Global AI-Powered Robot Picker Market Size, Share Report By Type (Fixed Type, Mobile Type), By Picking Object Types (Fixed Robotic Arm Picking Workstation, AMR/AGV + Robotic Arm Integrated Picking Robot, Collaborative Robotic Arm), By Perception and Algorithm Technology (2D Vision + Barcode Recognition, 3D Vision Recognition + Posture Estimation, Vision + Force Control Fusion Type), By Application (Retail and E-Commerce, Healthcare, Consumer Electronics, Automotive, Warehouse & Logistics, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169570

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- By Type

- By Picking Object Types

- By Perception and Algorithm Technology

- By Application

- By Region

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

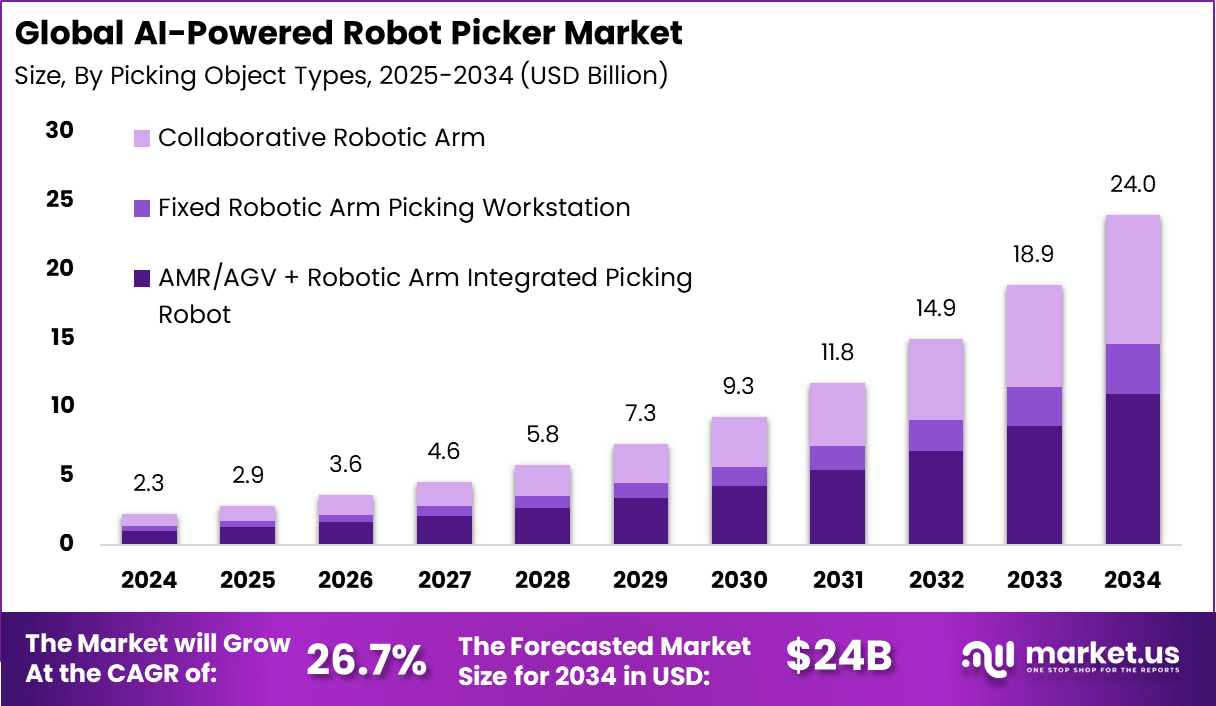

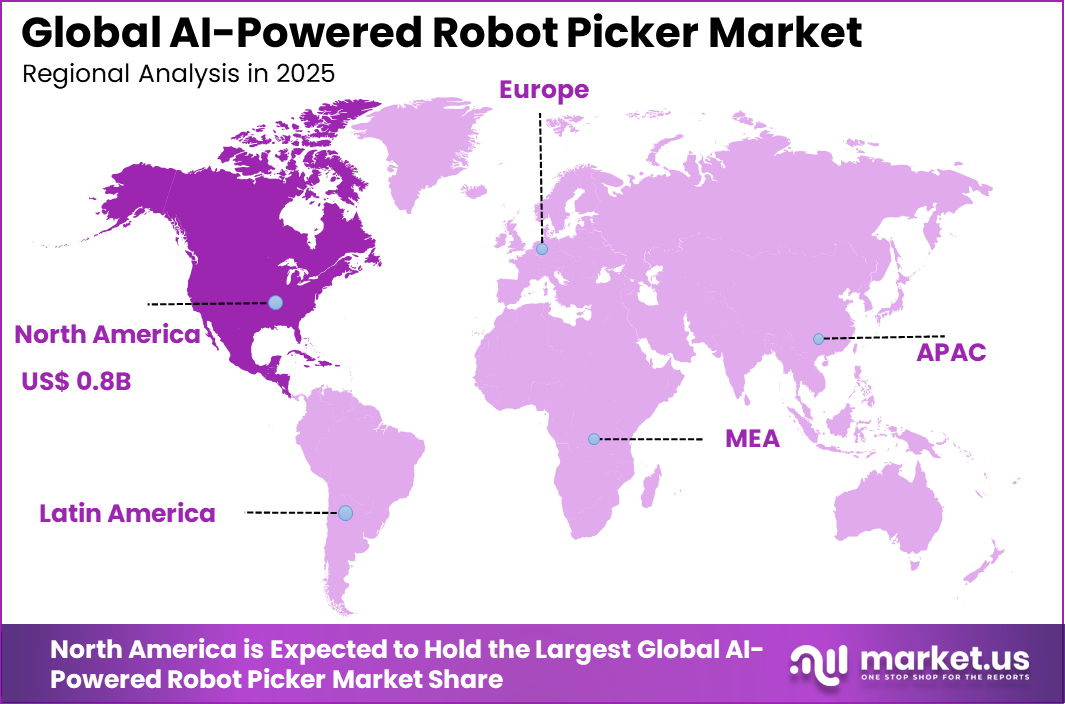

The Global AI-Powered Robot Picker Market generated USD 2.3 billion in 2024 and is predicted to register growth from USD 2.9 billion in 2025 to about USD 24 billion by 2034, recording a CAGR of 26.7% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 37.6% share, holding USD 0.8 Billion revenue.

The AI powered robot picker market has grown as warehouses and distribution centers increase the use of automated systems for item handling and order picking. Growth is linked to higher online sales activity, larger storage facilities and the need for faster product movement. These robots are now widely used in storage, sorting and packing operations across retail, logistics and manufacturing supply chains.

The growth of the market can be attributed to worker shortages, rising order volumes and the need to improve accuracy in picking operations. Manual picking is slow and prone to errors, especially during peak demand periods. Robot pickers help reduce dependence on human labor and maintain steady output across long operating hours.

Demand is rising across online retail warehouses, third party logistics centers, grocery storage facilities, pharmaceutical distribution units and factory warehouses. Facilities handling thousands of product types rely on robot pickers to manage mixed inventory with consistent results. Demand is strongest in regions with high online shopping activity and large scale warehouse development.

Key technologies supporting adoption include image recognition cameras, motion control systems, object detection software, robotic arms, gripping tools, warehouse mapping software and task scheduling systems. Vision systems allow robots to identify items of different sizes and shapes. Control software guides smooth movement and correct placement during picking and sorting.

Organisations adopt AI powered robot pickers to improve picking speed, reduce errors and lower dependence on manual workers. These robots operate continuously without fatigue and maintain the same level of accuracy across all shifts. They also help reduce work related injuries caused by lifting, bending and repetitive movement.

Investment opportunities exist in robotic arm development, gripping systems for fragile goods, mobile picking robots, vision systems for low light conditions and software platforms that connect robots with warehouse management systems. Strong potential is seen in food storage, cold chain logistics, medicine distribution and large e commerce storage centers.

Top Market Takeaways

- Mobile-type robot pickers dominated with 64.7%, showing strong demand for flexible and autonomous picking systems in dynamic warehouse environments.

- AMR and AGV integrated with robotic arms captured 45.8%, reflecting rising preference for hybrid systems that combine mobility with precise item handling.

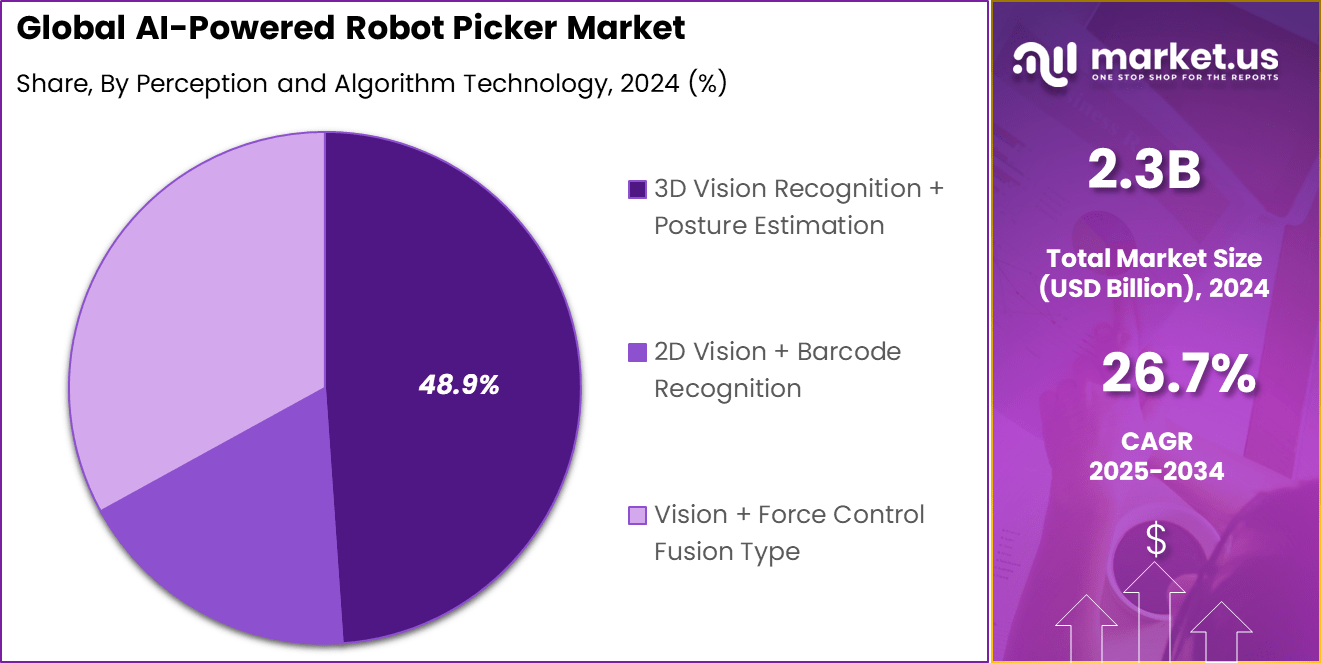

- 3D vision recognition and posture estimation accounted for 48.9%, confirming that advanced perception is now central to accurate and damage-free picking.

- Retail and e-commerce held 40.6%, driven by high order volumes, fast fulfillment expectations, and growing automation in distribution centers.

- North America recorded 37.6%, supported by early automation adoption and large-scale warehouse infrastructure.

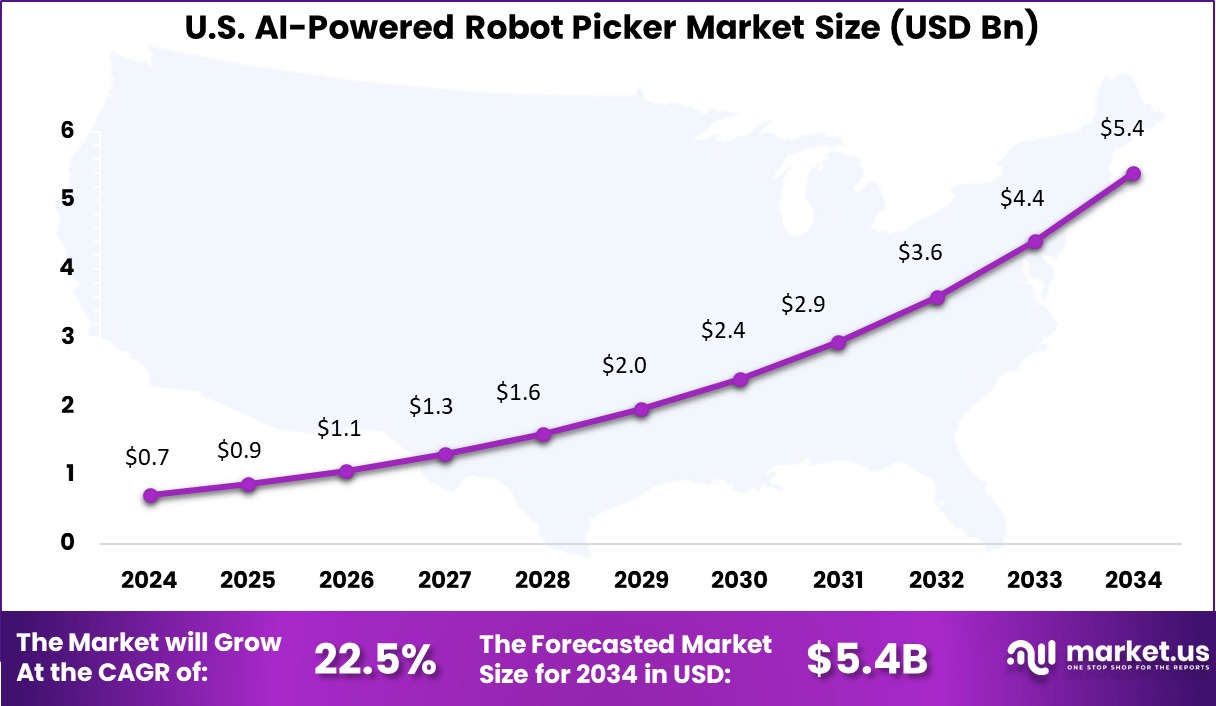

- The U.S. market reached USD 0.71 billion in 2024 with a strong 22.5% CAGR, reflecting rapid investment in AI-driven fulfillment automation.

Quick Market Facts

Key Performance Statistics

- AI-powered picking systems achieve over 99% accuracy, sharply reducing errors that cost about USD 22 per mistake in manual operations.

- Advanced robotic systems such as the ABB robotic item picker can reach up to 1,400 items per hour, while human workers average about 2,100 picks per hour but require breaks and shift limitations.

- Autonomous Mobile Robots increase picking rates by about 70% and lift combined human-robot productivity by up to 85%.

- Case studies show order processing speed improvements of up to 40% after robotic automation.

- Labor cost savings typically range from 30% to 50%, and some firms achieve ROI in as little as two months.

- One large retailer cut operational costs by 65% after full warehouse automation.

- Labor shortages remain severe, with 73% of warehouse operators reporting difficulty in fully staffing operations, making automation a structural necessity.

Industry Adoption and Market Trends

- The Global AI in Robotics Market size is expected to be worth around USD 146.8 Billion by 2033, from USD 12.3 Billion in 2023, growing at a CAGR of 28.12% during the forecast period from 2024 to 2033.

- Amazon now operates over 1 million robots across its fulfillment centers, contributing to a 75% reduction in picking and packing time.

- Nearly 50% of logistics companies plan to deploy AI-based autonomous warehouse systems by the end of 2024.

- Computer vision and machine learning allow robots to adapt to changing warehouse layouts and handle mixed items such as polybags, cartons, and electronics without major reprogramming.

- This operational flexibility is now one of the strongest drivers accelerating large-scale adoption of AI-powered robot pickers.

By Type

The mobile type segment holds the largest share at 64.7%, showing that warehouses strongly prefer robots that can move freely across the floor. These robots navigate between aisles, shelves, and picking zones without fixed tracks. This mobility allows operators to adjust layouts easily as inventory changes. It also supports round the clock operations with minimal setup changes.

The dominance of mobile robots reflects the need for flexibility in daily warehouse work. These systems help reduce walking time for workers and improve order movement speed. Their ability to operate in existing warehouse spaces makes them suitable for both new and older facilities.

By Picking Object Types

AMR/AGV combined with robotic arm integrated picking robots lead with 45.8% share, blending mobility and precision for efficient item handling. These systems let the mobile base transport the arm to shelves, where it grabs items using grippers or suction, ideal for mixed-size goods in e-commerce warehouses. The setup speeds up order fulfillment by minimizing human movement while maintaining accuracy in tight spaces. Such integration handles everything from boxes to fragile packages effectively.

This combination excels in goods-to-person workflows, where robots deliver shelves directly to pickers for quick selection. Enhanced arm dexterity from AI control reduces errors and supports diverse inventory types, from apparel to electronics. Warehouse managers report smoother operations during high-demand periods, as these robots adapt to real-time inventory shifts without constant reprogramming. Their rise reflects a push for automation that feels intuitive and labor-saving.

By Perception and Algorithm Technology

3D vision recognition paired with posture estimation holds 48.9% of the market, enabling robots to see and grasp items in cluttered or varied orientations. 3D cameras create detailed depth maps, while posture algorithms calculate the best grip points, even for irregular shapes like bags or bottles. This tech shines in fast-paced picking where flat 2D vision falls short, ensuring reliable performance under different lighting or stacking conditions. It mimics human-like judgment for complex selections.

Refinements in processing speed make this duo indispensable for high-throughput environments, cutting mis-picks and boosting cycle times. Integration with machine learning allows continuous improvement from operation data, adapting to new product types over time. Facilities using these systems note fewer damages and higher uptime, as robots confidently handle dynamic shelf arrangements. The focus on real-time accuracy fuels their dominance in modern automation setups.

By Application

Retail and e-commerce drive 40.6% of demand, fueled by surging online orders that require rapid, accurate picking around the clock. AI-powered pickers tackle variable SKUs and peak volumes, streamlining fulfillment from sorting to packing without slowdowns. They address labor shortages by automating repetitive tasks, letting staff focus on oversight and customer service. This application transforms how stores manage inventory for same-day delivery promises.

E-commerce growth amplifies the need for these robots in handling returns, restocking, and personalized orders efficiently. Their speed in zone picking or direct-to-packer routes aligns with consumer expectations for quick shipping. Operators see clear gains in throughput during sales events, making this segment a cornerstone of competitive retail logistics. Scalable deployment keeps costs in check as volumes rise.

By Region

North America captures 37.6% of the market, anchored by advanced warehouses and heavy e-commerce activity. Investments in automation here prioritize speed and integration, supporting massive distribution networks that serve urban consumers. The region’s tech ecosystem fosters innovations in AI navigation and grippers tailored to local logistics challenges. Strong adoption stems from proven returns in efficiency and workforce optimization.

The U.S. stands out with USD 0.71 billion value and a robust 22.5% CAGR, propelled by fulfillment center expansions and labor dynamics. Rapid rollout of mobile picking solutions meets rising demands from online giants, emphasizing reliability in diverse inventory scenarios. Focus on sustainable operations and quick ROI positions U.S. facilities as leaders in deploying these technologies at scale. Ongoing refinements ensure they evolve with market shifts.

Emerging Trends

One emerging trend in the AI powered robot picker market is the growing focus on systems that can handle a wider variety of items with improved accuracy. Warehouses increasingly deal with mixed inventories that include fragile goods, irregular shapes, and soft packaging. New robot pickers use advanced vision tools and learning models that help them understand object size, placement, and orientation. This allows them to pick items more safely and reduces the number of failed attempts.

Another trend is the rise of collaborative picking setups. Many facilities now combine human workers with AI guided robots to balance speed and precision. Robots take on repetitive or heavy tasks, while workers focus on more complex picks or quality checks. This blended approach helps warehouses increase output without fully replacing human involvement. It also allows companies to scale automation gradually as they learn how robots perform in day to day operations.

Growth Factors

A major growth factor is the continued expansion of online retail. As orders rise in number and variety, warehouses face pressure to shorten fulfillment times and reduce errors. AI powered robot pickers support this need by working steadily, handling large volumes, and reducing the dependence on manual labour during peak periods. This capability makes them valuable for companies seeking faster delivery performance and more predictable operations.

Another growth factor comes from rising labour shortages in logistics centers. Many regions report difficulty hiring and retaining warehouse workers, especially for repetitive tasks such as picking and sorting. Robot pickers help fill these gaps by taking on physically demanding work. This reduces strain on existing staff and helps warehouses maintain consistent output even when labour availability is limited.

Key Market Segments

By Type

- Fixed Type

- Mobile Type

By Picking Object Types

- AMR/AGV + Robotic Arm Integrated Picking Robot

- Fixed Robotic Arm Picking Workstation

- Collaborative Robotic Arm

By Perception and Algorithm Technology

- 3D Vision Recognition + Posture Estimation

- 2D Vision + Barcode Recognition

- Vision + Force Control Fusion Type

By Application

- Retail and E-Commerce

- Healthcare

- Consumer Electronic

- Automotive

- Warehouse & Logistics

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A major driver in the AI powered robot picker market is the rising need for faster and more accurate order fulfillment. As warehouses handle larger volumes of online orders, they depend on systems that can pick items with steady speed and reduced error.

AI guided robots can identify, grasp, and sort products with consistent precision, which supports higher throughput in busy facilities. This improvement in daily performance encourages companies to adopt automated picking solutions.

Another driver comes from advances in machine vision. Robots can now recognize different object types, shapes, and positions more reliably. This allows them to work with mixed inventories instead of only uniform items. As a result, more industries find these systems suitable for their operations, strengthening market demand.

Restraint Analysis

A key restraint is the high initial investment required to deploy robot pickers. Hardware, sensors, software, and storage layout adjustments can be costly. For small and medium facilities, these expenses may be difficult to justify, especially if order volumes are not consistently high. This financial barrier slows adoption in certain segments.

Another restraint involves integration with existing systems. Many warehouses use older inventory tools or manual processes. Connecting new robots to these systems requires planning, testing, and temporary operational disruption. The complexity of this transition can discourage some organizations from moving toward automation.

Opportunity Analysis

There is strong opportunity in supporting round the clock warehouse operations. Robot pickers do not require breaks or shift rotation, which allows facilities to run longer hours without increasing labour demands. This capability is valuable for businesses aiming to offer faster delivery options and handle peak season surges.

Another opportunity lies in industries with large variations in product size and shape. Traditional automation often struggles with irregular items. AI powered robots that can adapt to different products open the door for adoption in sectors such as fashion, electronics, and general retail. This flexibility creates room for wider market expansion.

Challenge Analysis

A significant challenge is maintaining picking accuracy in real world warehouse environments. Lighting changes, item crowding, and damaged packaging can reduce vision quality and lead to incorrect picks. Continuous monitoring and tuning are needed to keep performance stable over time. This adds operational effort for warehouse teams.

Another challenge relates to workforce adjustment. As robots take on more tasks, staff roles shift toward supervision and maintenance. Training workers to manage these new responsibilities requires time and resources. Facilities that are not prepared for this transition may struggle to achieve smooth adoption of robotic systems.

Competitive Analysis

Nomagic, Covariant, ABB, and Siemens lead the AI-powered robot picker market with advanced vision-guided robotics and adaptive grasping technologies. Their systems enable high-speed piece picking, mixed-SKU handling, and continuous learning in dynamic warehouse environments. These companies focus on improving pick accuracy, throughput, and reliability. Growing demand from e-commerce and fulfillment centers continues to reinforce their leadership in large-scale automation deployments.

Pickr.AI, KNAPP, inVia Robotics, and Mecalux strengthen the competitive landscape with modular robot picking cells and software-driven orchestration. Their platforms support goods-to-person workflows, rapid SKU changeovers, and real-time inventory alignment. These providers emphasize fast deployment, scalable design, and seamless WMS integration. Rising labor shortages and order volume volatility continue to drive adoption of their solutions.

Inther Group, SSI Schaefer, Swisslog, Vanderlande, Dematic, Honeywell, Quicktron, and Geekplus broaden the market with integrated picking robots, AMRs, and full intralogistics automation suites. Their solutions target high-density storage, fast order consolidation, and multi-robot coordination. These companies focus on system-level optimization and global deployment capability. Expanding warehouse automation across retail, apparel, and grocery segments continues to support strong market growth.

Top Key Players in the Market

- Nomagic

- Covariant

- ABB

- Siemens AG

- Pickr.AI

- KNAPP AG

- inVia Robotics, Inc.

- Mecalux, S.A.

- Inther Group

- SSI Schaefer

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Dematic

- Honeywell International Inc.

- Quicktron

- Geekplus Technology Co., Ltd.

- Others

Recent Developments

- March, 2025 – ABB launched AI-powered functional modules for its Robotic Item Picking Family, including the Fashion Inductor and Parcel Inductor, achieving over 99.5% picking accuracy in dynamic warehouse settings.

- March, 2025 – Siemens introduced Simatic Robot Pick AI Pro, a vision software that enables robots to pick unknown objects with vacuum grippers, speeding up single-piece order fulfillment for e-commerce.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Bn Forecast Revenue (2034) USD 24 Bn CAGR(2025-2034) 26.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Fixed Type, Mobile Type), By Picking Object Types (Fixed Robotic Arm Picking Workstation, AMR/AGV + Robotic Arm Integrated Picking Robot, Collaborative Robotic Arm), By Perception and Algorithm Technology (2D Vision + Barcode Recognition, 3D Vision Recognition + Posture Estimation, Vision + Force Control Fusion Type), By Application (Retail and E-Commerce, Healthcare, Consumer Electronics, Automotive, Warehouse & Logistics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nomagic, Covariant, ABB, Siemens AG, Pickr.AI, KNAPP AG, inVia Robotics, Inc., Mecalux, S.A., Inther Group, SSI Schaefer, Swisslog Holding AG, Vanderlande Industries B.V., Dematic, Honeywell International Inc., Quicktron, Geekplus Technology Co., Ltd., Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Robot Picker MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Robot Picker MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nomagic

- Covariant

- ABB

- Siemens AG

- Pickr.AI

- KNAPP AG

- inVia Robotics, Inc.

- Mecalux, S.A.

- Inther Group

- SSI Schaefer

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Dematic

- Honeywell International Inc.

- Quicktron

- Geekplus Technology Co., Ltd.

- Others