Global Aquaculture Fertilizer Market Size, Share, And Business Benefits By Form (Granules, Powder, Liquid, Pellets), By Fertilizer Type (Nitrogenous Fertilizers, Phosphatic Fertilizers, Potassic Fertilizers, Compound, Organic, Chelated Micronutrient Fertilizers, Others), By Cultured Species (Finfish, Crustaceans, Mollusks, Seaweed and Algae, Others), By Application Method (Pond Soil Conditioning, Water Column Fertilization, Foliar/Direct Plant Fertilization in Integrated Systems, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 156984

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

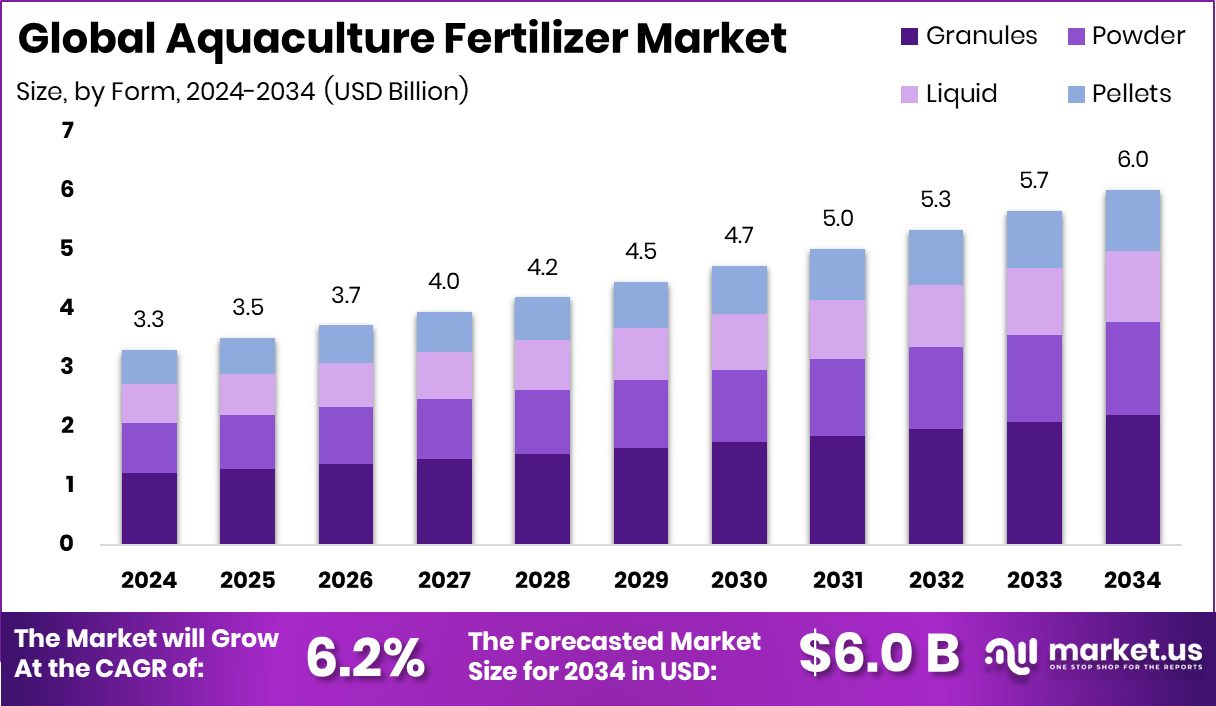

The Global Aquaculture Fertilizer Market is expected to be worth around USD 6.0 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. Strong seafood demand and supportive government initiatives boosted the Asia Pacific’s 43.7% market presence.

Aquaculture fertilizer refers to nutrient-based inputs used in fish and aquatic farming systems to boost the productivity of ponds and water bodies. These fertilizers provide essential nutrients like nitrogen, phosphorus, and potassium, which help stimulate the growth of natural food organisms such as plankton and algae.

This natural food becomes a vital nutritional source for farmed fish, shrimp, and other aquatic species, reducing dependence on artificial feed and improving the overall sustainability of aquaculture practices. According to an industry report, Additionally, the European Union announced €5.7 million under its blue economy initiative, targeting regenerative ocean farming and seaweed-centered projects to strengthen marine innovation.

The aquaculture fertilizer market represents the industry focused on producing, distributing, and adopting fertilizers specifically designed for aquatic farming. As aquaculture continues to expand globally to meet the rising demand for seafood, the market for these fertilizers grows in parallel.

It caters to a wide range of users, from small-scale fish farmers to large commercial operations, highlighting its importance in food security and sustainable farming practices. According to an industry report, in Europe, funding of €9 million has been committed to advance a large-scale seaweed project, focusing on sustainability and resource efficiency.

One of the key growth factors for the aquaculture fertilizer market is the rapid expansion of aquaculture as a reliable source of protein. With global fish consumption steadily increasing, farmers are under pressure to enhance pond productivity. Fertilizers that boost natural feed availability offer an efficient way to meet this demand while keeping costs balanced. According to an industry report, Umaro and Sway secured a $1.5 million DOE grant to transform seaweed waste into sustainable bioplastics, highlighting the role of ocean resources in green material development.

The demand for aquaculture fertilizers is also fueled by the need for sustainable and eco-friendly practices. As environmental concerns over feed waste and water pollution rise, fertilizers that enhance natural productivity offer a safer, more balanced option. This not only helps in maintaining water quality but also reduces the heavy reliance on manufactured feeds. According to an industry report, the U.S. Department of Energy has awarded USD 20 million to support 10 algae-based biofuel research projects, aiming to boost renewable energy innovation.

Key Takeaways

- The Global Aquaculture Fertilizer Market is expected to be worth around USD 6.0 billion by 2034, up from USD 3.3 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- Granular form leads the aquaculture fertilizer market, holding a 36.7% share due to easy application methods.

- Nitrogenous fertilizers account for 26.3%, driving strong growth with their essential role in pond productivity improvement.

- Finfish cultivation dominates usage at 49.1%, highlighting fertilizers’ importance in supporting high-yield aquaculture systems globally.

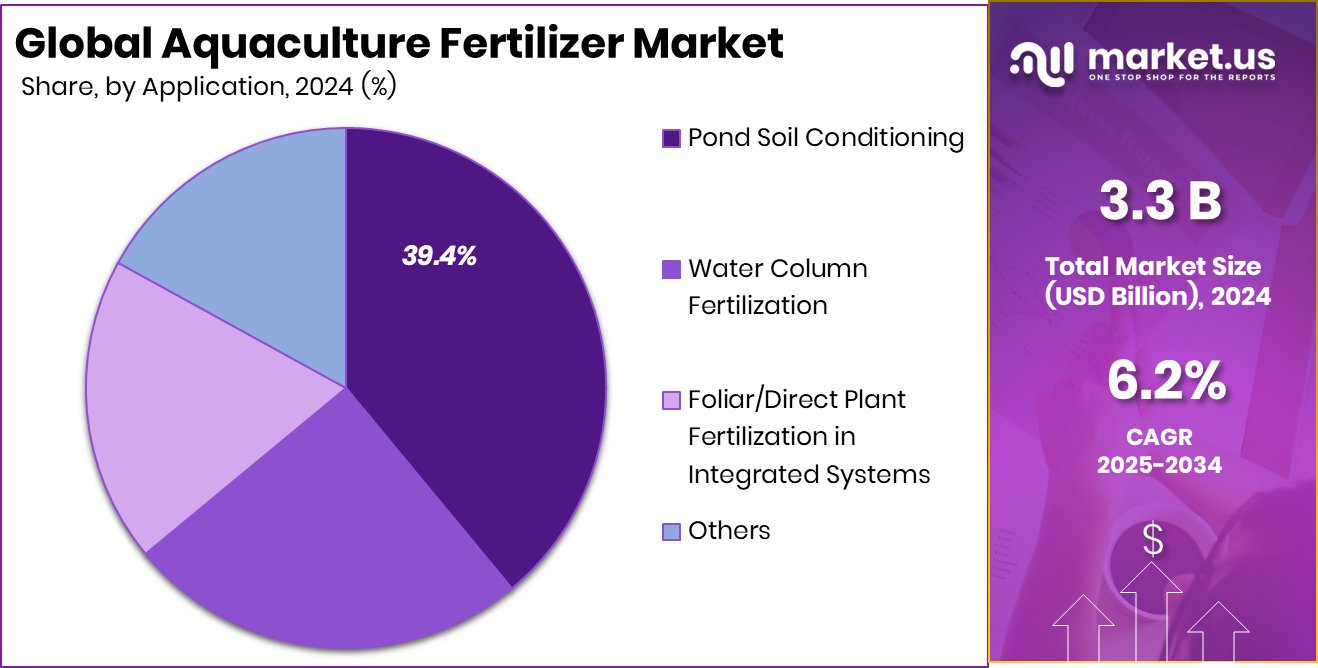

- Pond soil conditioning captures a 39.4% share, proving critical for maintaining balanced ecosystems and sustaining aquatic health.

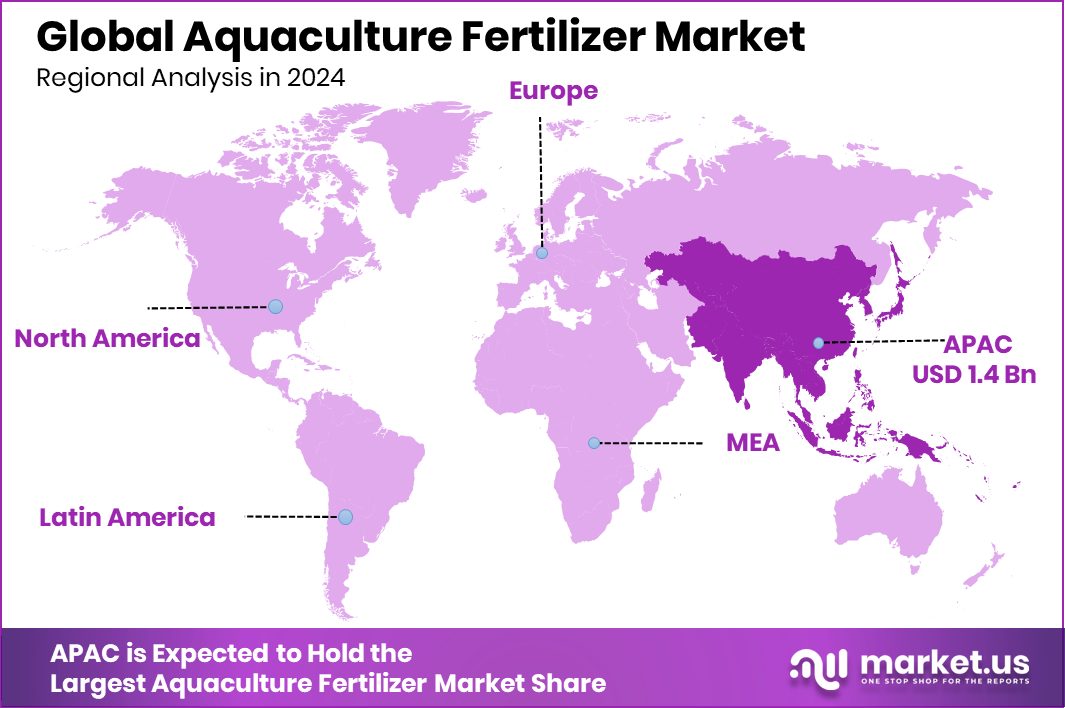

- The Asia Pacific market value reached USD 1.4 billion, driven by extensive aquaculture practices.

By Form Analysis

Granules dominate the aquaculture fertilizer market, holding a strong 36.7% share.

In 2024, Granules held a dominant market position in the By Form segment of the Aquaculture Fertilizer Market, with a 36.7% share. This leadership reflects the strong preference among aquaculture farmers for granular fertilizers due to their ease of handling, storage stability, and slow-release nutrient profile.

Granules provide a consistent supply of essential nutrients such as nitrogen, phosphorus, and potassium into ponds, which supports the sustained growth of plankton and other natural feed organisms. Their ability to enhance water productivity while maintaining nutrient balance makes them highly effective in intensive and semi-intensive aquaculture systems.

The granular form is also favored because of its efficiency in minimizing nutrient loss compared to liquid alternatives. Farmers benefit from better control over application rates, ensuring cost-effectiveness and improved yield outcomes. Moreover, granular fertilizers are adaptable across different aquatic species, including fish and shrimp, making them a versatile choice for diverse aquaculture practices.

As aquaculture expands globally to meet rising seafood demand, the granular segment’s share is expected to remain significant. The 36.7% share underscores its role as a reliable solution that addresses both productivity and sustainability goals, positioning it as a cornerstone in the overall aquaculture fertilizer market.

By Fertilizer Type Analysis

Nitrogenous fertilizers lead the aquaculture fertilizer market with a 26.3% contribution.

In 2024, Nitrogenous Fertilizers held a dominant market position in the By Fertilizer Type segment of the Aquaculture Fertilizer Market, with a 26.3% share. This dominance highlights the critical role of nitrogen in supporting the rapid growth of phytoplankton, which serves as a primary food source in aquaculture systems.

Nitrogenous fertilizers are widely recognized for their ability to enhance pond fertility, boost natural feed availability, and improve the overall carrying capacity of water bodies. These benefits translate directly into healthier and faster-growing fish and shrimp, making nitrogen-based products a preferred choice among aquaculture farmers.

The 26.3% share also reflects the cost-effectiveness and widespread adoption of nitrogenous fertilizers across both small-scale and commercial aquaculture operations. Their quick solubility ensures efficient nutrient uptake, enabling farmers to maintain consistent productivity even in highly intensive farming setups.

Furthermore, nitrogenous fertilizers contribute to reducing dependency on external feed, lowering input costs while improving sustainability. As aquaculture continues to grow as a major source of global protein supply, the reliance on nitrogen-rich solutions is expected to remain strong. This solid market position demonstrates how nitrogenous fertilizers have become integral in achieving yield optimization and meeting the increasing global demand for seafood.

By Cultured Species Analysis

Finfish culture drives the aquaculture fertilizer market, capturing 49.1% of global demand.

In 2024, Finfish held a dominant market position in the By Cultured Species segment of the Aquaculture Fertilizer Market, with a 49.1% share. This strong presence is largely attributed to the global preference for finfish as a primary source of protein, with species such as tilapia, carp, and catfish being widely cultivated.

Fertilizers play a crucial role in finfish farming by enhancing the natural food web in ponds, particularly through the stimulation of phytoplankton and zooplankton growth, which form the foundational diet for many finfish species. The ability of fertilizers to improve water productivity and sustain consistent growth cycles has made them indispensable in this segment.

The 49.1% share also reflects the extensive adoption of aquaculture fertilizers in regions where finfish farming is most prominent, including Asia-Pacific, Africa, and parts of Latin America. The reliance on fertilizers ensures that farmers can maintain pond fertility at optimal levels, reducing the pressure on supplementary feed inputs while keeping operational costs balanced.

With the global demand for affordable and sustainable fish protein continuing to rise, the finfish segment is expected to hold its dominant position. This significant market share highlights the vital role fertilizers play in supporting finfish aquaculture and meeting expanding seafood consumption needs.

By Application Method Analysis

Pond soil conditioning powers the aquaculture fertilizer market, accounting for 39.4% usage.

In 2024, Pond Soil Conditioning held a dominant market position in the By Application Method segment of the Aquaculture Fertilizer Market, with a 39.4% share. This dominance stems from the critical role soil quality plays in aquaculture productivity, as the pond bottom directly influences water chemistry and nutrient availability.

Fertilizers used for soil conditioning improve the organic matter content and nutrient balance in pond soils, which in turn promotes the growth of natural feed organisms such as plankton. By creating a stable and nutrient-rich foundation, pond soil conditioning helps farmers achieve healthier aquatic environments and better yield outcomes.

The 39.4% share also reflects the effectiveness of soil conditioning in addressing common challenges such as nutrient depletion, acidity, and imbalances caused by repeated farming cycles. Farmers prefer this method because it ensures long-term pond fertility, enhances water stability, and reduces dependency on costly artificial feeds.

Moreover, soil-based applications provide sustained nutrient release, supporting continuous productivity throughout the culture period. With aquaculture expanding as a global food source, the reliance on pond soil conditioning is expected to remain strong. This dominant share highlights its importance as a reliable method that improves pond health, enhances sustainability, and supports consistent aquaculture growth.

Key Market Segments

By Form

- Granules

- Powder

- Liquid

- Pellets

By Fertilizer Type

- Nitrogenous Fertilizers

- Phosphatic Fertilizers

- Potassic Fertilizers

- Compound

- Organic

- Chelated Micronutrient Fertilizers

- Others

By Cultured Species

- Finfish

- Crustaceans

- Mollusks

- Seaweed and Algae

- Others

By Application Method

- Pond Soil Conditioning

- Water Column Fertilization

- Foliar/Direct Plant Fertilization in Integrated Systems

- Others

Driving Factors

Rising Global Demand for Aquaculture-Based Protein

One of the biggest driving factors for the aquaculture fertilizer market is the rising global demand for fish and other aquaculture-based protein. With the world population growing rapidly, seafood has become an essential source of affordable and healthy protein.

Fertilizers play a key role in supporting this demand by improving pond productivity and ensuring the growth of natural feed like plankton, which is vital for fish and shrimp.

As more people shift toward healthier diets, aquaculture continues to expand, especially in the Asia-Pacific and developing regions. This creates a consistent need for fertilizers that can boost yields, maintain water quality, and help farmers meet both local and export market demands efficiently and sustainably.

Restraining Factors

Environmental Concerns Over Excessive Nutrient Runoff

A major restraining factor for the aquaculture fertilizer market is the environmental concern linked to excessive nutrient runoff. When fertilizers are not applied properly, nutrients like nitrogen and phosphorus can accumulate in water bodies, leading to problems such as algal blooms and oxygen depletion.

These imbalances harm aquatic life and may reduce overall pond health, creating risks for both farmers and ecosystems. Increasing awareness about water pollution and stricter government regulations on fertilizer use make farmers cautious in adopting.

While fertilizers are essential for boosting productivity, their misuse can backfire, limiting growth in the market. Balancing higher yields with safe, sustainable application practices remains a key challenge for aquaculture fertilizer adoption worldwide.

Growth Opportunity

Expansion of Bio-Based and Eco-Friendly Fertilizers

A key growth opportunity in the aquaculture fertilizer market lies in the development and adoption of bio-based and eco-friendly fertilizers. Farmers and regulators are increasingly seeking sustainable solutions that improve pond productivity without harming water quality or surrounding ecosystems.

Bio-based fertilizers, made from natural materials such as organic waste, seaweed, or plant extracts, can provide balanced nutrients while reducing the risk of pollution. They also support long-term soil and water health, which is vital for sustainable aquaculture.

With rising global focus on green farming and government encouragement for eco-friendly inputs, the shift toward bio-based fertilizers offers strong potential. This opportunity not only addresses environmental concerns but also creates value for farmers through improved yields and reduced risks.

Latest Trends

Adoption of Precision Fertilization in Aquaculture Practices

One of the latest trends in the aquaculture fertilizer market is the adoption of precision fertilization techniques. Farmers are now using data-driven tools and monitoring systems to apply fertilizers more accurately, ensuring the right nutrients reach ponds in the right amount and at the right time.

This approach helps reduce wastage, prevents water pollution, and enhances overall pond productivity. Precision fertilization also lowers input costs by avoiding overuse of fertilizers, making aquaculture more sustainable and profitable.

With the rise of digital farming technologies and increased awareness about resource efficiency, this trend is gaining momentum. It reflects the industry’s move toward smarter, controlled, and environmentally responsible farming practices that align with global sustainability goals.

Regional Analysis

In 2024, the Asia Pacific dominated the Aquaculture Fertilizer Market with a 43.7% share.

The Aquaculture Fertilizer Market shows strong regional variations, reflecting differences in aquaculture practices, consumption patterns, and resource availability. Asia Pacific emerged as the dominating region in 2024, holding a 43.7% share valued at USD 1.4 billion.

This dominance is largely driven by the region’s vast aquaculture base in countries such as China, India, Vietnam, and Indonesia, where fish and shrimp farming are integral to food security and export earnings. Fertilizer use in these regions is essential for enhancing pond productivity and ensuring a stable supply of affordable seafood for growing populations.

North America and Europe demonstrate steady adoption, supported by advanced farming practices and a strong focus on sustainability. Farmers in these regions emphasize controlled fertilizer usage to balance productivity with environmental safeguards, aligning with regulatory frameworks.

In the Middle East & Africa, aquaculture fertilizer demand is growing as nations diversify food resources and improve local aquaculture systems in arid conditions. Latin America, with its expanding aquaculture production of shrimp and tilapia, is also increasing fertilizer adoption to maximize yields and support exports.

While each region contributes to market growth, Asia Pacific’s scale, population-driven demand, and government support keep it at the forefront of global aquaculture fertilizer development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

URALCHEM JSC maintained its position as a prominent supplier of nitrogen and phosphate-based fertilizers, catering to the growing demand for nutrient-rich solutions in aquaculture. The company’s focus on reliable product quality and large-scale distribution allowed it to meet the needs of both domestic and international aquaculture markets, especially in regions where nitrogenous fertilizers remain critical for pond productivity.

Sinofert Holdings Limited, one of China’s largest fertilizer enterprises, played a vital role in driving aquaculture fertilizer adoption across the Asia Pacific, the world’s dominant aquaculture hub. The company’s extensive distribution networks and government-linked initiatives provided a competitive advantage, ensuring that fertilizers reached small-scale and commercial fish farmers efficiently. Its strong presence in China’s aquaculture industry reinforced its role as a key growth driver in the regional market.

Yara International ASA, recognized for its global reach and commitment to sustainable solutions, advanced its presence in aquaculture fertilizers through innovative nutrient products and eco-friendly practices. The company’s focus on balanced formulations helped enhance pond ecosystems while aligning with environmental standards. Yara’s expertise in precision agriculture further supported efficient fertilizer use, minimizing waste while maximizing yield benefits.

Top Key Players in the Market

- URALCHEM JSC

- Sinofert Holdings Limited

- Yara International ASA

- Nutrien Limited

- The Mosaic Company

- OCP SA

- ICL Group Ltd

- Sinochem Group Co., Ltd.

- Ostara Nutrient Recovery Technologies Inc.

Recent Developments

- In December 2024, Uralchem JSC donated 55,000 tonnes of potash fertilizer to Sri Lanka in a humanitarian initiative, marking a significant contribution to food support efforts in the country.

- In July 2024, Sinofert successfully acquired China Fertilizer (Holdings) Company Limited and its subsidiaries. This move broadened their fertilizer supply chain and strengthened their market presence.

Report Scope

Report Features Description Market Value (2024) USD 3.3 Billion Forecast Revenue (2034) USD 6.0 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Granules, Powder, Liquid, Pellets), By Fertilizer Type (Nitrogenous Fertilizers, Phosphatic Fertilizers, Potassic Fertilizers, Compound, Organic, Chelated Micronutrient Fertilizers, Others), By Cultured Species (Finfish, Crustaceans, Mollusks, Seaweed and Algae, Others), By Application Method (Pond Soil Conditioning, Water Column Fertilization, Foliar/Direct Plant Fertilization in Integrated Systems, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape URALCHEM JSC, Sinofert Holdings Limited, Yara International ASA, Nutrien Limited, The Mosaic Company, OCP SA, ICL Group Ltd, Sinochem Group Co., Ltd., Ostara Nutrient Recovery Technologies Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aquaculture Fertilizer MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample

Aquaculture Fertilizer MarketPublished date: September 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- URALCHEM JSC

- Sinofert Holdings Limited

- Yara International ASA

- Nutrien Limited

- The Mosaic Company

- OCP SA

- ICL Group Ltd

- Sinochem Group Co., Ltd.

- Ostara Nutrient Recovery Technologies Inc.