Global Antimicrobial Hospital Textile Market By Product Type (Cotton, Polyamide and Polyester), By Application (Attire, Sheets & Blankets and Surgical Supplies & Wipes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170989

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

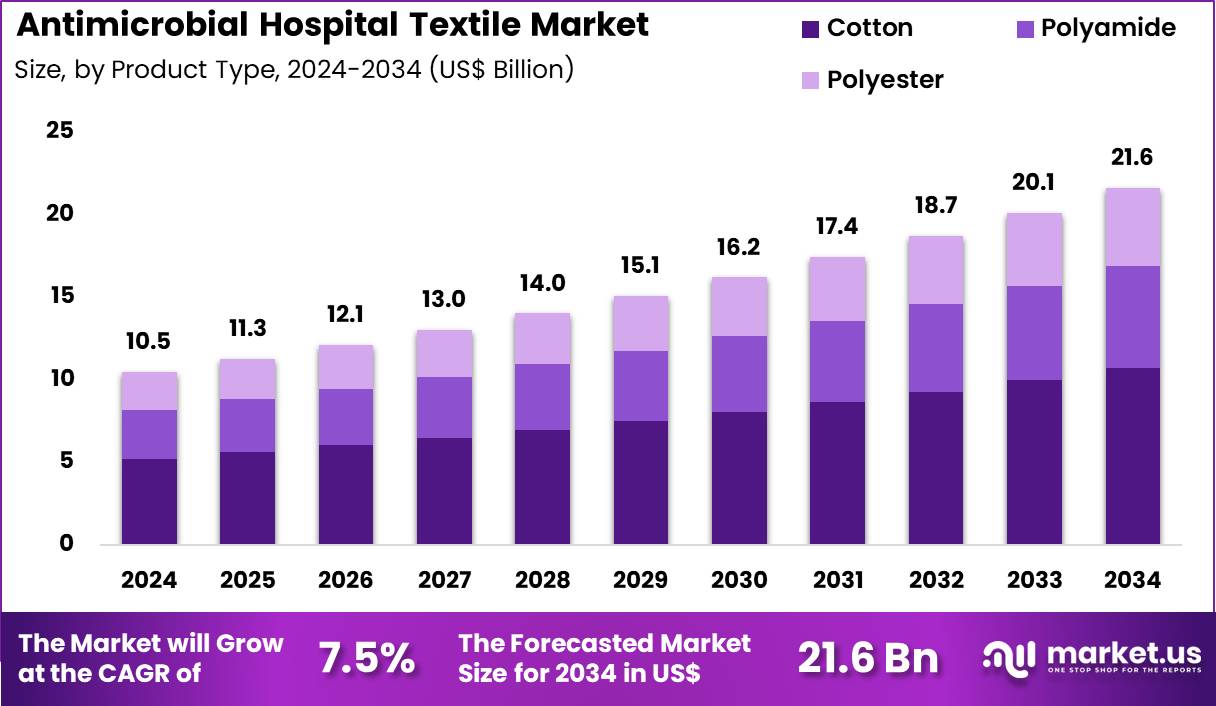

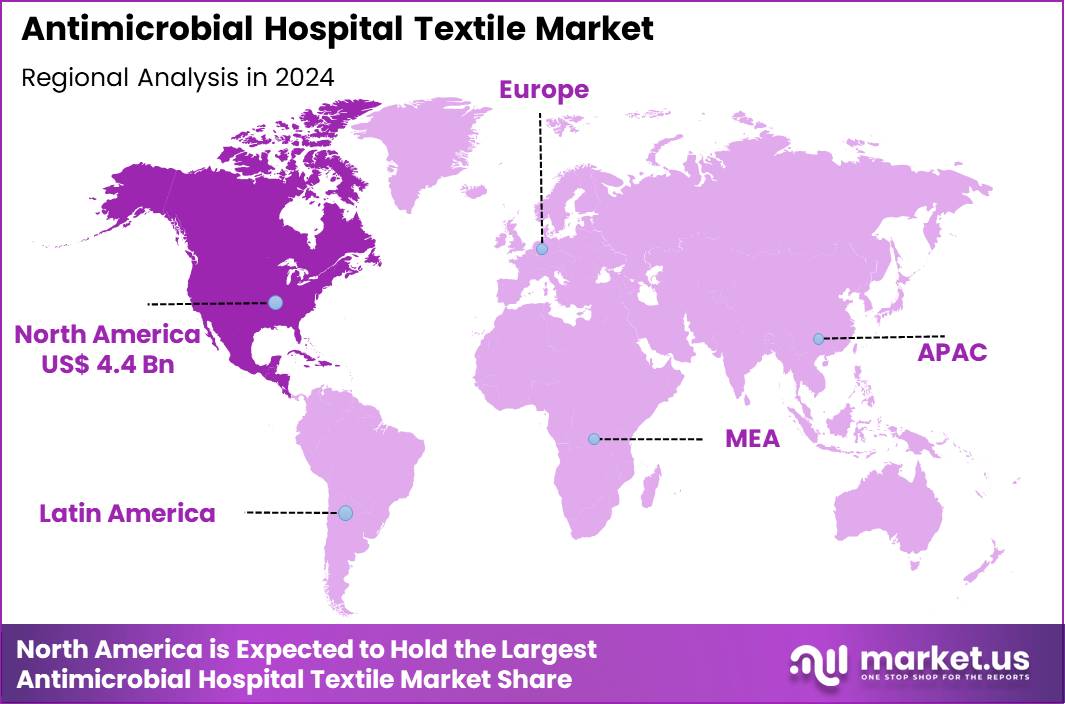

The Global Antimicrobial Hospital Textile Market size is expected to be worth around US$ 21.6 Billion by 2034 from US$ 10.5 Billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.6% share with a revenue of US$ 4.4 Billion.

Increasing healthcare-associated infection risks drives the Antimicrobial Hospital Textile market, as facility managers implement protective fabrics to curb pathogen transmission and enhance patient safety protocols. Manufacturers infuse textiles with silver ions, copper nanoparticles, and quaternary ammonium compounds to achieve durable antimicrobial efficacy against bacteria, fungi, and viruses. These materials apply in surgical drapes to minimize intraoperative contamination, patient gowns for reducing skin flora dissemination, and bed linens to prevent cross-contamination in isolation wards.

Strategic acquisitions create opportunities for sustainable innovations that align infection control with environmental stewardship. In March 2024, Milliken & Company acquired Zebra-chem GmbH, a specialist in peroxide-based additives for plastics, positioning the firms to integrate high recycled content into antimicrobial textiles for greener production. This move directly advances eco-friendly fabric development and bolsters market resilience against regulatory pressures for sustainability.

Growing emphasis on evidence-based hygiene practices accelerates the Antimicrobial Hospital Textile market, as hospitals adopt treated fabrics that demonstrate reduced microbial burden in controlled studies. Suppliers refine coating technologies that maintain breathability and comfort while ensuring wash-durable protection through repeated sterilization cycles.

Applications extend to privacy curtains that limit airborne pathogen spread in shared rooms, staff uniforms to lower healthcare worker colonization rates, and wheelchair covers for protecting mobility-impaired patients. Durability enhancements open avenues for cost-effective leasing models that guarantee performance over extended lifespans. Diagnostic firms increasingly collaborate with textile producers to validate antimicrobial claims through standardized microbial challenge tests. This rigorous validation trend strengthens buyer confidence and expands procurement in high-acuity care environments.

Rising integration of smart fabric technologies invigorates the Antimicrobial Hospital Textile market, as innovators embed sensors into antimicrobial matrices to monitor environmental hygiene in real time. Companies develop hybrid materials that combine biocidal agents with conductive fibers for data transmission on contamination levels.

These advanced textiles support operating room floor coverings that alert to persistent biofilms, infusion pump sleeves to safeguard against touch-transfer infections, and transport stretchers for emergency response teams. Sensor-enabled designs create opportunities for predictive maintenance programs that preempt outbreak risks through IoT connectivity. Research partnerships actively explore biocompatible nanomaterials to enhance efficacy without toxicity concerns. This fusion of antimicrobials and intelligence positions the market as a leader in proactive hospital ecosystem management

Key Takeaways

- In 2024, the market generated a revenue of US$ 10.5 Billion, with a CAGR of 7.5%, and is expected to reach US$ 21.6 Billion by the year 2034.

- The product type segment is divided into cotton, polyamide and polyester, with cotton taking the lead in 2024 with a market share of 49.6%.

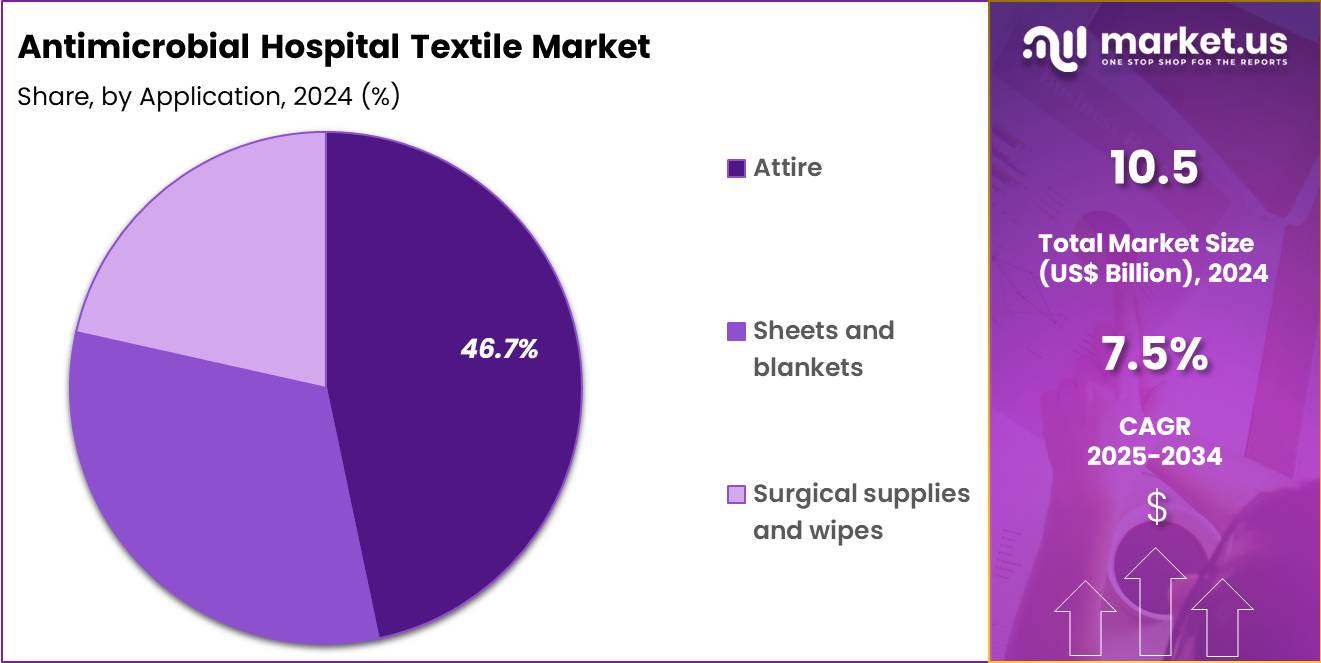

- Considering application, the market is divided into attire, sheets & blankets and surgical supplies & wipes. Among these, attire held a significant share of 46.7%.

- North America led the market by securing a market share of 41.6% in 2024.

Product Type Analysis

Cotton, holding 49.6%, is expected to dominate because it offers superior comfort, breathability, and skin compatibility for medical environments where extended patient and staff contact occurs. Hospitals increasingly adopt antimicrobial-treated cotton fabrics to reduce microbial load and lower the risk of healthcare-associated infections.

Cotton’s natural absorbency supports better moisture control, improving hygienic conditions in high-use linens and clothing. Advancements in antimicrobial finishes enhance durability without affecting cotton’s softness, making it suitable for frequent laundering cycles. Rising infection-control guidelines strengthen demand for reliable textile solutions that enhance patient safety.

Healthcare facilities prioritize cotton for its familiarity, patient acceptance, and capacity to incorporate innovative antimicrobial technologies. These factors keep cotton anticipated to remain the leading product type in this market.

Application Analysis

Attire, holding 46.7%, is projected to dominate because hospital staff uniforms, scrubs, and gowns account for a significant portion of direct microbial exposure risk within clinical environments. Antimicrobial-treated attire supports safer working conditions and reduces cross-contamination between patients, surfaces, and caregivers.

Growing awareness of hospital-acquired infections encourages facilities to invest in performance-enhanced textiles for staff protection. Increased surgical procedures and emergency care visits drive higher turnover of protective garments, strengthening demand. Manufacturers develop durable antimicrobial coatings that withstand repetitive washing and maintain biocidal effectiveness.

Infection prevention protocols increasingly incorporate antimicrobial attire as part of mandatory safety measures. These drivers keep attire expected to remain the dominant application segment in the antimicrobial hospital textile market.

Key Market Segments

By Product Type

- Cotton

- Polyamide

- Polyester

By Application

- Attire

- Sheets & Blankets

- Surgical Supplies & Wipes

Drivers

Increasing incidence of antimicrobial-resistant hospital-onset infections is driving the market

The escalation in antimicrobial-resistant infections within hospital environments has underscored the critical need for proactive infection control measures, including the adoption of antimicrobial textiles in patient care areas. These textiles, such as treated bedding and privacy curtains, serve as passive barriers to microbial proliferation, complementing traditional hygiene protocols. Healthcare facilities are under mounting pressure to reduce transmission risks, as resistant pathogens prolong patient stays and elevate treatment complexities.

Regulatory bodies advocate for integrated environmental controls, positioning antimicrobial fabrics as essential components of comprehensive strategies. This driver is particularly acute in intensive care units, where vulnerable populations face heightened exposure to contaminated surfaces. Investments in durable, fabric-integrated antimicrobials align with efforts to minimize cross-contamination during routine operations.

The persistence of these infections despite vaccination and stewardship programs highlights the value of multifaceted defenses. Procurement decisions increasingly favor textiles with verified efficacy against resistant strains, influencing supplier specifications. Collaborative guidelines from health authorities emphasize surface-level interventions, boosting demand for compliant materials. Collectively, this dynamic propels the market toward innovative, resilient solutions that enhance overall facility safety.

Restraints

Rising concerns over antimicrobial resistance development is restraining the market

The potential contribution of persistent antimicrobial agents in textiles to the broader ecosystem of resistance poses significant hurdles to unrestricted market expansion. Overuse or leaching of biocides from fabrics may accelerate adaptive mutations in environmental microbes, complicating long-term efficacy. Healthcare regulators caution against indiscriminate applications, mandating rigorous environmental fate assessments for treated materials. This scrutiny delays product launches, as manufacturers navigate extended validation periods for leachate profiles.

Costly remediation for non-compliant formulations further burdens development pipelines, deterring smaller innovators. Clinical hesitancy arises from fears that fabric-derived exposures could undermine systemic antibiotic effectiveness. Standardization gaps in resistance monitoring exacerbate uncertainties, limiting cross-facility adoption.

Ethical considerations around ecological footprints temper enthusiasm for high-volume deployments. Supply chain dependencies on scrutinized chemistries heighten vulnerability to policy shifts. In aggregate, these reservations foster a cautious approach, constraining aggressive scaling despite evident benefits.

Opportunities

Expansion of bio-based antimicrobial technologies is creating growth opportunities

The shift toward naturally derived antimicrobials in hospital textiles opens avenues for eco-compatible innovations that address both infection control and sustainability mandates. Plant-extracted agents, such as essential oils and chitosan, offer broad-spectrum activity without synthetic residues, appealing to green procurement policies. Regulatory approvals for these alternatives streamline market entry, reducing approval timelines compared to traditional compounds.

Compatibility with existing manufacturing processes enables retrofitting of legacy production lines, broadening accessibility. Enhanced durability through encapsulation techniques extends functional lifespan, optimizing replacement cycles in budget-constrained settings. Integration with multifunctional fabrics supports hybrid applications, like UV-resistant and moisture-wicking properties. Global health initiatives prioritizing low-impact materials incentivize R&D collaborations, accelerating prototype validations.

Scalability in emerging markets benefits from locally sourced botanicals, mitigating import dependencies. Performance equivalency studies validate efficacy parity, building stakeholder trust. Ultimately, this trajectory positions bio-based solutions as pivotal enablers for resilient, forward-looking healthcare infrastructures.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces propel the antimicrobial hospital textile market forward as escalating healthcare investments and heightened hygiene awareness drive hospitals to adopt treated fabrics like curtains and bedding for infection control. Manufacturers actively expand portfolios with innovative silver-infused materials, capitalizing on the surge in demand from aging populations and preventive care initiatives across global healthcare systems.

Persistent inflation and volatile economic conditions, however, elevate raw material costs for cotton and synthetics, compelling suppliers to raise prices and straining budgets for smaller medical facilities. Geopolitical tensions, including U.S.-China trade disputes and regional conflicts, disrupt global supply chains for key antimicrobial agents, leading to shortages and delivery delays that challenge production timelines for textile firms.

Current U.S. tariffs impose broad duties on imported medical textiles, particularly from Asia, driving up procurement expenses for American distributors and reducing competitiveness in domestic markets. These tariffs prompt retaliatory measures in overseas territories that limit U.S. exports of advanced fabrics and hinder collaborative R&D efforts on new treatments.

Nevertheless, the policies accelerate investments in North American manufacturing plants and localized sourcing strategies, building more resilient networks that will enhance innovation and ensure steady market growth for the long haul.

Latest Trends

EPA determination on non-pesticide status for polymer additives is a recent trend

In November 2025, the U.S. Environmental Protection Agency classified Micrillon, a polymer-based antimicrobial additive, as non-pesticidal, facilitating its incorporation into hospital textiles without stringent biocide regulations. This ruling, following a decade of review, exempts qualifying applications from Federal Insecticide, Fungicide, and Rodenticide Act oversight, simplifying compliance for built-in fabric protections.

The additive demonstrates complete elimination of pathogens including SARS-CoV-2, influenza A (H1N1), and methicillin-resistant Staphylococcus aureus within two minutes on treated surfaces. Hospitals gain flexibility in deploying rechargeables via laundering, sustaining efficacy across multiple cycles without reapplication. This development aligns with demands for seamless, low-maintenance hygiene solutions in high-touch environments.

Manufacturers anticipate broader adoption in linens and upholstery, leveraging the additive’s cost-effectiveness as a melt-processable inclusion. Regulatory clarity mitigates prior uncertainties, encouraging investments in variant formulations for specialized uses. Early pilots report alignment with Joint Commission standards, enhancing credentialing prospects.

The trend reflects a maturing framework for inherent antimicrobials, prioritizing functionality over topical treatments. This advancement heralds expanded utility in infection prevention paradigms, emphasizing durability and regulatory harmony.

Regional Analysis

North America is leading the Antimicrobial Hospital Textile Market

In 2024, North America secured a 41.6% share of the global antimicrobial hospital textile market, impelled by stringent regulatory mandates and escalating imperatives for infection mitigation in clinical environments. Healthcare facilities intensify procurement of copper-infused linens and quaternary ammonium-treated fabrics to comply with Centers for Disease Control and Prevention guidelines, curtailing surface-mediated pathogen transmission in high-acuity wards.

Post-pandemic infrastructure upgrades in major medical centers incorporate smart textiles with self-sterilizing properties, aligning with Joint Commission accreditation standards that emphasize durable hygiene solutions. Pharmaceutical suppliers collaborate with textile innovators to embed nano-silver coatings, enhancing durability against repeated laundering while targeting multidrug-resistant strains prevalent in surgical suites.

Demographic shifts toward an aging populace amplify bed occupancy rates, necessitating scalable antimicrobial drapes and gowns that reduce cross-contamination risks during prolonged stays. Supply chain optimizations from domestic manufacturers mitigate import dependencies, ensuring timely delivery amid fluctuating raw material costs.

Educational initiatives by professional associations promote evidence-based adoption, fostering a culture of proactive environmental decontamination. These converging influences underscore a resolute commitment to elevating patient safety metrics through resilient material sciences. The Centers for Disease Control and Prevention estimates that on any given day, about one in 31 hospital patients has at least one healthcare-associated infection.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry observers project accelerated advancement in antimicrobial hospital textiles across Asia Pacific over the forecast period, as burgeoning healthcare networks confront persistent contamination challenges head-on. National health administrations in Indonesia and Vietnam channel investments into localized production of chitosan-blended fabrics, equipping tertiary hospitals with cost-efficient barriers against bacterial biofilms in neonatal units.

Fabric engineering firms introduce photocatalytic variants activated by ambient light, empowering frontline staff in Singapore to maintain sterility in outpatient clinics without chemical additives. Cross-border consortia standardize testing protocols for antiviral weaves, enabling exporters in Malaysia to penetrate premium markets while safeguarding against emerging zoonotic threats.

Urban expansion drives retrofitting of community polyclinics with modular antimicrobial curtains, addressing overcrowding-induced exposure in densely served locales. Philanthropic foundations sponsor pilot programs in rural Thailand, distributing treated uniforms that withstand tropical humidity and curtail fungal propagations.

Academic collaborations refine zeolite-embedded polymers for superior ion release, optimizing longevity in resource-stretched facilities across the Philippines. These targeted innovations cultivate a fortified ecosystem, empowering regional caregivers to sustain superior outcomes amid demographic pressures. The World Health Organization indicates that 15% of patients in low- and middle-income countries acquire at least one health care-associated infection during their hospital stay, according to its 2024 global report on infection prevention and control.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key companies in antimicrobial hospital textile production strengthen growth by integrating advanced biocidal coatings, silver-ion technologies, and durable antimicrobial chemistries that maintain efficacy through repeated industrial laundering. They expand penetration by partnering with hospital networks, long-term care facilities, and medical laundries to standardize infection-control fabrics across bedding, gowns, drapes, and staff uniforms.

Product-development teams enhance performance by focusing on breathability, comfort, and material longevity, which increases adoption among clinicians and procurement teams seeking cost-efficient safety improvements. Commercial organizations secure long-term contracts through compliance with international hygiene and textile standards, reinforcing trust in high-risk clinical environments.

They invest in sustainable manufacturing processes and hypoallergenic formulations to align with environmental and patient-safety expectations. Milliken & Company exemplifies this strategy with its advanced performance-textile portfolio, strong R&D capabilities, and longstanding relationships with healthcare institutions, allowing the firm to deliver durable, high-quality antimicrobial fabrics that support hospital infection-prevention goals.

Top Key Players

- Milliken & Company

- PurThread Technologies

- BioCote Limited

- LifeThreads Global

- Trevira GmbH

- Herculite Products Inc.

- Smith & Nephew

- Medline Industries

Recent Developments

- In November 2023, BASF partnered with Empa, Switzerland’s research institute for materials science and technology, to create a specialized antimicrobial textile coating. Designed for hospital curtains and other large touch surfaces, the coating aims to continuously reduce microbial contamination in patient-care areas.

- In July 2024, Invista, part of Koch Industries, launched a new line of antimicrobial hospital textiles enhanced with nanotechnology. The innovations focus on improving the long-term stability and performance of the antimicrobial treatments, allowing the fabrics to endure the demanding wash and sterilization routines common in healthcare facilities.

Report Scope

Report Features Description Market Value (2024) US$ 10.5 Billion Forecast Revenue (2034) US$ 21.6 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cotton, Polyamide and Polyester), By Application (Attire, Sheets & Blankets and Surgical Supplies & Wipes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Milliken & Company, PurThread Technologies, BioCote Limited, LifeThreads Global, Trevira GmbH, Herculite Products Inc., Smith & Nephew, Medline Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Antimicrobial Hospital Textile MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Antimicrobial Hospital Textile MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Milliken & Company

- PurThread Technologies

- BioCote Limited

- LifeThreads Global

- Trevira GmbH

- Herculite Products Inc.

- Smith & Nephew

- Medline Industries