Global AR and VR Display Market By Technology(AR, VR), By Device(HMDs, Hologram, HUDs, Projectors), By Display Technology(LCD, Micro-LED, OLED, Others), By End-User(Gaming & Entertainment, Aerospace & Defense, Automotive, Consumer, Education, Healthcare, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 129258

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

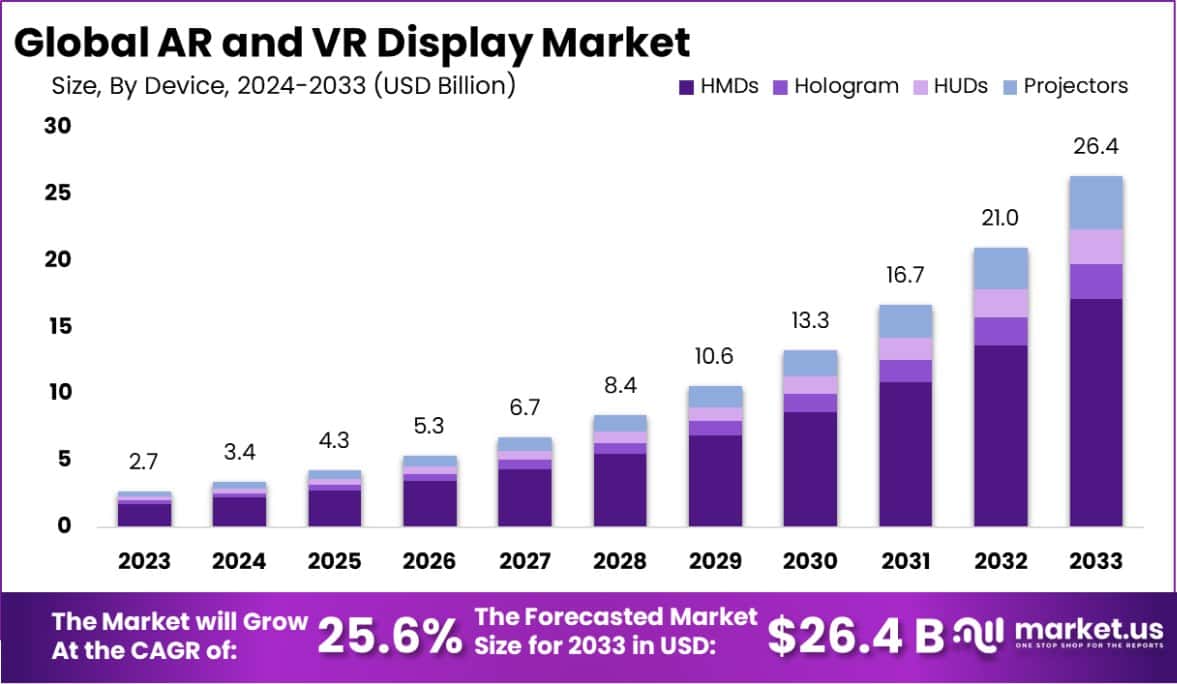

The Global AR and VR Display Market size is expected to be worth around USD 26.4 Billion By 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 25.6% during the forecast period from 2024 to 2033. Asia Pacific dominated a 41.6% market share in 2023 and held USD 1.12 Billion revenue of the AR and VR Display Market.

Augmented Reality (AR) and Virtual Reality (VR) displays are technologies that visually immerse users in enhanced or entirely virtual environments. AR displays overlay digital content onto the real world through devices like smartphones or specialized glasses, enriching the user’s interaction with reality. VR displays, on the other hand, offer a fully immersive experience, isolating the user from the physical world and substituting it with a digital one, typically using head-mounted displays.

The AR and VR display market is expanding rapidly, driven by applications across the gaming, healthcare, automotive, and education sectors. The demand for more immersive and interactive user experiences fuels this growth, with technological advancements in display resolutions and connectivity enhancing the quality and accessibility of AR and VR devices.

Significant growth factors include the increasing affordability of AR and VR devices and the integration of these technologies into mobile devices. Top opportunities lie in developing more energy-efficient displays and expanding into untapped markets like remote education and virtual travel, where users can benefit from rich, immersive experiences without the limitations of physical presence.

The AR and VR display market is poised for significant expansion, propelled by diverse industry applications and substantial investments in technology development. As enterprises and consumers increasingly seek immersive and interactive experiences, the demand for advanced AR and VR display technologies has surged. This growth trajectory is underpinned by a series of strategic funding initiatives, exemplifying the commitment of both the public and private sectors to advancing these technologies.

For instance, the National Institute of Standards and Technology (NIST) has made a pivotal investment of $9.7 million to enhance AR interfaces for public safety. This funding is targeted at developing AR solutions that improve situational awareness for first responders, marking a critical step toward integrating digital overlays with real-world operations, thereby enhancing the effectiveness and safety of emergency services.

Similarly, the U.S. Army’s $8.6 million grant to OLEDWorks reflects a strategic move to foster the development of cutting-edge OLED technologies for AR/VR applications. This initiative is not only aimed at bolstering the defense sector’s capabilities but also holds potential spill-over benefits for consumer electronics, highlighting the dual-use applications of these technologies.

These developments signal a robust outlook for the AR and VR display market, with increased funding acting as a catalyst for technological advancements. The focus on enhancing display qualities and integrating AR and VR into critical services underscores the market’s potential to revolutionize both professional and personal realms. As these technologies continue to evolve, they offer substantial opportunities for market players to innovate and capture value from new applications across various sectors.

Key Takeaways

- The Global AR and VR Display Market size is expected to be worth around USD 26.4 Billion By 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 25.6% during the forecast period from 2024 to 2033.

- In 2023, VR (Virtual Reality) held a dominant market position in the By Type segment of the AR and VR Display Market, capturing more than a 57% share.

- In 2023, HMDs (Head-Mounted Displays) held a dominant market position in the By Device segment of the AR and VR Display Market, capturing more than a 65% share.

- In 2023, OLED (Organic Light Emitting Diode) held a dominant market position in the By Display Technology segment of the AR and VR Display Market, capturing more than a 42.3% share.

- In 2023, Gaming & Entertainment held a dominant market position in the end-user segment of the AR and VR Display Market, capturing more than a 45% share.

- Asia Pacific dominated a 41.6% market share in 2023 and held USD 1.12 Billion revenue of the AR and VR Display Marke.

By Type Analysis

In 2023, VR (Virtual Reality) held a dominant market position in the “By Type” segment of the AR and VR Display Market, capturing more than a 57% share. This dominance is primarily attributed to the extensive integration of VR technologies in various sectors such as gaming, training simulations, and educational content, which demand highly immersive experiences.

Virtual reality’s capacity to create entirely digital environments gives it an edge in applications where total immersion is critical, driving its substantial market share.

Conversely, AR (Augmented Reality) also shows promising growth prospects, although it currently occupies a smaller portion of the market. AR’s ability to overlay digital information onto the real world finds indispensable applications in fields like medical procedures, complex manufacturing, and retail, hinting at a broadening scope that could eventually challenge VR’s supremacy in the market.

The continuous advancements in AR technologies, coupled with increasing accessibility and affordability, are expected to catalyze its market share growth, making it an essential segment to watch in the coming years.

By Device Analysis

In 2023, HMDs (Head-Mounted Displays) held a dominant market position in the “By Device” segment of the AR and VR Display Market, capturing more than a 65% share. This significant market share is driven by the widespread adoption of HMDs in consumer electronics, particularly in gaming and immersive video content sectors, where they provide a deeply engaging experience.

The ability of HMDs to deliver high-quality visual and auditory immersion makes them a preferred choice for both personal entertainment and professional training simulations.

Other segments, such as Holograms, HUDs (Head-Up Displays), and Projectors, also contribute to the market dynamics but to a lesser extent. Holograms are increasingly used in experiential advertising and medical imaging, whereas HUDs find essential applications in the automotive and aviation industries for safety and operational efficiency.

Projectors are utilized in educational and corporate settings, enhancing presentations and collaborative projects with interactive displays. Despite their utility, the demand for these devices currently trails behind that of HMDs, as the latter continues to lead the market with their broad application spectrum and evolving technological enhancements.

By Display Technology Analysis

In 2023, OLED (Organic Light Emitting Diode) held a dominant market position in the “By Display Technology” segment of the AR and VR Display Market, capturing more than a 42.3% share. OLED’s prominence in the market is attributed to its superior color accuracy, contrast ratios, and faster response times, which are crucial for creating highly immersive and visually stunning AR and VR experiences.

This technology’s ability to display deep blacks and high brightness levels enhances the user’s sense of presence and immersion in virtual environments.

Other technologies like LCD, Micro-LED, and other emerging display types also play significant roles in the market. LCDs are widely utilized due to their cost-effectiveness and availability, making them a popular choice for budget-conscious consumers in the AR and VR realms. Micro-LED technology, though in its nascent stages, is gaining traction for its potential to offer superior brightness and energy efficiency compared to OLED.

The “Others” category, which includes emerging technologies like quantum dots and flexible displays, continues to innovate, promising future shifts in market dynamics. However, as of 2023, OLED remains the preferred technology, leading the segment with its advanced features that meet the high demands of AR and VR applications.

By End-User Analysis

In 2023, Gaming & Entertainment held a dominant market position in the “By End-User” segment of the AR and VR Display Market, capturing more than a 45% share. This sector’s leadership is largely driven by the escalating demand for immersive gaming experiences and interactive entertainment, which heavily rely on advanced AR and VR displays to enhance user engagement and realism.

The growth in this segment is further fueled by the proliferation of VR gaming consoles and platforms that offer expansive virtual worlds and interactive scenarios, appealing to a broad audience of gamers and tech enthusiasts.

Other significant segments include Aerospace & Defense, Automotive, Consumer, Education, Healthcare, and Others. Aerospace & Defense utilizes these technologies for simulation training and virtual missions. In Automotive, AR and VR are used for design, safety simulations, and customer engagement through virtual showrooms.

The Education and Healthcare sectors are rapidly adopting AR and VR for interactive learning and complex medical procedures respectively, indicating a growing trend towards digital transformation in these fields. Each of these sectors, while currently holding smaller shares than Gaming & Entertainment, demonstrates the potential for growth as technological advancements continue to broaden the applicability of AR and VR solutions across diverse industries.

Key Market Segments

By Technology

- AR

- VR

By Device

- HMDs

- Hologram

- HUDs

- Projectors

By Display Technology

- LCD

- Micro-LED

- OLED

- Others

By End-User

- Gaming & Entertainment

- Aerospace & Defense

- Automotive

- Consumer

- Education

- Healthcare

- Others

Drivers

AR and VR Market Drivers

A key driver for the AR and VR display market is the rapid advancement in immersive technology that significantly enhances user experience. This trend is particularly evident in sectors such as gaming, entertainment, and training simulations where the demand for realism and interactivity is continuously increasing.

Innovations in display technology, such as higher resolutions and faster refresh rates, are making AR and VR experiences more vivid and engaging. Furthermore, the integration of AR and VR into mobile devices is expanding the user base, making these technologies more accessible to a broader audience.

This accessibility is supported by the growing content ecosystem, where developers are creating a diverse array of applications, thereby driving consumer interest and industry investment in AR and VR displays. As these technologies become more integrated into everyday devices, their adoption is expected to rise, further fueling market growth.

Restraint

Cost Barrier in AR/VR Adoption

A significant restraint in the AR and VR display market is the high cost associated with AR and VR technologies, which can limit widespread adoption, especially among price-sensitive consumers and small businesses.

The expenses related to advanced display components, sensors, and computing power necessary for effective AR and VR applications make these technologies less accessible to the general public. Furthermore, the development costs for high-quality AR and VR content are considerable, which can deter content creators and developers from fully investing in these platforms.

This economic barrier not only affects consumer purchase decisions but also impacts the pace at which these technologies are integrated into mainstream applications. Overcoming this cost hurdle is crucial for the broader acceptance and expansion of AR and VR technologies in various sectors.

Opportunities

Expanding AR/VR in New Markets

A major opportunity in the AR and VR display market lies in expanding into new industry sectors that have untapped potential for immersive technologies. Areas such as education, healthcare, and real estate are increasingly recognizing the benefits of AR and VR for training, diagnostic purposes, and virtual tours, respectively.

As these sectors continue to explore and integrate AR and VR solutions, the demand for specialized displays will grow. Additionally, the ongoing improvements in network technologies like 5G will enhance the capabilities and performance of AR and VR applications, enabling more complex and interactive experiences.

This network evolution opens doors to more robust and scalable AR and VR deployments, potentially transforming how various industries operate and interact with digital content. Such expansions represent significant growth prospects for market players in the AR and VR display domain.

Challenges

Technical Hurdles in AR/VR

One of the major challenges facing the AR and VR display market is overcoming technical limitations that affect user experience. Issues such as latency, motion sickness, and limited field of view can deter users from adopting AR and VR technologies.

These problems stem from the current technological constraints in processing power and display technology, which are crucial for delivering smooth and immersive experiences. Additionally, the ergonomic design of AR and VR hardware often lacks the comfort needed for prolonged use, which can further limit consumer acceptance and usage.

Addressing these technical and design challenges is essential for enhancing the appeal and functionality of AR and VR systems, thereby encouraging wider adoption across various consumer and business segments. Overcoming these obstacles is key to unlocking the full potential of AR and VR technologies in the market.

Growth Factors

Key Growth Drivers for AR/VR

The AR and VR display market is experiencing robust growth, driven by several key factors. The increasing demand for immersive experiences in gaming, entertainment, and professional training is a primary catalyst.

As virtual and augmented realities become more prevalent, industries such as real estate and tourism are also leveraging these technologies for virtual tours and enhanced customer engagement. Furthermore, technological advancements in display resolution, refresh rates, and lightweight materials are improving the user experience, making AR and VR devices more comfortable and visually appealing.

Another significant growth factor is the integration of AR and VR in educational and healthcare applications, providing innovative solutions for learning and medical treatment. These factors collectively foster a growing market environment, pushing the boundaries of traditional display technologies and expanding the potential applications of AR and VR.

Emerging Trends

Emerging Trends in AR/VR Displays

Emerging trends in the AR and VR display market are reshaping how users interact with technology. One significant trend is the development of more portable and user-friendly AR glasses and VR headsets, which aim to integrate seamlessly into daily life rather than being used only for specific tasks.

There is also a growing focus on enhancing the realism of virtual environments through higher-resolution displays and improved color accuracy, making the experiences more lifelike and immersive. Additionally, the use of AR and VR for remote work and collaboration is gaining traction, providing tools for virtual meetings and workspace customization.

This trend is particularly relevant in today’s increasingly remote and flexible work culture. These innovations are making AR and VR technologies more accessible and applicable across a wider range of industries, promising continued growth and expansion in the market.

Regional Analysis

The AR and VR display market is globally segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Asia Pacific emerges as the dominating region, accounting for 41.6% of the market share with a value of USD 1.12 billion. This dominance is attributed to significant investments in AR and VR technologies by major tech companies and a surge in consumer demand within the region.

North America follows closely, driven by advanced technological infrastructure and the presence of key market players who are pushing the boundaries of AR and VR capabilities. Europe also shows robust growth, fueled by increasing adoption across automotive and healthcare sectors, with supportive government initiatives boosting market expansion.

In contrast, the Middle East & Africa, and Latin America are experiencing slower growth but show potential due to rising digital literacy and mobile penetration. These regions are beginning to embrace AR and VR for educational purposes and retail, indicating gradual but promising market penetration. Collectively, these regional dynamics underline a diverse and expanding global market landscape for AR and VR displays, with Asia Pacific leading the way in innovation and market reach.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global AR and VR display market has witnessed significant advancements, with Sony Corporation emerging as a key player. Sony’s strategic focus on enhancing the quality and performance of their AR and VR displays has positioned them at the forefront of the industry. The company has leveraged its longstanding expertise in display technology to develop high-resolution, fast-refresh panels that are essential for immersive AR and VR experiences. These innovations cater not only to gaming but also to educational and professional virtual environments, expanding their market reach.

Samsung Display Co., Ltd. is another prominent contributor, primarily due to its investment in OLED technology, which is crucial for the next generation of AR and VR applications. Samsung’s displays are known for their vibrant colors and deep blacks, characteristics that significantly enhance user immersion. Their continued R&D efforts aim to reduce screen door effects and motion blur, two common challenges in AR and VR displays, thus providing a more seamless user experience.

LG Display Co., Ltd., with its focus on both OLED and flexible display solutions, has tailored its offerings to meet the diverse needs of the AR and VR market. LG’s ability to produce ultra-lightweight and flexible screens has made it a favorite among headset manufacturers looking to reduce the weight and improve the comfort of their devices. LG’s innovations in this area not only enhance user comfort but also open new possibilities for AR and VR applications in various sectors including medical, automotive, and consumer electronics.

Top Key Players in the Market

- Sony Corporation

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- Microsoft Corporation

- HTC Corporation

- Google LLC

- Oculus (Meta Platforms, Inc.)

- Panasonic Corporation

- Vuzix Corporation

- Kopin Corporation

- Other Key Players

Recent Developments

- In February 2024, HTC Corporation launched a new VR headset, the VIVE Cosmos Elite X, which features a 120 Hz refresh rate and a wider field of view. The launch aims to solidify HTC’s position in the competitive VR market and offer a more immersive experience to users.

- In August 2023, Microsoft Corporation expanded its AR and VR capabilities by acquiring Magic Window, a startup specializing in holographic displays. The acquisition helps Microsoft enhance its mixed reality portfolio, which already includes the popular HoloLens devices.

- In June 2023, Google LLC introduced the latest version of its ARCore SDK, which supports enhanced AR experiences on Android devices. The update includes new capabilities for environmental understanding, allowing for more interactive and realistic AR applications.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Billion Forecast Revenue (2033) USD 26.4 Billion CAGR (2024-2033) 25.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology(AR, VR), By Device(HMDs, Hologram, HUDs, Projectors), By Display Technology(LCD, Micro-LED, OLED, Others), By End-User(Gaming & Entertainment, Aerospace & Defense, Automotive, Consumer, Education, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sony Corporation, Samsung Display Co., Ltd., LG Display Co., Ltd., Microsoft Corporation, HTC Corporation, Google LLC, Oculus (Meta Platforms, Inc.), Panasonic Corporation, Vuzix Corporation, Kopin Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AR and VR Display MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

AR and VR Display MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sony Corporation

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- Microsoft Corporation

- HTC Corporation

- Google LLC

- Oculus (Meta Platforms, Inc.)

- Panasonic Corporation

- Vuzix Corporation

- Kopin Corporation

- Other Key Players