Global AI Sports Analytics Market Size, Share and Analysis Report By Component (Hardware, Software, Services), By Application (Performance & Tactical Analytics, Player Health & Recovery Optimization, Business & Operational Analytics, Athlete Development & Training, Others), By Sports Type (Football (Soccer), Basketball, Baseball, Tennis, Golf, Cricket, Others), By End-User (Professional Sports Teams & Leagues, Sports Betting Operators & Fantasy Sports Platforms, Media & Broadcasting Companies, Sports Associations & Governing Bodies, Educational Institutions (NCAA, etc.), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175035

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Application Analysis

- Sports Type Analysis

- End-User Analysis

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

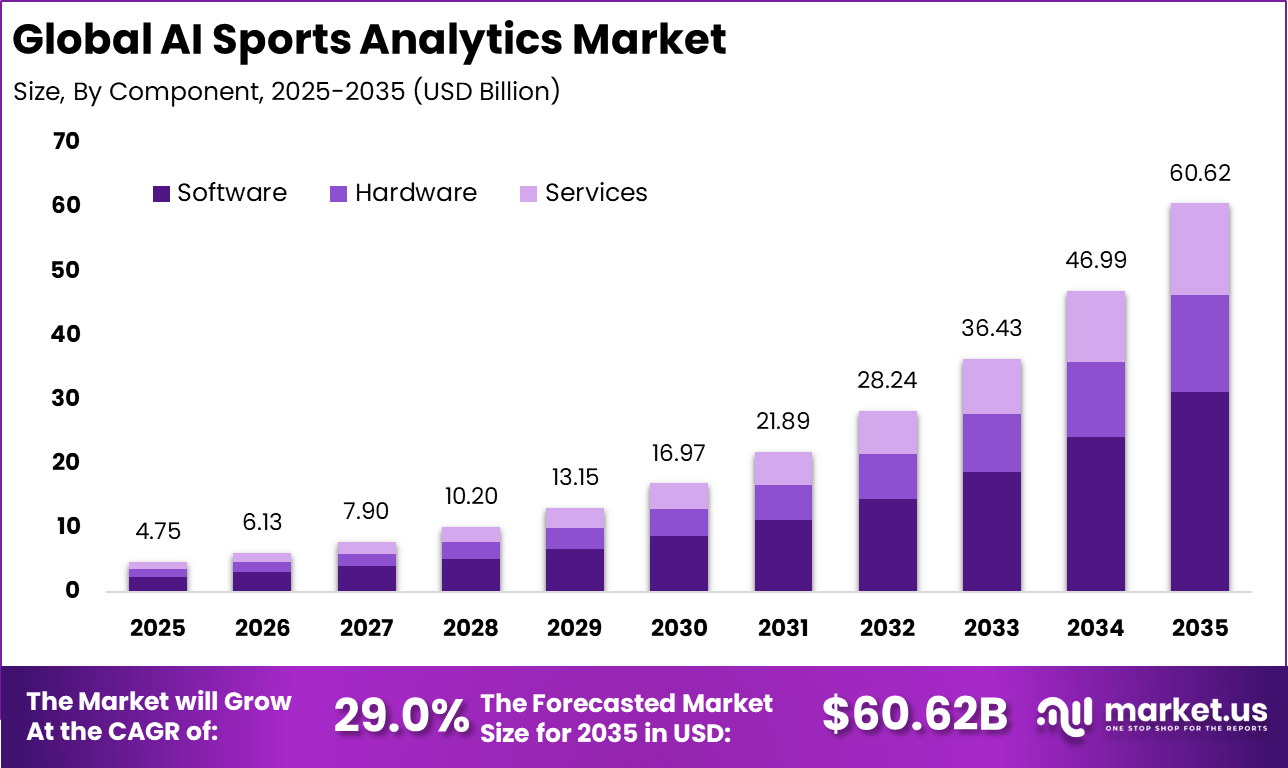

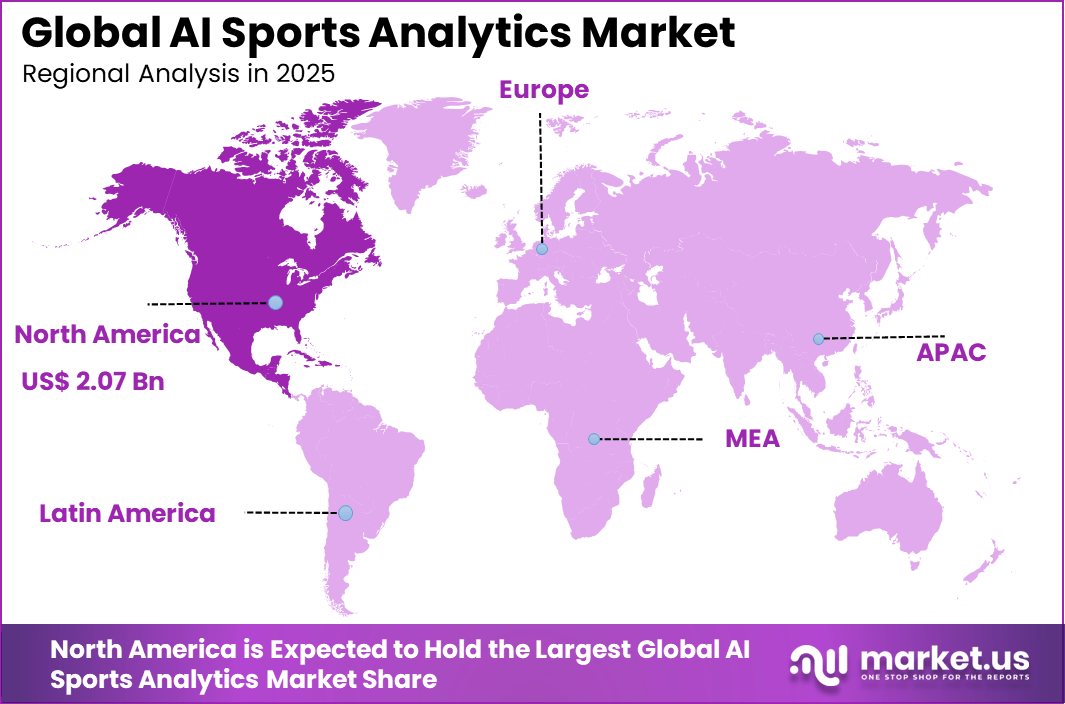

The Global AI Sports Analytics Market size is expected to be worth around USD 60.62 billion by 2035, from USD 751.05 billion in 2025, growing at a CAGR of 29.0% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 43.6% share, holding USD 2.07 billion in revenue.

The AI sports analytics market refers to software platforms that use artificial intelligence to analyze sports data for performance, strategy, and decision support. These solutions process data from matches, training sessions, wearables, and video feeds to generate actionable insights. AI sports analytics tools are used by professional teams, leagues, coaches, analysts, and sports organizations. They support player performance evaluation, tactical planning, and injury risk management. Adoption improves data-driven decision making in sports.

For instance, in August 2025, Genius Sports signed exclusive data deals with 18 European soccer leagues via the European Leagues Association, rolling out its GeniusIQ AI platform. This covers 8,000+ matches yearly, powering real-time betting markets and broadcast visuals. Genius Sports is locking in dominance with AI that turns raw data into instant insights.

One major driving factor of the AI sports analytics market is the need to improve athlete and team performance. Teams seek competitive advantages through deeper insights. AI systems identify performance trends and weaknesses. Data-driven feedback supports targeted training. Performance optimization strongly drives adoption. Another key driver is the growing emphasis on injury prevention and player health. Sports organizations aim to reduce downtime and medical costs.

Key Takeaway

- In 2025, the software segment led the global AI sports analytics market with a 51.4% share, reflecting strong reliance on analytics platforms and AI-driven insights.

- In 2025, performance and tactical analytics dominated applications with a 37.2% share, driven by demand for real-time decision support and match optimization.

- In 2025, football (soccer) held the leading sports segment with a 30.5% share, supported by high data availability and global adoption of AI tools.

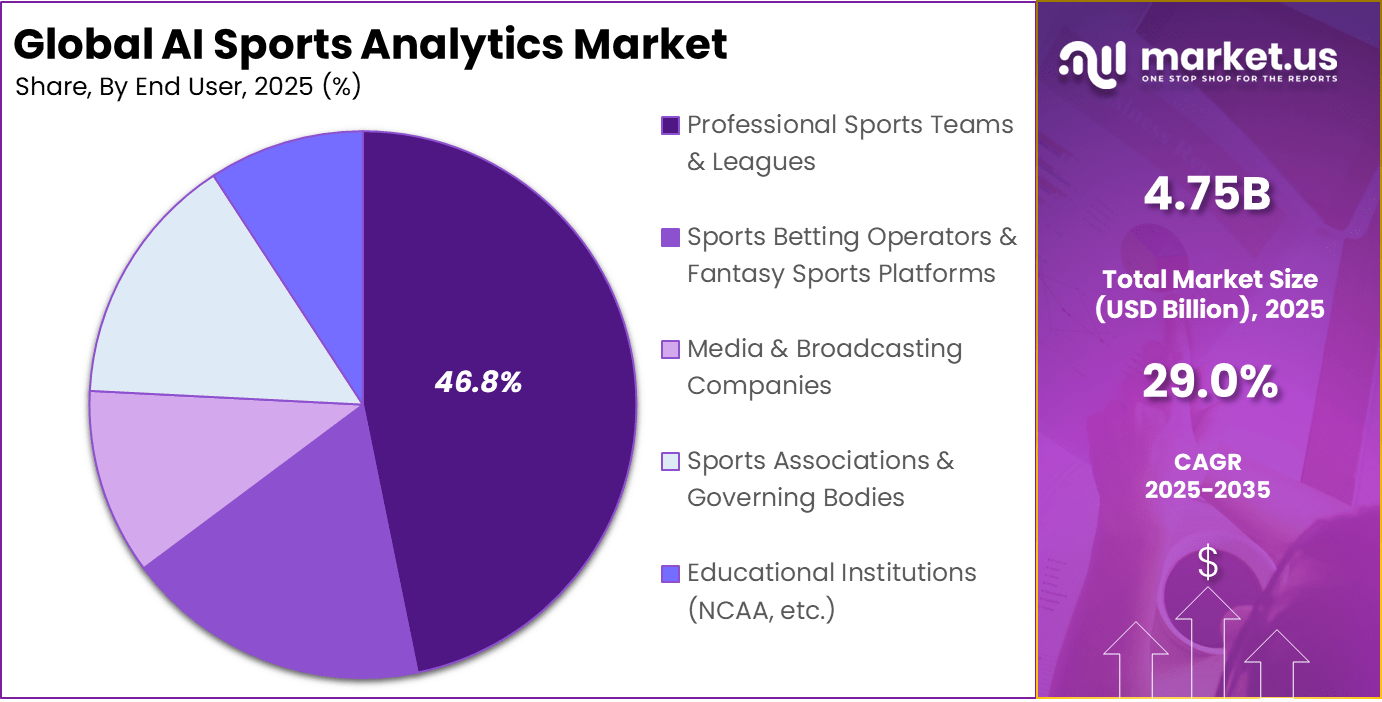

- In 2025, professional sports teams and leagues accounted for 46.8% of adoption, highlighting institutional investment in competitive analytics.

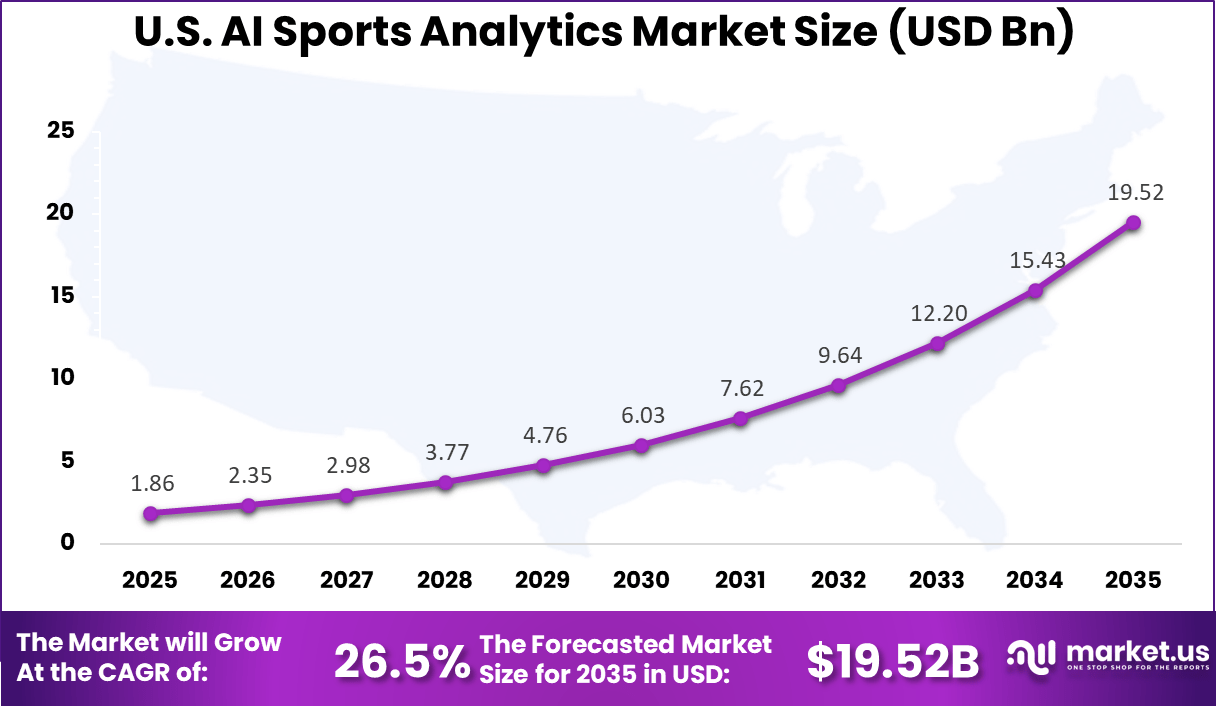

- The U.S. AI sports analytics market reached USD 1.86 billion in 2025, expanding at a 26.5% CAGR.

- North America led the global market in 2025 with more than a 43.6% share, supported by advanced sports technology ecosystems and strong investment levels.

Key Insights Summary

- In 2026, machine learning models improved professional sports decision making accuracy by up to 40%.

- AI driven injury prediction systems reduced player injuries by 30%, lowering financial losses linked to athlete downtime.

- AI powered betting platforms achieved a 62% increase in prediction accuracy compared with traditional models.

- AI systems process over 10,000 records per hour with around 85% forecast accuracy.

- Data analysis time declined by up to 80% due to automation and real time analytics.

- Deep learning models such as CNN LSTM reached a pooled classification accuracy of 92.3%.

- Traditional machine learning methods averaged 78.6% accuracy, showing a clear performance gap.

- During a single NFL game, nearly 250 trackers collect more than 200 data points per play for AI analysis.

- AI systems in the Premier League predict goal scoring opportunities with 76% accuracy up to 15 seconds in advance.

- By 2026, AI chatbots and virtual assistants handle about 50% of all fan interactions.

- Platforms using AI fantasy coaches recorded a 78% increase in user retention.

- Around 38% of professional sports teams now use AI for scouting and recruitment decisions.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on Growth (%) Geographic Relevance Impact Timeline Professional sports digitization Data centric performance optimization ~7.4% North America, Europe Short Term Rising competition intensity Tactical and opponent analysis demand ~6.2% Global Short Term Expansion of football analytics Match, player, and formation modeling ~5.5% Europe, North America Mid Term Integration of AI and ML models Predictive performance insights ~4.8% Global Mid Term Commercialization of sports data Monetization and fan engagement analytics ~3.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact (%) Geographic Exposure Risk Timeline Data inconsistency Incomplete or unstandardized match data ~5.1% Global Short Term Model interpretability Limited trust in AI outputs ~4.3% Global Short Term Privacy and data governance Athlete data protection requirements ~3.7% North America, Europe Mid Term Integration complexity Alignment with coaching workflows ~3.0% Global Mid Term Cost sensitivity Budget constraints for smaller leagues ~2.4% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration High software licensing cost Enterprise grade analytics platforms ~5.6% Emerging Markets Short to Mid Term Limited analytics expertise Shortage of sports data specialists ~4.4% Global Mid Term Resistance to AI adoption Preference for traditional scouting ~3.6% Global Mid Term Data integration challenges Multiple data source complexity ~2.9% Global Long Term ROI uncertainty Performance gains not immediate ~2.2% Global Long Term Component Analysis

Software accounts for 51.4% of the AI sports analytics market, highlighting its role as the core enabler of data-driven sports decision making. Analytics software processes large volumes of match, training, and player data into structured insights. Sports organizations rely on software platforms to centralize analysis and improve operational efficiency.

These solutions support visualization, reporting, and real-time analytics. Coaches and analysts use software dashboards to evaluate performance trends and tactical outcomes. The ability to customize analysis workflows strengthens adoption.

As data intensity in sports continues to rise, demand for advanced analytics software remains strong. Continuous feature enhancements support evolving use cases. This sustains software as the leading component in the market.

For Instance, in November 2025, Hudl acquires ADI to enhance its software with athlete tracking metrics. The platform merges GPS and video data into unified KPIs for load and injury risk, all software-driven. This powers performance analysis across sports, showing why software dominates as it handles multi-source data seamlessly for coaches daily.

Application Analysis

Performance and tactical analytics account for 37.2% of application demand, reflecting the importance of strategy optimization. These tools help teams analyze formations, player positioning, and match dynamics. AI enhances understanding of complex tactical interactions. Teams use tactical analytics to prepare for opponents and refine in-game strategies.

Performance metrics support player evaluation and role optimization. This improves match readiness and competitive outcomes. As competition intensifies, reliance on tactical insights increases. AI-driven analytics provide faster and more accurate evaluations. This application segment remains a key growth driver.

For instance, in January 2026, Teamworks buys Sportlogiq for AI hockey performance tracking. It adds automated video player insights to predict development and prep, blending with existing models. Performance analytics surges as such tech uncovers hidden patterns for better training and scouting in fast team sports.

Sports Type Analysis

Football represents 30.5% of market adoption by sports type, making it the largest contributor. The sport generates extensive data from matches, training, and player tracking systems. AI analytics help process this data efficiently. Football clubs use analytics to assess player performance and tactical execution. Insights support transfer decisions and match preparation.

The complexity of the sport benefits strongly from AI analysis. The global scale of football supports widespread adoption of analytics tools. Clubs seek competitive advantages through data-driven strategies. Football remains a leading sport type in the market.

For Instance, in March 2025, Veo rolls out AI auto-follow cameras for soccer video analysis. It tracks the ball and players automatically for broadcast-quality footage, aiding play breakdowns and highlights. Soccer leads as this tech makes pro-level reviews easy for clubs worldwide, fueling tactical growth in the global game.

End-User Analysis

Professional sports teams and leagues account for 46.8% of end-user demand. These organizations manage performance, competition scheduling, and talent development. AI analytics support strategic and operational decisions. Teams use analytics to monitor player workloads and optimize tactics. Leagues apply analytics to enhance competition quality and fan engagement.

AI-driven insights support long-term planning. As professional sports become more data-centric, adoption continues to grow. Teams and leagues invest in analytics to maintain competitiveness. This segment remains dominant.

For Instance, in September 2025, Genius Sports acquires Sports Innovation Lab for fan data in pro leagues. It bolsters media ops with game data and insights for teams like Premier League users. Pro end-users thrive as combined analytics enhance broadcasts, betting, and engagement for big leagues.

Regional Analysis

North America holds a 43.6% share of the AI sports analytics market, supported by advanced sports infrastructure and technology adoption. Organizations in the region integrate analytics into daily operations. Strong digital ecosystems support rapid deployment.

Region Primary Growth Driver Regional Share (%) Adoption Maturity North America Advanced professional league analytics 43.6% Advanced Europe Football focused tactical analytics 31.2% Advanced Asia Pacific Rapid digitization of sports leagues 16.9% Developing Latin America Talent development analytics 5.2% Developing Middle East and Africa Early professional sports investments 3.1% Early For instance, in March 2025, Veo advanced AI sports analytics with auto-follow camera technology for automated video capture and analysis. The system provides broadcast-level precision in player tracking and tactical insights, making professional-grade analytics accessible to teams at all levels and driving North America’s innovation in sports performance tools.

The United States contributes USD 1.86 billion in market value, driven by adoption across professional leagues and teams. Analytics support performance optimization and business decision making. AI tools align with evolving sports management needs.

A CAGR of 26.5% reflects strong growth momentum across the region. Rising data availability and competitive pressure support expansion. North America remains a leading region for AI sports analytics adoption.

For instance, in December 2025, Second Spectrum continues powering NBA analytics like the Boston Celtics’ defensive strategies using spatiotemporal data and machine learning. This enables precise opponent analysis and shot selection, contributing to competitive edges in professional leagues and highlighting U.S. leadership in advanced AI sports prediction.

Driver Analysis

The AI sports analytics market is being driven by the rising demand for data-driven performance insights, competitive advantage, and enhanced decision making in professional and amateur sports. Teams, coaches, and sports organisations are increasingly leveraging artificial intelligence to analyse performance metrics, player behaviour, game strategies, and injury risk indicators.

AI models process vast volumes of match data, sensor inputs, and historical performance records to reveal actionable insights that support tactical planning, player selection, and training optimisation. As digital tracking technologies and wearable sensors become more prevalent, the need for sophisticated analytics that can interpret complex datasets continues to strengthen adoption of AI-enabled sports analytics solutions.

Restraint Analysis

A significant restraint in the AI sports analytics market relates to data availability, consistency, and standardisation across teams, leagues, and competition levels. High-quality analysis depends on comprehensive, accurate, and structured datasets, yet many organisations face challenges in aggregating performance, biometric, and event data due to varied capture technologies and proprietary formats.

Smaller clubs or lower-tier leagues may lack access to advanced tracking infrastructure, which can limit the depth of AI insights and strengthen the gap between well-resourced and resource-limited teams. Addressing these disparities is essential to extend AI analytics benefits more uniformly across the sporting ecosystem.

Opportunity Analysis

Emerging opportunities in the AI sports analytics market are linked to expanding applications that go beyond on-field performance into fan engagement, broadcast enhancement, and commercial optimisation. AI engines can generate predictive insights for fan behaviour, personalise content recommendations, and automate highlight generation for media distribution, creating new value in fan experience and monetisation.

There is also opportunity in integrating AI analytics with training platforms, rehabilitation systems, and talent development pathways to support long-term athlete growth and injury prevention strategies. As sports organisations seek differentiated insights across competitive and commercial domains, AI analytics platforms that unify performance and engagement data can deliver strategic advantage.

Challenge Analysis

A central challenge confronting this market involves balancing the technical complexity of AI models with interpretability and operational adoption by coaching and support staff. While AI algorithms can produce sophisticated predictions and pattern recognition, stakeholders often require transparent, explainable insights to inform tactical decisions and justify strategic changes.

Ensuring that AI outputs are interpretable, actionable, and aligned with sport-specific contexts demands close collaboration between data scientists, sport scientists, and practitioners. Without clear understanding of model reasoning, adoption may be limited to technical specialists, reducing practical impact on broader team operations.

Emerging Trends

Emerging trends in the AI sports analytics landscape include the rise of real-time analytics that support live decision support during competitions, allowing coaches and analysts to adjust strategies on the fly based on evolving game conditions. There is also growing use of multi-modal data fusion that combines video feeds, sensor measurements, and contextual metadata to build richer performance profiles and situational insights.

Predictive modelling for injury risk assessment, workload management, and player fatigue forecasting is gaining momentum, supporting proactive athlete care and training design. AI-powered fan experience features such as personalised highlights and interactive data visualisations further expand use cases beyond traditional performance analysis.

Growth Factors

Growth in the AI sports analytics market is supported by technological advances in data capture devices, cloud computing, and artificial intelligence frameworks that make complex analytics more accessible and scalable. Sports organisations are under increasing pressure to optimise performance outcomes, reduce injury occurrence, and engage fans in competitive digital environments, all of which drive investment in intelligent analytics solutions.

Additionally, the rising commercialisation of sports through broadcasting, sponsorship, and digital platforms reinforces the strategic value of insights that can improve competitive performance and enhance audience retention. As adoption deepens across professional and emerging levels of sport, AI sports analytics continues to evolve as a foundational element of modern sport management and competition strategy.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Professional sports teams and leagues Very High ~46.8% Competitive advantage Long term platform contracts Sports analytics vendors High ~22% Platform expansion R and D intensive Media and broadcasters Moderate ~14% Content and insights enrichment Selective adoption Sports federations Moderate ~11% Performance benchmarking Program based Amateur organizations Low ~6% Cost sensitive analytics Limited usage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Growth (%) Adoption Status AI and machine learning Player and match performance modeling ~6.9% Growing Video analytics Movement and tactical analysis ~6.1% Mature Cloud analytics platforms Scalable data processing ~5.2% Mature Data visualization tools Coaching and management insights ~4.1% Growing API based data integration Multi source analytics ~3.3% Developing Key Market Segments

By Component

- Hardware

- IoT Devices

- Wearables

- Optical Tracking Cameras

- Others

- Software

- Cloud-based

- On-Premises

- Services

- Consulting

- System Integration

- Support

By Application

- Performance & Tactical Analytics

- Player Health & Recovery Optimization

- Business & Operational Analytics

- Athlete Development & Training

- Others

By Sports Type

- Football (Soccer)

- Basketball

- Baseball

- Tennis

- Golf

- Cricket

- Others

By End-User

- Professional Sports Teams & Leagues

- Sports Betting Operators & Fantasy Sports Platforms

- Media & Broadcasting Companies

- Sports Associations & Governing Bodies

- Educational Institutions (NCAA, etc.)

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in November 2025, Hudl acquired Athletic Data Innovations (ADI), bringing advanced multidirectional athlete tracking to its video analytics platform. ADI’s AI algorithms unify GPS, LPS, and optical data to measure true workload and injury risk with metrics like gait analysis. This move tackles data fragmentation head-on, giving coaches deeper performance insights across football, rugby, and more.

Top Key Players in the Market

- Genius Sports

- Stats Perform (Opta)

- Hudl

- Sportradar

- Catapult

- Second Spectrum

- Veo

- Sportlogiq

- PULSE

- Sports Analytics World

- Real Sports AI

- Vekta

- Balltime

- Zone14

- Sports AI

- BodyPro

- HIT Coach

- GameCam

- Others

Recent Developments

- In January 2026, Teamworks acquired Sportlogiq to supercharge hockey analytics with automated video tracking. Paired with predictive AI models, it now offers talent scouting and game prep insights invisible to the eye, building a full data platform for pro teams.

- In December 2025, Sportradar completed its IMG Arena acquisition, boosting AI innovations like GenAI audio ads and Alpha Odds for cricket. With 150+ AI scientists and 100 use cases, they’re transforming fan engagement and betting from 1M+ games yearly, cementing their sports tech momentum.

Report Scope

Report Features Description Market Value (2025) USD 4.7 Bn Forecast Revenue (2035) USD 60.6 Bn CAGR(2026-2035) 29% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Application (Performance & Tactical Analytics, Player Health & Recovery Optimization, Business & Operational Analytics, Athlete Development & Training, Others), By Sports Type (Football (Soccer), Basketball, Baseball, Tennis, Golf, Cricket, Others), By End-User (Professional Sports Teams & Leagues, Sports Betting Operators & Fantasy Sports Platforms, Media & Broadcasting Companies, Sports Associations & Governing Bodies, Educational Institutions (NCAA, etc.) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Genius Sports, Stats Perform (Opta), Hudl, Sportradar, Catapult, Second Spectrum, Veo, Sportlogiq, PULSE, Sports Analytics World, Real Sports AI, Vekta, Balltime, Zone14, Sports AI, BodyPro, HIT Coach, GameCam, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Sports Analytics MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI Sports Analytics MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Genius Sports

- Stats Perform (Opta)

- Hudl

- Sportradar

- Catapult

- Second Spectrum

- Veo

- Sportlogiq

- PULSE

- Sports Analytics World

- Real Sports AI

- Vekta

- Balltime

- Zone14

- Sports AI

- BodyPro

- HIT Coach

- GameCam

- Others