Global Anastomosis Devices Market Analysis By Product (Disposable, Reusable), By Application (Cardiovascular Surgery, Gastrointestinal Surgery, Other applications), By End-use (Hospitals, Ambulatory Care Centers & Clinics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 24969

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

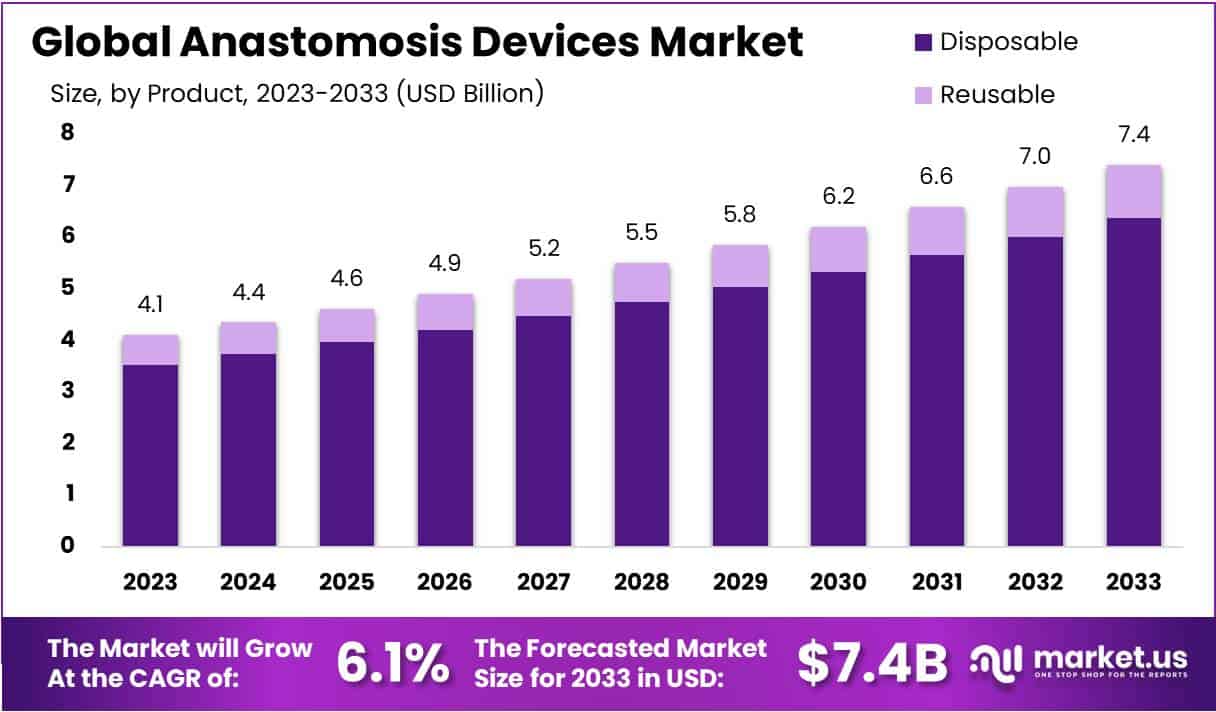

The Anastomosis Devices Market Size is anticipated to reach approximately USD 7.4 billion by the year 2033, marking a significant increase from USD 4.1 billion in 2023. This growth is projected to occur at a Compound Annual Growth Rate (CAGR) of 6.1% throughout the forecast period spanning from 2024 to 2033.

Anastomosis devices play a crucial role in modern surgical procedures, facilitating the connection of two hollow or tubular structures within the human body. These devices streamline the process of joining tissues during surgery, offering efficiency and enhanced security. One common type of anastomosis device is the surgical stapler, widely employed in gastrointestinal surgeries for its ability to quickly and securely connect tissues using staples.

Additionally, sutures and suturing devices are utilized, particularly in procedures where a more traditional approach is preferred. Vascular clips find application in vascular surgery, temporarily occluding blood vessels or securing anastomosis sites. The diverse range of anastomosis devices allows surgeons to tailor their approach based on the specific requirements of each medical scenario, ensuring optimal outcomes and promoting effective tissue healing.

The global market for anastomosis devices has experienced growth driven by factors such as the rising number of surgical procedures, advancements in surgical techniques, and an expanding aging population. Anastomosis devices play a crucial role in various surgical contexts, facilitating the connection of blood vessels and other tubular structures.

This market encompasses diverse devices, including surgical staplers, sutures, bovine pericardial strips, vascular closure devices, and synthetic grafts. Companies in this competitive market focus on innovations like minimally invasive techniques and biodegradable materials. The dynamics are influenced by technological advancements, regulatory considerations, reimbursement policies, and overall healthcare infrastructure.

Key Takeaways

- Market Growth: The Anastomosis Devices Market is set to reach USD 7.4 billion by 2033 with a projected CAGR of 6.1% from 2024 to 2033.

- Device Dominance: In 2023, Disposable devices held a commanding market share of 86.4%, driven by convenience, hygiene, and infection risk reduction.

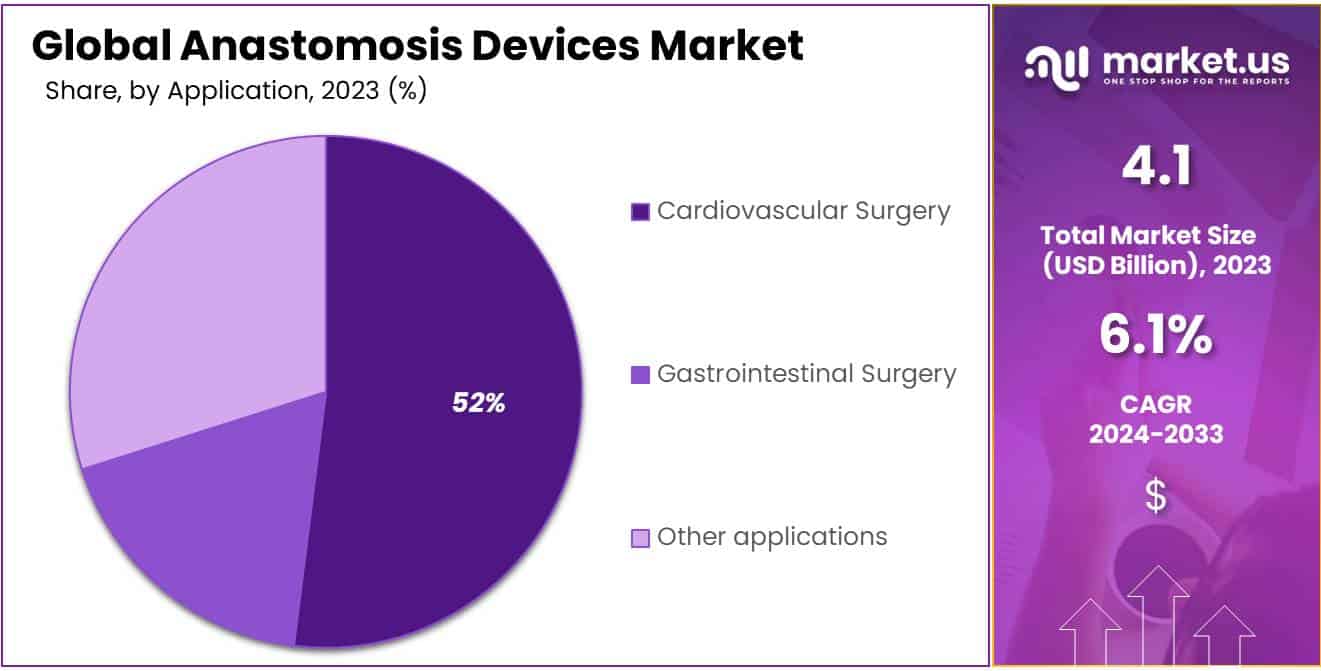

- Application Focus: Cardiovascular Surgery led with a substantial 52% market share in 2023, emphasizing the devices’ pivotal role in heart-related procedures.

- End-Use Landscape: Hospitals dominated, securing a significant market share exceeding 58.6% in 2023, showcasing the devices’ indispensability in complex healthcare scenarios.

- Market Drivers: Increased surgical procedures, technological advancements, and an aging population propel the market, addressing diverse medical needs.

- Challenges: Cost barriers, complication risks, and regulatory hurdles hinder adoption, impacting market growth and acceptance among surgeons and patients.

- Opportunities: Emerging markets and novel technologies, especially bioabsorbable devices, present growth prospects, fostering collaborations and partnerships for accessibility.

- Trends: Minimally invasive procedures, personalized solutions, and the use of 3D printing technology signify industry shifts, reflecting preferences for safety and infection control.

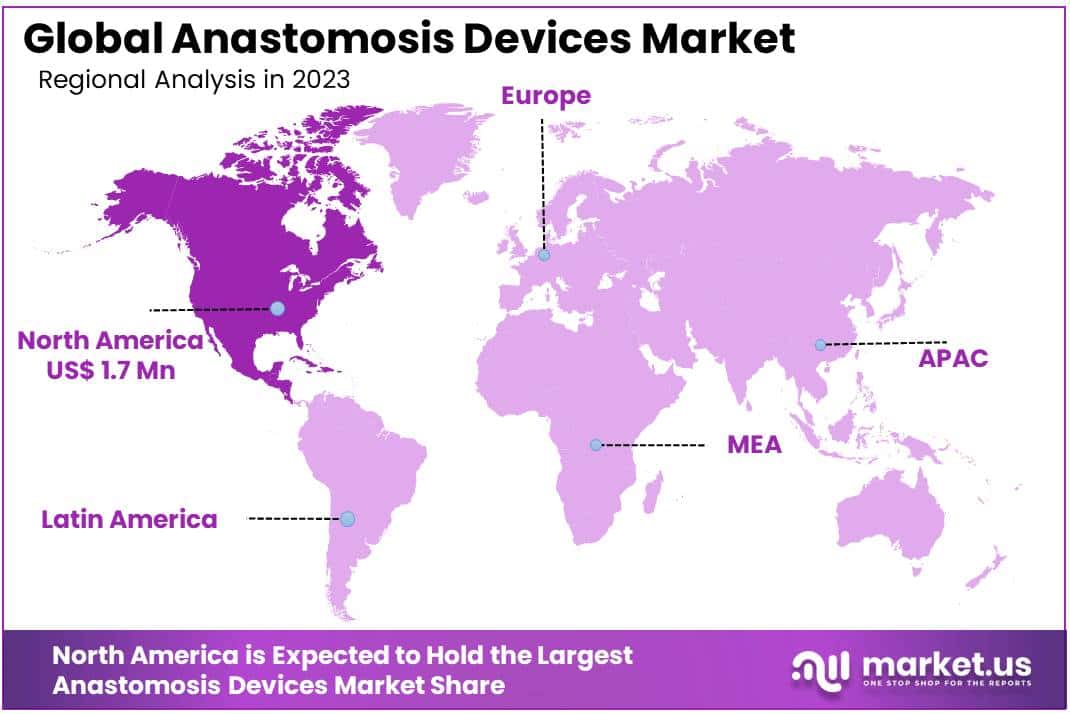

- Regional Dominance: North America leads with a 42.6% market share in 2023, driven by robust healthcare infrastructure, innovation, and favorable reimbursement policies.

Product Analysis

In 2023, the Anastomosis Devices Market showcased a significant dominance within its product segments, with the Disposable category emerging as the frontrunner, securing an impressive market share exceeding 86.4%. This notable position underscores the widespread adoption and preference for disposable devices in medical procedures involving anastomosis.

The Disposable segment’s commanding presence is attributed to its inherent advantages, offering a convenient and hygienic solution for healthcare practitioners. The one-time use nature of disposable devices minimizes the risk of infections and ensures a sterile environment during critical procedures. Healthcare professionals widely appreciate the simplicity and efficiency that disposable anastomosis devices bring to the table.

Conversely, the Reusable segment, while maintaining a noteworthy presence, trails behind its disposable counterpart in market share. In 2023, it accounted for the remaining market share, highlighting a discernible preference among healthcare providers for the convenience and safety offered by disposable alternatives.

The Disposable segment’s dominance in the Anastomosis Devices Market is indicative of the industry’s commitment to advancing patient care through innovative and practical solutions. As healthcare standards continue to prioritize safety and efficiency, the disposable category is anticipated to retain its leading position, shaping the landscape of anastomosis procedures in the foreseeable future.

Application Analysis

In 2023, the Anastomosis Devices Market showcased a notable dominance in the Cardiovascular Surgery segment, securing a commanding position with a substantial 52% market share. This underscores the pivotal role of these devices in procedures related to heart and blood vessels.

Gastrointestinal Surgery emerged as another vital application, contributing significantly to the market landscape. The demand for anastomosis devices in gastrointestinal surgeries demonstrated a robust presence, addressing critical needs in digestive health interventions.

Furthermore, the market extended its reach into diverse applications beyond cardiovascular and gastrointestinal realms. Other applications witnessed a growing adoption of anastomosis devices, reflecting the versatility and adaptability of these instruments across a spectrum of medical procedures.

This segmentation not only emphasizes the significance of anastomosis devices in cardiovascular surgeries but also highlights their expanding role in gastrointestinal procedures and other diverse applications. The market’s multifaceted growth is indicative of the pivotal role these devices play in advancing medical interventions across various healthcare domains.

End-Use Analysis

In 2023, the Anastomosis Devices Market showcased a notable dominance in the Hospitals segment, securing a commanding market position with a share exceeding 58.6%. Hospitals emerged as the leading end-use category for these innovative medical devices, underlining their pivotal role in the healthcare landscape.

Ambulatory Care Centers, while contributing significantly to the market, trailed behind hospitals with a distinct market share. These centers, designed for outpatient services, accounted for a noteworthy portion of the market, emphasizing the versatility of anastomosis devices in various healthcare settings.

Clinics, though a key player in the adoption of these devices, held a slightly lower market share compared to hospitals and ambulatory care centers. The clinic segment’s contribution showcased the widespread integration of anastomosis devices across diverse healthcare facilities, catering to the evolving needs of patient care.

The dominance of hospitals can be attributed to their comprehensive healthcare services, intricate surgeries, and the sheer volume of patients treated within these facilities. The preference for anastomosis devices in hospital settings underscores their efficacy in addressing complex medical scenarios, cementing their status as indispensable tools in modern healthcare practices.

As the market continues to evolve, understanding the distinct roles played by hospitals, ambulatory care centers, and clinics is crucial for stakeholders. This segmentation provides valuable insights for manufacturers, healthcare professionals, and investors, guiding strategic decisions and fostering innovation in the dynamic landscape of anastomosis devices.

Key Market Segments

Product

- Disposable

- Reusable

Application

- Cardiovascular Surgery

- Gastrointestinal Surgery

- Other applications

End-use

- Hospitals

- Ambulatory Care Centers & Clinics

Drivers

Driving Forces, A Closer Look at Surgical Trends, Technological Advancements, and Healthcare Landscape

The Anastomosis Devices Market is experiencing a notable surge due to several key factors. Firstly, there’s a marked increase in surgical procedures, particularly in gastrointestinal and cardiovascular surgeries. This uptick is attributed to the aging global population and the growing prevalence of surgical interventions. Additionally, technological advancements, including minimally invasive techniques and robotic-assisted surgeries, are fostering a demand for innovative anastomosis devices.

The rise in chronic diseases like colorectal cancer and cardiovascular ailments further propels the need for these devices. Improved healthcare infrastructure, coupled with heightened awareness of surgical benefits, is also contributing to the expanding market for anastomosis devices.

Restraints

Cost Barriers, Complication Risks, and Regulatory Hurdles

The high cost associated with anastomosis devices, especially advanced ones, poses a substantial barrier to adoption, particularly in regions with constrained healthcare budgets or among patients lacking adequate insurance coverage. Surgical procedures involving these devices carry inherent risks of complications, such as leaks or strictures, leading to hesitancy among both surgeons and patients, impacting market growth. Additionally, the stringent regulatory approval processes for medical devices can impede the timely introduction of innovative products. Limited reimbursement policies for certain procedures involving anastomosis devices further hinder market growth by discouraging healthcare providers and patients from opting for these interventions.

Opportunities

Opportunities in Anastomosis Devices Market through Emerging Markets, Novel Technologies, and Collaborative Partnerships

The untapped potential in emerging markets is a significant growth opportunity for the anastomosis devices market. As healthcare infrastructure improves in developing regions, the demand for advanced surgical techniques is on the rise, creating a favorable environment for market expansion. Another avenue for growth stems from the development of novel technologies, particularly bioabsorbable anastomosis devices.

These innovations, resulting from ongoing research and development, address current limitations and contribute to market expansion. The increasing geriatric population, especially in developed countries, is driving a higher incidence of age-related diseases requiring surgical interventions, presenting a substantial growth opportunity. Collaborations and partnerships between medical device manufacturers and healthcare providers further fuel market growth by enhancing accessibility and promoting adoption in various healthcare settings.

Trends

Emerging Trends in Anastomosis Devices: Minimally Invasive Procedures, Personalized Solutions, and 3D Printing Revolution

The medical field is witnessing a significant inclination toward minimally invasive surgical techniques like laparoscopic and robotic-assisted procedures, driving a surge in demand for anastomosis devices compatible with these approaches. Notably, a trend towards personalized medicine is shaping the development of patient-specific anastomosis devices, tailoring solutions to individual characteristics.

Additionally, the rise of 3D printing technology in manufacturing these devices allows for intricate, customized structures, enhancing precision and patient outcomes. Moreover, the market is experiencing a shift towards the increased adoption of disposable anastomosis devices, reflecting a broader industry preference for single-use medical tools to enhance safety and infection control.

Regional Analysis

North America holds the largest share of the global anastomosis devices market over 42.6% in 2023. This equates to a substantial market value of USD 1.7 billion. The region leads primarily owing to well-developed healthcare infrastructure and systems that enable access and adoption of advanced surgical devices like anastomosis instruments.

Further supporting market dominance is the high and growing incidence of obesity, gastrointestinal diseases, and other chronic disorders in North America. These require surgeries involving anastomoses, fueling demand for specialty devices used in joining organs or structures. Access to the newest technologies also assists rapid uptake.

While disease burden creates need, favorable reimbursement coverage and infrastructure for advanced procedures involving anastomosis enables greater device usage. Government and private payer support for minimally invasive surgeries which utilize these instruments is especially high. This reduces cost barriers to adoption.

North America also thrives as many key medtech innovators focusing on advancing anastomosis instrumentation are based in the region. Players continuously launch improved products with novel technologies that add precision, speed and ease-of-use maintaining the regional industry’s leadership position.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Anastomosis Devices Market is marked by the dynamic presence of key players such as Medtronic, LivaNova PLC, MAQUET Holding B.V. & Co. KG., and Dextera Surgical Inc., among others. Their collective contributions, ranging from technological innovation to global outreach, shape the market’s growth trajectory. As the demand for advanced surgical solutions continues to rise, these key players are at the forefront, driving progress and setting benchmarks for the industry.

LivaNova PLC brings a unique perspective to the Anastomosis Devices Market, leveraging its expertise in medical technology. Known for cardiovascular and neuromodulation solutions, LivaNova’s anastomosis devices stand out for their quality and performance. The company’s strategic initiatives and focus on meeting evolving clinical demands make it an integral part of the competitive landscape, influencing market dynamics.

MAQUET Holding B.V. & Co. KG. is a prominent player in the Anastomosis Devices Market, offering comprehensive solutions for surgical procedures. With a commitment to advancing healthcare, MAQUET’s anastomosis devices are designed with precision and efficiency in mind. The company’s global presence and emphasis on customer satisfaction contribute significantly to its influence in the market, reflecting its dedication to improving patient outcomes.

Dextera Surgical Inc. is a key player specializing in innovative anastomosis devices, providing surgical solutions that prioritize minimally invasive techniques. Their focus on enhancing surgeon capabilities and patient recovery aligns with the market’s growing demand for advanced and patient-friendly devices. Dextera Surgical’s agility and focus on niche segments contribute to its noteworthy presence in the Anastomosis Devices Market.

Beyond the aforementioned industry leaders, several other key players contribute to the dynamism of the Anastomosis Devices Market. These companies, through their specialized offerings and regional strengths, add diversity and competition to the landscape. The collective efforts of these players foster innovation, ensuring a constant evolution of anastomosis devices to meet the evolving needs of healthcare professionals and patients alike.

Market Key Players

- Medtronic

- LivaNova PLC

- MAQUET Holding B.V. & Co. KG.

- Dextera Surgical Inc.

- Vitalitec Internaional Inc.

- Synovis Micro Companies Alliance Inc.

- Ethicon US LLC

- Peters Surgical

Recent Developments

- In September 2023, Medtronic, a prominent player in medical technology, made headlines with its acquisition of CryoLife, a company specializing in tissue-based and regenerative medical products for cardiovascular and surgical applications. This strategic move is anticipated to bolster Medtronic’s presence in the cardiovascular surgery market, offering access to CryoLife’s cutting-edge technologies, including the innovative CryoSeal technology for vascular anastomosis.

- In June 2023, Abbott, a global healthcare company, introduced its groundbreaking Absorbable Stapler tailored for minimally invasive surgical procedures. Distinguished by its unique absorbable design, this stapler eliminates the need for suture removal, thereby reducing the risk of complications associated with traditional staplers.

- In August 2023, Ethicon, a subsidiary of Johnson & Johnson, celebrated FDA approval for its LigaSure Precise Energy Vessel Sealing System. This advanced system is engineered to deliver precise and controlled vessel sealing during surgical procedures, effectively mitigating the risk of bleeding and associated complications.

- In October 2023, Integra LifeSciences, a global biomaterials and medical device company, joined forces with Medtronic to develop a next-generation surgical sealant. This collaborative effort combines Integra’s proficiency in tissue adhesives with Medtronic’s extensive experience in surgical devices, aiming to create a new sealant with enhanced adhesion and biocompatibility.

Report Scope

Report Features Description Market Value (2023) USD 4.1 Bn Forecast Revenue (2033) USD 7.4 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Disposable, Reusable), By Application (Cardiovascular Surgery, Gastrointestinal Surgery, Other applications), By End-use (Hospitals, Ambulatory Care Centers & Clinics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Medtronic, LivaNova PLC, MAQUET Holding B.V. & Co. KG., Dextera Surgical Inc., Vitalitec Internaional Inc., Synovis Micro Companies Alliance Inc., Ethicon US LLC, Peters Surgical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the anastomosis devices size in 2023?The Anastomosis devices size is USD 4.1 million for 2023.

What is the CAGR for the anastomosis devices?The Anastomosis devices is expected to grow at a CAGR of 6.1% during 2024-2033.

What are the segments covered in the anastomosis devices report?Market.US has segmented the Global Anastomosis Devices Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By product type, market has been segmented into disposable and reusable. By Application, market has been further divided into cardiovascular surgery, gastrointestinal surgery, others. By End-User, market has been segmented into hospitals, ambulatory care centers & clinics.

Who are the key players in the anastomosis devices?Medtronic, LivaNova PLC, MAQUET Holding B.V. & Co. KG., Dextera Surgical Inc., Vitalitec Internaional Inc., Synovis Micro Companies Alliance Inc., Ethicon US LLC, Peters Surgical and Other Key Players are the key vendors in the Anastomosis devices.

Which region is more attractive for vendors in the anastomosis devices?North America accounted for the highest market share of 42.6% among the other regions. Therefore, the Anastomosis devices in North America is expected to garner significant business opportunities for the vendors during the forecast period.

What are the key markets for anastomosis devices?The U.S., Canada, U.K., Germany, Italy, and France, are key areas of operation for anastomosis devices Market.

Which segment has the largest share in the anastomosis devices?In the anastomosis devices, vendors should focus on grabbing business opportunities from the disposable segment as it accounted for the largest market share in the base year 2023.

-

-

- Medtronic

- LivaNova PLC

- MAQUET Holding B.V. & Co. KG.

- Dextera Surgical Inc.

- Vitalitec Internaional Inc.

- Synovis Micro Companies Alliance Inc.

- Ethicon US LLC

- Peters Surgical