Global Ammonium Nitrate Market By Product Type (Solid ammonium and Liquid ammonium), By Application (Fertilizers, Explosives and Other Applications), By End Use(Agriculture , Mining, Defence, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 31489

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

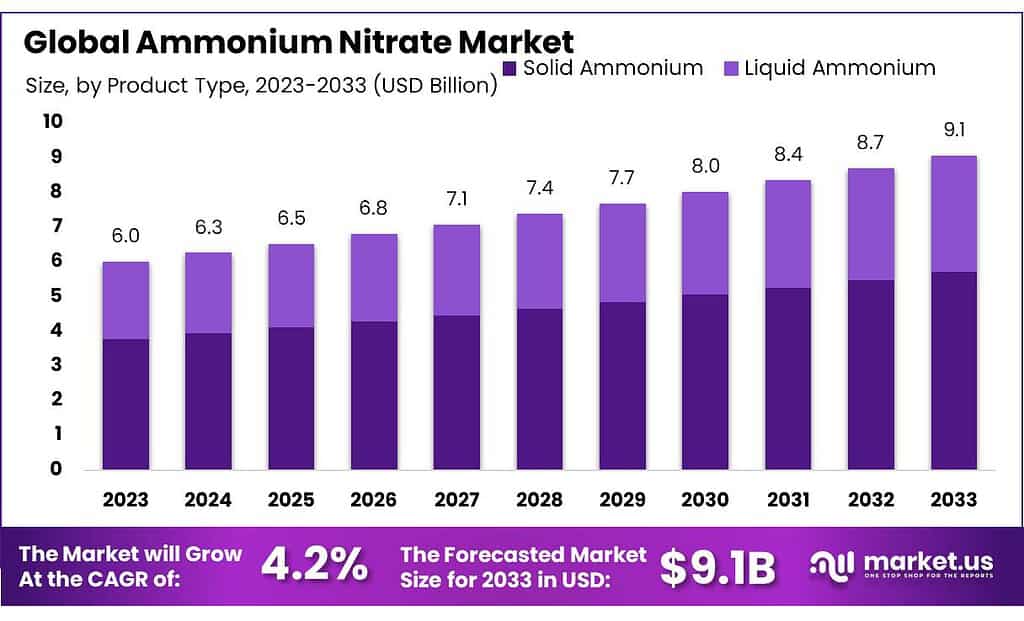

The global ammonium nitrate market size is expected to be worth around USD 9.1 billion by 2033, from USD 6.1 billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

The market is expected to grow due to the rising demand for the product in fertilizers that use it as a nitrogen source. Also, explosive manufacturing is a major market for the product, which is expected to help propel industry growth.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth and Projections: Expected market worth around USD 9.1 billion by 2033, growing at a CAGR of 4.2% from USD 6.1 billion in 2023. Fertilizer and explosive industries are major drivers for market growth.

- Product Type Analysis: Solid ammonium holds a significant share (63%) due to its stability and ease of handling, primarily used in military and demolition applications.

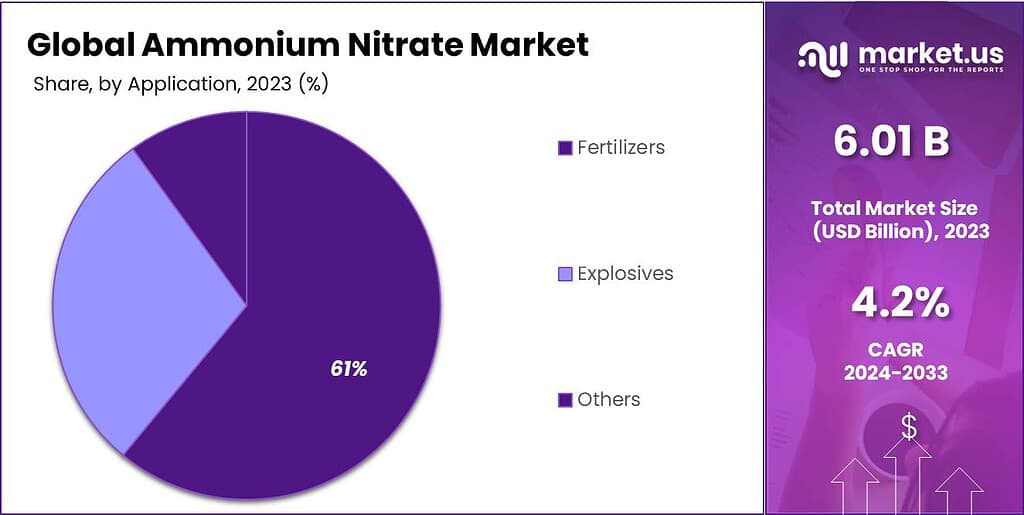

- Application Insights: Fertilizers dominate (61% market share) due to the use of ammonium nitrate in enhancing plant growth and crop yields.

- End Use Segmentation: Agriculture is the primary sector, relying heavily on ammonium nitrate for fertilizers to enhance crop productivity and quality.

- Drivers Impacting Market Growth: Increased agricultural activities and growth in mining operations are driving the demand for ammonium nitrate. However, security concerns related to potential misuse and environmental impact pose challenges to market expansion.

- Challenges and Opportunities: Stricter regulations in regions like Asia Pacific impact production costs and market growth. Innovations in ‘green’ ammonia production and adaptation to evolving regulations present opportunities for sustained growth.

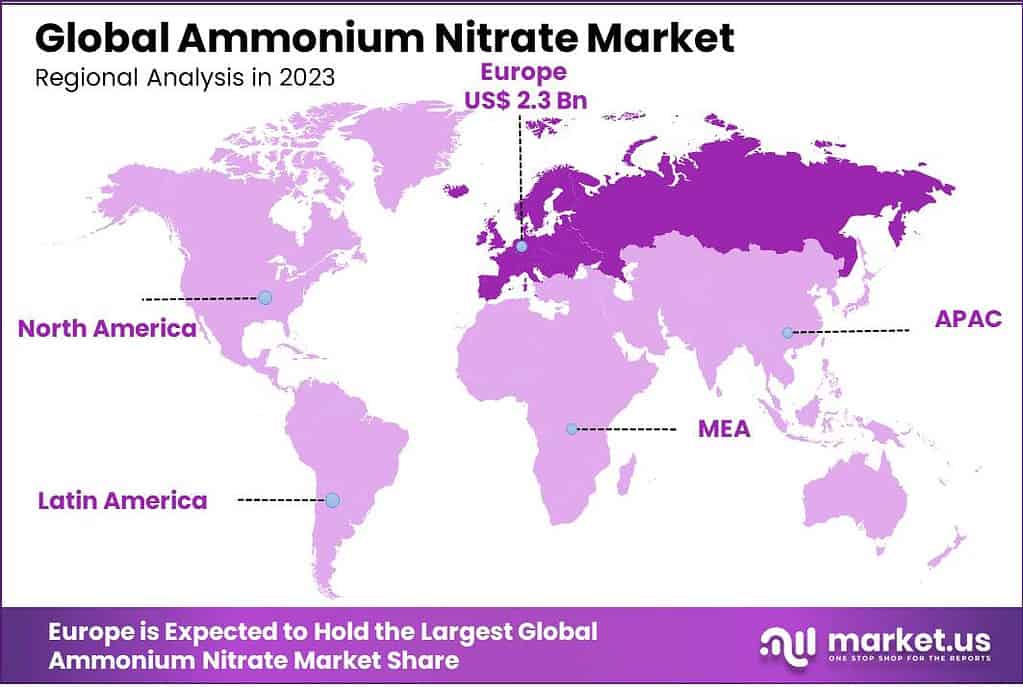

- Regional Analysis: Europe dominated the market in 2023, followed by significant contributions from the U.S.A., China, and Japan.

- Key Players and Recent Developments: Major players like Orica, Incitec Pivot Limited, and EuroChem Group AG are contributing to market growth through expansions and strategic partnerships.

Product Type Analysis

In 2023, by-product types in the Ammonium Nitrate market had their own sway. Solid ammonium took the lead, holding a hefty 63% share. This segment stands out for its stability and ease of handling, making it a preferred choice for various applications.

The solid ammonium nitrate consists of two components of varying densities. The higher density components are used in a wide range of industries, but most commonly in military and demolition.

Application analysis

In 2023, when broken down by applications for Ammonium Nitrate markets, fertilizers dominated with 61% market share.

This result can be explained by ammonium nitrate’s use as an essential component in fertilizers that promote plant growth and increase crop yields – using ammonium nitrate has long been recognized for improving plant yields through increased plant health and increased crop production.

Rising demand for soybean, maize, and barley for various non-food and food applications, including biofuel production, is expected to drive demand for fertilizers. This will have a positive effect on the industry trend. From 2023 to 2022, the industry trend is positive as the demand for fertilizers should grow at a 4.4% CAGR.

ANFO, or Ammonium Nitrate fuel oil, contains approximately 94% porous Ammonium Nitrate. This is an industrial explosive mix that is widely used for mining operations such as the extraction of coal and metal. Market growth will be driven by increasing mining activities in different countries worldwide, including the U.S.A., Argentina, and India.

Projections for blasting products will continue to grow due to the rising demand for bauxite (manganese), diamonds, and other base metals. High investments made by mining companies in the exploration of new sites for valuable metals or minerals are expected to further fuel market growth for mining applications.

Note: Actual Numbers Might Vary In the Final Report

By End Use

In 2023, the Ammonium Nitrate market showcased distinct preferences across various end uses. Agriculture emerged as the dominant sector, accounting for a significant share due to its extensive reliance on ammonium nitrate in fertilizers. This sector’s demand is driven by the continual quest for enhanced crop productivity and quality.

Following closely behind, the mining industry held a substantial share in the market. Ammonium nitrate’s use in mining operations, particularly in explosive formulations, remained pivotal due to its effectiveness in controlled blasting, excavation, and quarrying.

Meanwhile, the defense sector also marked its presence as a notable consumer of ammonium nitrate, utilizing it in specialized applications for explosive formulations and military-grade explosives.

The “Others” category encompassed a range of smaller yet diverse applications across industries like manufacturing, chemicals, and wastewater treatment, contributing to the overall market but holding relatively smaller individual shares.

The dominance of agriculture signifies the enduring need for efficient fertilizers, while the significance of mining and defense underscores the critical role of ammonium nitrate in vital industrial operations. As industries adapt to technological advancements and regulations, the market for ammonium nitrate across these end uses is expected to witness continual evolution and growth, driven by distinct sector-specific demands and applications.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Solid ammonium

- Liquid ammonium

By Application

- Fertilizers

- Explosives

- Other Applications

By End Use

- Agriculture

- Mining

- Defence

- Others

Drivers

Increased Agricultural Activities: As the global population is projected to expand by 2.3 billion between 2009-2050, food production needs to expand accordingly. Ammonium nitrate, an essential fertilizer, is expected to play a crucial role; however, its use is restricted in countries like the US and India due to security fears related to potential bomb-making misuse of ammonium nitrate. These limitations might impede market growth despite the rising demand for agricultural fertilizers.

Usage in Mining: The growth in mining operations is anticipated to boost the demand for ammonium nitrate. Although ammonium nitrate itself isn’t inherently explosive, it’s a key ingredient in explosive formulations used in mining, classified as an oxidizer. These formulations require additional components like fuel and initiation systems to become explosives.

Notably, ammonium nitrate from fertilizer sources is often used in improvised explosive compositions. Despite this, it remains a primary component in slurry explosives used extensively in mining operations. With mining activities expanding, ammonium nitrate consumption should increase accordingly.

Both agriculture and mining play an instrumental role in driving ammonium nitrate sales worldwide. However, security concerns surrounding its potential misuse, particularly in improvised explosives, could pose challenges despite the anticipated growth in demand from these sectors. The market’s trajectory will likely be influenced by regulatory measures aimed at balancing agricultural needs with security considerations.

Restraints

Government regulations on ammonium nitrate have tightened significantly due to concerns regarding its potential misuse in creating explosives. This has led to stringent restrictions in various regions worldwide. In response, several fertilizer vendors have ceased dealing with ammonium nitrate due to limitations on sales and transportation.

Tragic and fatal explosions have underscored the risks associated with the extensive use of this chemical. Equally concerning is its significant contribution to environmental degradation and climate change. The improper handling or unauthorized use of ammonium nitrate has led to catastrophic incidents, prompting governments to enforce strict regulations to mitigate these risks.

The dual concerns of safety hazards related to illegal use and the environmental impact have spurred regulatory bodies to impose stringent measures on the production, distribution, and handling of ammonium nitrate. Balancing the necessity of ammonium nitrate for agricultural and industrial applications while mitigating its potential risks remains a critical challenge for governments and regulatory agencies globally.

Opportunity

The Ammonium Nitrate market is ripe with potential, primarily fueled by the increasing demand in agriculture and mining sectors. Its pivotal role in boosting crop productivity as a fertilizer and its significance in mining explosives contribute significantly to its continuous market growth. However, stringent regulations and safety concerns pose significant challenges.

Recent incidents in countries like China and India have led to stricter rules, impacting compliance costs for manufacturers. Environmental policies aiming to curtail nitrogen emissions further complicate matters.

Nevertheless, the market is witnessing promising avenues through innovations like ‘green’ ammonia production methods and by adapting to evolving regulatory landscapes. Despite these obstacles, strategic adaptation holds the key to sustained growth and innovation within the Ammonium Nitrate market.

Challenges

The Ammonium Nitrate market in Asia Pacific faces big challenges because of strict rules and safety worries. This chemical is used as both a fertilizer and for making explosives, so governments have made tough regulations. In China, recent accidents made rules stricter and raised costs for many local makers.

Australia watches ammonium nitrate closely to prevent misuse, making the fertilizer industry spend more on security. Rules about making, storing, and moving this chemical are different in each country in Asia Pacific, making it harder to follow the rules.

India’s rules from 2012 are strict too, making it cost more to produce ammonium nitrate. This higher cost can make prices go up and slow down the market’s growth.

Governments also want to cut nitrogen pollution from fertilizers, making things harder for producers. Rules like “nitrate vulnerable zones” affect a lot of farmland and how traditional fertilizers are used.

All these rules and changes make it tough for the Ammonium Nitrate market in Asia Pacific. It affects how much it costs to make, how much it sells for, and how much it can grow.

Regional Analysis

Europe was the dominant market, accounting for over 39.5% of global revenue in 2023. The industry was dominated by the U.S.A., Europe, China, and Japan in 2021 in terms both of production and consumption.

However, high levels of urea in fertilizer application to substitute the product in Spain (and Portugal) have hampered product demand over recent years. This trend is expected to continue for the next eight years and could impact industry growth in Europe.

China’s ammonium nitrogen nitrate exports increased by more than 25% in July 2015 to Oman (Thailand), Malaysia (Malaysia), and Thailand (Thailand). The region’s growing fertilizer manufacturing sector due to rising domestic consumption will likely drive product demand during the forecast period.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The market is competitive due to the presence of many buyers and suppliers. Due to high initial investments in equipment such as screeners, driers, and recycle-slurry mixers, as well as tight profit margins, the industry rivalry will likely be lower over the forecast period.

India has seen a decrease in ammonium nitrate distributors and manufacturers over recent years. This is due to stricter regulations and shorter margins. Gujrat Hari Narmada Valley Fertilizers is the only major manufacturer of the product in India, thus contracting the market

Мarkеt Кеу Рlауеrѕ

- Orica

- Incitec Pivot Limited

- Neochim PLC

- URALCHEM Holding P.L.C.

- San Corporation

- CF Industries Holdings

- EuroChem Group AG

- Austin Powder Company

- Vijay Gas Industry P Ltd

- OSTCHEM Holding

Recent Development

November 2022- IPL and MCC partnered to build Saudi Arabia’s first technical-grade ammonium nitrate facility in Ras Al Khair Industrial City. With an annual capacity of 300,000 tonnes, the project aims for local supply chain sustainability and supports civil explosives production in the region’s growing mining sector.

November 2022– UralChem announced plans to construct a port in Taman, scheduled to be operational by late 2023. This strategic investment aims to facilitate the handling of their ammonia, ammonium nitrate, and other products. By expanding their infrastructure, UralChem aims to meet the rising demand from Asia and Africa’s burgeoning economies.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Billion Forecast Revenue (2033) USD 9.1 Billion CAGR (2023-2032) 4.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Solid ammonium and Liquid ammonium), By Application (Fertilizers, Explosives and Other Applications), By End Use(Agriculture , Mining, Defence, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Orica, Incitec Pivot Limited, Neochim PLC, URALCHEM Holding P.L.C., San Corporation, CF Industries Holdings, Inc., EuroChem Group AG, Austin Powder Company, Vijay Gas Industry P Ltd, and OSTCHEM Holding. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is ammonium nitrate?Ammonium nitrate (NH4NO3) is a chemical compound containing nitrogen and oxygen. It's commonly used in agriculture as a high-nitrogen fertilizer and in the manufacturing of explosives.

How is ammonium nitrate used in agriculture?As a fertilizer, ammonium nitrate provides a high concentration of nitrogen, which is essential for plant growth and the production of proteins. It's used in various crops to enhance yield and quality.

What’s the future outlook for the ammonium nitrate market?The market is expected to grow moderately, driven by the continuous demand for fertilizers in agriculture and the stable need for ammonium nitrate in explosives used in various industries.

-

-

- Orica

- Incitec Pivot Limited

- Neochim PLC

- URALCHEM Holding P.L.C.

- San Corporation

- CF Industries Holdings

- EuroChem Group AG

- Austin Powder Company

- Vijay Gas Industry P Ltd

- OSTCHEM Holding