Global Alternative Credit Scoring Market By Component (Software/Platforms & Scoring Models, Data Aggregation & Analytics Services), By Deployment (Cloud-based, On-premises), By Data Source (Telecommunications & Utility Payments, Rental & Housing Payment History, Others), By Application (Personal Loans & Credit Cards, Microfinance & Small Business Lending, Others), By End-User (Traditional Lenders (Banks, Credit Unions), FinTech & Digital Lenders, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176788

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Drivers Impact Analysis

- Restraints Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- By Component Analysis

- By Deployment Analysis

- By Data Source Analysis

- By Application Analysis

- By End User Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

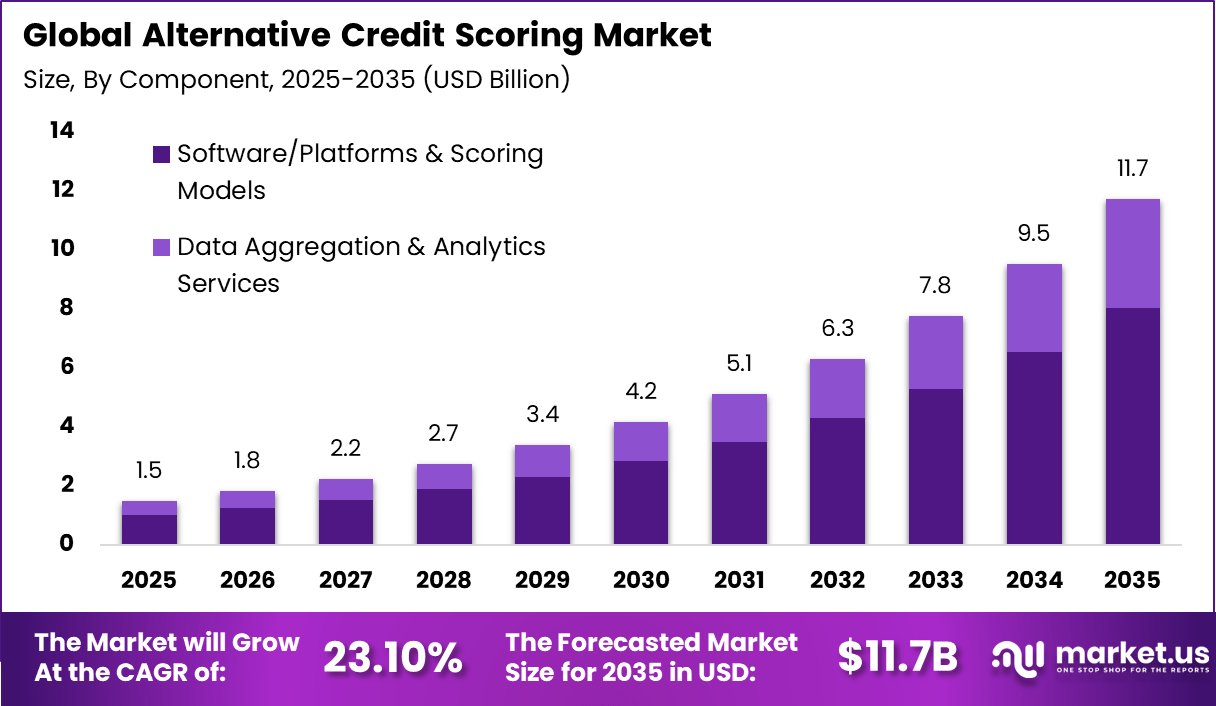

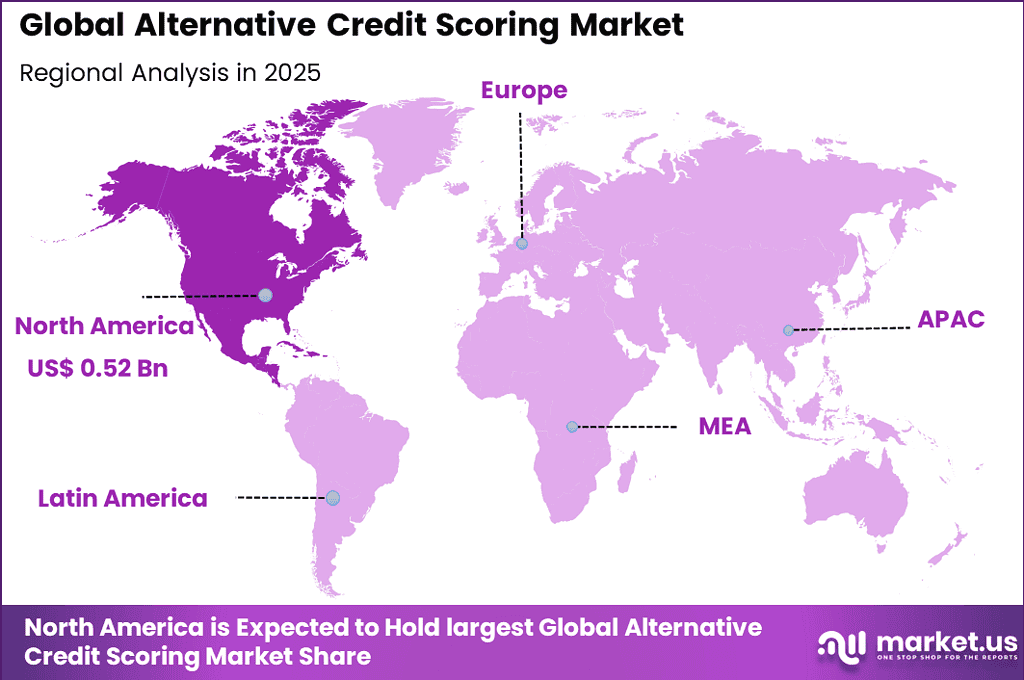

The Global Alternative Credit Scoring Market generated USD 1.5 billion in 2025 and is predicted to register growth from USD 1.8 billion in 2026 to about USD 11.7 billion by 2035, recording a CAGR of 23.10% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 35.6% share, holding USD 0.52 Billion revenue.

The alternative credit scoring market refers to credit assessment systems that rely on non traditional data instead of only credit bureau records. Data such as banking transactions, utility payments, mobile usage, and digital behavior are increasingly used to evaluate borrower risk. This approach has expanded access to credit for individuals and small businesses with limited or no formal credit history. The growth of digital lending platforms and open banking frameworks has supported wider adoption of these models.

Alternative credit scoring systems operate alongside or as complements to traditional credit models. They are widely used in consumer lending, small business finance, and short term credit products. Industry observations indicate that nearly 40% of adults in emerging economies remain underbanked or credit invisible, creating a strong use case for alternative scoring methods.

One of the primary driving factors is the large population of consumers without formal credit histories. Traditional scoring models exclude these individuals from formal lending channels. Alternative credit scoring enables lenders to assess risk using behavioral and cash flow signals. This expands addressable borrower segments without lowering underwriting discipline.

Demand for alternative credit scoring is rising among lenders targeting first time borrowers and small enterprises. These segments often lack long term credit records but demonstrate reliable income or transaction behavior. Internal lending studies show that alternative data models can improve approval rates by more than 20% without increasing default levels. This performance improvement drives lender interest.

Top Market Takeaways

- By component, software/platforms & scoring models account for 68.4% of the market, powering AI-driven algorithms that analyze non-traditional data for precise risk assessment.

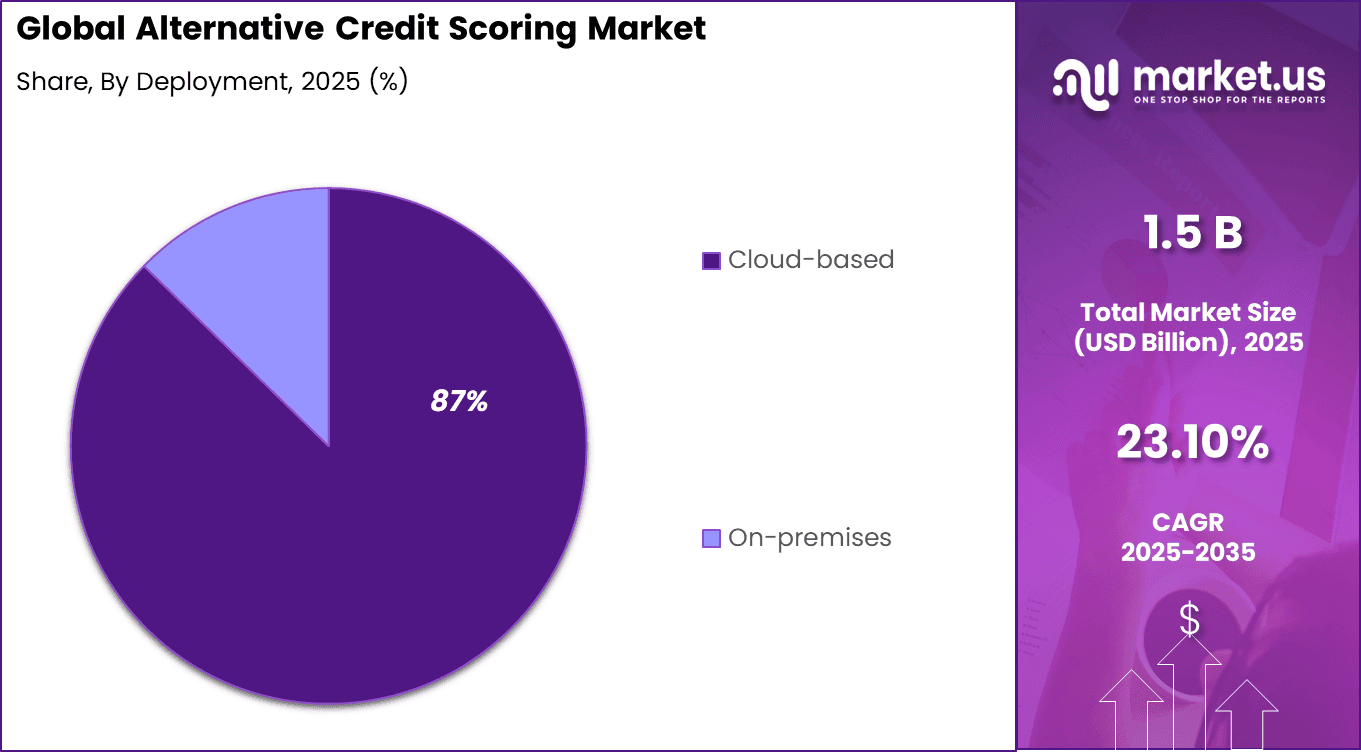

- By deployment, cloud-based solutions represent 87.3%, offering scalability, real-time processing, and seamless integration for dynamic lending ecosystems.

- By data source, transaction & banking data (open banking) captures 41.7%, leveraging APIs to access spending patterns, cash flows, and behavioral insights beyond conventional credit histories.

- By application, personal loans & credit cards hold 38.6% share, enabling financial inclusion for thin-file consumers through alternative scoring models.

- By end-user, FinTech & digital lenders command 53.9%, adopting these tools to accelerate approvals, reduce defaults, and expand underserved markets.

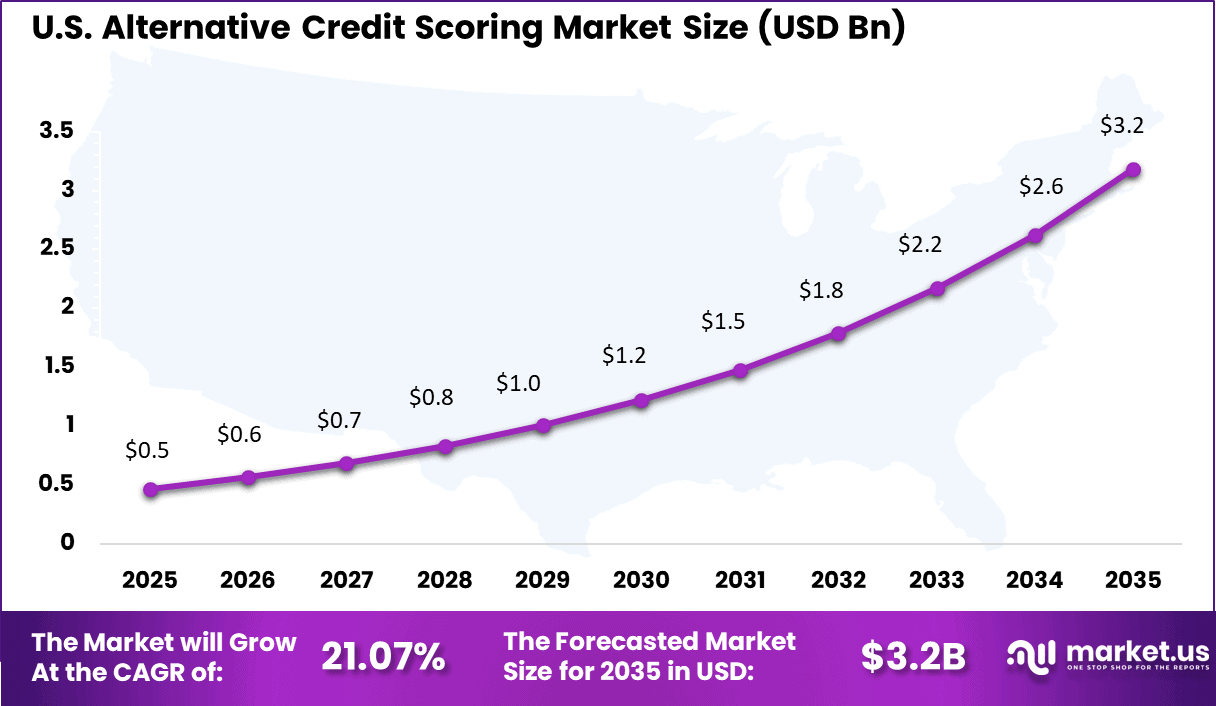

- By region, North America leads with 35.6% of the global market, where the U.S. is valued at USD 0.47 billion with a projected CAGR of 21.07%, driven by regulatory support and data availability.

Key Insights Summary

- Around 62% of financial institutions use alternative data to strengthen risk profiling and credit decision accuracy.

- For credit invisible individuals, alternative credit scoring can more than double approval rates, rising from about 15% under traditional models to between 31% and 47%.

- Use of alternative data improves model predictive power by 20% to 45%, depending on regional conditions and data sources.

- Nearly 26 million Americans have no credit history, while another 19 million have insufficient data for traditional credit scoring.

- Globally, about 1.4 billion adults remain unbanked, and in low and middle income countries fewer than 10% of individuals appear in public credit registries.

- Younger borrowers are highly affected, with many under age 35 and around 53 million US consumers lacking enough data for a traditional bureau score.

- Inclusion of utility, telecom, and streaming data increased credit scores for 2.5 million US consumers by an average of 13 points.

- Integration of behavioral and device based data has reduced default rates by as much as 50% in observed case studies.

- Some alternative scoring models achieve a 100% hit rate, successfully scoring all applicants, compared with frequent no hit outcomes under traditional systems.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising demand for credit access among underbanked populations +6.1% North America, Asia Pacific Short to medium term Rapid growth of digital lending and fintech platforms +5.3% North America, Europe Medium term Increasing use of non-traditional data sources for risk assessment +4.7% Global Medium term Expansion of BNPL, micro-lending, and SME credit models +3.9% North America, Asia Pacific Medium to long term Regulatory support for financial inclusion initiatives +3.1% Asia Pacific, Latin America Long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Data privacy and consumer consent concerns -4.2% Europe, North America Short to medium term Lack of standardized alternative data frameworks -3.6% Global Medium term Model explainability and regulatory transparency challenges -3.1% Europe, North America Medium term Integration complexity with traditional credit systems -2.7% Global Medium term Limited acceptance by conservative financial institutions -2.3% Europe Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Fintech credit scoring and analytics providers Very High Medium North America, Europe Strong platform scalability Digital lenders and BNPL platforms High Medium North America, Asia Pacific Strategic risk optimization Banks and financial institutions Medium Low to Medium Global Gradual adoption for inclusion goals Private equity firms Medium Medium North America, Europe Consolidation of analytics platforms Venture capital investors Very High High North America Innovation-led growth potential Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Machine learning-based credit risk models +6.4% Improved prediction accuracy Global Short to medium term Use of transaction, mobile, and behavioral data +5.6% Broader borrower profiling Asia Pacific, North America Medium term AI-driven fraud detection and anomaly analysis +4.9% Risk mitigation Global Medium term Cloud-based credit scoring platforms +4.1% Scalability and speed Global Medium to long term Explainable AI and regulatory reporting tools +3.2% Compliance transparency Europe, North America Long term By Component Analysis

By component, software platforms and scoring models held a dominant share of 68.4%. These platforms integrate data ingestion, risk modeling, decision engines, and compliance tools within a single system. Lenders prefer integrated platforms as they reduce operational complexity and improve speed to decision.

Scoring models have evolved from rule based systems to adaptive models that update with borrower behavior. This allows lenders to adjust risk exposure over time rather than relying on static credit scores. The ability to retrain models using fresh data has improved default prediction accuracy. As credit portfolios grow, scalable software platforms remain essential.

Investment has focused on model governance and auditability. Lenders increasingly demand clear explanations of score outcomes for regulatory and customer transparency. Software platforms now include monitoring tools to detect bias and performance drift. This has strengthened confidence in automated credit decisions.

By Deployment Analysis

By deployment, cloud based solutions accounted for 87% of adoption. Cloud infrastructure enables rapid deployment across regions and supports high volume data processing. Digital lenders benefit from lower upfront costs and flexible scaling. This deployment model aligns with the growth of online lending and embedded finance.

Cloud environments also support continuous model updates without service disruption. This is critical in volatile economic conditions where risk patterns change quickly. Security standards in cloud systems have improved, addressing earlier concerns around sensitive financial data. As a result, cloud deployment has become the default choice.

Operational efficiency has been a key driver. Cloud based scoring systems reduce internal IT maintenance and allow faster integration with external data providers. Lenders can launch new products faster and respond to customer demand in real time. These benefits have reinforced cloud dominance.

By Data Source Analysis

By data source, transaction and banking data through open banking represented 41.7% of usage. Bank account data provides direct insight into income stability, spending behavior, and cash flow patterns. This data is viewed as more reliable than proxy indicators such as social data. As open banking adoption expands, its role in credit scoring continues to grow.

Transaction data enables lenders to assess affordability more accurately. Regular income deposits and payment behavior offer strong signals of repayment capacity. This has reduced reliance on collateral and manual verification. Borrowers also experience faster approval processes.

Regulatory support for data portability has accelerated this trend. Consumers are increasingly willing to share banking data when credit decisions are faster and more transparent. Lenders benefit from standardized data access frameworks. This has strengthened the long term role of open banking in alternative scoring.

By Application Analysis

By application, personal loans and credit cards accounted for 38.6% of usage. These products require fast decision making and high approval volumes. Alternative scoring enables lenders to approve thin file customers with controlled risk exposure. This has supported rapid growth in unsecured lending.

Credit card issuers use alternative data to set initial limits and adjust them dynamically. Spending behavior and repayment patterns are monitored continuously. This improves portfolio performance and reduces delinquency risk. Consumers also gain access to entry level credit products earlier.

Personal loan providers benefit from reduced onboarding friction. Automated assessments lower processing costs and improve customer experience. As digital borrowing becomes more common, alternative scoring remains central to unsecured credit growth.

By End User Analysis

By end user, fintech and digital lenders held a dominant share of 53.9%. These lenders operate primarily online and rely heavily on automated decision systems. Alternative credit scoring aligns with their need for speed, scalability, and data driven risk management.

Fintech lenders often target underserved segments overlooked by traditional banks. Alternative data allows them to assess risk without long credit histories. This supports differentiated lending strategies and higher approval rates. Competitive pressure has further driven adoption.

Partnerships between fintech lenders and traditional financial institutions are increasing. Banks use fintech scoring models to modernize their credit processes. This collaboration is accelerating market penetration across established lending channels.

Emerging Trends Analysis

An emerging trend in the alternative credit scoring market is the use of transaction level and cash flow based analysis. Continuous assessment of income and spending behavior provides dynamic risk insights. This approach reflects real time financial health rather than static credit snapshots. Dynamic scoring is gaining relevance.

Another trend is increased collaboration between lenders and technology platforms. Partnerships allow access to richer datasets and improve scoring accuracy. These collaborations support more tailored and responsible lending decisions. Ecosystem driven scoring models are becoming more common.

Growth Factors Analysis

One of the key growth factors for the alternative credit scoring market is expansion of mobile and digital payments. As more financial activity moves online, data availability increases. This creates stronger foundations for alternative risk assessment. Digital transaction growth directly supports scoring adoption.

Another growth factor is rising demand for faster credit decisions. Consumers and businesses expect near instant approval experiences. Alternative credit scoring enables automated and real time evaluation. Speed and convenience driven demand supports sustained market growth.

Opportunity Analysis

A significant opportunity in the alternative credit scoring market lies in financial inclusion initiatives. Governments and financial institutions aim to expand credit access to small businesses, gig workers, and first time borrowers. Alternative scoring supports these goals by evaluating real world financial behavior. This alignment creates strong institutional demand.

Another opportunity is integration with embedded finance and digital commerce platforms. Credit decisions are increasingly made within apps and platforms where users already transact. Alternative scoring can leverage in platform data to assess risk more accurately. This contextual scoring improves approval quality and reduces defaults.

Challenge Analysis

A major challenge for the alternative credit scoring market is ensuring data quality and consistency. Alternative data sources may be fragmented, incomplete, or biased. Poor data quality can lead to inaccurate risk assessment. Strong data governance is required to maintain model reliability.

Another challenge is managing bias and fairness. Certain data signals may unintentionally disadvantage specific groups. Regulators and lenders increasingly focus on fairness and non discrimination. Models must be carefully designed and monitored to avoid unintended outcomes.

Key Market Segments

By Component

- Software/Platforms & Scoring Models

- Data Aggregation & Analytics Services

By Deployment

- Cloud-based

- On-premises

By Data Source

- Telecommunications & Utility Payments

- Rental & Housing Payment History

- Social Media & Digital Footprint

- Transaction & Banking Data (Open Banking)

- Others

By Application

- Personal Loans & Credit Cards

- Microfinance & Small Business Lending

- Buy Now, Pay Later (BNPL)

- Tenant Screening

- Others

By End-User

- Traditional Lenders (Banks, Credit Unions)

- FinTech & Digital Lenders

- Retail & E-commerce Platforms

- Others

Regional Analysis

North America accounts for 35.6% of the alternative credit scoring market, supported by a mature lending ecosystem and growing demand for broader credit inclusion. Financial institutions and lenders are increasingly using non-traditional data to assess borrowers with limited or no formal credit history. Adoption is driven by the need to improve risk assessment accuracy, reduce default rates, and expand access to credit across underserved segments.

The United States market is valued at USD 0.47 Bn and is growing at a CAGR of 21.07%, reflecting rapid uptake of data-driven credit evaluation models. Demand is shaped by the rise of digital lending platforms and the need for faster, automated credit decisions. Growth is further supported by regulatory openness to responsible data use and increasing lender focus on financial inclusion and portfolio diversification.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Global credit bureaus and scoring leaders such as Experian plc, Equifax, Inc., and TransUnion hold a strong position in the alternative credit scoring market. They extend traditional bureau data with utility payments, rental history, and transactional signals. FICO enhances this segment through advanced modeling and explainable scoring frameworks. These players benefit from deep lender trust, regulatory alignment, and large data assets.

Data intelligence and identity-focused providers such as LexisNexis Risk Solutions, Jumio Corporation, and Advan Research Corporation emphasize behavioral, device, and digital footprint data. Credolab, Ltd. and Aire, Inc. use consent-based data and machine learning to assess thin-file customers. These solutions support faster credit decisions and reduced default risk. Adoption is strong among fintech lenders and digital banks.

Emerging market specialists and AI-driven lenders such as Trusting Social, Inc., LenddoEFL, and CreditVidya, Inc. address underbanked populations. Upstart Network, Inc. and Enova International, Inc. integrate alternative scores into lending workflows. The Credit Bureau Singapore, Ltd. supports regional adoption. Other providers expand competition and innovation, supporting broader access to credit globally.

Top Key Players in the Market

- Experian plc

- Equifax, Inc.

- TransUnion

- FICO (Fair Isaac Corporation)

- LexisNexis Risk Solutions (RELX plc)

- Credolab, Ltd.

- Aire, Inc.

- Trusting Social, Inc.

- Advan Research Corporation

- Jumio Corporation

- Enova International, Inc.

- Upstart Network, Inc.

- CreditVidya, Inc.

- LenddoEFL

- The Credit Bureau Singapore, Ltd. (CBS)

- Others

Future Outlook

The future outlook for the Alternative Credit Scoring Market is promising as financial institutions and lenders seek new ways to assess borrower creditworthiness. Demand for alternative scoring methods is expected to increase because these systems use non-traditional data such as digital footprints, payment history, and social data to evaluate risk.

Adoption of advanced analytics, machine learning, and artificial intelligence will further enhance prediction accuracy and support faster decisions. Growth can be attributed to the need for financial inclusion, improved risk assessment, and expansion of credit access for underserved populations. Overall, the market is expected to grow as lenders pursue more flexible and comprehensive scoring solutions.

Recent Developments

- November, 2025 – Experian launched the Credit + Cashflow Score, blending traditional credit data with consumer‑permitted bank transaction info, Clarity Services alternative data and trended behaviors into a single 300-850 score that boosts predictive accuracy by over 40% for personal loans, cards and mortgages compared to legacy models.

- January, 2026 – FICO teamed with Plaid on the next‑gen UltraFICO Score, piping real‑time bank transactions into automated scoring to capture cash flow and short‑term obligations for thin‑file borrowers, with Forrester naming FICO a leader in AI decisioning platforms back in June 2025.

Report Scope

Report Features Description Market Value (2025) USD 1.5 Billion Forecast Revenue (2035) USD 11.7 Billion CAGR(2025-2035) 23.10% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platforms & Scoring Models, Data Aggregation & Analytics Services), By Deployment (Cloud-based, On-premises), By Data Source (Telecommunications & Utility Payments, Rental & Housing Payment History, Others), By Application (Personal Loans & Credit Cards, Microfinance & Small Business Lending, Others), By End-User (Traditional Lenders (Banks, Credit Unions), FinTech & Digital Lenders, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Experian plc, Equifax, Inc., TransUnion, FICO (Fair Isaac Corporation), LexisNexis Risk Solutions (RELX plc), Credolab, Ltd., Aire, Inc., Trusting Social, Inc., Advan Research Corporation, Jumio Corporation, Enova International, Inc., Upstart Network, Inc., CreditVidya, Inc., LenddoEFL, The Credit Bureau Singapore, Ltd. (CBS), Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alternative Credit Scoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Alternative Credit Scoring MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Experian plc

- Equifax, Inc.

- TransUnion

- FICO (Fair Isaac Corporation)

- LexisNexis Risk Solutions (RELX plc)

- Credolab, Ltd.

- Aire, Inc.

- Trusting Social, Inc.

- Advan Research Corporation

- Jumio Corporation

- Enova International, Inc.

- Upstart Network, Inc.

- CreditVidya, Inc.

- LenddoEFL

- The Credit Bureau Singapore, Ltd. (CBS)

- Others