Global AI Rendering Market Size, Share Analysis Report By solution (AI Rendering Software (Cloud-Based, AI Rendering Software - On-premises), Services (Implementation & Integration Services, Consulting & Training Services, Services - Support & Maintenance Services)), By Enterprise Size (Large Enterprises, SMEs), By Application (Visualisation and Simulation, Animation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152642

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- AI Rendering Market Size

- Key Insight Summary

- Analysts’ Viewpoint

- US Market Size

- By Solution: AI Rendering Software – 76.8%

- By Enterprise Size: Large Enterprises – 70.5%

- By Application: Visualization and Simulation – 38.6%

- By End-use: Gaming – 30.8%

- Key Market Segments

- Emerging Trend Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Player Analysis

- Recent Developments

- Report Scope

AI Rendering Market Size

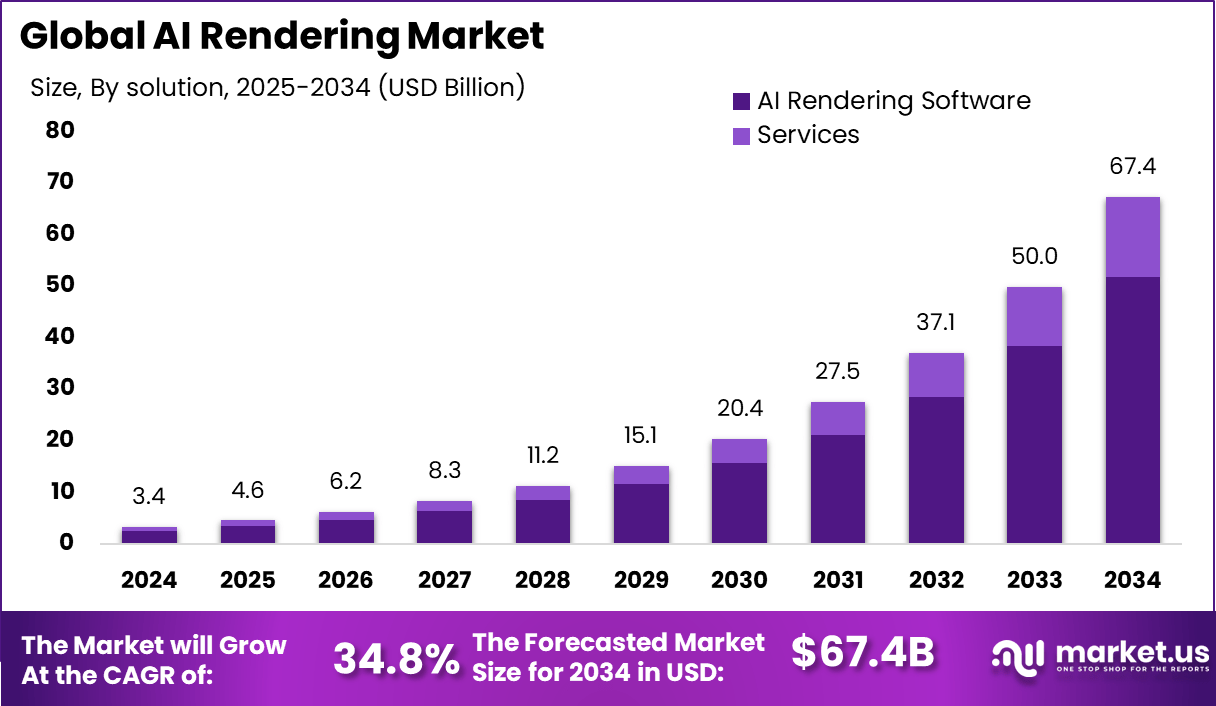

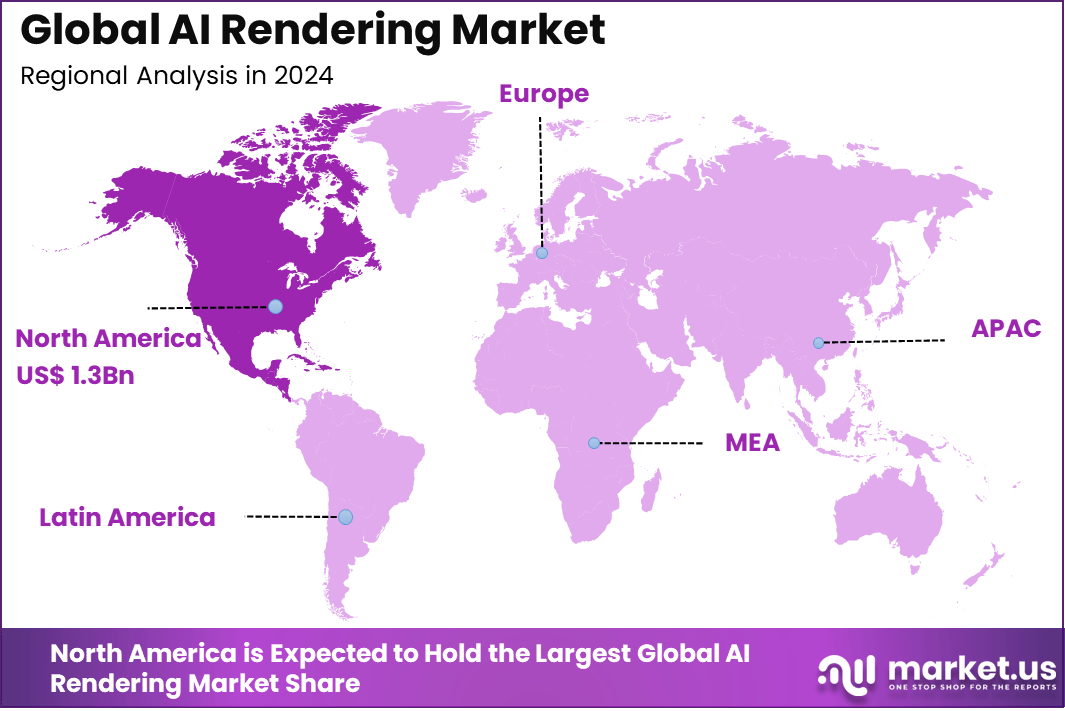

The Global AI Rendering Market size is expected to be worth around USD 67.4 Billion By 2034, from USD 3.4 billion in 2024, growing at a CAGR of 34.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39% share, holding USD 1.3 Billion revenue.

The AI Rendering Market is defined by the integration of artificial intelligence into visual content generation, enabling the automated transformation of design files into photo-realistic images. This sector spans applications in architecture, product design, film, gaming, and advertising. It has emerged as a pivotal enabler of enhanced realism and faster delivery, reshaping traditional rendering workflows by offloading computationally heavy processes to AI-powered engines.

According to Market.us, The Global Artificial Intelligence Market is projected to witness substantial growth, reaching around USD 3,527.8 billion by 2033, up from USD 250.1 billion in 2023, driven by a strong CAGR of 30.3% during the forecast period. In 2023, North America held a dominant position in the market, accounting for the largest revenue share with approximately USD 97.25 billion.

Scope and Forecast

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 67.4 Bn CAGR (2025-2034) 34.8% Largest market in 2024 North America [39% market share] The top driving factors in this market include mounting demand for high‑quality visuals and the imperative to reduce production timelines. Content creators, developers, and designers are under pressure to produce lifelike simulations swiftly and cost‑effectively. AI rendering systems have stepped in, leveraging deep learning to simulate lighting, materials, and textures with minimal manual intervention.

From a demand analysis perspective, a confluence of growth in gaming, architectural visualization, and immersive media is propelling the trend. Interactive 3D environments used in virtual and augmented reality demand speed and realism – elements well catered to by AI rendering tools. Additionally, the expansion of digital advertising aligns closely with AI rendering since promotional campaigns increasingly require photorealistic visual content generated at scale.

Key Insight Summary

- The market is projected to grow from USD 3.4 billion in 2024 to approximately USD 67.4 billion by 2034, registering a robust CAGR of 34.8%, driven by rising demand for high-quality, real-time rendering in gaming, simulation, and design.

- North America led the global market in 2024, capturing over 39% share and generating about USD 1.3 billion, supported by strong adoption of AI technologies in creative industries and advanced computing infrastructure.

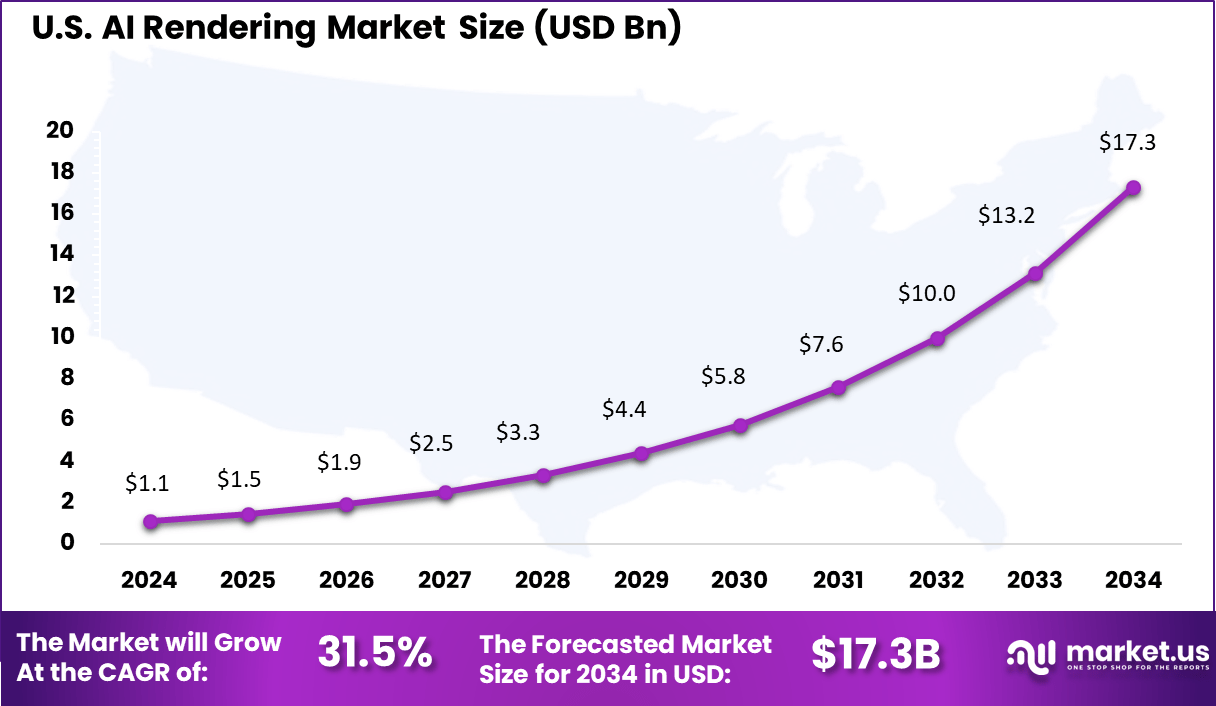

- The U.S. market contributed approximately USD 1.12 billion in 2024, with an expected CAGR of 31.5%, driven by significant investments in gaming, media, and design automation.

- By solution, AI Rendering Software dominated with a commanding 76.8% share, reflecting enterprise preference for scalable, feature-rich software over hardware-based solutions.

- By enterprise size, Large Enterprises led with 70.5% share, owing to their higher budgets and need for advanced rendering capabilities to support complex projects.

- In applications, Visualisation and Simulation accounted for the largest share at 38.6%, driven by growing use of AI for immersive design, architectural visualization, and virtual prototyping.

- Among end uses, Gaming was the largest segment, holding 30.8% share, as demand rises for photorealistic graphics and seamless player experiences powered by AI-driven rendering engines.

Analysts’ Viewpoint

Investment opportunities emerge in cloud-based rendering platforms and workflow‑centric tools. Venture capital and corporate investment are flowing into rendering-as-a-service offerings and hybrid on‑premise/cloud solutions that balance speed, security, and customization. EU‑backed initiatives and incentive programs focused on AI startups further facilitate investment momentum in regions prioritizing digital innovation.

Business benefits have been clearly observed across multiple segments. Efficiency gains translate into leaner production cycles, enabling faster project completions and improved utilization of creative staff. Enhanced realism supports better marketing outcomes and strengthens customer engagement. Firms gain a competitive advantage by delivering higher‑quality output with fewer resources.

Adoption of technologies such as machine learning‑based denoising, neural style transfer, and photogrammetry-driven texture mapping is accelerating. These techniques enable rapid refinement of renders, reduction of noise in early output stages, and efficient texture creation based on real-world imagery. The integration of these technologies is making rendering pipelines more intelligent, reducing manual oversight and iterative cycles.

US Market Size

The U.S. AI Rendering Market was valued at USD 1.1 Billion in 2024 and is anticipated to reach approximately USD 17.3 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 31.5% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 39% share, holding USD 1.3 billion in revenue. This leadership is primarily attributed to the region’s strong presence of advanced digital media production studios, high adoption of AI technologies in rendering pipelines, and early access to scalable cloud infrastructure.

The U.S. market, in particular, has been a frontrunner in integrating deep learning algorithms into real-time rendering applications across gaming, virtual reality, and advertising industries. A mature ecosystem of AI research institutions and tech innovators has further accelerated the pace of adoption.

Another key factor behind North America’s dominance is the increasing demand for photorealistic and immersive content driven by the entertainment and e‑commerce sectors. Content creators and design firms across the region are using AI-powered tools to reduce production time and enhance visual quality, especially for high-end animations and product showcases.

The availability of skilled professionals, combined with heavy investment in generative media startups, has helped maintain a technological edge. As regulations around AI transparency and data ethics begin to take clearer shape in the U.S. and Canada, enterprises are also gaining more confidence to scale AI rendering workflows responsibly.

By Solution: AI Rendering Software – 76.8%

The dominance of AI rendering software, accounting for 76.8%, reflects the market’s shift toward intelligent, algorithm-driven visualization tools. These software platforms are being widely integrated into design, animation, and simulation workflows because of their ability to reduce rendering time, improve quality, and optimize lighting and texture generation with minimal manual effort. Their flexibility to operate on both local machines and cloud environments has expanded accessibility across creative and engineering sectors.

The preference for software over hardware-based solutions is rooted in adaptability and lower entry barriers. Software tools powered by neural networks, generative models, and real-time rendering engines are evolving rapidly, often with modular compatibility that fits into existing creative pipelines. Users are also valuing the automation features embedded in these platforms, which allow them to produce hyper-realistic content with fewer iterations and shorter feedback cycles.

By Enterprise Size: Large Enterprises – 70.5%

Large enterprises represent 70.5% of the adoption in the AI rendering ecosystem. These companies are better positioned to implement AI rendering due to their greater access to skilled talent, larger design departments, and established digital infrastructure. Their projects often demand high-quality visualization output, particularly in industries such as architecture, gaming, automotive, and entertainment, where visual storytelling and design accuracy are critical.

The adoption by large enterprises is also being driven by their ability to invest in innovation and manage complex workflows. Implementing AI-powered rendering involves coordination across departments including IT, creative, and data science. These organizations also tend to be early adopters of scalable rendering platforms that integrate AI into pre-visualization and post-production phases. This segment continues to lead as they prioritize efficiency, realism, and faster content delivery.

By Application: Visualization and Simulation – 38.6%

The application of AI rendering in visualization and simulation constitutes 38.6% of the total usage, with its impact seen prominently in fields requiring lifelike replication of real-world environments. From engineering prototypes to architectural walkthroughs, AI rendering streamlines the process of creating detailed and interactive virtual models. It supports decision-making by generating accurate and immersive simulations that were once difficult and time-consuming to produce.

This segment’s growth is closely linked to rising demand for real-time rendering and the need to reduce manual workload in previsualization. AI is increasingly being used to speed up iterations and ensure consistency across simulation projects. The ability of AI algorithms to enhance lighting, simulate environmental changes, and generate realistic reflections or shadows without human input has improved the quality and usability of digital simulations across various industries.

By End-use: Gaming – 30.8%

Within end-use categories, the gaming sector accounts for 30.8% of the AI rendering adoption. Game developers are utilizing AI to create visually rich environments, optimize rendering workflows, and dynamically adjust graphics in real-time. This adoption is enhancing not only the realism of virtual worlds but also improving game performance across devices by making rendering more efficient.

Gaming studios are integrating AI tools to automate repetitive visual tasks, such as texture enhancement and procedural environment generation. This reduces development cycles and enables teams to focus on gameplay mechanics and narrative design. The gaming industry has also become a testing ground for advanced rendering technologies, particularly where real-time user interaction and immersive graphics are prioritized.

Key Market Segments

By Solution

- AI Rendering Software

- Cloud-Based

- On-premises

- Services

- Implementation & Integration Services

- Consulting & Training Services

- Support & Maintenance Services

By Enterprise Size

- Large Enterprises

- SMEs

By Application

- Visualisation and Simulation

- Animation

- Product, Design and Modelling

- Others

By End-use

- Automotive

- Gaming

- Healthcare

- Media and Entertainment

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

Proliferation of Neural Rendering Accelerators

Neural rendering is entering a transformative phase as purpose-built hardware accelerators are being introduced to handle the intensive computational demands of real-time 3D visualizations. These accelerators are capable of adapting dynamically to different neural rendering pipelines, allowing applications such as AR, VR, and digital twins to perform locally with greater speed and efficiency. This trend reflects a shift from centralized to edge-based processing.

As edge devices gain the ability to handle complex rendering workloads, latency is reduced and user interaction becomes more immersive. This development is expected to enable broader deployment of AI rendering in consumer electronics and enterprise environments, encouraging real-time applications that were previously impractical on standard hardware.

Driver Analysis

AI-Powered Automation in Rendering Workflows

AI has made it possible to automate several time-consuming elements within the rendering process, such as noise reduction, lighting enhancement, and procedural modeling. These features not only accelerate production timelines but also improve the scalability of rendering tasks across various industries, from entertainment to product design.

With improved efficiency and reduced manual workload, professionals can achieve consistent, high-quality results in less time. As AI rendering becomes more refined and user-friendly, the productivity gains will further incentivize organizations to adopt intelligent automation across their visual workflows.

Restraint Analysis

Complexity and Infrastructure Cost

The technological infrastructure needed to deploy high-quality AI rendering solutions is still cost-intensive. Many advanced rendering systems require powerful GPUs, specialized neural processors, or cloud-based rendering farms, which may not be financially viable for small and mid-sized companies.

Additionally, there remains a steep learning curve for deploying and managing AI-based rendering pipelines. This complexity often necessitates specialized training or the hiring of technical experts, limiting access for non-technical teams and slowing down widespread industry adoption.

Opportunity Analysis

Edge-Enabled Immersive Experiences

The rising compatibility of AI rendering with edge computing platforms presents a major opportunity. By processing visual content closer to the user, such as on mobile devices or local hardware, latency and bandwidth limitations are significantly minimized. This unlocks new use cases, especially in areas like remote assistance, virtual training, and live simulation.

Industries looking to enhance user engagement through real-time visualization can now consider edge rendering as a viable solution. This not only improves responsiveness but also ensures privacy and data sovereignty by limiting cloud dependency.

Challenge Analysis

Ethical Concerns and Content Authenticity

The ability of AI rendering to create photorealistic content introduces complex ethical concerns. Content generated through these systems can be mistaken for real images or videos, which increases the risk of manipulation or misinformation. The lack of visible indicators distinguishing AI-generated content from authentic media remains a growing concern.

In regulated sectors such as journalism or legal documentation, unverified use of AI-rendered visuals may result in legal ramifications or damage to public trust. The implementation of detection frameworks, digital watermarking, and content certification protocols will become critical to address these challenges in the near future.

Key Player Analysis

MyArchitectAI, ArchiVinci, and Vizcom Technologies, Inc. are leading innovation in AI rendering by offering automated visualization tools tailored for architects and designers. Their platforms help speed up design workflows and improve visual quality using generative AI and sketch-to-render capabilities.

Dimension 5, Integrated BIM, and GENENSE Global 3D Rendering Services are enhancing the integration of AI in BIM and cloud rendering. These players focus on efficiency in 3D modeling and global access to real-time rendering, supported by GPU acceleration from NVIDIA Corporation.

Carahsoft Technology Corp, paintit, Neolocus, and Architect Render, LLC are addressing niche demands in government, creative, and branding applications. Their services expand the scope of AI rendering across sectors, supporting high-quality output and intelligent design automation.

Top Key Players Covered

- MyArchitectAI

- ArchiVinci

- Vizcom Technologies, Inc.

- Dimension 5

- Integrated BIM

- GENENSE Global 3D Rendering Services

- NVIDIA Corporation

- Carahsoft Technology Corp

- paintit

- Neolocus

- Architect Render, LLC

- Others

Recent Developments

- Vizcom continued to gain traction throughout 2024, offering a platform that transforms sketches and 3D models into photorealistic renderings using advanced machine learning. Its collaborative features and rapid rendering speeds have made it essential for design teams aiming to iterate quickly and visualize concepts with remarkable accuracy.

- In March 2024, Carahsoft announced a partnership with Rendered.ai to bring synthetic data generation platforms to government agencies. As the Master Government Aggregator, Carahsoft is now distributing Rendered.ai’s solutions through a network of resellers, expanding access to AI-driven computer vision and rendering tools in the public sector

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By solution (AI Rendering Software (Cloud-Based, AI Rendering Software – On-premises), Services (Implementation & Integration Services, Consulting & Training Services, Services – Support & Maintenance Services)), By Enterprise Size (Large Enterprises, SMEs), By Application (Visualisation and Simulation, Animation) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape MyArchitectAI, ArchiVinci, Vizcom Technologies, Inc., Dimension 5, Integrated BIM, GENENSE Global 3D Rendering Services, NVIDIA Corporation, Carahsoft Technology Corp, paintit, Neolocus, Architect Render, LLC, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- MyArchitectAI

- ArchiVinci

- Vizcom Technologies, Inc.

- Dimension 5

- Integrated BIM

- GENENSE Global 3D Rendering Services

- NVIDIA Corporation

- Carahsoft Technology Corp

- paintit

- Neolocus

- Architect Render, LLC

- Others