Global AI Legal Drafting Tools Market Size, Share, Industry Analysis Report By Component (Software/Platform, Services), By Technology (Natural Language Processing (NLP) and Generation (NLG), Machine Learning (ML) & Deep Learning, Predictive Analytics, Others); By Deployment Mode (Cloud-based, On-premise), By Application (Contract Drafting & Review, Legal Agreements & Deeds, Pleadings & Motions, Compliance & Regulatory Documents, Patent Drafting, Discovery Documents, Others), By End-User (Law Firms, Corporate Legal Departments, Legal Process Outsourcers (LPOs), Government & Judiciary, Individual Lawyers & Solo Practitioners), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163698

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Legal AI Adoption and Impact

- US Market Size

- By Component

- By Technology

- By Deployment Mode

- By Application

- By End-User

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

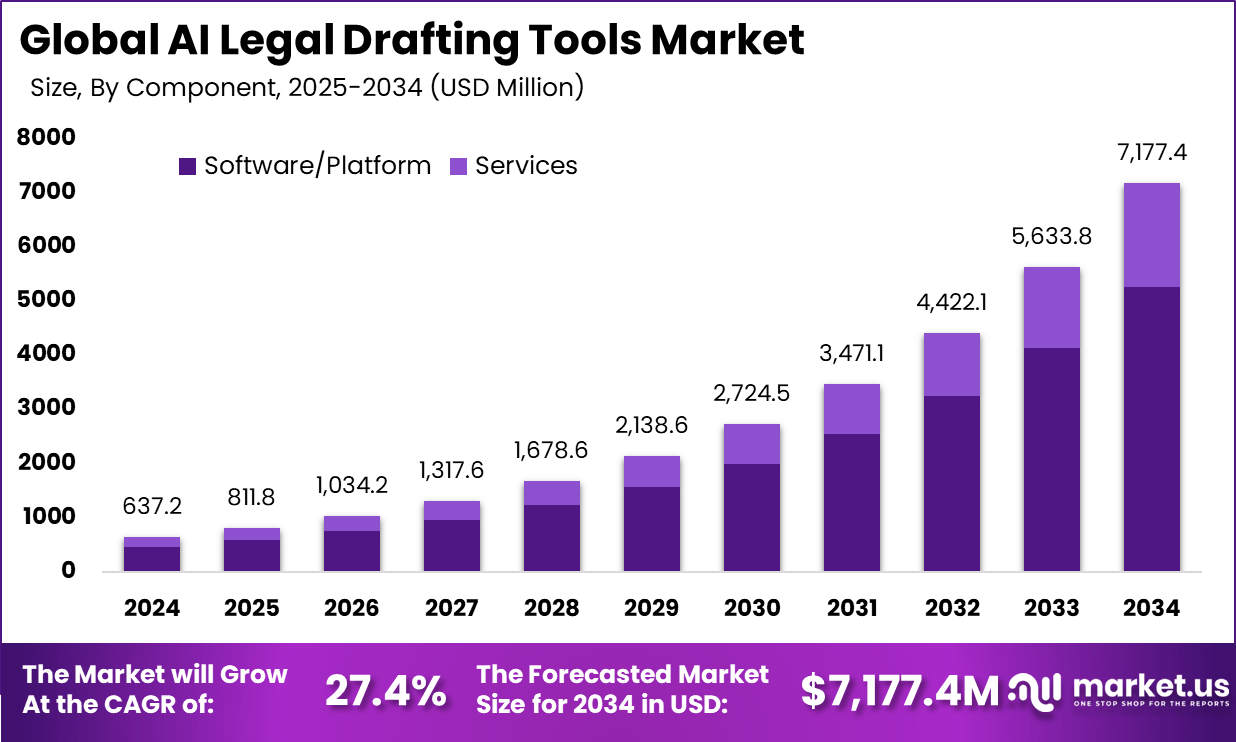

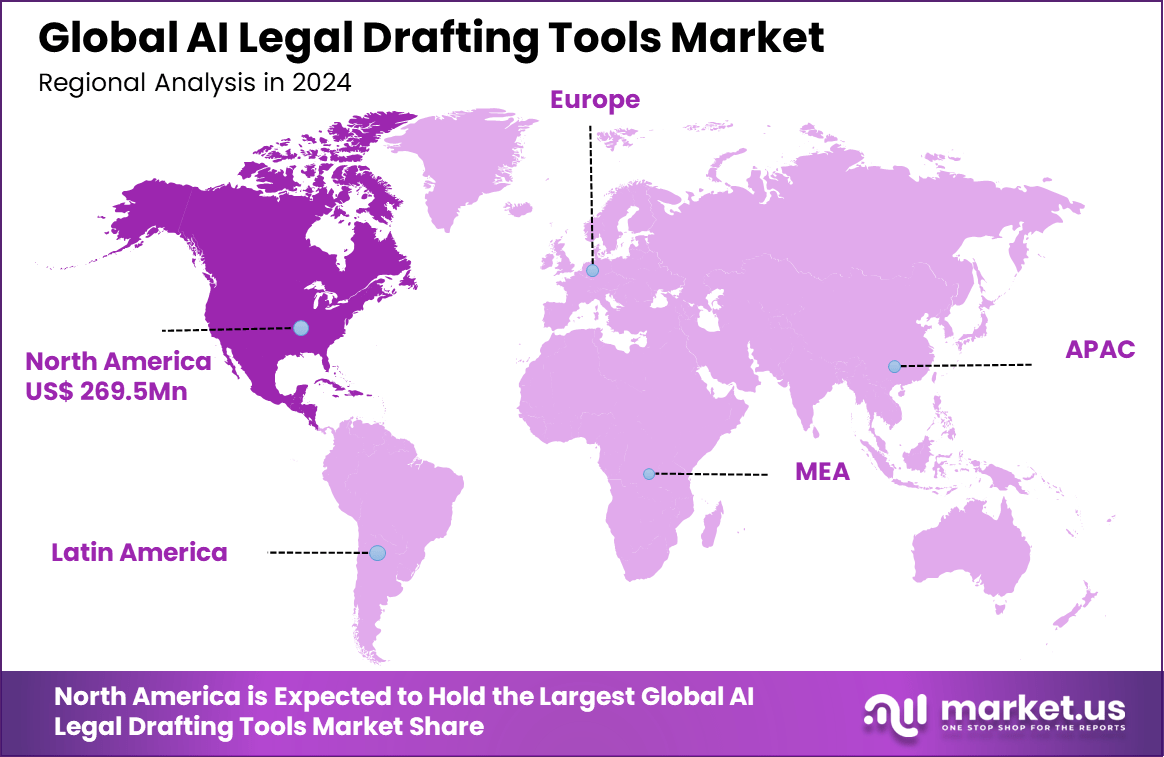

The Global AI Legal Drafting Tools Market generated USD 637.2 Million in 2024 and is predicted to register growth from USD 811.8 Million in 2025 to about USD 7,177.4 million by 2034, recording a CAGR of 27.4% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 42.3% share, holding USD 269.5 Million revenue.

The AI Legal Drafting Tools market is rapidly evolving, driven by a growing need for efficiency and accuracy in legal document creation. As legal teams face increasing caseloads and complex regulations, AI-powered drafting tools offer significant time savings, producing initial drafts in minutes and reducing manual errors. These tools enable legal professionals to concentrate more on critical analysis and strategic decision-making rather than repetitive tasks.

Top driving factors include the increasing demand for automation in routine legal processes and improving accuracy in document drafting. AI tools excel in reducing time spent on contract review, legal research, and compliance monitoring while enhancing consistency by enforcing legal playbooks and jurisdiction-specific requirements. Around 50% or more of legal professionals now report AI helps cut drafting time by nearly half, highlighting its impact on productivity.

Demand for AI legal drafting tools is fueled by their ability to integrate with existing workflows, such as Microsoft Word, enabling lawyers to work in familiar environments with real-time collaboration and editing features. Technologies like generative AI, natural language processing, and predictive analytics increase drafting precision while providing actionable legal insights.

Key reasons for adopting AI legal drafting tools include significant reductions in drafting errors, improved risk management, and faster contract turnaround. These tools help identify inconsistencies automatically and provide context-aware suggestions to ensure regulatory compliance. For example, over 500 contracts per year are reviewed by some senior executives, a volume challenging to manage manually without errors or delays.

Top Market Takeaways

- By component, software/platform dominates with 73.4%, reflecting growing adoption of AI-driven legal automation solutions.

- By technology, machine learning (ML) and deep learning lead with 43.8%, enabling context-aware drafting, clause detection, and intelligent document analysis.

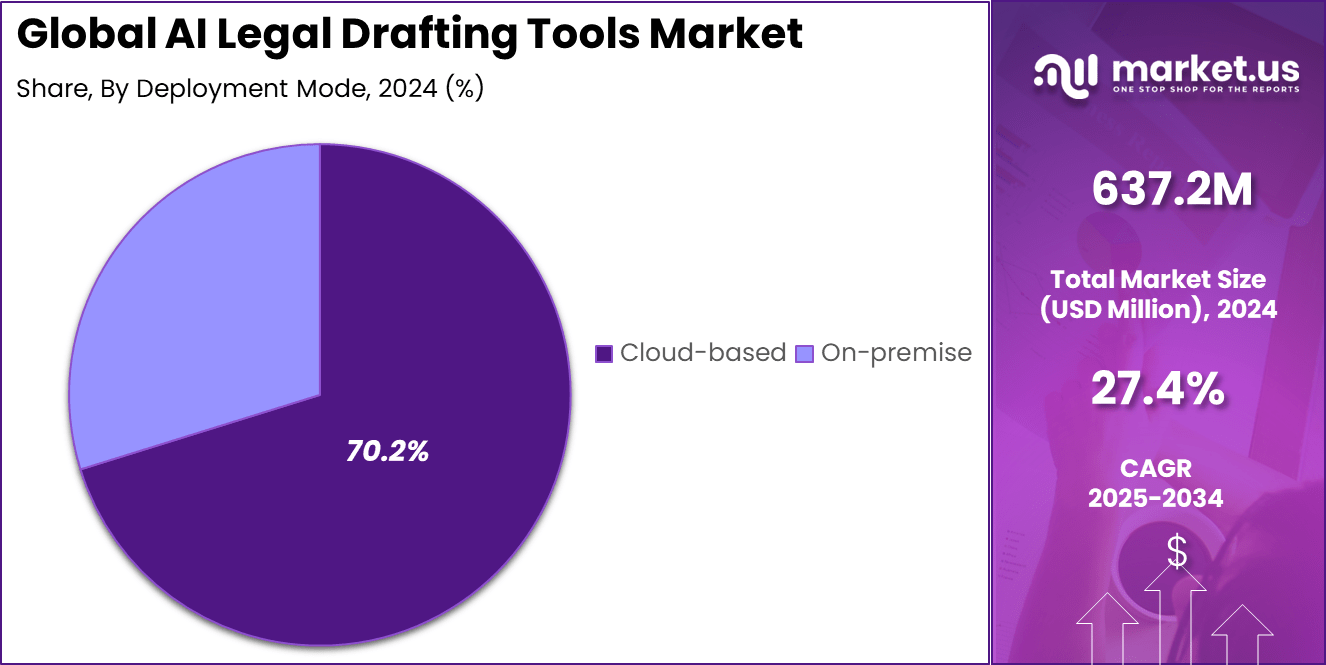

- By deployment mode, cloud-based systems account for 70.2%, favored for scalability, collaboration, and real-time access to legal data.

- By application, contract drafting and review holds 31.6%, showcasing AI’s capability to enhance speed, accuracy, and compliance in legal documentation.

- By end-user, law firms represent 38.7%, as firms increasingly adopt AI platforms to streamline case workflows and reduce operational burdens.

- North America leads with 42.3%, supported by strong legal tech innovation and AI adoption among professional service firms.

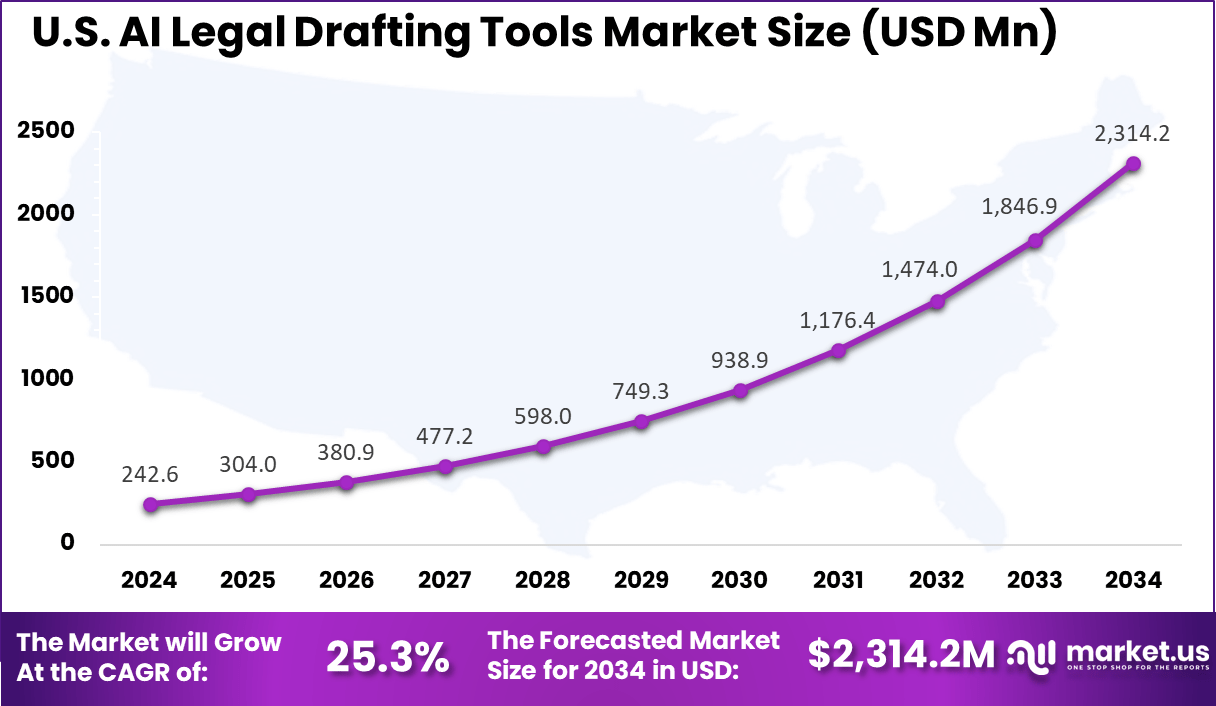

- The US market reached USD 242.6 million and is growing at a robust CAGR of 25.3%, underscoring rapid digital transformation across the legal sector.

Legal AI Adoption and Impact

Adoption and Growth

- High adoption: The legal industry is rapidly embracing artificial intelligence. In 2024, approximately 79% of law firm professionals reported using AI tools, marking a significant step toward digital transformation in legal operations.

- Rapid market growth: The Global Legal AI Software Market size is expected to be worth around USD 19.3 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 29.1% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 37.2% share, holding USD 0.5 Billion revenue.

- Rising use of generative AI: Adoption of generative AI is accelerating within the legal sector. The proportion of legal organizations using these tools nearly doubled from 14% in 2024 to 26% in 2025- reflecting growing trust in AI-assisted drafting and analysis.

Efficiency and Productivity

- Significant efficiency gains: Around 82% of law firms report measurable improvements in operational efficiency after implementing AI-driven legal writing and research tools.

- Time savings: Approximately 65% of firms have saved up to five hours per week through AI-enabled automation, enabling staff to focus on higher-value legal tasks.

- Faster drafting: Case studies show a 40% reduction in drafting time and a 25% increase in accuracy, according to Consultadd. AI tools also enable faster client communications and more streamlined workflows across practice areas.

Accuracy and ROI

- Improved accuracy: AI enhances accuracy in due diligence, compliance, and document analysis, minimizing the risks associated with manual review.

- Reduced errors: Advanced legal AI platforms have achieved 98% accuracy in contract data extraction, compared with 10-20% human error rates, underscoring AI’s reliability in precision-driven legal work.

- Positive ROI: Adoption is translating into financial performance. Approximately 53% of organizations are already realizing a positive return on investment (ROI) from their AI initiatives, according to Thomson Reuters Legal Solutions.

US Market Size

The United States alone represents approximately USD 242.6 million of this market and experiences a strong growth rate with a 25.3% CAGR. This growth is fueled by increasing pressure on law firms and corporate legal departments to reduce costs and accelerate contract processing times. Investments in AI research and development, along with widespread adoption of cloud-based tools, further reinforce the U.S. position as a leader in this market.

In 2024, North America holds a dominant 42.3% share of the AI legal drafting tools market, supported by a mature legal ecosystem and strong technology adoption. The region’s well-established regulatory environment and high-volume legal cases drive demand for automated solutions to improve productivity and compliance.

By Component

In 2024, Software and platforms account for the majority of the AI legal drafting tools market at 73.4%. This dominance reflects the critical role that software solutions play in automating complex legal drafting tasks. These platforms offer a range of functionalities including contract generation, legal document review, and intelligent editing.

Their ease of integration across various legal workflows makes them essential tools for law firms and corporate legal departments focused on enhancing efficiency. The ongoing improvements in AI algorithms embedded in these platforms allow for better understanding and processing of legal language.

This leads to faster, more accurate drafting and review processes, reducing the reliance on manual labor. The software-driven approach also supports scalability, enabling firms to handle large volumes of contracts and legal documents without proportional increases in staffing.

By Technology

In 2024, Machine learning (ML) and deep learning technologies form the backbone of AI legal drafting tools, holding a 43.8% share. These technologies enable systems to learn from vast datasets of legal documents, improving their drafting capabilities and predictive accuracy.

The adoption of ML and deep learning allows tools to better understand complex legal terminology and context, producing more precise and relevant drafts. With the progression of natural language processing techniques, these AI models continually become more adept at interpreting subtle nuances in legal texts.

This evolution is crucial for handling diverse contract types and legal scenarios. ML and deep learning also support ongoing tool enhancement through feedback loops, helping the technology adapt to changing legal requirements and new document forms.

By Deployment Mode

In 2024, Cloud-based deployment dominates with 70.2% of the market. Cloud platforms offer ease of access, scalability, and cost efficiency, which are critical for law firms managing fluctuating workloads. They enable users to use AI drafting tools from any location and device, supporting remote work and collaboration across distributed legal teams.

Cloud deployment also facilitates ongoing software updates and security improvements without the need for complex IT investments by the firms. Hosting on secure cloud servers ensures compliance with data privacy standards while allowing seamless integration with other legal and enterprise systems. The model removes many barriers to adoption, especially for small and mid-sized firms.

By Application

In 2024, Contract drafting and review is the largest application segment, holding 31.6% of the market. This area benefits immensely from AI tools, which automate routine and repetitive tasks such as clause insertion, error detection, and consistency checks. These tools free up lawyers’ time, allowing them to focus on higher-value advisory work and strategy.

The automation of contract processes reduces the risk of human error and speeds turnaround times, improving client satisfaction. AI also supports complex contract analysis by flagging risky clauses or regulatory issues, helping firms maintain compliance and manage risk proactively. This application remains the bedrock of AI adoption in legal drafting.

By End-User

In 2024, Law firms are the primary users of AI legal drafting tools, accounting for 38.7% of the market. The competitive and high-volume nature of legal services drives firms to adopt AI solutions to increase productivity and maintain margins. AI tools help law firms manage extensive document loads, reduce bottlenecks, and deliver faster results for their clients.

Besides improving internal efficiencies, AI technologies give firms a technological edge in a demanding market where clients expect faster turnaround and higher accuracy. Law firms also benefit from enhanced analytics and knowledge management provided by AI, aiding case preparation and decision-making. The embrace of digital solutions is reshaping how law firms operate at scale.

Emerging Trends

Emerging trends in AI legal drafting tools reveal a shift towards hyper-personalized workflows that adapt to individual user needs, increasing usability for both lawyers and legal support staff. Around 59% of firms report using AI for brief or memo drafting, evidencing adoption beyond basic automation into more sophisticated legal writing.

In addition, AI tools now increasingly incorporate advanced natural language processing and machine learning to maintain consistency and compliance with regulations automatically, decreasing errors in complex contract management.

Another developing trend is the integration of AI-powered chatbots within legal services, handling client queries and preliminary advice, which enhances client interaction efficiency. Document summarization is also on the rise, employed by about 74% of legal professionals, saving crucial time in interpreting dense legal texts.

Growth Factors

Growth factors contributing to the expanding use of AI in legal drafting revolve mostly around the need for automation and efficiency in legal practices. Legal firms face increasing caseloads and tight budgets, prompting 58% of law teams to adopt AI solutions that automate time-consuming tasks such as contract review and compliance monitoring.

These tools reduce manual labor and human error, enabling legal professionals to concentrate on higher-value strategic activities. Furthermore, regulatory complexity drives AI adoption, as law firms and corporations require tools capable of keeping pace with evolving laws and ensuring compliance.

About 47% of legal teams use AI for knowledge management and regulatory tracking, facilitating risk mitigation and more informed decision-making. This reliable regulatory compliance support is a key growth driver for AI tools across diverse legal sectors including finance, healthcare, and pharmaceuticals.

Key Market Segments

By Component

- Software/Platform

- Services

- Professional Services (Integration, Consulting)

- Managed Services

By Technology

- Natural Language Processing (NLP) and Generation (NLG)

- Machine Learning (ML) & Deep Learning

- Predictive Analytics

- Others

By Deployment Mode

- Cloud-based

- On-premise

By Application

- Contract Drafting & Review

- Legal Agreements & Deeds

- Pleadings & Motions

- Compliance & Regulatory DocumentsPatent Drafting

- Discovery Documents

- Others

By End-User

- Law Firms

- Corporate Legal Departments

- Legal Process Outsourcers (LPOs)

- Government & Judiciary

- Individual Lawyers & Solo Practitioners

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Demand for Automation and Efficiency

The primary driver for AI legal drafting tools is the increasing demand for automation to improve efficiency in legal processes. Legal professionals face growing workloads with complex regulations and rising client expectations for faster service. AI legal drafting solutions automate routine tasks such as contract creation and document review, significantly reducing time and effort needed from lawyers.

This allows legal teams to focus on higher-value work, improving productivity and service delivery. Moreover, automation leads to cost savings by minimizing manual labor and reducing errors. Law firms and corporate legal departments benefit from faster turnarounds and enhanced accuracy, helping them stay competitive in a cost-sensitive market.

Restraint Analysis

Integration and Adoption Challenges

A major restraint in the AI legal drafting market stems from difficulties integrating AI tools into existing legal workflows and legacy systems. Many law firms and legal departments rely on traditional processes and technology stacks that are not fully compatible with AI solutions. This creates friction when trying to embed AI drafting tools into established practices, requiring significant customization and training.

Additionally, the legal industry’s conservative culture fuels resistance to change. Legal professionals may distrust AI’s reliability or fear loss of control over critical decisions. The demand for high compliance and data security standards also complicates implementation. These factors slow adoption, as firms weigh the benefits of AI against risks related to workflow disruption and data privacy concerns.

Opportunity Analysis

Predictive Analytics and Risk Mitigation

AI legal drafting tools have a strong opportunity to expand by incorporating predictive analytics capabilities. By analyzing vast amounts of case law, regulatory updates, and contract data, AI can forecast litigation outcomes, identify compliance risks, and provide data-driven insights to inform legal strategies. This transforms legal drafting from a reactive task into a proactive risk management function.

Firms leveraging AI for predictive insights can streamline contract negotiations and optimize compliance workflows, gaining competitive advantages. There is growing demand for AI tools that support specialized practice areas with predictive legal intelligence. As regulatory complexity rises, adopting AI-powered analytics offers firms new value-added services and enhances decision-making accuracy.

Challenge Analysis

Ensuring Accuracy and Trustworthiness

One significant challenge is maintaining the accuracy and trustworthiness of AI-generated legal content. Despite advances, AI tools occasionally produce errors, inconsistencies, or “hallucinations” (fabricated or misleading outputs not backed by real legal precedent). These inaccuracies risk undermining user confidence and exposing firms to liability.

Legal professionals must validate AI drafts thoroughly, but this adds review overhead and delays. Also, ethical concerns arise when AI outputs lack transparency or comprehensive legal context. Building reliable, auditable AI systems that comply with professional responsibility rules remains a key hurdle for vendors and users alike. This challenge requires ongoing refinement of AI models and careful user training to ensure tools are aids rather than risks.

Competitive Analysis

The AI Legal Drafting Tools Market is led by established legal technology providers and emerging AI innovators transforming contract and document automation. Thomson Reuters and LexisNexis have established strong positions through advanced natural language processing (NLP) and legal analytics platforms that streamline research, drafting, and compliance.

Icertis, ContractPodAi, and Evisort specialize in contract lifecycle management using AI to automate contract generation, review, and risk analysis. These platforms use machine learning and clause recognition to ensure compliance and identify anomalies, improving efficiency in corporate legal operations. Kira Systems, Luminance, and Harvey are known for leveraging deep learning for document review and due diligence, enabling lawyers to extract relevant clauses.

Emerging players such as DoNotPay, Casetext, Juro, LegalSifter, Robin AI, and Lawgee are contributing to market expansion through innovative, cost-effective solutions designed for small and mid-sized law firms. Their tools simplify legal drafting through AI-powered chat interfaces, automated templates, and contextual assistance.

Top Key Players in the Market

- Thomson Reuters

- LexisNexis

- Lawgee

- Clio

- Icertis

- ContractPodAi

- Kira Systems

- Luminance

- Harvey

- DoNotPay

- Casetext

- Evisort

- Juro

- LegalSifter

- Robin AI

- Others

Recent Developments

- September 2025, LexisNexis introduced Lexis+ AI®, an AI-powered drafting assistant that helps in-house counsel create tailored first drafts in seconds, identify missing clauses, and strengthen contracts using trusted LexisNexis legal intelligence. The system supports jurisdictional customization and collaboration across teams, markedly speeding up contract turnaround and reducing risk.

- October 2025, Clio launched the Intelligent Legal Work Platform, a first-of-its-kind integrated AI system that connects legal practice management with AI-powered research and drafting workflows. By uniting its acquisition of vLex with Vincent AI, Clio delivers a unified toolset that boosts productivity across legal operations and merges legal intelligence with case and firm management.

Report Scope

Report Features Description Market Value (2024) USD 637.2 Mn Forecast Revenue (2034) USD 7,177.4 Mn CAGR(2025-2034) 27.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Platform, Services), By Technology (Natural Language Processing (NLP) and Generation (NLG), Machine Learning (ML) & Deep Learning, Predictive Analytics, Others); By Deployment Mode (Cloud-based, On-premise), By Application (Contract Drafting & Review, Legal Agreements & Deeds, Pleadings & Motions, Compliance & Regulatory Documents, Patent Drafting, Discovery Documents, Others), By End-User (Law Firms, Corporate Legal Departments, Legal Process Outsourcers (LPOs), Government & Judiciary, Individual Lawyers & Solo Practitioners) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thomson Reuters, LexisNexis, Lawgee, Clio, Icertis, ContractPodAi, Kira Systems, Luminance, Harvey, DoNotPay, Casetext, Evisort, Juro, LegalSifter, Robin AI, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI Legal Drafting Tools MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

AI Legal Drafting Tools MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thomson Reuters

- LexisNexis

- Lawgee

- Clio

- Icertis

- ContractPodAi

- Kira Systems

- Luminance

- Harvey

- DoNotPay

- Casetext

- Evisort

- Juro

- LegalSifter

- Robin AI

- Others