2034, from USD 101.3 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034.

The Asia Pacific Direct Selling Market is a rapidly growing sector, contributing significantly to the global direct selling landscape. As of 2022, the region comprised 44.47% of the global direct selling business, highlighting its dominance and importance. This growth can be attributed to factors such as increasing internet penetration, rising disposable incomes, and the shift towards entrepreneurial opportunities. As more individuals seek flexible income sources, direct selling offers an appealing alternative to traditional employment, fueling its expansion.

Trust plays a pivotal role in the success of direct selling in Asia Pacific. A PwC survey conducted across 11 territories in the region revealed that trust is a key purchase driver for consumers engaging in direct sales. The survey, which included responses from over 7,000 participants, underscores the importance of building strong, transparent relationships between sellers and buyers. This trust factor has contributed to the stability and growth of the market, as consumers are more likely to purchase from individuals or companies they trust.

In the Philippines, consumer awareness of direct selling is remarkably high. According to LifestylePlusPH, 95% of respondents correctly understood how direct selling works. This strong consumer knowledge is crucial for the market’s continued success, as it indicates that the public is not only familiar with direct selling but also embraces it as a viable purchasing model. This high level of awareness, coupled with the region’s increasing adoption of e-commerce, suggests a robust foundation for direct selling in the coming years.

The Asia Pacific Direct Selling Market is expected to continue its growth trajectory as companies increasingly leverage digital tools to connect with potential customers. Online platforms, social media, and mobile apps are becoming essential for reaching broader audiences, especially as younger generations become more digitally savvy. Additionally, the rise of social commerce in countries like China and India has created new avenues for direct selling businesses to expand their reach and grow their customer base.

Looking ahead, the Asia Pacific Direct Selling Market is anticipated to remain a dominant force in the global sector, driven by evolving consumer behaviors, technological advancements, and the rising popularity of entrepreneurship. As companies refine their strategies to foster trust and adapt to the digital landscape, the market is expected to witness sustained growth in the next decade.

Key Takeaways

- The Asia Pacific Direct Selling Market is projected to reach USD 206.8 Billion by 2034, growing from USD 101.3 Billion in 2024, at a CAGR of 7.4%.

- Health & Wellness products dominate the market in 2024, driven by growing consumer demand for fitness, nutrition, and preventive care.

- The integration of e-commerce platforms is accelerating growth by combining traditional face-to-face selling with online sales, especially in urban and semi-urban areas.

- Rural and semi-urban areas are emerging as significant growth regions due to improved internet and mobile access, expanding the reach of direct sellers.

- Digital payment systems like mobile wallets enhance convenience and trust, promoting faster transactions and market growth.

- Influencer-led strategies are gaining popularity, leveraging social media influencers to build authentic connections and increase brand visibility.

- The use of AI tools is transforming the market by improving lead generation, customer retention, and personalized marketing.

Health & Wellness Leads the Asia Pacific Direct Selling Market in 2024

In 2024, Health & Wellness held a dominant market position in the By Product Analysis segment of the Asia Pacific Direct Selling Market, with a strong share reflecting its growing consumer demand. This category continued to capture the attention of health-conscious customers who prioritize fitness, nutrition, and preventive care. The increased awareness around healthy lifestyles and well-being drove the consistent growth in this segment, making Health & Wellness the clear front-runner.

Household Goods & Durables followed as another significant product category, catering to the everyday needs of households across the region. Its market share highlighted the steady demand for practical and durable items that enhance home living and convenience.

Cosmetics and Personal Care remained an important segment, driven by rising beauty consciousness and personal grooming trends among consumers. Innovations and expanding product ranges in this space contributed to maintaining a solid presence in the market.

The Others category included a variety of miscellaneous products that, while smaller in share, still contributed to the overall diversity of the direct selling market in Asia Pacific. This segment showed potential for niche products and emerging trends.

Overall, Health & Wellness clearly dominated the product landscape in 2024, reflecting the evolving consumer priorities in the Asia Pacific direct selling sector.

Key Market Segments

By Product

- Health & Wellness

- Household Goods & Durables

- Cosmetics and Personal Care

- Others

Drivers

Rising Penetration of E-commerce Platforms Supporting Hybrid Direct Selling Models

The Asia Pacific direct selling market is growing rapidly, thanks to the rising use of e-commerce platforms. These platforms enable hybrid direct selling models, combining traditional face-to-face selling with online sales. This approach helps sellers reach more customers easily and efficiently, especially in urban and semi-urban areas. The convenience of shopping online along with personalized service is attractive to many buyers.

Another key driver is the expanding middle-class population in the region. More people now have higher disposable incomes, which allows them to spend on direct selling products. This trend supports growth in many product categories, including beauty, wellness, and household items. As incomes rise, consumers are more willing to try new products from direct sellers.

There is also a strong surge in demand for personalized wellness and nutrition products. People in Asia Pacific are becoming more health-conscious and prefer products tailored to their specific needs. This trend encourages direct sellers to offer customized health supplements and wellness solutions. Overall, the combination of e-commerce growth, rising income, and health trends is driving the direct selling market forward in the region.

Restraints

Complex Multi-Level Marketing Regulations Varying by Country

The Asia Pacific direct selling market faces challenges due to complex multi-level marketing (MLM) regulations that differ across countries. Each country has its own rules, making it difficult for companies to operate smoothly in multiple markets. This regulatory complexity increases compliance costs and slows market expansion.

Another restraint is declining consumer trust. Past fraudulent schemes linked to direct selling have made many buyers cautious. Negative experiences with scams have hurt the reputation of the entire industry. As a result, potential customers often hesitate before engaging with direct sellers, affecting overall sales growth.

Limited product diversification in some emerging markets also restricts market development. In certain countries, direct selling companies offer a narrow range of products. This limits appeal to different consumer groups and reduces opportunities for cross-selling. Expanding product varieties could help overcome this challenge and attract more customers.

Together, these factors create significant barriers for direct selling companies trying to grow in Asia Pacific.

Growth Factors

Untapped Rural and Semi-Urban Markets with Growing Digital Access

There are major growth opportunities for direct selling in Asia Pacific’s rural and semi-urban areas. These regions have been underserved but are now gaining better internet and mobile access. This digital connectivity opens doors for direct sellers to reach new customers who were previously hard to access.

Integration of digital payment systems like mobile wallets also supports market growth. Consumers increasingly prefer quick and easy payment methods, making it simpler for sellers to complete transactions online. This trend helps build trust and convenience in direct selling.

Expanding into Gen Z consumers through digital storytelling is another opportunity. Younger buyers are active on social media and respond well to engaging content. Direct selling companies can use this to connect with Gen Z and build lasting relationships.

Lastly, localization of product lines to match regional preferences can boost sales. Customizing products to fit local tastes and lifestyles increases relevance and consumer interest. By tapping into these factors, the Asia Pacific direct selling market can unlock significant new potential.

Emerging Trends

Rise of Influencer-Led Direct Selling Strategies on Social Media

A key trending factor in Asia Pacific’s direct selling market is the rise of influencer-led strategies. Social media influencers with loyal followings promote direct selling products, creating authentic connections with consumers. This approach helps brands gain visibility and trust quickly.

The adoption of AI tools is also transforming the market. Companies are using artificial intelligence for lead generation and customer retention. AI helps identify potential buyers, personalize marketing efforts, and maintain long-term engagement. This technology-driven approach improves efficiency and sales success.

There is also a growing shift toward eco-friendly and sustainable products. Consumers increasingly prefer brands that care about the environment. Direct sellers are responding by offering green products, which appeal to eco-conscious buyers and differentiate them in the market.

These trends show how technology and changing consumer values are shaping the future of direct selling in Asia Pacific.

Key Asia Pacific Direct Selling Company Insights

In 2024, the Asia Pacific direct selling market continues to be strongly influenced by several key players who are driving growth through innovation and regional expansion.

Friedrich Vorwerk Group SE ADR remains a significant contender, leveraging its diversified product portfolio and established brand reputation to capture a broad consumer base across the region. Their focus on quality and technological integration in their offerings helps maintain a competitive edge.

Natura &Co Holding SA ADR has been gaining momentum by emphasizing sustainability and ethical business practices, which resonate well with the increasingly eco-conscious consumers in Asia Pacific. Their strategic acquisitions and strong presence in emerging markets enhance their footprint and contribute to steady market share growth.

Amway Corporation continues to dominate the market with its extensive distributor network and broad range of health, beauty, and home care products. Amway’s investment in digital platforms and personalized customer engagement supports its leadership position, enabling it to tap into evolving consumer preferences effectively.

Herbalife Ltd remains a major player through its focus on nutrition and wellness products, capitalizing on growing health trends in the region. Its robust training programs for distributors and aggressive marketing strategies ensure consistent brand loyalty and expansion within key Asia Pacific countries.

Top Key Players in the Market

- Friedrich Vorwerk Group SE ADR

- Natura &Co Holding SA ADR

- Amway Corporation

- Herbalife Ltd

- Tupperware Brands Corp

- Oriflame

Recent Developments

- In May 2025, Blank Beauty closed an oversubscribed $6 million Series A round to accelerate innovation in personalized beauty solutions. Strategic investments came from EPSON and Kirker Enterprises, signaling strong industry alignment.

- In May 2025, Wonderskin secured a substantial $50 million Series A funding round aimed at scaling operations and advancing its proprietary beauty technologies. This major raise underscores growing investor confidence in next-gen cosmetic brands.

- In January 2025, Ras Luxury Skincare raised $5 million in Series A funding, led by Unilever Ventures, to expand its premium Ayurvedic skincare line globally. The partnership strengthens its brand reach and formulation R&D.

Report Scope

Report Features Description Market Value (2024) USD 101.3 Billion Forecast Revenue (2034) USD 206.8 Billion CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Health & Wellness, Household Goods & Durables, Cosmetics and Personal Care, Others) Competitive Landscape Friedrich Vorwerk Group SE ADR, Natura &Co Holding SA ADR, Amway Corporation, Herbalife Ltd, Tupperware Brands Corp, Oriflame Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Asia Pacific Direct Selling MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample

Asia Pacific Direct Selling MarketPublished date: Jul 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Friedrich Vorwerk Group SE ADR

- Natura &Co Holding SA ADR

- Amway Corporation

- Herbalife Ltd

- Tupperware Brands Corp

- Oriflame