Global Airport Information Systems Market Report By System (Airport Operation Control System, Departure Control), By Airport (Class A Airports, Class B Airports, Class C Airports, Class D Airports), By Type (Airside, Terminalside), By End-User (Passenger System, Non-Passenger System), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 127157

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Airport Information Systems Market size is expected to be worth around USD 5.77 Billion by 2033, from USD 4.05 Billion in 2023, growing at a CAGR of 3.6% during the forecast period from 2024 to 2033.

The Airport Information Systems Market encompasses the software and technology used to manage and distribute information at airports. This includes systems for flight information display, baggage tracking, passenger processing, and air traffic management.

Airports rely on these systems to enhance operational efficiency, improve passenger experience, and ensure safety. The market is expanding as airports modernize their infrastructure to handle increasing passenger volumes and enhance security. Companies in this market provide solutions that integrate various airport operations, enabling real-time data sharing and decision-making.

The Airport Information Systems (AIS) market is experiencing steady growth, driven by advancements in automation and digital technologies across major airports worldwide. Key areas of innovation include baggage handling systems, passenger information system, passenger check-in solutions, and ground handling services. These systems are increasingly automated, improving efficiency, reducing errors, and enhancing the passenger experience, making them essential for modern airport operations.

Baggage Handling Systems (BHS) are a major focus of investment. Airports like Stansted in the UK have invested £70 million to upgrade to automated systems, which include 2.4 kilometers of track and 180 automated carts. These systems can process baggage at speeds of 18 km/h, significantly reducing mishandling rates and boosting throughput.

Additionally, the adoption of RFID technology by airlines such as Delta has achieved a 99.9% baggage tracking accuracy across 344 stations worldwide, demonstrating the growing impact of technology on operational efficiency.

Passenger Check-In Systems have also advanced with the introduction of touchless solutions. These systems have been deployed at 26 locations globally, processing over 200,000 bags weekly. The result is reduced queue times, higher terminal efficiency, and a more streamlined experience for passengers. Such innovations are increasingly becoming standard at busy international airports.

Ground handling services are another area benefiting from automation. European hubs, for example, have seen performance improvements through self-service kiosks and automated baggage systems, leading to reduced wait times and fewer handling errors. The global implementation of RFID-based baggage tracking has reduced mishandled baggage rates to 5.57 per 1,000 passengers, a significant improvement that enhances overall airport efficiency.

The growth of the AIS market is being driven by the need for greater efficiency and accuracy in airport operations. As airports continue to invest in automated systems, the market for these technologies is expected to expand. With increasing air travel demand, especially post-pandemic, the adoption of advanced information systems will be critical for maintaining operational efficiency and enhancing the passenger experience in the years to come.

Key Takeaways

- Airport Information Systems Market was valued at USD 4.05 billion in 2023, and is expected to reach USD 5.77 billion by 2033, with a CAGR of 3.6%.

- In 2023, Airport Operation Control System dominated the system segment with 59%, due to its importance in optimizing airport operations.

- In 2023, Class B Airports led the airport segment with 63%, driven by growing traffic at mid-sized airports globally.

- In 2023, Airside dominated the type segment with 66%, due to increasing focus on improving air traffic management and safety.

- In 2023, North America led the market with 34% and a valuation of USD 1.38 billion, driven by modernization efforts in airport infrastructure.

System Analysis

Airport Operation Control System dominates with 59% due to its critical role in ensuring efficient airport operations.

The Airport Operation Control System (AOCS) holds a dominant position in the airport information systems market, capturing 59% of the segment. This predominance is largely due to AOCS’s essential role in centralizing airport operations, managing everything from air traffic control to gate assignments and ground handling services.

By integrating various operational processes, AOCS enhances the efficiency and safety of airport operations, which is crucial for handling the increasing passenger and cargo traffic globally.

AOCS is particularly valued for its ability to provide real-time data and operational updates to all stakeholders, improving decision-making and operational responsiveness. This system is indispensable in large airports where the complexity and volume of operations demand precise coordination.

While AOCS leads in market share, the Departure Control Systems segment also plays a significant role. These systems manage passenger check-in and boarding, crucial for customer satisfaction and operational efficiency. Although they have a smaller share, they are critical for streamlining passenger flow and ensuring on-time departures.

Airport Analysis

Class B Airports dominate with 63% due to a balanced combination of high traffic volumes and manageable operational complexity.

Class B airports, which typically handle significant but not overwhelming passenger numbers, dominate the airport category with a 63% market share. This dominance is attributed to their size and operational demands, which necessitate sophisticated information systems to manage substantial traffic effectively while not reaching the complexity or scale of Class A airports.

These airports benefit immensely from advanced information systems that help manage a balance between efficiency and passenger service quality. Systems implemented in Class B airports need to handle high volumes of traffic and provide flexibility in managing seasonal fluctuations and peak times, which are common in airports of this class.

Class A airports, while larger and more complex, represent a smaller segment of the market due to their fewer numbers. However, they drive innovation and technology adoption in airport information systems due to their higher demands and operational scales. Class C and Class D airports, with more manageable operational scales, contribute to the market by adopting scaled versions of these technologies, often focusing more on cost efficiency.

Type Analysis

Airside dominates with 66% due to the critical need for managing air traffic and ground operations.

The airside segment of the airport information systems market, encompassing the systems used to manage aircraft movements, runway operations, and general airfield safety, dominates with a 66% share. This dominance underscores the critical importance of efficient and safe airside operations in overall airport management and the increased emphasis on reducing ground delays and optimizing traffic flow.

Airside systems are crucial for maintaining the punctuality of flights and the safety of airport operations. They include advanced radar and tracking systems, which are vital for managing takeoffs, landings, and taxiing aircraft. The complexity and necessity of airside operations demand robust and reliable information systems to handle these tasks efficiently.

While airside leads the type category, terminalside systems are also essential, focusing on passenger and baggage movements within the airport terminal. These systems are vital for ensuring passenger satisfaction and operational efficiency within the airport terminal itself.

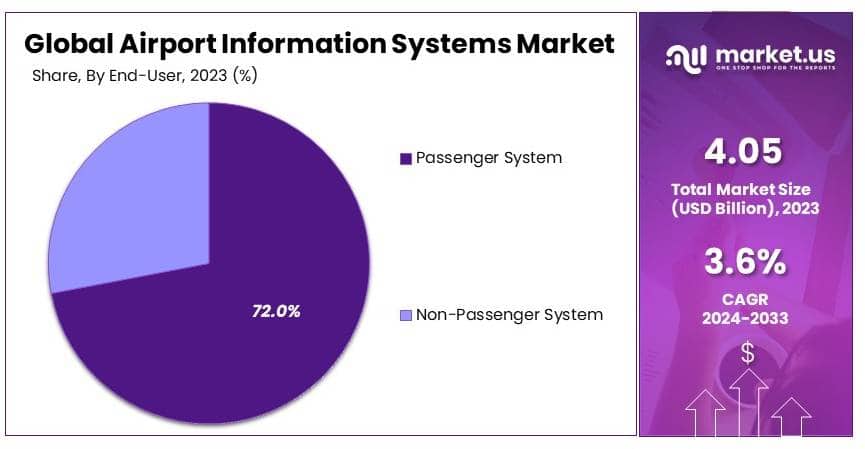

End-User Analysis

Passenger System dominates with 72% due to its direct impact on passenger experience and airport efficiency.

In the end-user segment of the airport information systems market, passenger systems hold the largest share at 72%. This dominance is driven by the growing emphasis on enhancing passenger experiences, reducing check-in and security clearance times, and providing real-time information updates to travelers.

Passenger systems include check-in kiosks, baggage handling systems, and information displays, all designed to streamline the passenger journey from arrival at the airport to boarding.

These systems are crucial for airports looking to improve operational efficiencies and passenger flow, which directly impacts airport revenue and customer satisfaction. The focus on passenger systems is also a response to the increasing competition among airports to attract airlines and travelers by offering superior services and facilities.

Non-passenger systems, while less prevalent, support airport operations by managing non-public areas and operations, including security protocols, staff scheduling, and other logistical aspects of airport management. They play a complementary role by ensuring that the backend operations support the frontend passenger services effectively, contributing to overall airport operational efficiency.

Key Market Segments

By System

- Airport Operation Control System

- Departure Control

By Airport

- Class A Airports

- Class B Airports

- Class C Airports

- Class D Airports

By Type

- Airside

- Terminalside

By End-User

- Passenger System

- Non-Passenger System

Driver

Rising Air Traffic and Technological Advancements Drive Market Growth

The Airport Information Systems Market is growing rapidly, driven by rising air traffic and significant technological advancements. As global air travel continues to increase, airports are under pressure to manage larger volumes of passengers and flights efficiently.

Technological advancements are another key driver of market growth. The integration of artificial intelligence (AI), machine learning, and data analytics into AIS is transforming how airports operate. These technologies enable more accurate predictions of flight delays, optimize resource allocation, and improve passenger experiences by providing timely and personalized information.

Additionally, the push towards smart airports is fueling demand for advanced AIS solutions. Smart airports leverage connected devices and automated systems to enhance operational efficiency and passenger convenience. AIS is at the core of these developments, offering the necessary infrastructure to support seamless and integrated airport operations.

Moreover, stringent regulatory requirements regarding safety and security at airports are further driving the adoption of advanced AIS. Compliance with these regulations necessitates the use of sophisticated information systems to monitor and manage various airport processes, ensuring safe and secure operations.

Restraint

High Implementation Costs and Integration Issues Restrain Market Growth

The growth of the Airport Information Systems Market is restrained by high implementation costs and integration issues. Implementing advanced airport information systems (AIS) requires significant financial investment, which includes the cost of technology, infrastructure upgrades, and ongoing maintenance.

Additionally, integrating these systems with existing airport infrastructure can be complex and time-consuming. Many airports rely on legacy systems, and ensuring that new AIS solutions work seamlessly with these older technologies often requires substantial customization. This complexity increases the risk of project delays and escalates costs, further restraining market growth.

Moreover, the need for continuous updates and compliance with evolving aviation regulations adds another layer of financial and operational strain. Airports must regularly update their systems to meet new standards, which can be both costly and disruptive to operations.

Finally, the variability in technological standards across different regions complicates the implementation of AIS, leading to challenges in system compatibility and interoperability. These factors collectively restrain the growth of the Airport Information Systems Market, emphasizing the need for cost-effective solutions and standardized technologies to overcome these barriers.

Opportunity

Expansion of Smart Airports and AI Integration Provide Opportunities

The expansion of smart airports and the integration of artificial intelligence (AI) present significant opportunities for players in the Airport Information Systems Market. As airports around the world adopt smart technologies to improve efficiency and passenger experiences, there is a growing demand for advanced AIS solutions that can support these initiatives. Smart airports rely heavily on interconnected systems, and AIS plays a central role in managing and optimizing these operations.

AI integration into AIS offers further opportunities for market growth. AI-powered systems can analyze vast amounts of data in real time, providing insights that enhance decision-making and operational efficiency. This capability is particularly valuable in dynamic environments like airports, where timely information is crucial.

Moreover, the global trend towards digital transformation and Airport 4.0 in the aviation industry creates additional opportunities. Airports are increasingly investing in digital infrastructure to stay competitive, and advanced AIS solutions are a key part of this transformation.

Collaboration with technology providers to develop customized AIS solutions tailored to the specific needs of different airports can further enhance market opportunities. By leveraging AI and smart technologies, companies can position themselves as leaders in the Airport Information Systems Market, driving sustained growth and innovation.

Challenge

Integration Complexity and Regulatory Compliance Challenge Market Growth

The growth of the Airport Information Systems Market is challenged by integration complexity and regulatory compliance. Integrating new AIS technologies into existing airport systems is a significant hurdle. Airports often operate with a mix of outdated and new technologies, making seamless integration difficult.

Regulatory compliance also presents a substantial challenge. The aviation industry is highly regulated, and AIS must meet stringent standards for safety, security, and efficiency. Keeping up with these evolving regulations requires continuous updates to the systems, adding to the operational burden.

Additionally, the global nature of the aviation industry means that AIS must be compatible with different regulatory frameworks across countries, further complicating system development and deployment.

Furthermore, the need for real-time data processing and management in AIS introduces technical challenges. Ensuring that the systems can handle large volumes of data efficiently and accurately requires significant investment in technology and expertise. These challenges collectively impact the growth of the Airport Information Systems Market, highlighting the need for simplified integration processes and adaptive regulatory strategies.

Growth Factors

Increasing Air Traffic and Digital Transformation Are Growth Factors

Increasing air traffic and digital transformation are key growth factors driving the Airport Information Systems Market. The global rise in air passenger numbers has created a greater demand for efficient airport operations. Airport Information Systems (AIS) help manage passenger flow, baggage handling, and aircraft scheduling, making them essential as traffic continues to grow.

Digital transformation is also pushing market expansion. Airports are adopting advanced technologies such as cloud computing, real-time data analytics, and artificial intelligence (AI) to enhance operational efficiency. These innovations allow for smoother management of airport systems, leading to better passenger experiences and streamlined processes.

The need for enhanced security measures further supports growth. With heightened concerns about airport security, information systems that integrate security features like biometric authentication and advanced surveillance are increasingly in demand. This trend ensures airports stay compliant with international security standards while improving operational transparency.

Additionally, government investments in airport infrastructure upgrades are fueling market growth. Many countries are expanding and modernizing airports to accommodate the rising air traffic, creating more opportunities for the deployment of sophisticated AIS solutions. These growth factors collectively drive the expansion of the Airport Information Systems Market.

Emerging Trends

AI Integration and Smart Airports Are Latest Trending Factors

AI integration and the development of smart airports are the latest trending factors in the Airport Information Systems Market. Airports are increasingly implementing artificial intelligence to enhance predictive maintenance, optimize resource allocation, and automate routine tasks, such as check-in and baggage handling. These advancements increase efficiency and reduce delays.

Another major trend is the shift toward smart airports. Smart technologies, including the Internet of Things (IoT) and big data analytics, are helping airports to collect and process large volumes of data in real time. This enables airports to better manage congestion and improve the overall passenger experience.

Self-service technologies are also gaining popularity. Automated kiosks for ticketing, self-check-in, and biometric scanning for security are becoming more prevalent. These systems reduce wait times and enhance the passenger journey, contributing to increased satisfaction and operational efficiency. Moreover the use of intelligent virtual assistants to provide real-time information and support to passengers is a growing trend, enhancing the convenience and efficiency of airport services.

Sustainability is another trend influencing the market. Airports are focusing on energy-efficient solutions and eco-friendly infrastructure. From smart lighting systems to electric ground support equipment, sustainability trends are pushing airports to adopt greener technologies.

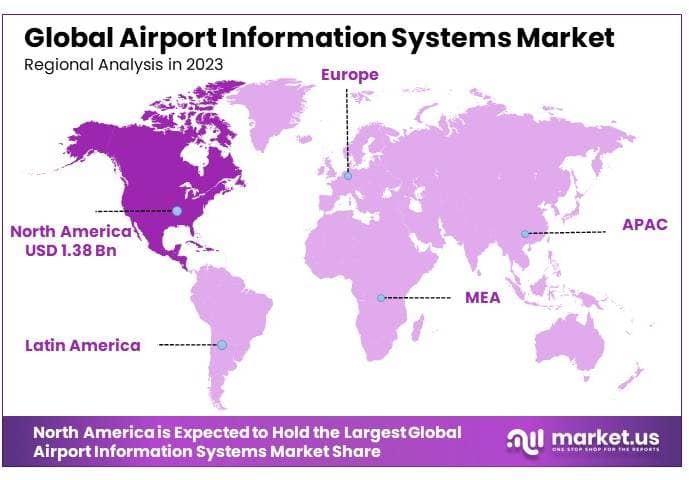

Regional Analysis

North America Dominates with 34% Market Share

North America leads the Airport Information Systems Market with a 34% share, valued at USD 1.38 billion. This market dominance is underpinned by the region’s advanced aviation infrastructure, substantial investment in airport technology, and a high volume of both domestic and international air traffic.

The region benefits from a robust demand for efficient, real-time information systems to manage increasing passenger flows and complex airport operations. Integration of advanced technologies such as IoT and AI into these systems further strengthens the market’s dynamic nature and operational efficiency.

The future looks promising for North America in the Airport Information Systems Market. Ongoing technological upgrades and expansions in airport infrastructure are expected to drive further growth. The region’s commitment to enhancing passenger experience and operational efficacy will likely sustain its market leadership.

Other Regions:

- Europe: Europe maintains a strong position in the market, driven by high safety standards and significant technological advancements in its airports. The region’s focus on sustainability and passenger-centric services continues to promote market growth.

- Asia Pacific: Asia Pacific is rapidly expanding in this market due to the construction of new airports and upgrades to existing facilities in response to rising air travel demand. Technological integration is key to this growth, with many airports adopting cutting-edge information systems.

- Middle East & Africa: The MEA region is witnessing moderate growth in airport information systems, driven by major airport development projects and increasing air traffic in countries like the UAE and Saudi Arabia. This growth is supported by a focus on enhancing airport efficiencies and passenger services.

- Latin America: Latin America’s market for airport information systems is developing, spurred by modernization efforts in major airports to improve operational efficiency and handle growing passenger numbers. Increased investments in technology play a crucial role in this growth trajectory.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

In the Airport Information Systems Market, three companies stand out as key players: Amadeus IT Group, S.A., Collins Aerospace, and Thales Group.

Amadeus IT Group, S.A. is a leading player in the airport information systems market. Amadeus is strategically positioned due to its expertise in travel technology and its extensive global network. Their solutions for airport information systems are widely adopted, providing comprehensive and integrated platforms that enhance operational efficiency. Amadeus’s impact on the market is significant, with a strong presence in airports worldwide, particularly in Europe and Asia. Their influence is driven by their continuous innovation and ability to meet the evolving needs of airports.

Collins Aerospace is another key player with a substantial impact on the market. Collins Aerospace offers advanced airport information systems that focus on enhancing passenger experience and airport operations. Their strategic advantage lies in their deep understanding of the aviation industry and their ability to deliver reliable, high-quality solutions. Collins Aerospace’s market influence is strong, especially in North America and Europe, where they are a preferred supplier for major airports.

Thales Group is a major player with a strong strategic position in the airport information systems market. Thales offers cutting-edge solutions that integrate advanced technologies like AI and cybersecurity into airport operations. Their strategic positioning is reinforced by their global reach and partnerships with key stakeholders in the aviation industry. Thales’s impact on the market is notable, particularly in the areas of security and efficiency, where their systems are highly valued.

These three companies are at the forefront of the Airport Information Systems Market. Their strategic positioning and market influence are critical in driving the adoption of advanced systems that improve airport operations and passenger experience.

Top Key Players in the Market

- ADB Safegate

- Advantech Co., Ltd.

- Airport Information Systems Limited

- Amadeus IT Group, S.A.

- Damarel Systems International Ltd.

- Harris Corporation

- Indra Sistemas S.A.

- IBM Corporation

- INFORM Institute for Operations Research and Management GmbH

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Collins Aerospace

- Siemens AG

- Thales Group

- Other Key Players

Recent Developments

- Collins Aerospace Enhances Air Traffic Management Systems:

In August 2023, Collins Aerospace expanded its ARINC Air Traffic Management (ATM) solutions with advanced surveillance and data-driven insights to improve global airspace utilization. The enhancement includes real-time aircraft tracking and predictive technologies, supporting over 10,000 aircraft operators and the increasing complexity of air traffic. - Thales Group Expands Digital Air Traffic Control Systems:

In July 2023, Thales Group introduced new digital air traffic control systems featuring high-definition cameras, remote sensing technologies, and automated surveillance systems. These innovations aim to replace traditional control towers with centralized, remote operations, enhancing safety and operational efficiency in response to increasing air traffic. - Amadeus IT Group Launches Customizable Flight Information Display System:

In August 2023, Amadeus IT Group unveiled a new Flight Information Display System (FIDS), offering fully customizable digital displays for airports. This system is designed to optimize passenger flow and increase revenue opportunities, providing real-time updates and scalability for airports of various sizes.

Report Scope

Report Features Description Market Value (2023) USD 4.05 Billion Forecast Revenue (2033) USD 5.77 Billion CAGR (2024-2033) 3.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System (Airport Operation Control System, Departure Control), By Airport (Class A Airports, Class B Airports, Class C Airports, Class D Airports), By Type (Airside, Terminalside), By End-User (Passenger System, Non-Passenger System) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ADB Safegate, Advantech Co., Ltd., Airport Information Systems Limited, Amadeus IT Group, S.A., Damarel Systems International Ltd., Harris Corporation, Indra Sistemas S.A., IBM Corporation, INFORM Institute for Operations Research and Management GmbH, Lockheed Martin Corporation, Northrop Grumman Corporation, Collins Aerospace, Siemens AG, Thales Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Airport Information Systems Market?The Airport Information Systems Market involves software and hardware solutions used for managing airport operations, including flight information, passenger processing, and airport resource management. These systems are critical for ensuring efficient airport operations and enhancing passenger experience.

How big is the Airport Information Systems Market?The Airport Information Systems Market was valued at USD 4.05 billion and is projected to reach USD 5.77 billion, growing at a CAGR of 3.6% during the forecast period.

What are the key factors driving the growth of the Airport Information Systems Market?Key drivers include the increasing demand for efficient airport management systems, the growing adoption of digital technologies in airports, and the need for enhanced passenger processing and safety.

What are the current trends and advancements in the Airport Information Systems Market?Trends include the shift towards integrated airport operations control systems, the adoption of cloud-based solutions for better scalability, and the increasing focus on cybersecurity in airport information systems.

What are the major challenges and opportunities in the Airport Information Systems Market?Challenges include the high cost of system implementation and maintenance, as well as the need for continuous updates to meet regulatory standards. Opportunities lie in the expansion of airports in emerging markets and the increasing adoption of smart airport technologies.

Who are the leading players in the Airport Information Systems Market?Key players include ADB Safegate, Advantech Co., Ltd., Airport Information Systems Limited, Amadeus IT Group, S.A., Damarel Systems International Ltd., Harris Corporation, Indra Sistemas S.A., IBM Corporation, INFORM Institute for Operations Research and Management GmbH, Lockheed Martin Corporation, Northrop Grumman Corporation, Collins Aerospace, Siemens AG, Thales Group, and other key players.

Airport Information Systems MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

Airport Information Systems MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ADB Safegate

- Advantech Co., Ltd.

- Airport Information Systems Limited

- Amadeus IT Group, S.A.

- Damarel Systems International Ltd.

- Harris Corporation

- Indra Sistemas S.A.

- IBM Corporation

- INFORM Institute for Operations Research and Management GmbH

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Collins Aerospace

- Siemens AG

- Thales Group

- Other Key Players