Aldosterone-Renin Screening Market By Product Type (Immunoassay-based Kits, Radioimmunoassay-based Kits, LC–MS/MS-based Assays, ELISA-based Kits, and Aldosterone-to-Renin Ratio (ARR) Panels), By Sample (Plasma, Whole Blood, Urine, Serum, and Others), By Application (Primary Aldosteronism (PA), Secondary Hypertension, Resistant Hypertension, Adrenal Adenoma, and Others), By End-user (Diagnostic Kit Manufacturers/CROs, Pathology Laboratories, Hospitals, Endocrinology Clinics, and Cardiology Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164926

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

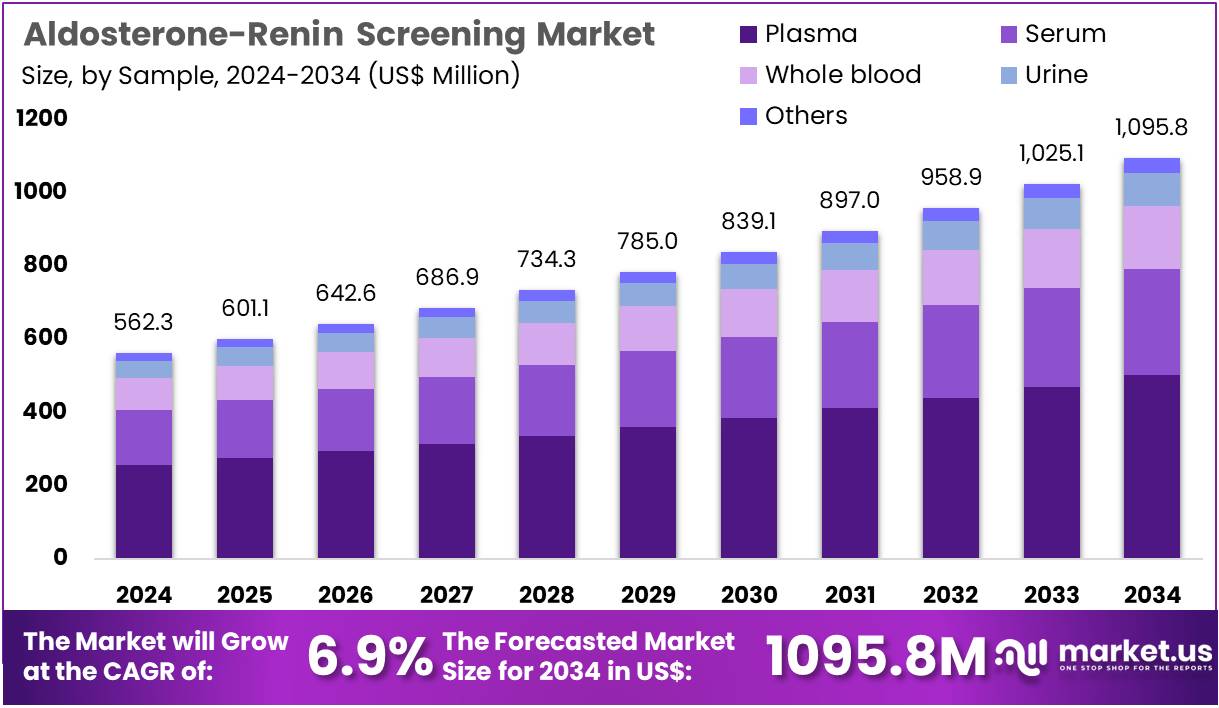

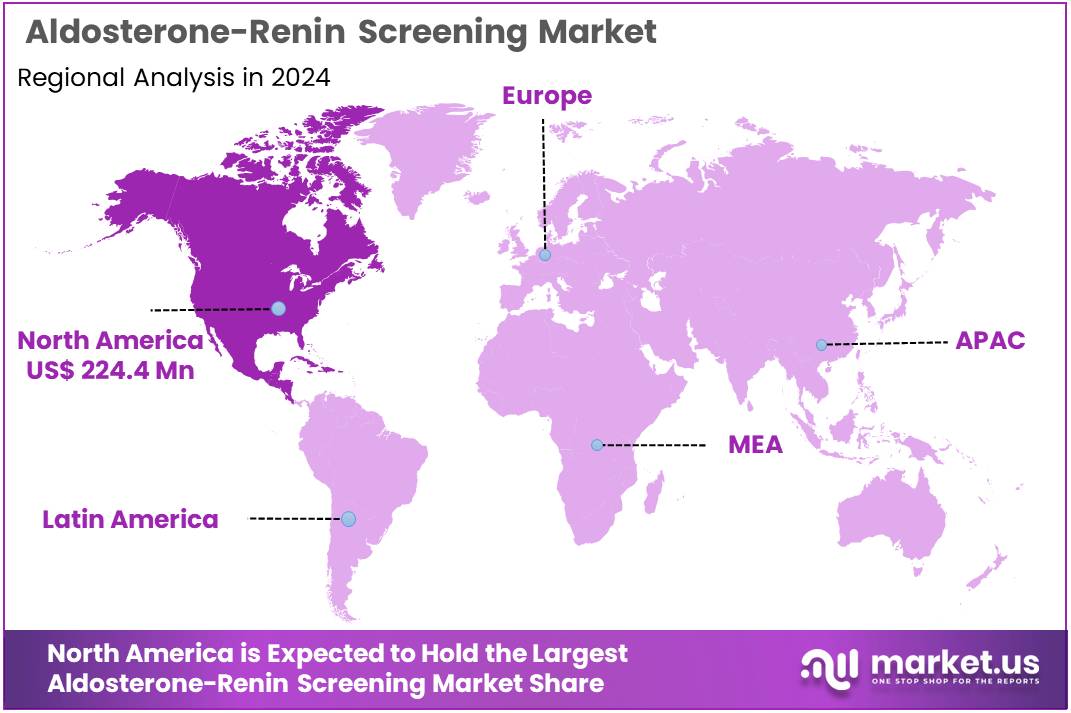

The Aldosterone-Renin Screening Market Size is expected to be worth around US$ 1095.8 million by 2034 from US$ 562.3 million in 2024, growing at a CAGR of 6.9% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.9% share and holds US$ 224.4 Million market value for the year.

Increasing hypertension prevalence drives the Aldosterone-Renin Screening Market, as endocrinologists expand screening to identify primary aldosteronism early. Primary care physicians calculate aldosterone-renin ratios (ARR) in newly diagnosed hypertensive patients, detecting autonomous aldosterone secretion. These tests support cardiology by evaluating secondary hypertension causes in heart failure cohorts, guiding mineralocorticoid receptor antagonist therapy.

Nephrologists apply ARR assays to assess renal artery stenosis effects, differentiating renovascular from essential hypertension. In July 2025, the Endocrine Society revised Primary Aldosteronism guidelines to recommend ARR screening for all hypertension cases, boosting testing volumes and high-throughput system adoption. This guideline fuels market growth by standardizing ARR in routine blood pressure management.

Growing recognition of resistant hypertension creates opportunities in the Aldosterone-Renin Screening Market, as protocols mandate hormone profiling regardless of electrolyte levels. Cardiologists integrate ARR testing into multidrug regimen failures, uncovering treatable endocrine causes and improving blood pressure control. These assays aid pharmacology by monitoring spironolactone response through serial ratio measurements, optimizing dosing in refractory cases.

Automated chemiluminescent platforms enable rapid turnaround for urgent endocrine consultations. In 2025, the American Heart Association and American College of Cardiology updated hypertension frameworks to require ARR in all resistant cases, enhancing early detection and workflow integration. This update drives market expansion through broader hormone-based diagnostic inclusion.

Rising regulatory validations propel the Aldosterone-Renin Screening Market, as approvals ensure assay reliability across laboratory networks. Pathologists validate liquid chromatography-tandem mass spectrometry methods for aldosterone measurement, meeting stringent accuracy standards. These tests support population health initiatives by screening at-risk cohorts for adrenal disorders, facilitating preventive interventions.

Trends toward point-of-care ARR devices enable bedside decision-making in emergency hypertension evaluations. In July 2023, ARUP Laboratories gained New York state approval for its ARR testing service, expanding validated endocrine diagnostics availability. This authorization positions the market for sustained growth through enhanced access and standardized aldosterone-renin screening.

Key Takeaways

- In 2024, the market generated a revenue of US$ 562.3 million, with a CAGR of 6.9%, and is expected to reach US$ 1095.8 million by the year 2034.

- The product type segment is divided into immunoassay-based kits, radioimmunoassay-based kits, LC–MS/MS-based assays, ELISA-based kits, and aldosterone-to-renin ratio (ARR) panels, with immunoassay-based kits taking the lead in 2023 with a market share of 42.8%.

- Considering sample, the market is divided into plasma, whole blood, urine, serum, and others. Among these, plasma held a significant share of 45.9%.

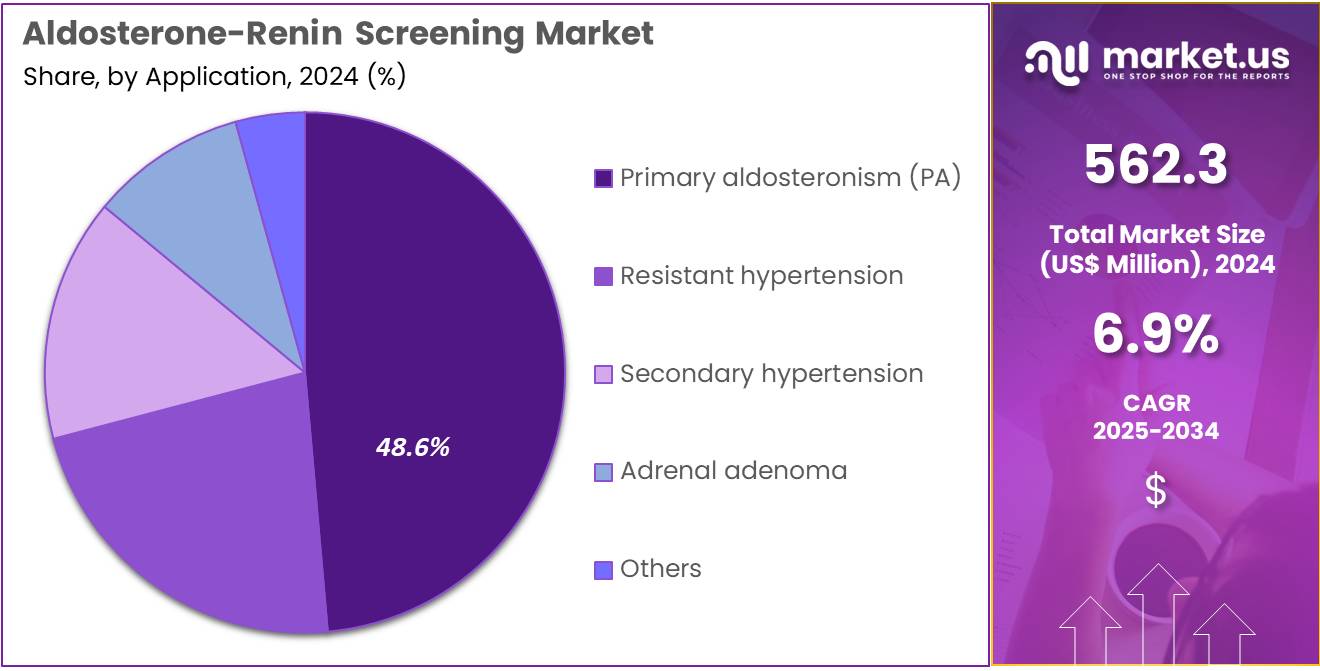

- Furthermore, concerning the application segment, the market is segregated into primary aldosteronism (PA), secondary hypertension, resistant hypertension, adrenal adenoma, and others. The primary aldosteronism (PA) sector stands out as the dominant player, holding the largest revenue share of 48.6% in the market.

- The end-user segment is segregated into diagnostic kit manufacturers/CROs, pathology laboratories, hospitals, endocrinology clinics, and cardiology clinics, with the diagnostic kit manufacturers/CROs segment leading the market, holding a revenue share of 40.5%.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Immunoassay-based kits hold 42.8% of the Aldosterone-Renin Screening market and are expected to maintain dominance due to their high accuracy, ease of automation, and compatibility with routine laboratory workflows. These kits facilitate rapid quantification of aldosterone and renin concentrations in plasma, enabling clinicians to evaluate hormonal imbalances linked to hypertension and adrenal disorders.

Growing clinical emphasis on early detection of primary aldosteronism is supporting their widespread adoption in diagnostic centers. Technological improvements in chemiluminescent and electrochemiluminescent immunoassays are enhancing assay sensitivity and reproducibility.

The increased use of high-throughput immunoassay analyzers in hospitals and CROs accelerates test processing efficiency. Manufacturers are investing in next-generation immunoassay kits that minimize cross-reactivity and improve analytical precision.

Additionally, the integration of automated immunoassay platforms in point-of-care settings strengthens accessibility. The expanding geriatric population and the rising incidence of hypertension worldwide are projected to reinforce the demand for immunoassay-based screening tools in endocrine diagnostics.

Technology Analysis

Plasma accounts for 45.9% of the Aldosterone-Renin Screening market and is anticipated to remain the preferred sample type due to its superior reliability in reflecting circulating hormone levels. Plasma-based testing provides consistent and quantifiable results for aldosterone-to-renin ratio (ARR) assessment, a critical biomarker for diagnosing primary aldosteronism and related adrenal dysfunctions.

The medical community increasingly relies on plasma assays as they allow greater stability and precision compared to serum or whole blood samples. Clinical laboratories prefer plasma for its ability to support both immunoassay and LC–MS/MS-based analyses.

The increasing adoption of standardized pre-analytical collection procedures has improved result accuracy and reduced variability. Continuous validation of plasma-based protocols across multicenter studies enhances diagnostic confidence.

The rising awareness among clinicians regarding plasma’s diagnostic superiority encourages its use in hypertensive and endocrine evaluations. As healthcare systems adopt more evidence-based approaches to endocrine testing, plasma-based analysis is projected to remain the benchmark sample type for aldosterone-renin screening globally.

Application Analysis

Primary aldosteronism represents 48.6% of the Aldosterone-Renin Screening market and is projected to remain the dominant application due to its increasing recognition as a leading cause of secondary hypertension. PA accounts for approximately 5–10% of hypertensive cases globally, emphasizing the need for accurate hormonal screening. Early detection through aldosterone-renin ratio testing is crucial for preventing long-term cardiovascular and renal complications.

Improved awareness among clinicians regarding the underdiagnosis of PA is driving test adoption in both hospital and outpatient settings. Technological advancements in assay kits and automation have streamlined large-scale screening processes. Guidelines from endocrine societies recommending routine ARR testing for resistant hypertension patients further support growth. Rising diagnostic testing in endocrinology and cardiology departments across Asia-Pacific and North America also fuels market expansion.

Integration of dual biomarker analysis combining renin and aldosterone quantification enhances clinical decision-making accuracy. As healthcare policies emphasize precision medicine, primary aldosteronism testing is anticipated to remain a key growth driver within this diagnostic category.

End-User Analysis

Diagnostic kit manufacturers and contract research organizations (CROs) together account for 40.5% of the Aldosterone-Renin Screening market and are anticipated to lead due to their role in product innovation and validation. These entities play a critical role in developing high-quality assay kits that adhere to global regulatory and performance standards. The growing collaboration between CROs and diagnostic firms for clinical validation of new immunoassay and LC–MS/MS-based kits strengthens product pipelines.

Rising demand for research-based screening solutions to study hormonal disorders is driving contract outsourcing. Manufacturers are increasingly focusing on reagent standardization and assay reproducibility to meet clinical laboratory accreditation requirements. Expansion of GMP-compliant production facilities ensures consistent global supply. Furthermore, CROs provide end-to-end services for method optimization, sample testing, and data analysis, supporting clinical trial workflows.

Strategic partnerships with hospitals and diagnostic centers accelerate technology transfer and product commercialization. As healthcare providers move toward precision endocrinology and cost-efficient testing solutions, diagnostic kit manufacturers and CROs are expected to remain pivotal in sustaining innovation and meeting clinical demand.

Key Market Segments

By Product Type

- Immunoassay-based Kits

- Radioimmunoassay-based Kits

- LC–MS/MS-based Assays

- ELISA-based Kits

- Aldosterone-to-Renin Ratio (ARR) Panels

By Sample

- Plasma

- Whole Blood

- Urine

- Serum

- Others

By Application

- Primary Aldosteronism (PA)

- Secondary Hypertension

- Resistant Hypertension

- Adrenal Adenoma

- Others

By End-user

- Diagnostic Kit Manufacturers / CROs

- Pathology Laboratories

- Hospitals

- Endocrinology Clinics

- Cardiology Clinics

Drivers

Increasing Prevalence of Hypertension is Driving the Market

The growing number of individuals affected by hypertension has significantly expanded the aldosterone-renin screening market, as this ratio test serves as a key initial step in identifying secondary causes like primary aldosteronism. Aldosterone-renin screening measures the balance between these hormones to detect autonomous aldosterone production, guiding further diagnostic workups in resistant hypertension cases. This driver is particularly relevant in populations with uncontrolled blood pressure, where early screening prevents cardiovascular complications through targeted mineralocorticoid receptor antagonist therapy.

Healthcare providers are incorporating the test into routine evaluations for patients on multiple antihypertensives, enhancing precision in etiology determination. The condition’s asymptomatic progression underscores the need for proactive testing, integrating it into primary care algorithms. Public health efforts to address hypertension epidemics promote its use to reduce stroke and heart failure risks, subsidizing laboratory capacities.

The Centers for Disease Control and Prevention reported that nearly 48% of U.S. adults had hypertension during August 2021–August 2023, consistent with 48.1% from 2017–March 2020, highlighting the ongoing need for effective screening tools. This percentage illustrates the clinical demand, as screening identifies treatable subsets to avert organ damage. Improvements in direct renin assays increase reliability, handling interferences from medications.

Economically, its application streamlines referrals, lowering costs from prolonged mismanagement. International societies align cutoff values, ensuring comparable results across regions. This hypertension rise not only elevates screening volumes but also embeds the test within cardiovascular risk frameworks. In summary, it encourages enhancements in automated platforms, linking evaluations to therapeutic optimizations.

Restraints

Regulatory Approval Delays is Restraining the Market

Prolonged regulatory approval processes for aldosterone-renin screening assays continue to constrain market accessibility, as exhaustive validation demands extend timelines for innovative test kits. These assays, requiring proof of analytical accuracy and clinical relevance, often face extended FDA evaluations, delaying deployment in diagnostic laboratories. This hurdle particularly burdens novel formats like mass spectrometry-based methods, where evidence of superiority over immunoassays lags.

Coverage inconsistencies among payers compound the challenge, with Medicare’s local determinations mandating stringent necessity documentation. Developers allocate substantial resources to compliance reviews, diverting funds from scalability improvements. The consequence upholds dependence on legacy tests, impeding adoption of faster alternatives.

Clinician reliance on approved standards marginalizes emerging options. Efforts for streamlined pathways advance gradually, limited by standardization gaps. These approval impediments not only hinder rollout but also perpetuate inefficiencies in secondary hypertension detection. Accordingly, they necessitate collaborative validations to balance innovation with regulatory rigor.

Opportunities

Expansion of Hypertension Management Programs is Creating Growth Opportunities

The proliferation of structured hypertension control initiatives has unveiled considerable prospects for the aldosterone-renin screening market, institutionalizing ratio testing within community-based screening to identify treatable secondary forms. These programs, targeting resistant cases through subsidized evaluations, leverage the test to stratify patients for specialist referrals, bridging gaps in primary care. Opportunities arise in point-of-care adaptations, where funding supports validations for ambulatory clinics amid rising program enrollments.

Public-private partnerships underwrite assay optimizations, addressing interferences in diverse populations. This programmatic emphasis counters underdiagnosis, positioning screening as a cornerstone of blood pressure optimization. Appropriations for national registries accelerate procurements, diversifying toward integrated endocrine panels. The World Health Organization’s Global Hearts Initiative reached over 50 million people in 2022, incorporating aldosterone-renin screening in hypertension workups to enhance secondary cause detection in participating countries. This reach exemplifies scalable frameworks, with expansions projecting increased test demands in routine assessments.

Innovations in saliva-based sampling improve feasibility, mitigating venipuncture barriers. As digital tracking evolves, screening data unlock outcome-linked revenues. These initiative enlargements not only broaden evaluation scopes but also interweave the market into population health architectures.

Impact of Macroeconomic / Geopolitical Factors

Rising hypertension rates and proactive wellness campaigns inspire primary care providers to routinely deploy aldosterone-renin screening for pinpointing endocrine imbalances in blood pressure regulation, enabling endocrinologists to prescribe aldosterone blockers that effectively manage sodium retention and mitigate risks of kidney strain.

Economic headwinds, including persistent supply chain inflation, however, compel diagnostic centers to curtail investments in comprehensive hormone panels, as budget overseers favor abbreviated electrolyte scans to conserve resources amid escalating operational expenses. Geopolitical strains, such as disruptions in Suez Canal routes due to regional instability, prolong the arrival of affinity-purified antibodies from Mediterranean suppliers, requiring procurement teams to contend with escalated demurrage fees that complicate alignment with diagnostic surges.

Current US tariffs, imposing a 10% surcharge on imported immunoassay substrates and centrifuges from over 180 nations effective April 2025, augment expenses for aldosterone extraction columns from Southeast Asian origins, obliging ambulatory labs to consolidate purchases and potentially postpone upgrades to high-sensitivity platforms. Nevertheless, these import constraints catalyze alliances with American assay developers, engendering portable, salinity-resistant renin kits that support field deployments and alleviate bottlenecks in centralized processing.

Latest Trends

Endocrine Society’s Updated Guideline on Primary Aldosteronism Screening is a Recent Trend

The release of revised clinical guidelines has denoted a transformative direction in aldosterone-renin screening during 2025, advocating universal testing for hypertensive patients to detect primary aldosteronism more broadly. The Endocrine Society’s 2025 update recommends measuring aldosterone and renin levels in all hypertension cases, regardless of severity, to facilitate early intervention with mineralocorticoid antagonists. This directive embodies a paradigm shift toward proactive screening, accommodating both biochemical and confirmatory phases in streamlined workflows.

Regulatory endorsements validate its evidence base, hastening integrations into primary care protocols amid elevated hypertension burdens. This universality aligns with cardiovascular prevention goals, associating outputs to electronic alerts for specialist triage. The guideline addresses underrecognition pitfalls, favoring thresholds resilient to medication influences.

The Endocrine Society published its updated Clinical Practice Guideline on Primary Aldosteronism in August 2025, presented at ENDO 2025, recommending universal screening with aldosterone-renin ratio for all hypertensive individuals. These recommendations underscore practicality, as implementations affirm alignment with prior benchmarks.

Forecasters anticipate widespread adoptions, elevating its priority in national health directives. Progressive evaluations demonstrate detection enhancements, refining resource allocations. The future contemplates AI-assisted interpretations, envisioning predictive risk stratifications. This guideline-driven evolution not only heightens screening acuity but also coordinates with hypertension management imperatives.

Regional Analysis

North America is leading the Aldosterone-Renin Screening Market

In 2024, North America commanded a 39.9% share of the global aldosterone-renin screening market, bolstered by the Endocrine Society’s 2024 position statement advocating ARR testing for all hypertensive patients with resistant or hypokalemic profiles, which drove a surge in plasma renin activity assays to identify primary aldosteronism, the most common secondary hypertension cause affecting up to 20% of cases.

Endocrinologists increasingly utilized automated chemiluminescent immunoassays for simultaneous aldosterone and renin quantification, achieving turnaround times under 2 hours and enabling confirmatory saline infusion tests in outpatient settings, where early mineralocorticoid receptor antagonist therapy averts cardiovascular events by 30% in diagnosed individuals. The National Institutes of Health’s funding for hypertension research supported expanded ARR screening in diverse cohorts, addressing underdiagnosis in Black Americans, where prevalence reaches 11%, and correlating with federal initiatives to integrate testing into routine lipid panels.

Regulatory advancements under the FDA’s CLIA oversight expedited clearances for point-of-care ARR kits, aligning with Medicare expansions for annual evaluations in diabetic hypertensives. Demographic trends, including a 10% rise in resistant hypertension diagnoses, amplified demand for ratio-based panels in cardiology clinics. These factors exemplified the region’s commitment to targeted endocrine diagnostics. The Endocrine Society’s 2024 position statement estimates primary aldosteronism prevalence at 5-10% in hypertensive patients, rising to 20% in resistant cases.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National agencies across Asia Pacific project the aldosterone-renin screening sector to advance during the forecast period, as regulatory harmonization accelerates ARR testing to manage secondary hypertension in high-diabetes populations. Officials in China and India allocate resources to renin immunoassay kits, equipping urban labs to profile hypokalemic patients from low-sodium diets.

Diagnostic developers collaborate with regional institutes to standardize ARR cutoffs, anticipating refined detections of adenoma subtypes in coastal endemic zones. Oversight bodies in South Korea and Indonesia subsidize confirmatory saline tests, positioning community centers to assess renin suppression without urban referrals. Administrative frameworks estimate integrating ARR data into digital hypertension registries, expediting spironolactone trials for resistant cohorts in migrant groups.

Regional endocrinologists pioneer multiplex panels, coordinating with WHO networks to monitor aldosterone excess in tropical climates. These initiatives establish a scalable foundation for endocrine hypertension control. The Korean Endocrine Society’s 2023 consensus guidelines recommend ARR screening for all hypertensive patients, with 48 respondents from nine ASEAN countries reporting routine use in six nations as of 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Aldosterone-Renin Screening Market drive growth by launching LC-MS/MS assays for accurate hormone ratio calculations in hypertension diagnostics. They collaborate with research networks to validate multiplex kits with genetic markers for primary care adoption. Companies invest in automated analyzers to handle high-volume demands efficiently. Leaders integrate with EHRs for seamless monitoring and outcomes. They expand in Asia-Pacific and Africa, tailoring to local guidelines for subsidized programs.

Additionally, they offer predictive modeling packages to strengthen partnerships and revenue. Thermo Fisher Scientific Inc., formed in 2006 in Waltham, Massachusetts, leads in analytical tools with Q Exactive spectrometers for precise endocrine testing. CEO Marc N. Casper oversees operations in over 50 countries, focusing on R&D and sustainability. The firm partners with consortia to advance standards, maintaining dominance through innovative, integrated diagnostics.

Top Key Players in the Aldosterone-Renin Screening Market

- Wuhan Fine Biotech Co., Ltd.

- Thermo Fisher Scientific Inc.

- Revvity

- Mindray Medical International Ltd.

- Immunodiagnostic Systems Ltd.

- Enzo Biochem Inc.

- EagleBio

- DiaSorin S.p.A.

- Bio‑Techne

- ALPCO

Recent Developments

- In May 2025: Quest Diagnostics introduced an improved test for primary aldosteronism using plasma renin activity measurements. The simplified design supports quicker turnaround times and easier access for both clinicians and patients, strengthening the role of large-scale diagnostic networks in promoting widespread adoption of PA screening across routine care settings.

- In June 2024: Labcorp advanced PA diagnostics with its new aldosterone-renin ratio assay powered by LC-MS/MS technology. This innovation delivers superior analytical accuracy and reproducibility, reinforcing confidence among endocrinologists in hormone-based hypertension testing and positioning mass spectrometry as a preferred standard for ARR measurement.

Report Scope

Report Features Description Market Value (2024) US$ 562.3 million Forecast Revenue (2034) US$ 1095.8 million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Immunoassay-based Kits, Radioimmunoassay-based Kits, LC–MS/MS-based Assays, ELISA-based Kits, and Aldosterone-to-Renin Ratio (ARR) Panels), By Sample (Plasma, Whole Blood, Urine, Serum, and Others), By Application (Primary Aldosteronism (PA), Secondary Hypertension, Resistant Hypertension, Adrenal Adenoma, and Others), By End-user (Diagnostic Kit Manufacturers/CROs, Pathology Laboratories, Hospitals, Endocrinology Clinics, and Cardiology Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wuhan Fine Biotech Co., Ltd., Thermo Fisher Scientific Inc., Revvity, Mindray Medical International Ltd., Immunodiagnostic Systems Ltd., Enzo Biochem Inc., EagleBio, DiaSorin S.p.A., Bio‑Techne, ALPCO. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aldosterone-Renin Screening MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Aldosterone-Renin Screening MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wuhan Fine Biotech Co., Ltd.

- Thermo Fisher Scientific Inc.

- Revvity

- Mindray Medical International Ltd.

- Immunodiagnostic Systems Ltd.

- Enzo Biochem Inc.

- EagleBio

- DiaSorin S.p.A.

- Bio‑Techne

- ALPCO