Global AI Watermarking Market Size, Share, Industry Analysis Report By Type (Invisible Watermarking, Visible Watermarking, Hybrid), By Technology (Reversible Watermarking, Non-Reversible Watermarking), By Deployment (On-premises, Cloud), By Application (Authentication & Security, Copyright Protection, Branding & Marketing, Others), By End-Use (BFSI, Healthcare, Media & Entertainment, Government & Defense, Retail & E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 159649

- Number of Pages: 206

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Role of Generative AI

- Government-led Investments

- Investment and Business Benefits

- US Market Size

- By Type

- By Deployment Mode

- By Application

- By Technology

- By End-Use

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

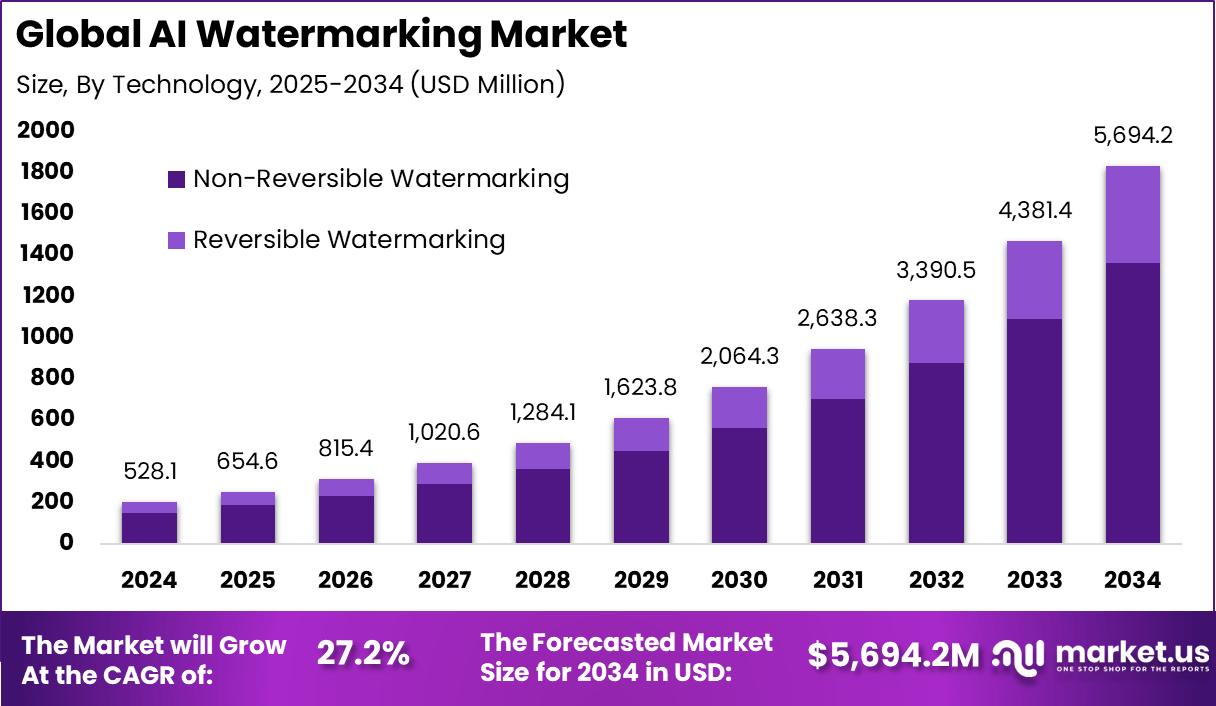

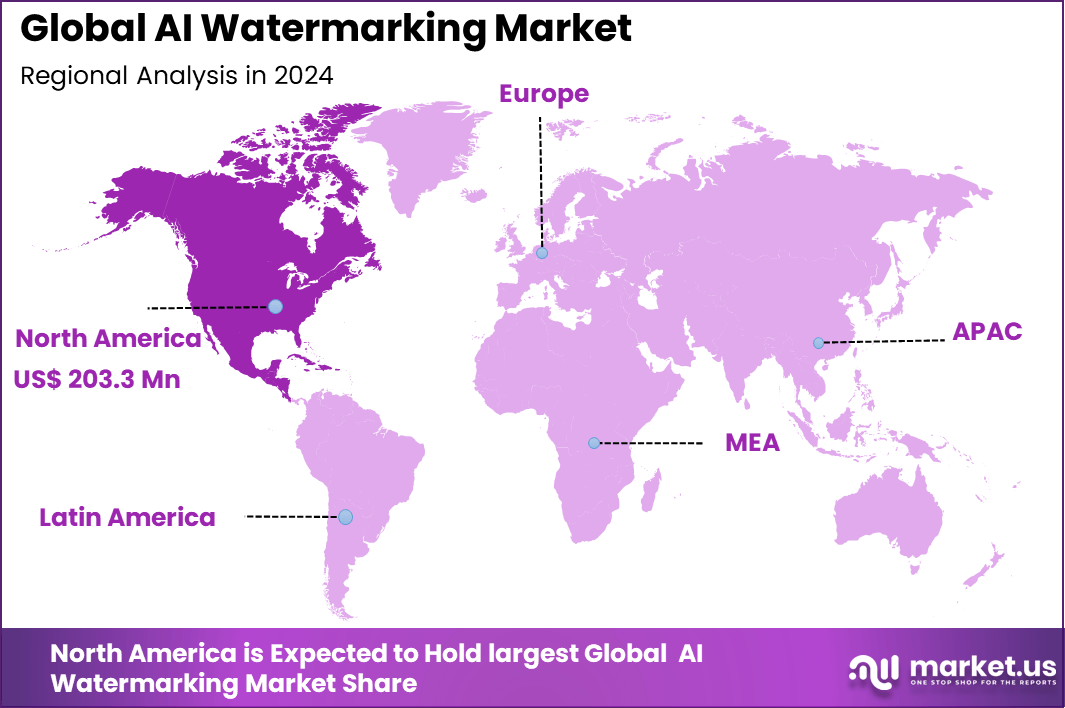

The Global AI Watermarking Market size is expected to be worth around USD 5,694.2 Million By 2034, from USD 528.1 Million in 2024, growing at a CAGR of 27.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 38.5% share, holding USD 203.3 Million revenue.

The AI Watermarking Market has gained remarkable traction due to the rapid expansion of AI-generated content such as images, videos, and text. The need to distinguish authentic content from AI-manipulated or deepfake media has become critical in preserving digital trust. This market thrives primarily on embedding hidden or visible markers in AI-generated outputs, ensuring content traceability and authenticity.

The adoption is especially strong among enterprises and governments aiming to combat misinformation and copyright infringement in an increasingly digital world. This rising demand aligns closely with the growing presence of generative AI tools and heightened concerns around digital content’s credibility and integrity.

According to Market.us, The global artificial intelligence market is witnessing exceptional growth, valued at USD 391.70 billion in 2024 and projected to rise from USD 542.50 billion in 2025 to nearly USD 10,173.05 billion by 2034. This reflects a strong compound annual growth rate of 38.50% during the period from 2025 to 2034.

Based on data from exploding topics, The AI industry is on a rapid growth path, with its value expected to expand by nearly 5 times over the next five years. By 2025, the sector is projected to employ around 97 million people, reflecting its growing role in shaping global employment trends. Businesses are also prioritizing adoption, as 83% of companies now consider AI a central part of their strategic planning.

Real-world applications highlight the technology’s impact. Netflix generates $1 billion annually through automated personalized recommendations powered by AI, while 48% of businesses already use AI to manage and analyze big data. In healthcare, about 38% of medical providers integrate computers into diagnostic processes, demonstrating how AI is reshaping critical industries with both efficiency and precision.

Key Insight Summary

- 58.5% of the market is dominated by invisible watermarking, reflecting its effectiveness in securing digital assets without altering content quality.

- 73.2% share is held by non-reversible watermarking, chosen for its strength against tampering and unauthorized modifications.

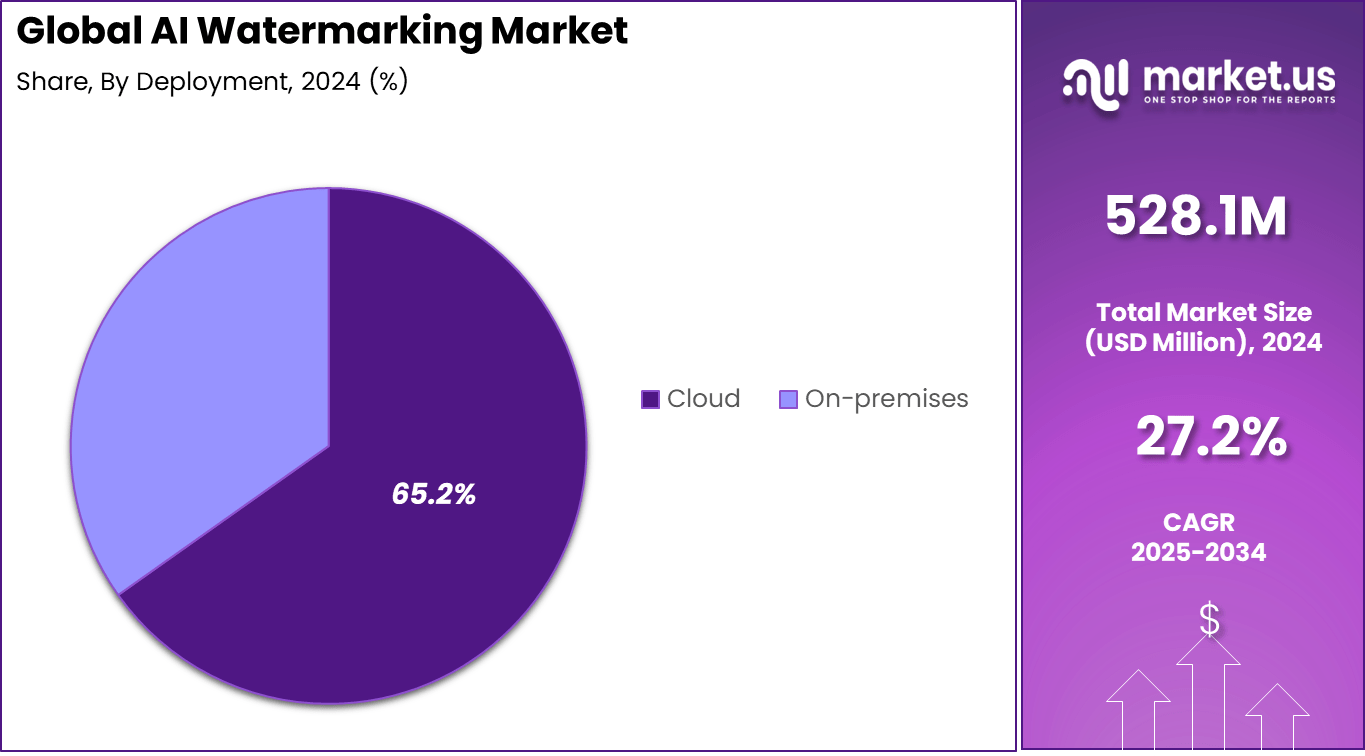

- 65.5% of deployments are cloud-based, showing preference for scalable, flexible, and cost-efficient solutions.

- 40.6% of adoption comes from copyright protection, confirming its role as the primary driver of AI watermarking demand.

- 35.6% of end-use is from media and entertainment, where protecting original content remains a top priority.

- 38.5% of the global share is concentrated in North America, supported by strong digital ecosystems and IP laws.

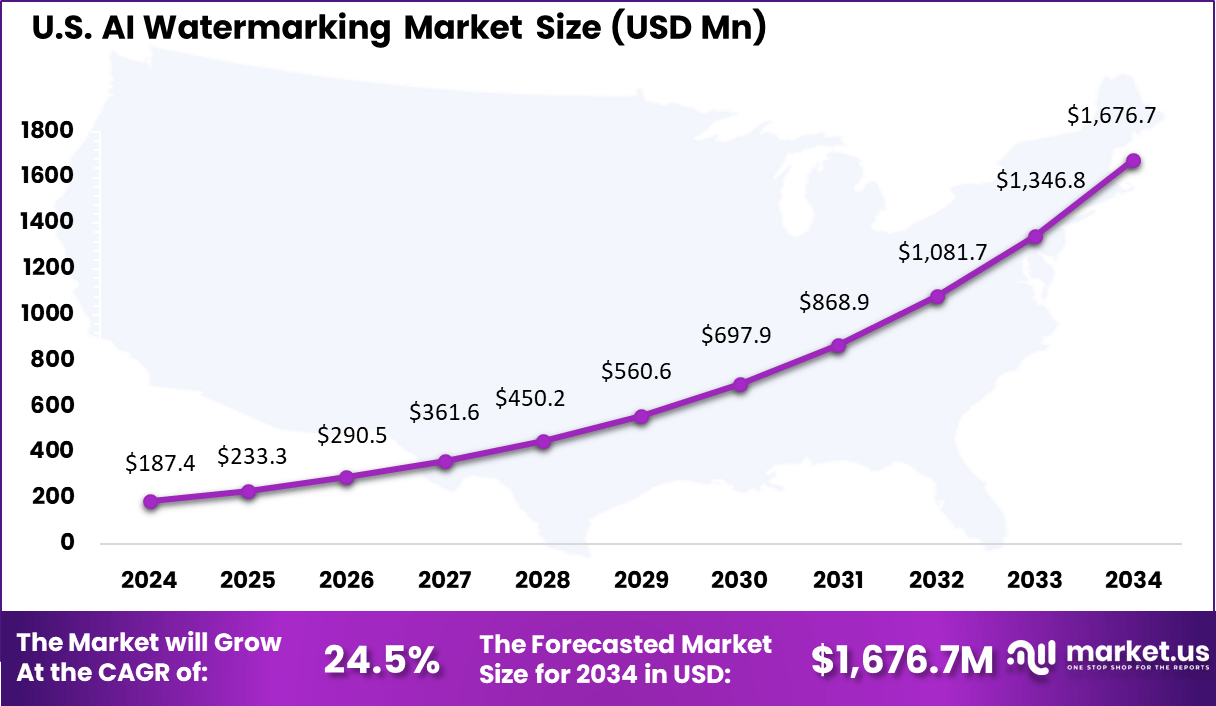

- The U.S. leads with 24.5% share, valued at 187.4 Mn, underscoring its dominance in AI-powered content protection technologies.

- Asia-Pacific shows the strongest growth, rising from 24.0% in 2020 to 27.6% in 2024.

- North America steadily declines from 41.6% in 2020 to 38.5% in 2024.

- Europe experiences a mild decrease from 25.7% in 2020 to 24.8% in 2024.

- Latin America shows gradual growth from 4.8% in 2020 to 5.1% in 2024.

- The Middle East & Africa remains almost unchanged, moving from 3.9% to 4.0% over the same

- period.

Role of Generative AI

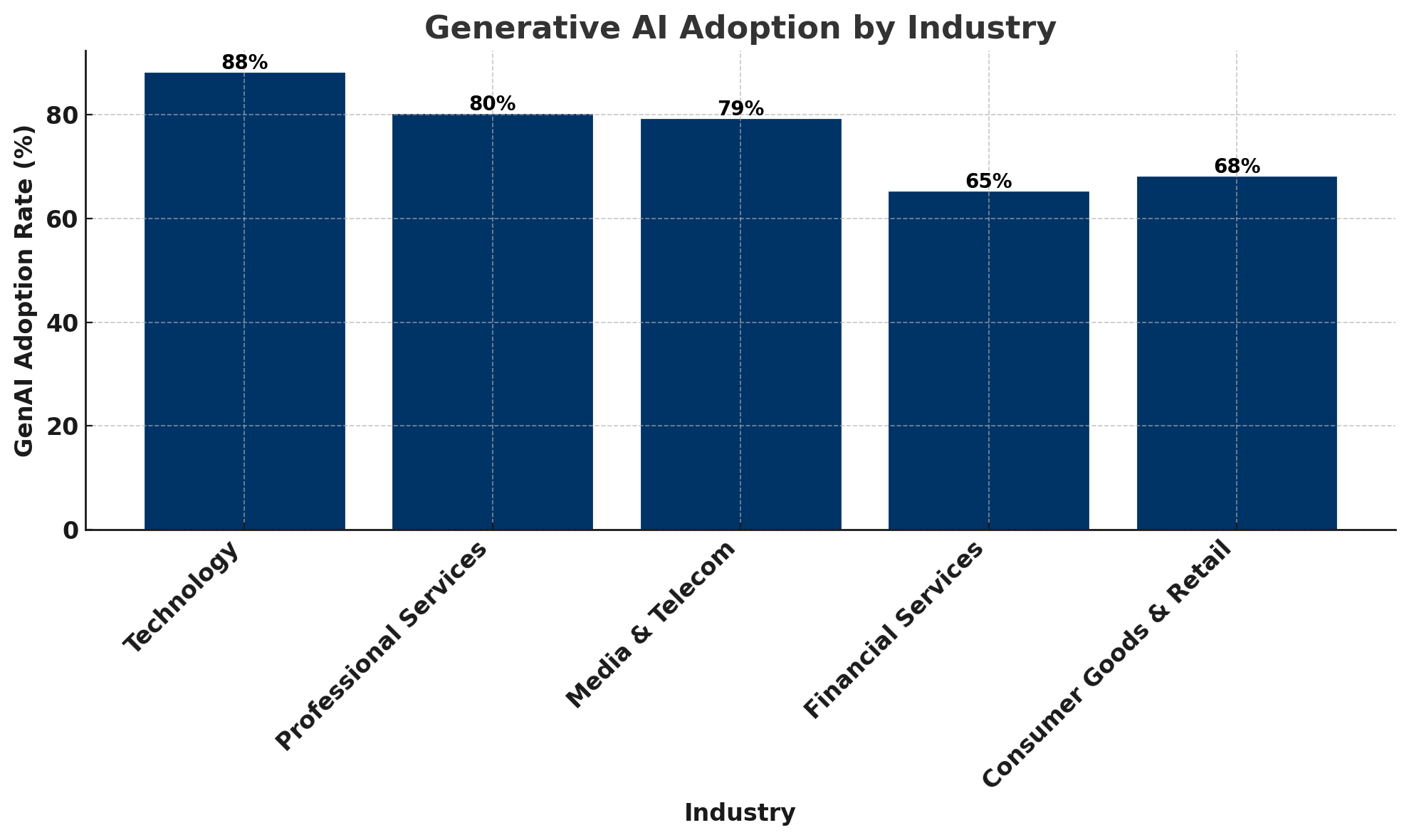

The role of generative AI in AI watermarking is increasingly crucial as it embeds imperceptible markers within AI-created content, allowing verification of authenticity without affecting the content’s quality. Around 38% of AI image generators now use watermarking techniques to ensure the traceability of their outputs, helping to combat misinformation and copyright infringement.

This technology supports transparency, giving users and platforms tools to identify AI-generated media confidently. With the rise of generative AI models, embedding such watermarks has moved from a security option to an essential feature for responsible content creation in digital ecosystems. The ability to subtly alter text, images, or videos creates a reliable signature that machines detect yet stays invisible to humans, enhancing trust in AI-produced works.

High-Adoption Sectors

- Technology: 88% of companies use generative AI, making information technology the most advanced sector for adoption.

- Professional services, media, and telecom: Adoption rates stand at 80% and 79%, showing strong uptake in knowledge-driven and content-heavy industries.

- Financial services: Around 65% of firms have implemented generative AI. The banking sector alone is expected to see a $1 billion revenue boost by 2027 from AI integration.

- Consumer goods and retail: Adoption is at 68%, with applications focused on personalization, customer engagement, and sales optimization.

- Industrial and automotive: Particularly strong in India, where the automotive sector has seen a 48% increase in machine learning adoption.

Low-Adoption Sectors

- Energy and materials: The slowest adoption rate among major industries, at 59%.

- Construction and agriculture: The least digitized sectors, with only 1.4% adoption of AI tools.

Common Reasons for AI Adoption

- Internal process automation: Reported by 36% of executives as the leading reason for adopting AI.

- Data analysis and analytics: Widely leveraged to manage and extract insights from large volumes of information.

- Marketing and sales: Deployed for content creation, lead generation, and customer personalization.

- Research and development (R&D): Around 44% of firms use AI in R&D, particularly within the information and communication sector.

- ICT security: High adoption observed in electricity, gas, and water supply sectors, where AI strengthens cybersecurity and operational reliability.

Government-led Investments

Government-led investments play a key role in advancing AI watermarking technology. In North America, governmental bodies contribute to over 22% of funding for watermarking research, fostering partnerships between public institutions and private players. This support accelerates the development of new watermarking methods designed to endure various digital manipulations and enable transparent content verification.

Furthermore, governments are actively introducing regulations that mandate watermarking in AI-generated content, with about 25% of policy proposals in 2024 including such requirements. These initiatives reinforce the importance of watermarking as a tool to curb misinformation and protect intellectual property in the digital space.

Such government initiatives not only provide financial backing but also push for the implementation of watermarking standards across industries. Regulatory frameworks are evolving to compel platforms and content creators to adopt watermarking for AI outputs, creating a culture of accountability and trust. This regulatory momentum encourages technology providers to innovate watermarking solutions that meet compliance demands while supporting scalability.

Investment and Business Benefits

Investment opportunities in the AI Watermarking Market arise from expanding generative AI adoption, growing regulatory frameworks enforcing content provenance, and advancements in AI-driven detection algorithms. Cloud deployment models offer scalable business models.

Emerging regional markets, especially in Asia Pacific, present high-growth potential supported by government initiatives in digital economy and IP enforcement. Innovations such as AI watermarking in real-time monitoring, deep learning enhancements, and blockchain integration open avenues for differentiated product offerings and partnerships between AI developers, cybersecurity firms, and media platforms.

Business benefits of AI watermarking include enhanced protection against copyright infringements, improved credibility and trust for digital content, reduced financial and legal risks from unauthorized use, and alignment with regulatory standards.

Watermarking supports secure content distribution and serves as a deterrent against tampering and fake content propagation. It also provides enterprises with a mechanism for traceability and auditability, promoting transparency in AI-generated outputs which can be crucial for consumer confidence and brand integrity.

US Market Size

In 2024, The US market is a major contributor within North America, with estimated revenue reaching approximately USD 187.4 million and a growth rate around 24.5% CAGR. The US is home to many technology innovators developing watermarking solutions integrated into major software, hardware, and cloud platforms.

Strong efforts and legal frameworks around copyright and digital content protection further stimulate market growth. The US continues to lead in AI watermarking adoption thanks to its technology infrastructure, policy support, and presence of key industry stakeholders focused on securing digital assets.

North America commands a strong presence with 38.5% of the AI watermarking market, reflecting its advanced technology ecosystems and regulatory environment supporting digital content authenticity. Industries here are early adopters of AI watermarking solutions, driven by regulatory frameworks, intellectual property protection demands, and increasing deployment in media, cloud services, and government sectors.

Regional Insights Share (%), 2020-2024

Region 2020 2021 2022 2023 2024 North America 41.6% 40.9% 40.2% 39.6% 38.5% Europe 25.7% 25.5% 25.2% 25.0% 24.8% Asia-Pacific 24.0% 24.8% 25.5% 26.3% 27.6% Latin America 4.8% 4.9% 5.0% 5.1% 5.1% Middle East & Africa 3.9% 3.9% 4.0% 4.0% 4.0% The region benefits from robust innovation and integration of watermarking technologies into creative platforms and digital pipelines. This leadership helps address misinformation risks and unauthorized usage while ensuring traceability in synthetic and AI-generated media.

By Type

In 2024, Invisible watermarking accounts for a significant 58.5% share of the AI watermarking market. This technology embeds hidden data within digital content in a way that is imperceptible to users, allowing creators to protect their intellectual property without affecting the user experience. Its subtlety and ability to maintain content quality make it a preferred choice, particularly for media, entertainment, and digital art industries concerned with content authenticity and anti-piracy measures.

Market Share By Type (%), 2020-2024

Type 2020 2021 2022 2023 2024 Invisible Watermarking 58.4% 58.4% 58.4% 58.5% 58.5% Visible Watermarking 26.5% 26.4% 26.2% 26.0% 25.9% Hybrid 15.1% 15.2% 15.4% 15.5% 15.6% The widespread use of deepfakes and manipulated media has increased reliance on invisible watermarking to verify content provenance. Advances in AI algorithms and steganographic techniques strengthen its adoption by providing robust protection while remaining discreet. This approach balances security needs with the requirement of preserving the original content’s integrity.

The adoption of invisible watermarking continues to expand as industries look for ways to protect valuable digital content from misuse. Its discreet nature allows for stronger copyright enforcement while maintaining content integrity, especially across video, image, and audio formats that demand visual clarity.

By Deployment Mode

In 2024, The cloud deployment segment leads with 65.2% market share. Cloud-based AI watermarking offers scalability, remote accessibility, and cost efficiency, which is essential for enterprises managing large volumes of digital content. Cloud systems enable real-time watermarking and easy integration into existing digital workflows, facilitating seamless protection across various platforms and services.

Market Share By Deployment Mode (%), 2020-2024

Deployment 2020 2021 2022 2023 2024 On-premises 35.6% 35.3% 35.0% 34.8% 34.5% Cloud 64.4% 64.7% 65.0% 65.2% 65.5% Cloud deployment’s flexibility supports industries with dynamic content distribution, including media, entertainment, and e-commerce. Adoption is further driven by the ability to centrally manage watermarking services, reducing the need for extensive hardware investment. This makes cloud the favored choice for businesses requiring robust yet agile content protection solutions.

By Application

In 2024, Copyright protection holds 40.6% of the application market share. AI watermarking plays a critical role in embedding digital signatures that prove ownership and deter unauthorized distribution or piracy. It has become indispensable in publishing, broadcasting, and entertainment sectors, where protecting creative works is vital for maintaining revenue streams and brand integrity.

The rise in AI-generated and shared digital content has heightened the need for reliable intellectual property protection mechanisms. Watermarking solutions support legal enforcement by providing evidence of ownership and helping mitigate risks associated with content misappropriation or unlawful replication.

Market Share By Application (%), 2020-2024

Application 2020 2021 2022 2023 2024 Authentication & Security 35.1% 35.5% 35.8% 36.1% 36.5% Copyright Protection 40.5% 40.5% 40.6% 40.6% 40.6% Branding & Marketing 17.5% 17.2% 16.9% 16.7% 16.4% Others 6.9% 6.8% 6.7% 6.6% 6.5% By Technology

In 2024, Non-reversible watermarking dominates the technology segment, capturing 73.2% of the market. It offers permanent protection by embedding watermarks that cannot be removed without degrading the content, making it ideal for industries like media, defense, and BFSI that prioritize content security and authenticity. This permanence provides strong legal enforceability in copyright cases, increasing trust in digital intellectual property management.

Despite its permanence, non-reversible watermarking is highly robust against typical attacks such as compression or tampering. Its widespread adoption is boosted by growing regulatory frameworks and awareness about digital piracy risks. This technology secures digital rights by making alterations evident, ensuring that the original content can be reliably traced back to its creator or owner.

Market Share By Technology (%), 2020-2024

Technology 2020 2021 2022 2023 2024 Reversible Watermarking 26.2% 26.3% 26.5% 26.6% 26.8% Non-Reversible Watermarking 73.8% 73.7% 73.5% 73.4% 73.2% By End-Use

In 2024, Media and entertainment constitute 35.6% of the AI watermarking market’s end-use segment. This sector’s growing investment in watermarking is driven by the need to protect valuable assets like films, music, streaming content, and images. Watermarking ensures traceability of ownership and reduces piracy risks across multiple digital distribution channels.

Industry reliance on watermarking is amplified by the expanding digital consumption of media and the proliferation of online streaming platforms. Protecting content copyright and managing royalty distribution are critical factors motivating media companies to adopt advanced watermarking technologies.

Market Share By End-Use (%), 2020-2024

End-Use 2020 2021 2022 2023 2024 BFSI 19.2% 19.3% 19.4% 19.5% 19.6% Healthcare 8.2% 8.4% 8.6% 8.8% 9.0% Media & Entertainment 37.2% 36.8% 36.4% 36.1% 35.6% Government & Defense 17.0% 17.2% 17.4% 17.6% 17.9% Retail & E-commerce 10.3% 10.3% 10.3% 10.3% 10.4% Others 8.2% 8.1% 7.9% 7.8% 7.5% Emerging Trends

Emerging trends in AI watermarking indicate a rapid integration of watermarking directly into generative AI platforms. Watermarks are being embedded into various formats including text, images, and videos within AI generation pipelines. One notable trend is the use of blockchain for tamper-proof watermark tracking and auditability, which enhances transparency and security in content provenance.

Real-time monitoring frameworks are also gaining traction, allowing companies to detect manipulated content or unauthorized reuse across multiple channels quickly. The growing demand for interoperability standards like C2PA is pushing the market towards more consistent and reliable watermarking solutions. As of 2025, the AI watermarking market comprises around 4.8% of the overall AI market and is becoming a default security feature embedded by leading industry platforms.

Growth Factors

Growth factors driving AI watermarking include the explosion of AI-generated content across industries such as media, entertainment, and social platforms. The risks related to deepfakes, misinformation, and copyright infringement have created strong demand for watermarking to authenticate content and protect intellectual property.

Regulatory pressures globally are prompting businesses to apply watermarking to meet compliance and reduce legal risks. Advances in invisible and hybrid watermarking technologies further support growth by enhancing security without affecting content quality.

The surge in digital media consumption also encourages enterprises to adopt watermarking to maintain brand trust and secure digital assets. Reports highlight a compound annual growth rate (CAGR) of approximately 25% for the AI watermarking market from 2025 onwards, reflecting robust industry adoption

Key Market Segments

By Type

- Invisible watermarking

- Visible watermarking

- Hybrid

By Technology

- Reversible watermarking

- Non-reversible watermarking

By Deployment Mode

- On-premises

- Cloud

- Hybrid

By Application

- Copyright protection

- Authentication & security

- Branding & marketing

- Others

By End Use

- BFSI

- Healthcare

- Media & entertainment

- Government & defense

- Retail & e-commerce

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Rising Demand for Content Authenticity and Intellectual Property Protection

The growing volume of AI-generated content across industries is increasing the need to verify and protect digital assets against unauthorized use. Media, entertainment, and publishing sectors are particularly focused on safeguarding ownership and ensuring that content authenticity is maintained.

This has led to more businesses adopting AI watermarking solutions that embed invisible or visible marks to track and authenticate AI-produced images, text, and videos. For instance, enterprises requiring proof of originality to combat deepfakes and misinformation are driving the market’s early expansion.

Moreover, regulatory pressures further fuel adoption as governments and organizations establish compliance guidelines for transparency in AI-created content. These measures compel companies to implement watermarking for traceability and copyright protection. Tech advancements such as real-time watermark embedding and blockchain-enabled verification enhance the robustness and appeal of AI watermarking tools.

Restraint

Interoperability and Standardization Issues

A major restraint limiting AI watermarking market growth is the lack of consistent standards and interoperability across different platforms and providers. Watermarking products vary widely in their algorithms and formats, causing challenges for cross-platform content verification.

This fragmentation can lead to unreliable authentication results and lowers confidence among potential users in industries that require seamless integration of digital rights management systems across devices. Additionally, performance problems such as watermark fragility under compression or content editing pose usability challenges.

If a watermark is easily removed or corrupted during normal use, it undermines the purpose of protecting AI-generated content. For example, media companies relying on watermarking for copyright enforcement may hesitate to adopt solutions that fail under real-world conditions. This constraint slows widespread deployment and creates a need for improved technology standardization.

Opportunity

Expanding Use in New Digital Formats and AI Applications

There is a growing opportunity for AI watermarking in emerging content types such as augmented reality (AR), virtual reality (VR), and synthetic media generated by advanced AI models. These novel formats present complex challenges in content ownership and authenticity that traditional watermarking methods struggle to address.

Companies and solution providers focusing on these niches can capitalize on rising demand for next-generation watermarking techniques that offer robust, real-time, and multi-format protection. Furthermore, the expanding ecosystem of AI-powered content creation creates openings for partnerships that integrate watermarking with blockchain, IoT security, and digital identity verification.

For instance, enterprises exploring decentralized content distribution and creator monetization are beginning to embed AI watermarks as a foundational layer for trust and provenance. This evolving market segment is ripe for innovation and diversification, positioning AI watermarking as a critical tool in the expanding digital economy.

Challenge

Regulatory Uncertainty and Global Legal Differences

A significant challenge is the uncertainty surrounding global regulatory frameworks governing AI-generated content and watermarking requirements. Different regions and countries impose varying levels of disclosure, privacy, and content authenticity obligations, creating difficulties for companies seeking uniform compliance.

For example, businesses operating across borders must navigate conflicting rules in the EU, the US, and Asia, complicating the adoption and deployment of watermarking technologies. This patchy regulatory environment can delay investment decisions, hinder product standardization, and create risk for early adopters of AI watermarking solutions.

Furthermore, rapid advances in generative AI and deepfake techniques mean that watermarking tools must constantly evolve to meet legal standards and protect against increasingly sophisticated manipulation. Adapting to this shifting landscape remains a core strategic challenge for the AI watermarking market.

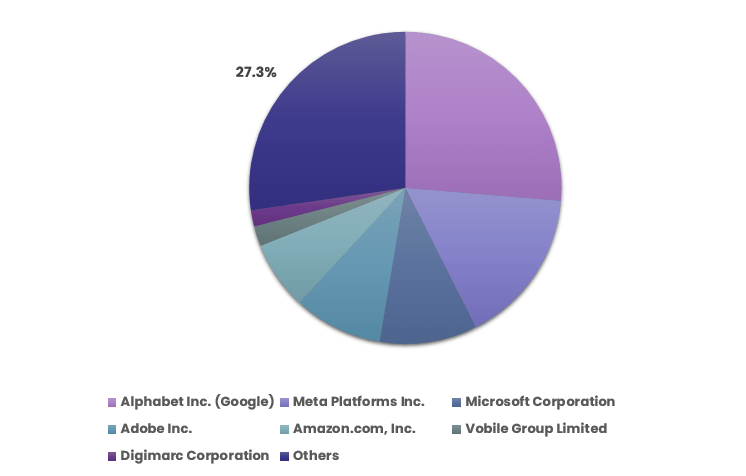

Competitive Analysis

The AI Watermarking Market is led by major technology companies such as Alphabet Inc. (Google), Microsoft Corporation, Meta Platforms Inc., and Adobe Inc. These firms are embedding watermarking capabilities into their AI content generation tools to ensure traceability, copyright protection, and compliance with emerging regulatory frameworks. Their focus is on invisible, tamper-resistant watermarks for images, text, audio, and video generated through AI systems.

Large cloud and platform providers such as Amazon.com, Inc. are enhancing watermarking through integration with their AI and content moderation services. Their solutions enable authentication, ownership tracking, and detection of AI-generated media across digital platforms. These companies also support developers and enterprises through APIs and compliance-ready tools for responsible AI content distribution.

Specialized firms including Vobile Group Limited and Digimarc Corporation contribute with proprietary watermarking and content identification technologies tailored for media companies, broadcasters, and digital rights holders. Their platforms focus on piracy prevention, content monitoring, and licensing management. A growing number of other players are entering the market with niche solutions in digital media, education, and enterprise security, expanding adoption across industries.

Top Key Players in the Market

- Alphabet Inc. (Google)

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- Meta Platforms Inc.

- Microsoft Corporation

- Adobe Inc.

- Amazon.com, Inc.

- Vobile Group Limited

- Digimarc Corporation

- Others

Note (*): Similar analysis will be provided for other companies as well.

Recent Developments

- February 2025 – Google incorporated its SynthID watermarking into the Photos app for Pixel 9 devices, marking images edited by generative AI in Magic Editor. Users can detect watermarks easily, improving transparency of AI altered photos.

- January 2025 – IMATAG released an invisible watermarking demo on Hugging Face for AI-generated images, integrating watermark embedding during generation for robustness against image modifications. This is noted as a pioneering independent solution outside AI model creators.

- September 2024 – Microsoft announced a watermarking feature in its Azure OpenAI Service that embeds invisible watermarks in DALL·E 3 AI-generated images. This adds transparency and provenance verification while maintaining image quality even if images are resized or cropped.

- June 2024 – Meta Platforms introduced AudioSeal, a system embedding hidden watermarks in AI-generated audio clips. It claims high accuracy in detecting AI audio segments, aiming to fight misinformation and deepfake scams, though widespread adoption and industry standards remain a work in progress.

- July 2024 – NVIDIA filed a patent for an imperceptible audio watermarking method in conversational AI, designed to prevent fraud and misinformation by encoding identifiable signals in synthetic speech. The technology allows detection and robustness to tampering.

Report Scope

Report Features Description Market Value (2024) USD 528.1 Mn Forecast Revenue (2034) USD 5,694.2 Mn CAGR(2025-2034) 27.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Invisible watermarking, Visible watermarking, Hybrid), By Technology (Reversible watermarking, Non-reversible watermarking), By Deployment Mode (On-premises, Cloud, Hybrid), By Application (Authentication & security, Copyright protection, Branding & marketing, Others), By End Use (BFSI, Healthcare, Media & entertainment, Government & defense, Retail & e-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alphabet Inc. (Google), Meta Platforms Inc., Microsoft Corporation, Adobe Inc., Amazon.com, Inc., Vobile Group Limited, Digimarc Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alphabet Inc. (Google)

- Meta Platforms Inc.

- Microsoft Corporation

- Adobe Inc.

- Amazon.com Inc.

- Vobile Group Limited

- Digimarc Corporation

- Others