Alpha Emitter Market By Type of Radionuclide (Lead-212, Actinium-225, Astatine-211, Radium-223, Bismuth-213, and Others), By Source (Natural Sources (Radium-226 and Uranium-238) and Artificially Produced Sources (Americium, Curium, Plutonium, and Californium)), By Application (Prostate Cancer, Bone Metastases, Pancreatic Cancer, Ovarian Cancer, Neuroendocrine Tumors, and Others), By End-user (Hospitals, Diagnostic Centers, Specialty Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124979

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

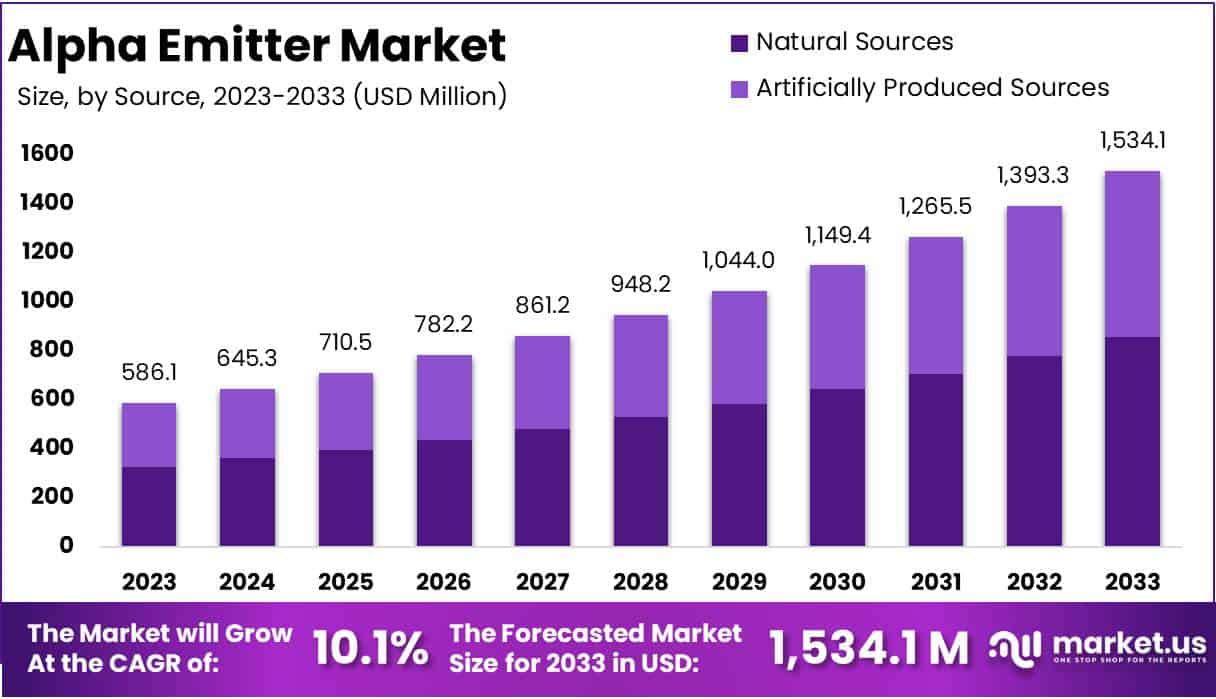

The Global Alpha Emitter Market size is expected to be worth around USD 1534.1 Million by 2033, from USD 586.1 Million in 2023, growing at a CAGR of 10.1% during the forecast period from 2024 to 2033.

The market is experiencing growth due to the increasing prevalence of cardiovascular and cancer conditions, as well as rising awareness about the benefits of targeted alpha therapy. Additionally, the market is expected to receive a boost from the growing number of product approvals by regulatory authorities and investments in the R&D of alpha emitter products.

The COVID-19 pandemic had a hampering impact on the alpha emitter market, leading to reduced patient referrals to nuclear medicine for diagnosis and treatment due to decreased face-to-face interactions with physicians. Despite this minor hurdle, the market has recovered and is growing due to the increased awareness of the advantages of targeted alpha emitters and a high number of patients with various types of cancer, including ovarian cancer, lymphoma, pancreatic cancer, and melanoma.

- The global cancer burden is expected to increase significantly by 2040, with the International Agency for Research on Cancer (IARC) projecting 27.5 million new cancer cases and 16.3 million cancer-related deaths, driven primarily by population growth and aging. This burden is likely to drive the demand for effective treatments, including alpha emitters, and contribute to market growth.

Key Takeaways

- In 2023, the market for alpha emitter generated a revenue of USD 586.1 million, with a CAGR of 10.1%, and is expected to reach USD 1,534.1 million by the year 2033.

- The type of radionuclide segment is divided into Lead-212, Actinium-225, Astatine-211, Radium-223, Bismuth-213, and others, with Radium-223 taking the lead in 2023 with a market share of 23.1%.

- Considering the source, the market is divided into natural sources and artificially produced sources. Among these, natural sources held a significant share of 55. 9%.

- Furthermore, concerning the application segment, the market is segregated into prostate cancer, bone metastases, pancreatic cancer, ovarian cancer, neuroendocrine tumors, and others. The prostate cancer sector stands out as the dominant player, holding the largest revenue share of 35.8% in the alpha emitter market.

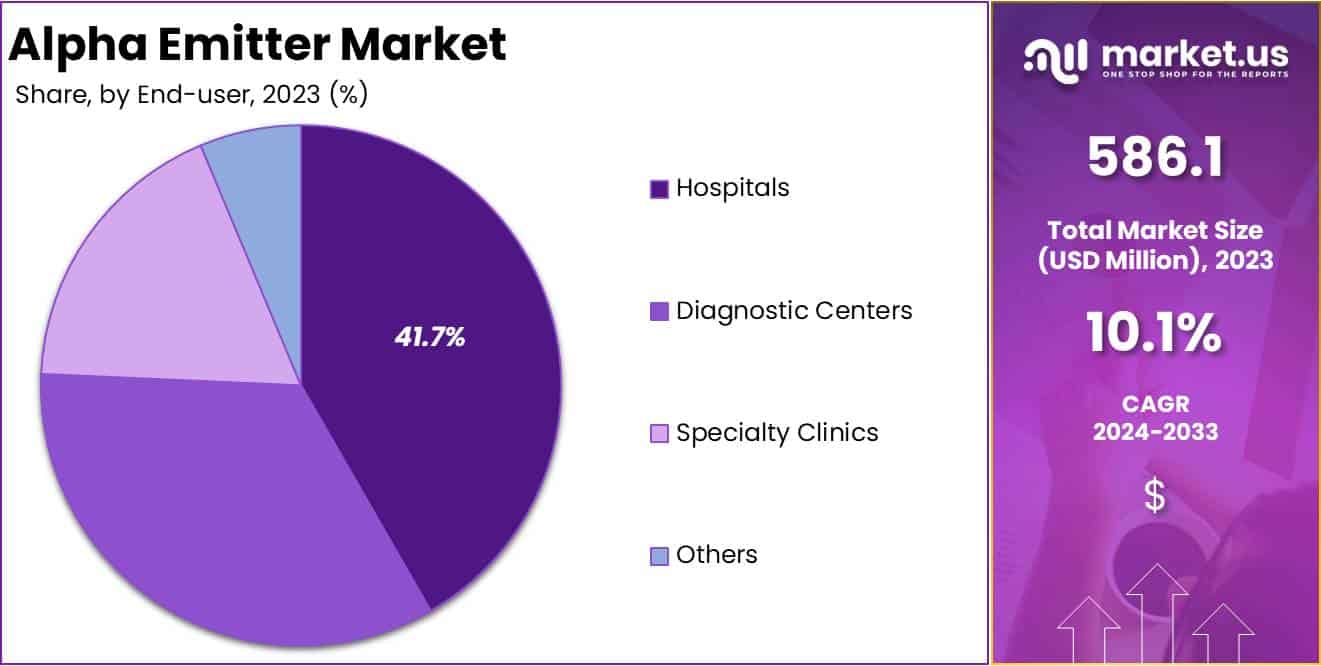

- The end-user segment is segregated into hospitals, diagnostic centers, specialty clinics, and others, with the hospital segment leading the market, holding a revenue share of 41.7%.

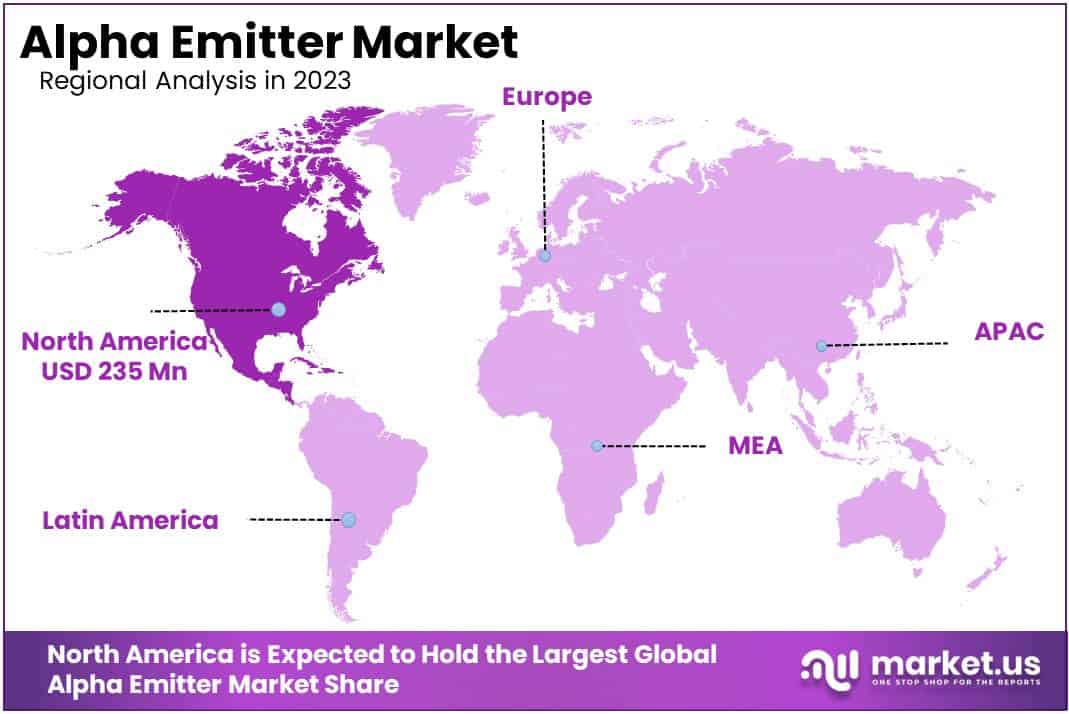

- North America led the market by securing a market share of 40.1% in 2023.

Type of Radionuclide Analysis

The Radium-223 segment led in 2023, claiming a market share of 23.1% owing to the increasing research and development efforts focused on treating metastatic castration-resistant prostate cancer. A study published by the Radiation Journal in August 2022 explored the optimal approach for Radium-223 therapy, revealing significant overall survival improvements with early administration, suggesting the benefits of using Ra-223 before other treatments.

Source Analysis

The natural sources held a significant share of 55.9% due to the presence of Uranium and Thorium, which are naturally available in the earth’s crust, emit alpha particles when they decay and release energy in the form of alpha radiation to form decay products such as radon and radium.

Application Analysis

The prostate cancer segment had a tremendous growth rate, with a revenue share of 35.8% owing to the rising research and development on targeted alpha-particle-emitting radiopharmaceuticals as therapeutics in the treatment of prostate cancer. For instance, a study that was published on NCBI in April 2021 concerned the use of radium-223 dichloride, a radiopharmaceutical that emits alpha particles, which yielded better overall survival with the management of prostate cancer with bone metastases.

End-user Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 41.7% due to the rising use of alpha emitter therapies in cancer. Medical facilities are focusing on acquiring highly specialized radiation therapy tools and equipment, which in turn creates the need for alpha emitters.

Moreover, there has been growth in the establishment of nuclear medicine departments in hospitals, which translates to greater application of alpha emitters. The increasing interest in targeted therapy and individualized treatment is also applied to hospitals, as is in the use of alpha emitters.

Key Market Segments

By Type of Radionuclide

- Lead-212

- Actinium-225

- Astatine-211

- Radium-223

- Bismuth-213

- Others

By Source

- Natural Sources

- Radium-226

- Uranium-238

- Artificially Produced Sources

- Americium

- Curium

- Plutonium

- Californium

By Application

- Prostate Cancer

- Bone Metastases

- Pancreatic Cancer

- Ovarian Cancer

- Neuroendocrine Tumors

- Others

By End-user

- Hospitals

- Diagnostic Centers

- Specialty Clinics

- Others

Drivers

Increasing Prevalence of Cancer

Cancer is on the rise and thus, there is a push toward Targeted Anticancer/Alpha Therapy (TAT), which is a technique that uses short-range, efficient particles for the treatment of chronic diseases. This therapy has demonstrated superior cell destructive potential, which is a good treatment for chronic diseases like cancer.

Cancer is the second leading cause of death globally next to cardiovascular diseases. Alpha particles are very good at treating the condition directly by giving energy to the DNA of the cell and also by hindering chemical reactions. Because of this, they are widely used in the treatment of prostate cancer with bone metastases and other cancers with less impact on the healthy tissues. Therefore it will be possible for the market associated with TAT to grow at a rapid pace during the projection period.

- According to recent data from the National Cancer Institute, in 2024, around 2 million people are likely to be diagnosed with cancer in the US. Close to 2,790 men and 310,720 women are projected to be diagnosed with breast cancer, making it the most common diagnosis of cancer. Prostate cancer is the primary cancer diagnosis among men. It is the second most prevalent diagnosis with 299,010 estimated cases.

Restraints

Short Radiopharmaceuticals’ Half-life

The short half-life of radiopharmaceuticals is a restraint for the market as it requires frequent replenishment and production, thereby, increasing cost and logistical challenges. Radiopharmaceuticals with short half-life decay rapidly, reducing their effectiveness and requiring more frequent administration. This can lead to supply chain disruption, impacting market growth.

The short half-life also limits the shelf life of alpha emitter products, making it difficult to maintain a stable inventory. Furthermore, the need for frequent production and transportation of radiopharmaceuticals increases the risk of contamination and radiation exposure. Overall, the short half-life of radiopharmaceuticals creates operational and logistical hurdles, constraining market growth.

Opportunities

Rising Awareness Regarding Targeted Alpha Therapy’s Potential Benefits

The surge in the prevalence of cancer is leading to high attention toward the exploration of Targeted Anticancer/Alpha Treatment (TAT) clinical trials, which are still in progress to show TAT’s capabilities to treat disseminated and micro-metastatic cancers without significant side effects. Therefore nuclear medications are growing popular as a novel field for early diagnosis and imaging, which provides easy and efficient procedures.

According to a report published by the National Institute of Health in October 2022, molecular targeted therapies are transforming cancer treatment, allowing personalized treatment of tumors where the growth is being driven by specific mutations. Contrary to traditional chemotherapies that are harmful to both, tumor and healthy cells, the targeted agents are intended to precisely block the effects of certain signaling proteins whose action is mostly restricted to cancerous tissue.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the alpha emitter market, influencing its trajectory and dynamics. The market is propelled forward through macroeconomic factors such as economic growth and higher expenditure on healthcare in addition to geopolitical factors such as global health policies and international partnerships. Increased government spending on healthcare facilities and suitable reimbursement mechanisms are the other factors that open up the market.

However, the market growth can be slowed down because of economic crisis restrictions on imports and exports and changes in the legislation. Nevertheless, rising global cancer cases and the rising use of targeted alpha particle therapy set these difficulties. Even political stability on the international level and cooperation can also help to promote the market.

Trends

Development of Novel Alpha Emitters

Researchers are actively developing innovative alpha emitters with improved characteristics, such as extended half-life, enhanced targeting capabilities, and reduced systemic toxicity. These advancements aim to overcome key limitations of existing alpha emitters pharma including short half-lives that require frequent administration and limited targeting specificity that can lead to unwanted side effects.

For example, Actinium-225 is a promising alpha emitter with a longer half-life than Radium-223, a commonly used alpha emitter. This extended half-life enables less frequent administration of Actinium-225, reducing radiation exposure and potentially improving treatment adherence.

Regional Analysis

North America is leading the alpha emitter market

North America dominated the market with the highest revenue share of 40.1% owing to the growing trend of strategic collaborations among key players. For example, North Star Medical Radioisotopes, a pioneer nuclear medicine company in the US, entered a strategic partnership with Inhibrx, Inc., another US-based clinical-stage biotechnology company on January 1, 2023, to advance novel cancer theranostics, exemplifying this trend.

The development of advanced novel cancer theranostics is driving the market, as these innovative diagnostic and therapeutic tools rely on alpha-emitting isotopes, fueling demand for these isotopes and contributing to the market’s growth in the region.

Europe is expected to experience the highest CAGR during the forecast period

Europe is expected to grow with the fastest CAGR owing to the major advances in the research & development of radiopharmaceuticals and the presence of relatively large number of firms involved in the development of initiatives that use radiopharmaceuticals for treatment. Moreover, high incidences of cancer in Europe coupled with Europe’s ageing population which seeks effective treatment such as alpha emitter are also instrumental in driving the regional market growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the alpha emitter market are vigorously engaged in the growth and institution of innovative products, as well as executing strategic initiatives aimed at augmenting their competitive positioning. For instance, in November 2021, RadioMedix, one of the key market players, was given a USD 2 million grant to support Phase I/II clinical development of ground-breaking alpha-emitter labeled peptide, AlphaMedix. It is intended for treating somatostatin receptor-positive neuroendocrine tumors.

Top Key Players in the Alpha Emitter Market

- Telix Pharmaceuticals Ltd.

- RadioMedix Inc.

- IBA Radiopharma Solutions

- Fusion Pharmaceuticals

- Bayer AG

- Alpha Tau Medical Ltd

- Actinium Pharmaceutical Inc.

- Orano Med

- Other Key Players

Recent Developments

- In January 2023: Orano Med announced that it performed the first injection of 212Pb-GRPR in a Phase 1 trial. 212Pb-GRPR is a therapy of alpha radioligand featuring lead-212, designed for patients with solid tumors that exhibit the peptide receptor that releases gastrin.

- In June 2022: One of the market leaders, Alpha Tau Medical Ltd., announced the approval of its Investigational Device Exemption (IDE) application by the U.S. Food and Drug Administration (FDA). This approval allows them to commence a pivotal, multi-center study for the treatment of recurrent cutaneous Squamous Cell Carcinoma (SCC) using their Alpha DaRT technology.

Report Scope

Report Features Description Market Value (2023) USD 586.1 Million Forecast Revenue (2033) USD 1,534.1 Million CAGR (2024-2033) 10.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Radionuclide (Lead-212, Actinium-225, Astatine-211, Radium-223, Bismuth-213, and Others), By Source (Natural Sources (Radium-226 and Uranium-238) and Artificially Produced Sources (Americium, Curium, Plutonium, and Californium)), By Application (Prostate Cancer, Bone Metastases, Pancreatic Cancer, Ovarian Cancer, Neuroendocrine Tumors, and Others), By End-user (Hospitals, Diagnostic Centers, Specialty Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Telix Pharmaceuticals Ltd., RadioMedix Inc., IBA Radiopharma Solutions, Fusion Pharmaceuticals, Bayer AG, Alpha Tau Medical Ltd, Actinium Pharmaceutical Inc., Orano Med, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Alpha Emitter market in 2023?The Alpha Emitter market size is USD 586.1 Million in 2023.

What is the projected CAGR at which the Alpha Emitter market is expected to grow at?The Alpha Emitter market is expected to grow at a CAGR of 10.1% (2024-2033).

List the segments encompassed in this report on the Alpha Emitter market?Market.US has segmented the Alpha Emitter market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type of Radionuclide the market has been segmented into Lead-212, Actinium-225, Astatine-211, Radium-223, Bismuth-213, and Others. By Source the market has been segmented into Natural Sources (Radium-226 and Uranium-238) and Artificially Produced Sources (Americium, Curium, Plutonium, and Californium). By Application the market has been segmented into Prostate Cancer, Bone Metastases, Pancreatic Cancer, Ovarian Cancer, Neuroendocrine Tumors, and Others. By End-user the market has been segmented into Hospitals, Diagnostic Centers, Specialty Clinics, and Others.

List the key industry players of the Alpha Emitter market?Telix Pharmaceuticals Ltd., RadioMedix Inc., IBA Radiopharma Solutions, Fusion Pharmaceuticals, Bayer AG, Alpha Tau Medical Ltd, Actinium Pharmaceutical Inc., Orano Med, and Other Key Players.

Which region is more appealing for vendors employed in the Alpha Emitter market?North America is expected to account for the highest revenue share with 40.1%, and boasting an impressive market value of USD 235 Million. Therefore, the Alpha Emitter industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Alpha Emitter?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Alpha Emitter Market.

-

-

- Telix Pharmaceuticals Ltd.

- RadioMedix Inc.

- IBA Radiopharma Solutions

- Fusion Pharmaceuticals

- Bayer AG

- Alpha Tau Medical Ltd

- Actinium Pharmaceutical Inc.

- Orano Med

- Other Key Players