Global AI Search Engine Market Size, Share, Industry Analysis Report By Organization Size (Large Enterprises, SMEs), By Technology (Machine Learning, Natural Language Processing (NLP), Generative AI, Computer Vision, Other), By Deployment (On-premises, Cloud), By End Use (BFSI, Media & Entertainment, Healthcare, IT & Telecom, Retail & E-commerce, Travel & Hospitality, Manufacturing, Education, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 156813

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Regional Insight

- Emerging Trends

- Growth Factors

- By Organization Size

- By Deployment

- By End Use

- Key Market Segments

- Top Use Cases

- Customer Insight

- Driver Factor

- Restraint Factor

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

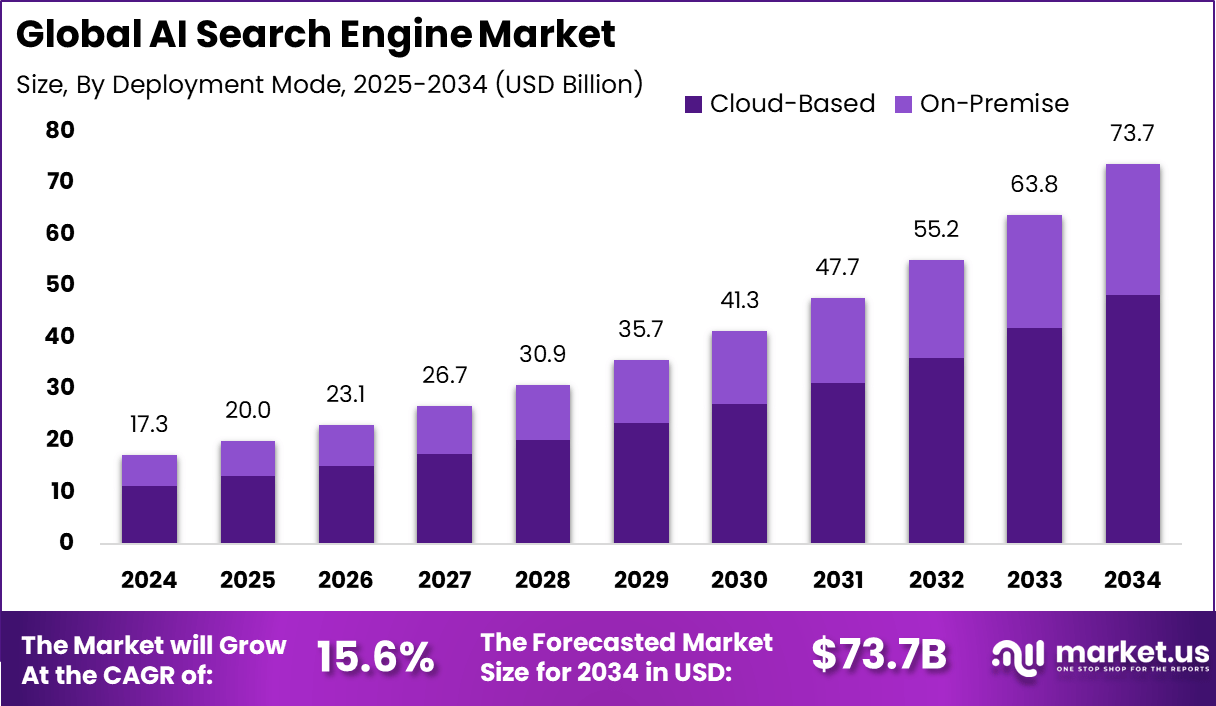

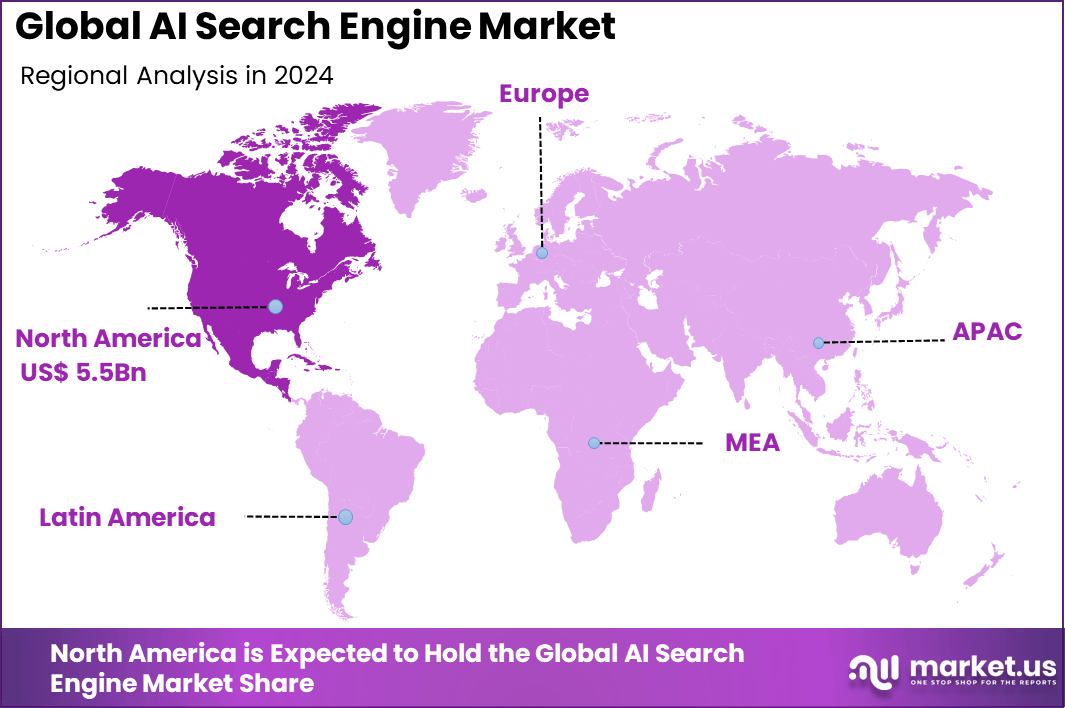

The Global AI Search Engine Market size is expected to be worth around USD 73.7 Billion By 2034, from USD 17.3 billion in 2024, growing at a CAGR of 15.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 31.9% share, holding USD 5.5 Billion revenue.

The AI search engine market is built around technologies that enable users to find information more intelligently and accurately using machine learning and natural language processing. These solutions not only understand the meaning behind queries but also provide personalized answers that adapt to the user’s context. AI-powered search engines are now core tools for fast, intuitive information access, driving both personal productivity and enterprise workflows.

This market is propelled by the increasing need for personalized and context‑aware search experiences. Improvements in language understanding and generative capabilities enable these systems to interpret complex queries and deliver relevant information with greater precision. In parallel, the explosion of digital content and the demands of decision‑making environments in enterprises and consumers are motivating adoption of AI‑driven search technologies.

Based on data seo sandwitch, about 45% of U.S. adults used AI-powered search engines at least once a month in 2024. Perplexity.ai reached over 30 mn monthly active users by Q1 2025, rising from 10 mn in mid-2023. Around 27% of enterprises globally integrated AI search tools into their internal systems, while 51% of Gen Z preferred AI tools for academic queries. In India, more than 60% of AI search traffic came from mobile devices, and 38% of users expressed greater trust in AI search results than traditional engines.

According to gitnux, 61% of marketers reported that AI increased their organic traffic, and 72% considered it central to future strategies. Nearly 95% of customer interactions are expected to be managed without humans by 2025, while by 2024, 80% of search queries were projected to be handled by AI-powered agents. These figures highlight the scale of AI’s impact on customer engagement and marketing operations.

Among smaller businesses, adoption is also rising, with 55% planning to expand AI investment in search marketing. AI-driven personalization is improving performance by boosting conversion rates up to 20%. Together, these insights confirm that AI-powered search is reshaping both consumer behavior and enterprise strategies, accelerating the global shift toward automated, intelligent engagement.

Key Insight Summary

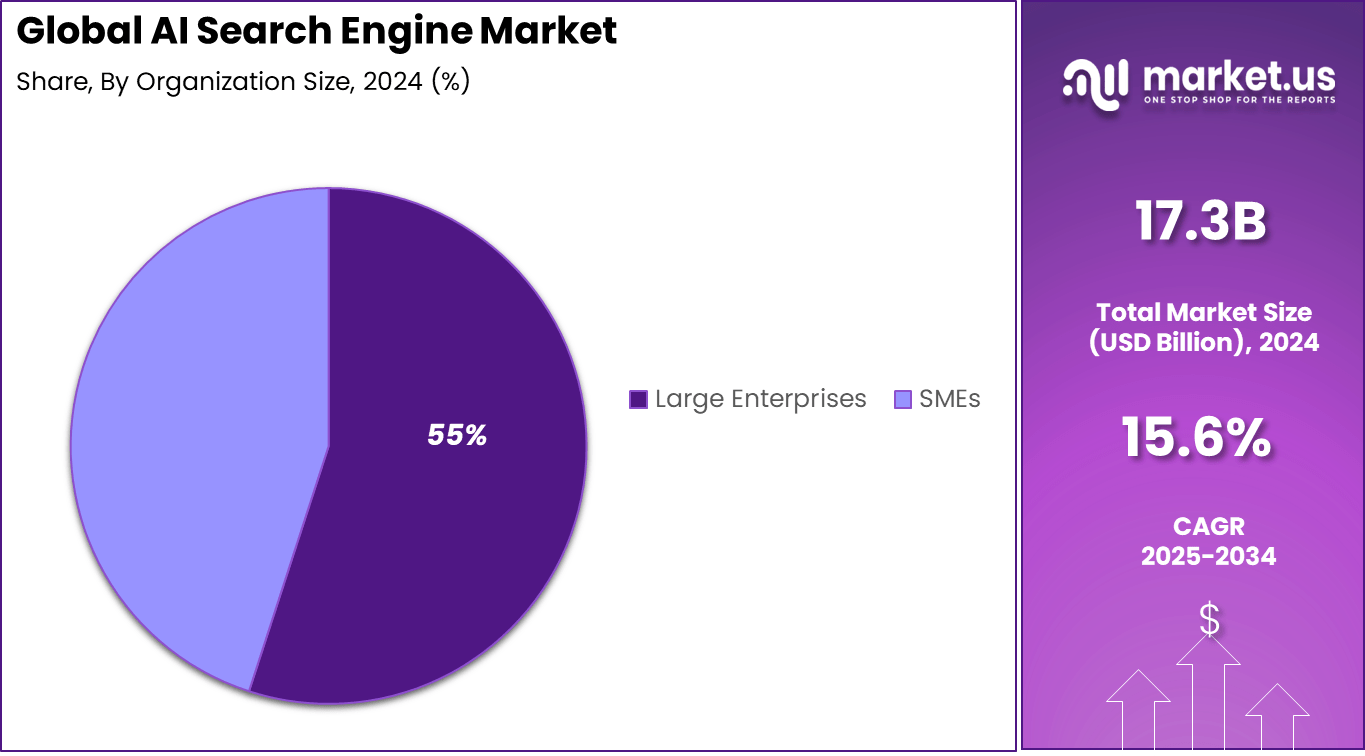

- Large Enterprises are the top adopters, holding 64.9% share of the market.

- Natural Language Processing (NLP) is the leading technology segment.

- Cloud deployment dominates with a 65.6% share of total adoption.

- retail & e-commerce emerged as the primary end-use sector, driving demand for AI search engines.

Analysts’ Viewpoint

Investment opportunities abound in enterprise-focused AI search products, cloud-based solutions, industry-specific customizations, and privacy-focused platforms. The sector is attracting funds for agentic AI engines and multi-modal interaction models. Regions like North America and Asia Pacific provide dynamic opportunities due to rapid technology adoption, government-backed innovation, and sizable populations of digital users.

Business benefits realized from AI search adoption include better productivity, increased efficiency in knowledge management, reduced cost in handling vast data, and enhanced customer interactions. Intelligent search engines minimize manual effort, automate document indexing, and allow organizations to respond swiftly to evolving market and customer needs.

The regulatory environment varies regionally but is especially shaped by frameworks such as GDPR and CCPA that govern privacy, user consent, and data protection. Compliance requirements in Europe and North America drive innovation toward secure, transparent, and ethically designed AI search solutions. Privacy-oriented development and algorithmic fairness are increasingly seen as non-negotiable standards, influencing adoption and trust in AI-powered platforms.

Regional Insight

In 2024, North America held a dominant market position, capturing more than 31.9% share and generating USD 5.51 billion revenue in the AI search engine market. The region’s leadership is mainly supported by the rapid digital transformation of enterprises and the strong presence of technology innovators.

Businesses across sectors such as e-commerce, finance, and healthcare are increasingly adopting AI-driven search platforms to deliver faster, more relevant, and personalized results. The high demand for intelligent search solutions that can process natural language queries, analyze unstructured data, and improve decision-making has positioned North America at the forefront of this industry.

The leadership of North America is also reinforced by the widespread integration of advanced AI models, including natural language processing and generative AI, into enterprise applications. Strong investment activity in artificial intelligence, combined with robust cloud infrastructure, has accelerated the deployment of AI-powered search solutions across organizations.

Emerging Trends

Key Points Description Generative AI Integration AI-enhanced engines provide conversational answers and summarized instead of simple link lists. Growth of Voice and Visual Search Voice assistants and image-based search are rapidly expanding the modalities for finding information. Hyper-personalization Engines increasingly use detailed behavioral analysis for ultra-tailored search results. Smarter Enterprise Search Business adoption of AI-powered internal knowledge discovery is accelerating. SEO Evolution Search optimization strategies now emphasize entity relevance, structured data, and conversation-like content. Growth Factors

Key Points Description Rising Data Volume Explosive digital data growth fuels demand for smarter, faster, and more accurate search. Demand for Personalization Users and organizations seek context-aware, tailored experiences and results. Advances in NLP and ML Improved language and machine learning models enhance the processing of complex, nuanced queries. Cloud Adoption Scalable cloud-based search tools drive accessibility and rapid market expansion. Industry-Specific Solutions Sector-focused AI search products increase adoption and open new revenue streams. By Organization Size

In 2024, the large enterprises segment led the AI Search Engine Market in 2024 with a significant market share of 63.1%. These organizations typically manage vast and intricate datasets across multiple departments and regions, requiring advanced AI-driven search engines to streamline data access and knowledge management.

AI search engines help large enterprises break down information silos, enhance efficiency in document indexing, and provide real-time data insights critical for rapid decision-making. This segment’s dominance is attributed to ongoing investments in digital transformation and AI adoption to maintain competitive advantage and operational excellence.

Moreover, large enterprises benefit from customized AI search solutions that integrate with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems. Such integration supports workflow automation, compliance management, and improved regulatory reporting. As enterprises face growing pressure to innovate while managing complexity, AI search technologies enable scalability and agility by adapting to evolving business requirements.

By Deployment

In 2024, the cloud deployment segment held the dominant market position in 2024 due to its inherent advantages of scalability, flexibility, and reduced infrastructure costs. Cloud-hosted AI search platforms allow enterprises to rapidly scale their search capabilities based on fluctuating demand without the need for heavy upfront investments in hardware.

The cloud also facilitates easier integration with other cloud-native enterprise applications such as data lakes, analytics tools, and AI services. Additionally, pay-as-you-go pricing models and subscription services make cloud AI search accessible to businesses of various sizes, fueling widespread adoption. Security and compliance frameworks implemented by major cloud providers have also addressed many enterprise concerns around data governance, privacy, and protection.

Multi-tenant architectures enable collaborative work environments where diverse teams across locations can simultaneously access and analyze data through AI-powered search applications. The cloud’s agility supports innovative features like real-time indexing, continuous learning, and regular software updates, ensuring enterprises benefit from the latest AI advancements without disruption.

By End Use

In 2024, the retail and e-commerce segment dominated the AI Search Engine Market in 2024, driven by the sector’s need to offer personalized and seamless product discovery experiences. Consumers increasingly expect search engines on retail platforms to deliver contextually relevant results based on their preferences, past behavior, and real-time trends.

AI search engines enhance customer engagement by improving product recommendations, supporting voice and visual search, and enabling intuitive navigation through large inventories. This boosts conversion rates and customer loyalty while reducing bounce rates on e-commerce sites. Furthermore, AI-powered search technologies help retailers optimize merchandising and inventory management by analyzing customer search data and predicting demand trends.

The integration of AI with omnichannel retail strategies strengthens supply chain efficiency and customer experience. As online shopping continues to grow globally, retailers are investing heavily in AI search engines to differentiate their platforms and capture higher market shares. The retail sector’s adoption of AI search reflects a broader trend toward digital transformation aimed at meeting evolving consumer expectations and competitive pressures.

Key Market Segments

By Organization Size

- Large Enterprises

- SMEs

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Generative AI

- Computer Vision

- Other

By Deployment

- On-premises

- Cloud

By End Use

- BFSI

- Media & Entertainment

- Healthcare

- IT & Telecom

- Retail & E-commerce

- Travel & Hospitality

- Manufacturing

- Education

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Top Use Cases

Point Description Personalization AI tailors content and results based on individual user history and behavior. Natural Language Processing Queries in everyday language are understood and answered directly. Image & Video Search Users retrieve results using visual inputs, supporting diverse content types. Voice Search Speech-based queries increasingly dominate device interactions. Predictive Search AI anticipates user intent and offers suggestions before queries are complete. Customer Insight

Points Description Deep Behavioral Analysis AI mines patterns from web, purchase, and interaction data to reveal user motivators. Real-Time Feedback Analysis Automated analysis of feedback highlights product perception and customer sentiment. Predictive Analytics AI forecasts individual customer trends, enabling proactive business responses. Segmentation & Recommendation Machine learning segments customers and deploys targeted recommendations based on demographics and behaviors. Enhanced Personalization Insights drive customization of experiences—offers, content, and support—to maintain retention and satisfaction. Driver Factor

Personalization Enhances Relevance

The main driver in the AI search engine sector is their ability to personalize results based on individual user data. AI search engines use advanced techniques like natural language processing and machine learning to understand the intent behind each query, surfacing results that match a user’s habits, location, and search history. For instance, a user asking for restaurant options in their city receives listings tailored precisely to their preferences, time of day, and even dietary restrictions.

Personalized search means users get information that is truly relevant, not just a list of generic results. This shift toward individualized search experiences leads users to rely on AI engines for more complex and ambiguous questions, making these tools an essential part of modern information-seeking behavior.

Restraint Factor

Growing Privacy Concerns

One of the clearest limiting factors for AI search engines comes from mounting privacy concerns. AI-powered systems often require extensive access to user data so they can tailor those responses and improve results. However, handling large sets of personal information raises worries about how data is collected, stored, and used.

Public awareness and new regulations, such as GDPR and CCPA, have created hurdles for providers of AI search engines. These rules mandate strict data security protocols and greater transparency about data use. As a result, some innovations in personalization are held back, and users may hesitate to trust or adopt these new search technologies when privacy feels compromised.

Opportunity Analysis

Expanding into Voice and Visual Search

A standout opportunity in the AI search engine space is expansion into voice and visual search. As technology evolves, users increasingly expect to find information without typing, using voice assistants or taking a quick picture. Incorporating natural language and image recognition allows AI search platforms to understand queries in a more human way, whether spoken or visual.

This new direction offers a richer, more accessible experience for users, making it easier to search and get contextual results in daily life. Companies that invest in multi-modal search – where spoken words, images, or even video can guide search – are positioned to shape the future of user interaction and engagement.

Challenge Analysis

Competing with Established Search Leaders

One of the major challenges for new AI search engines is breaking the dominance of established traditional engines, especially when users are deeply accustomed to platforms like Google. Building brand recognition and user trust takes time, especially when established competitors offer proven reliability and vast resources.

Additionally, creating technically robust systems able to interpret ambiguous or complex queries requires continuous innovation. Gaining a foothold means not only outperforming competitors on accuracy and relevance but also convincing people to try unfamiliar tools. This is compounded by the need for substantial investment in infrastructure and expertise, which further raises the barrier for newcomers.

Competitive Analysis

In the AI search engine market, leading enterprise technology providers such as SAP SE, Amazon Web Services, Salesforce, and Google LLC play a central role. Their focus lies in integrating AI-driven search functions into enterprise systems and cloud platforms. These companies leverage their vast customer base and advanced cloud ecosystems to deliver scalable search solutions.

Another group of influential players includes IBM Corporation, Zeta Global Corp., and Adobe, who emphasize personalization and data-driven decision-making in search technologies. IBM brings expertise in natural language processing and enterprise AI, while Adobe integrates AI search into content management systems. Zeta Global enhances customer engagement by using AI-powered insights.

Additionally, Microsoft, NVIDIA Corporation, and Oracle contribute significantly to market innovation. Microsoft strengthens the market with AI-powered tools within its productivity ecosystem, while NVIDIA accelerates AI search capabilities with its high-performance GPUs. Oracle integrates AI into its database and enterprise applications to support more intelligent information retrieval.

Top Key Players in the Market

- SAP SE

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Google LLC

- IBM Corporation

- Zeta Global Corp.

- Adobe

- Microsoft

- NVIDIA Corporation

- Oracle

Recent Developments

- In July 2025, Google LLC launched AI Mode in the UK, powered by Gemini 2.5. It delivers conversational answers instead of long lists of links, supports complex queries, and keeps context for follow-up questions, making search more natural and precise.

- In March 2025, One 97 Communications Limited partnered with Perplexity AI, Inc. to bring AI-driven search to the Paytm app. The integration improves accessibility in local languages and provides real-time insights, helping users make informed financial decisions and boosting digital inclusion.

- In October 2024, Meta Platforms Inc. started building its own AI-based search engine with a dedicated web crawler. Linked with Meta AI across its platforms, it provides real-time conversational answers and reduces reliance on external search providers, strengthening its independence in the search ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 17.3 Bn Forecast Revenue (2034) USD 73.7 Bn CAGR(2025-2034) 15.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Organization Size (Large Enterprises, SMEs), By Technology (Machine Learning, Natural Language Processing (NLP), Generative AI, Computer Vision, Other), By Deployment (On-premises, Cloud), By End Use (BFSI, Media & Entertainment, Healthcare, IT & Telecom, Retail & E-commerce, Travel & Hospitality, Manufacturing, Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAP SE, Amazon Web Services, Inc., Salesforce, Inc., Google LLC, IBM Corporation, Zeta Global Corp., Adobe, Microsoft, NVIDIA Corporation, Oracle Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SAP SE

- Amazon Web Services, Inc.

- Salesforce, Inc.

- Google LLC

- IBM Corporation

- Zeta Global Corp.

- Adobe

- Microsoft

- NVIDIA Corporation

- Oracle