Global AI in Precision Agriculture Market Size, Share, Industry Analysis Report By Offering (Hardware, Software, Services), By Technology (Machine Learning & Deep Learning, Computer Vision, Predictive Analytics, Natural Language Processing (NLP), Others), By Application (Precision Farming & Field Monitoring, Livestock Monitoring, Agricultural Robots (Agribots), Drone Analytics, Yield Mapping & Forecasting, Irrigation Management, Others), By Type of Farm (Large-Scale Farming, Small & Medium-Sized Farms, Greenhouse & Indoor Farming), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157468

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Insight Summary

- Analysts’ Viewpoint

- Investment and Business benefits

- Role of Generative AI

- Emerging Trends

- US Market Size

- By Offering

- By Technology

- By Application

- Type of Farm

- Growth Factors

- Top Use Cases

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

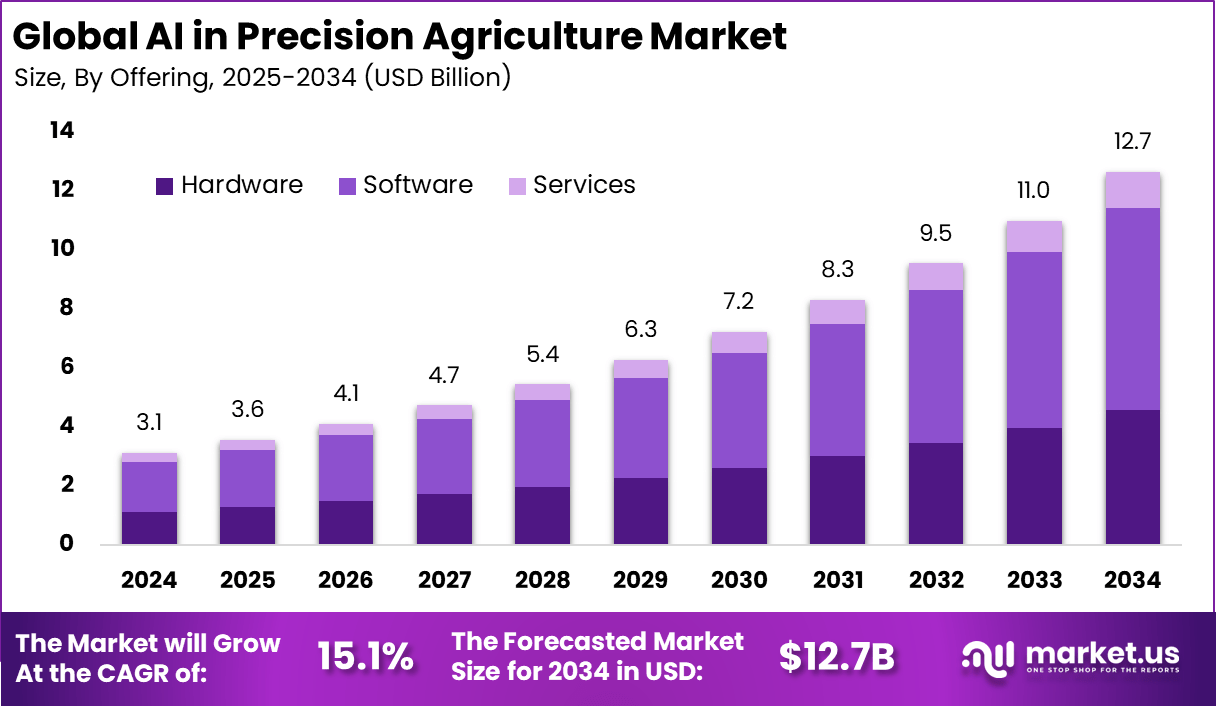

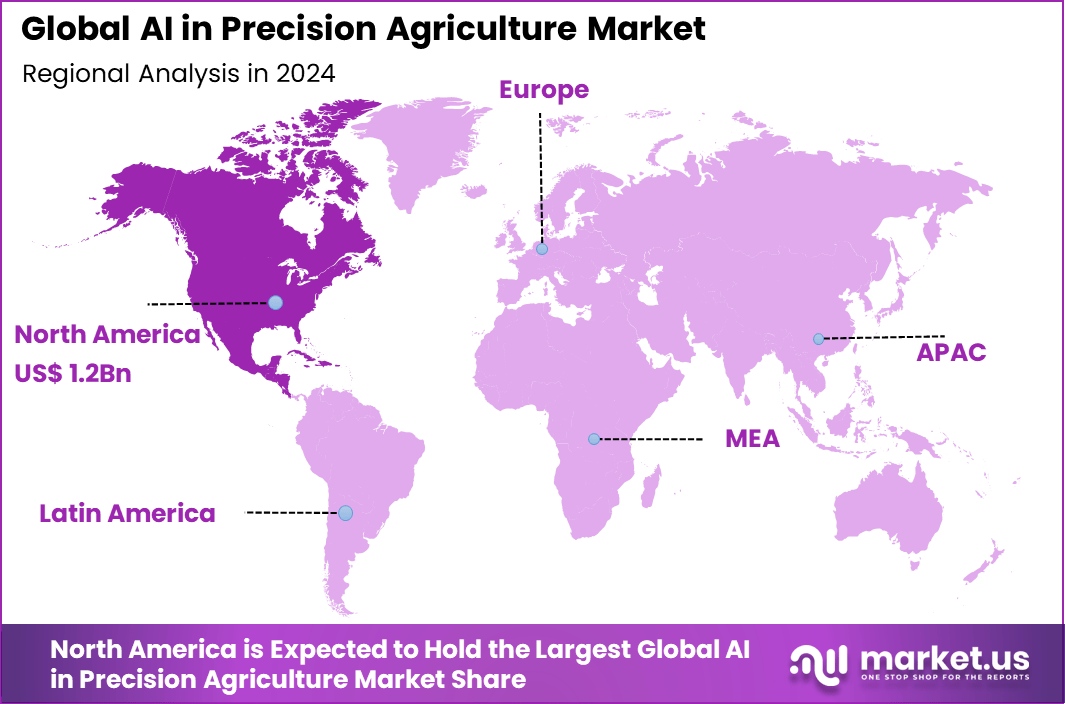

The Global AI in Precision Agriculture Market size is expected to be worth around USD 12.7 Billion By 2034, from USD 3.1 billion in 2024, growing at a CAGR of 15.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 40.7% share, holding USD 1.2 Billion revenue.

AI in Precision Agriculture market is transforming farming by applying artificial intelligence technologies to enhance crop management and resource use. It uses data from satellites, drones, sensors, and weather stations to give farmers real-time insights on soil health, crop conditions, and irrigation needs. This helps improve decision-making by making farming more precise and efficient, leading to better yields and lower costs.

Top driving factors for this market include the growing need for food security as the global population rises, pressure to reduce resource waste like water and fertilizer, and demand for sustainable farming practices. Advances in AI and big data analytics, combined with technological improvements in IoT sensors and drones, are accelerating adoption. Farmers and agricultural businesses are increasingly using AI to optimize planting schedules, detect pests and diseases early, and manage irrigation with minimal waste.

According to Market.us, The global AI in agriculture market is expanding rapidly, supported by the rising need for precision farming, resource optimization, and sustainable crop management. The market, valued at approximately USD 1.5 billion in 2023, is projected to reach nearly USD 10.2 billion by 2032, registering a CAGR of 24.5% during the forecast period from 2022 to 2032.

Within this space, the generative AI in agriculture market is emerging as a distinct and high-growth segment. It was valued at around USD 227.40 million in 2024 and is forecasted to reach approximately USD 2,705.7 million by 2034, growing at a CAGR of 28.1% from 2025 to 2034. In 2024, North America held a dominant position, accounting for more than 37.5% of the market share with revenues of USD 85.27 million.

Key Insight Summary

- By offering, Software dominated with a 54.3% share.

- By technology, Machine Learning & Deep Learning led the market, holding 42.6% share.

- By application, Precision Farming & Field Monitoring was the top segment, accounting for 40.4% share.

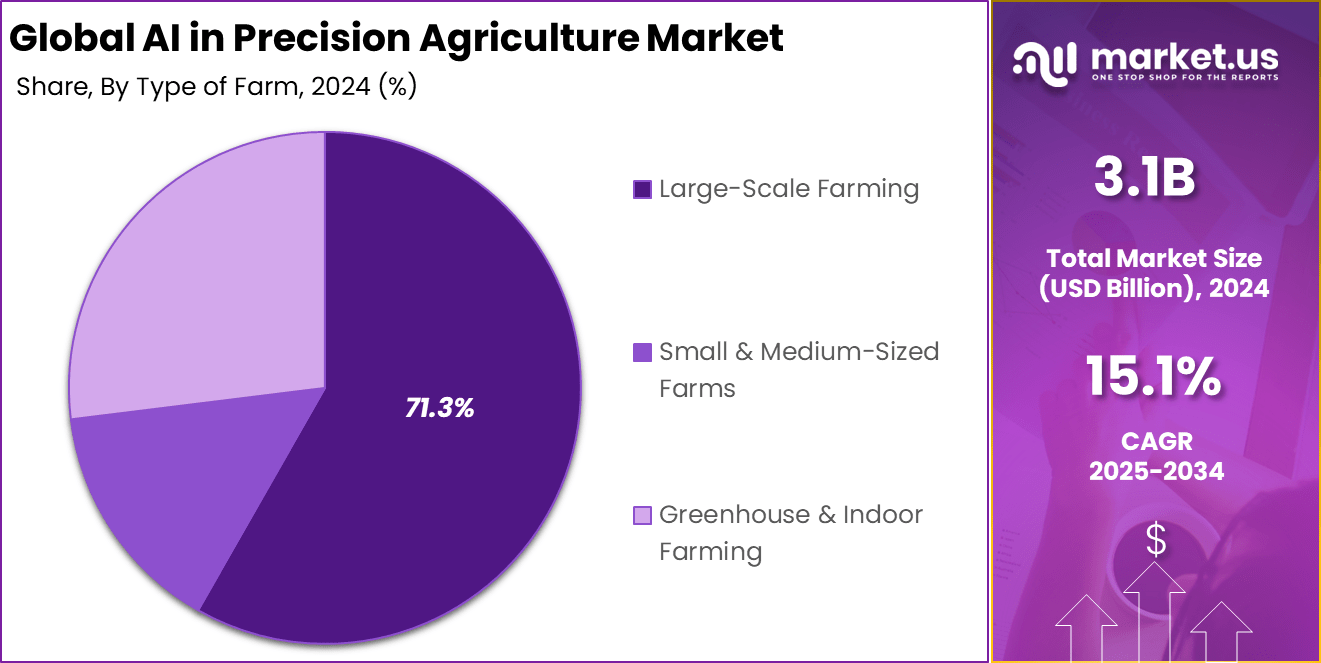

- By type of farm, Large-Scale Farming was the major adopter, securing 71.3% share.

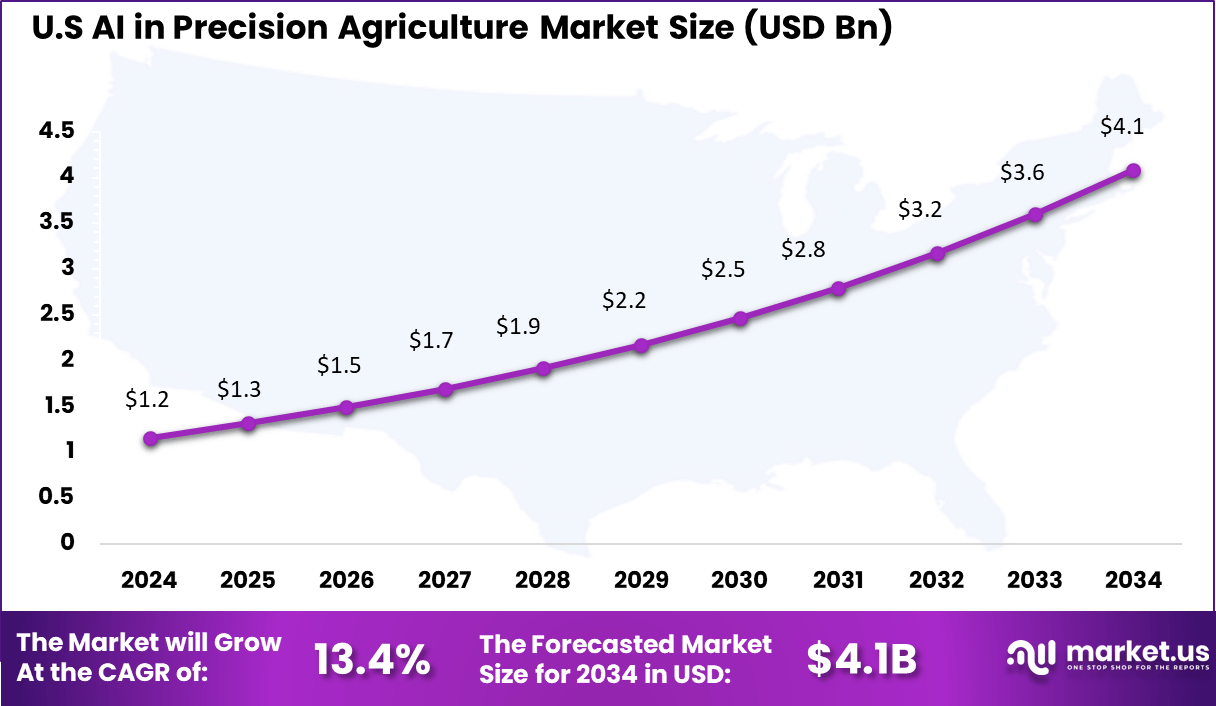

- Regionally, North America led with 40.7% share, while the U.S. market reached USD 1.16 Billion, growing at a CAGR of 13.4%.

Analysts’ Viewpoint

Demand analysis shows that farmers benefit from increased productivity and cost savings through precise input application, reducing overuse of water and chemicals. This drives consistent interest from both large-scale farms and smaller growers seeking efficiency gains. Adoption rises as AI solutions become more accessible, affordable, and easier to integrate into existing farming equipment and practices.

Increasingly adopted technologies in this field include machine learning for predictive analytics, computer vision for crop and pest monitoring, IoT for real-time soil and weather data, and robotics for autonomous machinery. These technologies improve accuracy, reduce labor needs, and enable sustainable resource management.

Key reasons for adopting AI in precision agriculture are enhancing crop yields, reducing operational expenses, minimizing environmental impact, and coping with labor shortages. AI’s ability to process wide datasets allows tailored interventions that boost farm profitability while supporting eco-friendly practices.

Investment and Business benefits

Investment opportunities abound as the market grows with innovations in AI software platforms, sensor technologies, autonomous farm equipment, and data management services. Strategic investments can drive further R&D to refine AI algorithms and expand global reach, especially in emerging agricultural regions.

Business benefits from AI adoption include improved crop output, optimized input costs, reduced waste, enhanced supply chain transparency, and stronger compliance with environmental standards. AI also helps farmers respond faster to unpredictable weather, pests, or diseases, securing more stable food production.

The regulatory environment is evolving to address safety, data privacy, and compliance for AI systems in agriculture. Harmonized standards and clear legal frameworks, especially in regions like the EU, are vital to encourage innovation while protecting farmers and consumers. These frameworks focus on machine safety, responsible AI use, and minimizing risks related to new autonomous technologies.

Role of Generative AI

Key Points Description Advanced Crop Health Insights Generative AI provides farmers with deeper insights on crop health, quality, and disease prediction by leveraging synthetic data and predictive models. Virtual Farm Simulation Digital twins of farms simulate, test, and predict outcomes of farming practices for optimized decision-making. Resource Optimization Generative AI designs optimal resource usage plans, reducing water, fertilizer, and energy consumption significantly. Operational Automation AI-driven automation manages climate control, irrigation, and lighting, reducing labor costs and errors. Adaptation to Local Conditions Generative models tailor solutions to specific regional climates, crop types, and economic factors. Emerging Trends

Key Trends Description Integration with Robotics and Automation Increasing use of AI-powered autonomous equipment like drones and robots to enhance precision and reduce labor. Predictive Analytics and Forecasting AI models forecast yields, pest outbreaks, and equipment failures for preventive action. Multi-Platform Data Integration Combining satellite, sensor, farm machinery, and weather data for holistic farm management. Regenerative and Sustainable Farming Focus on soil health, biodiversity, and reduced environmental footprint through AI insights. Expansion of Digital Agriculture Ecosystems Growing ecosystems of AI tools offering end-to-end farm intelligence US Market Size

The U.S. AI in Precision Agriculture Market was valued at USD 1.2 Billion in 2024 and is anticipated to reach approximately USD 4.1 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 13.4% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than 40.7% share and generating USD 1.2 billion in revenue in the AI in precision agriculture market. The region’s leadership is strongly influenced by the high adoption of advanced farming technologies, including machine learning, predictive analytics, and computer vision tools.

Farmers in the United States and Canada have embraced AI-based solutions for crop monitoring, soil health assessment, and irrigation optimization, which has significantly improved productivity while reducing resource wastage. The dominance of North America is also supported by well-established agricultural infrastructure and strong government initiatives that encourage the use of digital farming technologies.

Programs promoting sustainable agriculture and climate-resilient practices have accelerated the integration of AI tools across both large-scale commercial farms and smaller farming operations. Moreover, collaborations between agri-tech startups, research institutions, and technology giants have created a robust ecosystem that fosters innovation in precision agriculture.

By Offering

Software solutions account for 54.3% of the market, underscoring their essential role in driving precision agriculture. These AI-powered software platforms analyze vast amounts of agricultural data collected from sensors, drones, and satellite imagery. They enable farmers to make informed decisions on planting, irrigation, fertilization, and pest management by providing predictive analytics, real-time monitoring, and actionable insights to optimize farm productivity and resource use.

As software continues to advance, integration with machine learning models and other AI technologies allows for adaptive and precise farming practices that reduce waste, increase crop yields, and improve environmental sustainability. The scalability and ease of deployment of software solutions make them indispensable for farmers transitioning to digital and data-driven agriculture.

By Technology

Machine learning and deep learning technologies hold a significant 42.6% share, driving the intelligence behind decision-making in precision agriculture. These AI technologies process complex, multi-dimensional datasets including soil health, weather patterns, and crop conditions to predict outcomes and optimize farming operations. They enable detailed crop yield forecasting, pest detection, disease prediction, and adaptive resource management that adjust to changing environmental conditions.

The advancement of machine and deep learning accelerates innovation in smart farming tools such as autonomous tractors and drones equipped with AI, which leads to increased efficiency and cost reduction. Their capacity to learn from ongoing data inputs enhances the precision and responsiveness of agricultural practices, making them central to the digital transformation of farming.

By Application

Precision farming and field monitoring applications constitute 40.4% of the market, acting as the foundational use cases for AI deployment in agriculture. These applications leverage AI-enabled sensors, drones, and imaging technology to continuously monitor crop health, soil condition, moisture levels, and pest infestations. This real-time monitoring facilitates precise interventions that optimize input usage, reduce environmental impact, and improve crop productivity.

The adoption of precision farming technologies mitigates risks from climate variability and resource constraints while enhancing yield quality and quantity. Field monitoring enables proactive management practices and supports sustainable agriculture by providing detailed insights tailored to specific farm plots, ultimately driving higher profitability and ecological balance.

Type of Farm

Large-scale farming dominates the AI in precision agriculture market with a 71.3% share, reflecting the sector’s capacity to invest in and benefit from cutting-edge AI technologies. Large farms typically operate extensive land areas where efficient resource management and productivity are critical to economic viability. AI solutions help automate and optimize their vast operations, facilitating large-scale data collection, analysis, and action in near real-time.

The scale of operations in large farms allows for the deployment of diverse AI technologies such as autonomous machinery, sensor networks, and predictive analytics on a broader footprint. This leads to improved yield consistency, cost efficiency, and sustainability on a macro level, positioning large-scale farms at the forefront of AI adoption in precision agriculture.

Growth Factors

Key Growth Factors Description Rising Global Food Demand and Population Growth Need to increase food production efficiently for a growing population. Technological Advancements in AI, IoT, and Big Data Better sensors, connectivity, and improved AI algorithms expand capabilities. Government Support and Policies Subsidies and digital agriculture initiatives encourage adoption. Environmental and Sustainability Pressures Demand for eco-friendly farming to reduce chemical use, water waste, and carbon footprint. Cost Reduction and Profitability Focus AI-enabled optimization reduces input costs and improves yield and profitability. Top Use Cases

Key points Description Crop Monitoring and Health Assessment AI-powered drones and satellite imagery detect early signs of disease, pests, and nutrient deficiencies. Smart Irrigation Management Automated irrigation based on real-time soil moisture sensors and weather forecasts. Pest and Disease Prediction AI analyzes data to forecast outbreaks and recommend precise interventions to minimize crop loss. Automated Farm Equipment Autonomous tractors, harvesters, and robots perform complex tasks to improve efficiency. Key Market Segments

By Offering

- Hardware

- Software

- Services

By Technology

- Machine Learning & Deep Learning

- Computer Vision

- Predictive Analytics

- Natural Language Processing (NLP)

- Others

By Application

- Precision Farming & Field Monitoring

- Livestock Monitoring

- Agricultural Robots (Agribots)

- Drone Analytics

- Yield Mapping & Forecasting

- Irrigation Management

- Others

By Type of Farm

- Large-Scale Farming

- Small & Medium-Sized Farms

- Greenhouse & Indoor Farming

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increasing Need for Real-Time Data for Preventive Measures

The growing demand for real-time data is a key driver for AI adoption in precision agriculture. Farmers and growers increasingly rely on technologies such as sensors, drones, and satellite imagery to monitor soil moisture, nutrient levels, and crop health. This timely data enables them to make informed decisions quickly, such as applying fertilizers or pesticides only when needed, thus increasing crop productivity and preventing potential losses.

Regions like North America and Europe are leading in adopting these technologies, using AI-enhanced tools to gather and analyze farm data, which substantially improves operational efficiency and reduces waste. Moreover, AI-powered real-time monitoring allows farmers to detect pests or diseases early and optimize irrigation schedules based on current weather and soil conditions.

This proactive approach supports better crop management and aligns with sustainable farming practices by reducing excessive chemical usage and conserving water. The availability of precise field data helps farmers adopt more effective and cost-efficient strategies, making AI in precision agriculture a strategic tool for enhancing yield and profitability.

Restraint Analysis

High Initial Costs of AI-Enabled Precision Farming Equipment

One major restraint slowing down the widespread adoption of AI in precision agriculture is the high cost associated with AI-driven equipment and solutions. Advanced technologies like sensors, drones, and AI-powered software platforms often require significant upfront investments that many small or mid-sized farmers find difficult to afford.

Most AI solutions currently cater to large farms that can distribute these costs over extensive acreage, leaving smaller farms at a disadvantage. The cost barrier is compounded by the need for custom-built or highly specialized AI applications tailored to specific farming conditions, which further raises pricing.

Additionally, investments in infrastructure such as reliable internet connectivity and power supply add to the overall expenses. These financial challenges limit the adoption pace, especially in developing regions or among small-scale farmers who lack access to subsidies or financing options.

Opportunity Analysis

Growing Demand to Optimize Resource Usage and Reduce Waste

A significant opportunity in AI-driven precision agriculture lies in optimizing the use of fertilizers, pesticides, and water. AI technologies enable precision application of inputs only where and when needed, dramatically minimizing waste while improving crop yield quality.

This efficiency not only reduces operational costs for farmers but also supports environmental sustainability by decreasing chemical runoff and conserving scarce water resources. Governments worldwide are encouraging the use of smart farming solutions by offering support programs and subsidies, especially targeting small and medium-sized farms.

This governmental backing opens new markets for AI solution providers to develop affordable, scalable platforms for diverse farm sizes. The increasing global focus on sustainable agriculture and food security intensifies the demand for AI tools that deliver both economic and ecological benefits.

Challenge Analysis

Shortage of Skilled Personnel and Regulatory Complexities

One of the main challenges hindering the broader expansion of AI in precision agriculture is the shortage of skilled personnel who can implement, maintain, and interpret AI technologies effectively. Farmers often lack the technical expertise to fully utilize complex AI-driven systems, requiring additional training and support. This skill gap can slow technology adoption and reduce the expected benefits of AI applications.

Alongside this, regulatory frameworks around data privacy, AI use, and autonomous farming equipment are still evolving and can vary widely by region. Complex and unclear regulations create uncertainty for both farmers and AI solution providers, sometimes delaying deployment or complicating compliance.

Competitive Analysis

In the AI in Precision Agriculture market, major agricultural companies such as Monsanto Company, Syngenta AG, Trimble Inc., Deere & Company, and AGCO Corporation have played a leading role. Their focus has been on embedding AI into machinery, crop monitoring systems, and predictive analytics. This has allowed them to provide advanced tools for large-scale farms to improve yields and cut costs.

Technology-driven firms like Climate Corporation, Descartes Labs, Granular Inc., and Prospera Technologies Ltd. have strengthened the market with AI-based insights and satellite imagery. Startups such as Taranis, Blue River Technology, and PrecisionHawk are adding value by offering pest detection, drone imaging, and automated scouting. These solutions have gained traction among progressive farmers seeking data-driven methods.

Emerging innovators including Farmwise, Gamaya, Ceres Imaging, Tule Technologies, and Harvest Croo Robotics are advancing robotics and imaging tools. AgEagle Aerial Systems Inc. and CNH Industrial N.V. are extending AI into drones and autonomous equipment. Together with regional players, they are making precision agriculture more accessible and supporting its adoption across different farm sizes.

Top Key Players in the Market

- Monsanto Company

- Syngenta AG

- Trimble Inc.

- Deere & Company

- AGCO Corporation

- Climate Corporation

- Descartes Labs

- Granular Inc.

- Prospera Technologies Ltd.

- Taranis

- Blue River Technology

- PrecisionHawk

- Farmwise

- Gamaya

- The Climate Corporation

- Ceres Imaging

- Awhere Inc.

- Tule Technologies

- AgEagle Aerial Systems Inc.

- Harvest Croo Robotics

- CNH Industrial N.V.

- Others

Recent Developments

- By 2025, over 60% of John Deere’s new equipment will embed AI for precision farming tasks. Their focus is on AI-powered sensors, machine vision cameras, and real-time analytics to optimize operations like planting, spraying, and harvesting. An advanced product line called “See & Spray” uses AI to precisely target herbicide application, reducing chemical use while improving crop yields.

- Syngenta expanded its precision agriculture capabilities through a renewed multi-year partnership with Planet Labs in 2025. This provides farmers with near-daily, high-resolution satellite imagery integrated into Syngenta’s Cropwise platform, enhancing crop health monitoring and pest management.

- In early 2024, AGCO launched its PTx brand consolidating precision ag technologies including Precision Planting and its joint venture with Trimble under one umbrella. This platform aims to provide mixed-fleet precision solutions globally via dealers, OEMs, and factory-fit equipment.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 12.7 Bn CAGR(2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Hardware, Software, Services), By Technology (Machine Learning & Deep Learning, Computer Vision, Predictive Analytics, Natural Language Processing (NLP), Others), By Application (Precision Farming & Field Monitoring, Livestock Monitoring, Agricultural Robots (Agribots), Drone Analytics, Yield Mapping & Forecasting, Irrigation Management, Others), By Type of Farm (Large-Scale Farming, Small & Medium-Sized Farms, Greenhouse & Indoor Farming) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Monsanto Company, Syngenta AG, Trimble Inc., Deere & Company, AGCO Corporation, Climate Corporation, Descartes Labs, Granular Inc., Prospera Technologies Ltd., Taranis, Blue River Technology, PrecisionHawk, Farmwise, Gamaya, The Climate Corporation, Ceres Imaging, Awhere Inc., Tule Technologies, AgEagle Aerial Systems Inc., Harvest Croo Robotics, CNH Industrial N.V., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Precision Agriculture MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Precision Agriculture MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Monsanto Company

- Syngenta AG

- Trimble Inc.

- Deere & Company

- AGCO Corporation

- Climate Corporation

- Descartes Labs

- Granular Inc.

- Prospera Technologies Ltd.

- Taranis

- Blue River Technology

- PrecisionHawk

- Farmwise

- Gamaya

- The Climate Corporation

- Ceres Imaging

- Awhere Inc.

- Tule Technologies

- AgEagle Aerial Systems Inc.

- Harvest Croo Robotics

- CNH Industrial N.V.

- Others