Global API Management Market By Deployment Type (Cloud, On-Premises, and Hybrid), By Component (Solutions (API Platform, API Analytics, API Security) and Services (Integration & Implementation, Consulting, Training & Education, Others)), By Application (Aerospace and Defense, BFSI, Automotive, Transportation, Healthcare and Lifesciences,Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Sept. 2024

- Report ID: 49401

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

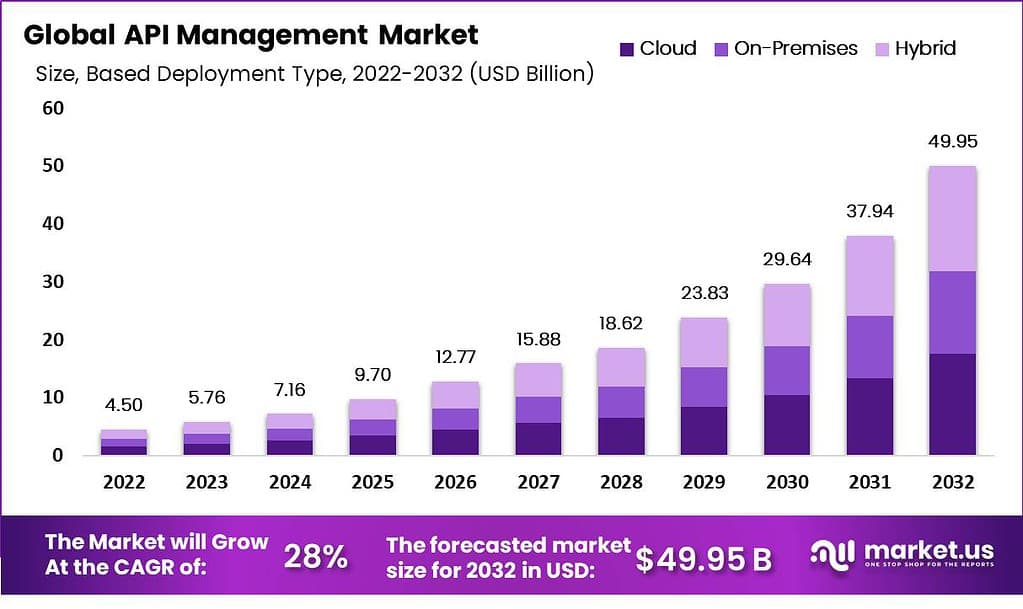

The Global API Management Market size is expected to be worth around USD 49.95 Billion By 2032, from USD 5.76 Billion in 2023, growing at a CAGR of 28% during the forecast period from 2023 to 2032.

API management refers to the processes involved in creating, publishing, documenting, and overseeing application programming interfaces (APIs) in a secure and scalable environment. This management encompasses the tools and practices that ensure that the APIs created by organizations or developers are consistent and provide the performance and functionality intended. Effective API management helps businesses monitor API usage, enforce security protocols, and manage the lifecycle of APIs, from creation to deprecation.

The API management market has been growing rapidly, driven by the increasing need for businesses to integrate and manage APIs effectively across a range of digital platforms. This market encompasses solutions that provide tools for security, analytics, gateway, and lifecycle management of APIs. As businesses continue to adopt cloud technologies and digital transformation strategies, the demand for robust API management solutions is expected to rise, fueling further growth in this sector.

The demand for API management solutions is primarily fueled by the rapid expansion of digital services and the need for seamless integration across various applications and data systems. As businesses increasingly rely on software applications to drive customer engagement and operational efficiency, managing the interfaces that allow these applications to communicate effectively has become critical. The proliferation of mobile apps, cloud-based services, and IoT devices further underscores the necessity for robust API management to ensure consistent and efficient data interchange.

For instance, IBM acquired StepZen in February 2023 to strengthen its API management portfolio, particularly in GraphQL API creation. This acquisition helps IBM provide faster, more efficient ways to manage APIs in hybrid cloud environments

Several factors contribute to the growth of the API management market. First, the increasing emphasis on digital transformation initiatives across industries drives the adoption of API management solutions. Secondly, regulatory requirements for data privacy and security, such as GDPR and HIPAA, necessitate more sophisticated management and monitoring of APIs.

Finally, the shift towards cloud environments and the need for integration with third-party services further enhance the demand for effective API management tools that can support scalable and secure API operations. These factors collectively propel the market forward, as organizations seek to optimize their API strategies in response to an evolving digital landscape.

In March 2023, OpenAI launched a new API for ChatGTP, designed for integration into websites, apps, and email systems. This move enables businesses to scale up their operations by incorporating advanced text generation capabilities. According to OpenAI, the ChatGTP API stands out for its efficiency, offering robust and scalable solutions that meet growing enterprise demands for automated and intelligent text generation.

The market offers significant opportunities for providers of API management solutions to innovate and expand their offerings. There is a growing need for advanced features such as real-time analytics, machine learning capabilities, and comprehensive security solutions to protect against data breaches.

Moreover, as more companies adopt a micro-services architecture, the complexity of managing multiple APIs increases, presenting further opportunities for API management platforms that can simplify and streamline this process. Businesses seeking to enhance their digital ecosystems can leverage these platforms to gain a competitive edge.

According to Analyzing Alpha, 70% of all public APIs are REST APIs, highlighting their widespread adoption due to their simplicity and efficiency in building applications. A substantial 56% of enterprise leaders recognize that APIs are pivotal in crafting superior digital experiences and products, underscoring their integral role in innovation and customer engagement. Furthermore, 57% of web applications rely on APIs, indicating their critical role in modern web development.

In the travel industry, APIs contribute significantly to revenue, with 90% of the top online travel aggregator income generated through APIs. This trend is mirrored in the eCommerce sector, where 60% of leading portal revenues stem from API integration, showcasing APIs’ capacity to streamline and enhance online commerce operations.

Despite the broad utility and economic benefits of APIs, only 15% are publicly available, which may stifle broader innovation and development. The banking sector, for instance, sees just 5% of APIs being used externally to generate revenue, suggesting a cautious approach towards open API strategies. Interestingly, the majority of APIs are either private (58%) or partner-facing (27%), limiting wider developer access and potentially curtailing collaborative opportunities.

By 2024, it is projected that 75% of mobile app development will leverage hybrid and microservices architectures that utilize APIs, indicating a shift towards more modular and scalable app construction. APIs are also a cornerstone in digital transformation strategies for 69% of organizations, emphasizing their role as essential tools for business evolution.

Executive perspectives reinforce this trend, with over 90% stating that APIs are mission-critical to their operations, highlighting the essential nature of APIs in driving business processes and fostering new avenues for growth and innovation

Key Takeaways

- The global API Management market is projected to expand significantly, reaching an estimated value of USD 49.95 billion by 2032, up from USD 5.76 billion in 2023. This growth represents a robust compound annual growth rate (CAGR) of 28% from 2023 to 2032.

- In 2022, the On-Premises deployment model was highly favored in the API Management sector, securing over 28% of the market share. This preference highlights the ongoing demand for on-premises solutions that provide organizations with control over their API infrastructure.

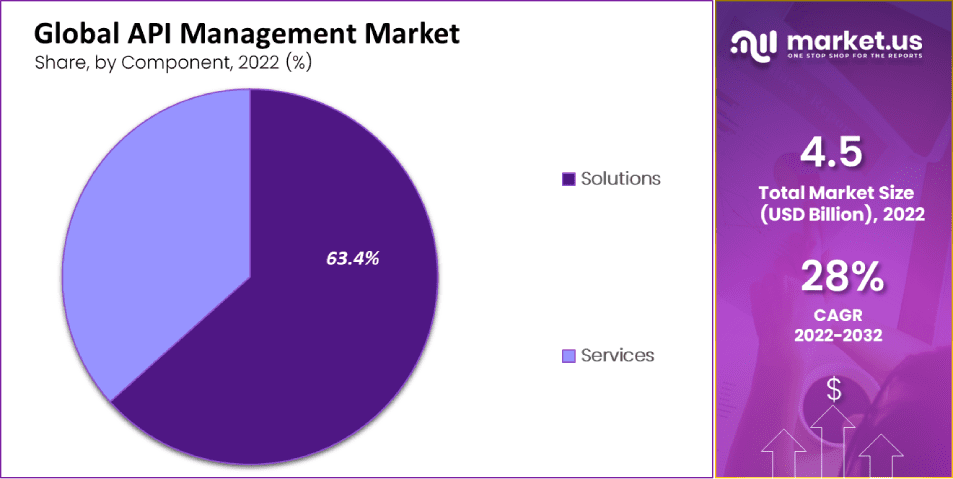

- The Solutions component of the API Management market also demonstrated a strong market presence, capturing more than 63.4% of the market in the same year. This dominance underscores the critical role of API management solutions in helping businesses streamline operations and enhance digital services.

- In the industry-specific breakdown, the BFSI (Banking, Financial Services, and Insurance) sector emerged as a leading adopter of API management technologies, reflecting the sector’s focus on enhancing digital transaction capabilities and security measures.

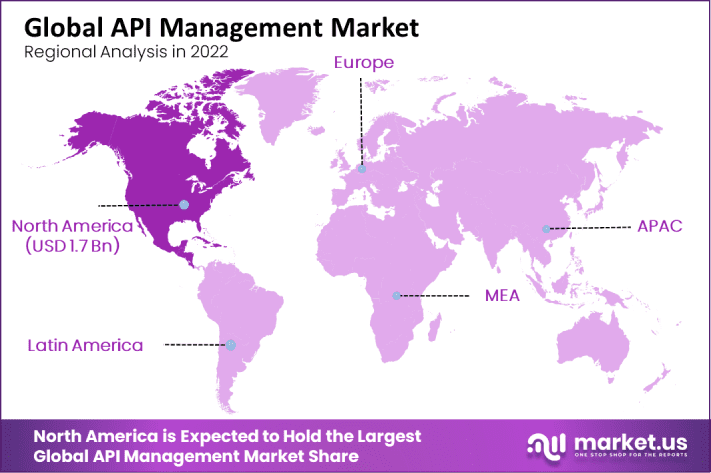

- Regionally, North America continued to lead the global landscape with a substantial market share of more than 37.6% and revenues amounting to USD 1.7 billion in 2022. This dominance can be attributed to the region’s advanced IT infrastructure, robust compliance standards, and the rapid adoption of new technologies aimed at improving business processes and customer engagements.

Deployment Type Analysis

In 2022, the On-Premises segment held a dominant market position within the API Management Market, capturing more than a 28% share. This prevalence can be attributed to several intrinsic advantages that on-premises deployment offers over its cloud-based counterparts.

Primarily, organizations opt for on-premises solutions due to the enhanced control and security it provides. These systems are hosted internally, giving companies direct oversight over their API management platforms and sensitive data, a critical factor for industries subject to stringent regulatory compliance such as finance and healthcare.

Additionally, on-premises API management solutions allow organizations to customize their setups extensively to align with specific operational requirements and integrate seamlessly with existing in-house IT infrastructure. This level of integration and customization is particularly beneficial for organizations with complex systems or those that operate in sectors where customization leads to significant performance improvements and operational efficiencies.

Another compelling factor for the prominence of the on-premises segment is the predictability in cost management. Unlike cloud solutions, where costs can vary based on data traffic and storage needs, on-premises solutions involve upfront investments but generally lead to lower ongoing operational costs. For large enterprises, this can translate into substantial cost savings over time.

Moreover, these solutions do not rely on external internet connectivity, which can further enhance system performance and reliability, critical factors for businesses that prioritize uptime and speed in their API interactions.

Component Analysis

In 2022, the Solutions segment held a dominant market position within the API Management Market, capturing more than a 63.4% share. This substantial market share can be largely attributed to the escalating demand for robust API management platforms that facilitate secure and efficient API creation, deployment, and maintenance.

As businesses increasingly adopt digital transformation strategies, the need for scalable and flexible API solutions that can support a growing number of digital services and applications has surged, driving the demand for comprehensive API management solutions.

These solutions offer a myriad of functionalities that are crucial for the seamless integration of backend systems and third-party services, including API gateway, analytics, developer portal, and security. By utilizing these solutions, businesses can ensure the security of their data transactions, monitor API performance, and enhance the overall user experience.

Moreover, the solutions segment benefits from the continuous innovations by key players who frequently introduce advanced features and integrations that further refine API management processes and expand their application across various industries.

Furthermore, the growing recognition of APIs as pivotal components in building a connected business environment has propelled the adoption of API management solutions. These solutions not only help in managing the life cycle of APIs but also enable organizations to harness the potential of their digital assets, optimize data exchange, and create new business models based on the interoperability of systems and data.

This trend is especially pronounced in sectors like banking, retail, and telecommunications, where the ability to quickly deploy and manage APIs directly correlates with enhanced operational efficiency and improved customer service.

Application Analysis

In 2022, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant position in the API Management Market, capturing a significant market share. This leadership can be attributed to several critical factors that are intricately linked to the digital transformation initiatives across the financial sector. As financial institutions continue to modernize their operations and service delivery, APIs have become pivotal in enabling interoperability and providing seamless customer experiences.

APIs facilitate a wide array of functionalities in BFSI, from enhancing mobile banking features to enabling secure transactions and expanding the integration of financial services into broader ecosystems. The push towards Open Banking regulations in regions like Europe and Asia-Pacific necessitates robust API management to securely expose banking services to third-party providers.

The demand for APIs in the BFSI sector is propelled further by the need for real-time banking data exchanges and the growing adoption of blockchain and payment gateways that rely on efficient API integration. Furthermore, the BFSI sector is highly regulated, necessitating stringent compliance and security measures.

API management solutions help institutions ensure that their API ecosystems comply with regulations such as PSD2, GDPR, and others, while also providing the analytics capabilities needed to monitor API performance and usage patterns. This not only aids in maintaining operational excellence but also protects against potential cyber threats, thereby enhancing trust and reliability among consumers.

Considering these factors, the BFSI segment’s prominence within the API Management Market is well justified. It represents a critical area where API management tools can deliver substantial value by improving service delivery, ensuring compliance, and driving innovations through secure and scalable API integrations.

The ongoing digital transformation and competitive pressures in the financial sector are likely to sustain, if not increase, the demand for advanced API management solutions, securing BFSI’s position as a leading segment in this market.

Key Market Segments

Based Deployment Type

- Cloud

- On-Premises

- Hybrid

Based on Component

- Solution

- API Platform

- API Analytics

- API Security

- Services

- Integration & Implementation

- Consulting

- Training & Education

- Others

Based on Application

- Aerospace and Defense

- BFSI

- Automotive

- Transportation

- Healthcare and Lifesciences

- Other Applications

Driver

Increasing Demand for Data Analytics and Automation

The API management market is being driven by a growing need for data-driven decision-making and the integration of automation to streamline workflows. As digital transformation accelerates across various sectors, organizations are increasingly reliant on APIs to enhance their operational efficiencies and customer interactions.

APIs facilitate the seamless flow of data and are pivotal in implementing advanced analytics and automation technologies that help in predictive analytics, improving customer service, and optimizing operational processes.

Restraint

High Costs

The expansion of API management solutions is significantly restrained by the high costs associated with their implementation and maintenance. Establishing a robust API management system requires substantial investment in technology, expert personnel, and continuous upgrades.

For many small to medium enterprises, these costs are prohibitive, and even larger organizations often hesitate due to the substantial initial and ongoing financial commitment required without guaranteed returns. This financial barrier can limit the adoption and scalability of API management systems across industries.

Opportunity

Expansion of API Marketplaces

The API management market sees a significant opportunity in the expansion and monetization of API marketplaces. These platforms allow businesses to list and monetize their APIs by making them available to a broader developer community, thus creating potential revenue streams.

As companies continue to develop both internal and public APIs, these marketplaces facilitate a thriving ecosystem where API providers and consumers can interact, fostering innovation and driving the API economy. This trend is supported by the success of established platforms like AWS and Google Cloud, which exemplify the viability and profitability of API marketplaces.

Challenge

Multi-cloud API Management

A major challenge in the API management market is the management of APIs across multi-cloud environments. As organizations increasingly adopt a multi-cloud strategy, managing APIs that are distributed across multiple cloud platforms becomes complex.

This complexity requires advanced solutions that can handle diverse cloud environments and ensure seamless integration, security, and governance across all platforms. Developing such comprehensive API management solutions that can efficiently operate in a multi-cloud ecosystem is a significant challenge for vendors in the market.

Emerging Trend

Low-code Development Platforms

An emerging trend in the API management sector is the adoption of low-code development platforms. These platforms simplify the API development process, allowing more users, including those with minimal coding skills, to create and manage APIs.

This democratization of API development is expected to broaden the base of API creators and users, accelerating innovation and application development within organizations. This trend is aligned with the overall movement towards more agile and inclusive digital transformation strategies across industries.

Regional Analysis

In 2022, North America held a dominant position in the API Management market, capturing more than a 37.6% share with revenues amounting to USD 1.7 billion. This region’s leading status can be attributed to several pivotal factors that support its robust market performance.

North America’s predominance in this market largely stems from the strong presence of key industry players and early adopters of technology. The region is home to numerous tech giants and innovative startups that continuously enhance and promote the adoption of advanced API management solutions. Such a concentrated tech ecosystem fosters a competitive environment where businesses rapidly adopt new technologies to maintain or enhance their market positions.

Furthermore, the region shows a high degree of digital transformation across various sectors, including government, healthcare, finance, and retail, which significantly contributes to the growth of the API management market. These industries are increasingly relying on digital solutions to improve customer experiences and operational efficiencies, driving demand for API management to handle the surge in digital interactions and data exchanges.

Additionally, North America has a mature regulatory framework that mandates stringent data protection and privacy standards. Organizations in this region are investing in on-premises and hybrid API management solutions to comply with these regulations, bolstering the market’s growth. For instance, compliance with standards such as HIPAA in healthcare and Sarbanes-Oxley in finance has pushed enterprises to adopt robust API management frameworks that ensure secure and compliant data handling.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the rapidly evolving landscape of API management, several key players have established themselves as leaders through strategic acquisitions, innovative product launches, and significant mergers. Google Inc., IBM Corporation, and Amazon Web Services are at the forefront, each making notable moves to enhance their market positions.

Google Inc. has been proactive in enhancing its API management capabilities, particularly through its acquisition of Apigee. This acquisition has allowed Google to integrate advanced API analytics and management tools into its cloud services, offering robust solutions that cater to the increasing demands for digital transformation and cloud-based architectures.

IBM Corporation, another major player, has expanded its API management offerings by launching IBM API Connect, a comprehensive solution that supports the entire API lifecycle from creation to management. This product leverages IBM’s strong cloud infrastructure and enterprise integration capabilities, enabling users to deploy and manage APIs with enhanced scalability and security features.

Amazon Web Services (AWS) has consistently led innovations in cloud services, which extends to their API management through AWS API Gateway. This service allows developers to create, publish, maintain, monitor, and secure APIs at any scale. Moreover, AWS’s focus on seamless integration with other AWS services enhances its attractiveness to developers looking for a unified cloud experience.

Top Key Players in the Market

- Google Inc.

- IBM Corporation

- Amazon Web Services

- Microsoft Corporation

- Akamai Technologies, Inc.

- WSO2

- Broadcom Inc.

- Axway Software

- TIBCO Software Inc.

- Software AG

- Torry Harris Business Solutions

- Cloud Elements, Inc.

- Mashape Inc.

- Workato

- Kong Inc.

- Tray.io

- Other Key Players

Recent Developments

- Akamai Technologies announced its intent to acquire Noname Security in May 2024 for approximately $450 million. This acquisition is designed to enhance Akamai’s API security capabilities, addressing the growing need for comprehensive API protection as API attacks have surged by 109% year-over-year.

- Google Cloud’s Apigee continues to innovate in the API management sector. In 2023, Apigee was once again named a leader in the Gartner Magic Quadrant for API Management, reflecting its strong position in the market due to its comprehensive capabilities in supporting diverse use cases.

- AWS strengthened its API Gateway services by adding new features such as Amazon API Gateway Versioning in 2023, which allows developers to manage and evolve their APIs more efficiently. AWS has also integrated machine learning tools into its API services to improve automation and analytics

Report Scope

Report Features Description Market Value (2023) USD 5.7 Bn Forecast Revenue (2032) USD 49.9 Bn CAGR (2023-2032) 28% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Type – Cloud, On-Premises, and Hybrid; By Component – Solution and Services; and By Application – Aerospace & Defense, BFSI, Automotive, Transportation, Healthcare & Lifesciences, and Other Applications Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google Inc., Apigee, IBM Corporation, Amazon Web Services, Microsoft, Akamai Technologies, WSO2, Broadcom Inc., Axway Software, TIBCO Software Inc., Software AG, Torry Harris Business Solutions, Cloud Elements, Inc., Mashape Inc., Workato, Kong Inc., Tray.io, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Google Inc.

- IBM Corporation

- Amazon Web Services

- Microsoft Corporation

- Akamai Technologies, Inc.

- WSO2

- Broadcom Inc.

- Axway Software

- TIBCO Software Inc.

- Software AG

- Torry Harris Business Solutions

- Cloud Elements, Inc.

- Mashape Inc.

- Workato

- Kong Inc.

- Tray.io