Global AI-Powered End-to-End Contract Management Solutions Market Size, Share and Analysis Report By Types (Cloud-Based, On-Premises), By Application (BFSI, Manufacturing, Pharmaceuticals & Healthcare, Real Estate, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174603

- Number of Pages: 321

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Type

- By Application

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

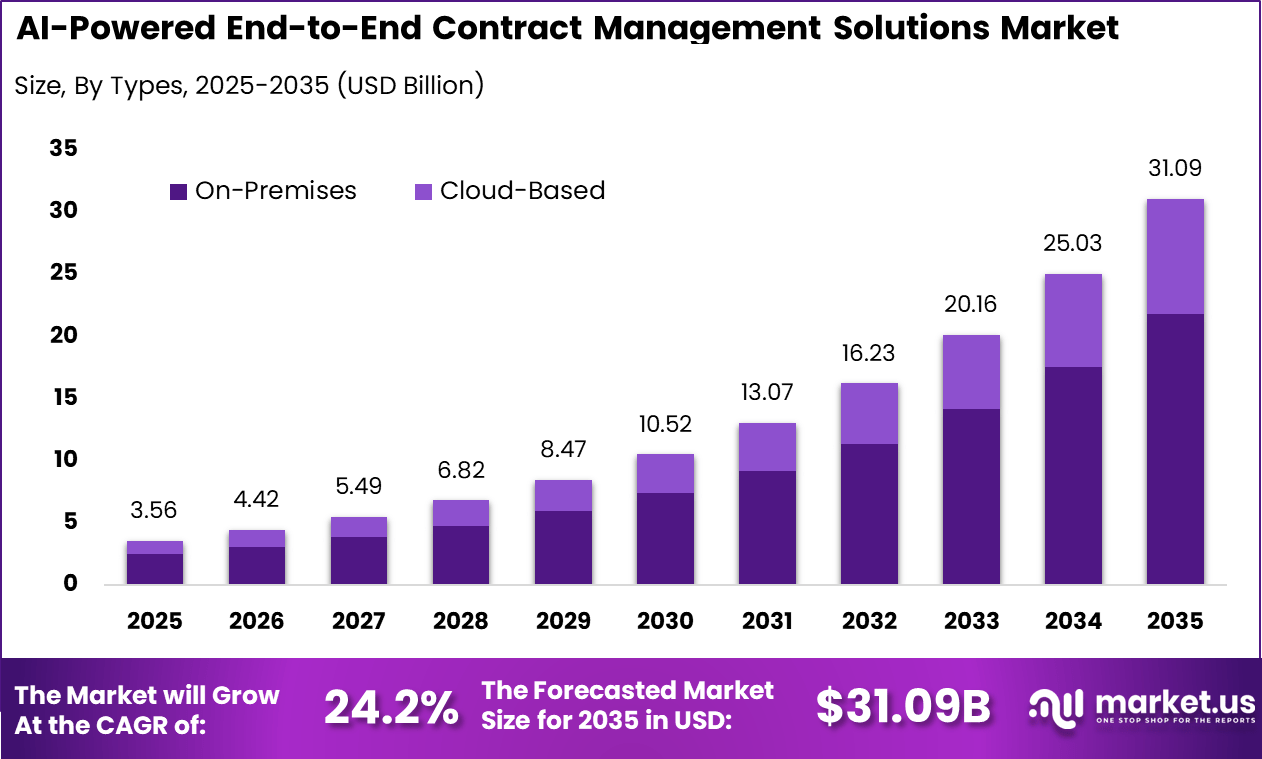

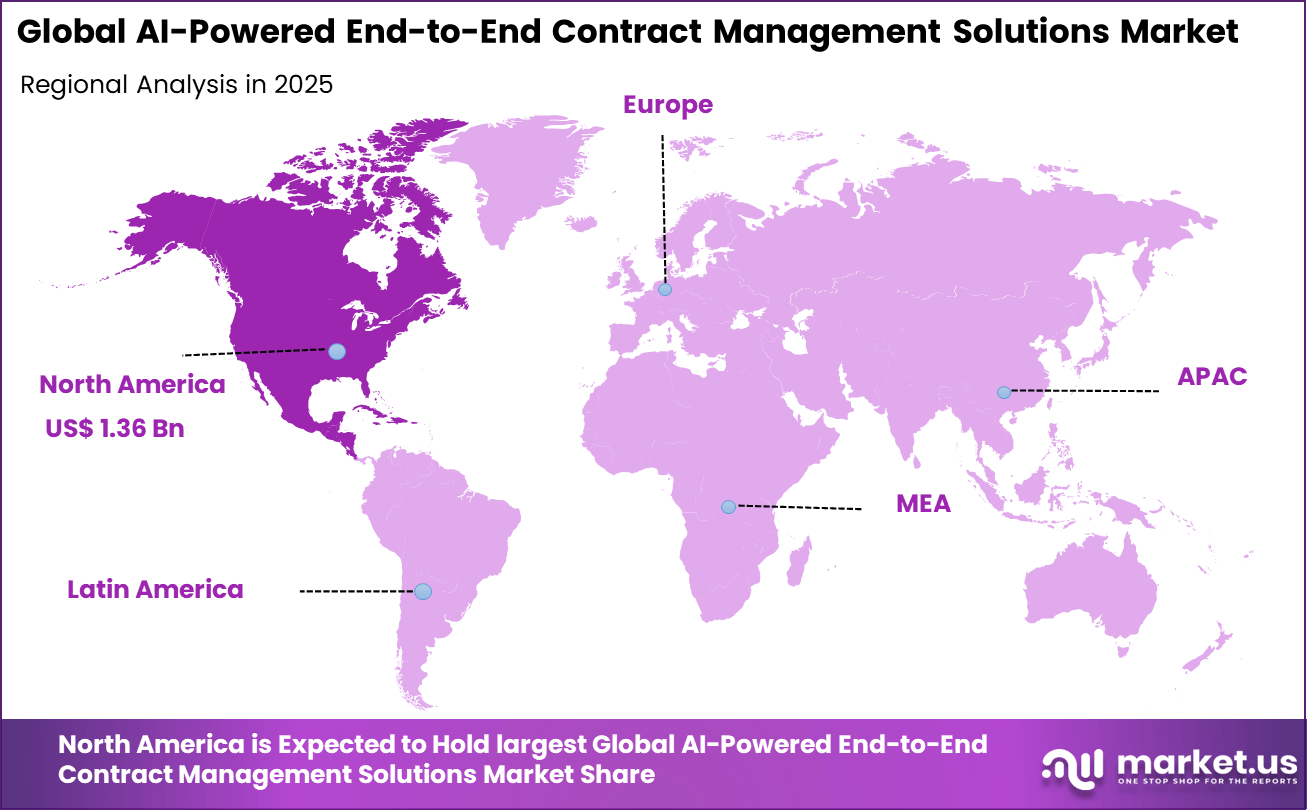

The Global AI-Powered End-to-End Contract Management Solutions Market size is expected to be worth around USD 31.09 billion by 2035, from USD 3.56 billion in 2025, growing at a CAGR of 24.2% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 38.4% share, holding USD 1.36 billion in revenue.

The AI powered end to end contract management solutions market refers to software platforms that manage the full contract lifecycle using artificial intelligence. These solutions support contract creation, review, negotiation, approval, execution, storage, and renewal tracking within a single system. AI capabilities help extract key terms, identify risks, and ensure compliance across large contract volumes.

Adoption is common among enterprises, legal departments, procurement teams, and sales organizations. These platforms improve visibility and control over contractual obligations. Market development has been influenced by the growing volume and complexity of business contracts. Manual contract handling is time consuming and prone to errors.

One major driving factor of the AI powered end to end contract management solutions market is the need to reduce contract-related risk. Missed obligations, unclear clauses, and non-compliance can lead to financial and legal exposure. AI tools identify risky language and deviations from standards. Early detection supports better decision making. Risk awareness drives adoption.

For instance, in December 2025, Conga enhanced its CLM with Contract AI features like semantic clause comparison and obligation management, enabling up to 50% faster contract reviews. Fresh updates in Salesforce-integrated tools automate risky term flagging, keeping teams ahead in dynamic deal cycles. Another key driver is the demand for operational efficiency in legal and commercial teams. Contract review and approval often slow down business processes.

AI powered automation accelerates these workflows. Faster turnaround improves business responsiveness. Efficiency needs support market growth. Demand for AI powered contract management solutions is influenced by enterprise digital transformation initiatives. Organizations aim to replace fragmented document systems with unified platforms. Centralized contract management improves accessibility and consistency.

Key Takeaway

- On-premises deployment dominated by type with a 70.2% share, driven by data security, compliance, and control requirements.

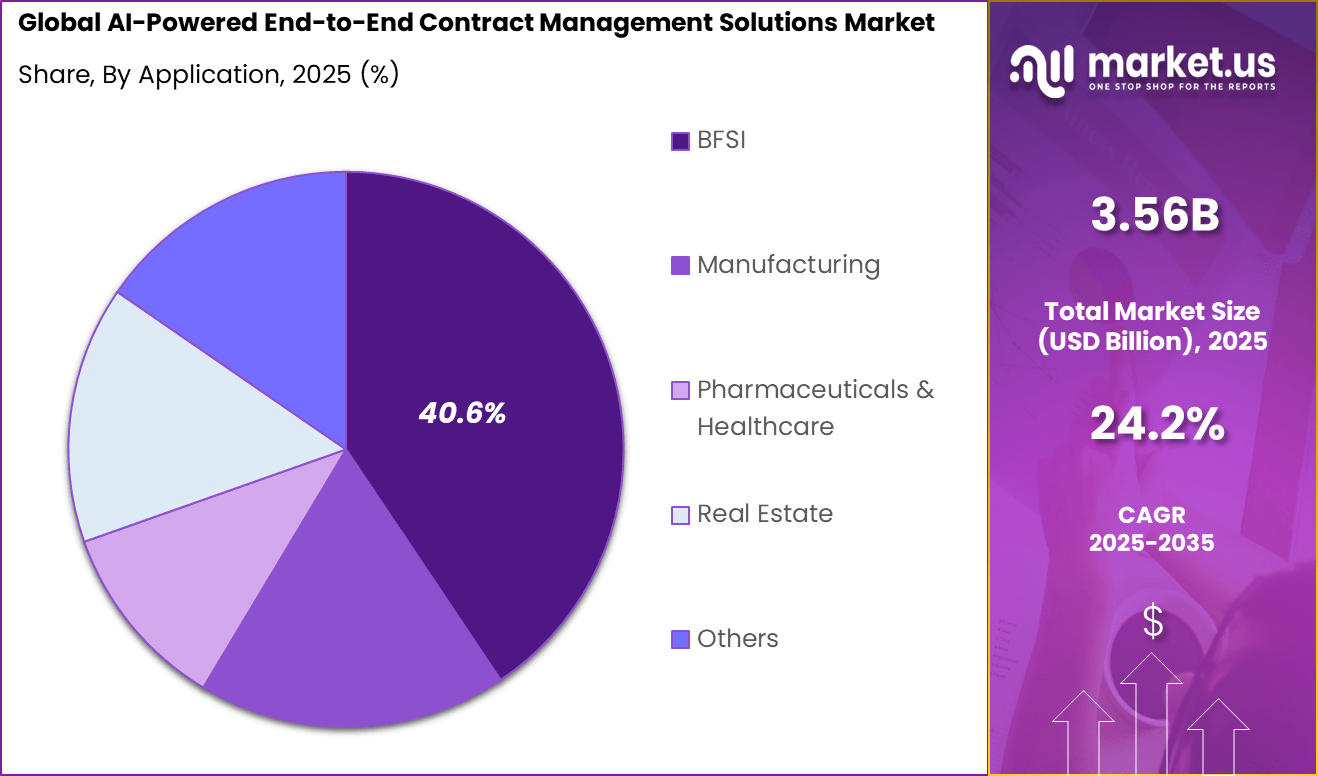

- BFSI led applications with a 40.6% share, supported by high contract volumes, regulatory complexity, and risk management needs.

- North America accounted for 38.4% of the global market, reflecting early AI adoption and mature enterprise software usage.

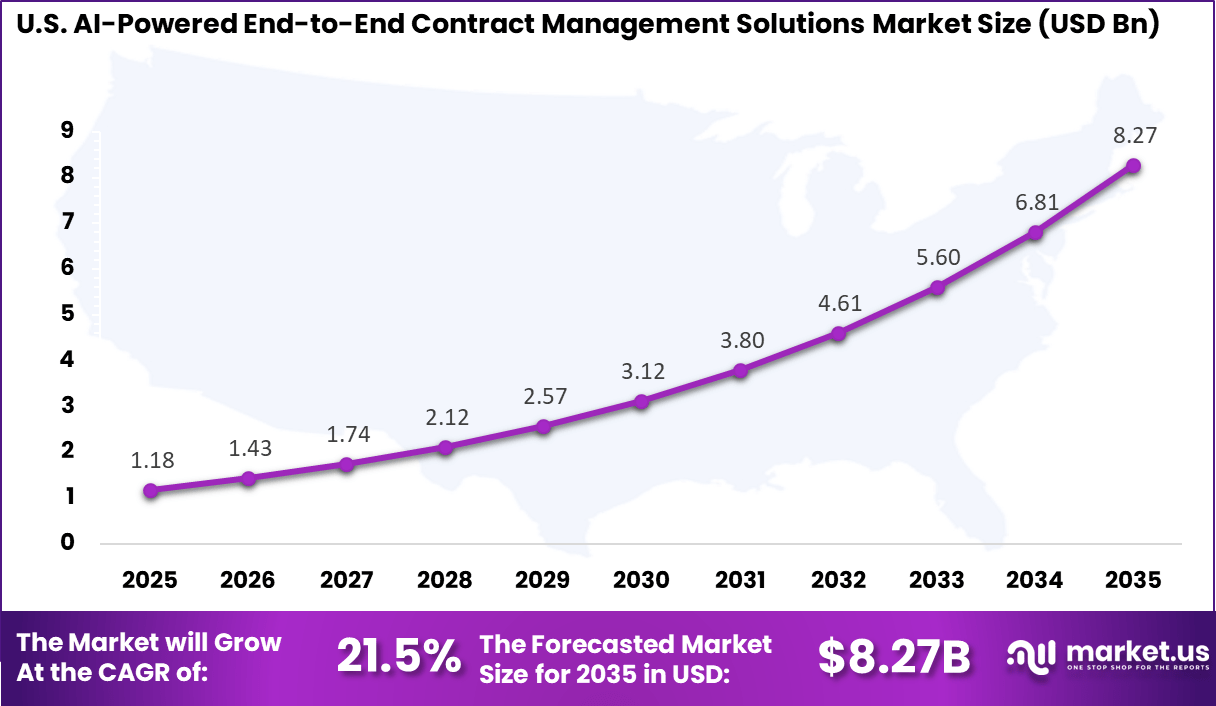

- The U.S. market reached USD 1.18 billion, supported by strong demand from banking, insurance, and financial services firms.

- The market is expanding at a 21.5% CAGR, driven by automation of contract creation, review, compliance, and lifecycle management.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Regulatory and compliance complexity Automated contract governance and audit trails ~6.8% North America, Europe Short Term Growth of digital transformation Replacement of manual contract workflows ~5.9% Global Short Term BFSI operational risk management Need for accurate clause and obligation tracking ~5.1% North America, Europe Mid Term Adoption of AI and NLP Intelligent clause extraction and analysis ~4.4% Global Mid Term Enterprise focus on cost control Reduction of contract leakage and disputes ~3.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data security concerns Sensitive contractual data exposure ~5.2% North America, Europe Short Term Integration challenges Alignment with ERP and CRM systems ~4.4% Global Short to Mid Term AI accuracy limitations Clause misinterpretation risks ~3.7% Global Mid Term Change management resistance Legal team adoption barriers ~3.0% Global Mid Term Vendor lock in Dependence on proprietary platforms ~2.4% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High implementation cost Enterprise grade deployment expenses ~5.9% Emerging Markets Short to Mid Term On premises infrastructure dependency Higher maintenance and upgrade costs ~4.6% Global Mid Term Limited SME adoption Budget and complexity constraints ~3.8% Emerging Markets Mid Term Customization complexity Industry specific contract requirements ~2.9% Global Long Term ROI realization delays Longer payback cycles ~2.3% Global Long Term By Type

On-premises solutions account for 70.2%, indicating a strong preference for locally deployed contract management systems. Organizations choose on-premises deployment to retain full control over sensitive contract data. Local systems support strict security and compliance requirements. Predictable performance improves reliability for contract workflows. Custom configurations align with internal processes.

The dominance of on-premises solutions is driven by data governance needs. Enterprises manage confidential agreements and legal documents. Internal deployment reduces exposure to external risks. On-premises systems allow tailored access controls. This sustains continued adoption of on-premises solutions.

For Instance, in July 2025, Icertis earned top marks as a Leader in the IDC MarketScape for AI-Enabled Buy-Side Contract Lifecycle Management Applications 2025. Their platform stands out for enterprises needing strong AI in on-premises setups for negotiation and compliance control. This nod highlights how they help big firms keep contract data secure and customized right on site.

By Application

The banking, financial services, and insurance sector represents 40.6%, making it the leading application area. This sector manages large volumes of contracts across products and services. AI-powered tools automate contract creation, review, and renewal. Improved accuracy reduces operational risk. Compliance remains a critical requirement.

Adoption in BFSI is driven by regulatory pressure and efficiency goals. Financial institutions require consistent contract governance. AI tools support audit readiness and reporting. Automation shortens approval cycles. This sustains strong demand within BFSI.

For instance, in December 2025, DocuSign reported that 120 Fortune 500 companies now use their CLM for the full lifecycle beyond eSignatures. In BFSI, this helps banks manage high-volume deals with AI risk checks and fast reviews. It cuts down errors in loans and policies where compliance is key.

By Region

North America accounts for 38.4%, supported by high adoption of enterprise legal technologies. Organizations in the region invest in contract automation. Digital transformation initiatives drive demand. Strong IT infrastructure supports deployment. The region remains influential.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Advanced legal tech adoption in BFSI 38.4% USD 1.37 Bn Advanced Europe Regulatory driven contract compliance 27.2% USD 0.97 Bn Advanced Asia Pacific Enterprise digitalization initiatives 24.1% USD 0.86 Bn Developing to Advanced Latin America Contract automation in large enterprises 5.8% USD 0.21 Bn Developing Middle East and Africa Early legal process automation 4.5% USD 0.16 Bn Early For instance, in March 2025, LinkSquares unveiled Agentic AI with a conversational interface for contract management, enabling natural language drafting, analysis, and extraction. This advancement cements North American leadership in AI-native end-to-end CLM platforms.

The United States reached USD 1.18 Billion with a CAGR of 21.5%, reflecting rapid market expansion. Growth is driven by enterprise automation efforts. AI adoption improves contract lifecycle efficiency. Demand for compliance-ready solutions continues to rise. Market momentum remains strong.

For instance, in July 2025, Icertis Inc. was named a Leader in the 2025 IDC MarketScape for AI-Enabled Buy-Side Contract Lifecycle Management. The recognition highlights Icertis Contract Intelligence’s advanced AI-driven negotiation, analytics, and compliance capabilities, solidifying U.S. leadership in enterprise-grade CLM solutions for global organizations managing complex contracts.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior BFSI enterprises Very High ~40.6% Compliance and risk reduction Platform wide deployment Large enterprises Very High ~70.2% Contract lifecycle efficiency Long term licensing Technology vendors High ~18% Platform and AI expansion R and D driven Legal service providers Moderate ~12% Workflow automation Selective adoption SMEs Low ~6% Cost sensitive digitization Limited usage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Natural language processing Clause extraction and classification ~6.4% Mature Machine learning analytics Risk scoring and obligation tracking ~5.5% Growing Contract workflow automation End to end lifecycle management ~4.6% Mature Secure document repositories Centralized contract storage ~3.9% Mature AI driven compliance monitoring Continuous contract oversight ~3.2% Developing Opportunity Analysis

Emerging opportunities in this market are linked to the ability of AI-powered contract management solutions to enhance strategic decision-making and cross-functional collaboration. Advanced platforms can apply natural language processing and predictive analytics to surface insights such as risk indicators, unusual clause patterns, or revenue impact scenarios.

These insights enable legal, procurement, and finance teams to make more informed decisions and negotiate favourable terms. There is also opportunity in expanding use cases beyond traditional contract workflow automation to areas such as compliance monitoring, audit readiness, and contract intelligence reporting, which add strategic value across enterprise functions.

Challenge Analysis

A central challenge confronting the AI-powered end-to-end contract management solutions market relates to ensuring transparency and trust in AI-driven recommendations. While AI models can accelerate analysis and highlight patterns, stakeholders often require explainable outputs that can be validated against legal standards and organisational policies.

Black box decision-making may undermine confidence among legal professionals and compliance teams who must justify contractual interpretations. Balancing sophisticated automation with contextual understanding and human review remains essential to maintain accuracy and accountability.

Emerging Trends

Emerging trends in the AI-powered end-to-end contract management solutions landscape include the adoption of generative AI for automated clause drafting and negotiation support. Tools are increasingly integrating natural language processing to understand subtle contract language nuances and propose contextually appropriate revisions.

Another trend is the integration of contract management platforms with enterprise risk and compliance systems to provide unified dashboards that visualise obligations, liabilities, and expiry risks across global portfolios. Self-service analytics and custom reporting capabilities are also becoming more common, empowering business users to derive insights without reliance on technical specialists.

Growth Factors

Growth in the AI-powered end-to-end contract management solutions market is anchored in the expanding volume and complexity of contractual relationships across industries. Organisations seeking to reduce cycle times, improve compliance, and mitigate operational risks are investing in intelligent solutions that streamline contract lifecycles from creation through renewal.

Advances in artificial intelligence, particularly in natural language understanding and machine learning, enhance the ability of these platforms to deliver actionable insights and automate routine tasks. The increasing focus on digital transformation and process optimisation further reinforces the role of AI-enabled contract management as a strategic enabler of operational excellence and legal governance.

Key Market Segments

By Types

- Cloud-Based

- On-Premises

By Application

- BFSI

- Manufacturing

- Pharmaceuticals & Healthcare

- Real Estate

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players such as Icertis Inc, DocuSign, Inc., and SAP SE focus on large scale enterprise contract automation. Their platforms use AI to manage contract creation, compliance tracking, and obligation monitoring. Integration with ERP and CRM systems strengthens adoption. These companies benefit from strong enterprise trust and global reach. Demand is driven by the need to reduce legal risk and improve contract visibility across complex organizations.

Mid-market and enterprise focused vendors such as Coupa Software Inc, Conga Inc, and Agiloft, Inc. emphasize workflow automation and analytics. AI is applied to clause analysis and contract risk identification. JAGGAER AG strengthens the market through procurement led contract solutions. These players address operational efficiency and regulatory compliance needs across procurement and legal teams.

Innovative providers such as Ironclad, Inc., ContractPodAi Ltd, and LinkSquares, Inc. focus on legal teams and in-house counsel. Their solutions use AI for contract review, data extraction, and lifecycle insights. Ease of use and faster deployment support adoption. Other regional vendors expand market coverage. This competitive landscape supports steady innovation and growing use across legal and compliance functions.

Top Key Players in the Market

- Icertis Inc

- DocuSign, Inc.

- SAP SE

- Coupa Software Inc

- Conga Inc

- Agiloft, Inc.

- Ironclad, Inc.

- ContractPodAi Ltd

- JAGGAER AG

- LinkSquares, Inc.

- Others

Recent Developments

- In April 2025, DocuSign introduced the industry’s first purpose-built AI contract agents within its Intelligent Agreement Management platform, analyzing agreements in seconds to flag risks and recommend compliance updates.

- In September 2025, Icertis launched Vera, its smarter AI agent for contract intelligence, powered by one of the largest contract repositories worldwide. This breakthrough delivers trusted insights and agentic automation, transforming static agreements into strategic assets for revenue optimization and compliance.

Report Scope

Report Features Description Market Value (2025) USD 3.5 Bn Forecast Revenue (2035) USD 31.0 Bn CAGR(2026-2035) 24.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Types (Cloud-Based, On-Premises), By Application (BFSI, Manufacturing, Pharmaceuticals & Healthcare, Real Estate, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Icertis Inc., DocuSign, Inc., SAP SE, Coupa Software Inc., Conga Inc., Agiloft, Inc., Ironclad, Inc., ContractPodAi Ltd, JAGGAER AG, LinkSquares, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered End-to-End Contract Management Solutions MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-Powered End-to-End Contract Management Solutions MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Icertis Inc

- DocuSign, Inc.

- SAP SE

- Coupa Software Inc

- Conga Inc

- Agiloft, Inc.

- Ironclad, Inc.

- ContractPodAi Ltd

- JAGGAER AG

- LinkSquares, Inc.

- Others