Global AI Processor Market Size and Forecast Industry Analysis Report By Type (General-Purpose AI Processors and Domain-Specific AI Processors), By Application (Image Processing and Recognition, Natural Language Processing, Machine Learning, Deep Learning and Predictive Analytics), By Technology (CPU-based AI Processors, GPU-based AI Processors, FPGA-based AI Processors and ASIC-based AI Processors), By End-User (Automotive, Healthcare, Manufacturing, Retail and Financial Services), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159144

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- AI Processor Market size

- Key Insight Summary

- Market Overview

- Role of Generative AI

- Government-led investments

- US Market Size

- By Type

- By Application

- By Technology

- By End-User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

AI Processor Market size

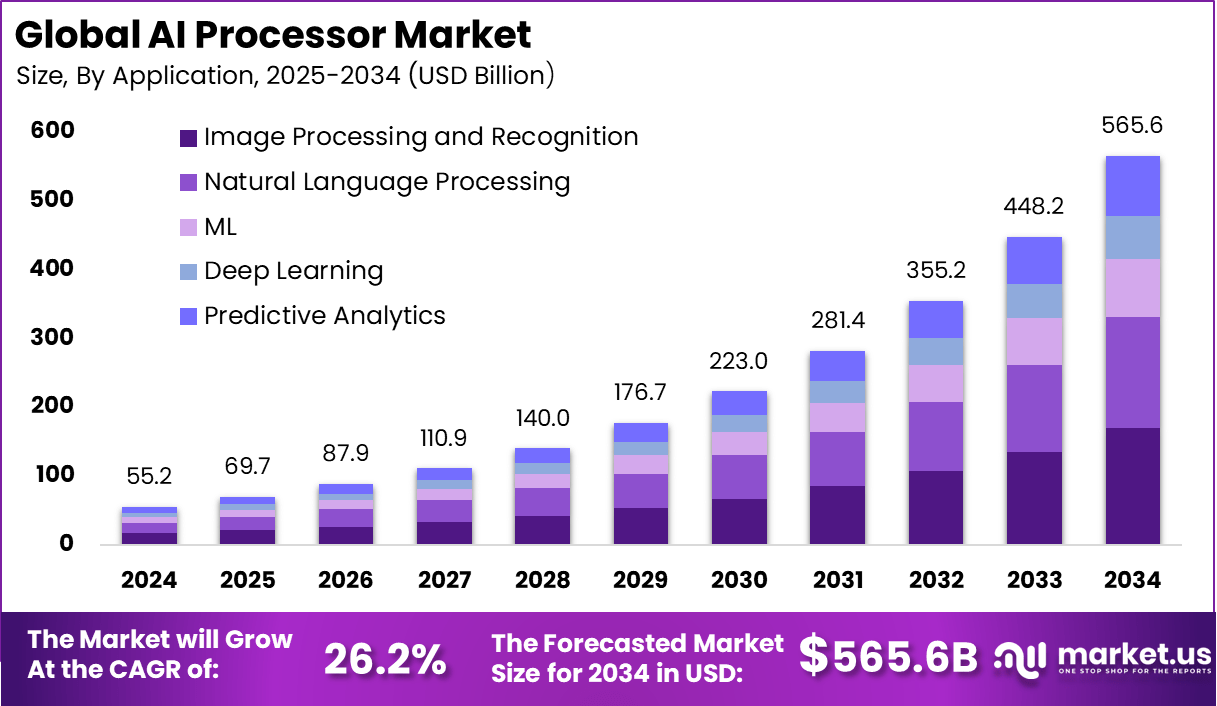

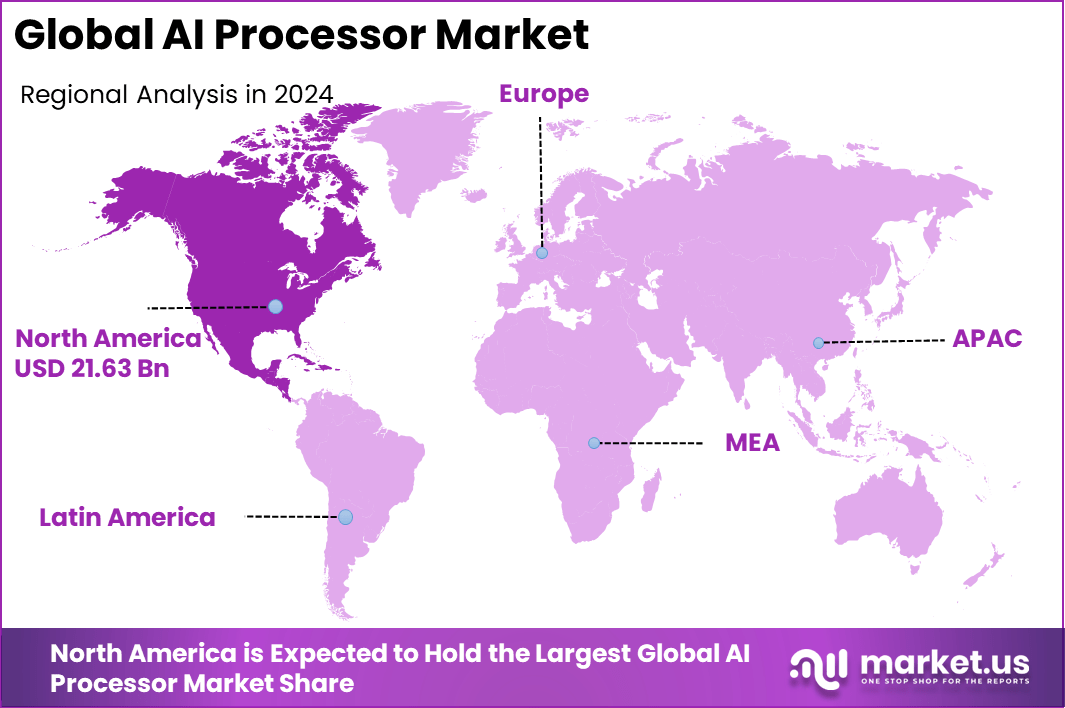

The Global AI Processor Market size is expected to be worth around USD 565.6 Billion By 2034, from USD 55.2 billion in 2024, growing at a CAGR of 26.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 39.2% share, holding USD 21.63 Billion revenue.

Key Insight Summary

- By type, Domain-Specific AI Processors dominated with 55.8% share, reflecting their efficiency in handling tailored AI workloads.

- By application, Image Processing and Recognition led with 30.1% share, driven by adoption in healthcare imaging, surveillance, and autonomous systems.

- By technology, GPU-based AI Processors held 45% share, highlighting their importance in deep learning and high-performance AI computing.

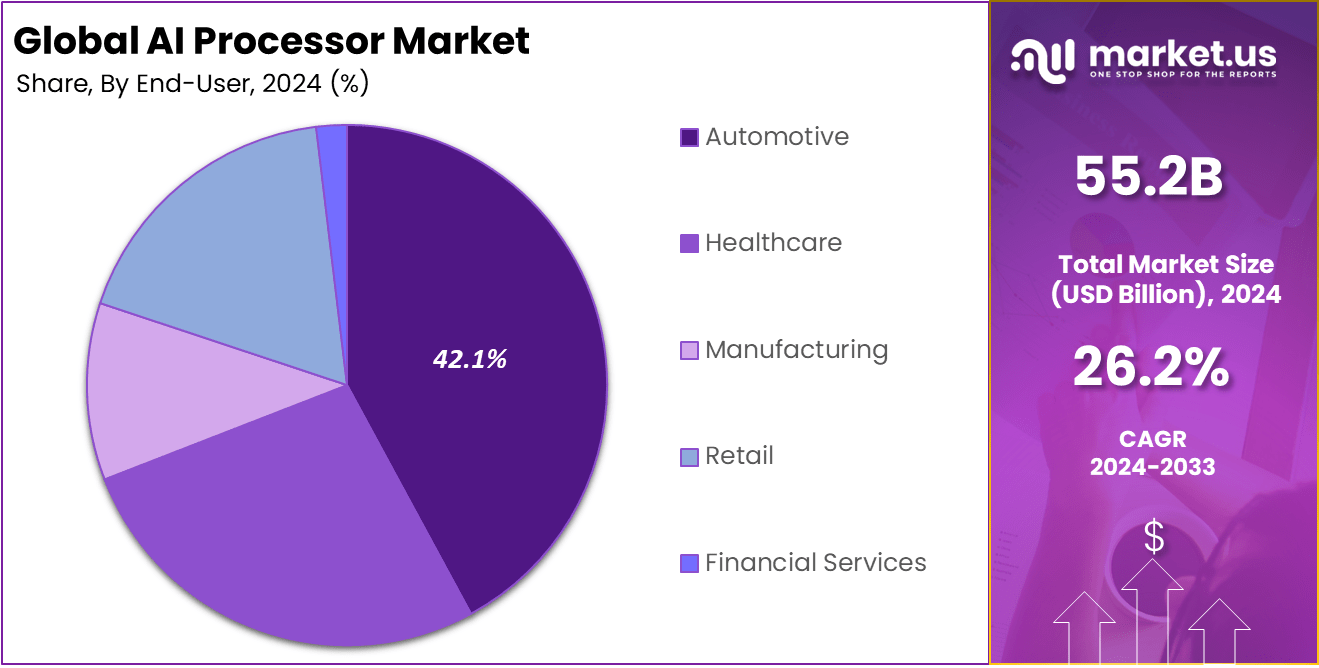

- By end-user, the Automotive segment captured 29.3% share, supported by AI-driven advancements in autonomous driving and smart mobility.

- Regionally, North America accounted for 39.2% share, underscoring its leadership in AI hardware innovation.

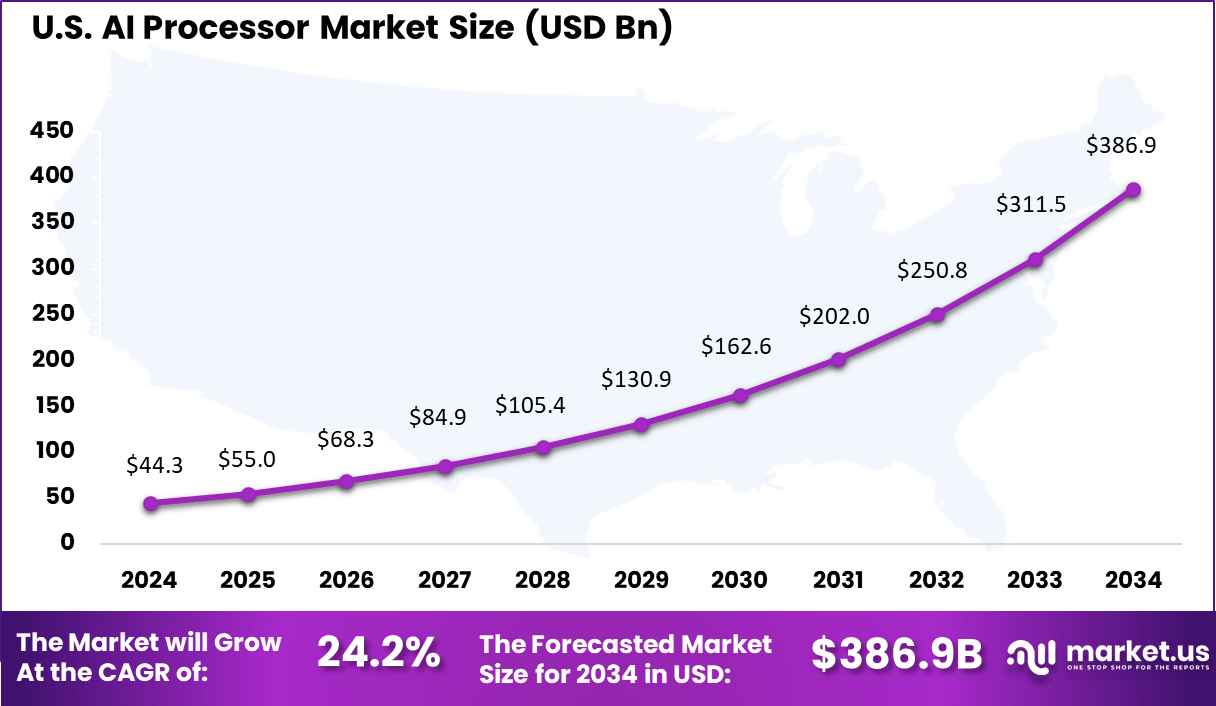

- The U.S. market was valued at USD 44.3 Billion in 2024, growing at a strong CAGR of 24.2%, positioning it as a key driver of global AI processor adoption.

Market Overview

The AI Processor Market covers specialized compute chips that run machine learning workloads efficiently. It includes general purpose CPUs configured for AI, GPUs optimized for parallel math, custom accelerators such as NPUs and TPUs, and domain specific ASICs used in data centers, edge devices, and consumer electronics. These processors execute inference and, in some settings, training, while balancing performance, power, memory bandwidth, and cost.

Top driving factors for the AI processor market include the surge in big data generation and the need for real-time analytics across industries. The rapid rise of AI applications in sectors like healthcare, automotive, finance, and consumer electronics creates demand for processors that can deliver high performance with energy efficiency. The increasing complexity of AI models, especially deep learning networks requiring parallel computation, further boosts demand.

For instance, NVIDIA unveiled its DGX Cloud Lepton marketplace in May 2025, enabling AI developers flexible cloud GPU access, bypassing traditional providers. Furthermore, NVIDIA’s Dynamo framework promises up to 30x faster generative AI deployment on their Blackwell GPUs. The rollout of NVIDIA RTX PRO Servers supports expansive enterprise AI workloads in multimodal AI and digital twin applications.

AMD released its Ryzen AI Pro 300 series, boasting three times better performance than its predecessor for AI-powered laptops, while Intel introduced its Gaudi 3 accelerator aimed at generative AI training, claiming 50% faster performance than NVIDIA’s H100 for certain models despite mixed sales performance. Adding competitive intensity from China, Huawei announced a major new AI computing system powered by its Ascend chips, with plans for a 500,000+ chip supercluster launching next year.

Role of Generative AI

The role of generative AI in the AI processor market has become increasingly significant over the past few years. By 2024, about 71% of businesses had adopted generative AI technologies, a remarkable increase from just 33% in 2023.

This rapid adoption is driven by the ability of generative AI to create content, assist data analysis, and enhance interactions between humans and computers, which requires processors that are specifically optimized for these complex functions.

Additionally, demand for talent in this space is booming; job postings for generative AI roles surged from 55 in early 2021 to nearly 10,000 by mid-2025, reflecting a robust ecosystem of expertise driving innovation and deployment in this area. The expansion of generative AI is also reflected in its market dynamics.

The generative AI software and services market grew from a modest $191 million in 2022 to over $25.6 billion in 2024, emphasizing how foundational models and AI-driven applications are integrated across industries. This adoption encourages companies to develop or acquire processors that can efficiently handle the immense computational requirements of generative AI tasks.

Government-led investments

Government-led investments are playing a significant role in advancing AI processor development and deployment worldwide. In the United States, federal funding for AI-related technologies, including semiconductor research and manufacturing, is expected to total over $470 billion in 2025.

This reflects the strategic national emphasis on maintaining competitiveness in AI hardware and infrastructure. Other leading countries such as China, the United Kingdom, Canada, and India are also investing heavily through targeted programs aimed at fostering innovation ecosystems that include AI processor design and manufacturing.

These government initiatives often involve public-private partnerships that support foundational AI research, pilot projects, and the establishment of advanced semiconductor fabrication facilities. The focus on AI chip technology is also aligned with broader digital transformation goals and national security considerations.

For instance, funding efforts are supporting both fundamental research on AI accelerators and ecosystem development, ensuring that these countries can secure a leadership position in the global AI processor supply chain. This government support not only accelerates hardware innovation but also helps stabilize supply chains critical for the scalable adoption of AI technologies.

US Market Size

Within the region, the U.S. accounted for the dominant share supported by rapid scaling of AI-driven enterprises, strong digital infrastructure, and growing emphasis on advanced analytics. The market is projected to expand at a 24.2% CAGR as more industries accelerate their transition to AI-powered systems.

North America led the market with 39.2% share. The strong presence of AI-focused research, early adoption across multiple industries, and significant investment in cloud infrastructure have supported the region’s lead. Widespread use in sectors such as finance, healthcare, and automotive has further cemented its position.

By Type

In 2024, Domain-specific AI processors accounted for 55.8% of the market. These processors are designed to optimize specific AI workloads such as natural language processing, computer vision, or machine learning model training. Their efficiency in handling focused tasks with higher performance per watt is driving adoption, especially in applications where speed and accuracy are critical.

Unlike general-purpose CPUs, domain-specific processors reduce computational overhead by delivering tailored architectures. This capability enables industries such as cloud computing and edge devices to operate more efficiently. As AI adoption grows, reliance on highly specialized processors continues to expand to meet performance and energy requirements.

By Application

In 2024, Image processing and recognition made up 30.10% of the application share. This reflects the strong demand for AI processors in areas such as medical imaging, surveillance, autonomous driving, and consumer electronics. High-performance processors are essential to run complex recognition algorithms with low latency.

The rising use of facial recognition for security and smart devices has reinforced this demand. In addition, sectors like retail and healthcare actively invest in AI systems that process vast volumes of visual data. This creates steady growth opportunities for processors tailored to support image-based operations.

By Technology

In 2024, GPU-based AI processors held 45% of the market. Their parallel computing capability makes them one of the most effective technologies for training deep learning models. GPUs are widely used in data centers and enterprise AI applications where scalability and performance are vital.

The ability of GPUs to handle large amounts of unstructured data at faster speeds compared to traditional processors has fueled their acceptance. They remain a preferred choice for both training and inference tasks across domains like gaming, autonomous systems, and cloud-based AI workloads.

By End-User

In 2024, the automotive segment contributed 29.3% of the demand. AI processors in this field are primarily deployed in advanced driver-assistance systems (ADAS) and self-driving platforms. Their role is to ensure real-time decision-making by processing sensor and image data instantly.

Growing investments in autonomous mobility and the push toward safer driving standards are supporting this adoption. As vehicles become more connected and intelligent, AI processors remain central to enabling these advanced automotive technologies.

Emerging Trends

Emerging trends in AI processors include a shift towards smaller, more specialized model architectures that offer improved efficiency without compromising power. These specialized processors often take the form of custom ASICs or new types of tensor processing units designed to maximize throughput for AI workloads while minimizing energy consumption.

In 2025, alternative AI processors beyond traditional GPUs are gaining market share, with custom AI chips now accounting for a significant proportion of data center deployments. Hybrid models combining standard CPUs with AI accelerators are also becoming commonplace, allowing tasks to be distributed optimally across hardware tailored for different computing functions.

Another key trend is the growing emphasis on edge AI processing, where power-efficient chips are deployed in devices like smartphones, routers, and IoT sensors. This trend has prompted a 26% increase in demand for inference chips suitable for edge deployment in 2025.

Simultaneously, multimodal AI platforms that integrate text, image, and audio processing have increased the need for versatile AI processors supporting diverse data types, driving chip revenue exceeding $2.3 billion this year alone. These trends signal a future where AI hardware is not only more powerful but also more versatile and integrated across diverse computing environments.

Growth Factors

Several growth factors underpin the rapid expansion of the AI processor market. One critical factor is the advancement of AI hardware architectures, such as the introduction of next-generation GPUs and AI accelerators that substantially increase processing speed and energy efficiency.

Spending on AI-accelerated servers increased by 178% year-over-year, signaling strong enterprise investment in infrastructure capable of supporting complex AI applications. The rollout of 5G networks has created fertile ground for AI processors by increasing the volume of connected devices by nearly 97%, thereby generating immense amounts of data that require real-time processing at the edge and in the cloud.

Edge computing itself is growing at a compound annual growth rate (CAGR) of over 28%, driven by use cases such as real-time video analytics, augmented reality, and industrial automation. These applications demand low-latency AI processing on small form-factor devices, fueling demand for processors that balance power and computational efficiency.

The convergence of 5G, edge AI, and improved AI accelerators is creating an ecosystem where AI processors play a central role in enabling new business models and digital services, thus fueling sustained market growth.

Key Market Segments

By Type

- General-Purpose AI Processors

- Domain-Specific AI Processors

By Application

- Image Processing and Recognition

- Natural Language Processing

- Machine Learning

- Deep Learning

- Predictive Analytics

By Technology

- CPU-based AI Processors

- GPU-based AI Processors

- FPGA-based AI Processors

- ASIC-based AI Processors

By End-User

- Automotive

- Healthcare

- Manufacturing

- Retail

- Financial Services

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Demand for AI Applications Across Industries

The demand for AI processors is being driven strongly by the expanding use of AI applications in various industries such as automotive, healthcare, finance, and retail. These processors enable real-time, efficient processing of complex data necessary for AI workloads in autonomous vehicles, robotic surgeries, fraud detection, and personalized recommendations.

For instance, in the automotive sector, more than 70% of autonomous vehicles now incorporate advanced AI processors to enable real-time decision-making, drastically reducing latency and improving safety. This growing reliance on AI-powered systems in everyday devices like smartphones, wearables, and smart assistants is also pushing the need for high-performance AI processors.

As enterprises seek faster, domain-specific processors to handle their cloud and edge AI workloads, the overall market is expanding rapidly. AI processors have notably reduced data processing times by up to 40%, which is critical for applications demanding immediate responses. This broad integration of AI technologies into diverse industries continues to fuel the rising demand for sophisticated AI processing hardware.

Restraint Analysis

Supply Chain Disruptions and Chip Shortages

Despite strong demand, the AI processor market faces significant challenges from supply chain disruptions and semiconductor shortages. Geopolitical tensions, trade restrictions, and manufacturing delays due to events like lockdowns have constrained the supply of essential components such as silicon wafers.

The market’s reliance on a few major foundries for advanced chip manufacturing intensifies these challenges, often delaying product launches and increasing procurement costs for original equipment manufacturers (OEMs).

For instance, the complexity and high precision required for AI processors, which depend on cutting-edge manufacturing nodes, make them particularly vulnerable to these supply bottlenecks. Such disruptions limit scalability and accessibility of AI-enabled products across industries, acting as a major barrier to market growth.

Opportunity Analysis

Expansion of Edge AI and Low-Power Processors

One of the most promising opportunities for AI processors lies in the growth of edge AI computing, where data processing occurs close to the source rather than centralized data centers. This approach reduces latency, bandwidth usage, and enhances data privacy, making it highly suitable for smart devices, autonomous vehicles, and industrial IoT applications.

Enterprises and manufacturers are investing heavily in hardware optimized for fast inference and thermal efficiency, expanding the market for innovative AI processors designed for edge deployment. For example, the growing push for Industry 4.0 and smart city development is creating a surge in demand for low-power AI chipsets that can operate efficiently on edge devices.

This enables real-time analytics in sectors like manufacturing, healthcare, and retail without relying on constant cloud connectivity. The rise of edge AI processors represents a critical growth factor, as these chips improve user experience and unlock new applications requiring instantaneous decisions.

Challenge Analysis

High Development Costs and Skilled Talent Shortage

The AI processor market is also constrained by the high costs associated with research, design, and manufacturing of these sophisticated chips. Developing AI processors requires significant capital investment, extensive development timelines, and advanced fabrication capabilities.

This high entry barrier limits the number of players who can compete, resulting in a concentration among a few leading tech firms with deep pockets and advanced R&D departments. Moreover, the industry faces a shortage of qualified professionals skilled in both AI algorithm development and hardware design.

The lack of talent hampers innovation capacity and slows down the pace at which new AI processors can be developed and launched commercially. For instance, smaller firms struggle to attract and retain such expertise, which compounds the challenge of accelerating AI processor technology development and deployment. This talent gap remains a critical obstacle to the broader AI processor ecosystem’s expansion.

Competitive Analysis

In the AI processor market, NVIDIA, Intel, AMD, and Qualcomm are dominant players with strong portfolios in GPUs, CPUs, and AI accelerators. These companies provide high-performance processors that power data centers, autonomous systems, and edge devices.

Technology leaders such as Apple, Google (Alphabet), Samsung, IBM, Microsoft, Arm, MediaTek, and Huawei expand the ecosystem with diverse AI-enabled processors. Their solutions integrate into smartphones, cloud infrastructure, and enterprise applications, supporting both consumer and business markets..

Emerging innovators including Graphcore, Cerebras Systems, Tenstorrent, Mythic AI, and major cloud providers like Amazon Web Services, Alibaba, Baidu, and Fujitsu contribute with specialized chips and AI-optimized infrastructure. Their focus on accelerating training, inference, and edge deployment drives efficiency and scalability.

Top Key Players in the Market

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices (AMD) Inc.

- Qualcomm Technologies Inc.

- Apple Inc.

- Alphabet Inc. (Google)

- Samsung Electronics Co. Ltd.

- IBM Corporation

- Microsoft Corporation

- Arm Ltd.

- MediaTek Inc.

- Huawei Technologies Co. Ltd.

- Graphcore Ltd.

- Tenstorrent Inc.

- Cerebras Systems Inc.

- Alibaba Group

- Baidu Inc.

- Amazon Web Services

- Fujitsu Ltd.

- Mythic AI

- Others

Recent Developments

- In December 2024, NVIDIA also closed its acquisition of Run:ai, a company that optimizes GPU resource orchestration for AI workloads, for around $700 million. This strengthens NVIDIA’s GPU efficiency and cloud-based AI workloads management.

- In October 2024, AMD announced the mass production of its MI325X AI chip planned for Q1 2025, designed to compete in the Nvidia-dominated market. They also announced upcoming MI350 series chips for late 2025, promising improved memory and architecture for better AI performance.

- In September 2024, Qualcomm launched its Snapdragon X Plus 8-core processor aimed at AI-powered PCs, challenging Intel and AMD in this segment. The chip supports AI workloads with power efficiency and received backing from Microsoft for inclusion in Copilot+ PCs. It aims to extend Qualcomm’s reach beyond smartphones into the AI PC market at a competitive price point starting around $700 per device.

Report Scope

Report Features Description Market Value (2024) USD 55.2 Bn Forecast Revenue (2034) USD 565.6 Bn CAGR(2025-2034) 26.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (General-Purpose AI Processors and Domain-Specific AI Processors), By Application (Image Processing and Recognition, Natural Language Processing, Machine Learning, Deep Learning and Predictive Analytics), By Technology (CPU-based AI Processors, GPU-based AI Processors, FPGA-based AI Processors and ASIC-based AI Processors), By End-User (Automotive, Healthcare, Manufacturing, Retail and Financial Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD) Inc., Qualcomm Technologies Inc., Apple Inc., Alphabet Inc. (Google), Samsung Electronics Co. Ltd., IBM Corporation, Microsoft Corporation, Arm Ltd., MediaTek Inc., Huawei Technologies Co. Ltd., Graphcore Ltd., Tenstorrent Inc., Cerebras Systems Inc., Alibaba Group, Baidu Inc., Amazon Web Services, Fujitsu Ltd., Mythic AI Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NVIDIA Corporation

- Intel Corporation

- Advanced Micro Devices (AMD) Inc.

- Qualcomm Technologies Inc.

- Apple Inc.

- Alphabet Inc. (Google)

- Samsung Electronics Co. Ltd.

- IBM Corporation

- Microsoft Corporation

- Arm Ltd.

- MediaTek Inc.

- Huawei Technologies Co. Ltd.

- Graphcore Ltd.

- Tenstorrent Inc.

- Cerebras Systems Inc.

- Alibaba Group

- Baidu Inc.

- Amazon Web Services

- Fujitsu Ltd.

- Mythic AI

- Others