Global AI Productivity Tools Market Size, Share, Industry Analysis Report By Component (Solutions and Services), By Technology (Machine Learning & Deep Learning, Natural Language Processing, Computer Vision, Generative AI, and Others), By Deployment Mode (Cloud-based and On-Premises), By Application, By Vertical, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 156145

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

- Market Summary

- Key Takeaways

- Market Overview

- US Market Size

- Economic Impact

- Emerging Trends

- By Component Analysis

- By Technology Analysis

- By Deployment Mode Analysis

- By Application Analysis

- By Organization Size Analysis

- By Vertical Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Key Player Analysis

- Recent Developments

- Report Scope

Market Summary

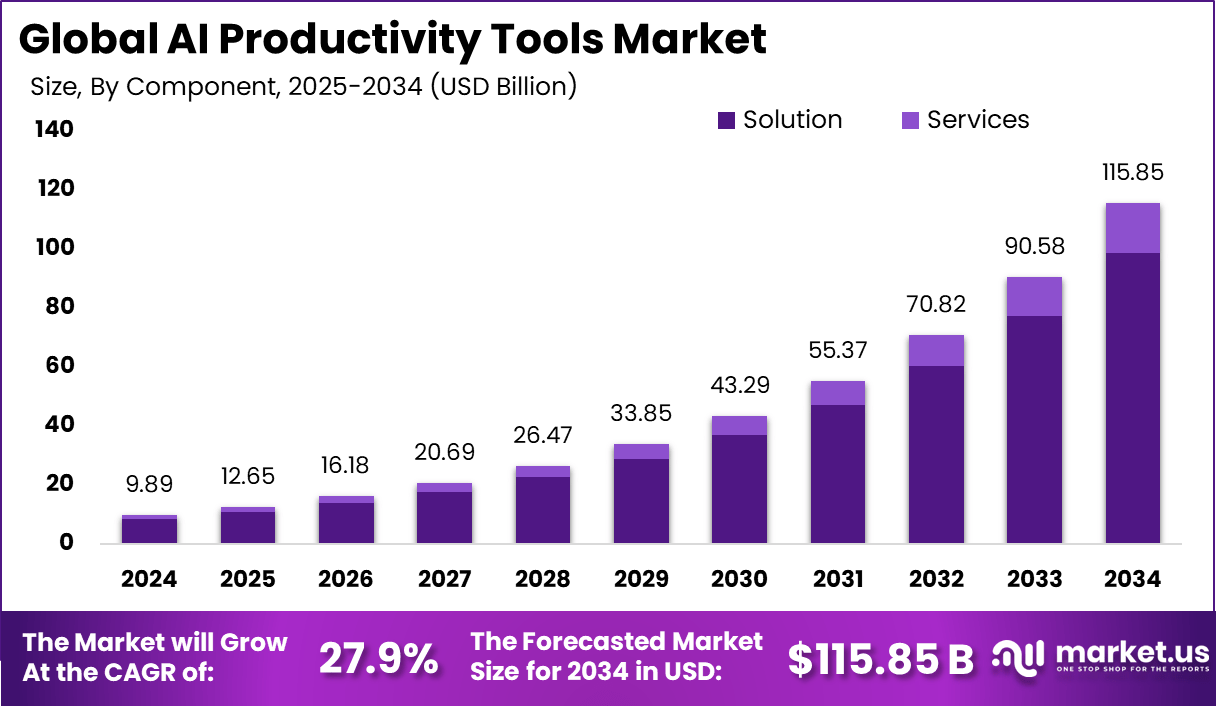

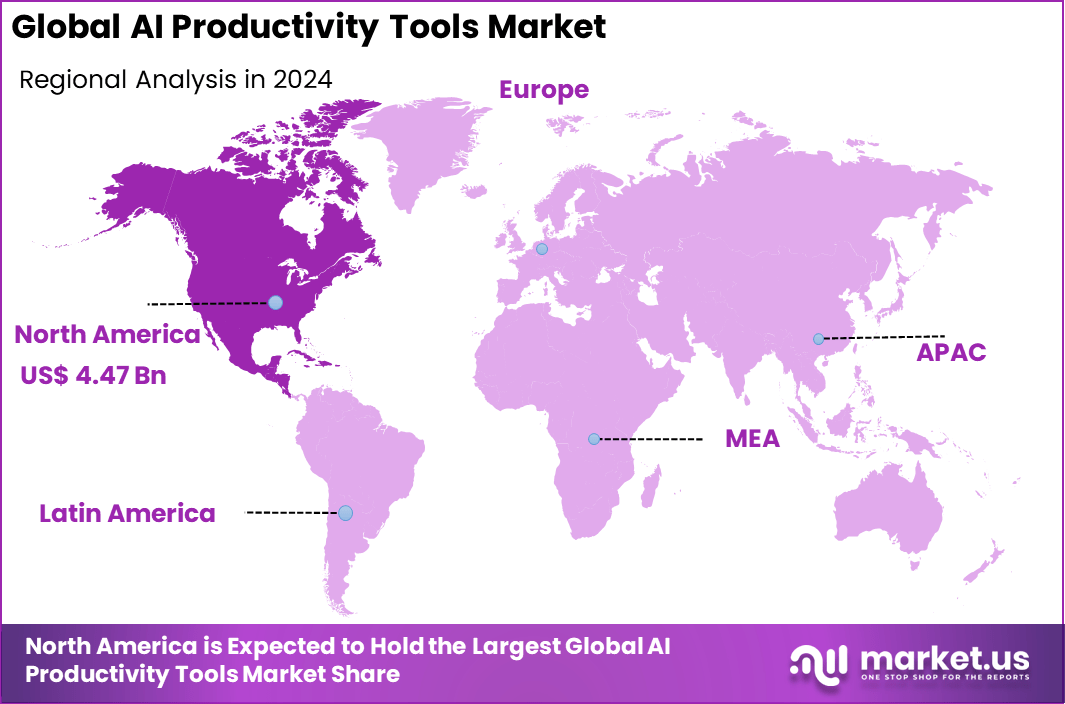

The Global AI Productivity Tools Market size is expected to be worth around USD 115.85 billion by 2034, from USD 9.89 billion in 2024, growing at a CAGR of 27.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.2% share, holding USD 4.47 billion in revenue.

The AI productivity tools market is evolving quickly as more organizations seek solutions to boost efficiency, streamline workflows, and improve collaboration in the workplace. These tools leverage artificial intelligence to automate routine tasks, enhance time management, and provide intelligent insights for decision-making.

One of the main drivers behind the growth of AI productivity tools is the increasing digital transformation across enterprises worldwide. Companies are under pressure to adopt technologies that help scale their operations while managing complex business processes more effectively. Additionally, the global shift toward remote work has accelerated interest in AI-powered productivity solutions that support distributed teams by enabling seamless communication, project tracking, and data-driven collaboration.

Key Takeaways

- By Component, Solutions dominated with 85.3% share, reflecting strong adoption of AI-powered platforms and tools.

- By Technology, Natural Language Processing led with 30.7% share, supporting chatbots, summarization, and writing assistance.

- By Deployment Mode, Cloud-based solutions held 70.5% share, driven by scalability and remote accessibility.

- By Application, Content Creation & Writing Assistance was the largest segment with 25.4% share, showing growing use in marketing, publishing, and enterprise workflows.

- By Organization Size, Large Enterprises led with 60.2% share, leveraging AI tools for automation and productivity optimization.

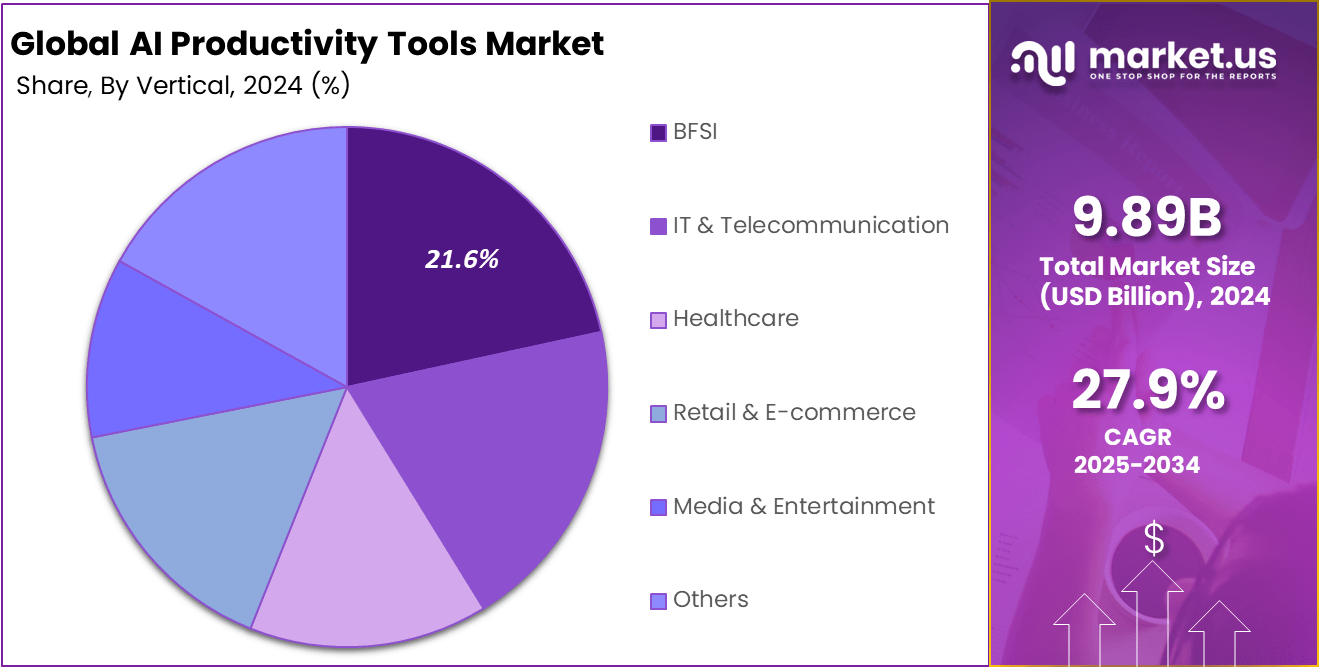

- By Vertical, BFSI accounted for 21.6% share, reflecting its adoption in document automation, customer communication, and compliance.

- By Region, North America led with 45.2% share in the global market.

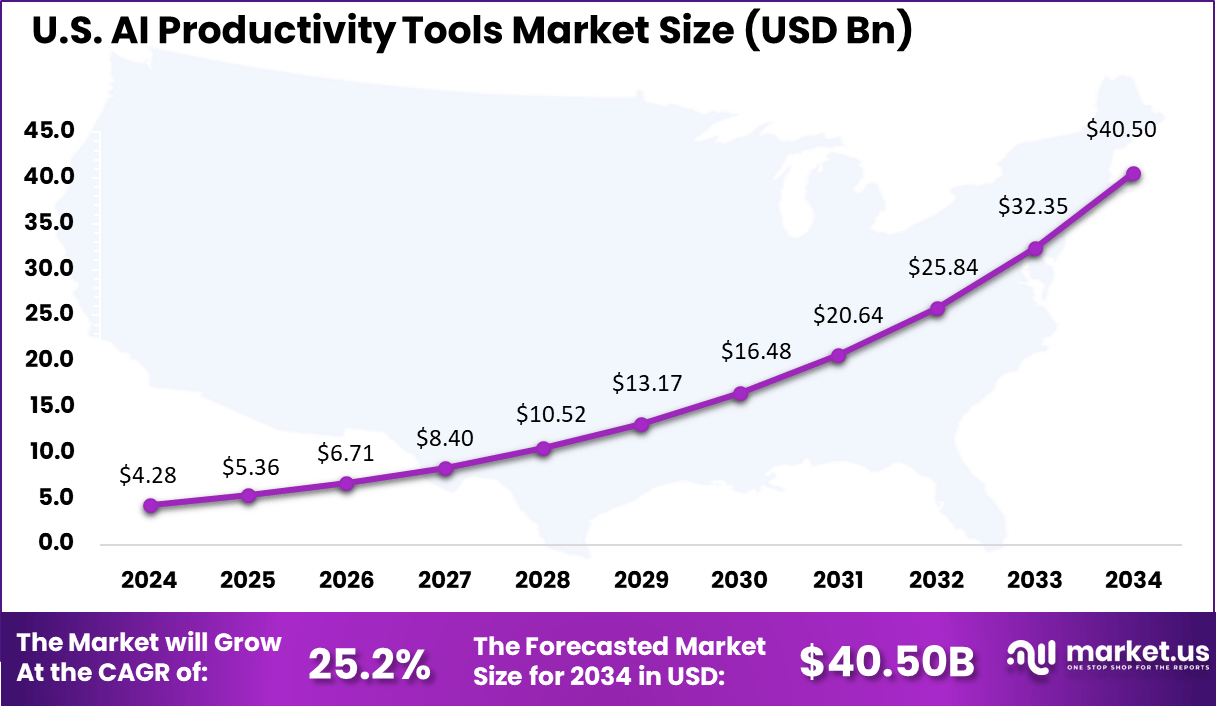

- U.S. Market reached USD 4.28 Billion in 2024, with a projected CAGR of 25.2%, highlighting rapid adoption across enterprises.

Market Overview

A rising adoption of tools such as natural language processing applications, project management systems enhanced with AI, and data analytics platforms that deliver predictive and prescriptive insights. Businesses value these tools for their ability to reduce manual workloads and empower employees to focus on high-value tasks. The trend towards integrating AI into cloud-based platforms further lowers the entry barriers, making these solutions accessible to small and medium enterprises as well as large corporations.

Investment opportunities in this market are attractive due to wide-ranging applications and the extensive scope for innovation. Funding is being directed toward startups developing specialized AI tools for sectors like healthcare diagnostics, financial modeling, and smart manufacturing. Additionally, hardware and infrastructure investments support the rising demand for AI computing capabilities necessary to run advanced productivity software.

From a business benefits perspective, AI productivity tools help organizations achieve faster decision-making, optimize resource allocation, and improve employee satisfaction by automating repetitive tasks. These improvements contribute to better overall business performance and create new possibilities for innovation within workflows. Enterprises that adopt AI-enabled productivity technologies report gains in operational efficiency and cost reductions, reinforcing the value proposition.

Regarding the regulatory environment, evolving standards around data privacy, ethical AI usage, and transparency are shaping how AI productivity tools are developed and implemented. Vendors and users must navigate compliance with laws that protect personal and business data while ensuring responsible AI application. This regulatory focus encourages best practices and places importance on trustworthy AI adoption, which in turn builds user confidence.

US Market Size

The U.S. AI Productivity Tools Market was valued at USD 4.28 Billion in 2024 and is anticipated to reach approximately USD 40.5 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 25.2% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position in the global AI productivity tools arena, capturing more than a 45.2% share and generating approximately USD 4.47 billion in revenue. This commanding lead can be attributed to several structural advantages.

First, the region benefits from a highly developed technology infrastructure and widespread adoption of cloud computing, which enables rapid deployment and scaling of AI tools. Additionally, robust investment ecosystems, including venture capital and strong corporate R&D budgets, have accelerated innovation in AI-driven productivity solutions.

The presence of leading technology giants and numerous AI-focused startups has ensured continuous refinement of both foundational platforms and user-centric applications, reinforcing North America’s leadership.

Economic Impact

Impact Area Details Productivity Increase Studies show usage by employees can improve productivity by up to 40% Cost Reduction Automation cuts manual labor, reduces errors, and saves operational costs Innovation Acceleration Frees up time for strategic and creative work Market Opportunity AI tools contribute significantly to global GDP growth through efficiency Emerging Trends

Trend Description AI-Powered Virtual Assistants More intelligent, proactive assistants like Copilot and Google Workspace Gemini Hyper-Personalization Tools adapt to user behavior and preferences Convergence with Collaboration AI integrated in team environments for brainstorming and decision making Generative AI AI creating text, code, and multimedia content Privacy-First AI Emphasis on data privacy, anonymization, and ethical AI By Component Analysis

In 2024, the Solutions segment accounts for the vast majority of the AI Productivity Tools Market with 85.3% market share. This reflects the strong demand for comprehensive software packages that offer capabilities such as automation, task management, data analysis, and collaboration features. Solutions provide end-users with integrated platforms designed to enhance efficiency and streamline workflows through AI-driven functionalities.

Organizations increasingly prefer ready-to-use solutions because they reduce the complexity and cost of implementing AI productivity enhancements. These solutions are adaptable across various business processes, enabling companies to realize immediate productivity gains while minimizing the need for extensive customization.

By Technology Analysis

In 2024, Natural Language Processing (NLP) holds a 30.7% share of the technology segment within the AI Productivity Tools Market. NLP enables these tools to understand, analyze, and generate human language, powering features such as chatbots, transcription, sentiment analysis, and automated content creation. Its ability to interpret and respond to user inputs in natural language makes productivity tools more intuitive and user-friendly.

The adoption of NLP is expanding as businesses recognize its value in reducing human effort for tasks like communication, documentation, and customer interaction. It also enhances collaboration by converting unstructured text data into actionable insights, which drives smarter decision-making and faster work cycles.

By Deployment Mode Analysis

In 2024, Cloud-based deployment dominates the market with 70.5% share, driven by the flexibility, scalability, and cost advantages it offers. Cloud platforms allow organizations of all sizes to access AI productivity tools without heavy upfront infrastructure investments. Users benefit from real-time updates, remote accessibility, and seamless integration with existing cloud-based business applications.

Cloud deployment also supports collaborative work environments by enabling multiple users to interact with the productivity tools simultaneously from different locations. The model facilitates continuous innovation as vendors can roll out new features quickly and securely.

According to Flexera’s 2024 State of the Cloud Report, 94% of enterprises already use some form of cloud services, reflecting a strong shift from legacy on-premises solutions. In industries like healthcare and finance, where sensitive data is involved, secure cloud environments such as AWS and Azure are increasingly adopted with compliance frameworks like HIPAA and SOC2.

By Application Analysis

In 2024, Content creation and writing assistance represent 25.4% of the AI productivity tool applications, highlighting the increasing reliance on AI to help generate, edit, and optimize written materials. These tools automate routine writing tasks such as drafting emails, creating reports, proofreading, and improving language clarity, freeing users to focus on higher-level creative and strategic work.

The growth in this application arises from content-centric industries and business functions seeking greater efficiency while maintaining quality. AI-powered writing assistants serve as valuable collaborators, speeding up workflows and supporting consistent communication across teams.

According to HubSpot, 47% of marketers already use AI to assist with content creation, reducing time-to-market for campaigns. In journalism, outlets such as The Washington Post’s Heliograf use AI to automate news briefs, while e-commerce firms employ AI to generate product descriptions at scale. Enterprises also integrate AI into Microsoft Word and Google Docs to improve grammar, tone, and style in real time.

By Organization Size Analysis

In 2024, Large enterprises dominate the market segment with a 60.2% share, reflecting their significant adoption of AI productivity tools to support complex operations and diverse teams. Bigger organizations often have the resources and scale to invest in enterprise-grade solutions that enhance collaboration, automate repetitive tasks, and improve operational efficiency.

These enterprises use AI productivity tools to manage large volumes of data, streamline communication, and drive digital transformation initiatives. The tools help reduce operational costs and improve employee productivity, key factors in sustaining competitiveness in fast-evolving markets.

By Vertical Analysis

In 2024, the BFSI vertical accounts for 21.6% of the AI productivity tools market, underscoring the sector’s growing emphasis on technology-driven efficiency. Institutions in banking, financial services, and insurance utilize AI tools to automate document processing, customer service, compliance management, and risk assessment.

Automating such critical tasks improves turnaround times, reduces errors, and helps maintain regulatory adherence. AI productivity tools also support data-driven decision-making and enhance client engagement, making them essential for BFSI organizations seeking to improve their operational resilience and customer experience.

For instance, JPMorgan Chase’s COiN platform automates the review of thousands of legal documents, saving an estimated 360,000 hours annually. AI chatbots like Bank of America’s Erica handle millions of customer interactions, reducing call center workload and improving response times. Nearly 52% of BFSI firms have integrated AI into core operations, citing enhanced productivity and reduced operational costs as major benefits.

These tools also assist in risk assessment, portfolio management, and compliance monitoring, where accuracy and efficiency are paramount. The sector’s high volume of structured and unstructured data, combined with stringent regulatory requirements, makes AI adoption a strategic imperative for maintaining competitiveness and operational agility.

Key Market Segments

Component

- Solution

- Virtual Assistants

- Document Management

- RPA

- Data Analytics

- Others

- Services

- Professional Services

- Managed Services

Technology

- Machine Learning & Deep Learning

- Natural Language Processing

- Computer Vision

- Generative AI

- Others

Deployment Mode

- Cloud-based

- On-premise

Application

- Content Creation & Writing Assistance

- Code Development & Assistance

- Communication & Meeting Enhancement

- Task & Project Management

- Data Analysis & Visualization

- Others

Organization Size

- Large Enterprises

- Small & Medium Enterprises

Vertical

- BFSI

- IT & Telecommunication

- Healthcare

- Retail & E-commerce

- Media & Entertainment

- Others

Key Regions and Countries Covered in this Report

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Driver

Increasing Need for Efficiency and Remote Collaboration

The growing demand for efficiency and the rise of remote work are driving adoption of AI productivity tools. Businesses seek solutions that can help employees work more effectively regardless of location. AI-powered features like smart scheduling, real-time language translation, and task automation support remote teams by reducing coordination time and enhancing communication.

Companies are under pressure to optimize operations and reduce costs while maintaining output quality. These needs encourage investments in AI tools that help streamline workflows, manage projects, and improve decision-making across distributed work environments.

Restraint

Concerns Over Data Privacy and Security

Data privacy and security concerns limit wider adoption of AI productivity tools. Since these tools often process sensitive company and personal information, users worry about potential data breaches or misuse. Ensuring that AI systems comply with privacy regulations and protect confidential information poses a challenge for software providers.

Trust issues emerge when organizations lack clarity about how AI processes and stores data. Without strong security measures and transparent policies, businesses may hesitate to deploy these tools fully, slowing market growth.

Opportunity

Expansion into Small and Medium-Sized Businesses

An important opportunity lies in expanding AI productivity solutions into small and medium-sized businesses (SMBs). Many SMBs have not yet adopted AI tools widely due to cost, lack of awareness, or limited technical resources. Offering affordable, easy-to-use AI productivity software tailored to their needs can unlock a large, untapped customer base.

Supporting SMBs with user-friendly onboarding, relevant features, and flexible pricing can accelerate market penetration. This expansion also helps businesses improve competitiveness and resilience by leveraging intelligent automation and insights.

Challenge

Balancing Automation with User Control

A significant challenge is finding the right balance between automation and user control. While AI productivity tools aim to simplify tasks, too much automation can lead to reduced creativity, oversight, or errors if users rely blindly on AI suggestions. If users feel that the AI takes too much control or produces inaccurate results, they may lose confidence in the tools.

Effective design must enable users to customize automation levels and intervene when needed. Educating users about AI capabilities and limitations is also important to foster productive collaboration between humans and machines.

Key Player Analysis

In the AI productivity tools market, large technology firms such as Google LLC, Microsoft Corporation, IBM Corporation, and Cisco Systems, Inc. play a central role. Their strong investment in artificial intelligence, cloud platforms, and collaborative ecosystems has enabled them to deliver integrated solutions that drive efficiency.

Specialized automation providers, including Automation Anywhere, Inc., UiPath, and Blue Prism Limited, are strengthening their positions by offering robotic process automation and workflow optimization solutions. These players are recognized for enabling businesses to automate repetitive tasks, reduce operational costs, and improve accuracy.

In addition, other innovators such as Grammarly Inc., Dropbox Inc., and Workato are addressing niche demands in communication, cloud storage, and integration. Grammarly has transformed workplace communication with AI writing assistance, while Dropbox has focused on secure file collaboration. Workato has expanded in integration-led automation by connecting enterprise applications seamlessly.

Top Key Players in the AI Productivity Tools Market

- Automation Anywhere, Inc.

- Blue Prism Limited

- Cisco Systems, Inc.

- Dropbox Inc.

- Grammarly Inc.

- Google LLC

- IBM Corporation

- Microsoft Corporation

- UiPath

- Workato

- Other Key Players

Recent Developments

- August 2025: Adobe launched Acrobat Studio, an AI-powered productivity platform combining Acrobat and Adobe Express. Key features include PDF Spaces for interactive document hubs, AI tools for workflow automation, and seamless content creation. Professionals can centralize files, collaborate efficiently, and reduce repetitive tasks, transforming project management, marketing, and legal workflows into streamlined, organized experiences.

- August 2025: Grammarly has transformed its platform with a document-based interface, an AI sidebar assistant, and advanced tools like AI Grader, Citation Finder, and plagiarism/AI detection. Built on its Coda acquisition, the update enhances writing for students and professionals. Backed by $1B funding and acquiring Superhuman, Grammarly expands AI productivity beyond grammar checks into broader communication.

- July 2025: Grammarly is acquiring Superhuman to expand its AI productivity suite beyond grammar tools. Backed by $1 billion in funding, Grammarly aims to integrate AI agents into email, enhancing workflows and competing with Google and Microsoft. Superhuman, valued at $825 million in 2021, brings $35 million in revenue and expertise in AI-powered communication efficiency.

Report Scope

Report Features Description Market Value (2024) USD 9.89 Bn Forecast Revenue (2034) USD 115.85 Bn CAGR(2025-2034) 27.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions and Services), By Technology (Machine Learning & Deep Learning, Natural Language Processing, Computer Vision, Generative AI, and Others), By Deployment Mode (Cloud-based and On-Premises), By Application, By Vertical Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Automation Anywhere, Inc., Blue Prism Limited, Cisco Systems, Inc., Dropbox Inc., Grammarly Inc., Google LLC, IBM Corporation, Microsoft Corporation, UiPath, Workato, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Productivity Tools MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

AI Productivity Tools MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Automation Anywhere, Inc.

- Blue Prism Limited

- Cisco Systems, Inc.

- Dropbox Inc.

- Grammarly Inc.

- Google LLC

- IBM Corporation

- Microsoft Corporation

- UiPath

- Workato

- Other Key Players