Global Amaranth Market Size, Share and Report Analysis By Product Type (Amaranth seeds, Amaranth oil, Amaranth leaves, Amaranth flour, and Others), By Application (Food And Beverages, Personal Care, Pharmaceuticals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176321

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

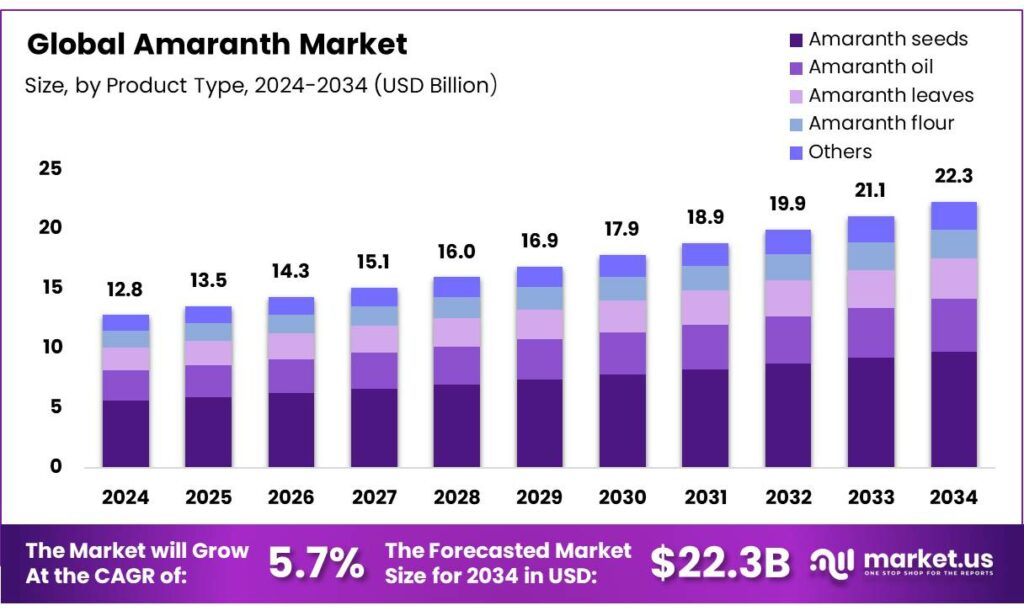

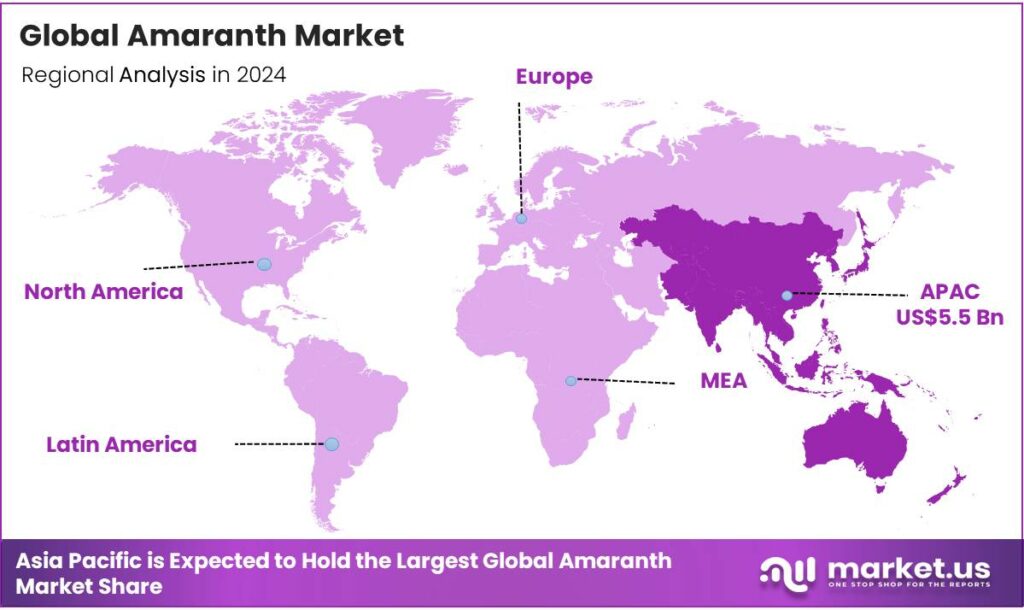

Global Amaranth Market size is expected to be worth around USD 22.3 Billion by 2034, from USD 12.8 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 42.3% share, holding USD 16.9 Billion in revenue.

Amaranth is an ancient, gluten-free pseudocereal that is highly nutritious, versatile in cooking, and comes from a resilient, ornamental plant. It was a staple food for the Aztecs, Maya, and Inca civilizations and is known as a superfood. Amaranth is one of the few plant sources that provide a complete set of all nine essential amino acids, making it a high-quality protein source.

- According to the Whole Grains Council, amaranth is a great source of magnesium and phosphorus, providing at least 20% of the recommended daily value, and it offers at least 50% of the daily recommended intake of manganese, which plays a key role in metabolizing protein and other macronutrients.

- Amaranth is a member of the Amaranthaceae family, comprising about 70 species of annual plants.

The amaranth market is shaped by its widespread use in food and beverages, driven by its nutritional benefits and versatility. The crop, primarily cultivated in regions such as China, Southeast Asia, India, West Africa, and parts of Latin America, is gaining popularity as a gluten-free, high-protein, and micronutrient-rich alternative to traditional grains.

- In Mexico alone, amaranth is produced mainly in six states, including Puebla, Tlaxcala, the State of Mexico, Mexico City, Oaxaca, and Morelos, with a national average yield of 1.66 tons per ha.

In addition, the amaranth seeds dominate the market due to their easy incorporation into a range of products such as cereals, flour, and snacks. Amaranth oil, valued for its squalene content, remains less utilized due to production costs, while the leaves are mainly consumed in specific cultural contexts. Furthermore, the market growth is challenged by limited consumer awareness and small-scale farming practices. However, as health-conscious trends rise globally, there is growing interest in amaranth’s applications in the nutraceutical and functional foods sectors.

- The U.S. Food and Drug Administration (FDA) has established strict labeling regulations requiring gluten-free products to contain less than 20 parts per million (ppm) of gluten, which boosts consumer confidence and encourages manufacturers to expand offerings.

Key Takeaways

- The global amaranth market was valued at USD 12.8 Billion in 2024.

- The global amaranth market is projected to grow at a CAGR of 5.7% and is estimated to reach USD 22.3 Billion by 2034.

- Based on the product type, amaranth seeds dominated the market, with a market share of around 43.7%.

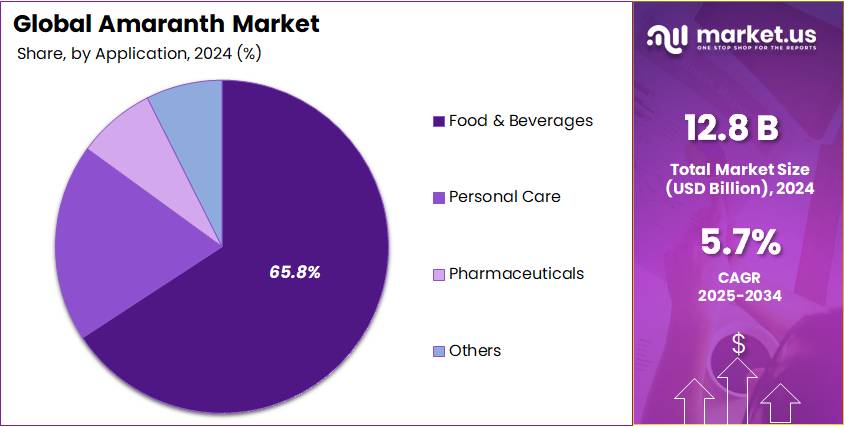

- Among the applications of amaranth, the food & beverages sector held a major share in the market, 65.8% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the amaranth market, accounting for around 43.2% of the total global consumption.

Product Type Analysis

Amaranth Seeds Held the Largest Share in the Market.

The amaranth market is segmented based on product type into amaranth seeds, amaranth oil, amaranth leaves, amaranth flour, and others. The amaranth seeds dominated the market, comprising around 43.7% of the market share, due to their versatile culinary applications and nutritional profile. The seeds are rich in protein, essential amino acids, and micronutrients, making them a popular choice for a variety of diets, including gluten-free and vegan.

Additionally, their ease of incorporation into various food products, such as cereals, granola bars, and baked goods, further drives their popularity. While amaranth oil and flour are nutritious, the oil is relatively expensive to produce, and the flour is less commonly available or used in very specific recipes. Similarly, amaranth leaves, consumed in certain cultures, are less mainstream compared to the seeds, limiting their broader market appeal.

Application Analysis

The Amaranth Was Mostly Utilized in Food & Beverages Sector.

Based on the applications of amaranth, the market is divided into food & beverages, personal care, pharmaceuticals, and others. The food & beverages sector dominated the market, with a market share of 65.8%, due to its rich nutritional profile and versatility in the culinary space.

Amaranth is a highly valued source of protein, essential amino acids, and micronutrients such as iron and magnesium, making it a popular choice for health-conscious consumers and those with dietary restrictions such as gluten sensitivity. In addition, the seeds are easy to incorporate into a variety of food products, such as cereals and snacks, which drives their widespread use.

While amaranth oil and other derivatives have potential in personal care and pharmaceuticals, the higher production cost, limited consumer awareness, and specialized application constraints make food and beverages the dominant sector for amaranth usage.

Key Market Segments

By Product Type

- Amaranth Seeds

- Amaranth Oil

- Amaranth Leaves

- Amaranth Flour

- Others

By Application

- Food & Beverages

- Personal Care

- Pharmaceuticals

- Others

Drivers

Rising Adoption of Gluten-Free Diets Drives the Amaranth Market.

The rising adoption of gluten-free and vegan diets has notably contributed to the increased demand for amaranth, a highly nutritious grain. Amaranth is naturally gluten-free and rich in essential amino acids, making it a suitable alternative for individuals with celiac disease or gluten sensitivities. The rising global prevalence of celiac disease has significantly propelled the amaranth market.

- According to a case study by the National Institutes of Health (NIH), the pooled global prevalence of celiac disease was 1.4%. The prevalence values for celiac disease were 0.4% in South America, 0.5% in Africa and North America, 0.6% in Asia, and 0.8% in Europe and Oceania.

Similarly, the growing vegan movement, supported by dietary guidelines from institutions such as the Academy of Nutrition and Dietetics, promotes plant-based, nutrient-dense foods such as amaranth, recognized for its high protein, fiber, and micronutrient content. Moreover, the European Food Safety Authority (EFSA) lists amaranth as a source of essential vitamins and minerals, further boosting its appeal within vegan and vegetarian diets.

- According to the Vegan Society, in 2025, approximately 25.8 million people globally tried veganism in January 2025.

Restraints

Small-Scale Farming and Limited Consumer Awareness Pose a Challenge to the Amaranth Market.

The limited adoption of amaranth as a mainstream crop is partly attributed to small-scale farming and insufficient consumer awareness. The amaranth cultivation is concentrated in small farming systems, primarily in regions of Asia, Africa, and Latin America, where it competes with more widely grown crops such as maize and wheat, which results in limited supply and scaling challenges.

According to a case study, in the U.S., over 25% of small-scale farms report no annual sales, as they are often excluded from liberalized markets and struggle with high input costs. While amaranth yields can reach 1,000-2,000 lbs per acre, surpassing commodity crops such as soybeans, farmers face difficulties marketing large volumes into the specialized health food sector.

Furthermore, despite amaranth’s nutritional benefits, consumer awareness remains low, particularly in Western markets. The consumer recognition of amaranth as a viable food source is still limited, with awareness lagging behind more common grains such as quinoa or oats. The broader acceptance of the crop requires sustained outreach efforts, as evidenced by the limited market penetration of amaranth-based products in global retail chains.

Opportunity

Application of Amaranth in the Nutraceutical and Functional Foods Industries Creates Opportunities in the Market.

Amaranth presents major opportunities in the nutraceutical and functional foods sectors, driven by its high nutritional profile. The amaranth is rich in protein, essential amino acids, and micronutrients such as iron and magnesium, making it suitable for incorporation into functional foods aimed at improving health outcomes.

Amaranth grain provides high levels of essential minerals, including phosphorus up to 5,011 mg/kg, magnesium up to 2,755 mg/kg, and calcium up to 1,930 mg/kg. Furthermore, research published by the National Institutes of Health (NIH) indicates that amaranth’s bioactive compounds possess anti-inflammatory and antioxidant properties, which are highly valued in the nutraceutical market.

As consumer demand for functional foods increases, regulatory bodies such as the U.S. Food and Drug Administration (FDA) have approved amaranth for use in various food products, facilitating its incorporation into functional food formulations. These developments highlight amaranth’s potential in offering value-added solutions within the growing sector of health-oriented food products.

Trends

Applications of Amaranth Oil in Cosmetics Products.

Amaranth oil is gaining traction in the cosmetics industry, primarily due to its rich content of squalene and antioxidants, which have proven benefits for skin health. Amaranth oil contains a high concentration of squalene, ranging from approximately 2.4% to 8% of the oil’s weight. This contrasts sharply with other common vegetable oils, such as olive oil, which contains around 0.5% squalene, and corn or soybean oil, which contains trace amounts, approximately 0.03%.

Squalene is a natural lipid in human skin that acts as an emollient, moisturizer, and antioxidant. Its production declines with age, making amaranth oil a valuable ingredient in anti-aging formulations.

Furthermore, the oil is rich in unsaturated fatty acids, with average levels of linoleic acid at 44.6% and oleic acid at 29.1%, which support skin barrier function and moisture retention. Similarly, it is high in Vitamin E, tocopherols, and phytosterols, about 1931 to 2762 mg/100g oil, which provide antioxidant protection against environmental damage. Moreover, the increasing consumer preference for natural and plant-based ingredients in skincare has been reflected in regulatory approval for amaranth oil’s use in cosmetics across various regions.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Amaranth Market by Shifting Trade Flows.

The geopolitical tensions, particularly the ongoing conflicts in Eastern Europe and trade disruptions between major agricultural producers, are influencing the amaranth market in several ways. According to the Food and Agriculture Organization (FAO), disruptions to global supply chains, including those affecting fertilizers and transportation routes, have led to increased production costs for many crops, including amaranth cultivation.

For instance, the war in Ukraine has significantly affected global grain markets, causing price volatility in agricultural commodities, which may divert farmers’ attention away from crops such as amaranth. The U.S. Department of Agriculture (USDA) noted that shifting focus towards more widely traded grains might limit the expansion of alternative grains, such as amaranth, which are niche products in global markets. The geopolitical climate poses risks in terms of supply chain stability and market access, which could restrict the growth of the amaranth market in the short term.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Amaranth Market.

In 2024, the Asia Pacific dominated the global amaranth market, holding about 43.2% of the total global consumption, driven by its historical and cultural significance as a staple crop. Amaranth is widely cultivated in countries such as India, China, and Nepal, where it has been a traditional food source for centuries. According to the Food and Agriculture Organization (FAO), India accounts for a significant share of global amaranth production.

- According to a 2023 intensive agriculture report by the Indian Ministry of Agriculture and Farmers Welfare, it was estimated that amaranth is grown in about 40-50 thousand hectares in India.

In China, amaranth is recognized as a vital crop for promoting food security due to its resilience in drought-prone areas and high nutritional value. Furthermore, the region’s growing awareness of health benefits is boosting demand for amaranth-based products. Similarly, the trend is reflected in the rise of amaranth-based products in regional food markets, underscoring the region’s dominant role in the crop’s global supply chain.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of amaranth emphasize product diversification, developing value-added products such as amaranth flour, snacks, and ready-to-eat meals to cater to a broader consumer base. Additionally, they invest in sustainable and efficient cultivation practices, often in collaboration with local farmers, to improve supply chain stability and reduce production costs.

Similarly, manufacturers focus on increasing consumer awareness by promoting the health benefits of amaranth through educational campaigns and partnerships with nutrition institutions. Moreover, they enhance product quality through rigorous testing for consistency in nutritional content and ensure compliance with food safety regulations, building trust with consumers and retailers.

The Major Players in The Industry

- Archer-Daniels-Midland Company (ADM)

- Kilaru Naturals Private Limited

- Ingredion Incorporated

- Cargill, Incorporated

- Mary’s Gone Crackers Inc.

- The Hain Celestial Group

- Ardent Mills

- Bob’s Red Mill Natural Foods

- Organic Products India

- Arrowhead Mills

- Other Key Players

Key Development

- In November 2024, Ardent Mills launched an ancient grains plus baking flour blend, which is made from whole-food ancient grains and chickpeas to offer more protein.

- In April 2025, Canada-based Dare Foods Ltd. acquired Reno-based organic, gluten-free snack brand Mary’s Gone Crackers from Japanese owner Kameda Seika Co. Ltd.

Report Scope

Report Features Description Market Value (2024) USD 12.8 Bn Forecast Revenue (2034) USD 22.3 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Amaranth seeds, Amaranth oil, Amaranth leaves, Amaranth flour, and Others), By Application (Food & Beverages, Personal Care, Pharmaceuticals, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Archer-Daniels-Midland Company (ADM), Kilaru Naturals Private Limited, Ingredion Incorporated, Cargill, Incorporated, Mary’s Gone Crackers Inc., The Hain Celestial Group, Ardent Mills, Bob’s Red Mill Natural Foods, Organic Products India, Arrowhead Mills, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Archer-Daniels-Midland Company (ADM)

- Kilaru Naturals Private Limited

- Ingredion Incorporated

- Cargill, Incorporated

- Mary's Gone Crackers Inc.

- The Hain Celestial Group

- Ardent Mills

- Bob's Red Mill Natural Foods

- Organic Products India

- Arrowhead Mills

- Other Key Players