Ambulatory Care Market By Type (Primary Care, Surgical Specialty, Emergency Departments, and Others), By Application (Gastroenterology, Ophthalmology, Orthopedics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146302

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

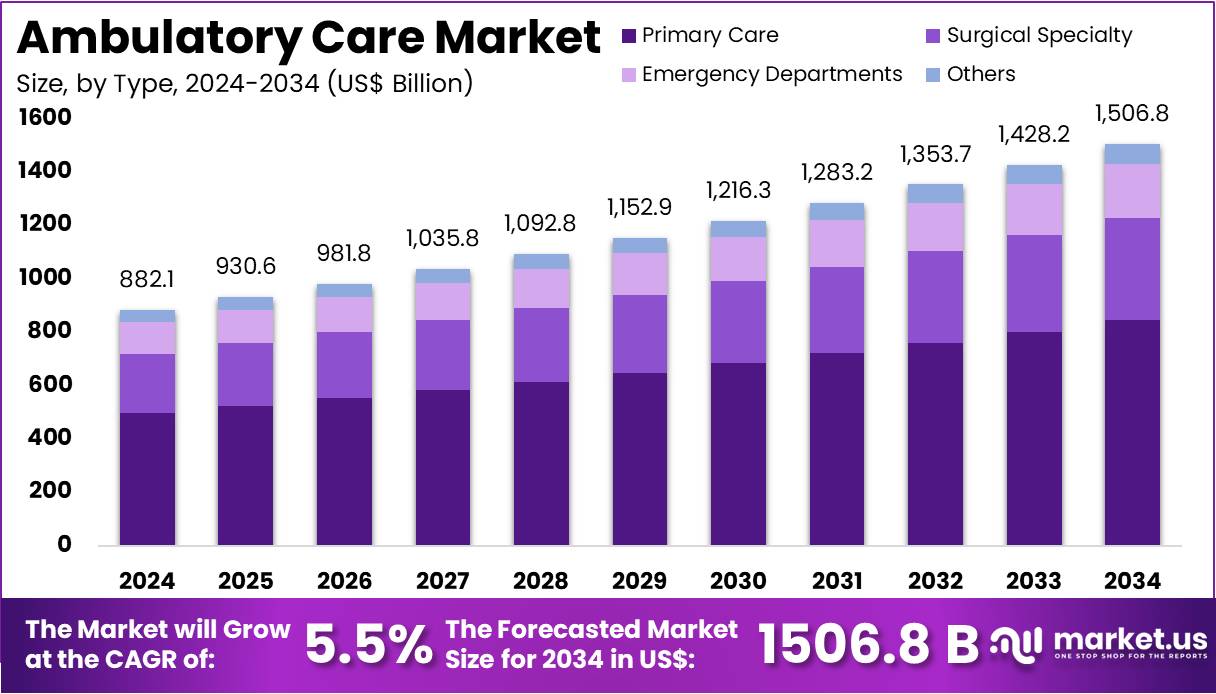

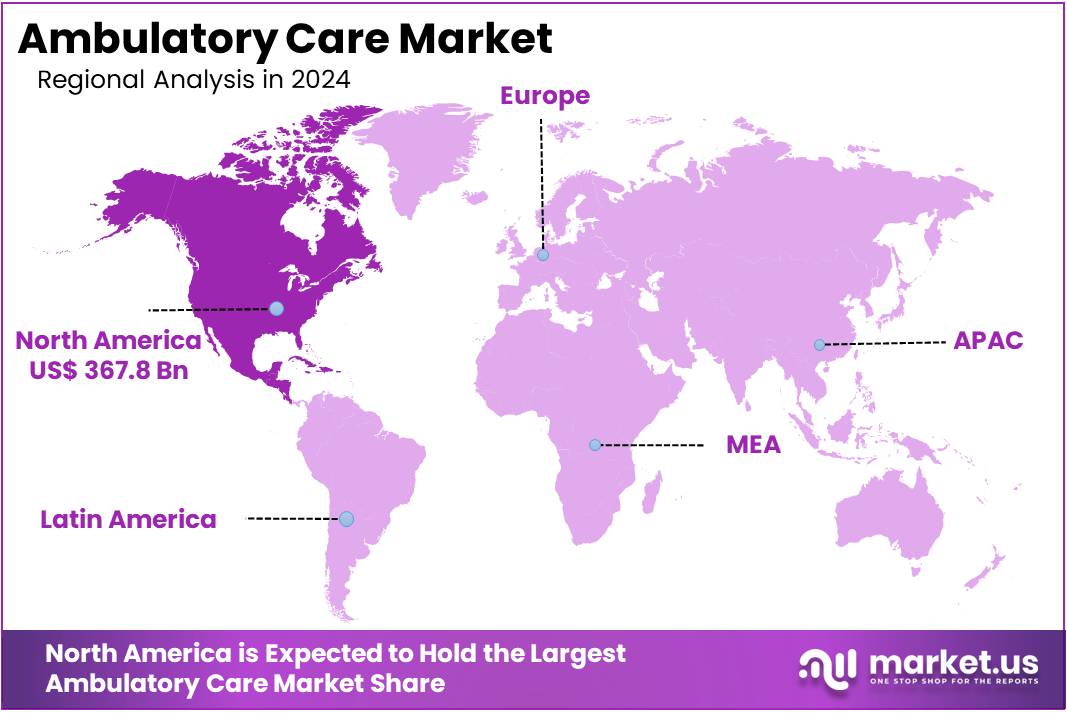

The Ambulatory care Market Size is expected to be worth around US$ 1506.8 billion by 2034 from US$ 882.1 billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.7% share and holds US$ 367.8 Billion market value for the year.

Increasing demand for cost-effective healthcare solutions and a shift toward outpatient services are driving the growth of the ambulatory care market. Patients increasingly prefer ambulatory care settings due to shorter hospital stays, reduced costs, and the convenience of receiving treatment without the need for overnight hospitalization.

Ambulatory care includes a wide range of services such as outpatient surgery, diagnostic testing, preventive care, and chronic disease management. The market also benefits from technological advancements, including telemedicine, remote monitoring, and enhanced electronic health record systems, which improve the efficiency and accessibility of care.

In April 2024, the University of Kentucky unveiled plans for a new facility dedicated to cancer care and outpatient services. The UK Cancer and Advanced Ambulatory Building will integrate various healthcare services, including cancer treatment and ambulatory surgery, and is expected to open its doors by 2027, ensuring a more streamlined experience for patients in need of specialized care. As healthcare systems continue to evolve, ambulatory care plays a pivotal role in meeting the growing demand for flexible, patient-centered healthcare solutions.

Key Takeaways

- In 2024, the market for ambulatory care generated a revenue of US$ 882.1 billion, with a CAGR of 5.5%, and is expected to reach US$ 1506.8 billion by the year 2033.

- The type segment is divided into primary care, surgical specialty, emergency departments, and others, with primary care taking the lead in 2024 with a market share of 56.2%.

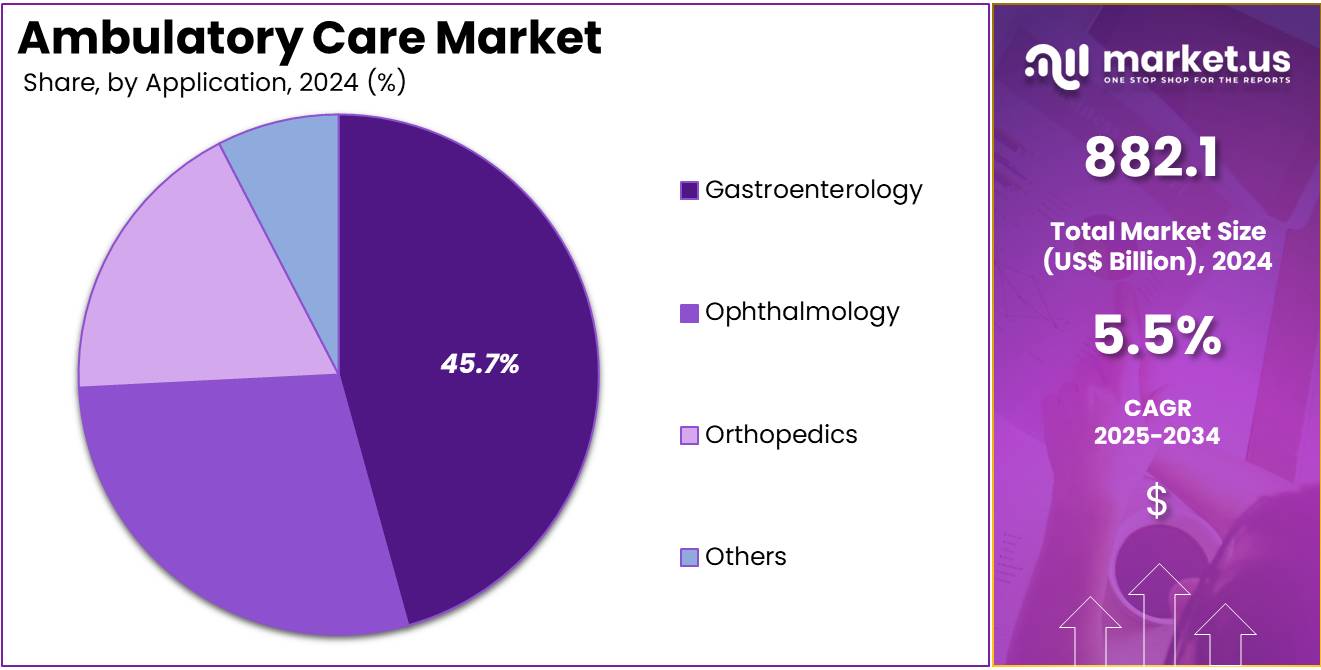

- Considering application, the market is divided into gastroenterology, ophthalmology, orthopedics, and others. Among these, gastroenterology held a significant share of 45.7%.

- North America led the market by securing a market share of 41.7% in 2024.

Type Analysis

The primary care segment led in 2024, claiming a market share of 56.2% owing to the increasing preference for outpatient services that offer convenience and cost-effectiveness. With patients seeking more affordable healthcare options and reduced waiting times, primary care settings have become more appealing compared to traditional hospital visits.

These facilities provide a range of services such as preventive care, diagnostic tests, and management of chronic conditions. The growth of telemedicine and enhanced access to primary care services will further drive the segment’s expansion. Additionally, the shift toward value-based care and a focus on early diagnosis are expected to contribute to the segment’s continued growth.

Application Analysis

The gastroenterology held a significant share of 45.7% due to the rising prevalence of gastrointestinal diseases, such as acid reflux, irritable bowel syndrome, and colorectal cancer. As patients seek quicker, less invasive treatments outside traditional hospital settings, outpatient gastroenterology procedures, such as endoscopies and colonoscopies, are becoming increasingly common.

The shift toward outpatient care for these procedures, coupled with advancements in medical technology, is likely to boost the demand for gastroenterology services in ambulatory settings. Additionally, the increasing awareness of the importance of preventive gastrointestinal screenings is expected to drive continued growth in this segment.

Key Market Segments

By Type

- Primary Care

- Surgical Specialty

- Emergency Departments

- Others

By Application

- Gastroenterology

- Ophthalmology

- Orthopedics

- Others

Drivers

Cost-Effectiveness Compared to Hospital Care is Driving the Market

The shift toward ambulatory care centers is accelerating due to their ability to provide high-quality care at lower costs than traditional hospitals. Outpatient procedures in these settings cost significantly less than inpatient equivalents. Major providers like Surgery Partners and Tenet Healthcare have reported growth in their ambulatory segments, reflecting growing patient and payer preference.

Employers and insurers are increasingly steering patients toward these facilities to reduce healthcare expenditures. As value-based care models continue to gain traction, the demand for efficient, lower-cost outpatient alternatives will continue to expand.

Restraints

Regulatory and Reimbursement Challenges are Restraining the Market

Strict licensing requirements and inconsistent reimbursement policies hinder the growth of ambulatory care centers. A percentage of ASCs faced claim denials or payment delays in 2023 due to complex billing rules. States like California and New York impose rigorous facility accreditation standards, increasing operational costs.

Medicare reimbursement rates for ASCs have lagged behind hospital outpatient departments, discouraging some providers from expanding services. Private insurers also limit coverage for certain outpatient procedures, creating financial uncertainty. These barriers disproportionately affect smaller operators, slowing market consolidation and innovation in underserved areas.

Opportunities

Expansion of Telehealth Integration is Creating Growth Opportunities

The rapid adoption of telehealth presents a major opportunity for ambulatory care providers to enhance accessibility and patient engagement. A significant portion of ASCs incorporated virtual consultations in 2023, up from previous years. Companies like Optum and AmSurg are investing in hybrid care models that combine in-person procedures with remote pre- and post-operative monitoring.

The US government allocated funding to expand telehealth infrastructure in 2023, benefiting outpatient providers. This integration allows centers to serve rural populations and reduce no-show rates while maintaining care continuity. As technology improves, telehealth will become a standard component of outpatient service offerings.

Impact of Macroeconomic / Geopolitical Factors

Economic pressures and global instability are reshaping outpatient healthcare delivery with mixed consequences. Rising inflation has increased labor and supply costs for clinics, squeezing profit margins, but demand remains strong as patients seek affordable alternatives to hospitals. Workforce shortages persist, yet automation and telehealth help mitigate service disruptions. Geopolitical tensions have caused medical supply chain delays, but domestic manufacturing initiatives are reducing dependency on imports.

Recession fears have led some health systems to delay facility expansions, while private equity firms continue investing in outpatient platforms due to their recession-resistant nature. Regulatory shifts toward site-neutral payments could threaten hospital-affiliated centers but benefit independent operators. Despite these challenges, the sector’s fundamental cost and convenience advantages ensure long-term resilience and growth potential.

Trends

Specialized Orthopedic and Pain Management Centers are a Recent Trend

Ambulatory care is increasingly focusing on niche specialties like orthopedics and chronic pain management to differentiate services. Many orthopedic surgeries performed in ASCs saw an increase in 2023 compared to the previous year. Companies like HCA Healthcare and Envision Healthcare are launching dedicated orthopedic ambulatory centers equipped with advanced surgical robots.

CMS added musculoskeletal procedures to its ASC-approved list in 2023, further driving this trend. Patients prefer these specialized centers for their streamlined care pathways and faster recovery times. As value-based payment models emphasize outcomes, providers will continue investing in high-demand specialty care units.

Regional Analysis

North America is leading the Ambulatory care Market

North America dominated the market with the highest revenue share of 41.7% owing to increasing demand for cost-effective, outpatient healthcare solutions and advancements in minimally invasive procedures. According to the Centers for Medicare & Medicaid Services (CMS), outpatient visits in the US rose by 12% between 2022 and 2023, with Medicare spending on ambulatory services increasing by US$ 8.5 billion in the same period.

The American Hospital Association (AHA) reported a 15% growth in freestanding ambulatory surgery centers (ASCs) from 2022 to 2023, reflecting a shift away from traditional hospital settings. The US Bureau of Labor Statistics noted a 10% increase in employment in outpatient care centers in 2023, indicating sector expansion.

Additionally, the US Food and Drug Administration (FDA) approved 23% more outpatient medical devices in 2023 compared to 2022, facilitating more efficient same-day treatments. The rise of telehealth, as highlighted by the Centers for Disease Control and Prevention (CDC), contributed to this trend, with 35% of US adults using virtual outpatient consultations in 2023. Government policies, such as CMS’s 2023 ruling to expand ASC-covered procedures, further accelerated market growth.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising chronic disease prevalence, healthcare infrastructure investments, and government initiatives promoting accessible care. India’s National Health Authority reported a 30% increase in outpatient visits under the Ayushman Bharat scheme between 2022 and 2023. China’s National Health Commission documented a 25% rise in same-day surgeries in 2023, supported by policy reforms encouraging decentralized healthcare.

Japan’s Ministry of Health, Labour and Welfare noted a 20% expansion in standalone clinics from 2022 to 2023, driven by an aging population seeking convenient care. Australia’s Department of Health recorded a 15% surge in Medicare-funded outpatient services in 2023, reflecting higher patient preference for non-hospital treatments.

Southeast Asia’s medical tourism boom is expected to further boost demand, with Thailand’s Ministry of Public Health reporting a 40% increase in international outpatient visits in 2023. Technological adoption, such as AI-driven diagnostics, is projected to enhance efficiency, with South Korea’s Ministry of Food and Drug Safety approving 18% more portable medical devices in 2023 than in 2022.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the ambulatory care market drive growth through technological innovation, strategic partnerships, and expanding their global presence. They invest in developing advanced healthcare technologies, such as telemedicine platforms and electronic health records, to enhance patient engagement and streamline care delivery.

Collaborations with healthcare providers and research institutions facilitate the integration of new technologies and broaden market reach. Additionally, targeting emerging markets with increasing healthcare infrastructure presents significant growth opportunities. Envision Healthcare Corporation, headquartered in Greenwood Village, Colorado, is a prominent provider of ambulatory care services.

The company offers a comprehensive range of services, including emergency medical transportation, physician services, and ambulatory surgery center operations. Envision emphasizes technological innovation and patient-centered care to improve health outcomes. With a presence across the United States, Envision continues to expand its influence in the ambulatory care market through strategic partnerships and continuous service enhancements.

Recent Developments

- In November 2024: Cooper Green Mercy Health Services Authority announced the development of a new outpatient facility designed to provide comprehensive healthcare to its patients. The five-story center will host a range of services, including primary and specialty care, urgent care, therapy services, and laboratory testing, enhancing access to essential healthcare for the community.

- In September 2024: HST Pathways entered into a strategic partnership with SYNERGEN Health to improve revenue cycle management (RCM) services for ambulatory surgery centers (ASCs). This collaboration integrates HST’s specialized ASC software with Synergen’s expertise in RCM, aiming to optimize financial performance and operational efficiency for ASCs.

Top Key Players in the Ambulatory care Market

- Surgical Care Affiliates

- Surgery Partners

- Sheridan Healthcare

- NueHealth

- HST Pathways

- Healthway Medical Group

- Cooper Green Mercy Health Services Authority

- AQuity Solutions

Report Scope

Report Features Description Market Value (2024) US$ 882.1 billion Forecast Revenue (2034) US$ 1506.8 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Primary Care, Surgical Specialty, Emergency Departments, and Others), By Application (Gastroenterology, Ophthalmology, Orthopedics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Surgical Care Affiliates, Surgery Partners, Sheridan Healthcare, NueHealth, HST Pathways, Healthway Medical Group, Cooper Green Mercy Health Services Authority, and AQuity Solutions. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Surgical Care Affiliates

- Surgery Partners

- Sheridan Healthcare

- NueHealth

- HST Pathways

- Healthway Medical Group

- Cooper Green Mercy Health Services Authority

- AQuity Solutions