Global Aluminum Extrusions Market; By Product(Shapes, Rods & Bars, Pipes & Tubes), By Type(2000 Series Aluminum, 3000 Series Aluminum, 5000 Series Aluminum, 6000 Series Aluminum, 7000 Series Aluminum), By Application(Building & Construction, Automotive & Transportation, Consumer Goods, Electrical & Energy, Others), as well as By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast: 2024-2033

- Published date: Dec 2023

- Report ID: 34646

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

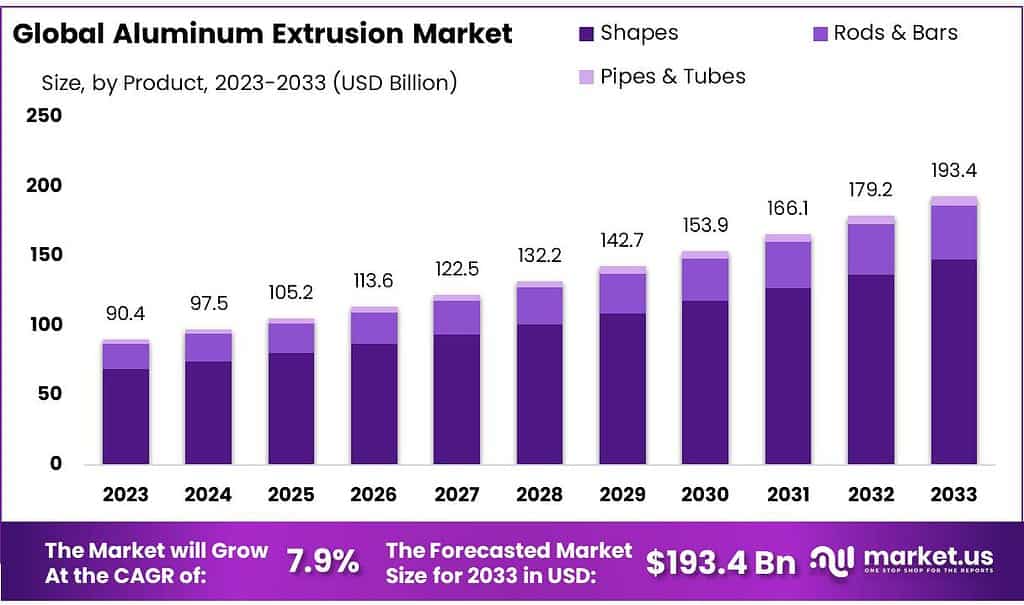

The global Aluminum Extrusion market size is expected to be worth around USD 193.4 billion by 2033, from USD 90.4 billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2023 to 2033.

The market demand for aluminum extrusion in automotive and transportation is expected to grow over the forecast period, due to a greater demand for aluminum in both internal combustion engines and Electrical Vehicles (EVs).

Automobile manufacturers face increasing regulatory pressure to comply with environmental norms. The U.S. Environmental Protection Agency, California Air Resource Board (CARB), and National Highway Traffic Safety Administration have enacted regulations & rules regarding Greenhouse Gases (GHG).

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth and Projection: The Aluminum Extrusion market is set to grow significantly, with an expected value of around USD 193.4 billion by 2033, exhibiting a CAGR of 7.9% from 2023.

- Primary Growth Drivers: Automotive and Transportation Demand: Increasingly stringent environmental regulations are pushing for greater adoption of aluminum in both internal combustion engines and Electric Vehicles (EVs).

- Segment Analysis: Product Dominance: Shapes account for the largest share (76.5%) in the market due to their versatility in construction, automotive, and consumer goods.

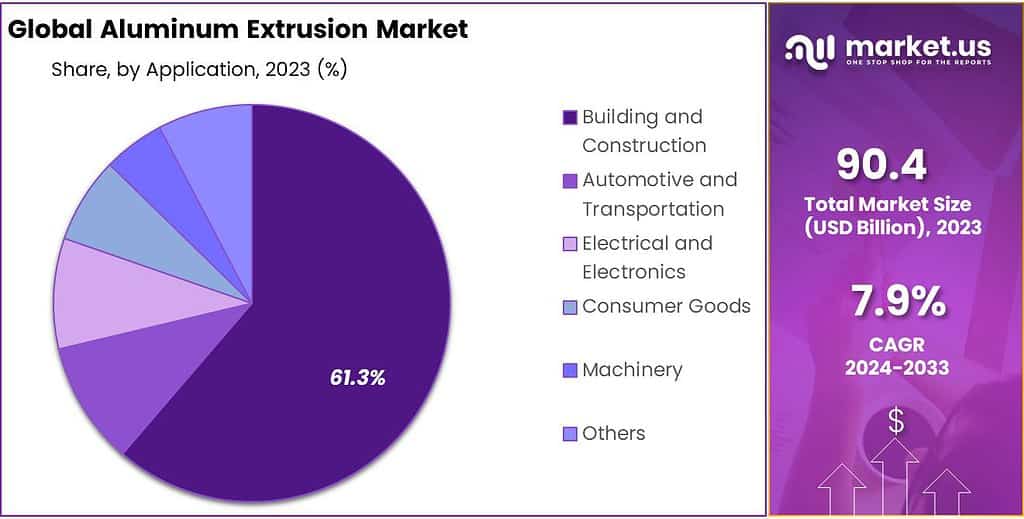

- Application Impact: Construction Sector Usage: In 2023, Building and Construction held the largest share (61.3%) due to the extensive use of aluminum extrusions in structures, windows, and facades.

- Market Dynamics and Challenges: Raw Material and Energy Costs: Fluctuating raw material costs and high energy consumption impact production costs, posing challenges to profitability. Environmental Regulations: Compliance with stringent environmental regulations demands investments in eco-friendly technologies, elevating operational costs.

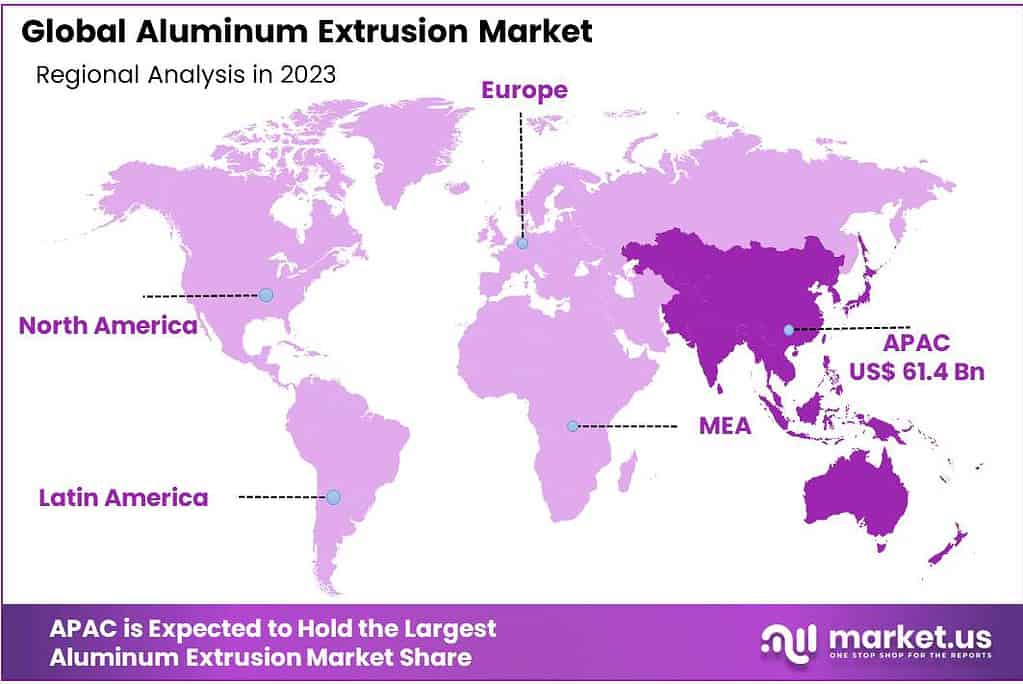

- Regional Analysis: Asia-Pacific Dominance: The Asia-Pacific region, led by countries like China and India, contributed more than 68% of the total revenues in 2023, and its dominance is expected to continue.

- Key Players and Developments: Industry Leaders: Market players like Sapa Extrusion, Gulf Extrusion, and Bonnell Aluminum are focusing on innovation and securing contracts across various sectors.

Product Analysis

In 2023, Shapes were the top players in the aluminum extrusion market, holding over 76.5% of the share. Shapes refer to various profiles like angles, channels, and sheets, widely used across industries for their versatility in construction, automotive, and consumer goods.

This process produces aluminum shapes. Aluminum shapes are used in the automotive and transportation sectors. They can be found in panels, roof rails, and transmission housings as well as in engine blocks for cars, trucks, boats, and locomotives. To make electric vehicles lightweight there is increasing demand for these structural components/parts.

Ford’s F-150 is made from significant amounts of aluminum. Extruded material shapes and aluminum body panels make up a significant portion of its body weight. Bars have flat sides, while rods are circular. Aluminum billets are heated, passed through several rolls, and then coiled.

They are then drawn through thinned dies into rods, bars, and tubes. These rods and bars are used extensively in construction, particularly when building scaffolding systems. These lightweight scaffolding systems have many advantages over traditional systems in terms of stability and weight as well as flexibility.

By Type

In 2023, 6000 Series Aluminum ruled the aluminum extrusion market, capturing the top spot. This series is favored for its versatility, strength, and corrosion resistance, making it a go-to choice across various industries like construction, automotive, and aerospace for structural and manufacturing purposes.

Following closely behind, the 5000 Series Aluminum held a significant market share due to its high strength and weldability, often used in marine and structural applications.

The 7000 Series Aluminum, known for its exceptional strength, found niche applications in aerospace and high-performance sports equipment, securing a smaller yet notable share.

Meanwhile, both the 2000 Series Aluminum, prized for its machinability, and the 3000 Series Aluminum, recognized for its formability and corrosion resistance, contributed to the market, albeit with smaller segments.

The dominance of the 6000 Series Aluminum in the market was attributed to its widespread use and adaptability across multiple industries, showcasing its significance in the aluminum extrusion landscape.

Application Analysis

In 2023, Building and Construction led the aluminum extrusion market, grabbing over 61.3% of the share. Aluminum extrusions are extensively used in structures, windows, and facades due to their durability, lightness, and resistance to corrosion, making them a staple in the construction industry.

Investment in the housing sector has greatly influenced the use of extruded lightweight materials in construction activities. China is the dominant country in construction, as per nominal value. China’s desire to invest in housing development will likely boost this sector’s growth over the forecast period.

In 2023, the automotive and transportation sector accounted for the 2nd largest revenue share and volume share. It is expected to grow at a favorable CAGR over the forecast period. Aluminum extrusions are used in many applications, including cross rails and anti-intrusion beams, as well as fuel distribution pipes, radiator beams, seat tracks, underbody space rockers, roof rails, and tailgate frames in vehicles.

In 2023, consumer goods accounted for the lowest market share because the number of aluminum applications in these goods is subsidiary than in other sub-segments. The forecast period is expected to register an increase in the production of consumer goods.

However, aluminum extrusions are expected to be more popular for furniture, appliances, refrigeration & freezers, as well as other major appliances. The consumer goods industry is a significant user of extruded sections such as sheets, custom shapes, and bars.

Extruded shapes can be used in a variety of appliances, including audio and video systems. Over the next few years, the demand for these products and appliances is anticipated to increase.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product

- Shapes

- Rods & Bars

- Pipes & Tubes

By Type

- 2000 Series Aluminum

- 3000 Series Aluminum

- 5000 Series Aluminum

- 6000 Series Aluminum

- 7000 Series Aluminum

By Application

- Building & Construction

- Automotive & Transportation

- Consumer Goods

- Electrical & Energy

- Others

Drivers

Growing Demand in Construction: Aluminum extrusions are widely used in construction due to their lightweight, durability, and corrosion resistance. As construction projects increase, especially in commercial and residential sectors, the demand for aluminum extrusions rises.

Transportation Sector Needs: The transportation industry uses aluminum extrusions extensively due to their lightweight nature, contributing to fuel efficiency in vehicles. With a push for lighter vehicles to reduce emissions, there’s a growing demand for aluminum extrusions in this sector.

Renewable Energy Growth: Aluminum extrusions are crucial components in renewable energy systems like solar panels and wind turbines. As these sectors expand, so does the need for aluminum extrusions, driving the market.

Advancements in Manufacturing Technology: Improvements in manufacturing techniques and technologies have made aluminum extrusions more cost-effective and efficient. This drives the market by making these products more accessible and appealing to various industries.

In essence, the demand for aluminum extrusions is propelled by their usage in construction, transportation, renewable energy, and advancements in manufacturing, making them increasingly vital across diverse industries.

Restraints

Raw Material Costs: Aluminum extrusion companies often depend on materials like aluminum billets to manufacture their extrusions, with fluctuating raw material costs impacting overall production costs and their profitability.

Energy Costs: Energy consumption is an integral component of aluminum extrusion production, so rising energy prices could potentially hurt manufacturing expenses and ultimately increase the overall costs of producing this extrusion.

Environmental Regulations: Regulations concerning emissions and environmental impact have an impactful influence on aluminum extrusion production processes, often necessitating additional investments into eco-friendly technologies at higher operational costs to meet them.

Substitute Competition: Substitute materials such as steel and composite can compete directly with aluminum extrusions for consumers’ attention, offering similar properties at reduced costs that could lower the demand for aluminum extrusions.

Simply stated, the aluminum extrusion industry faces challenges due to high raw material and energy costs, environmental regulations impacting production, and competition from substitute

Opportunities

Growing Demand in Construction: As construction projects increase worldwide, especially in developing regions, the demand for aluminum extrusions used in building materials and architectural designs rises.

Advancements in the Automotive Industry: With a focus on lighter and more fuel-efficient vehicles, the automotive sector is increasingly utilizing aluminum extrusions for parts and components, presenting a significant opportunity for growth.

Rising Renewable Energy Sector: The renewable energy industry, including solar panels and wind turbines, heavily relies on aluminum extrusions due to their durability and lightweight properties, offering opportunities for expansion in this sector.

Technological Innovations: Ongoing advancements in extrusion techniques and technologies open doors for developing new applications and products, driving market growth and catering to diverse industry needs.

In essence, the aluminum extrusion market has opportunities in the construction, automotive, and renewable energy sectors, and through technological advancements, presenting prospects for expansion and diversification.

Challenges

Tough Competition: Aluminum extrusions face strong competition from other materials like steel or composites. Sometimes, these alternatives offer similar qualities, affecting how much people want aluminum extrusions.

Unstable Costs: The prices of materials used for making aluminum extrusions can change a lot. If the cost of these materials, like aluminum billets, goes up and down frequently, it can make it hard for companies to make a profit.

High Energy Expenses: Making aluminum extrusions needs a lot of energy. Energy price fluctuations can dramatically impact production costs and thus their price tags. When energy costs increase, their effect can have ripple effects that directly impact products such as paper or glass bottles, increasing production expenses as well as cost.

Environmental Regulations: Companies are bound by certain environmental rules to ensure their manufacturing does not harm the environment. Following these rules might require companies to spend more on eco-friendly technologies, which can make things more expensive.

Overcrowded Markets: In some places, there might be too many companies making aluminum extrusions. This can create problems like too much supply, making it hard for companies to sell their products at good prices.

Regional Analysis

The Asia Pacific region was the dominant market driver including the major regions in 2023, accounting for more than 68% of the total revenues. Due to the presence of large manufacturing sectors in this dominant region from countries such as South Korea, China, India, and Vietnam, it is expected to continue its dominance over the next few years.

China, with its large construction sector, is expected to play a major role in fostering industry growth. China’s plan to invest in transport infrastructure and energy infrastructure will likely have a positive impact on the aluminum extrusion market growth factors over the forecast period.

In terms of revenue, North America is expected to experience a substantial rate of growth between 2022 and 2030. Market growth is anticipated to be boosted by the resumption of industrial operations following the pandemic.

The recovery of this regional market volume will also be aided by government initiatives in economic development. Canada, for example, unveiled a new infrastructure plan in October 2020 worth CAD 7.5 billion (US$5.8 billion) to promote a variety of renewable energy initiatives and to create jobs that were impacted by the pandemic in the country.

Due to this pandemic, the European automotive industry experienced a decline in growth rate and production. This impacted the demand for aluminum products company. To recover from this loss, regional producers have joined forces for the development and growth of key factors of the automotive applications industry. They support certain schemes or initiatives such as the vehicle-renewal scheme, which focuses on the sale of eco-friendly vehicles such as clean ICEs or EVs.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of the Middle East & Africa

Key Players Analysis

Several market players are now focused on developing less-weight ratio materials for downstream industries. The securing of new contracts in various end-use sectors is a significant area of focus.

China Zhongwang Holdings Ltd. recently supplied aluminum body parts for urban rail projects in Shanghai and Guangzhou. Through cooperation with CRRC, the company was able to secure contracts to supply aluminum extruded aluminum products and body parts for projects in Nigeria and Thailand.

Market Key Players

- Sapa Extrusion

- Trefinasa Mexico

- Bristol Aluminum

- Gulf Extrusion

- AMG Alpoco

- Bonnell Aluminum

- Vitex Extrusions

- Aluminium Extruded Shapes

- International Extrusions

- FRACSA ALLOYS

- Cuprum

- INDUSTRIAS GOCA

- Zahit

- Balexco

- Qatar Aluminium Extrusion Company

Recent Developments

In February 2022, Novelis announced the Launch of Net Zero Lab to Develop Carbon-Neutral Solutions for Aluminium Manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 90.04 Billion Forecast Revenue (2033) USD 193.4 Billion CAGR (2023-2032) 7.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Shapes, Rods & Bars, Pipes & Tubes), By Type(2000 Series Aluminum, 3000 Series Aluminum, 5000 Series Aluminum, 6000 Series Aluminum, 7000 Series Aluminum), By Application(Building & Construction, Automotive & Transportation, Consumer Goods, Electrical & Energy, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sapa Extrusion, Trefinasa Mexico, Bristol Aluminum, Gulf Extrusion, AMG Alpoco, Bonnell Aluminum, Vitex Extrusions, Aluminium Extruded Shapes, International Extrusions, FRACSA ALLOYS, Cuprum, INDUSTRIAS GOCA, Zahit, Balexco, Qatar Aluminium Extrusion Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are aluminum extrusions?Aluminum extrusions are profiles or shapes produced by pushing aluminum alloy through a die with the desired cross-sectional shape. They are used in various industries for structural, decorative, or functional purposes.

What factors influence the growth of the aluminum extrusions market?Factors such as increasing demand for lightweight, durable materials in various industries, the recyclability of aluminum, and its corrosion resistance contribute to the growth of this market.

What are the trends in the aluminum extrusions market?Current trends include an increased focus on sustainable production methods, development of high-strength alloys, surface finishing technologies for aesthetics, and advancements in extrusion techniques for complex profiles.

How is sustainability impacting the aluminum extrusions market?Sustainability is increasingly important in this market, with efforts focused on recycling scrap aluminum, reducing energy consumption during extrusion processes, and adopting eco-friendly practices throughout the supply chain.

-

-

- Sapa Extrusion

- Trefinasa Mexico

- Bristol Aluminum

- Gulf Extrusion

- AMG Alpoco

- Bonnell Aluminum

- Vitex Extrusions

- Aluminium Extruded Shapes

- International Extrusions

- FRACSA ALLOYS

- Cuprum

- INDUSTRIAS GOCA

- Zahit

- Balexco

- Qatar Aluminium Extrusion Company