Global AI-Powered Checkout Market Size, Share and Analysis Report By Offering (Hardware, Software, Services), By Transaction Type (Cash, Cashless), By Technology (Machine Learning and Predictive Analytics, Natural Language Processing, Generative AI and Large Language Models, Computer Vision (Image and Video), Chatbots and Virtual Assistants, Others), By Model Type (Standalone, Countertop, Mobile), By End-user Industry (Retail, Entertainment, Travel, Financial Services, Healthcare, Other End-user Industries), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 173679

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Offering – Hardware (58.2%)

- By Transaction Type – Cash (55.3%)

- By Technology – ML and Predictive Analytics (38.9%)

- By Model Type – Standalone (53.7%)

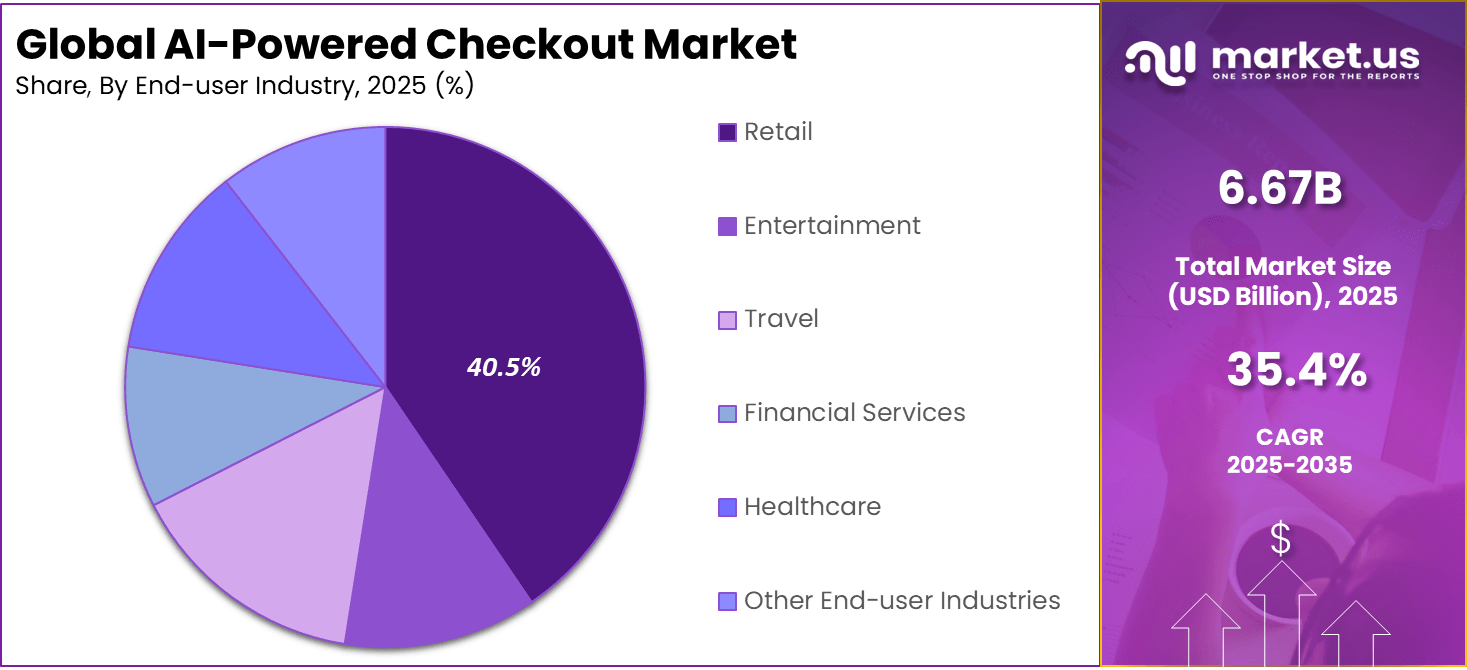

- By End-User Industry – Retail (40.5%)

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

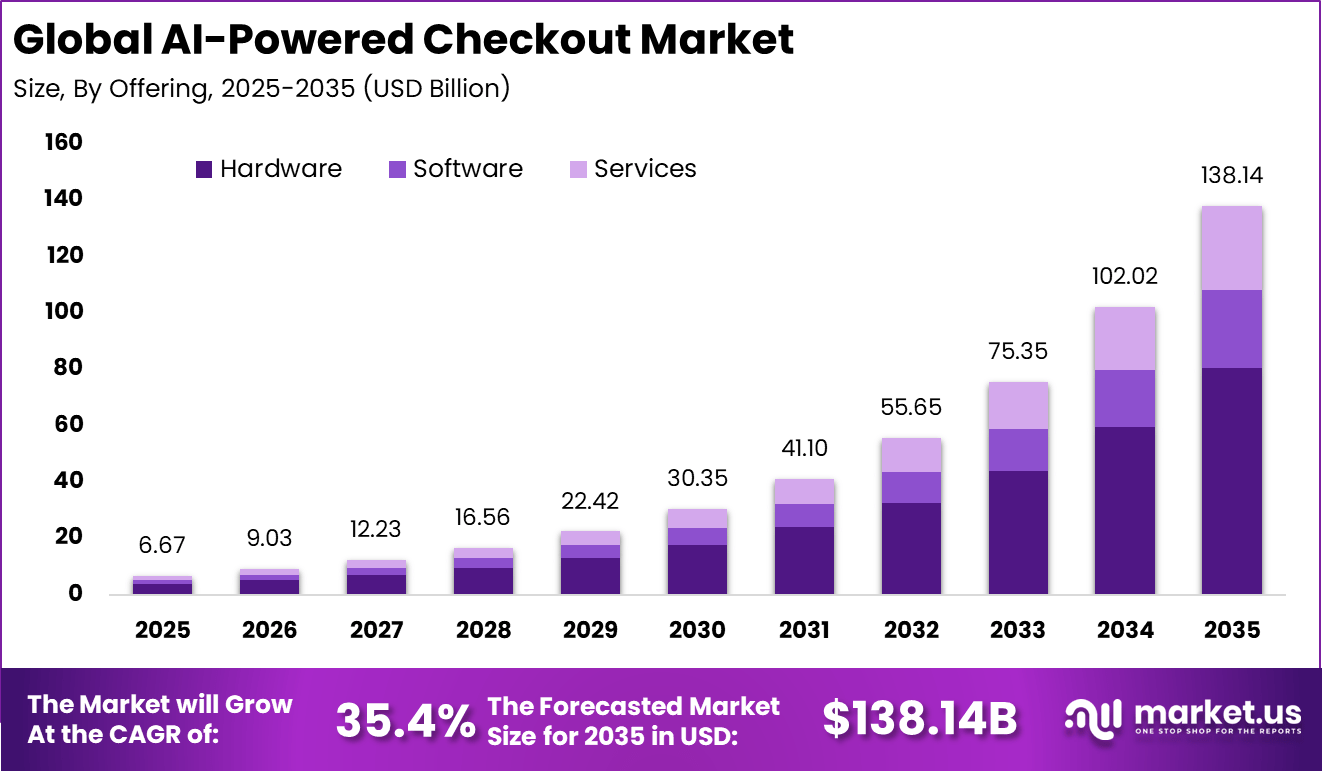

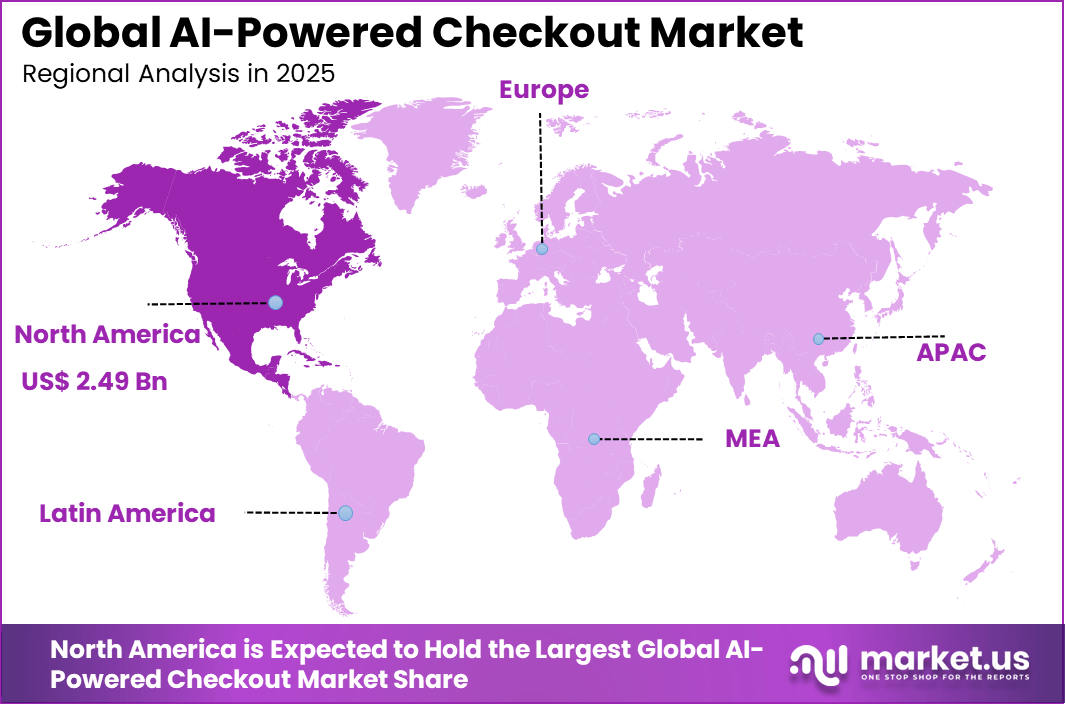

The Global AI-Powered Checkout Market size is expected to be worth around USD 138.14 billion by 2035, from USD 6.67 billion in 2025, growing at a CAGR of 35.4% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 35.4% share, holding USD 2.49 billion in revenue.

The AI powered checkout market refers to technologies that use artificial intelligence to automate and optimize the checkout process in retail and digital commerce environments. These solutions reduce or eliminate manual scanning, form filling, and payment friction by using computer vision, sensors, and intelligent software. AI powered checkout systems are applied in physical stores, self checkout kiosks, and online commerce platforms.

The market supports faster transactions, reduced queues, and improved customer experience. One major driving factor of the AI powered checkout market is the growing demand for frictionless customer experiences. Consumers increasingly prefer fast and simple transactions with minimal human interaction. AI powered checkout reduces waiting times and manual steps. This improvement directly enhances customer satisfaction and store throughput.

Demand for AI powered checkout solutions is influenced by growth in convenience stores, urban retail formats, and high traffic environments. Locations with high transaction volumes benefit most from faster checkout flows. Retailers in these settings prioritize technologies that improve speed and reduce congestion. This demand is particularly strong in metropolitan and travel related retail spaces.

For instance, in October 2025, ITAB Scanflow AB secured a major deal with a leading European grocery chain for self-checkout units across 19 countries, valued at up to €27 million for 2026-2027. The custom solution uses ITAB’s OnRed platform for monitoring and API integration, starting installations in December 2025.

Investment opportunities in the AI powered checkout market exist in scalable and modular platforms. Solutions that can be deployed across different store sizes and retail formats offer strong growth potential. Investors may focus on systems that integrate easily with existing point of sale infrastructure. Flexibility and interoperability are key value drivers.

Another opportunity lies in AI powered checkout for online and mobile commerce. Intelligent payment orchestration, identity verification, and fraud prevention tools add measurable value. Expansion into subscription commerce and cross border payments also presents growth potential. These segments support long term market expansion.

Key Takeaway

- In 2025, the hardware segment led the market with a 58.2% share, indicating strong reliance on smart cameras, sensors, and edge devices that enable accurate item recognition and frictionless checkout experiences.

- The cash based checkout segment captured a 55.3% share in 2025, showing that cash acceptance remains important in AI enabled checkout environments, especially in mixed payment ecosystems and high footfall retail locations.

- Machine learning and predictive analytics accounted for a 38.9% share, reflecting their central role in shopper behavior analysis, fraud detection, and real time transaction validation.

- The standalone deployment model held a 53.7% share, suggesting that many retailers prefer independent AI checkout systems that can operate without full store wide infrastructure upgrades.

- The retail sector dominated end use with a 40.5% share, driven by demand for faster checkout, reduced labor dependency, and improved in store customer experience.

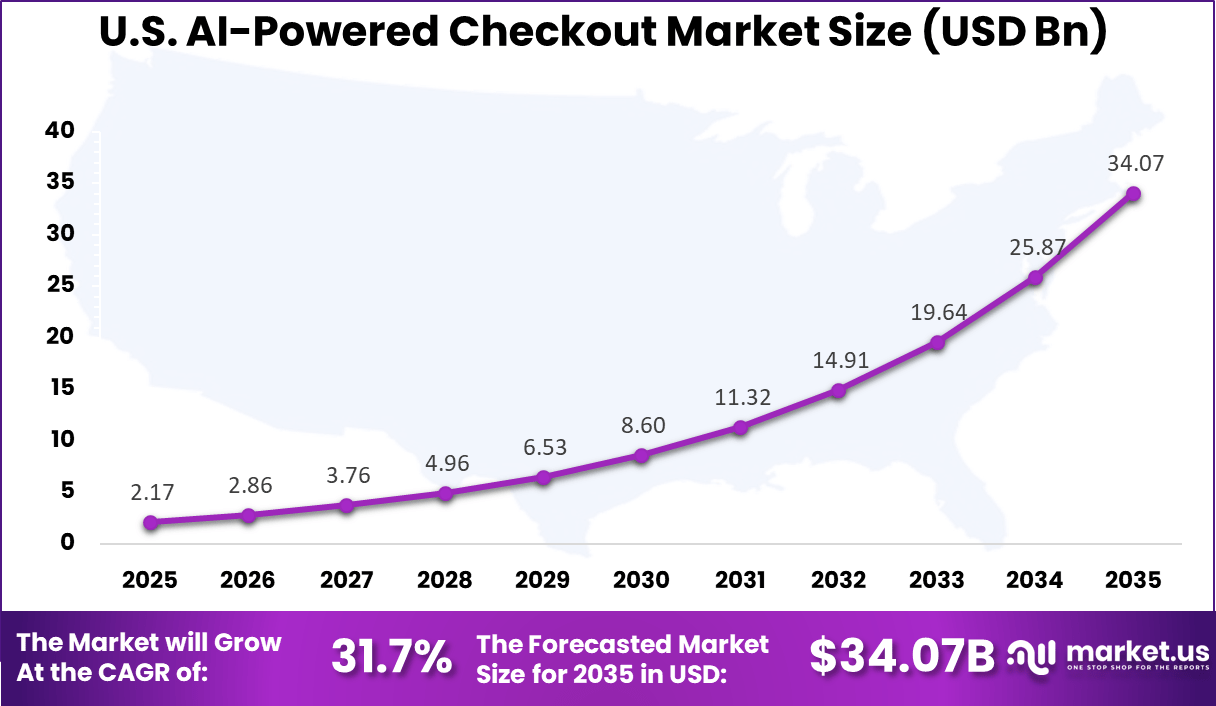

- The United States remained a major adoption market in 2025, supported by advanced retail digitization and early acceptance of AI driven store technologies.

- North America held more than a 37.4% share in 2025, maintaining regional leadership due to high technology readiness, strong investment capacity, and widespread pilot to scale deployments in retail environments.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Demand for frictionless checkout Reduced queues and faster transactions ~9.2% North America, Europe Short Term Labor cost optimization Automation reducing staffing requirements ~7.6% Global Short Term Growth of cashless payments Higher adoption of digital wallets and cards ~6.8% Global Mid Term Expansion of computer vision systems Accurate item recognition and billing ~5.9% North America, Asia Pacific Mid Term Retail data monetization Real time purchase analytics ~5.1% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High implementation cost Capital intensive hardware and software ~6.4% Emerging Markets Short Term Privacy and surveillance concerns Consumer resistance to camera based systems ~5.1% Europe, North America Short to Mid Term Technology accuracy limitations Errors in item detection and billing ~4.3% Global Short Term Integration complexity POS and inventory system compatibility ~3.6% Global Mid Term Cybersecurity risks Payment and customer data exposure ~2.9% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment Barrier for small retailers ~6.8% Emerging Markets Short to Mid Term Regulatory uncertainty Data protection and biometric laws ~5.4% Europe Mid Term Infrastructure readiness Store layout and network limitations ~4.2% Global Short Term Consumer trust challenges Acceptance of automated checkout ~3.5% Global Mid Term Maintenance requirements Ongoing system calibration needs ~2.6% Global Long Term By Offering – Hardware (58.2%)

Hardware accounts for 58.2%, showing its central role in AI-powered checkout systems. These solutions include cameras, sensors, scanners, and edge devices used at checkout points. Hardware enables real-time data capture for item recognition and transaction processing. Reliable physical infrastructure is essential for smooth checkout experiences. Retail environments depend on durable and accurate hardware.

The dominance of hardware is driven by the need for physical interaction with products. AI-powered checkout requires precise sensing and image capture. Hardware performance directly impacts system accuracy. Retailers invest in robust equipment to reduce errors. This sustains strong demand for hardware components.

For Instance, in August 2025, Diebold Nixdorf, Inc. rolled out AI-enabled self-service checkout hardware to EDEKA Paschmann in Germany. The Vynamic Smart Vision system uses sensors and cameras to detect scan errors and verify age for restricted items, cutting shrink and delays. This hardware upgrade boosts reliability in high-volume retail settings.

By Transaction Type – Cash (55.3%)

Cash transactions represent 55.3%, indicating their continued relevance in AI-powered checkout environments. Many retail locations still support cash payments alongside digital options. AI systems are designed to handle cash recognition and validation. This ensures inclusivity for all customer preferences. Cash handling remains important in several regions.

The continued use of cash is driven by consumer habits and accessibility. Retailers aim to support multiple payment types. AI-powered checkout systems adapt to mixed transaction environments. Cash support improves customer acceptance. This maintains cash as a significant transaction type.

For instance, in January 2025, NCR Corporation launched NCR Voyix Halo Checkout for convenience stores. This AI system handles bulk cash and card scans simultaneously, recognizing up to 20 items at once for faster transactions. It supports cash-heavy small retail with seamless verification.

By Technology – ML and Predictive Analytics (38.9%)

Machine learning and predictive analytics account for 38.9%, making them key enabling technologies. These tools analyze customer behavior and item movement in real time. Machine learning models improve item recognition accuracy. Predictive analytics help reduce checkout delays. Together, they enhance system performance.

Adoption of these technologies is driven by the need for intelligent automation. Retailers seek faster and more accurate checkout processes. Machine learning supports continuous improvement through data learning. Predictive insights help manage transaction flow. This keeps these technologies widely adopted.

For Instance, in November 2025, Toshiba Global Commerce Solutions partnered with Merco supermarkets in Mexico on MxP Self-Checkout using AI computer vision. Machine learning powers produce recognition and loss prevention, predicting issues in real-time. This cuts interventions and speeds analytics-driven decisions.

By Model Type – Standalone (53.7%)

Standalone systems hold 53.7%, highlighting preference for independent checkout units. These models operate without full store integration. Standalone systems are easier to deploy in existing retail spaces. They support flexible installation. Retailers use them to pilot AI checkout solutions.

The popularity of standalone models is driven by lower implementation complexity. Retailers can deploy them quickly. These systems reduce dependency on legacy infrastructure. Standalone units also allow gradual scaling. This sustains strong adoption.

For Instance, in December 2025, ITAB Scanflow AB advanced hybrid semi-automated standalone checkouts. Units switch between manned and self-service by rotating scanners, operating independently. Ideal for flexible store zones handling variable traffic.

By End-User Industry – Retail (40.5%)

Retail accounts for 40.5%, making it the primary end-user industry. Retailers adopt AI-powered checkout to improve customer experience. Faster transactions reduce waiting times. Automation improves operational efficiency. Retail environments benefit from reduced staffing pressure.

Adoption in retail is driven by competition and customer expectations. Shoppers value quick and seamless checkout. AI systems support high transaction volumes. Retailers aim to modernize store operations. This keeps retail at the center of adoption.

For Instance, in August 2025, Diebold Nixdorf deployed AI self-checkout to the EDEKA Paschmann retail chain. Predictive tech flags errors and verifies ages automatically, tailored for grocery retail flow. Enhances customer trust in busy supermarkets.

By Region

North America accounts for 37.4%, supported by strong adoption of retail automation technologies. The region invests heavily in smart store solutions. High consumer acceptance supports deployment. Retail innovation remains a priority. The region continues to lead adoption.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Early adoption of cashierless retail 37.4% USD 2.49 Bn Advanced Europe Smart retail and automation initiatives 26.1% USD 1.74 Bn Advanced Asia Pacific High density urban retail formats 28.3% USD 1.89 Bn Developing to Advanced Latin America Modern retail expansion 4.6% USD 0.31 Bn Developing Middle East and Africa Smart store pilot projects 3.6% USD 0.24 Bn Early For instance, in February 2025, Kroger partnered with NCR Corporation to deploy AI-powered self-checkout systems across select U.S. stores, enhancing product recognition accuracy and reducing scanning errors. This collaboration demonstrates NCR’s leadership in delivering advanced retail technology solutions from its Atlanta headquarters. The systems also provide real-time security monitoring, reinforcing North America’s dominance in AI-driven checkout innovation.

The United States reached USD 2.17 Billion with a CAGR of 31.7%, reflecting rapid expansion. Growth is driven by AI integration in retail operations. Retailers invest in automation to improve efficiency. Consumer demand for convenience accelerates adoption. Market momentum remains strong.

For instance, in August 2025, Diebold Nixdorf, based in North Canton, Ohio, enabled EDEKA Paschmann, the first German retailer, to use its Vynamic Smart Vision I Shrink Reduction AI solution at self-checkouts. The technology combats unintentional and deliberate errors while featuring automatic AI age verification. This global deployment underscores Diebold Nixdorf’s U.S.-led expertise in AI-powered checkout security.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Retail chains Very High ~40.5% Faster checkout and labor savings Store wide deployment Grocery operators High ~24% High throughput transactions Phased rollout Technology providers High ~18% Platform and hardware expansion Capital intensive Convenience stores Moderate ~12% Reduced staffing needs Selective adoption Specialty retailers Low to Moderate ~5% Customer experience differentiation Pilot projects Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Computer vision Item detection and tracking ~8.9% Growing AI and deep learning models Purchase recognition accuracy ~7.4% Growing Sensor fusion systems Movement and shelf interaction tracking ~6.1% Developing Cloud based transaction engines Real time billing and analytics ~5.2% Mature Edge computing Low latency in store processing ~4.1% Developing Emerging Trends

In the AI-powered checkout market, one trend is the use of intelligent fraud detection at the point of purchase. Checkout systems are increasingly incorporating artificial intelligence that can analyse transaction patterns, detect anomalies, and flag high-risk activity in real time. This helps reduce fraud losses without requiring manual review of every sale.

Another trend is the integration of personalised payment experiences. AI systems are being used to offer customers payment options that reflect their preferences or behaviour, such as preferred digital wallets, buy-now-pay-later choices, or tailored promotions during checkout. This trend improves convenience and can reduce cart abandonment.

Growth Factors

A key growth factor in the AI-powered checkout market is the expanding volume of online retail transactions. As more consumers shop through e-commerce channels, retailers seek checkout technologies that can handle higher transaction loads while reducing errors and improving conversion rates. AI-enhanced checkout helps ensure speed and reliability as demand increases.

Another important factor supporting growth is the rising expectation for seamless and secure checkout experiences. Consumers want fast, easy, and trusted payment processes whether they buy online or in-store. AI-powered systems that speed up checkout, reduce friction, and protect customer data contribute to greater satisfaction and repeat purchases.

Opportunity

A strong opportunity exists in expanding AI-assisted voice and image based checkout. Emerging solutions allow customers to complete purchases by speaking or scanning items with a camera. These interfaces can reduce friction further and open new paths for convenient payment in both online and physical settings.

Another opportunity lies in leveraging AI to support multi-currency and cross-border checkout optimisation. Retailers serving global audiences can use automated currency conversion, tax calculation, and local compliance checks to simplify international purchases. Enhancing these capabilities can support broader market reach.

Challenge

One challenge for the AI-powered checkout market is ensuring fairness and avoiding biased decisioning. AI models trained on historical data may inadvertently disadvantage certain customer groups or flag legitimate behaviour as risky. Ensuring that systems treat customers equitably requires continuous validation and adjustment of models.

Another challenge involves maintaining system performance under peak loads. Checkout systems must deliver fast responses even during high traffic periods such as sales events or holidays. Ensuring that AI-driven decisioning does not slow transaction throughput is essential to preserving user experience.

Key Market Segments

By Offering

- Hardware

- Software

- Services

By Transaction Type:

- Cash

- Cashless

By Technology

- Machine Learning and Predictive Analytics

- Natural Language Processing

- Generative AI and Large Language Models

- Computer Vision (Image and Video)

- Chatbots and Virtual Assistants

- Others

By Model Type

- Standalone

- Countertop

- Mobile

By End-user Industry

- Retail

- Entertainment

- Travel

- Financial Services

- Healthcare

- Other End-user Industries

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Diebold Nixdorf, Inc., NCR Corporation, and Fujitsu Ltd. lead the AI powered checkout market by delivering self checkout and cashierless solutions for large retail chains. Their platforms combine computer vision, AI based item recognition, and POS integration to reduce wait times and labor dependency. These companies focus on accuracy, scalability, and compliance with retail security standards. Rising demand for frictionless in store experiences continues to support their leadership.

Toshiba Global Commerce Solutions, ITAB Scanflow AB, ECR Software Corporation, and DXC Technology strengthen the market with modular AI checkout systems and analytics driven retail automation. Their solutions support shrink reduction, faster transactions, and real time inventory visibility. These providers emphasize seamless store integration and flexible deployment models. Growing adoption among supermarkets and convenience stores supports wider market penetration.

ShelfX Inc., Pan-Oston Corporation, Ombori, and other players expand the landscape with smart shelves, AI kiosks, and autonomous micro store concepts. Their offerings target specialty retail and unmanned store formats. These companies focus on innovation, compact design, and rapid rollout. Increasing investment in automated retail continues to drive steady growth in the AI powered checkout market.

Top Key Players in the Market

- Diebold Nixdorf, Inc.

- Fujitsu Ltd.

- NCR Corporation

- ECR Software Corporation

- Toshiba Global Commerce Solutions

- ITAB Scanflow AB

- Pan-Oston Corporation

- DXC Technology

- Slabb Kiosks

- ShelfX Inc.

- Pegasus (Pegasus Turnkey Solution (OPC) Private Limited)

- Ombori

- Others

Recent Developments

- In February 2025, NCR Corporation rolled out its Next Generation Self-Checkout Solution globally through 2025, powered by the NCR Voyix Commerce Platform. This AI-enhanced system improves transaction speed and accuracy for retailers, while an edge computing rollout in over 8,500 locations expands to restaurants. NCR also signed a February partnership with Worldpay for integrated payments.

- In June 2025, Diebold Nixdorf collaborated with LOC Software to deliver enhanced self-checkout solutions. The partnership leverages Diebold Nixdorf’s open platform with LOC’s ThriVersA software for seamless POS, kiosk, and mobile integration, simplifying deployment and optimizing retail performance across single-database transactions.

Report Scope

Report Features Description Market Value (2025) USD 6.6 Bn Forecast Revenue (2035) USD 138.1 Bn CAGR(2026-2035) 35.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services), By Transaction Type (Cash, Cashless), By Technology (Machine Learning and Predictive Analytics, Natural Language Processing, Generative AI and Large Language Models, Computer Vision (Image and Video), Chatbots and Virtual Assistants, Others), By Model Type (Standalone, Countertop, Mobile), By End-user Industry (Retail, Entertainment, Travel, Financial Services, Healthcare, Other End-user Industries) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Diebold Nixdorf, Inc., Fujitsu Ltd., NCR Corporation, ECR Software Corporation, Toshiba Global Commerce Solutions, ITAB Scanflow AB, Pan-Oston Corporation, DXC Technology, Slabb Kiosks, ShelfX Inc., Pegasus (Pegasus Turnkey Solution (OPC) Private Limited), Ombori, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Checkout MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Checkout MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Diebold Nixdorf, Inc.

- Fujitsu Ltd.

- NCR Corporation

- ECR Software Corporation

- Toshiba Global Commerce Solutions

- ITAB Scanflow AB

- Pan-Oston Corporation

- DXC Technology

- Slabb Kiosks

- ShelfX Inc.

- Pegasus (Pegasus Turnkey Solution (OPC) Private Limited)

- Ombori

- Others