Global AI Thermostat Market Size, Share, Industry Analysis Report By Product (Standalone Smart Thermostats, Learning Smart Thermostats, Connected Smart Thermostats), By Technology (Wi-Fi, Bluetooth, Zigbee, Others), By Installation Type (Wired, Wireless), By Connectivity (Smartphone-enabled, Voice Assistance-enabled, App-based, Cloud-based), By End-Use Industry (Residential Buildings, Commercial Buildings, Industrial Facilities, RetAIl and Restaurants, Government and Public Buildings, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161222

- Number of Pages: 203

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Quick Market Facts

- Role of Generative AI

- AI Adoption by Industry

- Government-Led Investments

- Energy efficiency and savings

- U.S. AI thermostat Market Size

- Product Analysis

- Technology Analysis

- Installation Type Analysis

- Connectivity Analysis

- End-Use Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

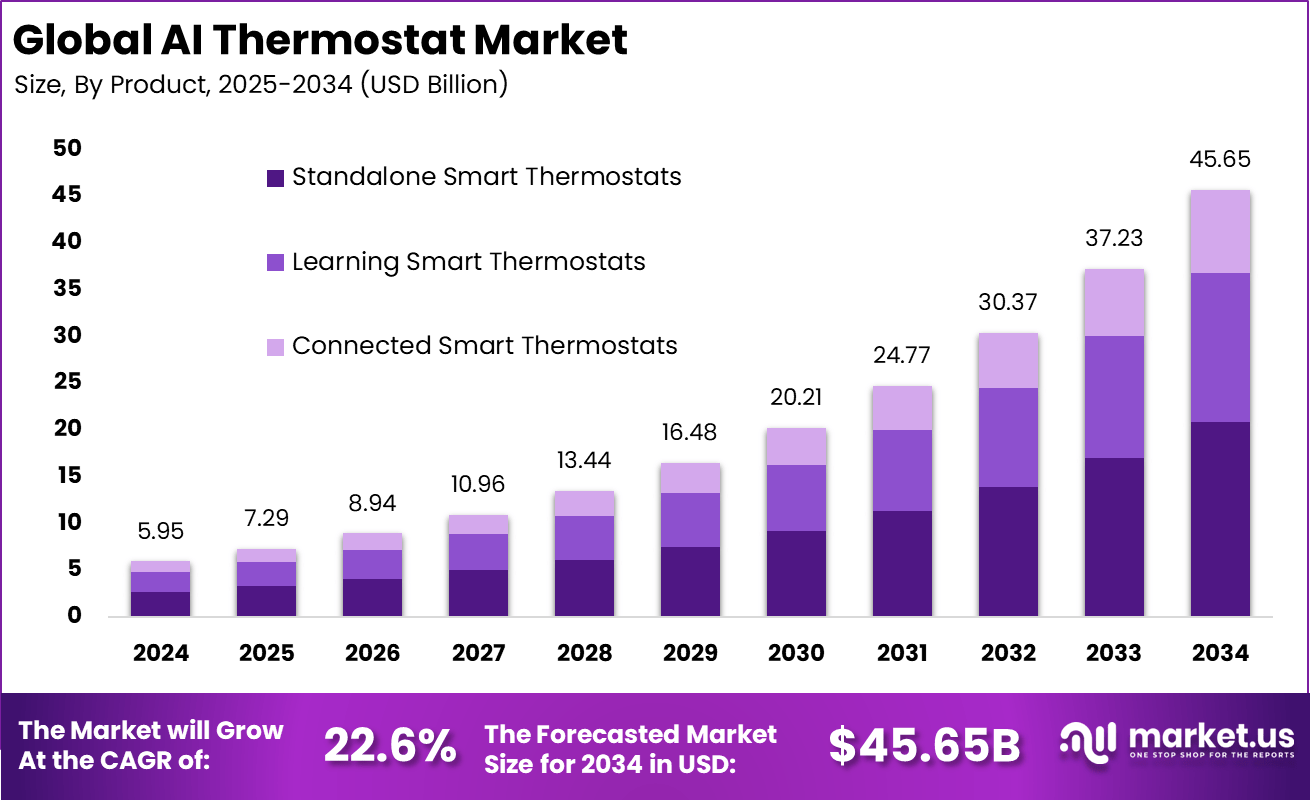

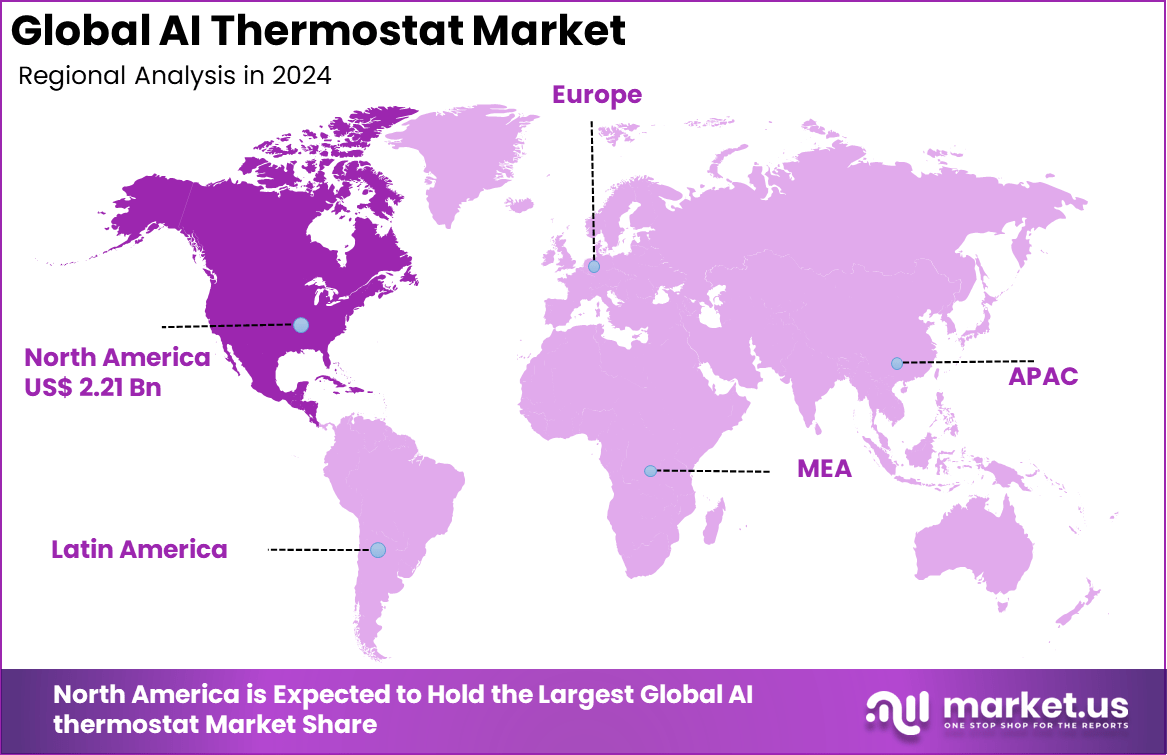

The Global AI Thermostat Market size is expected to be worth around USD 45.65 billion by 2034, from USD 5.95 billion in 2024, growing at a CAGR of 22.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.3% share, holding USD 2.21 billion in revenue.

The AI thermostat market is a subset of the broader smart thermostat and connected home segment, where devices use machine learning, predictive analytics, sensors, and control logic to autonomously optimize heating, ventilation, and air conditioning (HVAC) performance. Unlike simple programmable or WiFi thermostats that follow fixed schedules, AI thermostats adapt based on user habits, weather, occupancy, and energy pricing signals.

The increasing integration of IoT and connectivity features further accelerates adoption, as consumers and businesses seek more streamlined and remote control options for indoor climate management. The trend toward sustainable living and government incentives for energy conservation also play significant roles in expanding the market.

For instance, in August 2024, Google unveiled a new AI-powered Nest Smart Thermostat, designed to deliver smarter energy management and enhanced user comfort. The device incorporates advanced machine learning to anticipate user behavior, optimize heating and cooling schedules, and adapt to changing occupancy patterns.

A primary driver of growth is the demand for energy savings, with AI-enabled thermostats reducing energy costs by intelligently adapting to occupancy patterns and weather conditions. Consumer awareness about carbon footprints and government policies supporting green building practices are also boosting adoption. Additionally, improved comfort and convenience, such as voice control and remote access, influence consumers to choose AI-powered solutions over traditional thermostats.

Businesses see these thermostats as a way to manage large-scale HVAC systems more effectively. The hardware improvements, such as sensors and adaptive algorithms, enable more precise climate control and elevate the user experience. These factors combine to make AI thermostats a central component in smart building strategies.

Quick Market Facts

- By product, standalone smart thermostats dominate with 45.67%, reflecting demand for energy-efficient and connected devices.

- By technology, Wi-Fi-based systems account for 35.8%, enabling remote access and smart home integration.

- By installation type, wired thermostats lead with 64.4%, preferred for reliability in residential and commercial buildings.

- By connectivity, smartphone-enabled devices represent 35.6%, highlighting consumer preference for app-based control.

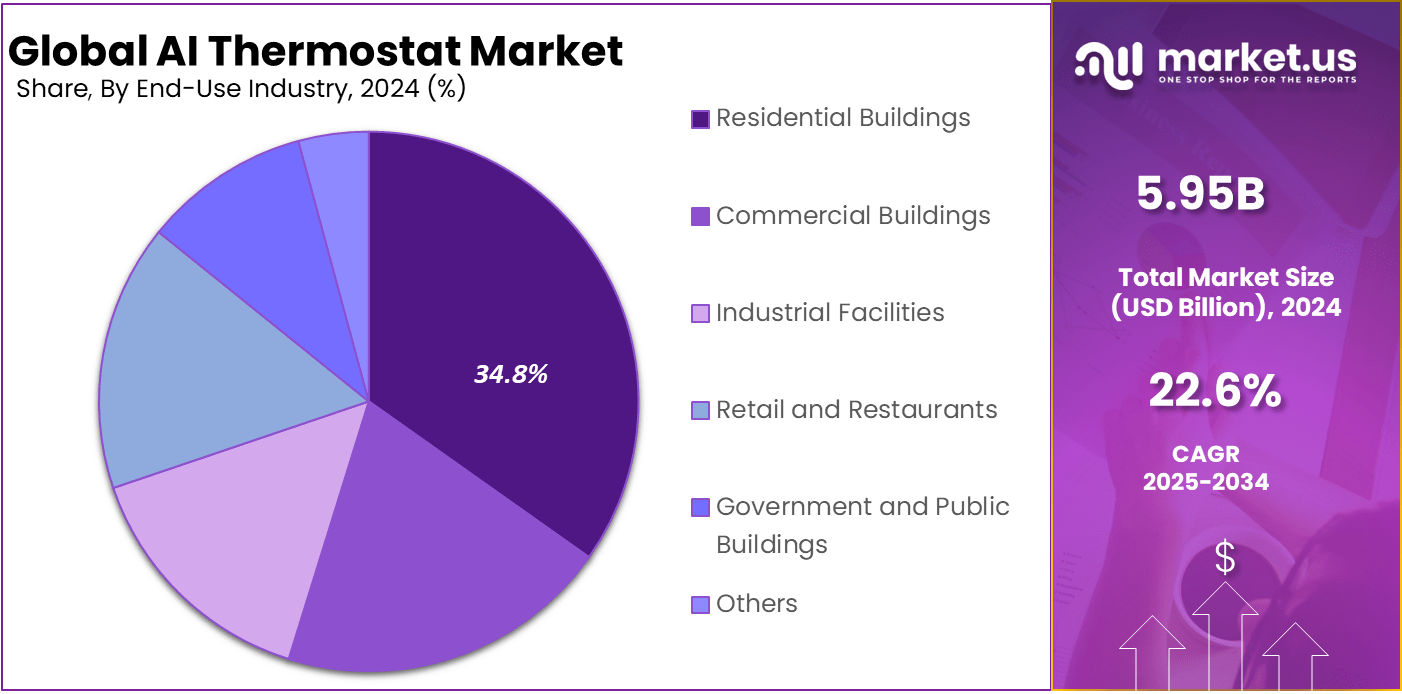

- By end-use industry, residential buildings hold 34.8%, driven by rising adoption of smart home ecosystems.

- North America captures 37.3%, supported by energy efficiency regulations and strong smart home adoption.

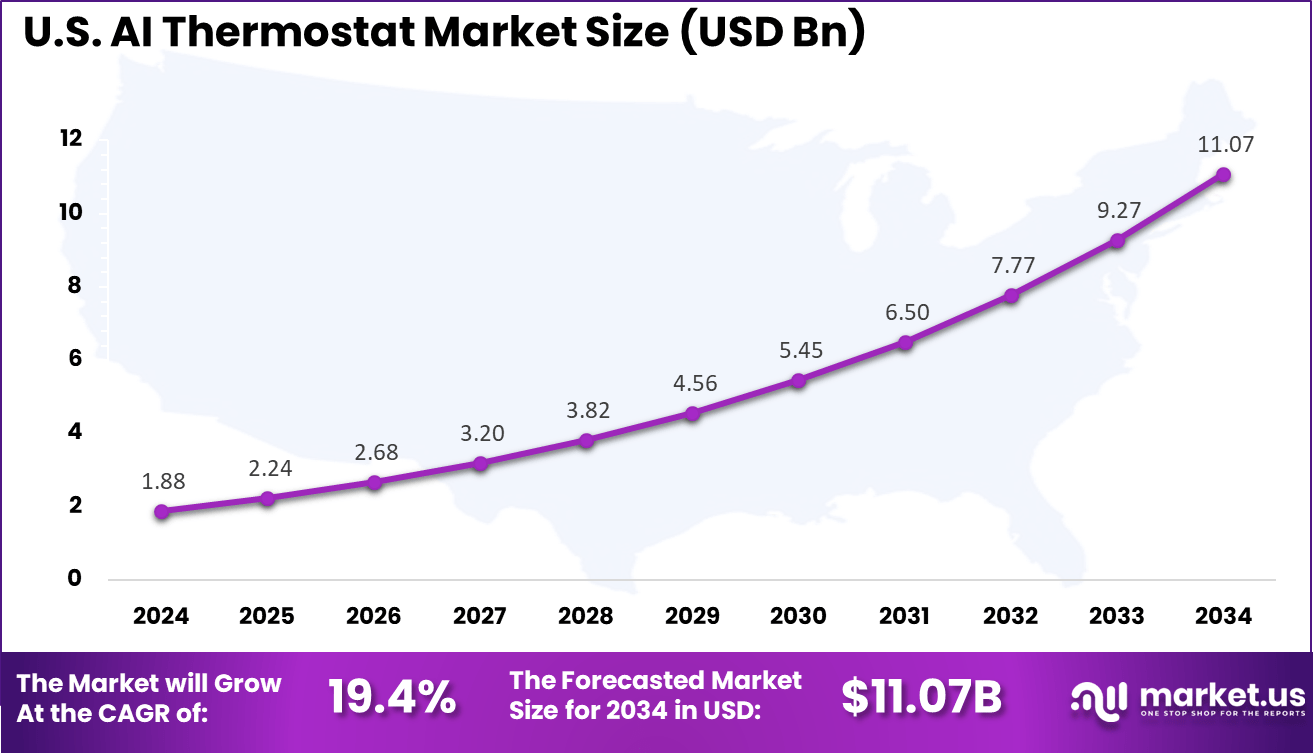

- The US market reached USD 1.88 billion and is expanding at a robust CAGR of 19.4%, underscoring rapid growth in AI-powered home automation.

Role of Generative AI

Generative AI is reshaping the AI thermostat market by enabling devices to learn and anticipate user behaviors in more sophisticated ways. Around 70% of smart thermostat advancements now integrate generative AI algorithms to create personalized heating and cooling patterns.

This technology analyzes not only occupancy but also external weather data and energy price fluctuations to optimize comfort and cost savings automatically. Such AI-driven thermostats reduce energy waste by adapting in real-time, enhancing efficiency without constant user input. This technology also supports seamless integration with smart home ecosystems, allowing voice controls and remote management to be more intuitive.

By using generative AI, thermostats can generate predictions based on historical usage and external conditions, improving indoor climate management while helping users save up to 20% on energy bills. This makes the thermostats proactive devices rather than reactive ones, making modern homes smarter and more energy-conscious.

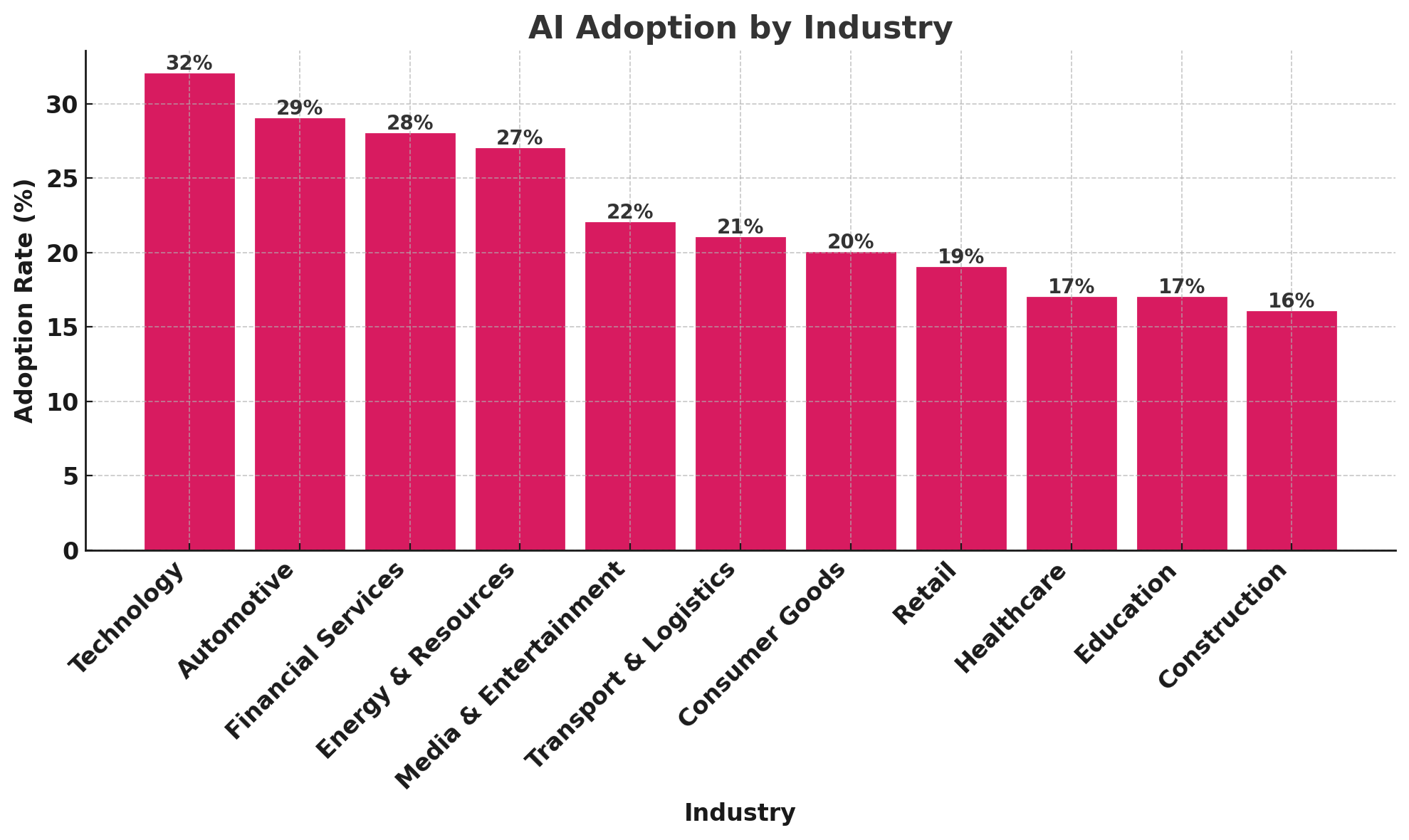

AI Adoption by Industry

Government-Led Investments

Government initiatives play a significant role in accelerating smart thermostat adoption. In the U.S., energy conservation programs offer rebates covering up to 30% of the cost for installing smart thermostats. These incentives make the technology more affordable and encourage consumers to replace older, less efficient heating and cooling systems, boosting market penetration.

In Europe, stricter regulations on building energy performance are pushing commercial and residential sectors to adopt AI thermostats. Nearly 40% of new building projects now mandate smart climate control systems that align with sustainability targets. Governments also invest in smart grid infrastructure, integrating thermostats for demand-response programs that help balance electricity loads and reduce peak energy consumption.

Energy efficiency and savings

AI thermostats have demonstrated measurable energy and cost savings across residential and commercial settings. Google Nest users reported average reductions of 12% in heating and 15% in cooling expenses as the system adapts to user behavior and optimizes schedules.

Similar industry results show Ecobee users saving up to 26% and Copeland Sensi users achieving around 23% in HVAC-related energy reductions. In commercial environments, such as hotels, brands like Anacove have delivered a 12–14 month payback period, driven by lower energy consumption and faster ROI.

U.S. AI thermostat Market Size

The market for AI thermostats within the U.S. is growing tremendously and is currently valued at USD 1.88 billion, the market has a projected CAGR of 19.4%. The market is growing rapidly due to increasing energy costs, strong consumer interest in smart home technologies, and supportive government incentives for energy-efficient appliances.

Consumers are prioritizing solutions that lower utility bills and reduce environmental impact. Additionally, widespread internet connectivity, high smartphone penetration, and the popularity of voice assistants like Alexa and Google Assistant have created a favorable ecosystem. Utility programs promoting demand response and real-time energy management further accelerate adoption across residential and commercial sectors.

In 2024, North America held a dominant market position in the Global AI thermostat Market, capturing more than a 37.3% share, holding USD 2.21 billion in revenue. This dominance is due to its mature smart home ecosystem, tech-savvy consumers, and strong presence of major players like Google Nest and Ecobee.

Early adoption of IoT, widespread internet access, and effective utility-led energy efficiency programs have fueled growth. The launch of innovative, affordable, and compatible products has further expanded market reach. Additionally, growing interest in sustainable living and seamless integration with home automation systems continues to reinforce the region’s leading position in the global market.

For instance, in May 2025, Copeland expanded its partnership with Mysa Smart Thermostats to extend their collaborative offerings across North America. This strategic move strengthens the region’s dominance in the AI thermostat market by combining Copeland’s HVAC expertise with Mysa’s advanced smart thermostat solutions. The partnership focuses on delivering energy-efficient, grid-responsive climate control systems tailored for residential and light commercial buildings.

Product Analysis

In 2024, Standalone smart thermostats command a significant portion of the market with a share of 45.67%. These devices are popular for their user-friendly design and ability to operate independently without requiring integration into complex home automation systems. They offer straightforward control over heating and cooling functions, helping consumers manage energy use effectively and reduce utility bills.

This product category is particularly appealing to homeowners looking for simple yet smart solutions to optimize comfort. Standalone units typically come with features like learning capabilities, remote access, and intuitive interfaces, allowing users to adjust settings via smartphone apps or voice commands. Their ease of installation and compatibility with various HVAC systems contribute to their widespread adoption.

For Instance, in March 2025, Ecobee introduced the Smart Thermostat Essential, a standalone device designed to deliver intelligent climate control at an accessible price point. The thermostat features a simplified interface, reliable energy-saving functions, and compatibility with major voice assistants, making it ideal for users seeking core smart features without the complexity of full smart home integration.

Technology Analysis

In 2024, Wi-Fi technology holds a prominent share of 35.8% in the AI thermostat market. Wi-Fi-enabled thermostats allow users to control their heating and cooling systems remotely through internet-connected devices, enhancing convenience and energy management. The wide availability of Wi-Fi networks in homes and businesses facilitates easy integration, making these thermostats a preferred choice.

Wi-Fi smart thermostats also support advanced features such as AI-driven learning, geofencing, and real-time energy usage analytics. These features provide improved comfort and cost savings by dynamically adjusting temperature settings based on user habits and environmental conditions. The scalability of Wi-Fi connectivity further encourages its adoption in both new installations and retrofit projects.

For instance, in September 2024, Beca launched the BHT-18GBLW Smart Thermostat, a Wi-Fi-enabled device designed to deliver precise climate control with smart learning capabilities. The thermostat features a sleek touchscreen interface, voice assistant compatibility, and app-based remote access.

Installation Type Analysis

In 2024, Wired installation types dominate the market with a share of 64.4%. Wired thermostats offer stable and reliable connections essential for uninterrupted HVAC system control. Their integration into existing wired infrastructure in residential and commercial buildings often makes them the preferred option for new constructions and extensive renovations.

Although wireless options are gaining popularity, wired thermostats maintain their lead due to their dependability in environments where wireless signals may be inconsistent. Additionally, wired systems are favored in installations requiring compliance with stringent safety and performance standards, particularly in larger or industrial settings.

For Instance, in September 2025, Aqara introduced a new wired AI thermostat as part of its product lineup revealed ahead of IFA 2025. Designed for precise temperature control and long-term reliability, the device supports Matter and Apple HomeKit, enabling seamless integration with smart home ecosystems. Its wired configuration ensures continuous power and stable performance, making it well-suited for fixed HVAC systems.

Connectivity Analysis

In 2024, Smartphone-enabled connectivity represents 35.6% of the market segment, reflecting the growing trend of mobile management for home environments. This connectivity allows users to adjust their thermostat settings from anywhere, providing greater flexibility and convenience. Through dedicated apps, homeowners can monitor energy consumption, set schedules, and receive maintenance alerts.

The rise of smartphone-enabled thermostats aligns with the increasing penetration of smart devices and IoT ecosystems. These thermostats often support voice assistants and other smart home integrations, creating a seamless user experience. The ability to control the thermostat remotely also contributes to energy savings by ensuring systems operate only when needed.

For Instance, in August 2025, Google updated its Google Home app to support advanced scheduling features for older Nest thermostats, including the 3rd-generation Nest Learning Thermostat and Nest Thermostat E. This update enables users to create, view, and adjust temperature schedules directly from their smartphones, eliminating the need to switch between the Google Home and Nest apps.

End-Use Industry Analysis

In 2024, Residential buildings account for a substantial 34.8% share in the AI thermostat market. The residential sector benefits greatly from smart thermostats due to the dual demand for energy efficiency and comfort. Homeowners increasingly invest in these technologies to automate climate control and reduce heating and cooling expenses.

Advancements in AI and machine learning empower residential thermostats to learn occupant patterns, adjusting temperature settings proactively. This personalization leads to enhanced comfort and optimized energy use, contributing to a growing adoption rate in single-family homes, apartments, and multi-unit residential complexes.

For Instance, in November 2024, NRG Energy, Renew Home, and Google Cloud announced a collaboration to deploy AI-enabled smart thermostats across residential buildings as part of a large-scale virtual power plant (VPP) initiative. The project aims to optimize energy use in homes by using AI to manage heating and cooling based on real-time grid conditions and household behavior.

Emerging Trends

One strong emerging trend is the shift towards multi-zone climate control, where individual rooms or zones within buildings are regulated independently to maximize comfort and reduce energy costs. More than 55% of new AI thermostats launched in 2025 feature this capability, enabling customized temperatures for different parts of the home or office.

Alongside this, voice assistant compatibility has improved, with over 80% of AI thermostats offering integration with Amazon Alexa, Google Assistant, or Siri, allowing hands-free convenience. Another notable trend is enhanced connectivity to renewable energy systems like solar panels and energy grids.

About 40% of current AI thermostats support real-time energy source monitoring, which helps users optimize usage based on green energy availability. These innovations reflect consumer demand for sustainable living solutions, making AI thermostats crucial in managing both comfort and environmental impact.

Growth Factors

Energy efficiency concerns continue to be a primary driver for adopting AI thermostats. Studies show a 25% increase in consumer preference for devices that demonstrate measurable energy savings. The ability of AI thermostats to learn from user habits and adjust heating or cooling accordingly leads to significant cost reductions in utility bills, which appeals strongly to budget-conscious households and businesses alike.

Additionally, rising smart home adoption fuels growth, with smart home penetration reaching 65% of households in key markets. These thermostats easily fit into broader home automation systems, adding valuable functionality without complexity. User-friendly interfaces and mobile app controls also make managing home temperature convenient, contributing to wider acceptance and faster market growth.

Key Market Segments

By Product

- Standalone Smart Thermostats

- Learning Smart Thermostats

- Connected Smart Thermostats

By Technology

- Wi-Fi

- Bluetooth

- Zigbee

- Others

By Installation Type

- Wired

- Wireless

By Connectivity

- Smartphone-enabled

- Voice Assistance-enabled

- App-based

- Cloud-based

By End-Use Industry

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Retail and Restaurants

- Government and Public Buildings

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Enhanced Energy Efficiency through AI Adaptation

AI thermostats optimize energy use by learning user behavior and adjusting temperature settings accordingly. The AI analyzes occupancy patterns and environmental data to reduce energy waste, leading to significant energy savings and lower utility bills. Consumers benefit from comfort without the need for manual adjustments, making these devices highly attractive for energy-conscious users.

North America has been a leading market due to strong consumer awareness and supportive energy conservation policies. With a growing focus on sustainability globally, especially in Asia Pacific, demand for AI-enabled thermostats continues to rise steadily, boosting overall market growth. This driver reflects how AI improves convenience while promoting responsible energy consumption.

For instance, in November 2024, NRG Energy, Renew Home, and Google Cloud announced a strategic collaboration to accelerate the deployment of smart thermostats integrated with virtual power plant (VPP) capabilities. This partnership aims to enhance grid reliability and customer energy savings by using AI to optimize heating and cooling across thousands of homes. Google Cloud provides the AI and data infrastructure, while Renew Home and NRG leverage their energy platforms and customer reach.

Restraint

High Initial Cost and Installation Complexity

One major restraint for AI thermostats is their relatively high upfront cost. Many potential users hesitate to pay for these devices because installation and integration with existing HVAC systems can be expensive and technically challenging. Additionally, professional installation is often required, which adds to the initial investment and complicates adoption, especially in price-sensitive and developing markets.

These financial and technical barriers slow down widespread adoption despite clear long-term energy saving benefits. Users unfamiliar with smart home technologies may find the setup process intimidating, further reducing market penetration. This restraint highlights the gap between advanced technology benefits and accessible consumer adoption.

Opportunities

Expansion in Emerging Markets and Smart Home Integration

Emerging economies offer a significant growth opportunity for AI thermostats. Rising disposable incomes, increasing urbanization, and growing awareness of energy efficiency propel demand for smart home solutions including AI thermostats. Manufacturers are launching cost-effective models tailored for these regions to tap into new customer bases.

Partnerships with real estate developers also promote integration of smart thermostats in new residential and commercial buildings. Moreover, enhancing compatibility with voice assistants and home automation ecosystems boosts user convenience, encouraging adoption. This opportunity reflects broad potential for market expansion fueled by evolving consumer lifestyles and technological integration

For instance, in August 2024, Google introduced its latest Nest Learning Thermostat, featuring upgraded AI algorithms for improved temperature prediction and energy savings. The new model includes enhanced compatibility with Matter, allowing seamless integration across various smart home ecosystems.

Challenges

Regulatory Compliance and Rapid Technological Change

The AI thermostat market faces challenges from varying regional regulations on energy efficiency, safety, and data privacy. Manufacturers must adapt their products to meet these differing standards, increasing development costs and sometimes delaying releases. Compliance with data security laws is especially critical, as these devices collect sensitive user information for AI learning functions.

Additionally, fast-paced innovation demands continuous investment in R&D. Technology that is cutting-edge today can quickly become obsolete as newer AI algorithms and connectivity standards emerge. Companies that cannot keep up with this pace risk losing competitiveness. Reliable internet connectivity is also a challenge in certain regions, limiting optimal thermostat performance and adoption.

For instance, in September 2025, Tado° introduced Adaptive AI Heating upgrades to its smart thermostat lineup, highlighting the intense competition and need for differentiation in the AI thermostat market. As intelligent climate control features become standard across brands, Tado° aimed to stand out by offering more personalized and predictive heating based on user behavior and real-time conditions.

Key Players Analysis

The AI Thermostat Market is led by major smart home and HVAC technology providers such as Alphabet Inc. (Google Nest), Honeywell International Inc. (Resideo Technologies), Amazon.com, Inc. (via Ecobee partnerships), and Emerson Electric Co. These companies offer AI-powered thermostats that enable automated heating and cooling adjustments, voice control, occupancy sensing, and energy optimization.

Building automation and energy management leaders such as Johnson Controls International plc, Schneider Electric SE, Siemens AG, Bosch Thermotechnology, and Carrier Global Corporation focus on AI-based climate control solutions for residential, commercial, and industrial environments.

Specialized and regional innovators including tado° GmbH, Netatmo (Legrand), Ecobee Inc. (acquired by Generac), Lennox International Inc., LG Electronics Inc., Panasonic Corporation, Trane Technologies plc, Centrica Connected Home (Hive), Ingersoll Rand Inc., Leviton Manufacturing Co., Inc., and Lutron Electronics Co., Inc. contribute with app-based control, learning algorithms, and smart sensor integration.

Top Key Players in the Market

- Alphabet Inc. (Google Nest)

- Amazon.com, Inc. (ecobee, Honeywell partnerships)

- Honeywell International Inc. (Resideo Technologies)

- Emerson Electric Co.

- Johnson Controls International plc

- Schneider Electric SE

- Siemens AG

- Bosch Thermotechnology

- Lennox International Inc.

- Carrier Global Corporation

- tado° GmbH

- Netatmo (Legrand)

- Ecobee Inc. (acquired by Generac)

- LG Electronics Inc.

- Panasonic Corporation

- Trane Technologies plc

- Centrica Connected Home (Hive)

- Ingersoll Rand Inc.

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

- Other Major Players

Recent Developments

- In January 2025, Resideo introduced the Honeywell Home X2S Smart Thermostat at CES 2025. The device features Matter compatibility, ENERGY STAR certification, and built-in indoor air quality monitoring. Designed for simplicity and energy efficiency, the X2S offers enhanced smart control while supporting major smart home platforms.

- In September 2025, Tado° launched AI-powered upgrades for its smart thermostats, introducing a feature called Adaptive AI Heating. This enhancement allows the system to intelligently learn and adjust heating patterns based on user habits, real-time weather data, and occupancy insights.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 13.8 Bn CAGR(2025-2034) 20.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Smart Ovens, Traditional Ovens with AI Features), By Technology (Voice-Activated Technology, Touchscreen Interface, Mobile App Integration, AI-Powered Cooking Assistance), By Application (Residential, Commercial), By Sales Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch, Welbilt, Midea, Haier, VIOMI, June Oven, Markov Corp, Unox Casa, LG, Siemens, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alphabet Inc. (Google Nest)

- Amazon.com, Inc. (ecobee, Honeywell partnerships)

- Honeywell International Inc. (Resideo Technologies)

- Emerson Electric Co.

- Johnson Controls International plc

- Schneider Electric SE

- Siemens AG

- Bosch Thermotechnology

- Lennox International Inc.

- Carrier Global Corporation

- tado° GmbH

- Netatmo (Legrand)

- Ecobee Inc. (acquired by Generac)

- LG Electronics Inc.

- Panasonic Corporation

- Trane Technologies plc

- Centrica Connected Home (Hive)

- Ingersoll Rand Inc.

- Leviton Manufacturing Co., Inc.

- Lutron Electronics Co., Inc.

- Other Major Players