Global Air Ambulance Services Market By Service Type (Hospital-based and Community-based), By Aircraft (Rotary Winged and Fixed Winged), By Application (Inter-Facility, Infectious Disease Services, Neonatal Transport, Organ Transplant Logistics, Overweight Patient Transport, Pediatric Transport, and Rescue Helicopter Services), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 62464

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

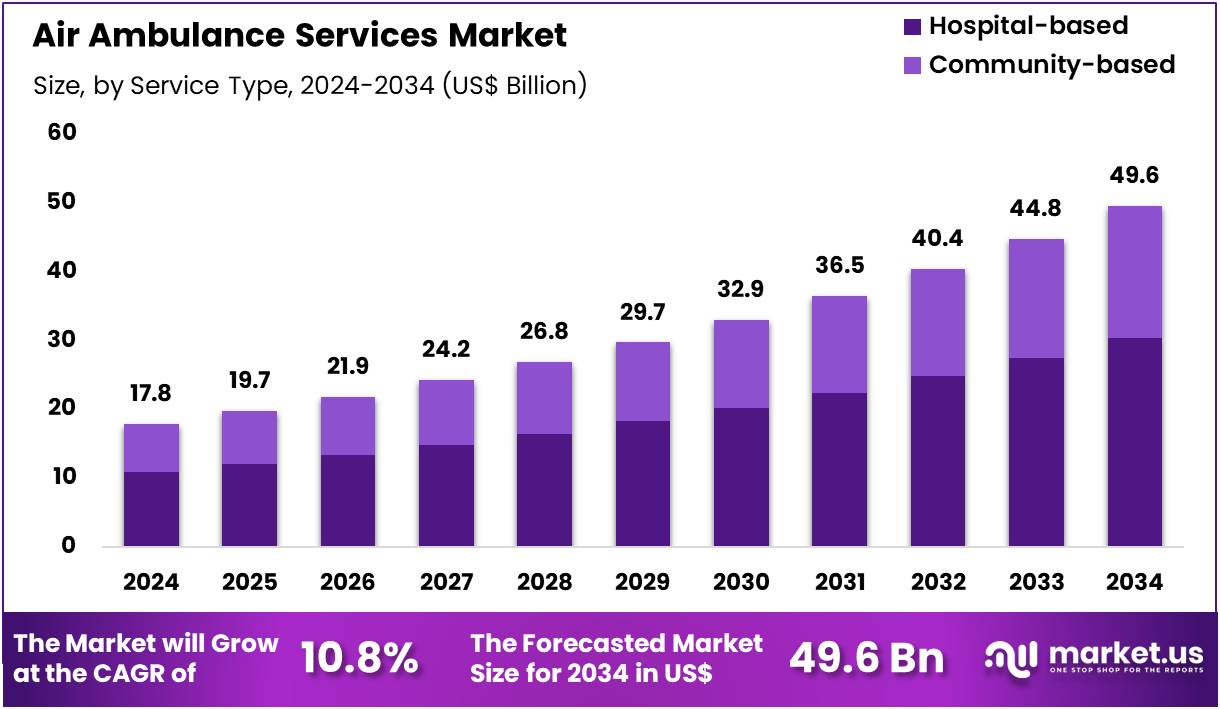

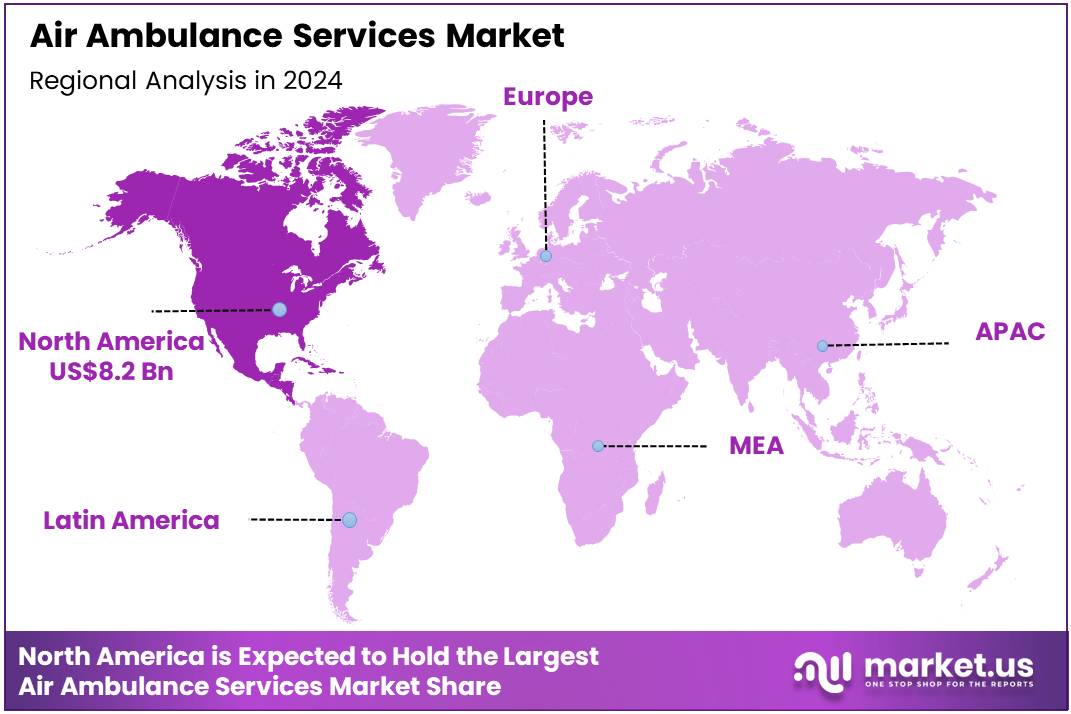

Global Air Ambulance Services Market size is expected to be worth around US$ 49.6 Billion by 2034 from US$ 17.8 Billion in 2024, growing at a CAGR of 10.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 45.9% share with a revenue of US$ 8.2 Billion.

Increasing frequency of medical emergencies in underserved areas propels the Air Ambulance Services market, as healthcare providers prioritize rapid aerial evacuation to bridge gaps in ground transportation. Operators equip rotor-wing and fixed-wing fleets with intensive care units that deliver hospital-level interventions en route, driving demand for time-sensitive critical care. These services facilitate inter-facility transfers for stroke patients needing thrombectomy, neonatal transports requiring incubators and ventilators, trauma evacuations from accident scenes to level-one centers, and organ procurement flights for time-critical transplantation.

Strategic fleet enhancements create opportunities to diversify mission profiles and integrate telemedicine for pre-arrival guidance. Air Methods advanced this capability in January 2023 by deploying a dedicated critical care transport unit, significantly elevating in-flight stabilization protocols and expanding emergency response networks. This initiative directly enhances patient outcomes through seamless, specialized aerial medical support.

Growing emphasis on operational versatility accelerates the Air Ambulance Services market, as providers adapt aircraft configurations to handle diverse patient acuity levels and environmental challenges. Aviation companies invest in multi-role helicopters that switch between search-and-rescue, disaster relief, and routine medical repatriation without extensive downtime. Applications now encompass wildfire victim extractions with hoist operations, maritime rescue from offshore platforms, high-altitude transports for altitude sickness cases, and bariatric patient handling with reinforced stretchers.

Bulk aircraft acquisitions open avenues for standardized maintenance programs and volume discounts from manufacturers. Global Medical Response executed this strategy in November 2024 by procuring 28 Airbus helicopters in varied models, instantly broadening mission adaptability across urban and rural scenarios while fortifying long-term supplier partnerships. Such fleet modernization ensures sustained scalability and reliability in dynamic emergency landscapes.

Rising collaboration among specialized operators invigorates the Air Ambulance Services market, as entities pool resources to achieve round-the-clock coverage and optimized geographic reach. Joint ventures deploy shared bases and cross-trained crews that minimize response delays during peak demand or overlapping incidents. These partnerships support cardiac emergency flights with onboard ECMO, pediatric critical care with isolette systems, infectious disease transports using isolation pods, and mass casualty events through multi-aircraft coordination.

Regional alliances unlock opportunities for cost-sharing on fuel, insurance, and regulatory compliance. Med-Trans Corporation and Med-Force Aeromedical Transport exemplified this trend in June 2024 by establishing 24/7 H135 and EC135 coverage in the Quad Cities, dramatically improving real-time emergency infrastructure through synergistic asset utilization. This cooperative model sets a benchmark for efficient, expanded aerial medical service delivery.

Key Takeaways

- In 2024, the market generated a revenue of US$ 17.8 billion, with a CAGR of 10.8%, and is expected to reach US$ 49.6 billion by the year 2034.

- The service type segment is divided into hospital-based and community-based, with hospital-based taking the lead in 2024 with a market share of 61.3%.

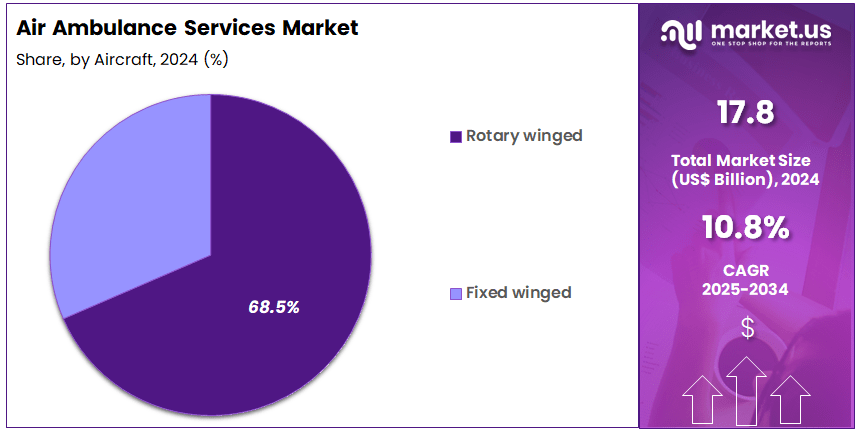

- Considering aircraft, the market is divided into rotary winged and fixed winged. Among these, rotary winged held a significant share of 68.5%.

- Furthermore, concerning the application segment, the market is segregated into inter-facility, infectious disease services, neonatal transport, organ transplant logistics, overweight patient transport, pediatric transport, and rescue helicopter services. The inter-facility sector stands out as the dominant player, holding the largest revenue share of 46.2% in the market.

- North America led the market by securing a market share of 45.9% in 2024.

Service Type Analysis

Hospital-based services account for 61.3% of the Air Ambulance Services market and are expected to maintain dominance due to their superior integration with clinical infrastructure and specialist medical staff. These services provide immediate access to emergency care teams, critical care physicians, and advanced life-support equipment, ensuring continuity of care during transport. Hospitals are increasingly investing in in-house air ambulance programs to strengthen their trauma and cardiac response capabilities.

The growing emphasis on golden-hour treatment for stroke, cardiac arrest, and polytrauma patients is anticipated to boost demand for hospital-operated fleets. Collaborations between hospitals and helicopter operators are improving operational efficiency and reducing response time. Technological upgrades, such as telemedicine-enabled communication systems and real-time patient monitoring, enhance clinical decision-making mid-flight.

The rise in tertiary care transfers and expanding hospital networks in remote areas are further strengthening the segment’s leadership. As healthcare systems prioritize integrated emergency care, hospital-based air ambulance services are projected to remain the market’s cornerstone.

Aircraft Analysis

Rotary winged aircraft dominate with a 68.5% market share and are anticipated to continue leading due to their exceptional versatility and rapid response capabilities. Helicopters are ideally suited for urban trauma response, mountain rescues, and inter-hospital transfers where short landing distances are critical. The ability to operate in challenging terrains and reach accident scenes or remote healthcare facilities within minutes enhances their adoption. Technological advancements in rotorcraft design, including noise reduction, autopilot navigation, and night-vision operations, are increasing mission safety and reliability.

Governments and private operators are expanding helicopter-based emergency medical service (HEMS) networks to meet rising demand for rapid medical evacuation. Increasing incidents of road accidents, natural disasters, and time-sensitive medical emergencies further stimulate rotary aircraft utilization.

The integration of advanced patient monitoring systems and lightweight stretchers has improved inflight treatment quality. With ongoing fleet modernization and cross-border operational support, rotary winged air ambulances are projected to dominate emergency aviation transport solutions globally.

Application Analysis

Inter-facility transport holds 46.2% of the Air Ambulance Services market and is projected to dominate the application segment due to the rising demand for transferring critical patients between specialized care units. Hospitals rely on air ambulances for rapid relocation of patients requiring organ transplants, cardiac surgery, or intensive neonatal care unavailable at smaller centers. The increasing prevalence of chronic and life-threatening conditions necessitates time-sensitive transfers to tertiary hospitals.

Integration of advanced intensive care units within aircraft enables continuous critical support during flight, ensuring safe transitions between facilities. Growing partnerships between healthcare providers and air ambulance operators enhance logistics coordination and patient handover efficiency. The expansion of multi-specialty hospitals and regional trauma centers is boosting inter-facility transport frequency.

Additionally, technological advancements in GPS tracking and telehealth support have optimized flight routing and patient monitoring. As healthcare delivery networks evolve toward centralized high-acuity treatment, inter-facility air transport is expected to remain a key operational focus of medical aviation services.

Key Market Segments

By Service Type

- Hospital-based

- Community-based

By Aircraft

- Rotary Winged

- Fixed Winged

By Application

- Inter-Facility

- Infectious disease services

- Neonatal transport

- Organ transplant logistics

- Overweight patient transport

- Pediatric transport

- Rescue helicopter services

Drivers

Escalating Incidence of Unintentional Injuries is Driving the Market

The rising number of unintentional injuries across populations has substantially boosted the air ambulance services market, as these incidents often necessitate swift, specialized transport to trauma centers for optimal outcomes. Urbanization and increased outdoor activities contribute to higher rates of falls, vehicle collisions, and poisonings, overwhelming ground-based emergency responses in remote or congested areas. Air ambulances provide critical time-sensitive interventions, equipped with advanced life-support systems to stabilize patients en route.

Government health agencies highlight the correlation between injury prevalence and the demand for rapid aerial medical evacuation. This driver prompts operators to expand fleets and training programs, ensuring readiness for surge scenarios. Collaborative protocols with emergency medical services integrate air assets into regional response networks, enhancing overall efficiency. Technological upgrades in onboard diagnostics further align services with injury management standards.

Public awareness campaigns emphasize the value of air transport in reducing mortality from severe traumas. Economic analyses from health departments underscore cost savings from prevented complications via prompt care. The Centers for Disease Control and Prevention reported 222,698 deaths from unintentional injuries in the United States in 2023. Such figures illustrate the persistent pressure on aerial services to scale operations amid growing caseloads. Consequently, this dynamic fortifies the market’s foundational role in public safety infrastructures.

Restraints

Elevated Operational and Billing Costs are Restraining the Market

Prohibitive operational expenses and associated billing complexities continue to impede the broader accessibility of air ambulance services, confining utilization to insured or affluent demographics. Fuel volatility, aircraft maintenance, and specialized crew certifications inflate per-flight expenditures, straining provider margins in competitive landscapes. Regulatory mandates for safety equipment and compliance audits add administrative overheads, diverting resources from service enhancements.

Insurance disputes over out-of-network charges exacerbate financial burdens for patients, leading to delayed payments and litigation risks. This restraint fosters hesitancy among potential users, particularly in underserved communities where alternatives are limited. Operators grapple with balancing profitability and affordability, often resulting in service curtailments in low-density regions. Government oversight on surprise billing seeks remedies, yet implementation lags hinder immediate relief.

Economic downturns amplify these pressures, prompting consolidations among smaller providers. Transparent pricing initiatives aim to rebuild trust, but adoption remains sporadic. The National Association of Insurance Commissioners estimated the median cost of a single air ambulance transport at between $36,000 and $40,000. These cost barriers not only suppress demand but also underscore the imperative for policy interventions to sustain equitable access.

Opportunities

Proliferation of Base Locations in Underserved Areas is Creating Growth Opportunities

The strategic establishment of additional air ambulance bases in rural and remote locales is generating considerable expansion prospects for the market, addressing longstanding gaps in emergency coverage. This decentralization facilitates quicker response times to incidents in geographically challenging terrains, where ground ambulances face delays. Partnerships with local health authorities enable site optimizations, incorporating helipads and communication relays for seamless integrations.

Opportunities arise in workforce development, training indigenous personnel to operate from these outposts and reduce dependency on urban hubs. Funding from federal grants supports infrastructure builds, catalyzing private investments in regional fleets. Demographic shifts toward suburban living further amplify the viability of peripheral basing. Data analytics guide placement decisions, prioritizing high-risk zones based on injury patterns. This approach not only diversifies revenue streams through contracted services but also enhances community resilience.

International models inspire adaptations, promoting scalable templates for global replication. The Federal Aviation Administration documented 1,021 base locations for helicopter air ambulance operations in the United States in 2023. Such infrastructural advancements herald a phase of inclusive market maturation.

Impact of Macroeconomic / Geopolitical Factors

Economic slowdowns and climbing fuel expenses erode profitability for air ambulance operators, leading many to restrict elective transports and add premiums to off-grid operations. Advancing telehealth protocols and higher earnings among premium clients, nonetheless, maintain solid utilization rates as coverage broadens for complex aerial relocations.

Geopolitical strains in areas like the Taiwan Strait and Russian frontiers mandate flight path alterations for overseas rescues, ramping up expenditures and impeding prompt aid near volatile borders. These issues, nevertheless, hasten the rollout of sustainable propulsion systems and data-driven routing software that enhance fuel savings and route precision.

Ongoing U.S. tariffs, including 25% on select Asian-sourced aircraft elements under Section 301, elevate repair outlays and undermine smaller fleets’ edge in public tenders. Operators deftly adjust by tapping zero-duty EU channels, bolstered by September 2025 exemptions that eliminate levies on European aviation imports, and forging pacts with partners to broaden origin diversity.

Latest Trends

Integration of Electric Vertical Takeoff and Landing Aircraft is a Recent Trend

The advent of electric vertical takeoff and landing (eVTOL) aircraft into air ambulance frameworks has crystallized as a transformative trend in 2025, promising quieter, greener alternatives to conventional rotorcraft for urban and short-haul missions. Regulatory advancements expedite certifications, focusing on noise reduction and emission cuts to align with sustainability mandates. Pilot programs test eVTOLs for inter-facility transfers, leveraging vertical capabilities to bypass traffic bottlenecks.

Battery innovations extend range viability, supporting onboard medical suites without refueling interruptions. This trend intersects with smart city initiatives, embedding aerial routes into urban mobility ecosystems. Stakeholder consortia refine operational protocols, ensuring interoperability with existing dispatch systems. Cost projections indicate long-term savings from lower energy and maintenance needs, appealing to budget-conscious operators.

Safety validations through simulations precede full deployments, mitigating adoption risks. The emphasis on modularity allows retrofits for specialized trauma configurations. In September 2025, the Federal Aviation Administration established the eVTOL and Advanced Air Mobility Integration Pilot Program, selecting a minimum of five participants to demonstrate medical transport applications. This initiative exemplifies the trend’s acceleration toward routine emergency utilization.

Regional Analysis

North America is leading the Air Ambulance Services Market

The Air Ambulance Services market in North America captured 45.9% of the global share in 2024, driven by escalating demand for rapid emergency responses in expansive rural and underserved territories spanning the United States and Canada. Providers expanded rotorcraft fleets with advanced avionics and enhanced fuel efficiency, enabling longer-range missions to remote sites like Alaskan outposts and Appalachian highlands.

Federal incentives through the Bipartisan Infrastructure Law allocated substantial grants for infrastructure upgrades at heliports, facilitating quicker takeoff and landing protocols. Collaborations between operators and hospital networks streamlined triage systems, prioritizing critical cases such as trauma and cardiac arrests for aerial evacuation. Technological integrations, including real-time telemedicine links aboard aircraft, improved en-route care outcomes and reduced transfer times by up to 30% in urban-to-rural corridors.

Insurance reforms expanded coverage for out-of-network transports, alleviating financial barriers and encouraging utilization among low-income populations. Workforce development programs trained over 5,000 new flight nurses and pilots, addressing shortages exacerbated by post-pandemic retirements. Environmental adaptations, such as low-emission engines compliant with stricter EPA standards, supported sustainable operations amid growing regulatory scrutiny.

Regional hubs in Texas and Colorado centralized dispatch centers, optimizing resource allocation during peak disaster seasons like wildfires. The Federal Aviation Administration documented 370,182 patients transported by helicopter air ambulance services in 2024, reflecting sustained operational intensity across the continent.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts anticipate the air ambulance services sector in Asia Pacific to surge during the forecast period, as governments ramp up investments in disaster-prone infrastructures. Australia fortifies its remote health networks through expanded federal subsidies, equipping operators with next-generation turboprops for cyclone-vulnerable coastal zones. Japan modernizes its fleet under the Ministry of Health, Labour and Welfare directives, incorporating AI-driven routing for earthquake aftermath responses. India accelerates state-level initiatives via the National Health Mission, deploying hybrid electric aircraft to bridge urban-rural divides in trauma care.

China bolsters provincial emergency protocols with centralized command systems, targeting high-altitude rescues in Himalayan frontiers. Southeast Asian nations like Indonesia cultivate cross-border agreements, harmonizing frequencies for archipelago-wide inter-island transfers. Private-public partnerships in Singapore introduce drone-assisted preliminary assessments, augmenting fixed-wing capabilities for offshore oil rig incidents.

Training academies in Malaysia and Thailand graduate specialized crews, elevating service reliability in monsoon-flooded terrains. Economic corridors under ASEAN frameworks spur joint ventures, importing Western safety benchmarks to localize manufacturing. The Royal Flying Doctor Service in Australia facilitated 32,949 aeromedical patient transports during the 2023/24 fiscal year, exemplifying the region’s burgeoning capacity for life-saving interventions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Premier providers in the aeromedical evacuation domain propel advancement by outfitting fleets with integrated telemedicine suites and advanced life-support modules, enabling en-route critical care that rivals hospital ICUs. They forge exclusive dispatch integrations with regional EMS networks to slash activation times and prioritize high-acuity missions across vast geographies. Leaders strategically position satellite bases near industrial corridors and recreational hotspots, capturing untapped demand for rapid trauma response in non-urban settings.

Innovators pursue vertical acquisitions of maintenance and training subsidiaries to internalize cost controls and guarantee 99.9% mission readiness. They diversify into specialized niches like ECMO transports and pediatric retrievals, commanding premium reimbursements from payers and self-insured employers. This disciplined execution fortifies market primacy amid rising expectations for seamless, borderless emergency continuity.

Global Medical Response, Inc., headquartered in Greenwood Village, Colorado, anchors the industry as the largest integrated air-ground medical transport conglomerate, unifying rotary, fixed-wing, and critical care ground operations under a singular command structure. The organization deploys a meticulously maintained armada of helicopters and turboprops configured for diverse payloads, from bariatric patients to infectious disease isolators.

GMR elevates standards through proprietary flight risk assessment algorithms and crew resource management curricula that exceed FAA mandates. The company extends its footprint via synergistic partnerships with hospital systems for dedicated neonatal and cardiac transfer programs. Global Medical Response relentlessly refines operational synergies to deliver unparalleled reliability, cementing its stature as the backbone of time-critical patient relocation worldwide.

Top Key Players

- REVA, Inc.

- PHI Air Medical

- Lifeguard Ambulance Service LLC.

- IAS Medical, Ltd.

- Global Medical Response

- Express Air Medical Transport

- Babcock Scandinavian Air Ambulance

- AMR

- American Air Ambulance

- AirMed International

- Air Methods

- Acadian Ambulance

Recent Developments

- In March 2025, Global Medical Response entered into an agreement with Airbus for up to 15 H140 helicopters, adding new-generation rotorcraft with superior fuel efficiency and safety technologies. This investment reflects the industry’s shift toward modernized fleets capable of supporting high-volume emergency operations, which enhances reliability and service sustainability.

- In February 2024, DRF Luftrettung enhanced its European presence by ordering 10 additional Airbus H145 helicopters to strengthen its air rescue fleet. These technologically advanced aircraft, equipped with upgraded avionics and medical equipment, illustrate how continuous fleet modernization directly supports the growing global demand for faster, safer, and more efficient air ambulance operations.

- In March 2023, Air Methods acquired Guardian Flight, extending its operational footprint in Alaska. The integration of Guardian’s regional expertise and fleet improved logistical coverage across difficult terrains, enabling faster medical evacuations and expanding the market’s service density in underrepresented geographies.

- In February 2023, Air Methods formed a partnership with UnitedHealthcare to offer air ambulance services without additional costs to plan members. This collaboration advanced market accessibility by aligning reimbursement models with patient affordability, thereby increasing service utilization rates and broadening the insured customer base.

Report Scope

Report Features Description Market Value (2024) US$ 17.8 Billion Forecast Revenue (2034) US$ 49.6 Billion CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Hospital-based and Community-based), By Aircraft (Rotary Winged and Fixed Winged), By Application (Inter-Facility, Infectious Disease Services, Neonatal Transport, Organ Transplant Logistics, Overweight Patient Transport, Pediatric Transport, and Rescue Helicopter Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape REVA, Inc., PHI Air Medical, Lifeguard Ambulance Service LLC., IAS Medical, Ltd., Global Medical Response, Express Air Medical Transport, Babcock Scandinavian Air Ambulance, AMR, American Air Ambulance , AirMed International, Air Methods, Acadian Ambulance. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Air Ambulance Services MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Air Ambulance Services MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- REVA, Inc.

- PHI Air Medical

- Lifeguard Ambulance Service LLC.

- IAS Medical, Ltd.

- Global Medical Response

- Express Air Medical Transport

- Babcock Scandinavian Air Ambulance

- AMR

- American Air Ambulance

- AirMed International

- Air Methods

- Acadian Ambulance