Global Ammonium Phosphate Market Type(Ammonium Polyphosphate, Monoammonium Phosphate, Diammonium Phosphate), Product Form(Granular, Powder), Grade( Food Grade, Technical Grade), Application(Fertlizer, Food Additives, Animal Feed, Fire Safety, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122084

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

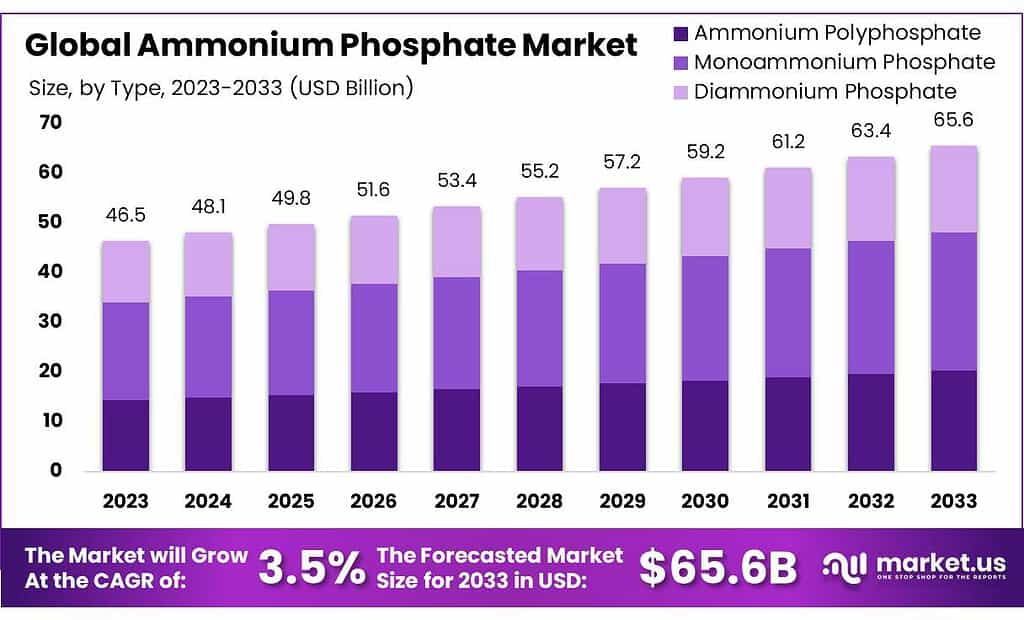

The global Ammonium Phosphate Market size is expected to be worth around USD 65.6 billion by 2033, from USD 46.5 billion in 2023, growing at a CAGR of 3.5% during the forecast period from 2023 to 2033.

The Ammonium Phosphate Market involves the production and sale of ammonium phosphate compounds, primarily used as fertilizers in agriculture. These compounds are highly effective as they deliver essential nutrients, nitrogen, and phosphorus, to plants, enhancing growth and crop yields. Ammonium phosphate comes in several forms, including monoammonium phosphate (MAP) and diammonium phosphate (DAP), each serving specific agricultural needs based on soil conditions and crop requirements.

Besides agriculture, ammonium phosphate is also used in fire extinguishers as a fire retardant agent. It helps suppress flames in forest management and in industrial fire safety systems. The versatility of ammonium phosphate extends into the food industry as well, where it acts as a leavening agent in baked goods and as a nutrient source in yeast fermentation processes.

The demand for ammonium phosphate is influenced by global agricultural trends, food security concerns, and industrial safety regulations. The market’s growth is driven by the increasing need to improve crop production to feed a growing global population and the rising awareness of fire safety standards. However, the market also faces challenges such as environmental concerns related to the overuse of fertilizers, leading to potential regulatory restrictions.

Innovation in product formulation and application methods continues to shape the market, with developments aimed at increasing the efficiency and environmental sustainability of ammonium phosphate products. This includes innovations in slow-release fertilizers that reduce runoff and improve nutrient uptake by plants. As the global focus on sustainable agriculture intensifies, the ammonium phosphate market is expected to adapt, offering solutions that meet both productivity and environmental goals.

Key Takeaways

- Market Growth: The Ammonium Phosphate Market is set to reach USD 65.6 billion by 2033, growing from USD 46.5 billion in 2023 at a 3.5% CAGR.

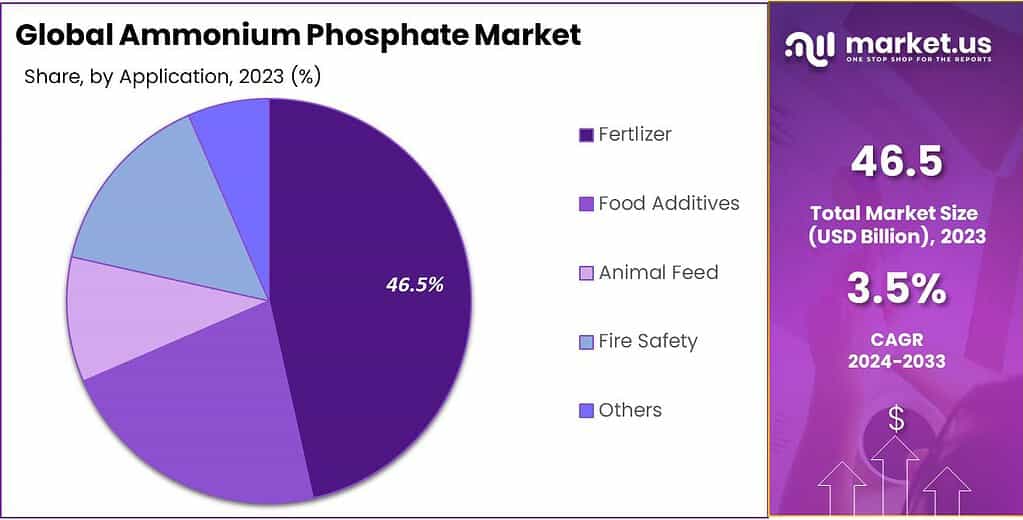

- Primary Application: Over 46.5% of the market in 2023 was dominated by ammonium phosphate’s use as a fertilizer, crucial for enhancing crop yields.

- Leading Type: Monoammonium phosphate (MAP) held a significant market share of 42.3% in 2023, valued for its high phosphorus content beneficial for crops like potatoes and corn.

- Preferred Form: Powdered ammonium phosphate commanded a 58.6% share in 2023 due to its ease of application and rapid nutrient absorption by plants.

- Key Segment: Technical Grade ammonium phosphate led with a 63.5% share in 2023, pivotal in industrial applications such as flame retardants and fertilizers.

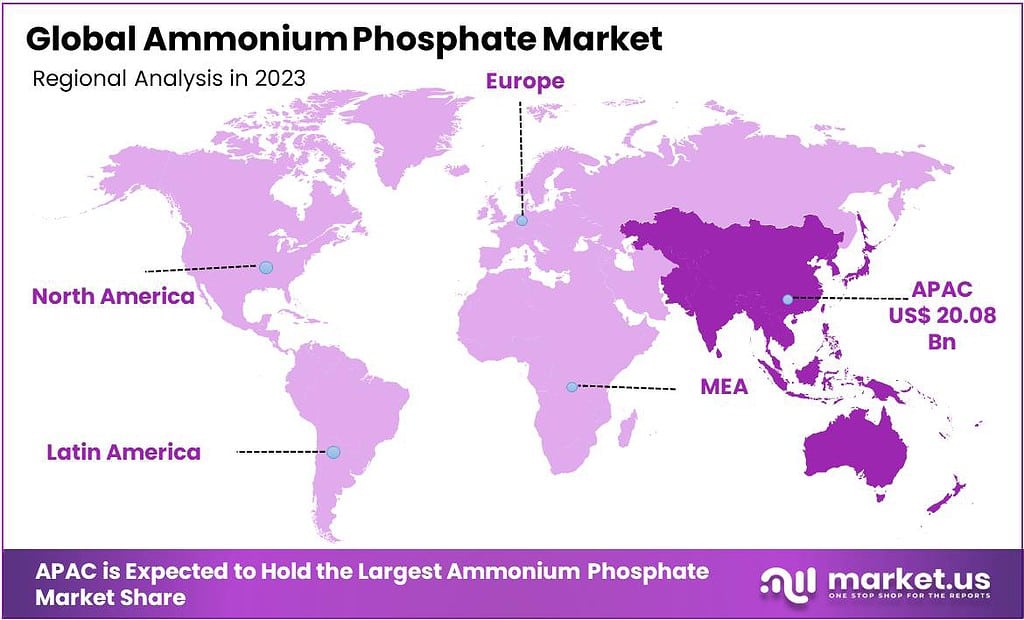

- Regional Dominance: Asia-Pacific holds a commanding 43.2% share in the market, driven by industrial growth, favorable policies, and increasing consumer demand for agricultural products.

By Type

In 2023, Monoammonium Phosphate (MAP) held a dominant market position in the Ammonium Phosphate Market, capturing more than a 42.3% share. This form of ammonium phosphate is extensively used due to its high phosphorus content, making it an ideal fertilizer for various crops that require significant phosphorus, such as potatoes, corn, and wheat. MAP is favored for its efficiency in soil nutrient delivery, promoting strong root development and early growth in plants, which is crucial for maximizing yield.

Diammonium Phosphate (DAP) is another key segment, known for its slightly higher nitrogen content compared to MAP, making it particularly useful during the seeding stage of crop cultivation. DAP is popular in regions with cooler climates where it helps accelerate plant maturity and enhances the grain or fruit quality, supporting robust agricultural output.

Ammonium Polyphosphate, the third type, is primarily used as a flame retardant in various industrial applications, including plastics and textiles, and as a fertilizer in liquid form. Its versatility in both fire safety and agriculture contributes to its demand, though its market share is smaller compared to MAP and DAP.

By Product Form

In 2023, the Powder form of ammonium phosphate held a dominant market position, capturing more than a 58.6% share. This product form is widely preferred for its ease of application and compatibility in various industrial processes. The powdered form is particularly valued in the agricultural sector, where it is used extensively as a fertilizer due to its ability to dissolve quickly and evenly distribute nutrients when applied to soil, ensuring efficient uptake by plants.

Conversely, the Granular form of ammonium phosphate is significant for its controlled-release properties, which are crucial in managing nutrient supply to crops over an extended period. Granular ammonium phosphate is favored in situations where slow and steady nutrient release is beneficial to crop growth, such as in perennial crops or in areas with high rainfall, where nutrient leaching might be a concern.

Both forms serve crucial roles in agriculture, each catering to specific application needs that ensure optimal growth conditions for crops, thus reflecting the diverse applications and flexibility of ammonium phosphate in enhancing agricultural productivity.

By Grade

In 2023, Technical Grade ammonium phosphate held a dominant market position, capturing more than a 63.5% share. This grade is primarily utilized in a wide range of industrial applications, including as a flame retardant in textiles and plastics, and as a fertilizer in agriculture.

The high demand for Technical Grade is due to its effectiveness and efficiency in these applications, where precise chemical composition and purity levels are critical for ensuring performance and safety.

On the other hand, Food Grade ammonium phosphate is used as an additive in the food industry, where it serves as a leavening agent in baked goods and a nutrient in yeast fermentation processes. Though it has a smaller market share compared to Technical Grade, food-grade ammonium phosphate is essential for maintaining food quality and safety, adhering to strict health and safety standards required for food products.

By Application

In 2023, Fertilizer held a dominant market position in the Ammonium Phosphate Market, capturing more than a 46.5% share. This application benefits significantly from ammonium phosphate’s high nutrient content, specifically phosphorus and nitrogen, which are essential for healthy crop growth and high yields. It is extensively used across various types of agriculture due to its ability to improve root strength and boost flowering and fruiting in plants.

Food Additives are another key segment where ammonium phosphate is used as a leavening agent in baked goods and as a nutrient in processed foods. While it has a smaller share compared to fertilizers, its role in ensuring food quality and safety is crucial.

In Animal Feed, ammonium phosphate serves as a dietary supplement, providing essential minerals to improve the health and productivity of livestock. This application is vital for supporting sustainable animal agriculture practices.

The Fire Safety segment utilizes ammonium phosphate primarily as a fire retardant. It is used in fire extinguishers and fire prevention treatments for fabrics and woods, leveraging its ability to suppress flames effectively.

Key Market Segments

Type

- Ammonium Polyphosphate

- Monoammonium Phosphate

- Diammonium Phosphate

Product Form

- Granular

- Powder

Grade

- Food Grade

- Technical Grade

Application

- Fertlizer

- Food Additives

- Animal Feed

- Fire Safety

- Others

Drivers

Global Increase in Agricultural Productivity Needs

A major driver for the Ammonium Phosphate Market is the global increase in the demand for agricultural productivity. As the world’s population continues to grow, the need for enhanced crop yields to feed the increasing number of people becomes more critical. Ammonium phosphate, a key ingredient in fertilizers, plays a vital role in improving agricultural productivity by providing essential nutrients, primarily phosphorus and nitrogen, to plants. These nutrients are crucial for root development, crop maturity, and overall plant health, leading to more robust crop yields and better food production efficiency.

In regions where soil fertility is low, the addition of ammonium phosphate can make a significant difference in crop production. Its effectiveness in increasing phosphorous content in the soil, which is often a limiting factor in agricultural productivity, is particularly valued. This has led to its widespread use in both developing and developed countries, where agricultural efficiency is pivotal to economic stability and growth.

Furthermore, the trend towards sustainable agriculture practices also supports the demand for ammonium phosphate. As farmers and agricultural enterprises aim to reduce environmental impact, the efficient use of fertilizers that provide essential nutrients without excessive runoff or waste becomes important. Ammonium phosphate’s properties allow it to be used effectively and responsibly, contributing to more sustainable agricultural cycles.

The adoption of modern agricultural techniques and the expansion of agro-based industries in emerging economies are additional factors driving the demand for ammonium phosphate. Governments and agricultural sectors in these regions are promoting the use of effective fertilizers to ensure food security and reduce dependency on food imports.

Restraints

Environmental Concerns and Regulatory Restrictions

A significant restraint facing the Ammonium Phosphate Market is the growing environmental concerns and regulatory restrictions related to the use of chemical fertilizers. Ammonium phosphate, widely used to boost crop productivity, can contribute to severe environmental issues, including water pollution and soil degradation. When used excessively, these fertilizers can leach into waterways, causing eutrophication—a process where nutrient overloads lead to excessive growth of algae and aquatic plants, depleting oxygen in water bodies and harming aquatic life.

The impact of eutrophication is a critical environmental issue that has led to stringent regulations governing the use of agricultural chemicals, including ammonium phosphate. These regulations aim to control the amount and manner in which fertilizers are applied to farmland, to minimize their negative environmental impacts. In regions like the European Union, strict directives and guidelines are in place to manage fertilizer usage, which directly affects the demand and production of ammonium phosphate.

Furthermore, there is a growing advocacy and preference for organic farming practices, which rely on natural fertilizers as opposed to synthetic chemicals. This shift is influenced by consumer demand for organic produce, which is perceived as healthier and more environmentally sustainable. The rising popularity of organic farming is gradually reducing the dependence on chemical fertilizers, posing a challenge to the market growth of ammonium phosphate.

Additionally, the production of ammonium phosphate itself involves significant energy consumption and greenhouse gas emissions, adding to environmental concerns. As global awareness and initiatives to combat climate change intensify, the pressure on industries to reduce their carbon footprint grows. This environmental scrutiny is encouraging the development of alternative, more sustainable agricultural inputs, which could further restrain the traditional ammonium phosphate market.

Opportunity

Expansion into High-Growth Regions

A major opportunity for the Ammonium Phosphate Market lies in its expansion into high-growth regions, particularly in Asia, Africa, and South America. These regions are experiencing rapid agricultural development due to the increasing need to enhance food production to meet the demands of growing populations. As countries like India, China, Brazil, and several African nations focus on increasing their agricultural output, the demand for effective fertilizers like ammonium phosphate is expected to rise significantly.

These regions present unique opportunities for the ammonium phosphate market because many of them are still transitioning from traditional farming methods to more modern agricultural practices, which include the use of chemical fertilizers to ensure crop health and productivity. The push towards improving agricultural yields is also often supported by government initiatives and subsidies, making these markets particularly attractive for fertilizer companies.

Moreover, these emerging markets have vast arable lands and diverse climates that allow for multiple farming cycles each year, further enhancing the demand for fertilizers. Establishing a strong presence in these regions could provide significant long-term benefits for players in the ammonium phosphate market. Companies can leverage local partnerships and tailor their products to meet specific regional needs, which can differ markedly due to varying soil compositions and agricultural practices.

In addition to market expansion, there is also an opportunity for innovation in product formulation and application technologies aimed at increasing the efficiency of ammonium phosphate fertilizers. Developing slow-release or controlled-release formulations can minimize environmental impact and improve nutrient uptake, making products more appealing in markets that are becoming increasingly sensitive to environmental issues.

Trends

Shift Towards Enhanced-Efficiency Fertilizers

A significant trend in the Ammonium Phosphate Market is the shift towards enhanced-efficiency fertilizers, which are designed to increase nutrient availability to plants while reducing environmental impacts. As global awareness around the environmental issues associated with traditional fertilizer use—such as nutrient runoff into waterways and emissions of greenhouse gases—grows, the demand for more sustainable and efficient fertilization solutions is also rising.

Enhanced-efficiency fertilizers, including slow-release and controlled-release ammonium phosphate products, are engineered to release nutrients gradually or in response to specific environmental triggers such as soil temperature and moisture levels. This controlled release not only ensures that nutrients are available at the right time and in the right amounts for optimal plant growth but also minimizes leaching and volatilization, which are common problems with conventional fertilizers.

This trend is particularly pronounced in regions with stringent environmental regulations and in markets where sustainable agriculture practices are highly valued. Farmers and agricultural companies are increasingly adopting these advanced products to comply with regulations aimed at reducing environmental damage and to fulfill consumer demands for sustainably produced food.

Moreover, the innovation in fertilizer technology is also being driven by the need to improve the economic efficiency of agricultural operations. Enhanced-efficiency fertilizers can reduce the frequency of applications needed, save labor and application costs, and potentially increase crop yields by improving nutrient use efficiency.

Regional Analysis

The Asia-Pacific (APAC) region commands a dominant position in the Ammonium Phosphate market, holding a substantial 43.2% share valued at USD 20.08 million. This leadership is propelled by APAC’s robust industrial base, particularly in countries like China, India, and Japan, where the chemical manufacturing sector thrives alongside increasing demands in pharmaceuticals and agrochemicals.

APAC benefits from cost-effective production capabilities and abundant raw materials, bolstering its competitive edge in the global market. Moreover, favorable government policies, coupled with low labor costs and strong infrastructure, facilitate the region’s growth trajectory in the Ammonium Phosphate sector.

The expanding middle class and rising disposable incomes across APAC drive significant demand for consumer goods, further fueling market expansion. Looking ahead, APAC is poised to sustain its leadership with an anticipated annual growth rate of around 5%, supported by ongoing investments in industrial expansion and advancements in sustainable practices and green chemistry initiatives.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Ammonium Phosphate market features a roster of prominent players driving industry dynamics. Yara International ASA, a key global player, contributes significantly with its diversified portfolio and extensive market presence. The OCP Group, based in Morocco, stands out for its robust phosphate mining and fertilizer production capabilities, bolstering its role in global markets.

SABIC, a major player in the chemical industry, leverages its integrated operations to supply ammonium phosphate products worldwide. Coromandel International Limited, Nutrien Ltd., and Solvay S.A. also play crucial roles, each bringing strong expertise in agricultural solutions and chemical manufacturing.

Wengfu Group, Jordan Phosphate Mines Company, and Prayon S.A. contribute through their specialized phosphate mining and processing operations. The Mosaic Company and Haifa Group are recognized for their extensive fertilizer and crop nutrition offerings, while EuroChem Group AG and Innophos Holdings, Inc. bring innovation and strategic expansions to the global ammonium phosphate market.

Market Key Players

- Yara International ASA

- The OCP Group

- SABIC

- Coromandel International Limited

- Nutrien Ltd.

- Solvay S.A.

- Wengfu Group

- Jordan Phosphate Mines Company

- Prayon S.A.

- The Mosaic Company

- Haifa Group

- EuroChem Group AG

- Innophos Holdings, Inc.

- Others

Recent Developments

February 2024, Yara’s initiatives aimed at bolstering its position in sustainable agriculture and innovative fertilizer solutions were ongoing, aligning with global trends towards environmentally friendly practices and precision agriculture.

By April 2024, OCP’s initiatives centered on sustainable development and digital transformation in agriculture, aligning with global trends towards efficient and eco-friendly farming practices.

Report Scope

Report Features Description Market Value (2023) US$ 46.5 Bn Forecast Revenue (2033) US$ 65.6 Bn CAGR (2024-2033) 3.5% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type(Ammonium Polyphosphate, Monoammonium Phosphate, Diammonium Phosphate), Product Form(Granular, Powder), Grade( Food Grade, Technical Grade), Application(Fertlizer, Food Additives, Animal Feed, Fire Safety, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Yara International ASA, The OCP Group, SABIC, Coromandel International Limited, Nutrien Ltd., Solvay S.A., Wengfu Group, Jordan Phosphate Mines Company, Prayon S.A., The Mosaic Company, Haifa Group, EuroChem Group AG, Innophos Holdings, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Ammonium Phosphate Market?Ammonium Phosphate Market size is expected to be worth around USD 65.6 billion by 2033, from USD 46.5 billion in 2023

What is the CAGR for the Ammonium Phosphate Market?The Ammonium Phosphate Market is expected to grow at a CAGR of 3.5% during 2024-2033.Name the major industry players in the Ammonium Phosphate Market?Yara International ASA, The OCP Group, SABIC, Coromandel International Limited, Nutrien Ltd., Solvay S.A., Wengfu Group, Jordan Phosphate Mines Company, Prayon S.A., The Mosaic Company, Haifa Group, EuroChem Group AG, Innophos Holdings, Inc., Others

-

-

- Yara International ASA

- The OCP Group

- SABIC

- Coromandel International Limited

- Nutrien Ltd.

- Solvay S.A.

- Wengfu Group

- Jordan Phosphate Mines Company

- Prayon S.A.

- The Mosaic Company

- Haifa Group

- EuroChem Group AG

- Innophos Holdings, Inc.

- Others