Global AI Training Dataset Market Size, Share Analysis Report Type (Text, Image/Video, Audio), By Vertical Type (IT, Automotive, Government, Healthcare, BFSI, Retail & E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 99270

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

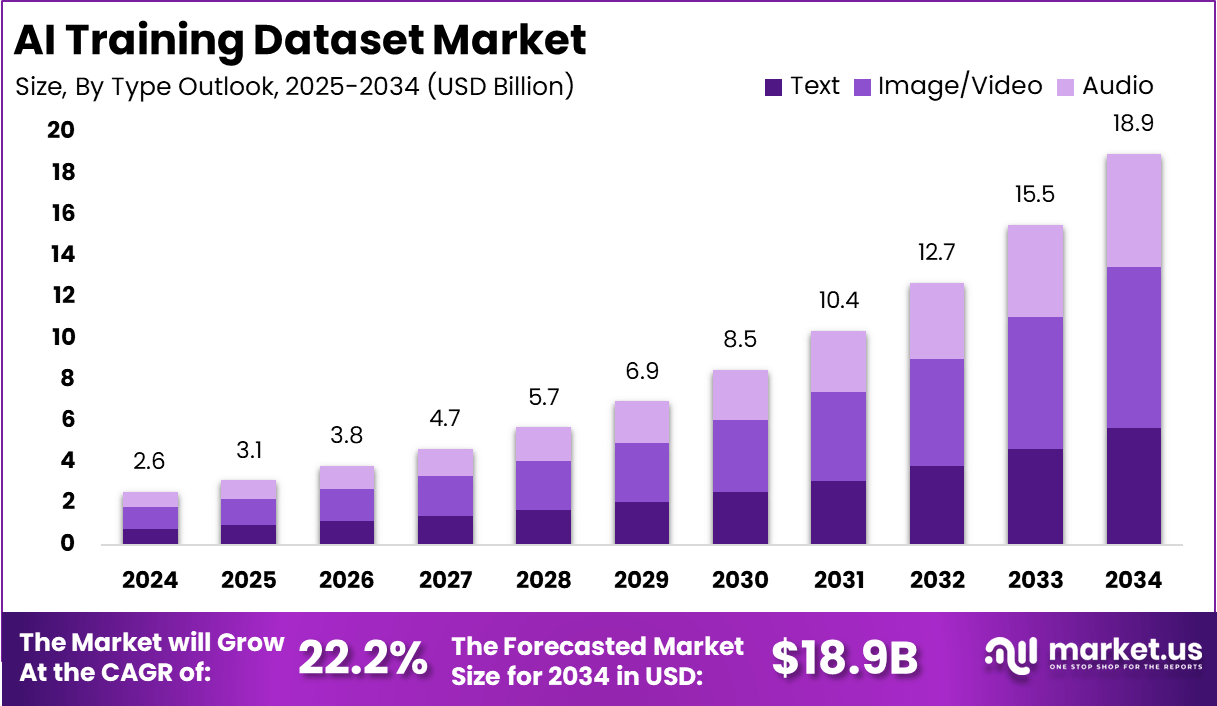

The AI Training Dataset Market size is expected to be worth around USD 18.9 Billion By 2034, from USD 2.6 billion in 2024, growing at a CAGR of 22.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.5% share, holding USD 0.9 Billion revenue. This surge is fueled by advancements in machine learning, the rise of generative AI, and the growing need for diverse and high-quality datasets.

The AI training dataset market is a segment focused on the provision and analysis of data used for training AI models. It encompasses the services and solutions that facilitate the collection, processing, and distribution of high-quality data for AI applications. This market is driven by the growing demand for advanced AI technologies across various sectors, including healthcare, automotive, and finance, which require extensive datasets to train increasingly sophisticated AI models.

The primary driving factors of the AI training dataset market include the escalating demand for AI and machine learning technologies across diverse industries. As businesses and organizations increasingly rely on data-driven decisions, the need for comprehensive and accurate AI training datasets has surged.

Additionally, advancements in AI technologies and the expansion of AI applications in emerging markets contribute significantly to the growth of this market. The demand for AI training datasets is intensifying as companies seek to enhance the capabilities of their AI systems.

This demand is characterized by the need for diverse, representative, and extensive datasets that can reduce biases and improve the generalization ability of AI models. The push towards more ethical AI also propels the demand for datasets that are balanced and inclusive of various demographic groups.

Key Takeaways

- The AI Training Dataset Market is anticipated to expand significantly, with projections indicating a rise from USD 2.6 billion in 2024 to approximately USD 18.9 billion by 2034. This represents a robust compound annual growth rate (CAGR) of 22.2% from 2025 to 2034.

- In 2024, North America maintained a leading position in the global AI training dataset market, accounting for more than 35.5% of the overall market share. The revenue from this region was reported at USD 0.9 billion, driven by technological advancements in machine learning, the emergence of generative AI, and an increasing demand for diverse and comprehensive datasets.

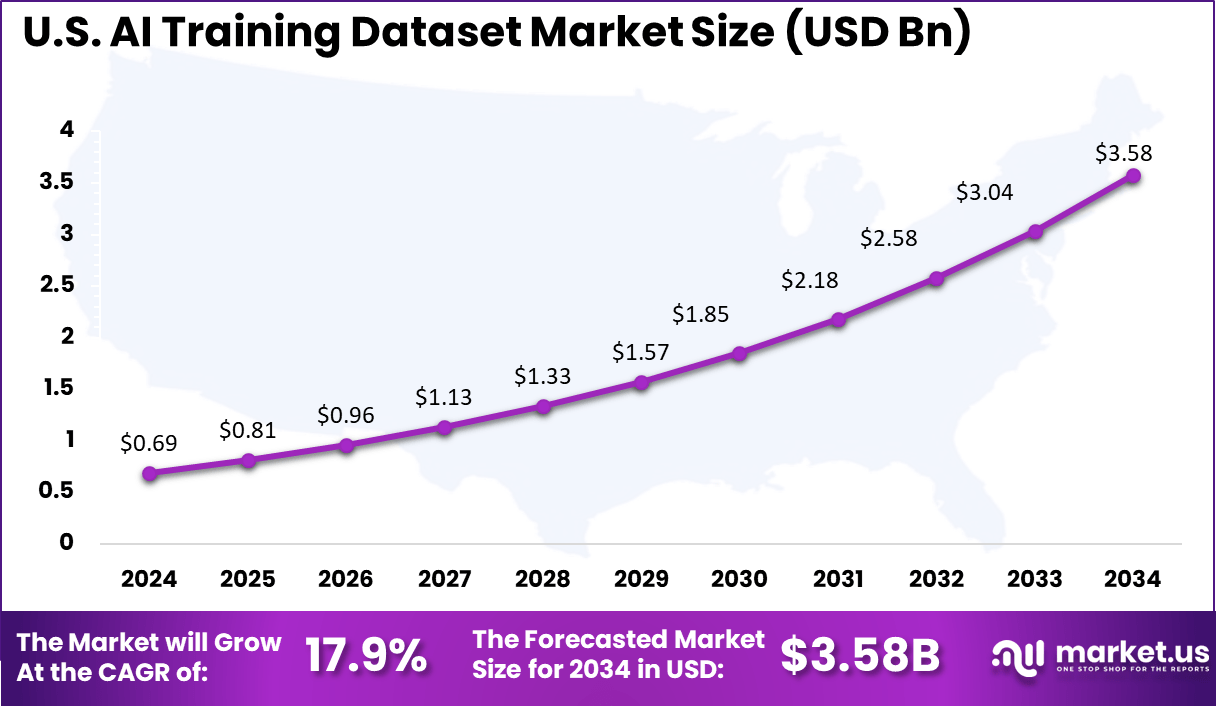

- Specifically, the U.S. AI training dataset market was valued at approximately USD 0.69 billion in 2024. Forecasts suggest an increase to USD 0.81 billion in 2025, reaching around USD 3.58 billion by 2034. The expected CAGR for this period is 17.9%.

- The Image/Video data segment proved predominant within the market in 2024, capturing more than 41.2% of the market share, reflecting its critical role in training AI systems.

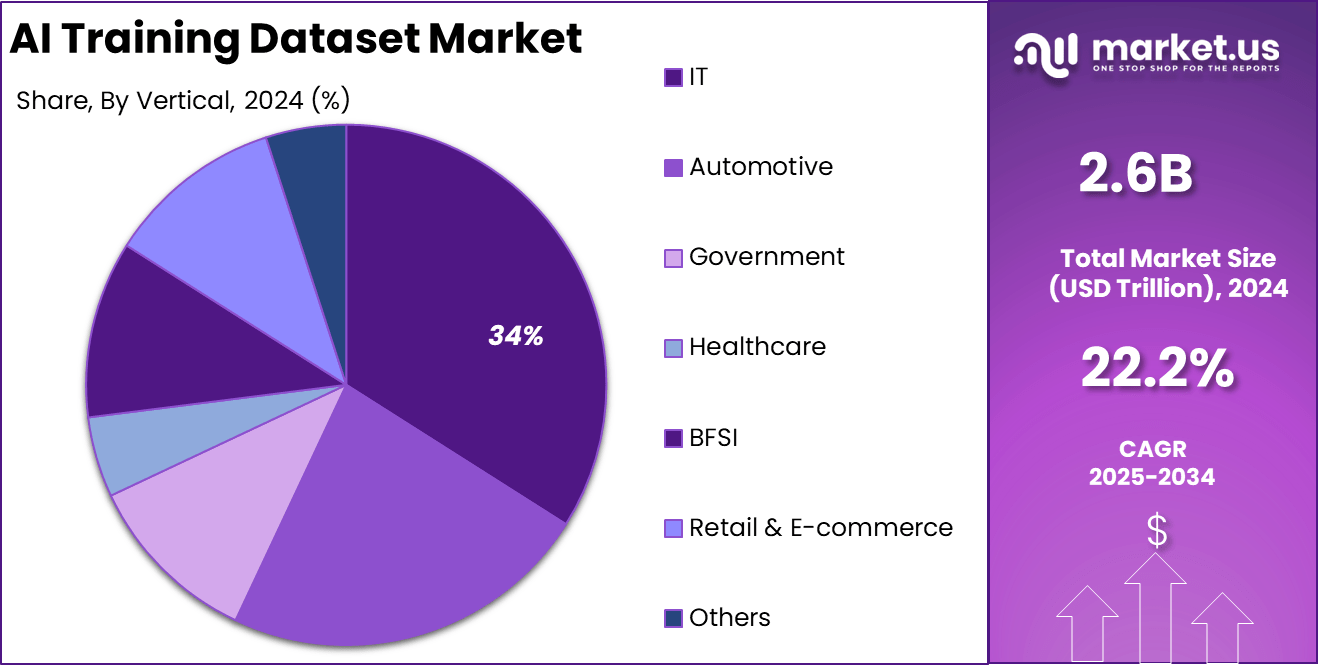

- The Information Technology (IT) sector continued to hold a significant stake in the market, securing over 34% of the market share in 2024. This dominance underscores the sector’s essential contribution to developing and utilizing AI training datasets.

Analysts’ Viewpoint

Businesses benefit from high-quality AI training datasets through improved model accuracy and efficiency, which can lead to better predictive insights and decision-making capabilities. These benefits are crucial for maintaining competitive advantages and can lead to significant cost savings and revenue opportunities as AI technologies are leveraged to optimize operations and innovate products and services.

The AI training dataset market presents substantial investment opportunities, particularly in the development of tools and platforms that can automate and streamline the data collection and processing stages. Investments in companies that specialize in producing high-quality, customized datasets for specific AI applications are also promising, given the critical role of tailored data in the successful deployment of AI solutions.

The regulatory environment for AI training datasets is increasingly becoming a focal point as governments and international bodies seek to address privacy, security, and ethical concerns associated with AI. Regulations and guidelines are being developed to ensure that data used in AI training is collected, used, and shared responsibly, which is crucial for maintaining public trust and compliance with global data protection standards.

Technological advancements in data processing and AI training techniques continually enhance the quality and accessibility of AI training datasets. Innovations such as automated data labeling and the use of synthetic data to supplement real-world datasets are examples of how technology is advancing the field. These advancements help in dealing with challenges such as data scarcity and biased datasets, thereby improving the training and performance of AI models.

US Market Size and Growth

The U.S. AI training dataset market was valued at approximately USD 0.69 billion in 2024. It is projected to grow from USD 0.81 billion in 2025 to around USD 3.58 billion by 2034, reflecting a compound annual growth rate (CAGR) of 17.9% during the forecast period from 2025 to 2034.

The United States is leading the AI training dataset market due to its strong technological infrastructure, significant investments in artificial intelligence, and the presence of major AI companies. The country is home to some of the largest tech firms, including Google, Microsoft, and Meta, which are continuously developing advanced AI models that require high-quality datasets.

Additionally, the U.S. benefits from a well-established research ecosystem, with leading universities and institutions driving innovation in machine learning and data collection. These factors have positioned the U.S. as a dominant player in the market, setting the foundation for rapid growth in the coming years.

Government support and regulatory initiatives have also played a key role in expanding the AI dataset market. Policies aimed at enhancing AI development, such as the National Artificial Intelligence Initiative, have encouraged investment in AI-driven industries.

Furthermore, collaborations between private companies and public institutions have fueled the demand for high-quality datasets to train more sophisticated AI models. The growing need for AI in healthcare, finance, and autonomous systems has further strengthened the U.S. market, as industries increasingly rely on large and diverse datasets to improve decision-making and automation.

In 2024, North America held a dominant market position in the AI training dataset market, capturing more than a 35.5% share with a revenue of USD 0.9 billion. This dominance can be attributed to several key factors that uniquely position North America at the forefront of AI technology and data management.

Firstly, the region is home to many of the world’s leading tech giants and innovative startups focused on AI and machine learning. These companies drive the demand for extensive, high-quality training datasets essential for developing sophisticated AI models. The presence of these industry leaders not only fuels technological advancements but also creates a robust market for AI training datasets due to their continuous need to improve and expand AI applications.

Additionally, North America benefits from substantial investments in AI research and development, supported by both private sector initiatives and government funding. These investments are aimed at advancing AI technologies and their applications across various sectors, including healthcare, automotive, and finance. The emphasis on innovation within the region promotes a dynamic market environment where AI training datasets are crucial for progress.

For example, Waymo LLC, a subsidiary of Google LLC, released a special dataset in September 2020 to support autonomous vehicle development. Collected using LiDAR and camera sensors, the data covers various real-world driving scenarios, including interactions with pedestrians, cyclists, road signs, and other vehicles. This dataset helps improve self-driving technology by providing crucial insights into road safety and navigation.

Moreover, the regulatory environment in North America increasingly supports the growth of AI technologies while addressing data privacy and ethical concerns. This balance of innovation-friendly policies with safeguards for data usage ensures a conducive environment for AI training dataset companies to operate and thrive.

Type Analysis

Dominance of the Image/Video segment in the AI Training Dataset Market in 2024

In 2024, the Image/Video segment held a dominant position in the AI training dataset market, capturing more than a 41.2% share. The prominence of the Image/Video segment is primarily driven by the widespread adoption of computer vision applications across various industries.

In sectors such as healthcare, AI models utilize medical imaging to assist in diagnostics and treatment planning, necessitating extensive image datasets for accurate training. Similarly, the automotive industry relies on vast collections of video data to develop and refine autonomous driving systems, which require precise object recognition and environment interpretation capabilities.

Furthermore, the proliferation of social media platforms and the increasing consumption of visual content have accelerated the need for advanced image and video recognition technologies. Companies are investing heavily in AI systems capable of analyzing and categorizing visual data to enhance user experiences and target advertising more effectively.

The continuous advancement in imaging technologies and the growing integration of AI in sectors like retail, security, and entertainment further reinforce the leading position of the Image/Video segment. As organizations seek to harness AI for tasks such as facial recognition, surveillance, and personalized content delivery, the requirement for high-quality image and video datasets is expected to persist, sustaining the segment’s dominance in the foreseeable future.

Vertical Analysis

Dominance of the IT Sector in the AI Training Dataset Market in 2024

In 2024, the IT sector maintained a dominant position in the AI training dataset market, securing over a 34% market share. This significant share can be primarily attributed to the escalating demand for AI and machine learning capabilities across various applications within the sector, such as data analytics, virtual assistants, and automated customer service solutions.

The IT sector’s leadership in the AI training dataset market is propelled by several key factors. Firstly, the rapid digital transformation across industries has necessitated the adoption of advanced AI technologies to enhance operational efficiencies and decision-making processes. Companies within the IT sector have been at the forefront of integrating AI to optimize their software solutions and service offerings, driving substantial demand for high-quality training datasets.

Secondly, the availability and generation of vast amounts of data within the IT industry have provided ample resources for training and refining AI models. This data abundance supports the development of more sophisticated and accurate AI applications, further reinforcing the sector’s dominant market position.

Moreover, the IT sector’s substantial investment in AI research and development has fostered innovation in AI training techniques and dataset quality improvements. These investments not only enhance the capabilities of AI systems but also ensure that the IT sector remains at the cutting edge of technological advancements.

Key Market Segments

By Type

- Text

- Image & Video

- Audio

By Vertical

- IT

- Automotive

- Government

- Healthcare

- BFSI

- Retail & E-commerce

- Others

Driving Factors

Increasing Demand for AI Applications Across Various Sectors

The expansion of artificial intelligence applications across diverse industries serves as a significant driver for the AI training dataset market. Industries such as healthcare, automotive, finance, and retail are increasingly deploying AI technologies to enhance efficiency, decision-making processes, and customer engagement.

As AI models require vast amounts of data for training to ensure accuracy and effectiveness, the demand for comprehensive and high-quality training datasets has surged. This need is particularly pronounced in sectors where precision and reliability are critical, such as in medical diagnostics and autonomous driving. Consequently, the growing adoption of AI technologies fuels the expansion of the market for AI training datasets, as these datasets are foundational to developing robust AI systems.

Restraining Factors

Data Privacy Concerns and Regulatory Challenges

Data privacy and regulatory compliance present significant restraints in the AI training dataset market. The collection, usage, and distribution of large datasets, especially those containing personal or sensitive information, are subject to stringent data protection laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States. .

These regulations mandate rigorous consent protocols and data handling practices, imposing constraints on the breadth and depth of data that can be legally and ethically utilized for AI training. Companies face challenges in navigating these regulatory landscapes, which can hinder the development and scalability of AI initiatives, thereby restraining market growth.

Growth Opportunities

Advancements in Data Synthesis and Simulation Technologies

One significant opportunity in the AI training dataset market lies in the advancements in data synthesis and simulation technologies. These technologies allow for the generation of large, diverse, and complex datasets that can effectively train AI models without relying on traditional data collection methods, which may be costly, time-consuming, or constrained by privacy issues.

Synthetic data generation, for example, can create realistic data that mimics the properties of real-world data, thereby providing an abundant and scalable resource for AI training. This opportunity not only addresses the challenges posed by data scarcity and privacy concerns but also enhances the ability of AI systems to perform under varied conditions and environments.

Key Challenge

Maintaining Data Quality and Diversity

Ensuring the quality and diversity of training datasets represents a crucial challenge in the AI training dataset market. AI models are only as good as the data they are trained on. Poor quality or biased data can lead to inaccurate or unethical AI behavior. The challenge lies in sourcing, vetting, and curating data that accurately reflects the complexity and diversity of real-world scenarios.

This task is further complicated by the rapid evolution of AI technologies and the continuous expansion of application domains, which require datasets to be regularly updated and expanded to include new variables and scenarios. Overcoming this challenge is essential for the sustained growth and reliability of AI technologies.

Emerging Trends

One of the most notable trends in the AI training dataset market is the shift towards cloud-based solutions. These platforms offer the flexibility and scalability necessary to handle large volumes of data while complying with stringent data privacy and sovereignty regulations.

Additionally, the use of AI in creating more personalized user experiences and improving operational efficiency is prompting companies to invest in precise and diverse datasets. The growing penetration of AI applications in sectors like telecommunications and healthcare further underscores the importance of robust dataset infrastructures

Business Benefits

Integrating AI training datasets brings numerous business advantages, including enhanced decision-making capabilities and more accurate predictive models. For industries such as retail and e-commerce, AI-driven insights can lead to improved customer service and optimized inventory management.

In healthcare, AI datasets are instrumental in developing more accurate diagnostic tools and personalized treatment plans, thereby enhancing patient outcomes.

Regional Analysis

Europe AI Training Dataset in Healthcare Market Trends

Europe’s AI training dataset market in healthcare is experiencing rapid growth, driven by strict data privacy regulations like the GDPR which influence how datasets are collected and used. The demand for AI in Europe is increasing as companies seek to comply with these regulations while ensuring their datasets are ethical and transparent.

The growth in this market is also fueled by the rising adoption of AI across various healthcare applications, from diagnostics to patient management, which requires comprehensive and compliant training datasets.

Asia Pacific AI Training Dataset Market Trends

Asia Pacific is the fastest-growing region in the global AI training dataset market, expected to exhibit significant growth during the forecast period. This growth is largely due to the technological advancements and large-scale digital transformation efforts in countries like China, Japan, and India.

The increased adoption of AI models across various sectors, including manufacturing, finance, and healthcare, is driving the demand for diverse and high-quality datasets. The region’s growth is also bolstered by the rising number of data centers, government spending, and improved infrastructure, making it a vibrant hub for AI development

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia

-Pacific - China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East

& Africa - South Africa

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East & Africa

Key Player Analysis

The AI training dataset market is fragmented into many companies offering the service. The companies are adopting various strategies to expand their market share across the globe.

Google is a dominant force in the AI training dataset market, leveraging its extensive data resources across platforms like Search, YouTube, and Google Maps. The company offers a wide array of AI models and datasets, such as Google Open Images and Google Speech Commands, which are essential for tasks in image recognition and natural language processing.

Microsoft has made significant strides in the AI training dataset market through its Azure AI platform and Cognitive Services, which help organizations to build robust AI models. In recent developments, Microsoft has launched new AI tools for data labeling and model training, which are part of its strategy to expand industry-specific AI solutions through partnerships with major enterprises.

Appen stands out in the market for its focus on providing high-quality training data that enhances the performance of AI models. The company has recently introduced new platform capabilities aimed at helping enterprises efficiently customize large language models.

AI training dataset market Companies

- Alegion

- Amazon Web Services, Inc.

- Appen Limited

- Cogito Tech LLC

- Deep Vision Data

- Google, LLC (Kaggle)

- Lionbridge Technologies, Inc.

- Microsoft Corporation

- Samasource Inc.

- Scale AI Inc.

Recent Developments

- Lionbridge Technologies, in August 2024, introduced the Aurora AI Studio. This platform supports companies in developing high-quality training datasets needed for advanced AI applications, leveraging Lionbridge’s data curation expertise to boost AI development and commercial outcomes.

- Microsoft Research’s July 2024 launch of AgentInstruct represents a leap in AI training efficiency. This framework automates the creation of synthetic data for AI training, reducing dependence on human data curation and demonstrating notable performance enhancements with the Orca-3 model across various benchmarks.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Bn Forecast Revenue (2034) USD 18.9 Bn CAGR (2025-2034) 22.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Type (Text, Image/Video, Audio), By Vertical (IT, Automotive, Government, Healthcare, BFSI, Retail & E-commerce, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Alegion, Amazon Web Services Inc., Appen Limited, Cogito Tech LLC, Deep Vision Data, Google, LLC (Kaggle), Lionbridge Technologies, Inc., Microsoft Corporation, Samasource Inc., Scale AI Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Training Dataset MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

AI Training Dataset MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alegion

- Amazon Web Services, Inc.

- Appen Limited

- Cogito Tech LLC

- Deep Vision Data

- Google, LLC (Kaggle)

- Lionbridge Technologies, Inc.

- Microsoft Corporation

- Samasource Inc.

- Scale AI Inc.