Global AI Shopping Assistant Market Size, Share, Industry Analysis Report By Offering (Solution, Services), By Technology (Natural Language Processing (NLP), Machine Learning (ML), Computer Vision (CV), Others), By Type (Voice, Text, Visual, Multimodal), By End-use (BFSI, Retail & E-Commerce, Healthcare, Travel & Hospitality, Media & Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 166997

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaway

- Consumer Adoption and Usage

- Business Impact and Effectiveness

- Role of Generative AI

- U.S. Market Size

- Offering Analysis

- Technology Analysis

- Type Analysis

- End-use Analysis

- Investment and Business Benefits

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

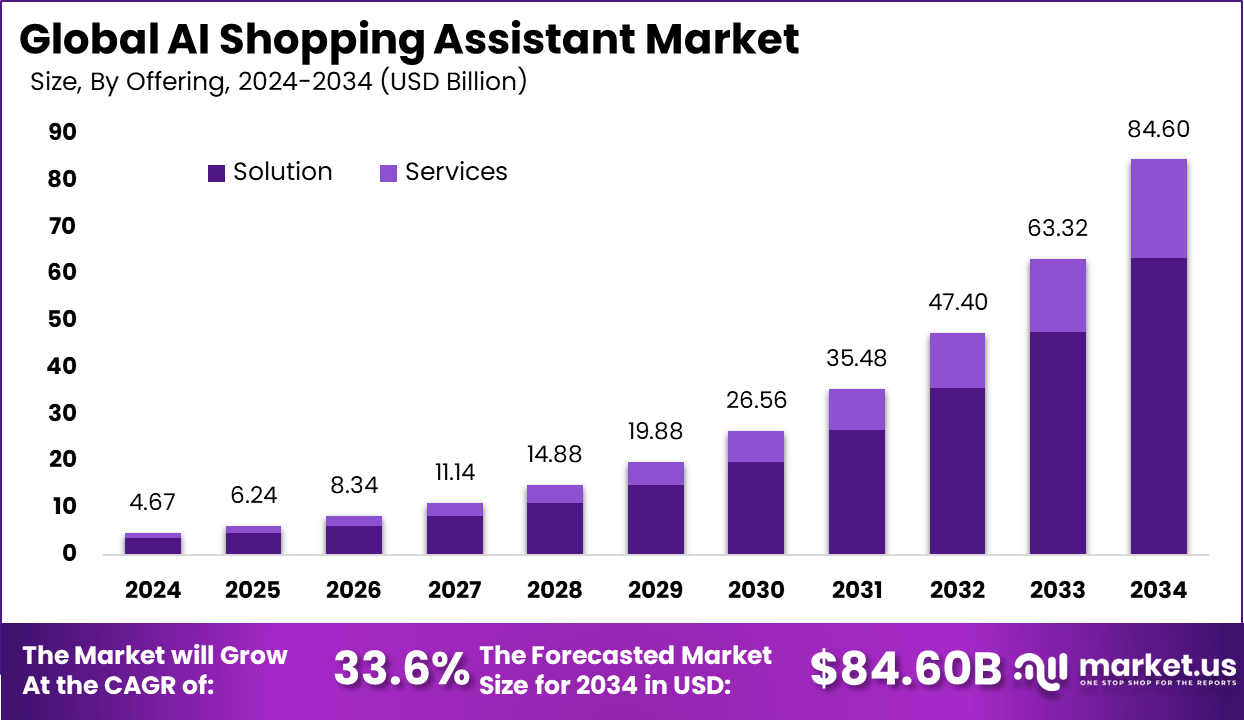

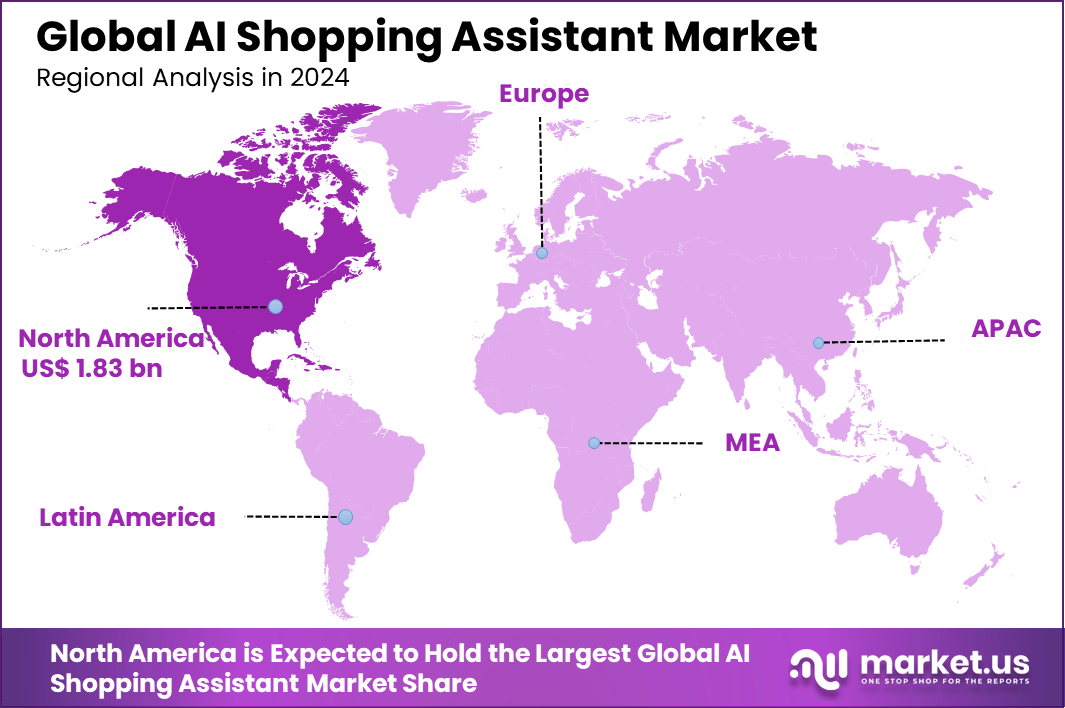

The Global AI Shopping Assistant Market size is expected to be worth around USD 84.60 billion by 2034, from USD 4.67 billion in 2024, growing at a CAGR of 33.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.4% share, holding USD 1.83 billion in revenue.

The AI shopping assistant market has expanded as retailers and e commerce platforms deploy intelligent systems that guide consumers through product discovery, comparison and purchase decisions. Growth reflects rising expectations for personalised shopping support and increasing use of conversational interfaces. These assistants operate across mobile apps, websites and smart devices, providing real time recommendations and simplified checkout experiences.

Top driving factors behind the rise of AI shopping assistants include increasing consumer demand for personalized experiences and the need for retailers to automate customer support efficiently. Many shoppers, around 31%, expect virtual assistants to help them select products tailored to their specific needs. Additionally, the convenience of voice-activated technology through smart speakers and smartphones has made hands-free shopping a popular trend, boosting AI assistant usage.

Demand analysis reveals growing adoption across both online and physical retail environments. Retailers using AI shopping assistants report higher customer engagement and satisfaction thanks to personalized product suggestions and quicker responses to queries. These assistants analyze shopper behavior and preferences to provide tailored recommendations, often leading to increased sales through upselling and cross-selling.

For instance, in November 2025, Meta Platforms, Inc. expanded its AI shopping assistant beyond ads to retail websites, integrating it on Facebook, Instagram, WhatsApp, and Shopify. This AI assistant helps with product recommendations and streamlines purchases, with CRM partners like Salesforce and Microsoft supporting integration.

Top Market Takeaway

- The Solution segment led the global landscape with a 75.2% share, driven by rising adoption of AI-powered recommendation engines, virtual assistants, and automated shopping support tools.

- Natural Language Processing (NLP) dominated the technology segment with 45.6%, reflecting its importance in enabling conversational product search, personalized guidance, and intent-based shopping experiences.

- The Voice interface segment accounted for 42.6%, supported by the increasing use of voice-controlled shopping on mobile devices, smart speakers, and in-app assistants.

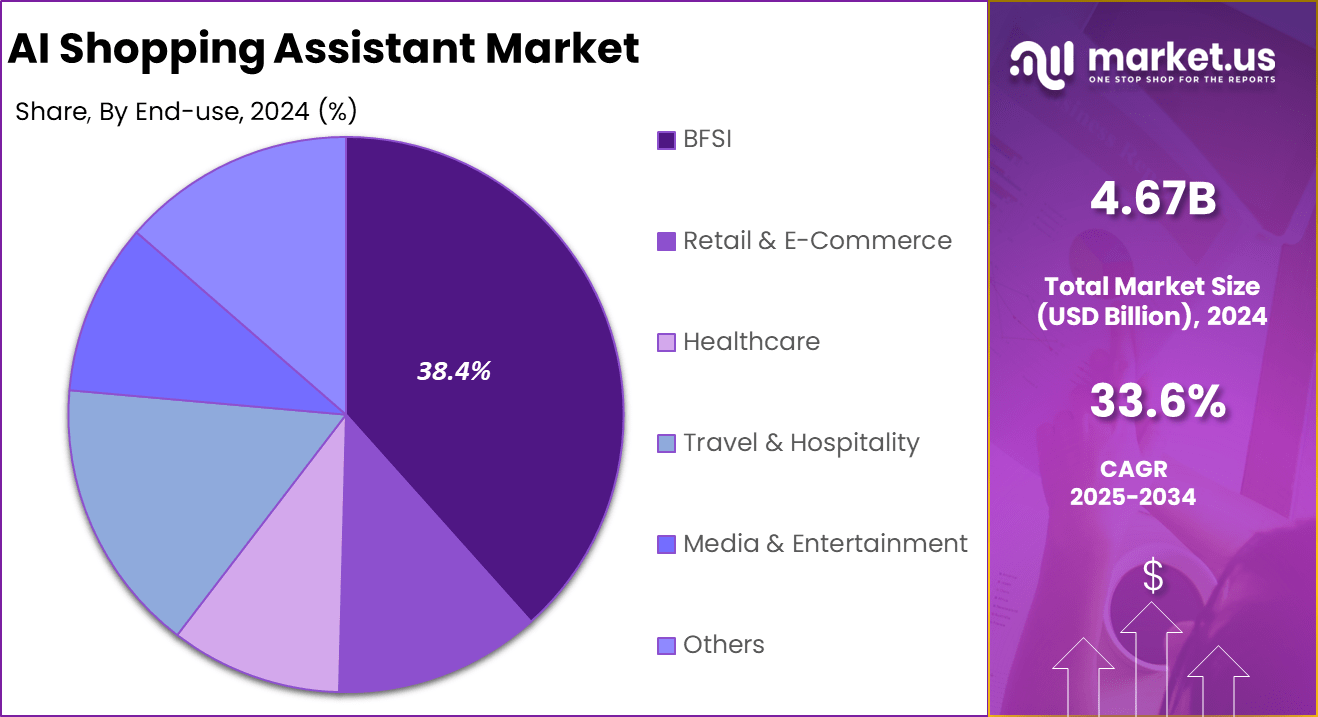

- The BFSI sector held a strong 38.4% share, as financial institutions leverage AI shopping assistants for product discovery, financial comparisons, and personalized customer engagement.

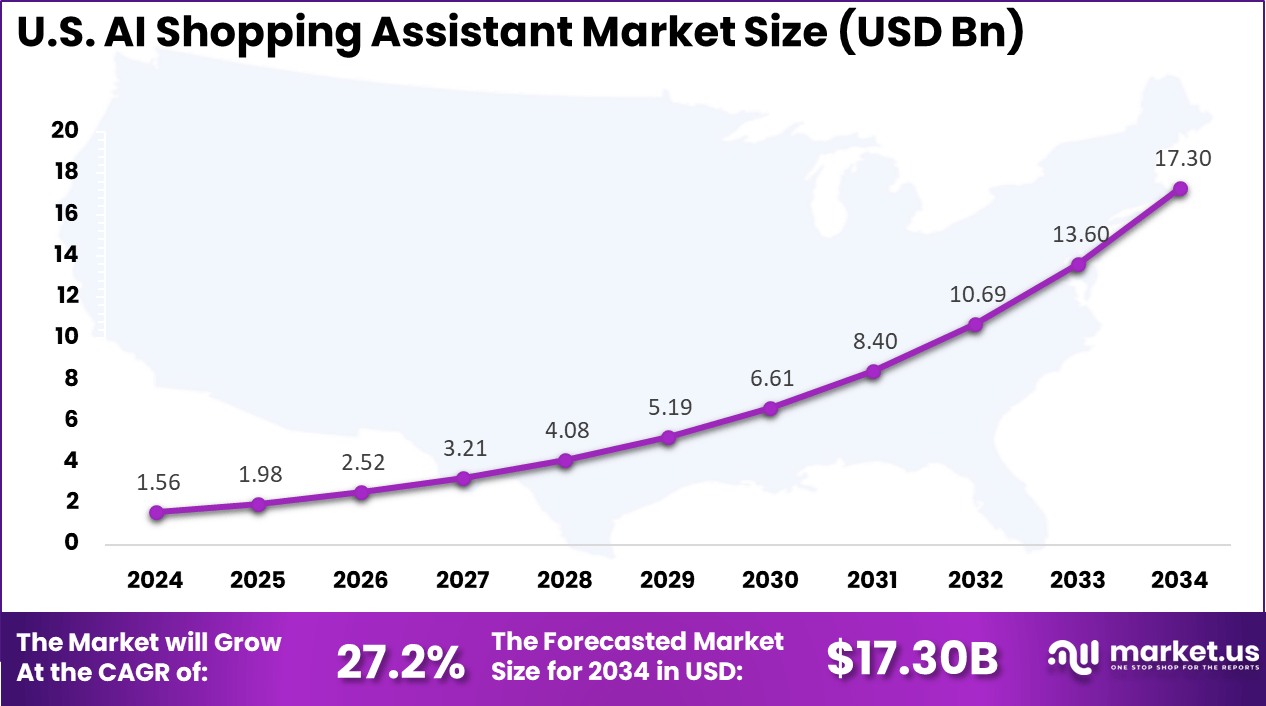

- The U.S. market reached USD 1.56 billion in 2024, expanding at a robust 27.2% CAGR, driven by high e-commerce penetration and rapid integration of conversational AI in retail platforms.

- North America maintained leadership with more than 39.4% share, supported by advanced AI ecosystems, strong investment in digital commerce technologies, and widespread consumer adoption of intelligent shopping assistants.

Consumer Adoption and Usage

- General Awareness vs. Usage: Around 70% of shoppers have tried AI tools, but fewer than 15% use retailer-branded AI shopping assistants.

- Generational Divide: Adoption is highest among younger consumers, with 24% of Gen Z using AI shopping assistants compared with 7% of Boomers.

- Primary Use Cases: Shoppers rely on AI mainly for product research (53%), recommendations (40%), and deal discovery (36%).

- Trust Gap: Only 34% of U.S. consumers feel comfortable allowing AI to complete purchases for them, and 21% question the reliability of AI recommendations.

Business Impact and Effectiveness

- Revenue and Sales: AI-driven personalization can increase revenue by 10–40%, and 64% of AI-powered sales are attributed to first-time shoppers.

- Conversion Rates: AI chat tools can raise conversion rates from 3.1% to 12.3%, showing a strong link between engagement and purchase behavior.

- Operational Efficiency: Some AI assistants resolve up to 93% of customer inquiries without human support. Klarna’s AI assistant handled work equal to 700 full-time agents in its first month.

- Speed and Satisfaction: AI enables purchases to be completed 47% faster, and 78% of shoppers prefer the personalized experiences that AI helps deliver.

Role of Generative AI

Generative AI has become a vital part of AI shopping assistants by enabling highly personalized product suggestions that feel natural and tailored to each shopper’s preferences. Around 39% of consumers already use generative AI when shopping online, with over 50% planning to use it this year.

This technology powers real-time conversational interactions, helping users find the right products quickly while mimicking human-like guidance. It also supports virtual try-ons and dynamic content creation, transforming static online stores into engaging, interactive experiences personalized just for the customer.

This form of AI analyzes vast amounts of historical data and shopping patterns to predict what consumers might want next, enhancing the relevance of product recommendations. By automating tasks such as demand forecasting and fraud detection, generative AI not only improves the customer experience but also streamlines backend retail operations, contributing to higher satisfaction and sales efficiency in a seamless way.

U.S. Market Size

The market for AI Shopping Assistant within the U.S. is growing tremendously and is currently valued at USD 1.56 billion, the market has a projected CAGR of 27.2%. This expansion is driven by increasing consumer demand for personalized, convenient shopping experiences and retailers’ efforts to improve engagement and operational efficiency.

Advances in AI technologies like natural language processing and voice assistants enable more natural, seamless interactions between shoppers and digital platforms. Additionally, the growing adoption of AI solutions across e-commerce and physical retail stores is fueling market momentum, supported by continuous innovation and rising digital transformation initiatives across the retail sector.

For instance, in November 2025, Amazon.com launched upgrades to its AI assistant “Rufus”, which can search for products based on activity or events, automatically add items to carts, track deals, and interact using natural conversation. Amazon’s AI shopping assistant enhances personalization and ease of purchase across a broad selection of products.

In 2024, North America held a dominant market position in the Global AI Shopping Assistant Market, capturing more than a 39.4% share, holding USD 1.83 billion in revenue. This leadership stems from the region’s advanced technological infrastructure, high internet penetration, and early adoption of AI technologies by major retailers and tech companies.

The widespread consumer readiness for personalized and convenient shopping experiences also drives adoption. Key players headquartered in the region, including Microsoft, Google LLC, and Amazon.com, Inc., continue to develop AI solutions that enhance retail operations and improve customer engagement, fueling the region’s strong market presence.

For instance, in November 2025, Google LLC expanded AI shopping capabilities with conversational search, agentic checkout, and an AI feature that calls stores to check product availability and prices. This advanced AI ecosystem aims to reduce friction in online shopping and make the experience more intuitive by handling price tracking and purchasing tasks on behalf of consumers.

Offering Analysis

In 2024, The Solution segment held a dominant market position, capturing a 75.2% share of the Global AI Shopping Assistant Market. This dominance reflects the strong preference of retailers for comprehensive AI solutions that include recommendation engines, virtual assistants, and voice-activated tools.

These solutions help businesses better engage customers, improve conversion rates, and streamline operational efficiency across multiple sales channels like websites, mobile apps, and social media platforms. Retailers favor solutions that are ready to deploy and scalable, enabling them to enhance personalized shopping experiences effectively.

This segment remains popular because it directly addresses the core needs of retailers aiming to deliver seamless, interactive, and data-driven shopping experiences. The broad adaptability of these solutions to different retail environments, from online to physical stores with digital kiosks, highlights why this segment holds a commanding position in the market.

For Instance, in August 2025, Shopify Inc. emphasized AI agents in commerce, building assistant tools like Catalog and Universal Cart to automate product discovery and purchase processes, making personalized shopping seamless and boosting conversion rates with smarter AI solutions.

Technology Analysis

In 2024, the Natural Language Processing (NLP) segment held a dominant market position, capturing a 45.6% share of the Global AI Shopping Assistant Market. NLP’s ability to understand and process human language makes it invaluable for creating conversational AI tools that shoppers can interact with naturally. By enabling chatbots and voice assistants to comprehend customer queries and respond intelligently, NLP improves user engagement and satisfaction.

This technology has become a pillar in AI shopping assistants because it allows consumers to find products, get recommendations, and complete transactions using simple text or voice commands. The ongoing advancements in NLP continue to enhance the quality of interactions, making shopping smoother and more intuitive for users.

For instance, in November 2025, Alibaba Group Holding Limited introduced AI Mode, featuring deep search powered by large language models for natural language queries. This helps users automatically analyze and compare suppliers, supporting a fully automated trade experience with AI capabilities embedded within their platform.

Type Analysis

In 2024, The Voice segment held a dominant market position, capturing a 42.6% share of the Global AI Shopping Assistant Market. Voice interaction provides customers with hands-free, convenient access to shopping assistance, which aligns well with today’s growing trend towards voice-activated devices and smart speakers. Voice assistants not only answer product questions but also support tasks such as placing orders and tracking deliveries.

The appeal of voice AI shopping assistants is rooted in their ability to offer a natural and efficient shopping experience, particularly for busy consumers who prefer quick spoken commands over typing. This type is a critical factor in driving adoption, especially as voice recognition technologies keep improving accuracy and responsiveness.

For Instance, in November 2025, Google LLC announced enhancements to AI-based conversational shopping in Google Search, including an agentic checkout and AI that can even call stores to check product availability. These voice-enabled features are designed to simplify and naturalize the shopping experience.

End-use Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 38.4% share of the Global AI Shopping Assistant Market. Financial services firms use these AI tools to offer personalized recommendations on insurance, loans, or banking products, improving how they support customers. By automating responses and driving tailored engagement, AI assistants help BFSI companies build better client relationships with less manual effort.

This adoption reflects BFSI’s push for digital transformation aimed at meeting customer expectations for fast, personalized, and easily accessible service. AI assistants in this sector also help improve efficiency by handling inquiries and guiding consumers through complex financial products smoothly.

For Instance, in September 2025, Microsoft Corporation launched a preview of its Personal Shopping Agent, providing brand-specific, conversational AI experiences for retail and BFSI sectors. The tool supports guided product discovery and personalized shopping assistance online and in-store.

Investment and Business Benefits

Investment opportunities abound in developing and deploying AI shopping assistant technologies, especially in voice interaction, predictive analytics, and multilingual support. As retailers prioritize seamless omnichannel experiences, there is increasing demand for AI solutions that integrate across websites, mobile apps, and social media platforms.

From a business benefits perspective, AI shopping assistants help increase revenue through higher conversion rates and better up/cross-selling, lower support costs by automating FAQs and order tracking, and improved customer retention from personalized experiences. Retailers gain actionable insights from shopper data to optimize inventory and marketing campaigns.

Emerging trends

One of the biggest trends in AI shopping assistants is the rise of agentic AI that anticipates needs before shoppers express them. Over half of online shoppers now expect their digital shopping experience to be proactive, with AI suggesting products on its own based on subtle behavioral cues and contextual data.

Virtual try-ons using augmented reality also continue to gain strong adoption, particularly in fashion and beauty sectors, where customers prefer to visualize items before buying to reduce returns and boost confidence.

Another important trend is the voice-activated shopping assistants that enable hands-free, conversational commerce, allowing users to add items to carts, track prices, and even check out using natural speech. Nearly 40% of shoppers are using voice or chat-driven AI assistants now, and businesses are embedding these tools across websites, mobile apps, and social platforms to meet customers wherever they prefer to shop.

Growth Factors

The growth of AI shopping assistants is mainly driven by rising consumer demand for personalized, smooth shopping journeys. Shoppers today want customized product options without the hassle of sifting through many irrelevant choices, and AI meets this by leveraging real-time data to provide accurate suggestions.

Additionally, as digital commerce expands worldwide, retailers are under pressure to improve customer support, making automated AI helpers a practical solution that cuts costs and enhances engagement. Another key factor is the increasing availability of multilingual AI assistants that cater to global audiences, opening up large new customer bases for retailers.

Ethical AI use is also gaining focus, encouraging brands to build trust by ensuring AI shopping experiences are respectful of privacy and fairness. Together, these elements create a strong foundation for ongoing adoption and innovation in AI-assisted shopping.

Key Market Segments

By Offering

- Solution

- Services

By Technology

- Natural Language Processing (NLP)

- Machine Learning (ML)

- Computer Vision (CV)

- Others

By Type

- Voice

- Text

- Visual

- Multimodal

By End-use

- BFSI

- Retail & E-Commerce

- Healthcare

- Travel & Hospitality

- Media & Entertainment

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Personalized Shopping

Consumers today want shopping experiences that feel personal and straightforward. AI shopping assistants use advanced technology to suggest products based on individual preferences and past behavior. This level of personalization helps shoppers find exactly what they want without sifting through countless options, making the process faster and more satisfying.

The rise in digital shopping and higher disposable incomes worldwide also support this trend. Customers appreciate AI’s ability to provide timely recommendations and simplify decision-making. Retailers who adopt these tools see better engagement and more sales, pushing the market forward. This demand for tailored experiences is a key force driving the growth of AI shopping assistants.

For instance, in November 2025, Amazon upgraded its next-generation AI shopping assistant, Rufus, making it smarter and more conversational. Rufus now uses over 50 technical improvements to better recommend products, assist with decisions, and automatically add items to carts based on shoppers’ past activity. Amazon’s goal is to save customers time and money by simplifying online shopping across 35+ product categories with real-time insights and personalized help.

Restraint

Concerns Over Data Privacy and Bias

AI shopping assistants rely heavily on collecting personal details like browsing habits and purchase history to offer custom suggestions. However, this raises worries about data privacy among users. Many shoppers hesitate to share sensitive information due to fears of misuse or data breaches. Strict privacy rules in different regions also make it harder and costlier for retailers to use AI freely.

Another issue is algorithmic bias. If the training data has unfair preferences or is regionally skewed, the AI might only recommend certain products, limiting options and creating a skewed shopping experience. This can harm brands and reduce trust in AI tools. These privacy and fairness concerns slow down the wider acceptance of AI shopping assistants.

For instance, in November 2025, Alibaba launched its Qwen AI chatbot with strong multimodal and conversational features. However, the company is aware of privacy and trust issues in AI shopping, planning to tightly control data use and build transparency as it integrates AI shopping capabilities into Taobao and Tmall. This highlights ongoing challenges with managing customer data privacy while advancing AI shopping assistants in China’s regulatory environment.

Opportunities

Expanding Use of Multilingual and Ethical AI

There is a growing chance for AI shopping assistants to tap into new customer groups by supporting multiple languages and practicing ethical AI. Retailers are increasingly focused on building AI systems that respect user privacy and provide transparent, fair recommendations. This approach helps win customer trust and complies with regulations in various countries.

As natural language processing improves, AI assistants can engage shoppers in their native languages, serving more diverse markets globally. The ability to handle complex queries and provide better support across cultures opens up new revenue opportunities. Retailers who invest in ethical and multilingual AI systems are well placed to lead this expanding market.

For instance, in October 2025, Salesforce introduced Agentforce Commerce, enabling merchants to deploy conversational AI shopping assistants that integrate deeply with their digital storefronts and customer data platforms. This allows brands to create agentic, highly personalized shopping tools that can work across channels and languages, improving global customer reach and ethical AI use by keeping brand control intact.

Challenges

Technical Complexity and Integration Issues

Creating effective AI shopping assistants requires large amounts of high-quality data and powerful computing resources. Gathering consistent and clean customer data is difficult, especially when it is spread across multiple platforms. Integration with existing retail systems can be complex and costly, often leading to fragmented user experiences.

Moreover, AI models still struggle with understanding nuanced or complicated queries, which frustrates shoppers when recommendations miss the mark. Retailers must continuously improve their AI’s accuracy and ensure smooth operation across websites, apps, and social media. Overcoming these technical hurdles is essential for scaling AI assistants and achieving reliable performance.

For instance, in August 2025, Shopify promoted its AI Shopping Assistant, which queries the company’s live product catalog in real time to answer detailed, natural language requests. However, this relies heavily on merchants maintaining detailed, consistently structured product data and integrating these AI functions with multiple sales and marketing platforms. These complexities reflect broader challenges of deploying effective AI shopping tools with smooth cross-system operation.

Key Players Analysis

Alibaba, Shopify, Salesforce, and eBay lead the AI shopping assistant market with strong capabilities in product discovery, recommendation engines, and personalized buying support. Their platforms use behavioral data and real-time analytics to guide shoppers through optimized purchase journeys. These companies focus on faster decision-making, improved conversion rates, and seamless omnichannel experiences.

Google, Amazon, Meta, Microsoft, and Adobe expand the competitive landscape with advanced conversational AI, visual search, and predictive modeling. Their solutions help customers compare products, evaluate alternatives, and receive tailored suggestions. Integration with voice assistants, mobile apps, and advertising networks enhances user engagement.

IBM and other emerging participants add market depth through customizable AI assistants designed for retailers, brands, and marketplaces. Their systems include automated customer support, real-time query resolution, and intelligent product matching. These providers focus on improving accuracy, reducing service costs, and supporting complex inventory environments.

Top Key Players in the Market

- Alibaba Group Holding Limited

- Shopify Inc.

- Salesforce, Inc.

- eBay Inc.

- Google LLC

- com, Inc.

- Meta Platforms, Inc.

- Microsoft

- Adobe Inc.

- IBM Corporation

- Others

Recent Developments

- In October 2025, Alibaba Group Holding Limited launched the Quark AI Chat Assistant, a conversational AI tool supporting images, voice, and text to aid shoppers. It’s powered by their advanced Qwen3 large language models and integrates with Alibaba’s e-commerce ecosystem, including Taobao.

- In November 2025, Amazon.com, Inc., enhanced its AI shopping assistant “Rufus” with smarter, context-aware capabilities. Rufus now helps shoppers by understanding activities or events, adding items to carts automatically, finding deals, and even remembering user preferences across Amazon’s ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 4.67 Bn Forecast Revenue (2034) USD 84.6 Bn CAGR(2025-2034) 33.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Solution, Services), By Technology (Natural Language Processing (NLP), Machine Learning (ML), Computer Vision (CV), Others), By Type (Voice, Text, Visual, Multimodal), By End-use (BFSI, Retail & E-Commerce, Healthcare, Travel & Hospitality, Media & Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alibaba Group Holding Limited, Shopify Inc., Salesforce, Inc., eBay Inc., Google LLC, Amazon.com, Inc., Meta Platforms, Inc., Microsoft, Adobe Inc., IBM Corporation, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Shopping Assistant MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

AI Shopping Assistant MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alibaba Group Holding Limited

- Shopify Inc.

- Salesforce, Inc.

- eBay Inc.

- Google LLC

- com, Inc.

- Meta Platforms, Inc.

- Microsoft

- Adobe Inc.

- IBM Corporation

- Others