Global Antiseptics and Disinfectants Market by Type (Quaternary Ammonium Compounds, Chlorine Compounds, Others), By Product (Enzymatic Cleaners, Medical Device Disinfectants, Surface Disinfectants), By Sales Channel (B2B, FMCG), By End Use (Hospitals, Clinics, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: May 2023

- Report ID: 13656

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Antiseptics And Disinfectants Market Overview:

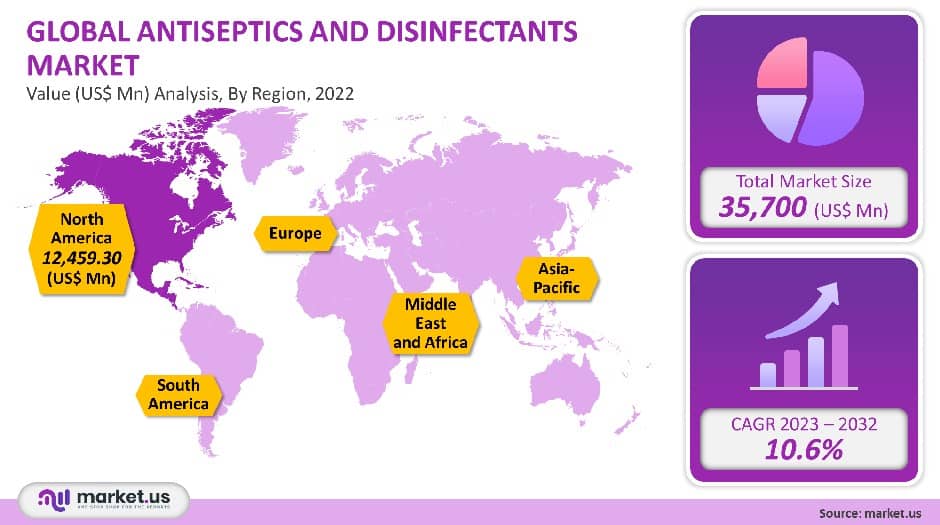

The global market for antiseptics & disinfectants market accounted for USD 35,700 million in 2021. In 2023-2032, CAGR will be 10.6%.

Market growth can be driven by an increase in diseases such as typhoid and cholera as well as food poisoning and hepatitis A. This is mainly due to poor hygiene at home.

According to WHO’s report, dengue cases have increased eightfold in the past 20 decades. From 505,430 cases in 2000 to over 2.4million in 2010, and to 5.2million in 2019, respectively. These diseases are mainly caused primarily by viruses, germs, and bacteria and thrive in unhygienic toilets, latrines, and kitchens.

Global Antiseptics and Disinfectants Market Scope:

Type Analysis

Based on type, the segment of quaternary ammonium compounds held the largest revenue share with 32.3% in 2021. They are expected to grow significantly over the forecast time. Quaternary compounds are often used in hospitals and labs as surface disinfectants. These are controlling the spread of healthcare-associated infections in hospitals and clinics.

It can also be used for disinfecting equipment that comes into contact directly with the skin. The growing incidence of hospital-acquired illnesses around the world is likely to have a positive impact on the segment growth.

The segment i.e enzyme is expected to experience the highest growth rate during the forecast period. Enzyme content disinfectants are used to remove odors that have been created by chemical processes. It is also used in research facilities to clean chemical-based or catalyst-based products. It is used to clean diagnostic kits in hospitals. These items will become more in demand as there is an increase in research facilities around the world.

Product Analysis

The largest revenue share was held by the medical device disinfectants segment at 46.5% in 2021. The majority of medical device disinfectants can be used for the reprocessing of surgical units and endoscopes. Phenol/phenate, hydrogen peroxide, Glutaraldehyde, and peracetic acid are some of the disinfectants used for the disinfection of medical devices.

It is important to properly clean medical devices and endoscopes. They can transmit infection by direct contact with the skin. This segment may be driven by the growing number of surgeries performed worldwide.

The fastest expected growth rate in the segment of enzymatic cleaning products is predicted to occur over the forecast period. Enzymatic cleaners are better at removing bacteria from surfaces. They are also used to prevent odor. It is used to disinfect equipment and test kits in hospitals and clinics. These two factors are important in determining the growth of the industry.

Enzyme cleaners that do not contain pathogenic beneficial microorganisms are effective in removing disease-causing bacteria without side effects. Some antiseptics can leave residues that can cause health problems for people. Enzymatic cleaners may be used to clean such residues. The segment is forecast to expand over the forecast period.

Sales Channel Analysis

B2B dominated the disinfectants market and had the highest revenue share, at 65.7%, in 2021. B2B sales channels allow companies to sell their products directly to businesses, and not to consumers. B2B sales channels typically have longer sales cycles, higher-order values, and more complex sales processes. B2B channel sales will experience a lower growth rate in the forecast period due to entry barriers.

These include a lack of investment in technologically advanced products and difficulties in coordinating with other vendors. The B2B channel is a major sales channel for disinfectants and antiseptics. The B2B channel is used by major end-users such as hospitals, clinics, healthcare providers, suppliers, and others.

The FMCG distribution channel consists of three main entities: agents and facilitators. Merchants are the third. Agents generate sales by promoting the products of the company. Agents can either be part of the company or independent individuals. Facilitators generally assist in the movement of manufactured goods between one place and another.

Facilitators can include warehouse owners, logistic professionals, and other types. The merchant’s category generally includes wholesalers and retailers. FMCG products are usually purchased by consumers directly from wholesalers or retailers. Hand Sanitizers, Antiseptic Topical Creams, Antiseptic Washes, and Antiseptic Wipes are all included in the FMCG product category.

There are many brands that make hand sanitizers, including Purell, Lifebuoy, Dettol, and Lifebuoy. The most prominent antiseptics brand names in topical creams are Nufree Finipil pro-Elec Antiseptic Creams, Tea Tree Therapy Antiseptic Creams, and Neosporin.

End-Use Analysis

Hospitals dominated the market in antiseptics/disinfectants, accounting for 47.2% revenue share in 2021. One of the main reasons for the segment’s growth in the forecast period is the rising incidence of hospital acquired infections.

According to CDC, one out of every 31 hospitalized patients gets a hospital acquired infection every day. It is essential to use the right disinfectants and antiseptics in order to prevent illness spread. Furthermore, rising healthcare expenditures in developing and developed nations might lead to an increase in the number of hospitals.

As such, demand for antiseptics is likely to increase. Eurostat reports that France and Germany have the highest healthcare expenditures (around 11.8% each) in terms of their GDP for 2019. These factors are expected to drive segment growth in the future.

The growth of hospitals and the number of surgeries will drive the segment’s expansion over the forecast period. Basic sanitation and hygiene are essential in order to maintain a healthy clinic environment. Antiseptics and Disinfectants may also be in demand as a result of an increase in hospital-acquired illnesses. The segment is expected to grow during the forecast period.

Key Market Segments

By Type

- Quaternary Ammonium Compounds

- Alcohols & Aldehyde Products

- Enzyme

- Chlorine Compounds

- Others

By Product

- Medical Device Disinfectants

- Enzymatic Cleaners

- Surface Disinfectants

By Sales Channel

- B2B

- FMCG

By End-Use

- Clinics

- Hospitals

- Others

Market Dynamics:

Antiseptic and disinfectant solutions are essential for maintaining home hygiene. They prevent the growth and spread of viruses and harmful bacteria, which reduces the likelihood of getting these diseases.

The market for antiseptics will see a rise in awareness regarding home cleanliness over the forecast period. The market for antiseptics is likely to be impacted by the COVID-19 epidemic. The demand for medical disposables has increased due to the COVID-19 outbreak and the overall rise in hospital admissions all over the globe.

The WHO has asked industry and governments worldwide to increase the production of antiseptics. This is to meet the rising demand for disinfecting and cleaning high-traffic places such as hospitals and offices.

According to the German Federal Statistical Office in Germany, disinfectants have seen a rise in demand since the outbreak of coronavirus. In fact, between January and September 2020, 80% more hygiene items were manufactured in Germany than they did last year. In order to produce and sell disinfectants and antiseptics to diverse customers, manufacturers of disinfectants and disinfectants use new and innovative technologies

One of the main factors driving the growth in the market for disinfectants is the increasing number of HAIs from poor sanitation. For instance, as per the Healthcare-Associated Infections in 2020, every year, around one in every 25 hospital patients acquires at least one HAI.

Antiseptics, disinfectants, and other anti-contamination agents can reduce the risk of HAIs. They can prevent bacterial and other microbial infections from reaching a patient’s body. These factors will be driving market expansion over the forecast period. Gastrointestinal endoscopy (GI) allows doctors to see the inner lining of the digestive tract. The endoscope can be used to diagnose and treat several GI conditions.

An outpatient or inpatient GI endoscopy may be performed. It can also lead to many complications if endoscopes do not get properly reprocessed. Endoscopes need to be processed according to infection control protocols. This will reduce the possibility of passing pathogens between patients or environmental agents. It is crucial to apply proper disinfectant or antiseptics solutions in these cases to prevent the spread of infection.

The likelihood of contracting HAIs will rise with the increasing demand for endoscopy. BMJ Publishing Group Ltd. (2018) reported that the demand for gastrointestinal screening for the detection of colon cancer has increased in patients who are symptomatic. The demand has nearly doubled in the U.K. over the past five years. The forecast period will see an increase in surgical and endoscope use, which is expected to drive the market for disinfectants.

Globally, the growing number of surgeries is expected to be a major driver of market growth during the forecast period. Molnlycke Health Care AB estimates that 70,00 million surgeries are performed annually in Europe each year.

The Healthcare Cost and Utilization Project HCUP (HCUP) also shows that in 2018, over 9,942,000 procedures were performed in the U.S. in ambulatory settings. The use of disinfectant products and antiseptics is a requirement in hospitals, clinics, ambulatory surgery centers, and other healthcare facilities. This is expected to increase the demand for antiseptics.

Regional Analysis

North America dominated in the disinfectants and antiseptics market, with a revenue share of 34.9% in 2021. There are two main factors driving the increase in demand for disinfectants and antibiotics in North America: the growing number and complexity of medical procedures performed in North America, and the rising number of surgeries. Because they prevent infection transmission, antiseptic and disinfectant solutions can be used in surgical procedures as well as research.

As doctors are more open to using disinfection treatment, there may be an increase in hospital-acquired infections that could drive the demand. These factors are projected to drive market growth throughout the forecast period.

The increasing incidence of healthcare-associated infections, cholera food poisoning, and typhoid fever is a major factor driving the market over the forecast period. Additionally, the market is expected to grow due to rising awareness about cleanliness in the home. The market is expanding because major players are actively seeking to access untapped markets throughout the Asia Pacific region.

Key Regions and Countries covered in the report:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Strategies such as mergers or acquisitions, partnerships, or launching new products are all key to strengthening their presence in the antiseptics market. Mergers and acquisitions are key to increasing their market share worldwide. STERIS bought Cantel Medical Corporation, a subsidiary based in the U.S., in January 2021. Cantel serves as a global provider of infection prevention services and products.

Its focus is on endoscopy and dental patients. This in turn will increase the market growth. Fortive Corporation, which is part of Ethicon, Inc., made a binding purchase offer for Johnson & Johnson’s Advanced Sterilization Products division in June 2018. These are just a few of the notable players in the disinfectants and antiseptics market:

Market Key Players:

- 3M

- Reckitt Benckiser

- Steris Plc

- Kimberly-Clark Corporation

- Bio-Cide International, Inc.

- Cardinal Health

- BD

- Johnson & Johnson

- Other Key Players

For the Antiseptics And Disinfectants Market research study, the following years have been considered to estimate the market size:

Attribute Report Details Historical Years

2016-2020

Base Year

2021

Estimated Year

2022

Short Term Projection Year

2028

Projected Year

2023

Long Term Projection Year

2032

Report Coverage

Competitive Landscape, Revenue analysis, Company Share Analysis, Manufacturers Analysis, Volume by Manufacturers, Key Segments, Key company analysis, Market Trends, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis, strategy for existing players to grab maximum market share, and more.

Regional Scope

North America, Europe, Asia-Pacific, South America, Middle East & Africa

Country Scope

United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa

Frequently Asked Questions (FAQ)

Q: What is the size of the Antiseptics and Disinfectants market in 2021?A: The Antiseptics and Disinfectants market is estimated to be valued US$ 35,700 million in 2021.

Q: What is the projected CAGR at which the Antiseptics and Disinfectants market is expected to grow?A: The Antiseptics and Disinfectants market is expected to grow at a CAGR of 10.6% (2023-2032).

Q: List the segments encompassed in this report on the Antiseptics and Disinfectants market?A: Market.US has segmented the Global Antiseptics and Disinfectants Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By type, market has been segmented into Quaternary Ammonium Compounds, Chlorine Compounds, Alcohols & Aldehyde Products, Enzyme, Others, By product, market has been segmented into Enzymatic Cleaners, Medical Device Disinfectants, Surface Disinfectants. By sales channel, market has been segmented into B2B, FMCG. By end-use, market has been segmented into Hospitals, Clinics, Others.

Q: List the key industry players of the Antiseptics and Disinfectants market?A: 3M, Reckitt Benckiser, Steris Plc, Kimberly-Clark Corporation, Bio-Cide International, Inc., Cardinal Health, BD, Johnson & Johnson Other Key Players are the key vendors in the Antiseptics and Disinfectants market.

Q: Which region is more appealing for vendors employed in the Antiseptics and Disinfectants market?A: North America is expected to account for the highest revenue share of 34.9%. Therefore, North America’s Antiseptics and Disinfectants industry is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Antiseptics and Disinfectants?A: Key Markets should be The US, Mexico, Canada, China, Japan, India, Brazil, etc. are key areas of operation for the Antiseptics and Disinfectants market.

Q: Which segment accounts for the greatest market share in the Antiseptics and Disinfectants industry?A: Concerning the Antiseptics and Disinfectants industry, vendors can expect to leverage greater prospective business opportunities through the Medical Device Disinfectants segment, as this area of interest accounts for the largest market share.

Antiseptics And Disinfectants MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample

Antiseptics And Disinfectants MarketPublished date: May 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company Company Profile

- Reckitt Benckiser Group PLC Company Profile

- Steris Plc

- Kimberly-Clark Corporation

- Bio-Cide International, Inc.

- Cardinal Health

- Becton, Dickinson and Company Profile

- Johnson & Johnson

- Other Key Players