Global Aroma Chemicals Market; By Source(Synthetic, Natural, Natural-Identical), By Products(Benzenoids, Terpenes and Terpenoids, Musk Chemicals, Others) (Ketones, Esters, Aldehydes), Application, Flavors, Convenience Foods, Confectionery, Dairy Products, Bakery Foods, Others, Fragrance, Cosmetics and Toiletries, Fine Fragrance, Soaps and Detergents, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast: 2023-2033

- Published date: Nov 2023

- Report ID: 19560

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

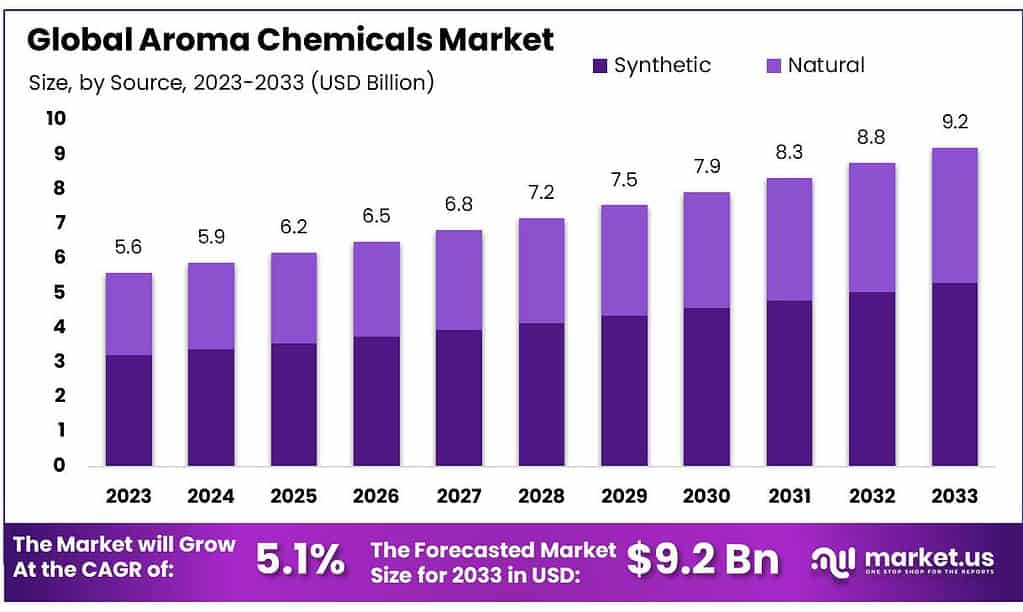

The global Aroma Chemicals market size is expected to be worth around USD 9.2 billion by 2033, from USD 5.6 billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2023 to 2033.

Product demand is expected to grow due to the increased sales of flavor and fragrance products in the food & beverage, soaps & detergents, and cosmetics & toiletries industries. This market report gives a detailed analysis of the Aroma Chemicals market size, share, growth, key trends, competitive landscape, and other key factors.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Growth and Trends: Predicted market worth by 2033: USD 9.2 billion, up from USD 5.6 billion in 2023, at a 5.1% CAGR. Increased demand in flavor and fragrance products across food & beverage, soaps & detergents, and cosmetics & toiletries drives market growth.

- Source Analysis: Synthetic aroma products dominate (57.6% in 2023) due to demand in the food & beverage, personal care, and cosmetics industries. Naturally derived aroma chemicals are gaining traction due to rising awareness of artificial additives.

- Product Insights: Terpenes/terpenoids lead (36.4% in 2023) due to natural availability and usage in paints, inks, and flavoring agents. Benzenoids show rapid growth in various applications like soaps, shampoos, cosmetics, and food products.

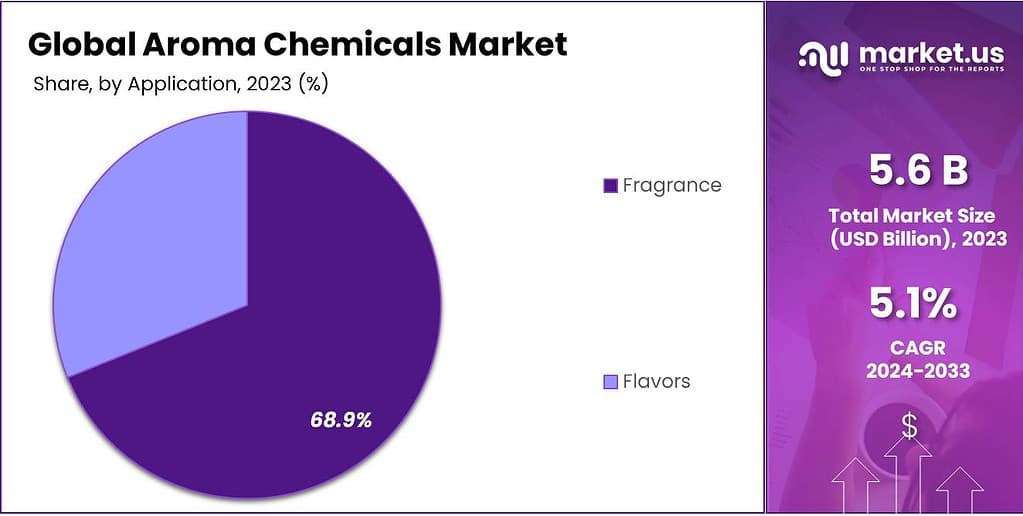

- Application Focus: Fragrance applications hold the largest share (68.9% in 2023), especially in the cosmetics and fine fragrance segments. Growing demand for natural flavoring products, particularly in emerging economies, fuels market growth.

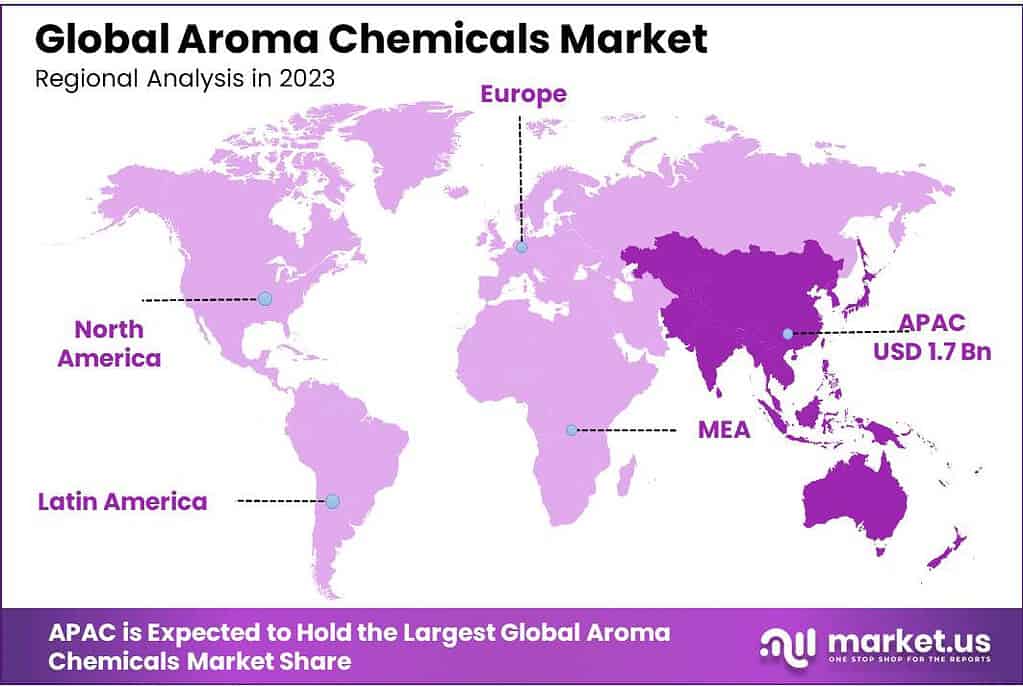

- Regional Analysis: Asia Pacific dominates (30.6% revenue share in 2023) due to demand from major economies like India, China, and Japan. North America’s market growth is moderate, driven by consumer preferences for healthier products.

Source Analysis

The synthetic source sub-segment dominated the market, which accounted for 57.6% of the total revenue shares in 2023. This is due to the growing demand for synthesized aroma products in food & beverage, personal care, and cosmetics, among other industries. The best way to obtain synthetic aroma chemicals is by using modern ingredient industry technologies. To reproduce different natural aromas, these products employ different kinds of chemicals.

Naturally, derived aroma chemicals are a major source of aroma products. They are extracted using natural extraction methods. Globally, people are more aware of the adverse effects of artificial additives in various products.

In certain cases, natural flavors may interact unexpectedly with other ingredients. It can be hard to create natural flavors or scents because some natural ingredients cannot blend with other fragrances. The high cost of manufacturing natural flavors or scents is an element that could restrict the aroma chemicals market growth.

By Products

Based on chemicals, this aroma chemicals market was dominated by the terpenes/terpenoids sub-segment, which accounted for 36.4% of total revenues in 2023. Its high market share can be attributed to both its natural availability and the increased usage of terpenes in paints and printing inks.

Terpenes can also be used in various end-use applications as flavoring and fragrance agents. The rubber and food & beverage industries consume a large portion of terpenes. Market growth is expected to be impeded by the low supply of raw materials in certain areas and the high cost of extraction.

Because of their increasing commercial significance, the benzenoids sector continues to grow rapidly. Due to their fragrance, they are used in various applications, including soaps, shampoos, detergents, cosmetics, and other personal care products, as well as in food and drinks.

Application Analysis

The fragrance applications sub-segment accounted for the largest share of the aroma chemicals market, amounting to 68.9% of total revenues. This significant share is due to growing demand and further growth into emerging industry areas such as cosmetics, and men’s perfume, among others. These products are anticipated to register significant demand due to the availability of rare ingredients in fine fragrance formulations.

The demand for natural flavoring products drives product manufacturers. Emerging economies can potentially be a major market driver for aroma chemicals. This demand will likely be driven by several factors, such as increasing disposable incomes, the growing demand for beverages and processed foods, the increasing popularity of exotic flavors, and a surge in demand from many food applications like baked goods, convenience foods, and confectionery products.

The demand for unique and organic fragrances and growing consumer awareness concerning organic products are expected to drive the fine fragrance market. PETA-certified organic perfumes are one such example of totally vegan products. The USDA also certifies that their perfumes contain safe, tested, pure ingredients and are free of harmful dyes, petrochemicals or pesticides, solvents, and alcohol. This segment will soon be slated to index a surge in demand for organic perfumes and personal-care products.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segmentation

By Source

- Synthetic

- Natural

- Natural-Identical

By Products

- Benzenoids

- Terpenes & Terpenoids

- Musk Chemicals

- Others (Ketones, Esters, Aldehydes)

Application

- Flavors

- Convenience Foods

- Confectionery

- Dairy Products

- Bakery Foods

- Others

- Fragrance

- Cosmetics and Toiletries

- Fine Fragrance

- Soaps and Detergents

- Others

Driving Factors

Expansion of the Cosmetics Industry to Drive Aroma Chemicals Market Growth

More people, both guys, and girls, are really into skincare and beauty stuff like creams, face masks, and peels. This interest is making the cosmetics market grow bigger. People are leaning towards natural and organic products because they’re more mindful of their lifestyle and have more money to spend. Big cities growing fast and online shopping booming are making people curious about fancy and new cosmetics.

Aroma chemicals play a huge role in stuff like gels, lipsticks, shampoos, and other toiletries. They make these products smell good without messing up their quality. Since cosmetics are super important to folks, big companies are making more products with natural stuff, and that’s making them sell more everywhere, making the market grow faster.

Restraining Factors

Synthetic Chemicals in Perfumes and Their Potential Health Effects May Affect the Industry

Most of the artificial chemicals used in making scents come from stuff like petroleum, which isn’t so great for our health. These chemicals, like benzene derivatives and phthalates, can cause a bunch of problems like birth defects, cancer, allergies, asthma, and issues with our nervous system.

Some are even listed as dangerous waste by the EPA. Researchers say that around 75% of scented products have phthalates, linked to stuff like breast cancer, diabetes, and messing with hormones. All these worries could slow down how much the market for these products grows.

Geopolitical and Recession Impact Analysis

Geopolitical Impact

Global Energy Security: Tensions between countries can disrupt the energy scene, affecting how we generate hydrogen. Disputes over energy resources might mess with how we make and deliver hydrogen, causing problems in how we get it.

International Collaboration: When countries aren’t getting along, it affects working together on making hydrogen tech. Good relationships help share knowledge and work on projects, but conflicts slow down progress in making better hydrogen tech.

Trade Policies and Export Restrictions: If rules about what we can sell and trade change, it can mess with getting the stuff needed for making hydrogen. Limits on what we can sell can make it hard to get what we need, affecting how much hydrogen we can make and how much it costs.

Energy Independence: Sometimes, countries want to make their own energy instead of relying on others. Making hydrogen at home can be part of this plan, changing how we get and use hydrogen worldwide.

Recession Impact

Research and Development Funding: When the economy isn’t doing well, spending on figuring out new hydrogen things can go down. This means less money for new ideas and slowing down how much we can improve hydrogen tech.

Infrastructure Investment: Tough times in the economy might delay or make smaller the projects to make and send out hydrogen. This could slow down how much hydrogen we can produce and use.

Demand Fluctuations: During tough times, how much hydrogen we need can go up and down, especially in things like transportation and industry. Changes in what people buy and how much industry makes can affect how much hydrogen we need.

Global Supply Chain Challenges: Tough times in the economy can mess with getting the things we need for hydrogen tech. It might take longer to find and get the stuff we need, delaying projects and making it hard to grow the hydrogen market.

Regional Analysis

The Asia Pacific was dominant in the aroma chemical market and accounted for the highest revenue share of 30.6% in 2023. This market is expected to experience a 4.8% CAGR between 2023 and 2032. This is due to the growing demand for flavors and fragrances coming from major economies like India, China, and Japan.

In countries such as Canada and the U.S., this product market is expected to grow moderately due to increasing demand for low-carbohydrate and low-fat food & beverages as well as consumer goods combined with an expanding food processing sector. Growing consumer preferences for healthy food and organic cosmetics have increased demand for aroma chemicals.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Market leaders continue to focus on expansion capacity prospects. Chemical companies partner with other companies to create distribution networks in diverse geographies. This ensures optimal coverage. Azelis’ subsidiary SammChem, which distributes specialty chemicals and food additives, partnered up with BASF SE in 2019. This partnership allows the company to distribute aroma ingredients to the flavors & fragrances market.

It is expected that the demand from the end-use industries will continue to grow over the forecast period. Manufacturers are intensifying their efforts to expand their existing product ranges and to introduce natural products to meet future needs for sustainable development. Major players included in the report are BASF SE, Privi Organics India Limited, Takasago International Corporation, Kao Corporation, etc.

Market Key Players

- Givaudan

- Firmenich

- Symrise

- IIF (International Flavors & Fragrances)

- Takasago International Corporation

- Privi Organics India Ltd.

- Bell Flavors & Fragrances

- S H Kelkar and Company

- Kao Corporation

- BASF SE

- Henkel AG & Co. KGAA

- Eternis

- Kao Chemicals Europe

- Privi Speciality Chemicals Limited

- Oriental Aromatics

Recent Development

Sept 2022: Solvay expanded the range of one of its flagship products, Rhovanil Natural CW, with three new natural flavors: Rhovanil Natural Delica, Alta, and Sublima. With these new products, the group will enable the F&B industry to make a cost-effective transition to natural products and respond to growing consumer expectations for healthier, safer, tastier, and more natural products.

Aug 2022: Kao Corporation plans to maintain and expand its market share in the European market for methyl dihydro jasmonate (MDJ), a synthetic fragrance. Methyl dihydro jasmonate is a fragrance base material that provides a refined, fresh, floral (jasmine) fragrance and is used in a wide range of consumer products.

Report Scope

Report Features Description Market Value (2023) USD 5.6 Billion Forecast Revenue (2033) USD 9.2 Billion CAGR (2023-2032) 5.1% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source(Synthetic, Natural, Natural-Identical), By Products(Benzenoids, Terpenes & Terpenoids, Musk Chemicals, Others)

(Ketones, Esters, Aldehydes), Application, Flavors, Convenience Foods, Confectionery, Dairy Products, Bakery Foods, Others, Fragrance, Cosmetics and Toiletries, Fine Fragrance, Soaps and Detergents, Others)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Givaudan, Firmenich, Symrise, IIF (International Flavors & Fragrances), Takasago International Corporation, Privi Organics India Ltd., Bell Flavors & Fragrances, S H Kelkar and Company, Kao Corporation, BASF SE, Henkel AG & Co. KGAA, Eternis, Kao Chemicals Europe, Privi Speciality Chemicals Limited, Oriental Aromatics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Aroma Chemicals market?Aroma chemicals are compounds used to create scents in various products like perfumes, soaps, and cosmetics. They provide distinctive fragrances and are derived from natural or synthetic sources.

How are Aroma Chemicals market Used?They are extensively used in perfumery, personal care products, household cleaners, and air fresheners to impart specific scents or fragrances.

Are Aroma Chemicals Safe?Aroma chemicals, when used within regulated limits, are considered safe. However, some individuals may have sensitivities or allergies to certain chemicals, causing reactions.

-

-

- Givaudan

- Firmenich

- Symrise

- IIF (International Flavors & Fragrances)

- Takasago International Corporation

- Privi Organics India Ltd.

- Bell Flavors & Fragrances

- S H Kelkar and Company

- Kao Corporation

- BASF SE

- Henkel AG & Co. KGAA

- Eternis

- Kao Chemicals Europe

- Privi Speciality Chemicals Limited

- Oriental Aromatics