Global Allantoin Market By Product Form(Powder Allantoin, Crystal Allantoin, Liquid Allantoin), By Application(Skincare, Haircare, Oral Care, Others), By End-Use(Cosmetic, Pharmaceutical, Oral Hygiene, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 14795

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

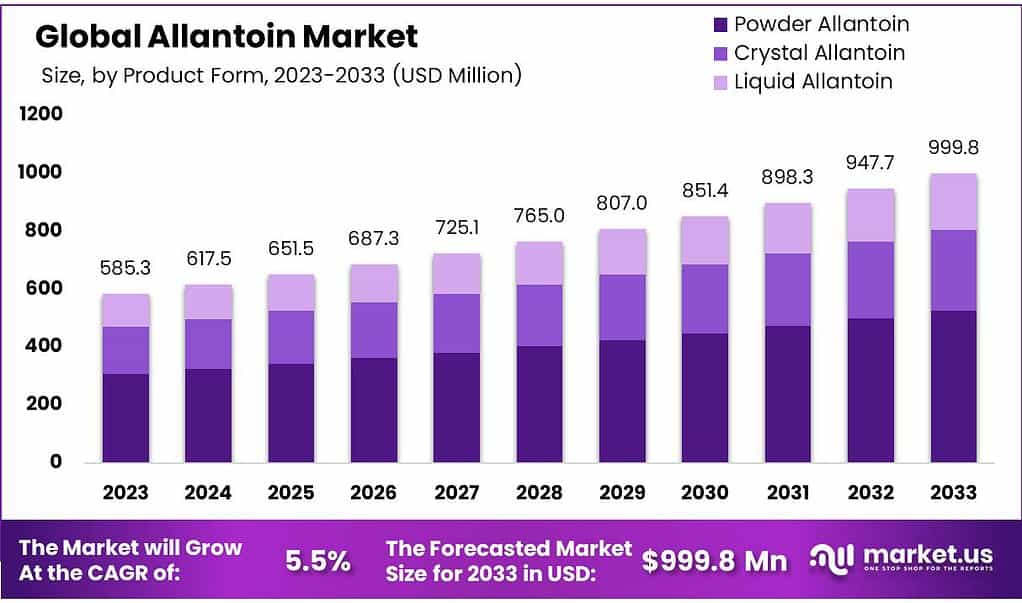

The Allantoin Market size is expected to be worth around USD 999.8 Billion by 2033, from USD 585.3 Billion in 2023, growing at a CAGR of 5.5% during the forecast period from 2023 to 2033.

Allantoin is a naturally occurring compound classified as a diureide of glyoxylic acid. Widely used in the cosmetics and pharmaceutical industries, it is known for its soothing and skin-conditioning properties. Allantoin is commonly sourced from botanical extracts, such as comfrey plants, or produced synthetically.

Its ability to promote cell regeneration and enhance skin moisture retention makes it a key ingredient in various skincare products, including creams, lotions, and ointments. Additionally, allantoin is utilized in pharmaceutical formulations for its anti-irritant and keratolytic effects, aiding in the treatment of various skin conditions. Its versatility and gentle nature contribute to its widespread application in personal care and medicinal products.

Key Takeaways

- Market Growth: The Allantoin Market is projected to reach USD 999.8 Billion by 2033, with a robust CAGR of 5.5% from the 2023 value of USD 585.3 Billion.

- Powder Dominance: In 2023, Powder Allantoin held 52.6% market share, favored for its ease of incorporation in skincare products like creams and lotions.

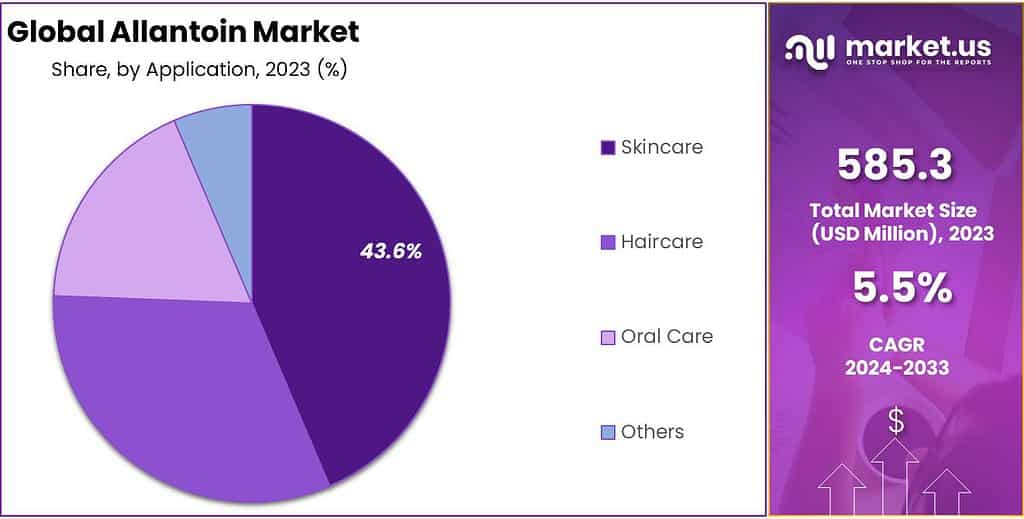

- Skincare Leader: Skincare emerged as the top application in 2023, holding 43.6% market share, driven by Allantoin’s moisturizing and skin-renewing effects in creams and masks.

- Cosmetic Dominance: In 2023, Cosmetics claimed the highest end-use share at 61.3%, emphasizing allantoin’s role in enhancing skin texture and appearance.

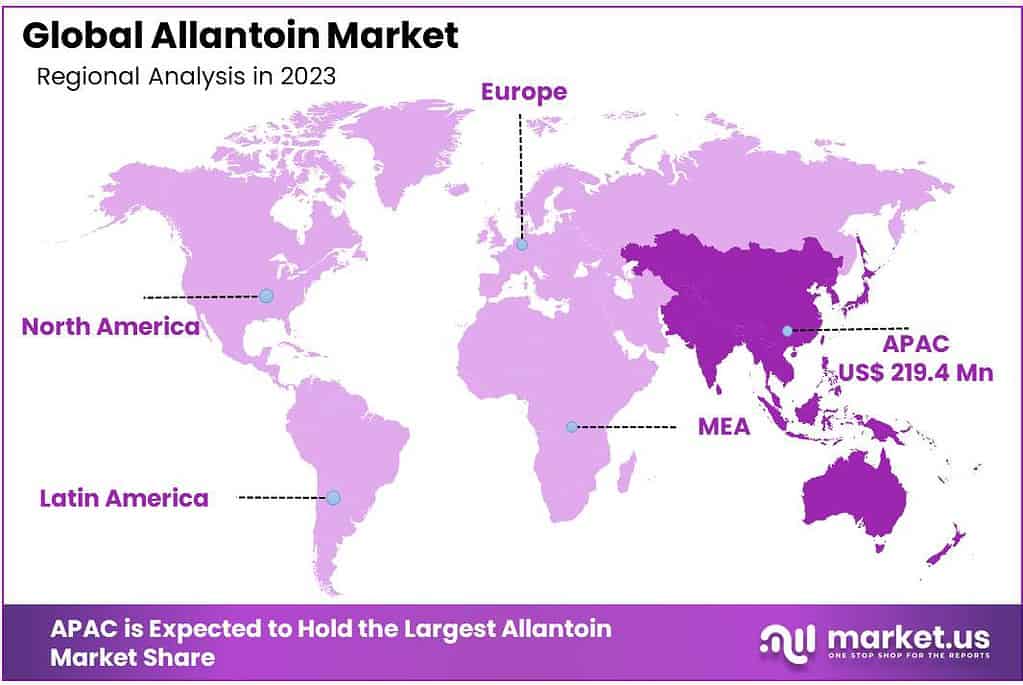

- Regional Insights: Asia Pacific led in 2023 with a 37.5% revenue share, driven by a booming cosmetics industry. Europe is projected to grow at a 5.6% annualized rate, emphasizing anti-aging product demand.

By Product Form

In 2023, Powder Allantoin was the most popular form in the market, holding over 52.6% of the share. This indicates that a significant portion of consumers preferred allantoin in powdered form for various applications.

Powder Allantoin is widely used in skincare and cosmetic products due to its ease of incorporation into formulations and versatility in product development. It is commonly utilized as an active ingredient in creams, lotions, and facial masks, known for its soothing and moisturizing properties.

Crystal Allantoin is another form available in the market. It offers similar benefits to Powder Allantoin but is typically used in more specialized applications, such as pharmaceuticals or industrial products. Crystal Allantoin is valued for its purity and consistency, making it suitable for use in pharmaceutical formulations or as an additive in manufacturing processes.

Liquid Allantoin represents a smaller segment of the market but offers unique advantages in certain applications. It is often used in products where solubility and ease of dispersion are essential, such as serums, toners, or hair care formulations. Liquid Allantoin can be easily incorporated into water-based formulations, providing moisturizing and conditioning benefits to the skin or hair.

Application Analysis

In 2023, Skincare emerged as the leading application segment in the allantoin market, capturing over 43.6% of the share. This indicates that a significant portion of allantoin usage is in skincare products. Allantoin is widely recognized for its beneficial properties in skincare formulations.

It is commonly used in creams, lotions, serums, and facial masks due to its moisturizing, soothing, and skin-renewing effects. Allantoin helps to hydrate the skin, reduce inflammation, and promote cell regeneration, making it a popular ingredient in skincare products targeted at addressing various skin concerns, such as dryness, irritation, and aging.

Haircare represents another important application segment in the allantoin market. Allantoin is incorporated into hair care products such as shampoos, conditioners, and hair masks due to its moisturizing and conditioning properties.

It helps to nourish the scalp, strengthen the hair follicles, and improve the overall health and appearance of the hair, making it a valuable ingredient in formulations aimed at promoting hair growth, preventing breakage, and enhancing shine and manageability.

Oral Care is also a significant application segment for allantoin. It is commonly used in toothpaste, mouthwash, and oral hygiene products due to its anti-inflammatory and healing properties. Allantoin helps to soothe oral tissues, reduce irritation, and promote the healing of minor oral injuries, making it a beneficial ingredient in oral care formulations targeted at maintaining oral health and hygiene.

By End-Use

In 2023, Cosmetics emerged as the dominant end-use segment in the allantoin market, capturing over 61.3% of the share. This indicates that the majority of allantoin usage is in cosmetic products. Cosmetics encompass a wide range of products, including skincare, makeup, and personal care items, where allantoin is widely utilized for its skin-conditioning and soothing properties. It is commonly found in creams, lotions, serums, and facial masks, where it helps to moisturize the skin, reduce irritation, and promote cell regeneration.

Allantoin is valued by cosmetic manufacturers for its ability to improve the overall texture and appearance of the skin, making it a popular ingredient in products aimed at addressing various skin concerns, such as dryness, inflammation, and aging. Pharmaceuticals represent another important end-use segment for allantoin. It is commonly used in pharmaceutical formulations such as topical ointments, creams, and gels for its wound-healing and skin-soothing properties.

Allantoin helps to accelerate the healing process, reduce inflammation, and promote tissue regeneration, making it a valuable ingredient in products targeted at treating minor cuts, burns, wounds, and skin irritations. Oral Hygiene is also a significant end-use segment for allantoin. It is incorporated into oral care products such as toothpaste, mouthwash, and oral hygiene solutions for its anti-inflammatory and healing properties. Allantoin helps to soothe oral tissues, reduce irritation, and promote healing of minor oral injuries, making it an effective ingredient in products aimed at maintaining oral health and hygiene.

Key Market Segments

By Product Form

- Powder Allantoin

- Crystal Allantoin

- Liquid Allantoin

By Application

- Skincare

- Haircare

- Oral Care

- Others

By End-Use

- Cosmetic

- Pharmaceutical

- Oral Hygiene

- Others

Drivers

The allantoin market is primarily driven by the growing demand for cosmetics, as it is highly sought after for its skin-conditioning and soothing properties. With consumers increasingly prioritizing skincare and personal grooming, Alantoin’s role in products like moisturizers, serums, and masks continues to rise. Its ability to moisturize, soothe irritation, and promote skin renewal makes it a favored choice among consumers, propelling its demand in the cosmetics industry.

The emphasis on personal hygiene and oral care contributes to the market growth, with allantoin being utilized in products like toothpaste, mouthwash, and oral hygiene solutions. Its anti-inflammatory and healing properties make it an effective ingredient for maintaining oral health and soothing oral tissues, aligning with consumers’ focus on overall wellness.

In pharmaceutical applications, allantoin’s widespread use in topical treatments and ointments for wound healing and skin soothing further drives market expansion. As skin conditions and minor injuries continue to prevail, the demand for allantoin-based pharmaceutical products is expected to grow, adding momentum to the market.

Advancements in formulation technologies and product innovation also play a significant role in driving the allantoin market. Manufacturers are continually incorporating allantoin into a diverse range of products, expanding its applications beyond traditional skincare and personal care items to include hair care, veterinary products, and industrial applications.

Restraints

The allantoin market faces several challenges or restraints that impact its growth and development. One significant challenge is the limited availability of raw materials. Allantoin is primarily derived from natural sources such as comfrey plants or synthesized from urea. However, the scarcity of these raw materials can constrain production, leading to supply shortages and price fluctuations in the market.

High production costs represent another obstacle for the allantoin market. The manufacturing process for allantoin can be complex and expensive, especially when extracting it from natural sources or synthesizing it from urea. These high production costs can hinder market growth and limit the affordability of allantoin-based products, impacting consumer accessibility.

Moreover, the stringent regulatory requirements imposed on allantoin add to the challenges faced by manufacturers. Compliance with various safety and quality standards set by regulatory authorities can be demanding, particularly concerning product purity and consistency. Meeting these requirements requires significant investments in testing and quality control measures, adding to the overall production costs.

Competition from alternative skincare ingredients poses another restraint for the allantoin market. Ingredients like glycerin, hyaluronic acid, and aloe vera offer similar skincare benefits and may compete with allantoin in the market. The availability of these alternative ingredients may limit the market share of allantoin and pose challenges for manufacturers in differentiating their products effectively.

Opportunities

The allantoin market presents several promising opportunities for growth and development. One significant avenue is the expanding application of allantoin in skincare products. With its proven beneficial properties for the skin, there’s a growing demand for allantoin in formulations such as moisturizers, serums, and masks.

Manufacturers can capitalize on this trend by innovating new formulations and expanding their range of skin care products containing allantoin, catering to the diverse needs and preferences of consumers. Moreover, there is potential for diversification into new end-use industries beyond cosmetics and pharmaceuticals.

Allantoin manufacturers can explore opportunities in sectors such as food and beverage, animal care, and industrial applications. By leveraging allantoin’s unique properties, such as its moisturizing and healing effects, manufacturers can develop innovative products that offer value across various industries, opening up new revenue streams and market opportunities.

In addition, there’s an increasing emphasis on sustainability and ethical sourcing practices in the skincare industry. Allantoin manufacturers have the opportunity to differentiate themselves by adopting sustainable sourcing practices, reducing their environmental footprint, and promoting eco-friendly production processes.

By aligning with consumer preferences for ethically sourced and environmentally friendly products, manufacturers can enhance their brand reputation and appeal to eco-conscious consumers. Expanding into emerging markets, particularly in regions like Asia-Pacific and Latin America, presents significant growth opportunities for the allantoin market.

Rising disposable incomes, urbanization, and shifting consumer lifestyles in these regions drive demand for skincare and personal care products, creating a fertile ground for allantoin manufacturers to expand their market presence and capture new customers.

Challenges

One challenge in the allantoin market is the limited availability of raw materials. Allantoin is primarily derived from natural sources like comfrey plants or synthesized from urea. However, the scarcity of these raw materials can lead to supply shortages and price fluctuations, making it challenging for manufacturers to maintain consistent production levels and pricing for allantoin-based products.

High production costs represent another hurdle for the allantoin market. The manufacturing process for allantoin can be complex and expensive, especially when extracting it from natural sources or synthesizing it from urea. These high costs can strain profit margins for manufacturers and impact the affordability of allantoin-based products, potentially limiting their accessibility to consumers.

Stringent regulatory requirements also pose challenges for allantoin manufacturers. Allantoin must comply with various safety and quality standards set by regulatory authorities, requiring rigorous testing and quality control measures. Ensuring compliance with these regulations can be resource-intensive and time-consuming for manufacturers, adding to the overall production costs and operational complexity.

Moreover, competition from alternative skincare ingredients presents a significant challenge for the allantoin market. Ingredients like glycerin, hyaluronic acid, and aloe vera offer similar skincare benefits and may compete with allantoin in the market. Manufacturers must differentiate their products effectively and demonstrate the unique benefits of allantoin to stand out amidst competition and capture consumer attention.

Region Analysis

Asia Pacific (APAC) had the largest revenue share at over 37.5% in 2023. Industry growth will be affected by the rapid growth in the cosmetics industry due to changing lifestyles, rising disposable income, and changing lifestyles. A shift by pharmaceutical companies to establish production facilities in India, China, and other countries will result in a significant increase in demand for the regional pharmaceutical industry. This will boost the allantoin market.

A rising consumer spending on personal care products, such as creams, eyedrops, and nutraceuticals could result in significant gains for Latin America and the Middle East & Africa over the forecast period. Europe’s allantoin industry is expected to grow at a 5.6% annualized rate over the forecast. The presence of major pharmaceutical and cosmetics manufacturers in the region has been a benefit to the region. The market is expected to grow due to the high quality of life and rising demand from women for anti-aging products.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

The global allantoin market has few industry players. These industry participants focus on R&D to create efficient products and adapt to changing consumer needs. Low initial costs and high operating costs make it less attractive for new entrants. Clariant, Ashland Inc. has integrated its businesses by expanding into both the raw material procurement sector as well as the distribution sector.

Laotian Guanghui and Akema both produce raw materials and cater to end-user industries, including cosmetics and pharmaceuticals. This allows the companies to lower their production costs. These types of initiatives by major players are expected to increase the industry’s competition.

Key Market Players

- Huanghua Suntime Chemical Industry Co., Ltd

- Rita Corporation

- Hubei Shunhui Bio-Technology Co., Ltd.

- Merck KGaA

- Clariant AG

- Akema Fine Chemicals

- Ashland Global Holdings Inc.

- Allan Chemical Corporation

- EMD Performance Materials

- RITA Corporation

- AkzoNobel N.V.

- Symrise AG

- Lubrizol Corporation

- Eastman Chemical Company

- Ashland Global Holdings Inc

Recent Developments

In March 2022, Hims & Hers announced the launch of several skin care products. Men and women are expected to benefit from SPF, while Hers will benefit from these products.

Report Scope

Report Features Description Market Value (2022) US$ 585.3 Mn Forecast Revenue (2032) US$ 999.8 Bn CAGR (2023-2032) 5.5% Base Year for Estimation 2022 Historic Period 2018-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Form(Powder Allantoin, Crystal Allantoin, Liquid Allantoin), By Application(Skincare, Haircare, Oral Care, Others), By End-Use(Cosmetic, Pharmaceutical, Oral Hygiene, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Huanghua Suntime Chemical Industry Co., Ltd, Rita Corporation, Hubei Shunhui Bio-Technology Co., Ltd., Merck KGaA, Clariant AG, Akema Fine Chemicals, Ashland Global Holdings Inc., Allan Chemical Corporation, EMD Performance Materials, RITA Corporation, AkzoNobel N.V., Symrise AG, Lubrizol Corporation, Eastman Chemical Company, Ashland Global Holdings Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Huanghua Suntime Chemical Industry Co., Ltd

- Rita Corporation

- Hubei Shunhui Bio-Technology Co., Ltd.

- Merck KGaA

- Clariant AG

- Akema Fine Chemicals

- Ashland Global Holdings Inc.

- Allan Chemical Corporation

- EMD Performance Materials

- RITA Corporation

- AkzoNobel N.V.

- Symrise AG

- Lubrizol Corporation

- Eastman Chemical Company

- Ashland Global Holdings Inc