Global Aloe Vera Drinks Market By Product (Unflavored and Flavored), By Distribution Channel (Hypermarket and Supermarket, Online, Drugstores, and Other Distribution Channels), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 43473

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

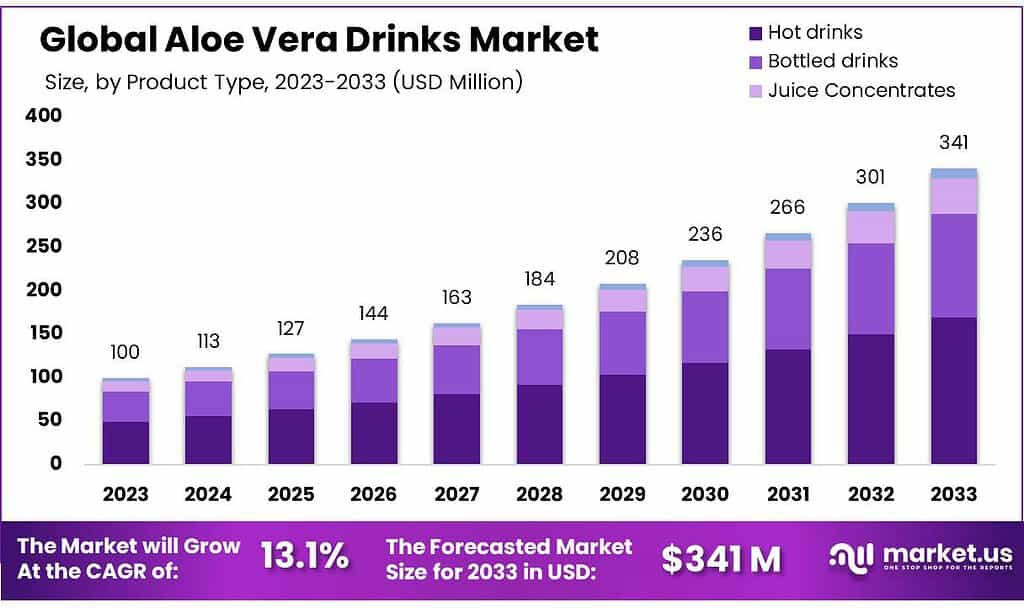

The Aloe Vera Drinks Market size is expected to be worth around USD 341 Mn by 2033, from USD 100 Mn in 2023, growing at a CAGR of 13.1% during the forecast period from 2023 to 2033.

The Aloe Vera Drinks Market refers to the sector involved in the production, distribution, and consumption of beverages that incorporate Aloe vera extracts. These drinks typically combine Aloe vera gel or juice with various flavors, sweeteners, and additional ingredients to create refreshing and potentially health-promoting beverages.

Aloe vera is known for its potential health benefits, including hydration, digestion support, and antioxidant properties. The market encompasses a range of products, including Aloe vera juices, flavored Aloe vera drinks, and Aloe vera-infused water, catering to consumer preferences for natural and functional beverages.

Key Takeaways

- Market Expansion: Projected growth from USD 100 million in 2023 to USD 341 million by 2033, with a CAGR of 13.1%.

- Hot Drinks Preference: Hot drinks lead with a 48.2% market share in 2023, showing a strong consumer preference for warm Aloe Vera beverages.

- Unflavored Drink Popularity: In 2023, unflavored drinks dominated, accounting for 51.3% of the market, indicating a trend towards natural taste preferences.

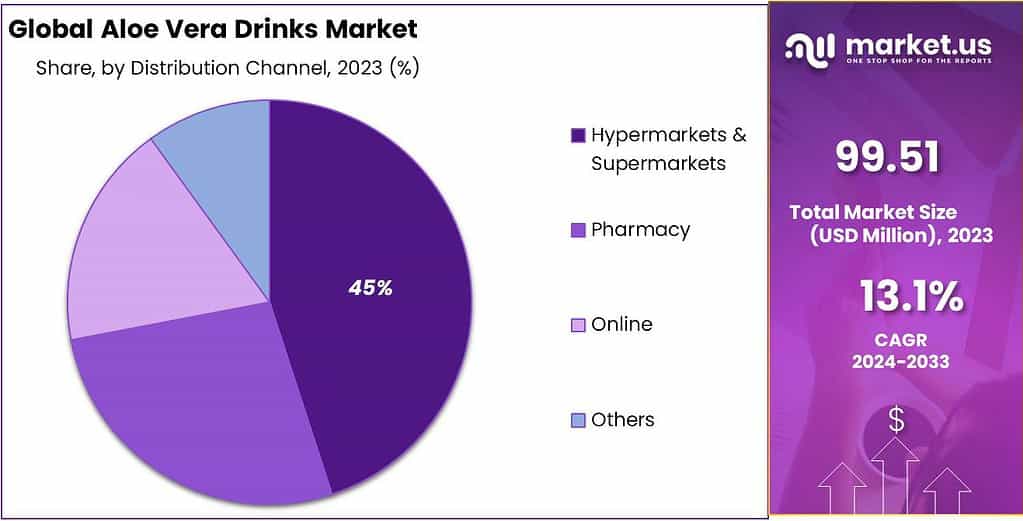

- Primary Distribution Channels: Supermarkets and Hypermarkets were the main distribution channels, making up over 45.3% of the market share in 2023.

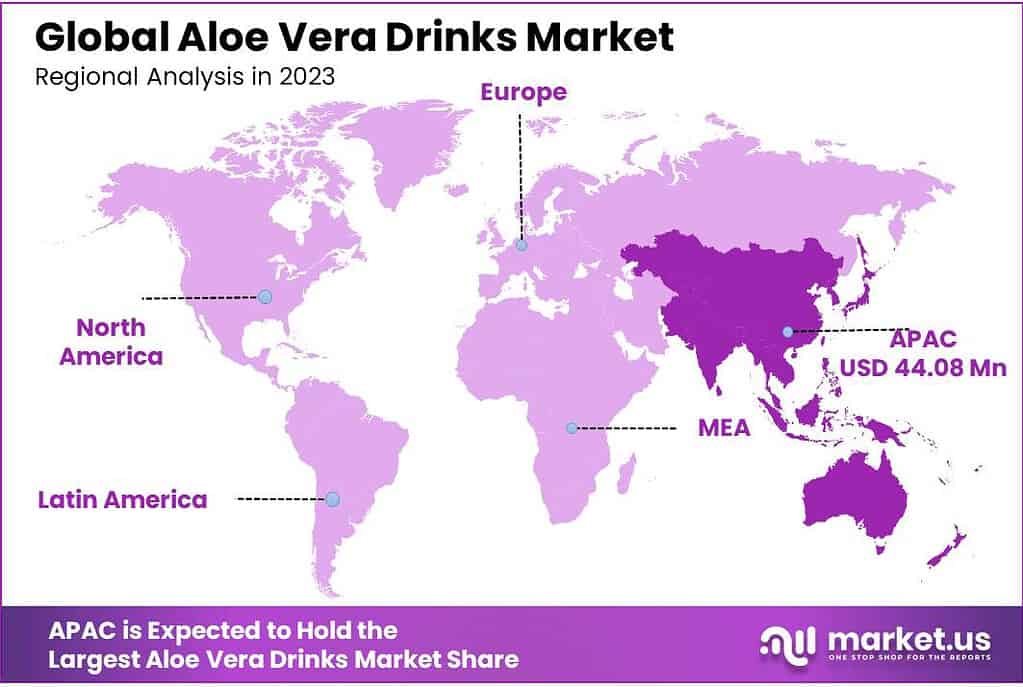

- Regional Insights: Asia Pacific leads with 44.3% revenue share in 2023; North America to grow fastest with a 12.1% CAGR from 2023 to 2032.

Product Analysis

In the year 2023, Hot Drinks emerged as the leading segment in the Aloe Vera Drinks market, securing a substantial market share of over 48.2%. This indicates that among the different types of Aloe Vera Drinks, hot beverages were the top choice for consumers. The dominance of Hot Drinks suggests an interesting trend in the market.

People like having Aloe Vera in warm drinks because it makes them feel cozy and comfortable. Aloe Vera can be used in different temperature drinks, like warm ones, showing that it can be flexible and fit into various kinds of drinks. The soothing and comforting feelings that come with hot drinks might be why consumers find Aloe Vera in warm beverages appealing.

The significant market share held by Hot Drinks emphasizes the importance of catering to diverse consumer preferences. While some people may prefer the convenience of bottled drinks or the concentrated goodness of juice concentrates, a substantial portion seems to lean towards the warmth and comfort associated with hot Aloe Vera beverages.

Keeping a close eye on the developments within the Hot Drinks segment will be crucial to understanding changing consumer tastes and maintaining a competitive edge in the Aloe Vera Drinks market.

By Flavor

In the Aloe Vera Drinks market of 2023, Unflavored options have notably emerged as the preferred choice among consumers, capturing a substantial market share of over 51.3%. This signifies a clear trend where individuals show a distinct inclination towards Aloe Vera Drinks that maintain the natural taste without additional flavors.

The dominance of Unflavored Aloe Vera Drinks suggests a consumer preference for simplicity and authenticity. It appears that a significant portion of consumers values the unaltered and pure experience of Aloe Vera, appreciating the beverage in its natural form. This trend underscores the importance of providing options that cater to those seeking a straightforward and unadorned Aloe Vera drink.

The substantial market share held by Unflavored Aloe Vera Drinks emphasizes the need for businesses to recognize and respond to diverse taste preferences within the market. While flavored options may have their appeal, a considerable segment of the consumer base leans towards the unadulterated taste of Aloe Vera. Staying attentive to the developments within the Unflavored segment will be pivotal for businesses to align their offerings with evolving consumer desires, ensuring a competitive position in the dynamic Aloe Vera Drinks market.

Distribution Channel Analysis

In the year 2023, Supermarkets and Hypermarkets emerged as the leading distribution channel in the Aloe Vera Drinks market, securing a dominant market position with over 45.3% share. This indicates that a significant portion of consumers prefer purchasing Aloe Vera Drinks from large retail stores.

The dominance of Supermarkets and Hypermarkets as a distribution channel suggests a noteworthy trend in consumer behavior. Many individuals find it convenient to buy Aloe Vera Drinks while doing their regular grocery shopping. The broad availability and accessibility of these beverages in well-known supermarkets contribute to their popularity.

The substantial market share held by Supermarkets and Hypermarkets highlights the importance of these retail giants in reaching a wide consumer base. While other channels like pharmacies and online platforms may have their appeal, Supermarkets and Hypermarkets play a crucial role in making Aloe Vera Drinks easily accessible to a broad audience. Staying informed about the developments within this distribution segment will be essential for businesses looking to maintain a competitive edge in the Aloe Vera Drinks market.

Key Market Segments

By Product Type

- Hot drinks

- Bottled drinks

- Juice Concentrates

- Aloe Vera water

By Flavor

- Flavored

- Unflavored

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy

- Online

- Others

Drivers

The Aloe Vera Drinks market is growing a lot because people want healthier drinks. Aloe Vera is popular because it’s seen as good for health and can keep you hydrated. People who care about being healthy like drinks with Aloe Vera. Another reason Aloe Vera Drinks are popular is because Aloe Vera can be used in different kinds of drinks, like juices and crushes.

This makes it easy for companies to make many types of Aloe Vera Drinks that people will like. In simple terms, the Aloe Vera Drinks market is going up because people want healthier options, and Aloe Vera fits what they’re looking for.

The fact that Aloe Vera can be used in different drinks also makes it a popular choice for people with different tastes. More people buying Aloe Vera Drinks online is helping the Aloe Vera Drinks market grow. Online shopping makes it easy for people to get Aloe Vera Drinks from their homes, and they can choose from many options. Reading reviews from other users also helps them make smart choices.

To sum it up, the Aloe Vera Drinks market is growing because more people want healthy drinks, Aloe Vera is flexible for making different kinds of drinks, and online shopping is making it convenient for people to get what they want. This shows that businesses need to pay attention to what people like and find new ways to make drinks that fit what customers want.

Restraints

While the Aloe Vera Drinks market is on the rise, there are challenges and limitations that businesses in this industry face. One significant restraint is the potential for variations in the natural composition of Aloe Vera. The quality and effectiveness of Aloe Vera can differ based on factors like climate, soil conditions, and cultivation methods. Maintaining consistent quality becomes a challenge, impacting the reliability of Aloe Vera Drinks.

Concerns about the taste and texture of Aloe Vera in beverages can be a limiting factor. Some consumers may find the unique taste or texture of Aloe Vera less appealing, which can hinder widespread acceptance. Striking the right balance in flavor and consistency is crucial for broad market appeal.

The perishable nature of fresh Aloe Vera presents logistical challenges. Preserving the freshness and nutritional properties during processing and distribution is essential, requiring efficient supply chain management. Any lapses in maintaining the integrity of Aloe Vera can lead to quality issues and affect consumer trust.

In conclusion, the Aloe Vera Drinks market faces restraints related to the variability in Aloe Vera’s natural composition, consumer preferences for taste and texture, and the logistical challenges associated with preserving freshness. Overcoming these challenges will require a focus on quality control, innovation in flavor profiles, and robust supply chain solutions.

Opportunities

Within the challenges, the Aloe Vera Drinks market also offers exciting opportunities for growth and innovation. One notable opportunity lies in the rising trend of plant-based and functional beverages. Aloe Vera, with its perceived health benefits, fits well into this category. Positioning Aloe Vera Drinks as a functional and natural beverage can tap into the increasing consumer interest in wellness-oriented products.

There is room for product diversification and innovation. Companies can explore creating Aloe Vera blends with other complementary ingredients, such as fruits or herbs, to enhance flavor profiles and appeal to a broader consumer base. Creating unique and appealing combinations can set products apart in a competitive market.

The global expansion of Aloe Vera-based products also presents an opportunity. Businesses can explore entering new geographical markets where there is growing awareness and demand for health-focused beverages. This involves adapting marketing strategies to cater to diverse cultural preferences and preferences.

The Aloe Vera Drinks market holds opportunities to align with the plant-based and functional beverage trend, exploring innovative product blends, and expanding into new global markets. Successfully capitalizing on these opportunities requires a strategic approach to product development, marketing, and understanding regional consumer preferences.

Challenges

Despite the growth potential, the Aloe Vera Drinks market faces certain challenges that businesses must navigate. One significant challenge is the potential for misinformation or lack of understanding about the health benefits of Aloe Vera. Clear communication and education about the positive aspects of Aloe Vera, along with its correct usage, are crucial to building consumer trust and dispelling any misconceptions.

Quality control is another challenge in the Aloe Vera Drinks market. Ensuring consistent quality and purity of Aloe Vera across different batches and products is essential. Variability in Aloe Vera composition due to factors like growing conditions can impact product effectiveness, making stringent quality assurance measures vital.

The taste and texture of Aloe Vera also pose challenges. While some consumers appreciate its unique attributes, others may find them less appealing. Achieving a balance that satisfies a broad range of taste preferences is essential for market acceptance and success. The competitive landscape in the beverage industry is intense.

Aloe Vera Drinks must compete with a wide array of other beverages, each vying for consumer attention. Differentiating products, creating unique value propositions, and effective marketing become crucial strategies in such a competitive environment.

In conclusion, challenges in the Aloe Vera Drinks market include addressing misinformation, maintaining consistent quality, managing taste and texture preferences, and navigating intense competition in the beverage industry. Successfully overcoming these challenges requires a holistic approach encompassing education, quality control, product innovation, and strategic marketing.

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 44.3% in 2023. North America is predicted to be the rapidly growing regional market, with a CAGR of 12.1% between 2023-2032. These aloe-based drinks are seeing rapid growth in America because Americans have busy lifestyles and work schedules. These aloe-based beverages can be used to help manage weight.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Because of the high number of players both domestically and internationally, the market is very fragmented. Large players dominate the Asia Pacific, North America, and Europe markets. Asia, such as South Korea, Japan, and India are among the top aloe drink consumers. The product has been used medicinally for centuries.

Due to increasing demand, domestic but major players in the region have launched new products. Baidyanath Group in India, a pioneering Indian pharmaceutical company, launched a wide variety of natural juices, including aloe, black plum, gooseberry, and bitter gourd. These product launches have opened up new market opportunities and are predicted to show a high growth rate during the forecast period.

Key Market Players

- ALO Drinks

- OKF Corporation

- Houssy Global

- Tulip International Inc.

- Lotte Chilsung Beverage Co., Ltd.

- Forever Living.com, L.L.C.

- Aloe Drink For Life

- Keumkang B&F Co., Ltd.

- Aloe Farms, Inc.

- Atlantia UK Ltd

Recent Development

In September 2022, 1NE Beverages, a seasoning and beverage brand under the subsidiary of US-based Livinia Foods, launched aloe vera juices available in a range of flavors in India. The company claims the product has antioxidant properties and multiple health benefits ranging from skin, oral, dental, or digestive health.

Report Scope

Report Features Description Market Value (2022) USD 100 Mn Forecast Revenue (2032) USD 341 Mn CAGR (2023-2032) 13.1% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Company Profiles, Recent Developments Segments Covered By Product Type(Hot drinks, Bottled drinks, Juice Concentrates, Aloe Vera water), By Flavor(Flavored, Unflavored), By Distribution Channel( Hypermarkets & Supermarkets, Pharmacy, Online, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; The Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA. Competitive Landscape ALO Drinks, OKF Corporation, Houssy Global, Tulip International Inc., Lotte Chilsung Beverage Co., Ltd., Forever Living.com, L.L.C., Aloe Drink For Life, Keumkang B&F Co., Ltd., Aloe Farms, Inc., Atlantia UK Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF). Frequently Asked Questions (FAQ)

What is the Size of Aloe Vera Drinks Market?Aloe Vera Drinks Market size is expected to be worth around USD 341 Mn by 2033, from USD 100 Mn in 2023

What is the CAGR for the Aloe Vera Drinks Market?The Aloe Vera Drinks Market is expected to grow at a CAGR of 13.1% during 2023-2033.Who are the key companies/players in the Aloe Vera Drinks Market?ALO Drinks, OKF Corporation, Houssy Global, Tulip International Inc., Lotte Chilsung Beverage Co., Ltd., Forever Living.com, L.L.C., Aloe Drink For Life, Keumkang B&F Co., Ltd., Aloe Farms, Inc., Atlantia UK Ltd

-

-

- ALO Drinks

- OKF Corporation

- Houssy Global

- Tulip International Inc.

- Lotte Chilsung Beverage Co., Ltd.

- Forever Living.com, L.L.C.

- Aloe Drink For Life

- Keumkang B&F Co., Ltd.

- Aloe Farms, Inc.

- Atlantia UK Ltd