Global Anticoagulant Rodenticides Market Size, Share, And Business Benefits By Product Type (First-generation Anticoagulants (Warfarin, Chlorophacinone), Second-generation Anticoagulants (Bromadiolone, Difenacoum)), By Form (Pellets, Blocks, Powder/Spray, Others), By Application (Agriculture, Pest Control Companies, Warehouses, Urban Centers, Household, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155445

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

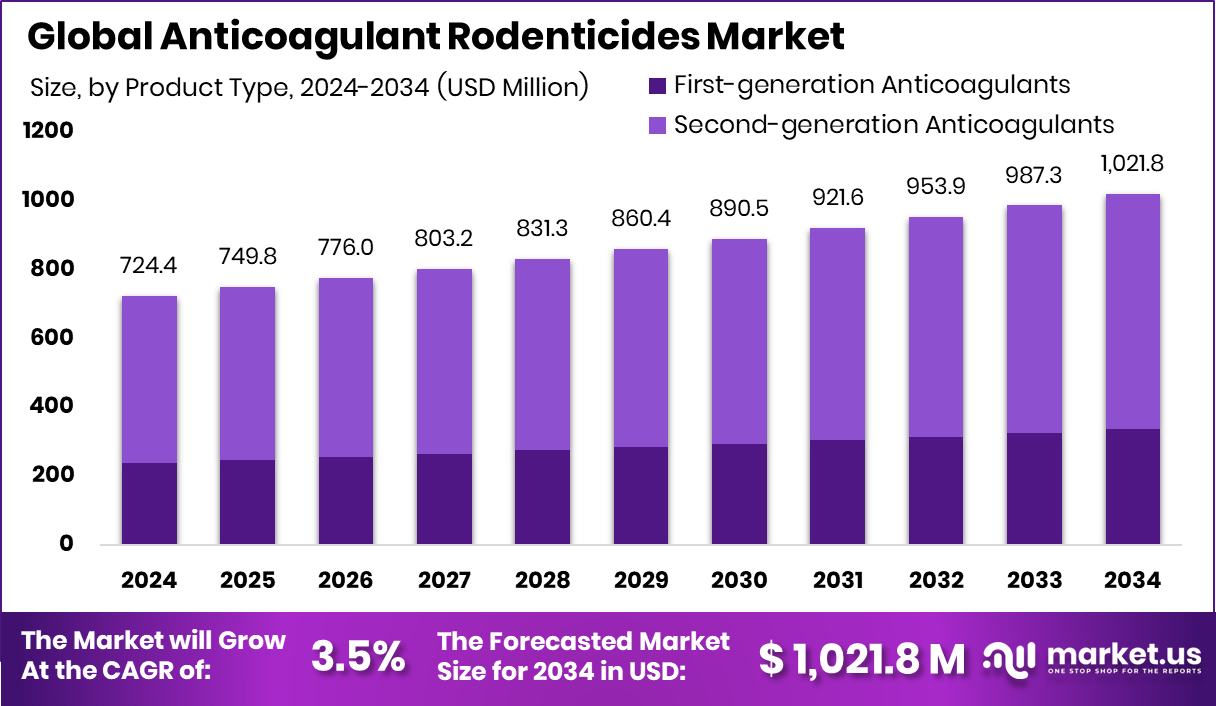

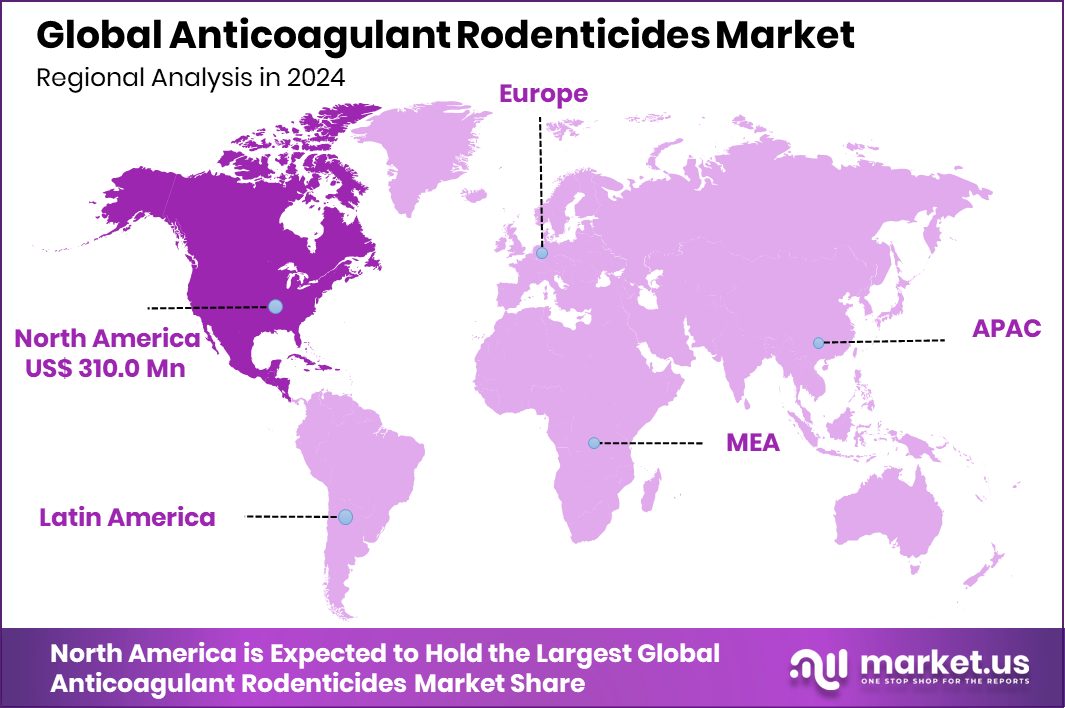

The Global Anticoagulant Rodenticides Market is expected to be worth around USD 1,021.8 million by 2034, up from USD 724.4 million in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034. North America maintained 42.80%, USD 310.0 Mn market share.

Anticoagulant rodenticides are chemical substances designed to control rodent populations by stopping blood clotting, causing internal bleeding and eventual death in targeted pests. They act by disrupting the vitamin K cycle, which is crucial for blood coagulation in rodents. These products are widely used in agriculture, food storage, and urban pest control because of their effectiveness against both rats and mice.

The global anticoagulant rodenticides market covers the production, trade, and use of these pest control solutions across agriculture, public health, and residential applications. Growth is fueled by increasing urbanization, stricter hygiene rules in food facilities, and rising concerns over food contamination.

The need for year-round rodent control is also increasing due to climate change, which is affecting rodent breeding cycles. Public health agencies play a key role by running large-scale rodent control campaigns, while farmers and households are increasingly aware of the damage rodents cause to crops, stored grains, and infrastructure.

Additionally, market expansion is supported by funding and innovation in related sectors. For instance, the Maine Pellet Fuels Association secured $100,000 for market growth initiatives. Sway launched seaweed pellets to replace single-use plastics after $5 million in funding.

A cardboard-to-pellet initiative received a $95,000 grant, and a planned wood pellet facility in Australia obtained a $5.5 million grant. These developments highlight ongoing investment in sustainable materials and production, indirectly boosting demand for pest control measures to protect stored resources and manufacturing facilities.

Key Takeaways

- The Global Anticoagulant Rodenticides Market is expected to be worth around USD 1,021.8 million by 2034, up from USD 724.4 million in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- In the Anticoagulant Rodenticides Market, second-generation anticoagulants hold a 67.9% share, showing strong dominance.

- Pellets account for a 44.6% share in the Anticoagulant Rodenticides Market, favored for ease of application.

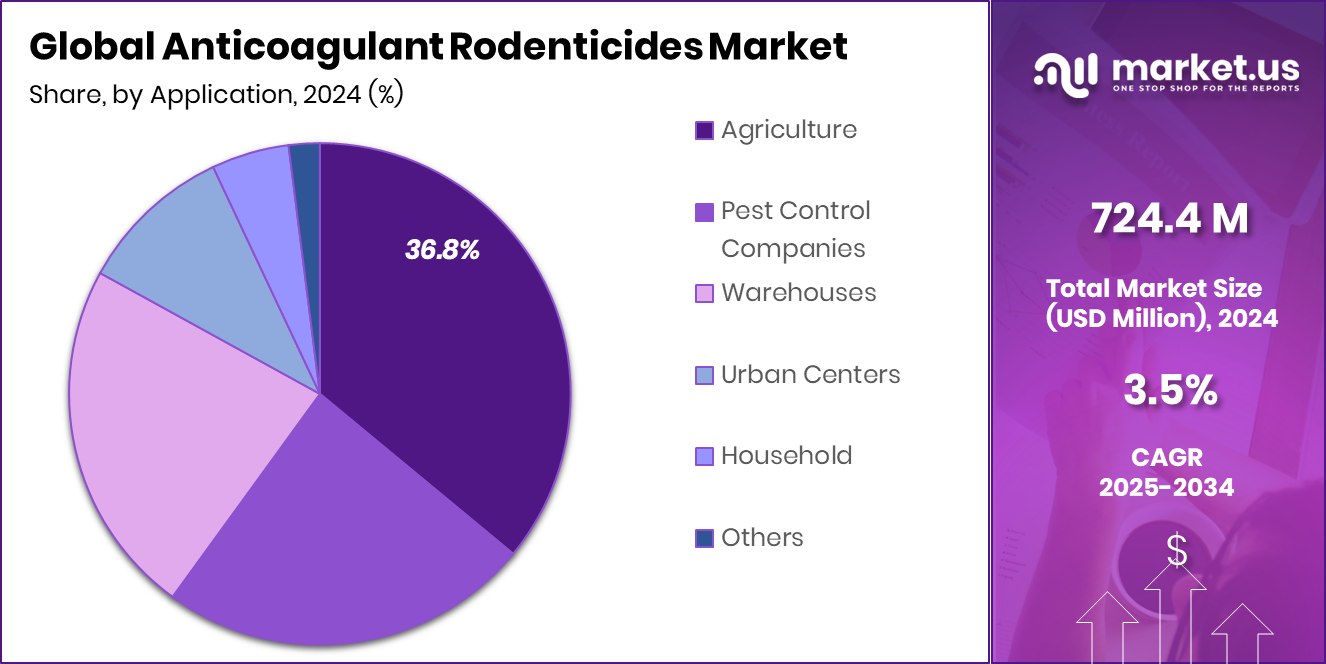

- Agriculture leads the Anticoagulant Rodenticides Market with 36.8% share, driven by crop protection and storage safety.

- Strong demand in North America drove 42.80%, USD 310.0 Mn.

By Product Type Analysis

Second-generation anticoagulants account for a 67.9% share of the Anticoagulant Rodenticides Market.

In 2024, Second-generation Anticoagulants held a dominant market position in the By by-product type segment of the Anticoagulant Rodenticides Market, with a 67.9% share. These products are preferred for their high potency and ability to eliminate rodents with a single feeding, making them more effective in severe infestations compared to first-generation options. Their longer persistence in rodent bodies ensures complete control, even in environments with abundant alternative food sources.

The strong market share reflects their extensive use in agricultural storage facilities, urban pest control programs, and commercial premises where quick and decisive results are essential. Regulatory acceptance in many regions, coupled with improved bait formulations, has supported steady adoption despite growing environmental safety concerns.

Demand is particularly strong in regions facing high rodent pressure due to dense urbanization and changing climate conditions, which enhance breeding cycles. Continuous innovations, such as moisture-resistant baits and targeted delivery systems, are also expanding application efficiency.

While environmental regulations encourage cautious use, the proven track record of second-generation anticoagulants in controlling resistant rodent populations ensures their sustained market leadership. Their dominance in 2024 highlights the balance between efficacy, ease of use, and the urgent need for reliable rodent management solutions in critical sectors.

By Form Analysis

Pellets account for a 44.6% share in the anticoagulant rodenticides market.

In 2024, Pellets held a dominant market position in the By Form segment of the Anticoagulant Rodenticides Market, with a 44.6% share. Their popularity stems from the ease of handling, consistent dosage, and high palatability that ensure effective rodent control across diverse environments. Pellets are designed to be durable and resistant to moisture, making them suitable for both indoor and outdoor use, including agricultural fields, warehouses, and urban infrastructures.

The compact form allows for precise placement in bait stations, reducing wastage and limiting exposure to non-target species. Their longer shelf life and stability under varying climatic conditions further enhance their appeal, particularly in regions facing high humidity or temperature fluctuations. Additionally, pellets offer uniform distribution of active ingredients, ensuring rodents consume a lethal dose quickly, which is crucial in areas with high infestation pressure.

Growing adoption in food storage facilities and public health campaigns reflects their reliability in meeting strict hygiene and pest management standards. Technological improvements, such as incorporating flavors to attract target species or adding deterrents to protect non-target animals, are further reinforcing their market leadership. The strong 2024 share underscores pellets’ role as a preferred, efficient, and adaptable solution for anticoagulant rodenticide applications worldwide.

By Application Analysis

Agriculture application captures 36.8% share in the anticoagulant rodenticides market.

In 2024, Agriculture held a dominant market position in the By Application segment of the Anticoagulant Rodenticides Market, with a 36.8% share. This dominance is driven by the critical need to protect crops, stored grains, and farm infrastructure from rodent damage, which can lead to significant economic losses. Rodents pose a major threat to agricultural productivity by consuming and contaminating food supplies, damaging irrigation systems, and undermining soil structures.

The use of anticoagulant rodenticides in agricultural settings ensures effective, long-term control of these pests, especially in large-scale farming operations where infestations can spread rapidly. Second-generation formulations are often preferred for their ability to control resistant rodent populations with minimal applications, reducing labor and operational costs. Additionally, the adoption of integrated pest management practices in agriculture has further encouraged the use of these products as part of comprehensive control strategies.

Seasonal spikes in rodent activity, particularly post-harvest, also fuel demand, as farmers aim to safeguard stored commodities against contamination and loss. Supportive government guidelines for pest control in agriculture, along with increased awareness of food safety standards, have reinforced product uptake. The strong 2024 share highlights agriculture’s pivotal role in sustaining demand for anticoagulant rodenticides as an essential tool for protecting food security.

Key Market Segments

By Product Type

- First-generation Anticoagulants

- Warfarin

- Chlorophacinone

- Second-generation Anticoagulants

- Bromadiolone

- Difenacoum

By Form

- Pellets

- Blocks

- Powder/Spray

- Others

By Application

- Agriculture

- Pest Control Companies

- Warehouses

- Urban Centers

- Household

- Others

Driving Factors

Rising Rodent Infestations Threaten Food Security Worldwide

One of the biggest driving factors for the Anticoagulant Rodenticides Market is the growing problem of rodent infestations, which threaten global food security. Rodents damage crops in the field, destroy stored grains, and contaminate food supplies with droppings and urine, leading to huge economic losses. With urban areas expanding and climate changes affecting rodent breeding cycles, their populations are increasing faster than before.

This creates a greater need for effective control methods to protect food production and storage systems. Anticoagulant rodenticides are a preferred choice because they offer reliable and long-lasting control, even against resistant rodent species. As nations focus more on food safety and reducing waste, the demand for these solutions is expected to stay strong in the coming years.

Restraining Factors

Environmental Concerns Limit Widespread Rodenticide Usage

A key restraining factor for the Anticoagulant Rodenticides Market is the growing concern over their environmental impact. These products, while effective against rodents, can also harm non-target animals such as birds, pets, and wildlife if consumed directly or indirectly. Residues from rodenticides may persist in the environment, raising risks of secondary poisoning when predators eat poisoned rodents.

Many countries are introducing stricter regulations and usage guidelines to minimize such risks, which can limit product availability and application scope. Additionally, public awareness campaigns about ecological safety are encouraging alternatives like traps and eco-friendly pest control methods. These restrictions and shifting preferences can slow market growth, especially in regions with strong wildlife protection policies and environmental sustainability goals.

Growth Opportunity

Eco-Friendly Formulations Open New Market Avenues

A major growth opportunity for the Anticoagulant Rodenticides Market lies in developing eco-friendly formulations that are effective against rodents but safer for the environment and non-target species. Growing global focus on sustainability is pushing manufacturers to innovate products with reduced toxicity, controlled dosage release, and targeted delivery systems. Such solutions can minimize risks to pets, wildlife, and humans while maintaining strong pest control performance.

Governments and regulatory bodies are more likely to approve and promote products that meet environmental safety standards, opening doors to new markets. Additionally, these eco-conscious rodenticides can appeal to consumers and businesses seeking to align with green initiatives, creating a strong competitive advantage and driving future demand in both developed and emerging regions.

Latest Trends

Smart Bait Stations Enhance Rodent Control Efficiency

A key trend in the Anticoagulant Rodenticides Market is the rise of smart bait stations equipped with technology to improve rodent control efficiency. These modern devices use sensors to detect rodent activity, track bait consumption, and send real-time alerts to pest control teams. This helps reduce the overuse of rodenticides, lowers environmental risks, and ensures targeted application only where needed.

By combining anticoagulant baits with digital monitoring, pest management becomes more precise, cost-effective, and compliant with strict regulations. Such systems are gaining popularity in commercial facilities, food storage sites, and large agricultural operations, where accurate tracking and prevention are essential. As technology adoption grows, smart bait stations are expected to transform how anticoagulant rodenticides are used worldwide.

Regional Analysis

In 2024, North America captured 42.80%, USD 310.0 Mn.

In 2024, North America emerged as the leading regional market for anticoagulant rodenticides, accounting for 42.80% of the global share, valued at USD 310.0 million. This dominance is driven by stringent food safety regulations, advanced pest control infrastructure, and high awareness about the economic and health risks posed by rodent infestations. The region’s strong agricultural output, extensive grain storage facilities, and dense urban environments create consistent demand for effective rodent control solutions.

Supportive regulatory frameworks allow the use of advanced formulations, particularly second-generation anticoagulants, in controlled applications, ensuring both efficacy and safety. Europe follows closely, supported by growing pest management requirements in urban and rural areas, especially in countries with strict hygiene compliance in food production. Asia Pacific is witnessing rapid growth, fueled by rising urbanization, increasing agricultural activities, and government-led pest control programs.

Meanwhile, the Middle East & Africa and Latin America present emerging opportunities, driven by improving pest control awareness and expanding commercial farming. However, North America’s strong market presence is reinforced by ongoing innovations, such as moisture-resistant baits and smart bait station adoption, which enhance efficiency and reduce environmental risks. This combination of regulatory support, infrastructure readiness, and technological adoption ensures the region’s continued leadership in the anticoagulant rodenticides market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, BASF strengthened its position in the global anticoagulant rodenticides market by focusing on advanced formulations that balance high efficacy with environmental safety. The company continues to innovate in bait technology, aiming to improve moisture resistance and palatability, ensuring consistent performance in varied climatic conditions.

Syngenta has maintained a strong presence through its integrated pest management approach, combining high-quality anticoagulant products with farmer education programs. In 2024, the company emphasized solutions that address resistance management, helping users control rodent populations effectively while reducing non-target exposure risks.

PelGar International remains a recognized specialist in rodent control, known for offering a wide range of anticoagulant formulations suited for both agricultural and urban applications. In 2024, it has focused on product versatility, introducing improved bait presentation methods to enhance uptake and control efficiency in challenging infestation scenarios.

Rentokil Initial plc, as a global leader in pest control services, continues to drive growth by integrating anticoagulant rodenticides into comprehensive service packages. In 2024, the company advanced its adoption of smart monitoring systems, combining traditional rodenticides with digital tracking to improve precision in treatment and reduce waste.

Top Key Players in the Market

- BASF

- Syngenta

- PelGar International

- Rentokil Initial plc

- UPL

- Bell Labs

- Kalyani Industries Limited

- Heranba Industries Ltd.

- NEOGEN Corporation

- Liphatech, Inc.

Recent Developments

- In October 2024, BASF revived its trusted Neosorexa® brand with a new, improved Neosorexa® Plus Blocks, featuring flocoumafen—a more potent anticoagulant than its predecessor. The soft‑yet‑durable blocks ensure fast control even against resistant rodents, combining palatability with weather resistance.

- In February 2024, Syngenta introduced SecureChoice, a plug-and-play digital monitoring system that works around the clock to detect rodent activity. It uses motion and vibration sensors paired with a wireless hub and online dashboard, helping professionals react quickly and manage pest issues more efficiently.

Report Scope

Report Features Description Market Value (2024) USD 724.4 Million Forecast Revenue (2034) USD 1,021.8 Million CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (First-generation Anticoagulants (Warfarin, Chlorophacinone), Second-generation Anticoagulants (Bromadiolone, Difenacoum)), By Form (Pellets, Blocks, Powder/Spray, Others), By Application (Agriculture, Pest Control Companies, Warehouses, Urban Centers, Household, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Syngenta, PelGar International, Rentokil Initial plc, UPL, Bell Labs, Kalyani Industries Limited, Heranba Industries Ltd., NEOGEN Corporation, Liphatech, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anticoagulant Rodenticides MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Anticoagulant Rodenticides MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Syngenta

- PelGar International

- Rentokil Initial plc

- UPL

- Bell Labs

- Kalyani Industries Limited

- Heranba Industries Ltd.

- NEOGEN Corporation

- Liphatech, Inc.