Global Aortic Aneurysm Market by Type (Thoracic Aortic Aneurysm (TAA), Abdominal Aortic Aneurysm (AAA), By Product Type (Stent Grafts, Catheters), By Treatment, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 102305

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

In 2022, the global aortic aneurysm market was worth USD 4 billion. It is estimated to reach USD 10.87 billion in 2032 at the highest CAGR of 10.8% between 2023-2032.

The balloon-like bulges in the aorta, the primary artery that transports oxygenated blood throughout the body, are described as aortic aneurysms. The aorta consists of tough walls that can withstand normal blood pressure.

Certain medical illnesses, genetic diseases, and trauma, on the other hand, can damage or weaken these walls. An aneurysm is caused by the force of blood pushing against weakened or injured walls. The prime location for an aneurysm is the abdominal aortic aneurysm. The aorta’s abdominal portion goes through the stomach. It transports oxygen-rich blood from the heart to the abdominal and lower limb tissues and organs. Thoracic aortic aneurysms are less common and develop in the chest part of the aorta, above the diaphragm.

An increasing incidence of cardiovascular diseases, the growing elderly population, technological innovations in therapeutics, and growing knowledge of the numerous treatment options are some of the primary drivers fuelling this market’s revenue growth. Furthermore, augmented demand for less invasive procedures and favorable reimbursements are driving expansion. The aortic aneurysm market is expected to gain from an increase in government-sponsored activities to raise awareness of the disease and promote early detection and treatment.

Key Takeaways

- Market Growth: Aortic aneurysm market is expected to grow at 10.8% CAGR from 2023 to 2032, reaching USD 10.87 billion.

- Geriatric Population: The global elderly population is rising; by 2050, 16% will be over 65, increasing the demand for treatment.

- Cardiovascular Disease Prevalence: Cardiovascular diseases caused 19.1 million deaths globally in 2020, driving demand for aortic aneurysm treatment.

- Minimally Invasive Surgery: Minimally invasive procedures offer faster recovery, leading to increased demand in the market.

- Market Segmentation: The market is categorized into TAA, AAA, stent-grafts, catheters, OSR, EVAR, and end-user segments.

- Regional Dominance: North America holds over 51% of the market share, driven by established healthcare infrastructure.

- Emerging Asia-Pacific Market: Asia-Pacific shows the fastest market growth due to an aging population and increased healthcare spending.

Driving Factors

Rising geriatric population

Almost every country in the world is witnessing a rise in the proportion of elderly people in its population. According to the World Population Prospects 2019, by the year 2050, one in every six individuals will be over the age of 65, up from one in every eleven in 2019. In 2019, there were 703 million people worldwide who were 65 or older. Globally, the proportion of the population aged 65 and up climbed from 6% in 1990 to 9% in 2019.

This number is expected to climb to 16% by 2050, implying that one in every six persons will be 65 or older. In Eastern and South-Eastern Asia, the percentage of the population aged 65 and up doubled from 6% in 1990 to 11% in 2019, and in Latin America and the Caribbean, it increased from 5% in 1990 to 9% in 2019.

The proportion of older people is expected to more than double between 2019 and 2050 in four regions: Northern Africa and Western Asia, Central and Southern Asia, Latin America and the Caribbean, and Eastern and South-Eastern Asia. As older people are most likely to suffer from chronic diseases, it is expected to fuel the growth of the market during the forecast period.

Increasing prevalence of cardiovascular diseases

According to the American Heart Association, cardiovascular disease (CVD) will be responsible for roughly 19.1 million deaths worldwide in the year 2020. The age-adjusted mortality rate per 100,000 people was 239.8. Also, 7354.1 per 100,000 was the age-adjusted prevalence rate. In 2020, Eastern Europe and Central Asia had the greatest CVD death rates, with greater levels also reported in Oceania, North Africa, the Middle East, Central Europe, sub-Saharan Africa, and South and Southeast Asia.

Ischemic heart disease (IHD) was expected to affect around 244.1 million individuals worldwide during 2020, with men being more affected than women (141.0 and 103.1 million persons, respectively). North Africa the Middle East, Central and South Asia, and Eastern Europe had the highest rates of IHD prevalence in the globe in 2020. Therefore, the rising prevalence of cardiovascular disease is expected to boost the demand for aortic aneurysm treatment devices during the forecast period.

High demand for minimally invasive surgical methods

Traditional surgery necessitates an incision to gain access to interior body components for operation, which necessitates high precision, intense concentration, and surgical expertise. However, the benefits of minimally invasive operations include less blood loss, little to no scarring, smaller incisions, and shorter hospital stays with faster recovery times, frequently with better outcomes.

Endovascular repair is a minimally invasive treatment method for aortic aneurysms. A stent graft is then implanted through a tiny incision in the groin area and transferred to the location of the aneurysm. This method is less intrusive than open surgery and has advantages such as faster recovery and a lower risk of problems. Therefore, an increasing demand for minimally invasive techniques is expected to stimulate the growth of the market during the projection period.

Restraining Factors

Risks associated with aortic aneurysm treatment

There are various non-procedural consequences of aortic aneurysm repair. Cardiopulmonary, ischemic, and renal difficulties associated with IV contrast and embolic illness are examples of systemic and non-specific consequences. Many patients are at risk for cardiovascular events such as stroke, myocardial infarction (MI), and thromboembolic events due to the common comorbidities associated with vascular illness.

Patients having both endovascular and open AAA repair are regarded to be at moderate to high risk for thromboembolic events; hence chemical or mechanical DVT prevention is advised. Thus, risks associated with aortic aneurysm procedures are anticipated to negatively impact the growth of the market during the forecast period.

Challenges in low and middle-income nations

Data on aortic aneurysm treatment and research is either scarce or non-existent in low- and middle-income nations. In addition to the aforementioned reality, many African countries lack quality aortic aneurysm treatment services.

Possible reasons for this include a lack of awareness of EVAR, a lack of trained surgeons, a lack of infrastructure and equipment for EVAR, the absence of comprehensive health policies concerning modern trends in surgical treatment, and a lack of health insurance and financing for health care, particularly EVAR. Thus, these challenges in low- and middle-income nations are expected to restrain the growth of the market over the projection period.

Type Analysis

Abdominal Aortic Aneurysm (AAA) leads the market

An abdominal aortic aneurysm (AAA) is a condition that could be fatal. Most occurrences of AAA occur either in the lower abdomen’s pararenal region, where it frequently occurs in the lower abdomen or below the kidney. Compared to TAA, the number of repairs for subrenal and pararenal aneurysms is significantly higher. Around 2.5% of persons aged over 65 have AAA, according to a Circulation article.

TAA only happens 4.5% to 5.9% of the time per 100,000 person-years. The growth of the segment is driven by a rise in innovative R&D activities and strong government backing for product approvals. For instance, the Zenith Fenestrated+ Endovascular Graft (ZFEN+) was given the U.S. FDA’s breakthrough device designation in March 2021 by Cook Medical, Inc. Intravascular AA is treated with it.

Also, thoracic aortic aneurysm (TAA) is expected to witness high growth during the forecast period. Abnormal aortic dilatation above the diaphragm is known as a thoracic aortic aneurysm (TAA). One-fourth of aortic aneurysms are TAAs. Thoracic aortic aneurysms are uncommon, occurring in 6–10 persons out of every 100,000. About 20% of those instances had a family history component. Key drivers driving the segment’s growth include the growing acceptance of minimally invasive procedures on a global scale, as well as technological advancements that cut down on extended hospital stays and overall treatment costs.

Product Type Analysis

Stent Grafts are witnessing high demand

During the estimated time period, technological developments in stent-graft design are expected to drive significant growth in this product category. For example, advanced stent graft systems with integrated imaging are being introduced by several manufacturers around the globe. It is beneficial for treating aneurysms and other critical vascular conditions.

The advantages of stent-grafted intravascular repair continue to drive the segment’s expansion. Terumo Corporation launched PANTHER, a global research project on knitted and woven surgical grafts, in September 2021. Such research endeavors by major firms are likely to boost the growth of the segment.

Also, catheters are likely to witness high growth during the projection period. Catheter-based aortic aneurysm repair technique is increasingly being used globally, as it is considered a safe treatment option for patients with aortic aneurysms. Also, new studies are being initiated for intra-arterial catheter-directed CT angiography to assess endovascular aortic aneurysm repair. This is expected to boost the growth of the segment over the forecast period.

Treatment Analysis

Endovascular Aneurysm Repair (EVAR) is likely to grow at the highest rate

A minimally invasive technique known as endovascular aneurysm repair (EVAR) is used for the treatment of abdominal aortic aneurysms. The segment growth can be attributed to key factors like the rising adoption of endovascular therapy over the world, technological advancements that shorten hospital stays, and the overall morbidity of aortic aneurysm repair. In 2017, 75% of all treatments carried out in the United States were EAVR, according to Endologix.

Also, the open surgical repair (OSR) segment is anticipated to witness significant growth during the estimated time period. Open repair is preferable for treating basic and uncomplicated instances in low-risk patients, as well as for numerous TAA anatomies when endovascular choices are limited. Because of the low cost and lack of technological technologies in Asia, Latin America, and the Middle East’s growing economies, open repair remains the preferred option.

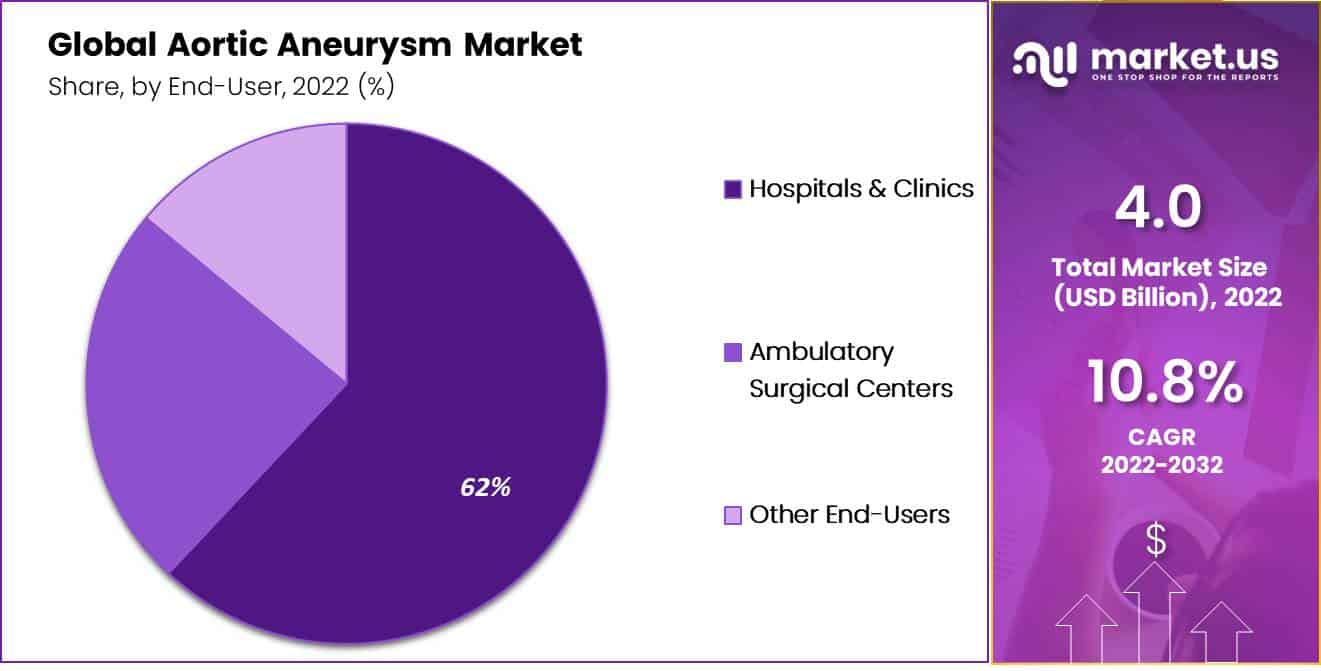

End-user Analysis

Hospitals & Clinics are major end-users

Physicians and vascular surgeons largely prefer hospitals for complex surgical procedures in developing as well as underdeveloped countries. Hospitals have a presence of an extensive infrastructure that is beneficial for the treatment of complicated surgeries that cannot be handled in ASCs. Additionally, favorable reimbursement regulations are projected to drive the growth of the segment.

On the other hand, ambulatory care centers are anticipated to grow at a high rate during the estimated time period. Shorter hospital stays and reduced overall treatment costs are two major benefits offered by ASCs, which are fuelling the segment’s expansion. Additionally, during the projection period, it is anticipated that the rising prevalence of AA, particularly in industrialized countries, and the need for prompt treatment would add to the segment’s growth.

Market Segmentation

By Type

- Thoracic Aortic Aneurysm (TAA)

- Abdominal Aortic Aneurysm (AAA)

By Product Type

- Stent Grafts

- Catheters

By Treatment

- Open Surgical Repair (OSR)

- Endovascular Aneurysm Repair (EVAR)

By End-User

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Other End-Users

Growth Opportunity

Supportive government initiatives

The aortic aneurysm market is expected to gain from an increase in government-sponsored activities to raise awareness of the disease and promote early detection and treatment. The US Preventive Services Task Force (USPSTF), for example, changed its recommendations in 2017 and now recommends that males aged 65 to 75 who have ever smoked have a single screening for abdominal aortic aneurysms. Thus, more people are being diagnosed with aortic aneurysms. As a result, such supportive government initiatives promoting awareness regarding aortic aneurysm is likely to provide promising growth opportunities for key players operating in the market.

Latest Trends

New research initiatives

Innovative research projects are being conducted to improve the diagnosis and treatment of aortic aneurysm. In the month of December 2021, Deep learning was utilized by researchers at Massachusetts General Hospital (MGH) to analyze how genetics could affect aorta size in order to identify people at high risk of aortic aneurysms. The discoveries, according to the experts, could aid in the development of preventive and targeted medicines.

An aortic aneurysm occurs when the aorta becomes excessively enlarged and has the potential to rip or rupture, resulting in rapid cardiac death. The problem for clinicians is that patients frequently show no signs or symptoms until the aorta fails. Deep learning was implemented by the research team utilizing data from a UK Biobank study that included several magnetic resonance imaging assessments of the heart and aorta in over 40,000 people. This research initiative is useful for identifying new drug targets for aortic enlargement. Thus, such research initiatives can be considered as an emerging trend and is likely to support the market growth in the upcoming time period.

Regional Analysis

North America is likely to hold the largest revenue share of over 51% during the projection period. North America’s established healthcare infrastructure and increased acceptance of innovative medical technology are driving market revenue growth in the region. Government initiatives to improve aortic aneurysm detection and treatment are expanding in the region, driving market growth during the forecast period.

The Asia Pacific market is likely to witness the fastest growth over the forecast period. The market growth in the region is stimulated by a growing elderly population, rising CVD prevalence, and rising healthcare spending. Government efforts to improve the region’s healthcare system and aortic aneurysm treatment options are also rising, driving revenue growth in the region.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Because of the presence of small and medium-sized businesses, the market might be described as fairly competitive. Furthermore, key market players are trying to invest in new, efficient, and advanced technologies, which in turn, is likely to stimulate significant competition among them. Furthermore, the deployment of several new business strategies, such as mergers and acquisitions, strategic agreements & contracts, and new product launches, is projected to have a beneficial impact on market growth during the forecast period and increase competition among leading market players.

Market Key Players

- Cardinal Health

- Medtronic

- Terumo Corporation

- MicroPort Scientific Corporation

- Cook Medical

- Gore & Associates Inc.

- Endologix Inc.

- Jotec GmbH

- Cryolife Inc.

- LivaNova PLC

- Other Key Players

Recent Developments

- September ’20: Terumo Corporation, a manufacturer of medical devices and supplies, and Orchestra BioMed, a biomedical innovation company, announced a strategic agreement for the manufacturing, marketing, and sale of the Virtue Sirolimus-Eluting Balloon (SEB), for the treatment of Coronary Artery Disease (CAD) and Peripheral Arterial Disease (PAD).

- March ’20: Endologix Inc., a California-based global medical device company, announced that the Food and Drug Administration (FDA) had approved their Alto Abdominal Stent Graft System for the treatment of Abdominal Aortic Aneurysms (AAA).

Report Scope

Report Features Description Market Value (2022) USD 4 Bn Forecast Revenue (2032) USD 11 Bn CAGR (2023-2032) 10.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Thoracic Aortic Aneurysm (TAA), Abdominal Aortic Aneurysm (AAA), By Product Type- Stent Grafts, Catheters, By Treatment- Open Surgical Repair (OSR), Endovascular Aneurysm Repair (EVAR) and By End-User- Hospitals & Clinics, Ambulatory Surgical Centers, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cardinal Health, Medtronic, Terumo Corporation, MicroPort Scientific Corporation, Cook Medical, Gore & Associates Inc., Endologix Inc., Jotec GmbH, Cryolife Inc., LivaNova PLC, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the value of the global Aortic Aneurysm Market?In 2022, the global Aortic Aneurysm Market was valued at USD 4 billion.

What will be the market size for Aortic Aneurysm Market in 2032?In 2032, the Aortic Aneurysm Market will reach USD 10.87 billion.

What CAGR is projected for the Aortic Aneurysm Market?The Aortic Aneurysm Market is expected to grow at 10.8% CAGR (2023-2032).

List the segments encompassed in this report on the Aortic Aneurysm Market?Market.US has segmented the Aortic Aneurysm Market Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Thoracic Aortic Aneurysm (TAA) and Abdominal Aortic Aneurysm (AAA). By Product Type, the market has been further divided into Stent Grafts and Catheters.

Which segment dominate the Aortic Aneurysm industry?With respect to the Aortic Aneurysm industry, vendors can expect to leverage greater prospective business opportunities through the Abdominal Aortic Aneurysm (AAA) segment, as this dominate this industry.

Name the major industry players in the Aortic Aneurysm Market.Cardinal Health, Medtronic, Terumo Corporation, MicroPort Scientific Corporation, Cook Medical, Gore & Associates Inc. and Other Key Players are the main vendors in this market.

-

-

- Cardinal Health

- Medtronic

- Terumo Corporation

- MicroPort Scientific Corporation

- Cook Medical

- Gore & Associates Inc.

- Endologix Inc.

- Jotec GmbH

- Cryolife Inc.

- LivaNova PLC

- Other Key Players