Global AI Meeting Assistant Market Size, Share, Growth Analysis By Offering (Meeting & Collaboration Assistant, Knowledge & Research Assistant, Scheduling & Calendar Optimization Assistant, Presentation & Design Assistant, Others), By Type (Meeting Note-taker, Meeting Organizer), By Application (Individual, Enterprises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161958

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role of AI

- Analysts’ Viewpoint

- AI Industry Adoption

- US Market Size

- Investment and Business Benefits

- By Offering

- By Type

- By Application

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging Factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

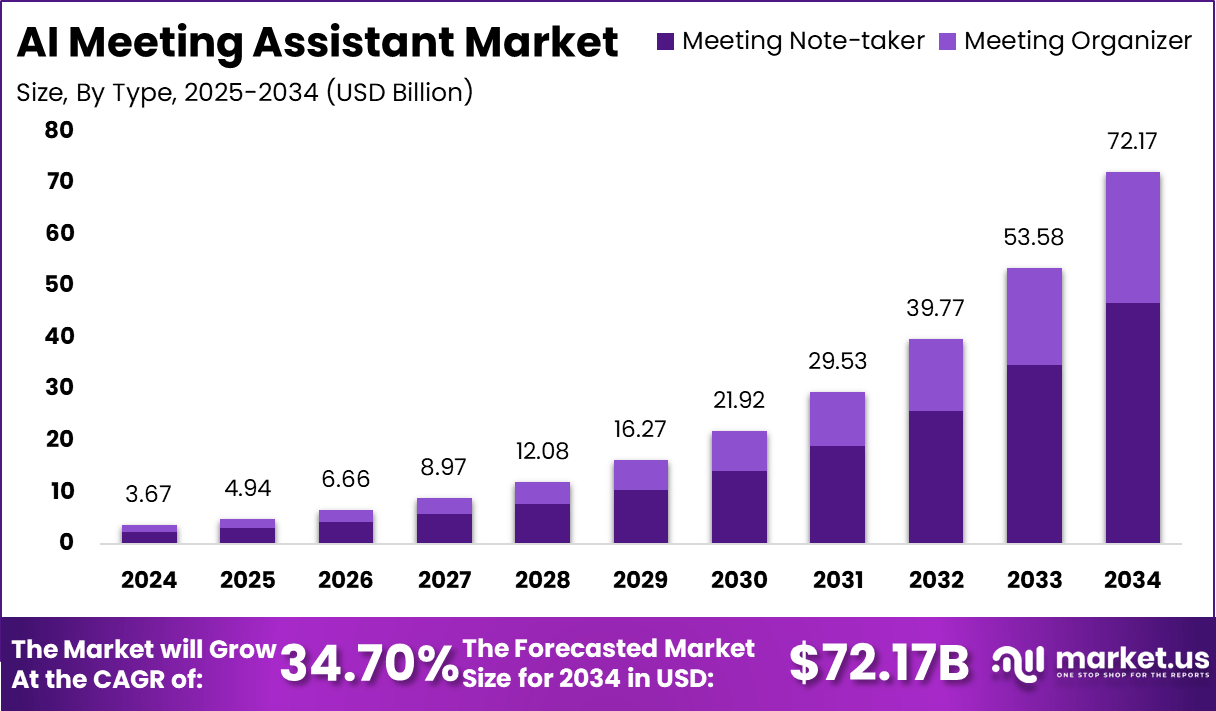

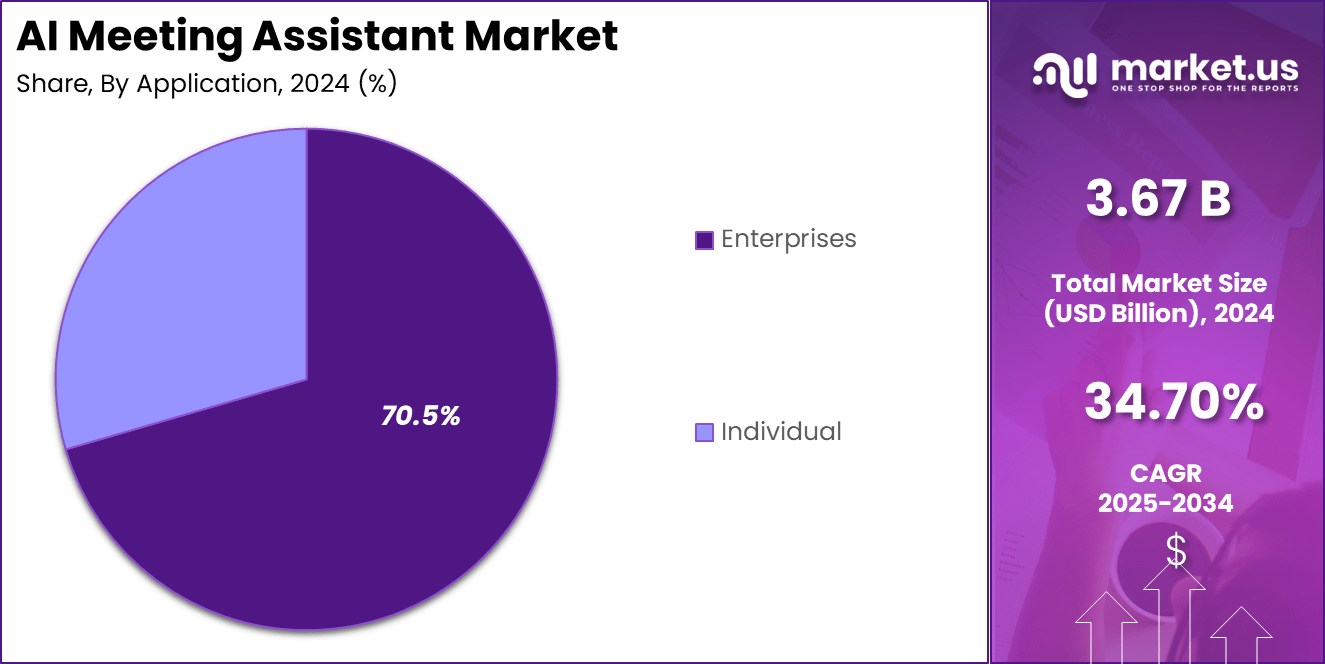

The Global AI Meeting Assistant Market was valued at USD 3.67 billion in 2024 and is projected to experience remarkable expansion, reaching approximately USD 72.17 billion by 2034, registering a robust CAGR of 34.7% over the forecast period. The market growth is primarily driven by the widespread adoption of AI-based productivity tools that automate meeting functions such as note-taking, transcription, summarization, and task tracking. Increasing integration of generative AI models, natural language understanding, and voice intelligence into enterprise communication platforms has further strengthened market adoption across industries.

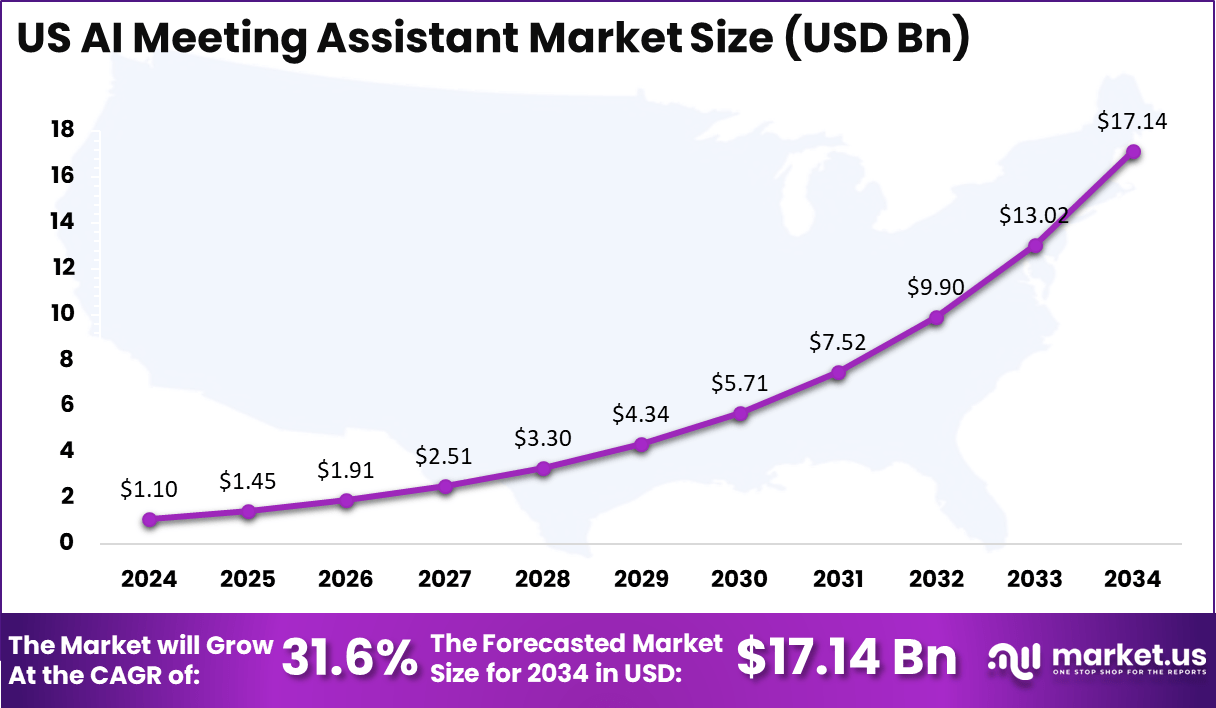

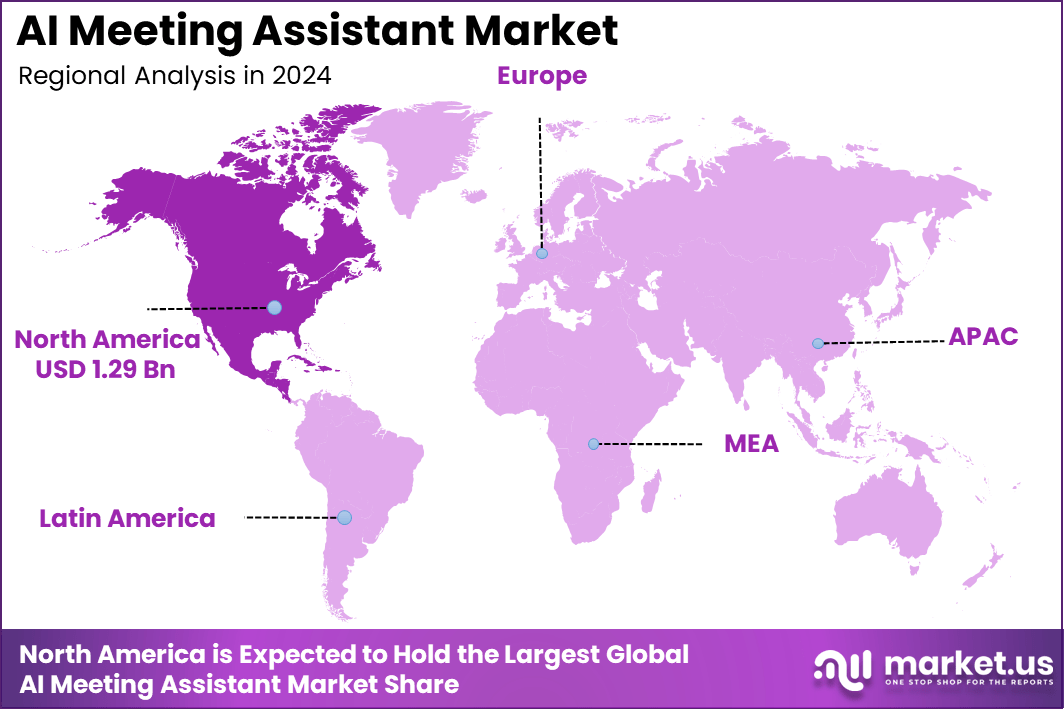

In 2024, North America held a dominant share of 35.3% in the global market, with a total valuation of USD 1.29 billion. The region’s growth is attributed to rapid technological advancements, strong enterprise digitalization, and significant investments by key players such as Microsoft, Google, and Zoom in AI-powered collaboration solutions. Within the region, the United States led the market with a value of USD 1.10 billion in 2024 and is projected to reach approximately USD 17.14 billion by 2034, expanding at a CAGR of 31.6%. This strong trajectory reflects the country’s growing demand for AI meeting automation, hybrid work adoption, and continuous innovation in virtual collaboration ecosystems.

The AI Meeting Assistant Market is transforming the way organizations manage meetings by integrating artificial intelligence into everyday collaboration workflows. These intelligent systems use advanced technologies such as natural language processing, speech recognition, and generative AI to automate key tasks, including transcription, summarization, scheduling, and action item tracking. By streamlining these processes, AI meeting assistants enhance productivity, reduce manual workload, and ensure that critical insights from discussions are captured and shared efficiently across teams.

The growing adoption of hybrid and remote work models has further accelerated the demand for AI-driven meeting solutions that enable seamless communication across geographies and time zones. Enterprises are increasingly deploying these assistants within popular platforms such as Microsoft Teams, Zoom, and Google Meet to improve meeting efficiency and post-meeting documentation.

The integration of contextual understanding, multilingual support, and predictive analytics is expanding its utility across sectors, including IT, finance, healthcare, and education. As organizations continue to invest in digital transformation and intelligent automation, AI meeting assistants are emerging as indispensable tools that redefine corporate collaboration, decision-making accuracy, and operational agility in the modern workplace.

In early 2025, Otter.ai launched its “Meeting Agent,” a voice-activated assistant that can join meetings, answer questions based on a company’s meeting database, schedule follow-ups, and draft emails—all via natural voice commands. It’s currently available on Zoom and will roll out to Microsoft Teams and Google Meet soon. This reflects a shift from simple transcription & summarisation toward more fully-capable meeting assistants.

Meanwhile, the specialist meeting-assistant startup Fireflies.ai (which records, transcribes, summarises, and analyses meetings) has raised around USD 19 million in a Series A funding round. The startup claims it serves over 300,000 organisations—including large names like Expedia, Nike, and Delta—which signals growing enterprise adoption.

On the investment/market expansion side, a wider study of meeting summary-tool startups shows there are at least 38 firms in this niche (e.g., Meet Geek, Read AI, Fathom) globally; of those, 16 have received funding and 7 have achieved Series A or higher. That suggests the market is still early in its growth phase but is gaining momentum.

Another notable funding round: the startup Onyx (which aims to build a “ChatGPT-style” assistant that connects to a company’s documents, Slack/Google Drive/Teams, etc.) raised around USD 10 million in seed funding – far above its initial target of USD 3 million. This shows that investors are valuing “meeting + workflow + AI agent” combinations more aggressively.

Finally, from the enterprise acquisition front, although not exclusively meeting assistants but adjacent: ServiceNow announced it would acquire Moveworks (a generative-AI assistant for employee support) for about USD 2.85 billion, which underscores the premium being placed on AI-assistant technologies in the workplace context. While the focus is slightly broader than just meeting assistants, this move signals that large enterprise software players see assistants/agents as strategically important.

Key Takeaways

- The global AI Meeting Assistant Market is expanding rapidly with a strong CAGR of 34.7%, showcasing rising enterprise demand for intelligent collaboration tools.

- The market value is projected to rise from USD 3.67 billion in 2024 to USD 72.17 billion by 2034, indicating significant technological adoption across industries.

- North America accounted for 35.3% of the total market in 2024, reflecting its leadership in the early implementation of AI-powered meeting technologies.

- The region’s market size stood at USD 1.29 billion in 2024, supported by strong digital infrastructure and enterprise investments in automation.

- The United States led the regional landscape with a market size of USD 1.10 billion in 2024, emphasizing its dominance in AI-integrated business operations.

- The US market is forecasted to reach USD 17.14 billion by 2034, expanding at a notable CAGR of 31.6%, driven by the increasing adoption of AI meeting assistants in corporate ecosystems.

- By Offering, the Meeting & Collaboration Assistant segment held the largest share at 38.8%, supported by increasing use of AI systems for real-time transcription, scheduling, and task automation.

- By Type, the Meeting Note-taker segment dominated with 64.8%, reflecting high demand for solutions that capture, summarize, and organize meeting discussions efficiently.

- By Application, the Enterprises segment accounted for 70.5% of the market, driven by large-scale deployment across corporate environments seeking to enhance productivity and streamline hybrid communication workflows.

Role of AI

Artificial intelligence plays a transformative role in reshaping the functionality and efficiency of meeting assistants, making them indispensable tools in modern workplaces. Through advanced natural language processing, speech recognition, and machine learning, AI enables meeting assistants to automatically capture, transcribe, and summarize conversations with high accuracy.

This automation eliminates manual note-taking and ensures that critical information, decisions, and action items are recorded in real time. AI also enhances contextual understanding, allowing these systems to identify key themes, assign tasks, and even generate follow-up reminders or emails based on meeting discussions.

Beyond transcription, AI meeting assistants are evolving into proactive collaborators capable of integrating with calendars, project management platforms, and communication tools to streamline workflow continuity. Generative AI now allows for real-time translation, voice synthesis, and personalized meeting summaries, enhancing inclusivity and cross-team collaboration.

As organizations shift toward hybrid and remote work models, AI-driven assistants ensure seamless coordination among distributed teams by providing insights, attendance analytics, and participation trends. Overall, AI not only boosts productivity and decision-making but also transforms meetings from passive discussions into actionable, data-driven engagements—making it a core enabler of the future digital workplace.

Analysts’ Viewpoint

From an analyst’s perspective, the AI meeting assistant market stands out as one of the more dynamic segments of the broader enterprise-AI space. With its very high projected CAGR and large addressable market, many analysts believe it presents a compelling growth opportunity for both software vendors and enterprise technology buyers. The rationale is that the convergence of hybrid/remote work, collaboration tool proliferation, and enterprise automation commitments means that tasks like note-taking, task follow-up, and agenda management are ripe for disruption.

However, analysts also caution that sustained success will depend on more than just basic “transcription + summary” capabilities. They emphasise that meaningful differentiation will require deeper workflow integration (e.g., calendar, project management, CRM), stronger AI-driven insights (e.g., sentiment, actions, decisions), and open-platform-friendliness. From an enterprise buyer-perspective, analysts note three critical success factors: ease of deployment / minimal friction, measurable productivity benefits (e.g., time saved, actions completed), and data-governance / privacy compliance given the sensitive nature of meeting content.

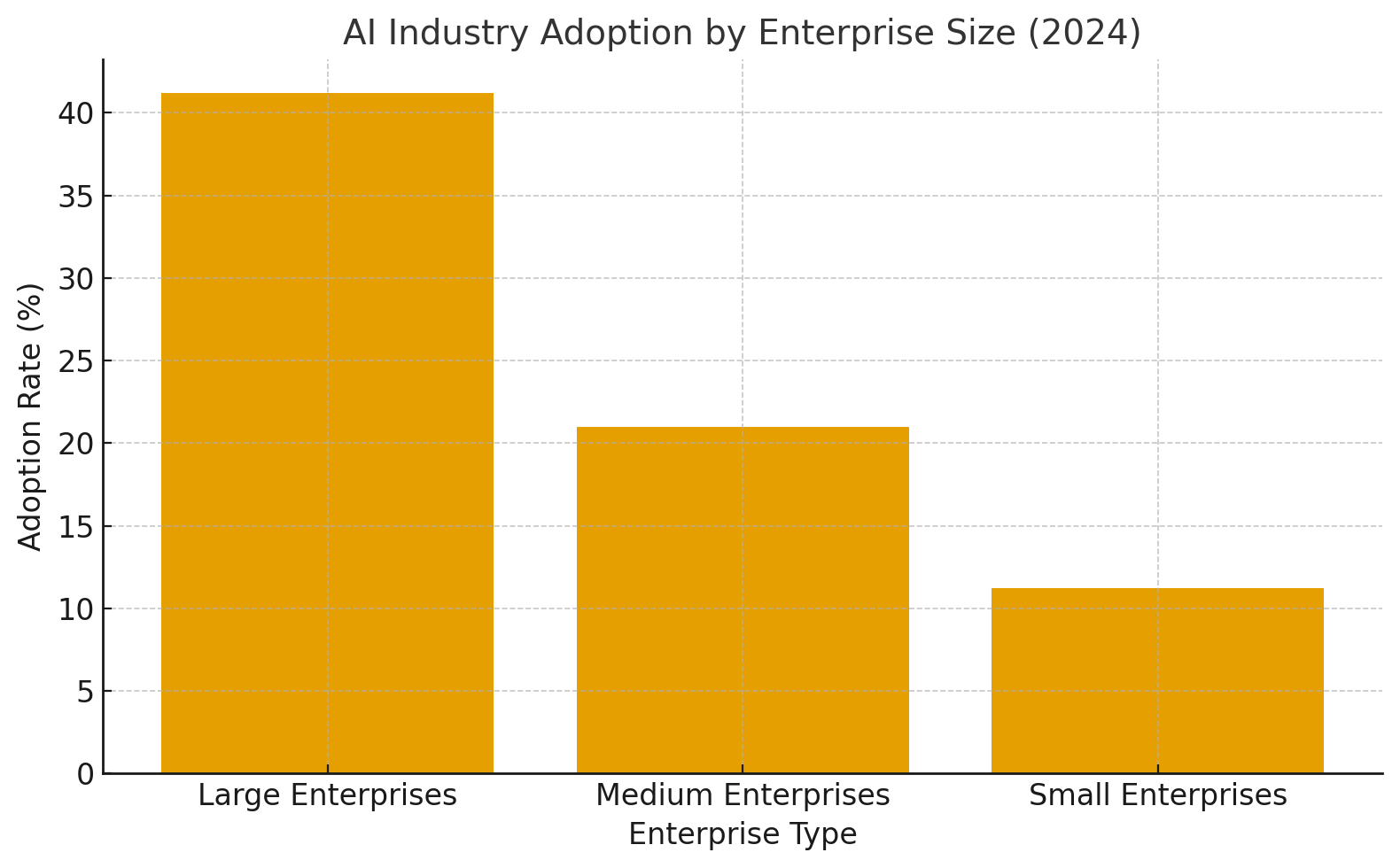

AI Industry Adoption

Many enterprises are embracing AI in their operations: for example, a recent Eurostat report shows that in 2024, around 41.2% of large enterprises had adopted AI technologies, compared with 20.97% of medium-sized and 11.21% of small firms. In more general terms across functions, one source reports that 78% of organisations are using AI in some form, and 85% have adopted “agents” (AI assistants/workflows) in at least one part of their operations.

In the context of meeting assistants specifically, uptake is driven by the shift to remote/hybrid work, growing meeting volumes, and the need to extract actionable insights from meeting content. Reports note that large enterprises in particular dominate deployments of meeting-assistant tools because they have the budgets, infrastructure, and meeting volumes to justify the investment.

However, adoption is uneven. Smaller firms lag, and many companies face hurdles such as integration complexity, data privacy concerns, and measuring a clear ROI. In practice, the “white-collar” functions (professional services, tech, finance) show higher adoption rates than frontline or less-digitised parts of organisations.

From a market-research stance, this means: the addressable base for full deployment of AI meeting assistants is still large. Vendors and adopters should differentiate between “early adopters” (large enterprises already using them) and “mass market” (SMEs, less digitised industries), where growth will happen next. Critical focus areas for market expansion include ease of integration, proof of productivity gains, cost rationalisation, and alignment with corporate data governance.

US Market Size

The United States represents the most mature and fastest-growing market for AI meeting assistants, accounting for a significant portion of global adoption. Valued at USD 1.10 billion in 2024, the market is projected to reach approximately USD 17.14 billion by 2034, expanding at a robust CAGR of 31.6%. This strong growth trajectory reflects the rapid digital transformation of US enterprises and the rising integration of artificial intelligence into workplace collaboration systems.

The widespread adoption of platforms such as Microsoft Teams, Google Meet, and Zoom has created fertile ground for AI meeting assistants that automate key processes, including transcription, summarization, scheduling, and task management.

The surge in hybrid and remote work models across the US corporate landscape has further accelerated the demand for AI-driven productivity tools that streamline communication and decision-making. Moreover, continuous advancements in natural language processing and generative AI technologies have enhanced the accuracy, contextual understanding, and multilingual capabilities of these assistants.

Government support for AI innovation and increased enterprise investments in intelligent automation are also contributing to the market’s rapid expansion. Overall, the US market is expected to remain the global leader, setting benchmarks in performance, adoption, and innovation in AI meeting intelligence solutions.

Investment and Business Benefits

Investing in AI meeting assistant solutions brings multiple tangible business advantages. First and foremost, these tools significantly reduce administrative overhead: features such as automatic transcription, agenda generation, note-taking, and follow-up action-item assignment free up valuable employee time. For example, organizations report that automating the meeting lifecycle (scheduling, recording, summarizing and follow-up) can save up to 1.5 hours per meeting cycle.

Secondly, these systems help elevate decision-making quality. By capturing every discussion, flagging key points, surfacing insights and making meeting outputs actionable, AI assistants bridge the gap between conversation and execution. This leads to faster response times, clearer alignment and higher accountability — all of which contribute to stronger business outcomes.

Thirdly, from an investment standpoint, AI meeting assistants can deliver strong return on investment (ROI) by boosting productivity and enabling better use of existing resources. Since many enterprises already have video conferencing, collaboration platforms and digital workflows, the incremental cost of adding an AI layer often yields disproportionate efficiency gains. Vendors highlight reduced meeting fatigue, improved clarity on follow-ups and better cross-team coordination as key value-drivers.

Finally, businesses that implement these tools effectively can gain competitive advantage. They are able to extract automated insights from meetings, convert conversations into structured knowledge, and scale best-practice workflows across teams. Over time, this creates a culture of smarter collaboration, faster execution, and measurable productivity gains.

By Offering

The Meeting & Collaboration Assistant segment accounted for 38.8% of the AI meeting assistant market, emerging as the leading offering category in 2024. This dominance is attributed to the rapid adoption of AI-driven tools that enhance collaboration, automate meeting documentation, and improve communication efficiency across hybrid and remote work environments.

These assistants leverage natural language processing, speech recognition, and generative AI to perform real-time transcription, summarization, translation, and task tracking, allowing teams to focus on strategic discussions rather than administrative work. Their integration with platforms such as Microsoft Teams, Zoom, and Google Meet has made them central to daily business operations.

Enterprises are increasingly investing in meeting and collaboration assistants to improve productivity and ensure that critical decisions and action items are accurately captured and distributed post-meeting. Moreover, the ability of these assistants to provide contextual insights, automate follow-ups, and support cross-department communication makes them essential for modern digital workplaces.

The growing trend toward unified communication ecosystems and workflow automation continues to strengthen their role across sectors like IT, finance, education, and healthcare. As AI technologies evolve, the Meeting & Collaboration Assistant segment is expected to maintain its leadership, driving efficiency and collaboration in intelligent business ecosystems.

By Type

The Meeting Note-taker segment held the dominant share of 64.8% in the AI meeting assistant market, reflecting the growing demand for automation in meeting documentation and knowledge management. These AI-powered note-takers use advanced speech recognition and natural language processing to accurately transcribe discussions, identify key decisions, and summarize action points in real time.

Organizations are increasingly relying on these tools to eliminate manual note-taking, reduce information loss, and improve post-meeting productivity. Their ability to integrate seamlessly with collaboration platforms such as Zoom, Microsoft Teams, and Google Meet has further accelerated adoption across corporate environments.

The rising complexity of enterprise meetings and hybrid communication models has also fueled the use of AI note-takers capable of generating multilingual transcriptions and context-aware summaries. This has proven especially valuable for global teams managing cross-border collaboration. By comparison, the Meeting Organizer segment is experiencing steady growth as businesses adopt AI assistants for scheduling, agenda management, and calendar optimization.

However, the larger share of note-takers underscores their immediate value in simplifying daily workflows and preserving institutional knowledge. As generative AI continues to enhance accuracy and contextual understanding, the Meeting Note-taker segment is expected to remain the market leader throughout the forecast period.

By Application

The Enterprises segment accounted for 70.5% of the AI meeting assistant market, establishing itself as the dominant application area. Large and medium-sized organizations are increasingly integrating AI-driven meeting assistants to streamline collaboration, automate repetitive administrative tasks, and enhance decision-making efficiency.

These tools are now a core part of enterprise communication infrastructure, enabling automatic transcription, real-time summarization, and intelligent follow-ups across teams and departments. The shift toward hybrid and remote work models has further accelerated enterprise adoption, as companies seek tools that maintain productivity and alignment across distributed workforces.

AI meeting assistants are also being deployed to improve workflow transparency and project tracking by linking meeting outputs to task management and CRM systems. Industries such as IT, finance, healthcare, and education have shown particularly strong uptake due to their reliance on frequent virtual meetings and documentation-heavy processes.

In contrast, the Individual segment is growing gradually, driven by freelancers, consultants, and small business professionals using AI note-takers for personal productivity. However, the enterprise segment’s dominance reflects the scalability, data analytics, and collaboration benefits that large organizations gain from AI integration. As enterprise digital transformation deepens, this segment is expected to remain the primary growth driver of the market.

Key Market Segments

By Offering

- Meeting & Collaboration Assistant

- Knowledge & Research Assistant

- Scheduling & Calendar Optimization Assistant

- Presentation & Design Assistant

- Others

By Type

- Meeting Note-taker

- Meeting Organizer

By Application

- Individual

- Enterprises

Regional Analysis

North America accounted for 35.3% of the global AI meeting assistant market in 2024, making it the leading regional contributor. The region’s dominance is supported by high enterprise digitalization, strong cloud infrastructure, and rapid adoption of AI-powered collaboration platforms. Organizations across industries such as information technology, finance, and healthcare are increasingly integrating AI assistants to streamline meetings, automate note-taking, and enhance productivity in hybrid work environments. The widespread use of platforms like Microsoft Teams, Google Meet, and Zoom has further strengthened the regional market’s foundation.

Within North America, the United States emerged as the primary growth driver with a market value of USD 1.10 billion in 2024. The country’s strong technological ecosystem and early adoption of AI-based enterprise solutions have positioned it as a leader in meeting automation. This growth reflects the growing demand for intelligent assistants capable of managing complex workflows, improving communication accuracy, and optimizing meeting outcomes. Overall, North America is expected to remain the most influential region, setting global benchmarks in AI meeting efficiency and innovation.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The market is being propelled by the sharp shift to remote and hybrid work models, which has dramatically increased reliance on virtual meetings and collaboration platforms. Businesses are under growing pressure to improve productivity, reduce wasted meeting time, and capture actionable outputs from discussions — driving demand for tools that automate transcription, summarisation, and task-tracking.

Advancements in natural language processing (NLP) and machine learning have improved the accuracy and contextual understanding of speech and meeting content, making AI assistants more viable. Integration of these assistants with existing collaboration ecosystems (conferencing, calendar, email) offers seamless workflow value, enhancing their appeal to enterprises.

Restraint Factors

Several factors slow adoption. Data privacy and security concerns are significant because meetings often carry sensitive corporate or legal content; organisations hesitate to entrust this to AI tools.

Accuracy remains a concern — overlapping speech, accents, background noise, and domain-specific terminology reduce reliability and trust in AI-generated transcripts or summaries. Implementation and integration costs (licensing, staff training, infrastructure) can be high, especially for smaller organisations. Legacy system compatibility and user resistance (employees preferring manual methods) further act as adoption barriers.Growth Opportunities

The market offers strong upside. Enterprises globally still have large volumes of meetings with untapped productivity improvement potential — offering a large addressable base for adoption. Expanding multilingual capabilities and regionalisation (for non-English markets) open new geographies. The trend toward deeper analytics — e.g., sentiment analysis, meeting effectiveness metrics, action-item tracking — moves beyond mere transcription into strategic insights, creating higher value.

Integration with broader digital workplace ecosystems (CRM, project management, workflows) offers bundling opportunities. Also, growth in emerging regions (Asia-Pacific, Latin America) and in sectors such as healthcare, education, and government — where compliance and documentation are critical — represent fertile expansion paths.

Challenging Factors

Despite the potential, there are real execution challenges. Ensuring trust in AI outputs is crucial — errors in meeting summaries or mis-assigned action items undermine credibility. The legal and regulatory validity of AI-generated meeting records remains unclear in many jurisdictions, making organisations cautious. Vendors must continuously improve accuracy and manage continuous model training, especially across different languages, dialects, industries and meeting contexts.

User adoption remains uneven: technology fatigue, change-management hurdles and low perceived ROI can slow uptake. Competitive pressure is rising, with many vendors entering — pushing margin compression, requiring differentiation through features and services. Ensuring interoperability with diverse enterprise systems and tailoring to specific industry workflows also adds complexity.

Competitive Analysis

The AI meeting assistant market is highly competitive, with several established and emerging players offering a diverse range of capabilities to enhance productivity and collaboration. Krisp Technologies, Inc. stands out for its advanced noise-cancellation and real-time transcription technology, providing clear and accurate meeting documentation without requiring bots or intrusive add-ons.

Airgram Inc. and Fireflies.ai Corp. focus on multi-language transcription, AI-driven summaries, and task automation, with Fireflies.ai serving over 500,000 organizations through its extensive integration capabilities across platforms such as Zoom, Google Meet, and Microsoft Teams. Dialpad, Inc. and Fathom, Inc. leverage AI analytics to capture conversational intelligence, enabling businesses to track engagement and improve meeting outcomes.

Equal Time and TLDV specialize in meeting recap and video summarization features, catering to remote and hybrid teams seeking quick, actionable insights from discussions. Avoma and Nyota AI Ltd. focus on sales and enterprise productivity, integrating CRM and analytics tools for real-time coaching and decision support.

Meanwhile, CLARA, Rewatch, and Fellow AI emphasize collaborative documentation and meeting review management, while OTTER.AI, one of the most established players, remains a benchmark for transcription accuracy and enterprise deployment. Emerging players such as Sembly AI, Notiv, Rev.com, Gong.io Inc., and Chorus.ai are expanding capabilities into sentiment analysis, sales enablement, and conversation intelligence. Overall, the market is witnessing consolidation, with leading companies focusing on deeper workflow integration, security compliance, and multilingual support to strengthen their positioning in the rapidly growing AI collaboration ecosystem.

Top Key Players in the Market

- Krisp Technologies, Inc.

- Airgram Inc.

- Fireflies.ai Corp.

- Dialpad, INC.

- Fathom, Inc.

- Equal Time

- TLDV

- Avoma

- Nyota AI Ltd.

- CLARA

- Rewatch

- Fellow AI

- OTTER.AI

- Sembly AI.

- Notiv

- Rev.com

- Gong.io Inc.

- Chorus.ai

- Other Major Players

Major Developments

March 2025: Otter Meeting Agent Launches Voice-Activated Meeting Assistant

The company behind Otter.ai introduced a new “Meeting Agent” in March 2025 that can join meetings, answer questions based on stored meeting data, schedule follow-ups, and draft emails through natural voice commands. It currently integrates with Zoom and is planned for roll-out on Microsoft Teams and Google Meet.

September 2025: MeetGeek Raises €1.6 Million to Develop Agentic AI Meeting Workspace

Romanian startup MeetGeek closed a funding round of €1.6 million to scale its AI meeting assistant into a broader agentic workspace that transforms meeting conversations into structured data and actionable outcomes, integrating with CRM and project-management tools.

October 2025: Glue Raises USD 20 Million Series A for Workplace Collaboration Platform

The startup Glue, positioning itself as a rival to Slack, raised USD 20 million in Series A financing to build a workplace collaboration platform with embedded AI agents that manage internal communications, plan and organise work, and act as a “model context protocol” for enterprise workflow.

Report Scope

Report Features Description Market Value (2024) USD 3.67 Billion Forecast Revenue (2034) USD 72.17 billion CAGR(2025-2034) 34.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Offering (Meeting & Collaboration Assistant, Knowledge & Research Assistant, Scheduling & Calendar Optimization Assistant, Presentation & Design Assistant, Others), By Type (Meeting Note-taker, Meeting Organizer), By Application (Individual, Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Krisp Technologies, Inc., Airgram Inc., Fireflies.ai Corp., Dialpad, INC., Fathom, Inc., Equal Time, TLDV, Avoma, Nyota AI Ltd., CLARA, Rewatch, Fellow AI, OTTER.AI, Sembly AI, Notiv, Rev.com, Gong.io Inc., Chorus.ai, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  AI Meeting Assistant MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

AI Meeting Assistant MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Krisp Technologies, Inc.

- Airgram Inc.

- Fireflies.ai Corp.

- Dialpad, INC.

- Fathom, Inc.

- Equal Time

- TLDV

- Avoma

- Nyota AI Ltd.

- CLARA

- Rewatch

- Fellow AI

- OTTER.AI

- Sembly AI.

- Notiv

- Rev.com

- Gong.io Inc.

- Chorus.ai

- Other Major Players