Global AI Pet Camera Market Size, Share, Industry Analysis Report By Component (Hardware (Cameras), Software & AI Services, Subscription Services), By Product Type (Indoor Pet Cameras, Outdoor Pet Cameras), By Sales Channel (Online, Offline), By Application (Monitoring & Interaction, Training & Behavior Analysis, Health & Safety Monitoring, Others), By End-User (Household, Pet Care Facilities, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 168761

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Product Type Analysis

- Sales Channel Analysis

- Application Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

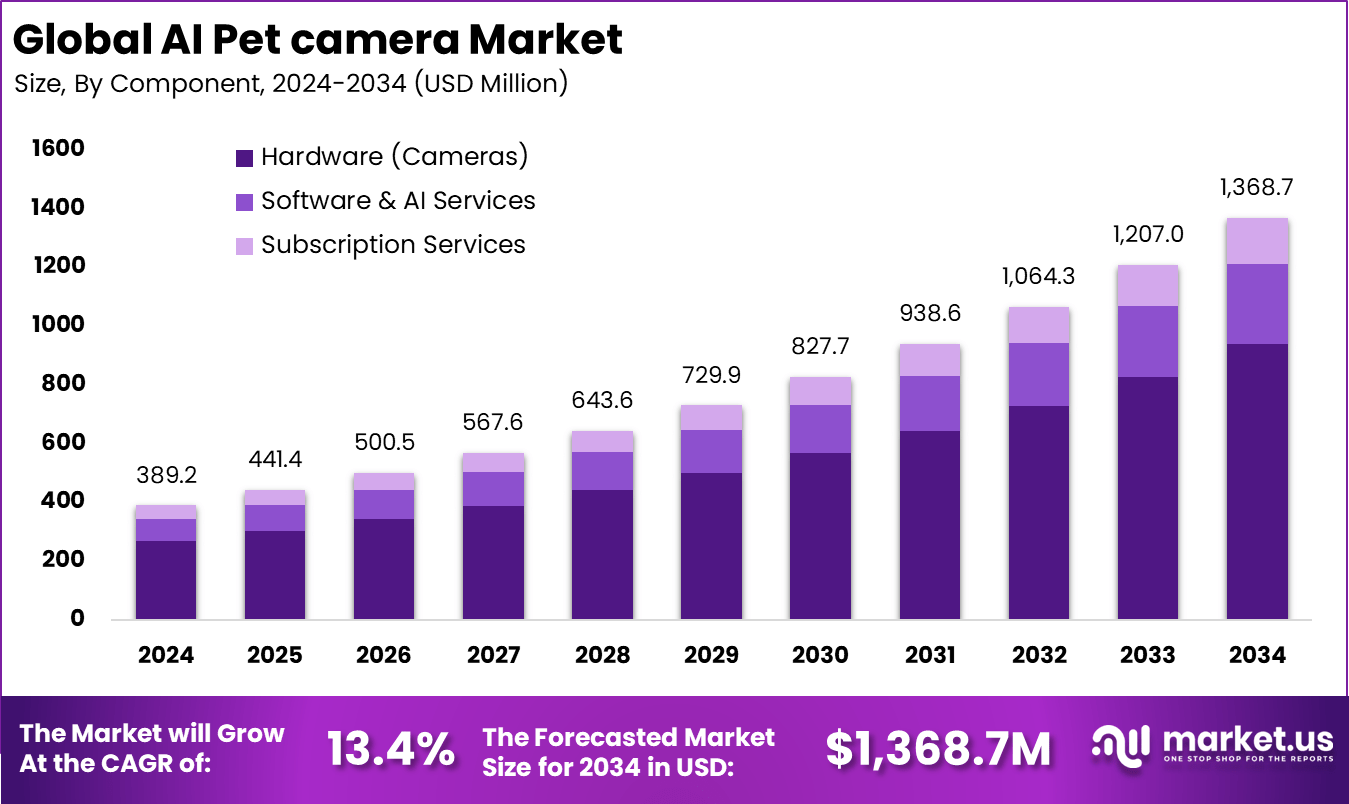

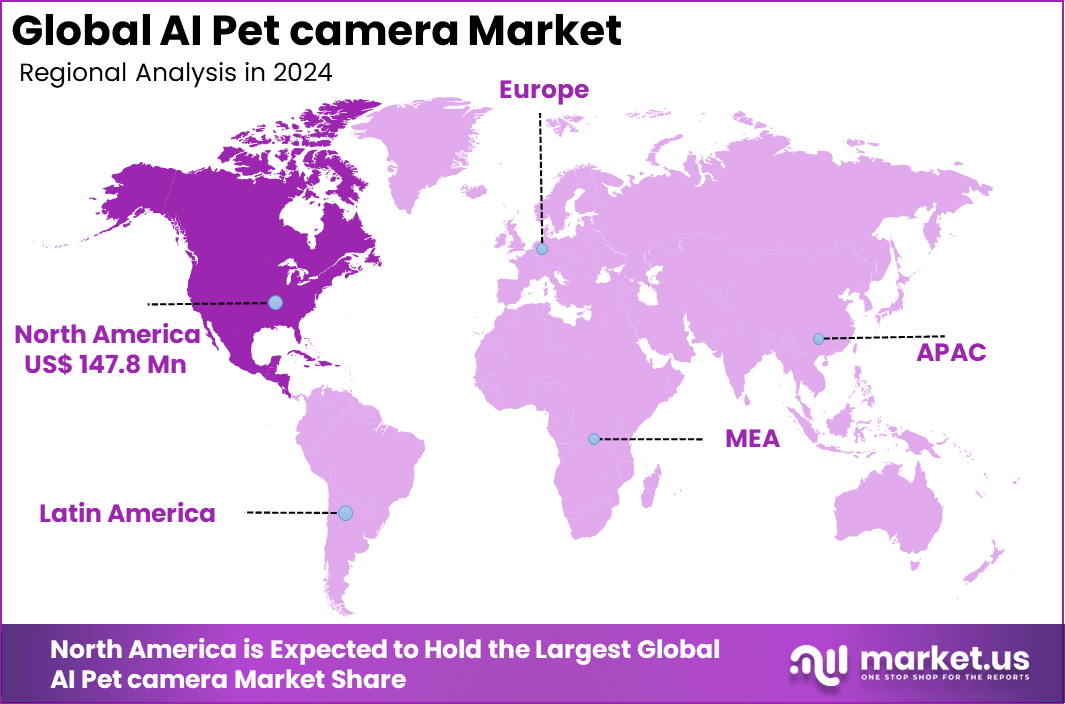

The Global AI Pet camera Market size is expected to be worth around USD 1,368.7 million by 2034, from USD 389.2 million in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38% share, holding USD 147.8 million in revenue.

The AI pet camera market has expanded as pet owners increasingly adopt smart monitoring devices that provide real time views, behavioural insights and remote interaction with pets. Growth reflects rising pet ownership, stronger emotional attachment to companion animals and wider availability of affordable smart home technologies. AI enabled cameras now serve households, pet daycare centres and veterinary facilities seeking continuous monitoring and early issue detection.

Top driving factors for the AI Pet camera market include the rising rate of pet ownership and an increasing trend toward treating pets as family members. Urban lifestyles with busy schedules have amplified the demand for remote pet care and monitoring solutions. Advances in AI and machine learning improve detection accuracy, helping the camera distinguish between pets, humans, and other moving objects.

The AI pet camera market is driven by the increasing number of pet owners who treat pets like family members and seek ways to stay connected remotely. Growing urbanization and busy lifestyles make remote pet monitoring a necessity for many. Advanced AI features, such as behavior detection and real-time alerts, enhance pet care and safety, further boosting demand.

For instance, in May 2025, Wyze Labs released firmware updates improving security features like embedded user-authenticated signatures and enhanced app functionalities to support AI-powered pet and home monitoring cameras. These updates ensure better privacy and responsiveness for AI-driven pet cameras.

Key Takeaway

- In 2024, the Hardware (Cameras) segment led the market with a 68.5% share, reflecting strong demand for AI-enabled smart cameras designed for pet monitoring.

- The Indoor Pet Cameras segment dominated with 72.3%, supported by rising adoption of in-home monitoring solutions for companion animals.

- The Online sales segment accounted for 63.7%, driven by growing e-commerce adoption and easy access to a wide range of smart pet devices.

- The Monitoring and Interaction segment held 58.9%, showing strong use of two-way communication, behavior tracking, and activity alerts powered by AI.

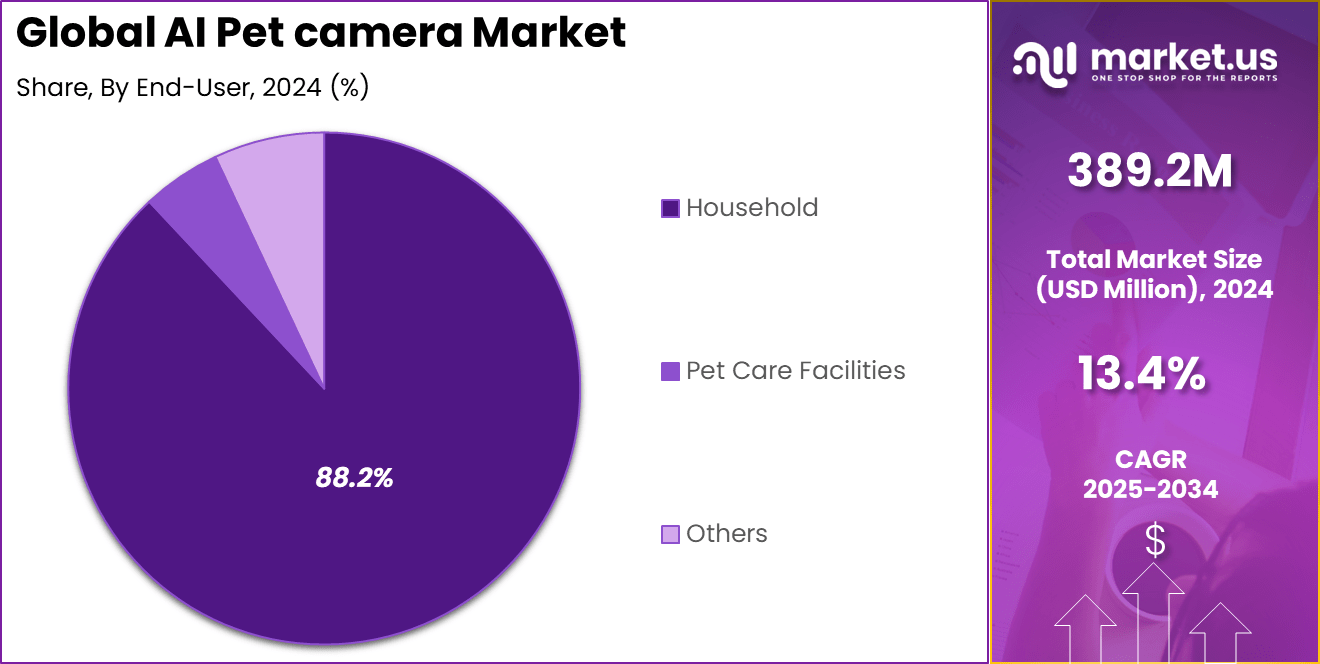

- The Household segment dominated with 88.2%, highlighting widespread consumer use as pet ownership increases and demand grows for smart home–integrated pet solutions.

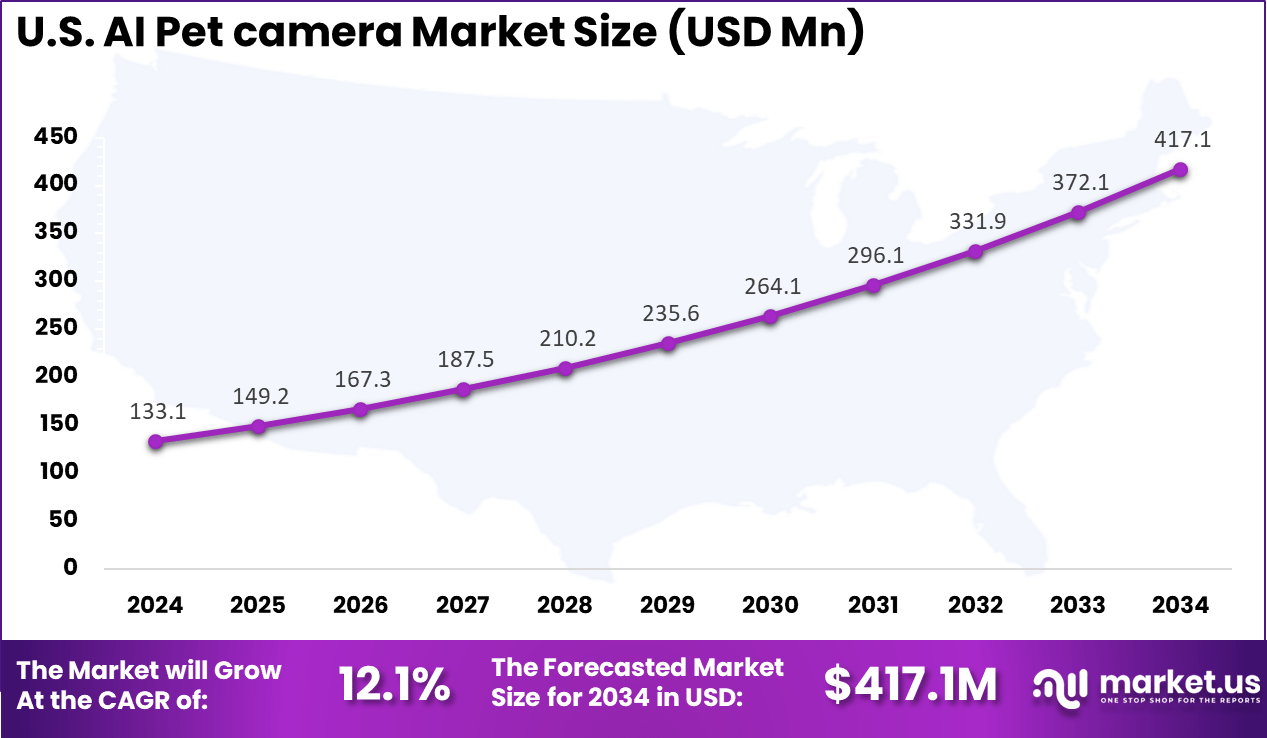

- The US market reached USD 133.1 million in 2024 and is expanding at a solid CAGR of 12.1%, supported by rising pet care spending and early adoption of connected home technologies.

- North America maintained leadership with over 38% share, driven by high pet ownership rates, strong digital infrastructure, and rapid uptake of smart monitoring devices.

Role of Generative AI

Generative AI plays an important role in AI pet cameras by enabling them to understand and track pet behavior better than before. These cameras use AI algorithms not only to recognize pets but also to analyze their movements, emotions, and habits in real time. This allows owners to receive detailed alerts and summaries about their pet’s activities, which helps in identifying unusual behaviors or potential health issues early on.

Research shows that generative AI can improve the accuracy of behavior analysis by up to 30%, reducing false alarms and increasing the reliability of these devices. This technology thus helps pet owners feel more connected and informed, even when they are away from home. Moreover, generative AI powers interactive features that let owners communicate with their pets remotely.

For instance, AI enables two-way audio and triggers like treat dispensers or sound signals based on pet behavior. The AI models learn each pet’s unique patterns, making responses more personalized and effective. AI integration also supports syncing pet cameras with other smart home devices, creating a smarter and more seamless pet care experience. This shift makes pet cameras more than just observation tools; they become active care partners that improve safety and engagement for pets and owners alike.

Investment and Business Benefits

Investment opportunities in the AI Pet camera segment are promising due to the growing pet care expenditure worldwide and the rising demand for automation in pet monitoring. Stakeholders are encouraged to invest in R&D focusing on AI, machine learning, and hardware miniaturization. There are opportunities for partnerships with health tech firms for integrated platforms that provide veterinary insights.

Expansion of smart home ecosystems and e-commerce sales channels also opens avenues to reach diverse customer bases globally. Investors must consider supply chain optimizations amid recent tariff pressures on electronic components. Business benefits of AI Pet cameras include enhanced customer satisfaction through reliable and interactive pet care solutions. Companies gain a competitive advantage by offering differentiated AI features like predictive behavior analysis and health monitoring.

The cameras support premium pricing strategies thanks to their advanced functionalities. Furthermore, incorporation into broader smart home security systems increases cross-selling potential. This creates an ecosystem that fosters long-term customer engagement and recurring revenue models via subscription services.

U.S. Market Size

The market for AI Pet camera within the U.S. is growing tremendously and is currently valued at USD 133.1 million, the market has a projected CAGR of 12.1%. The market is growing rapidly due to rising pet ownership and increasing emotional investment in pet care. Advances in AI-powered features such as real-time behavior tracking, treat dispensing, and two-way communication make these devices more appealing for pet owners seeking interactive and proactive monitoring solutions.

Consumers are also attracted to seamless integration with smart home ecosystems, enhancing convenience and connectivity. Additionally, growing awareness of pet anxiety and health issues drives demand for cameras that offer not only surveillance but also real-time alerts and health monitoring. The shift towards resuming outdoor activities post-pandemic has increased the need for reliable remote monitoring tools.

For instance, in August 2025, Petcube, headquartered in the U.S., introduced the Petcube Cam with an integrated online vet chat powered by Fuzzy Pet Health. This affordable AI pet camera offers sharp 1080p HD video, a wide-angle lens, night vision, two-way audio, and AI-based smart alerts for barks, meows, and unusual pet activities. It provides pet owners with on-demand access to veterinary advice, enhancing pet care remotely.

In 2024, North America held a dominant market position in the Global AI Pet Camera Market, capturing more than a 38% share, holding USD 147.8 million in revenue. This leadership is attributed to high pet ownership rates and a deep cultural affinity for pets, where animals are treated as valued family members. Technological advancements in AI-powered cameras, such as real-time video, two-way audio, and smart home integration, have significantly boosted consumer demand.

The region’s high disposable income and well-established e-commerce channels further accelerate market growth. Moreover, North America’s advanced digital infrastructure supports the widespread adoption of connected pet care devices. Consumers increasingly seek innovative features like AI-driven behavior alerts, interactive treat dispensing, and seamless smart home compatibility.

For instance, in August 2025, Wyze Labs unveiled the Wyze Cam Pan v4, featuring 4K resolution, color night vision, and AI-driven object tracking, which detects people, pets, and vehicles. This affordable pet and home security camera supports 360-degree panning and 180-degree tilt, with integration to smart home systems like Alexa and Google Assistant, improving the monitoring experience for pet owners.

Component Analysis

In 2024, The Hardware (Cameras) segment held a dominant market position, capturing a 68.5% share of the Global AI Pet Camera Market. This reflects how critical high-quality camera components are for delivering clear visuals and responsive monitoring features that pet owners demand.

Hardware improvements such as enhanced sensors, low-latency image processing, and integration with AI chips help ensure the cameras detect pet movements accurately and support interactive functions like treat dispensing or activity alerts.

Continuous innovation in camera modules supports 24/7 monitoring capabilities, including night vision and robust connectivity. These advances enable pet owners to rely on dependable, precise hardware that forms the foundation of AI-enabled pet care. As hardware remains essential for overall device performance, manufacturers prioritize quality and durability to meet consumer expectations for seamless pet surveillance.

For Instance, in September 2025, Furbo, a market leader, launched the Furbo Mini 360°, a compact AI pet camera featuring 2K 360° rotating view and advanced hardware for full-room coverage and auto pet tracking. This device highlights Furbo’s focus on high-quality camera hardware that supports real-time pet monitoring and interaction.

Product Type Analysis

In 2024, the Indoor Pet Cameras segment held a dominant market position, capturing a 72.3% share of the Global AI Pet Camera Market. Their popularity stems from the need for home-based monitoring solutions that provide convenience, privacy, and interactive features. These cameras are compact, easy to install, and typically include two-way audio and treat dispensing to facilitate owner-pet interaction when away from home.

The indoor environment allows these cameras to leverage stable Wi-Fi connectivity and smart home integration, supporting real-time video streaming and notifications. Rising pet humanization trends increase demand for indoor models that enable owners to check on their pets anytime, improving care and reducing anxiety for both pets and owners.

For instance, in October 2025, Petcube released its Petcube Cam, an affordable indoor smart pet camera with 1080p HD video, night vision, and vet chat integration. This indoor-focused device targets household pet owners seeking interactive monitoring with added health support.

Sales Channel Analysis

In 2024, The Online segment held a dominant market position, capturing a 63.7% share of the Global AI Pet camera Market. Consumers increasingly prefer to purchase pet cameras through online retailers for variety, competitive pricing, and easy access to detailed product information and user reviews. The ease of direct-to-consumer sales and frequent promotions online further bolsters this trend.

Online platforms also facilitate the rapid adoption of new models featuring AI technologies and integration with smart home ecosystems. Brands leverage digital marketing and tech-savvy consumer bases, making online the preferred route to market. The convenience of doorstep delivery and simple return policies reinforce online’s position as the leading sales channel in this space.

For Instance, in November 2025, Furbo announced updates to its subscription model (Furbo Nanny plan) primarily distributed via e-commerce platforms, emphasizing flexible access and updates through online sales channels.

Application Analysis

In 2024, The Monitoring & Interaction segment held a dominant market position, capturing a 58.9% share of the Global AI Pet Camera Market. Beyond basic surveillance, users seek interactive capabilities like two-way audio communication, treat dispensing, and AI-powered behavior alerts to strengthen the pet-owner bond even when physically apart. These features go beyond monitoring, providing emotional engagement and proactive care solutions.

This interactive dimension addresses rising concerns such as separation anxiety and behavioral health, turning cameras into essential pet wellness tools. Real-time notifications for unusual activity and AI-triggered alerts enable owners to respond to their pets’ needs, enhancing safety and satisfaction. Interaction-focused applications continue to push innovation and consumer value in this market.

For Instance, in October 2025, Pawbo continues to feature interactive 360° rotation pet cameras with two-way audio and noise cancellation, supporting interactive applications like play and communication with pets inside homes.

End-User Analysis

In 2024, The Household segment held a dominant market position, capturing an 88.2% share of the Global AI Pet Camera Market. This reflects increasing pet ownership, particularly among families and individuals who see pets as integral family members requiring constant care and attention. The residential market drives demand for easy-to-use, reliable AI pet cameras offering real-time interaction and peace of mind.

Home users typically prioritize convenience, intuitive app controls, and features that include video streaming, talkback, and treat dispensing. This market segment’s size and preference for premium features fuel continuous product improvements tailored to residential settings. The consumer focus on emotional connection with pets solidifies household demand as the backbone of AI pet camera usage.

For Instance, in September 2025, Eufy (Anker Innovations) launched the eufyCam S4 with AI features suited for home users, combining 4K and dual 2K lenses for detailed facial recognition and enhanced home pet security.

Emerging Trends

One notable emerging trend is the rise of AI-powered behavior analysis that offers deep insights into pet health and mood. Cameras equipped with machine learning algorithms can track subtle changes in activity and habits, providing early warnings for potential health issues like anxiety or illness.

Reports show that 45% of new AI pet camera buyers value these health monitoring features most when choosing a device, reflecting growing consumer demand for proactive pet wellness tools. Alongside this, the integration of pet cameras with smart home systems and IoT devices is becoming widespread, allowing owners to control pet care routines remotely and receive notifications via mobile apps in real-time.

Another trend is the expansion of multi-pet household management capabilities. AI pet cameras can now recognize different pets individually, sending targeted updates to users and enabling optimized care plans for each animal. Additionally, voice recognition features are enabling two-way interactions where owners can communicate with pets or remotely trigger actions such as feeding or play sessions.

Growth Factors

The growth of AI pet cameras is strongly driven by increasing pet humanization, where pets are considered family members deserving of attentive care. Urban lifestyles with busy schedules also fuel demand for remote monitoring solutions that give owners peace of mind.

Studies reveal that 60% of AI pet camera users are motivated by the ability to check on their pets when away from home, pointing to convenience as a key driver. Technological improvements, especially the rise of AI and machine learning, boost device functionality with features like behavior detection and health analytics, encouraging wider adoption.

Increasing disposable incomes and faster digital adoption in many urban centers contribute to expanding the customer base for AI pet cameras. Consumers seek smart home integrations that unify pet care devices with home security and lifestyle systems, enhancing the value proposition. The rising trend in pet adoption during recent years has also played a vital role, with more households investing in pet tech products.

Key Market Segments

By Component

- Hardware (Cameras)

- Software & AI Services

- Subscription Services

By Product Type

- Indoor Pet Cameras

- Outdoor Pet Cameras

By Sales Channel

- Online

- Offline

By Application

- Monitoring & Interaction

- Training & Behavior Analysis

- Health & Safety Monitoring

- Others

By End-User

- Household

- Pet Care Facilities

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Pet Ownership and Humanization

The AI pet camera market is supported by rising global pet ownership and the growing humanization of pets. As more households treat pets as family members, demand increases for technologies that allow remote monitoring and real time behavior detection. Higher disposable incomes in urban areas further encourage investment in smart pet care devices that provide reassurance and improve daily pet management.

Growth is also strengthened by the expanding smart home ecosystem, where AI pet cameras integrate easily with other connected devices. This integration enables automated interactions, behavioral notifications, and remote engagement features such as treat dispensing. Ongoing innovation and collaboration between manufacturers and AI specialists continue to enhance product capabilities and widen consumer appeal.

In November 2025, Furbo introduced new subscription options with extended video history and support for up to 10 cameras, meeting the needs of multi pet households. The company also added AI personalization features that identify up to four individual pets and deliver tailored alerts. These advancements reflect rising expectations for personalized and sophisticated pet care technologies that drive further market expansion.

Restraint

High Product Costs Limiting Accessibility

A significant restraint to the AI pet camera market is the high cost associated with advanced hardware, AI features, and recurring cloud storage subscriptions. Many potential users, especially in developing economies or lower-income groups, find the prices prohibitive. The price-sensitive customers often lean towards more affordable alternatives, which restricts the widespread adoption of premium AI-enabled pet cameras.

Furthermore, the complexity of integrating these cameras into existing smart home systems adds to the cost and user hesitation. The technical sophistication required not only increases production costs but also may discourage average users who lack technical proficiency from adopting these products. These factors collectively constrain market growth, particularly in regions with inconsistent internet infrastructure and low digital literacy.

For instance, in March 2025, Wyze announced the AI-powered “NBD” Notifications Filter to reduce notification overload for customers. However, this subscription-based feature adds to the ongoing cost burden for users, which can be a restraint for adoption, especially among price-sensitive consumers. The reliance on subscription fees for accessing key AI features highlights the challenge of high product and operating costs limiting broader accessibility.

Opportunities

Subscription Services and AI Feature Monetization

A major opportunity in the AI pet camera market comes from monetizing advanced AI features through subscription models. Freemium to premium upgrades can unlock capabilities such as bark detection, behavior classification, emotional analysis, and health insights, creating continuous value for pet owners and steady recurring revenue for manufacturers. This model extends product usefulness far beyond the initial hardware purchase.

Subscription services also support ongoing innovation, allowing companies to introduce features like tele-veterinary access and personalized behavior guidance. Dual-use devices that combine home security with pet monitoring can broaden appeal, particularly in regions such as Europe, which helps expand market reach. The shift toward SaaS models strengthens long term growth prospects by aligning with evolving consumer expectations.

In January 2025, Petcube enhanced its AI capabilities in health monitoring and behavior analysis, improving remote engagement features. These advancements support premium subscription offerings by providing deeper analytics and tailored alerts, meeting rising demand for smart pet care solutions that go beyond basic monitoring.

Challenges

Data Privacy and Connectivity Issues

A major challenge in the AI pet camera market involves protecting user data privacy while managing connectivity limitations. Consumers are increasingly concerned about cloud-based video storage and the risk of unauthorized access to personal footage. Strict regulations such as GDPR in Europe require strong data protection practices, raising both operational complexity and compliance costs for manufacturers.

Stable internet connectivity is also critical for real time streaming and AI-driven alerts. In rural or underserved regions, limited broadband access reduces device performance and affects overall usability. Setup difficulties and maintenance issues further discourage less tech-savvy users. Addressing these challenges calls for greater investment in on-device AI processing and improvements in network infrastructure to ensure secure and reliable operation.

In September 2025, at IFA 2025, Eufy introduced new AI-enabled security and pet monitoring devices. Despite these advancements, ensuring strong privacy safeguards and meeting regulatory requirements remains essential. Connectivity demands and data protection needs continue to pose obstacles for brands working to build and maintain user trust.

Key Players Analysis

Furbo, Petcube, SKYMEE, and WoPet lead the AI pet camera market with smart monitoring devices that combine real-time video, treat-dispensing, and AI-based behavior detection. Their platforms focus on motion alerts, barking analysis, and interactive engagement to help pet owners stay connected remotely. These companies emphasize reliability, intuitive apps, and high-quality video.

Eufy, Wyze, Pawbo, Motorola, Geedrive, Skymee, and YI Technology strengthen the competitive landscape with affordable, feature-rich AI pet cameras. Their solutions offer two-way audio, night vision, and automatic activity tracking. These providers support multi-pet households and users seeking budget-friendly smart monitoring tools.

Tenvis, Zmodo, PetChatz, CleverDog, and other participants broaden the market with niche capabilities such as scent-based interaction, remote feeding, and advanced environmental alerts. Their devices target pet owners looking for specialized engagement features and greater peace of mind. These companies focus on easy setup, secure connectivity, and customized notifications.

Top Key Players in the Market

- Furbo, Inc.

- Petcube, Inc.

- SKYMEE, Inc.

- Shenzhen WoPet Intelligent Technology Co., Ltd.

- Eufy (Anker Innovations)

- Wyze Labs, Inc.

- Pawbo, Inc.

- Motorola, Inc.

- Shenzhen Geedrive Technology Co., Ltd.

- Skymee, Inc.

- YI Technology

- Tenvis Technology

- Zmodo (Xiamen Huaxia Technology Co., Ltd.)

- PetChatz (Radio Systems Corporation)

- CleverDog (India) Pvt. Ltd.

- Others

Recent Developments

- In October 2025, Petcube, Inc. commercially released the Petcube Cam, an affordable AI pet camera offering 1080p HD video, night vision, and an integrated online vet chat powered by Fuzzy Pet Health. It provides real-time smart alerts on pet behaviors and allows owners to consult professional vets 24/7, enhancing pet health monitoring and remote care.

- In November 2025, Eufy (Anker Innovations) introduced the Pet Camera D605 as part of its Pet Care series. This AI-powered device features smart barking alerts, auto-tracking of dogs, and a 270° rotating camera lens for comprehensive pet monitoring. Equipped with four infrared sensors, it delivers crystal-clear video even at night, enabling continuous, high-quality interaction between pet and owner.

Report Scope

Report Features Description Market Value (2024) USD 389.2 Mn Forecast Revenue (2034) USD 1,368.7 Mn CAGR(2025-2034) 13.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware (Cameras), Software & AI Services, Subscription Services), By Product Type (Indoor Pet Cameras, Outdoor Pet Cameras), By Sales Channel (Online, Offline), By Application (Monitoring & Interaction, Training & Behavior Analysis, Health & Safety Monitoring, Others), By End-User (Household, Pet Care Facilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Furbo, Inc., Petcube, Inc., SKYMEE, Inc., Shenzhen WoPet Intelligent Technology Co., Ltd., Eufy (Anker Innovations), Wyze Labs, Inc., Pawbo, Inc., Motorola, Inc., Shenzhen Geedrive Technology Co., Ltd., Skymee, Inc., YI Technology, Tenvis Technology, Zmodo (Xiamen Huaxia Technology Co., Ltd.), PetChatz (Radio Systems Corporation), CleverDog (India) Pvt. Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Furbo, Inc.

- Petcube, Inc.

- SKYMEE, Inc.

- Shenzhen WoPet Intelligent Technology Co., Ltd.

- Eufy (Anker Innovations)

- Wyze Labs, Inc.

- Pawbo, Inc.

- Motorola, Inc.

- Shenzhen Geedrive Technology Co., Ltd.

- Skymee, Inc.

- YI Technology

- Tenvis Technology

- Zmodo (Xiamen Huaxia Technology Co., Ltd.)

- PetChatz (Radio Systems Corporation)

- CleverDog (India) Pvt. Ltd.

- Others