Global AI In Powered Direct-to-Device (D2D) Market Size, Share, Industry Analysis Report By Component (Hardware, Software, Services), By Application(Healthcare Devices, Consumer Electronics, Industrial IoT (IIoT), Smart Home Devices, Automotive Systems, Satellite Communication, Security & Surveillance, Others), By Device Type(Smartphones & Tablets, Wearables, Edge Computing Devices, AR/VR Headsets, Connected Consumer Devices, Others), By Technology Type(Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, Edge AI, Others), By Industry Vertical (Healthcare, IT & Telecom, Consumer Electronics, Manufacturing, Automotive, Retail & E-Commerce, Defense & Aerospace, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165810

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

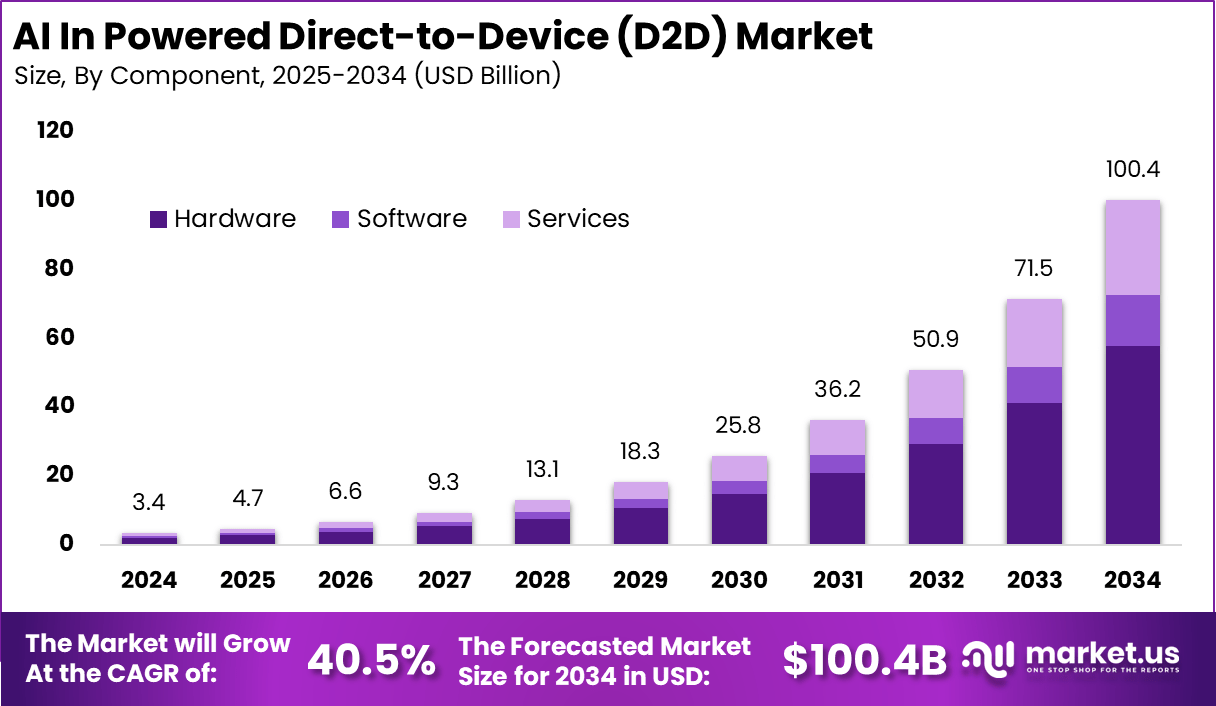

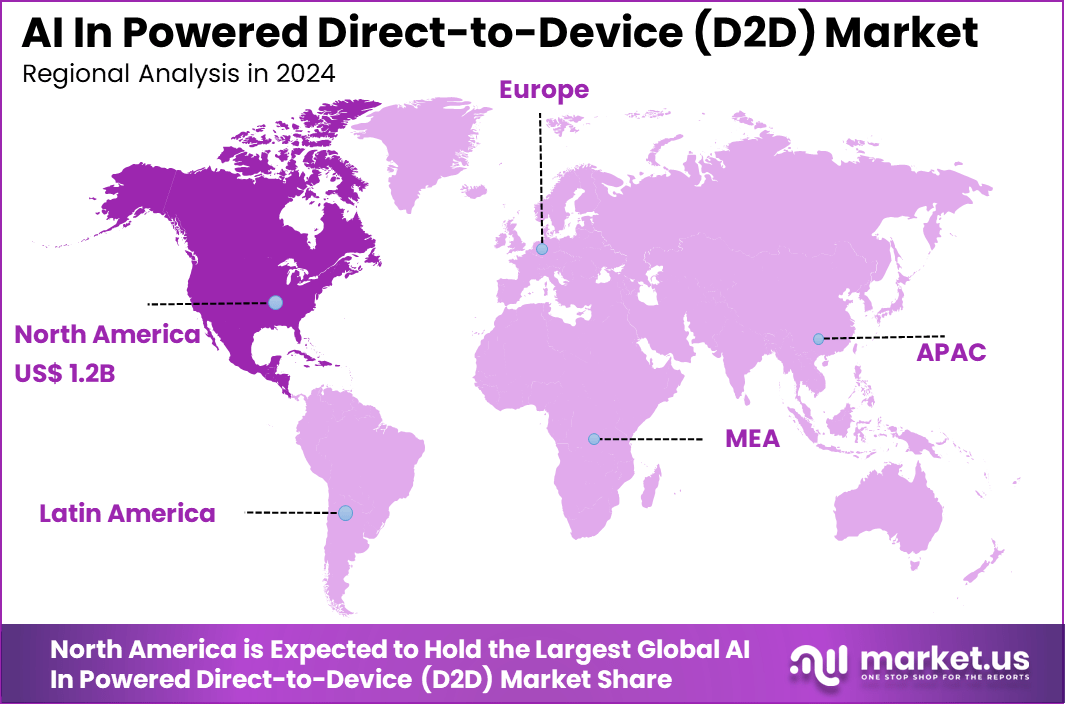

The Global AI In Powered Direct-to-Device (D2D) Market generated USD 3.4 billion in 2024 and is predicted to register growth from USD 4.7 billion in 2025 to about USD 100.4 billion by 2034, recording a CAGR of 40.5% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.6% share, holding USD 1.2 Billion revenue.

The AI powered direct to device market has grown steadily as more applications, services and models run directly on end-user devices rather than relying solely on cloud infrastructure. The market is now recognised as an important part of the wider edge computing and on-device AI ecosystem. Growth reflects rising demand for real time processing, enhanced privacy and reduced latency, which are all enabled by device level intelligence.

The growth of the market can be attributed to increased adoption of AI capable processors in smartphones, wearables, laptops, home devices and industrial equipment. The expansion of generative AI creates additional need for local inference to reduce bandwidth costs and improve response times. Strong consumer interest in privacy preserving systems is also pushing more computation onto devices.

Demand for AI-powered D2D solutions is strongest in sectors that require connectivity in remote or mobile environments. Industries such as maritime, aviation, agriculture, and emergency response benefit from the ability to maintain communication without relying on terrestrial networks. Enterprises are also adopting D2D for asset tracking, predictive maintenance, and smart infrastructure, while consumers are seeing new features like direct satellite messaging and emergency communication on smartphones.

AI is transforming D2D networks by enabling smarter resource allocation, dynamic spectrum management, and autonomous satellite control. Machine learning models analyze device connectivity patterns and adjust bandwidth distribution in real time, ensuring high-quality service during peak demand. AI also supports predictive maintenance, adaptive mission planning, and intelligent orbit management, making satellite constellations more efficient and resilient.

Quick Market Facts

- The Hardware segment led the market with a 57.5% share, driven by the increasing demand for advanced chips, sensors, and processors powering AI applications on consumer devices.

- Consumer Electronics dominated application-wise, capturing 32.2%, reflecting strong adoption of AI in smartphones, wearables, and other connected home devices.

- Smartphones & Tablets accounted for 36.7% of device types, highlighting their central role in deploying AI-driven functionalities such as voice assistants, AI-powered cameras, and personalized user experiences.

- The Natural Language Processing (NLP) technology segment held a strong 40.6% share, as NLP technologies are essential for voice recognition, chatbots, and language-based applications in D2D devices.

- Consumer Electronics led the industry verticals with 34.6%, driven by the integration of AI in smart TVs, gaming consoles, and connected appliances.

- North America captured 36.6% of the global market, supported by advanced AI research, robust consumer electronics markets, and high adoption rates in the U.S.

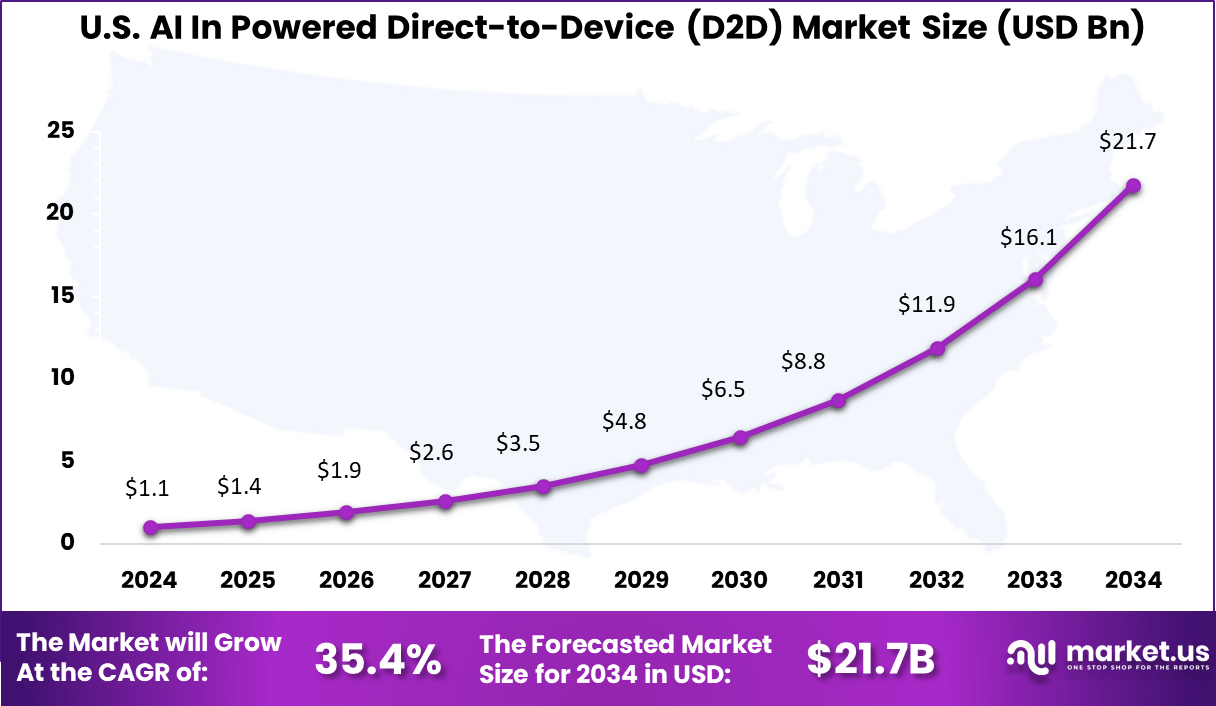

- The U.S. market was valued at USD 1.05 billion in 2024 and is projected to grow at a 35.4% CAGR, reflecting strong market demand for AI-powered consumer devices.

Enterprise Adoption Rates

- High integration: By 2024, nearly 90% of telecom companies had integrated AI into their operations. Within this group, 48% were in the piloting stage and 41% were actively deploying AI solutions across core functions.

- Rapid growth: AI adoption is rising across industries. One survey recorded an increase from 33% in 2023 to 65% in 2024. In the technology, media, and telecom sector, about 79% of companies use generative AI, reflecting strong momentum in advanced automation.

- Strategic priority: Around 83% of companies consider AI a major strategic priority in their business planning. This shows that AI is shifting from experimental use to a central driver of long-term growth and competitiveness.

- Workforce evolution: The share of telecom employees involved in AI and machine learning activities increased from 7% in late 2022 to 20% in 2024. This indicates strong demand for technical talent and expanding adoption across different job roles.

- Business impact: About 67% of TMT companies report achieving returns on their AI investments, confirming measurable business value from deployment.

US Market Size

The US market alone is valued at USD 1.05 billion, with a compound annual growth rate (CAGR) of 35.4%. This growth is fueled by rising demand for real-time data processing, enhanced privacy, and the integration of AI in consumer electronics, automotive, and healthcare sectors. The region’s robust regulatory environment and continuous technological advancements further support the expansion of AI-powered D2D services.

In 2024, North America holds 36.6% of the global AI-powered direct-to-device (D2D) market, making it the largest regional segment. The region’s strong R&D infrastructure, advanced digital ecosystem, and high consumer awareness have helped drive rapid adoption of AI technologies in devices. Early investment in AI hardware and edge computing has positioned North America as a leader in innovation and deployment of D2D solutions.

Emerging Trends

Trends Description Intelligent Network Management AI is optimizing how D2D networks allocate resources, manage bandwidth, and route signals. This ensures consistent, high-quality connectivity even as demand fluctuates or network conditions change. Predictive Connectivity AI models can forecast potential connection drops and reroute signals proactively. This helps maintain uninterrupted service for users in remote or mobile environments. Enhanced Security AI-driven analytics and encryption are improving the security of D2D communications, especially in sensitive sectors like defense and government. Adaptive Beamforming Smart antennas powered by AI can dynamically adjust their focus and orientation, improving coverage and signal strength for moving users or in challenging terrains. Real-Time Data Processing On-device AI allows for immediate analysis and decision-making, reducing latency and enabling faster responses in applications like autonomous vehicles and emergency response. Growth Factors

Factors Description Expanding Use Cases D2D technology is being adopted in sectors such as agriculture, logistics, disaster management, and defense, where reliable, direct connectivity is essential. Regulatory Support Governments are updating regulations to support the deployment of D2D networks, making it easier for organizations to implement these solutions. Technological Advancements Improvements in AI algorithms, edge computing, and satellite technology are making D2D systems more efficient and cost-effective. Demand for Global Connectivity There is a growing need for seamless, global connectivity, especially in underserved or remote regions. AI-powered D2D networks are helping bridge this gap. Hybrid Ecosystems Partnerships between satellite operators, telecom companies, and cloud providers are creating hybrid networks that combine terrestrial and non-terrestrial links for broader coverage and reliability. Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Healthcare Devices

- Consumer Electronics

- Industrial IoT (IIoT)

- Smart Home Devices

- Automotive Systems

- Satellite Communication

- Security & Surveillance

- Others

By Device Type

- Smartphones & Tablets

- Wearables

- Edge Computing Devices

- AR/VR Headsets

- Connected Consumer Devices

- Others

By Technology Type

- Natural Language Processing (NLP)

- Machine Learning (ML)

- Computer Vision

- Edge AI

- Others

By Industry Vertical

- Healthcare

- IT & Telecom

- Consumer Electronics

- Manufacturing

- Automotive

- Retail & E-Commerce

- Defense & Aerospace

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

AI Enables Smarter, Global Connectivity

AI is transforming direct-to-device (D2D) networks by making them more intelligent and efficient. With AI, satellite systems can dynamically allocate bandwidth, predict network congestion, and optimize signal routing, ensuring reliable connectivity even in remote areas. This is especially valuable for emergency services, rural communities, and industries operating in isolated locations.

The integration of AI also allows for personalized service delivery. By analyzing user behavior and device needs, AI can prioritize bandwidth for critical applications such as real-time video or emergency messaging. This adaptability not only improves user experience but also opens new revenue streams for providers, making D2D a more attractive option for both consumers and enterprises.

Restraint

Limited Device Processing Power

Many consumer devices, such as smartphones and IoT sensors, still struggle to handle advanced AI algorithms due to limited processing power and battery life. Running AI models on these devices can lead to overheating, slow performance, and rapid battery drain, which affects usability and satisfaction. This technical limitation is a major barrier to widespread adoption of AI-powered D2D services, especially in cost-sensitive markets.

Manufacturers are investing in more efficient chips and edge computing solutions, but progress is slow. The cost of developing and integrating high-performance, low-power AI hardware remains high, making it difficult to bring advanced features to mass-market devices. Until these challenges are resolved, the full potential of AI in D2D will remain constrained.

Opportunity

Bridging Digital Divides

AI-powered D2D technology is uniquely positioned to close the digital divide by providing connectivity to underserved and remote regions. Traditional telecom infrastructure is often too expensive or impractical to deploy in rural or disaster-prone areas, but satellite-based D2D networks can deliver affordable, reliable service without ground towers.

Governments and NGOs are increasingly supporting D2D initiatives to expand digital access. As more organizations recognize the social and economic benefits of universal connectivity, demand for AI-driven D2D solutions is expected to grow rapidly. This presents a significant opportunity for providers to expand their reach and impact.

Challenge

Data Privacy and Security Concerns

As AI-powered D2D networks collect and process vast amounts of user data, concerns about privacy and security are growing. Users worry about how their personal information is stored, used, and protected, especially when sensitive data is transmitted over satellite links. Regulatory frameworks like GDPR are helping to set standards, but global compliance remains a challenge for multinational providers.

Ensuring transparency and accountability in AI-driven decision-making is critical for building trust. Providers must implement robust encryption, clear data policies, and regular audits to protect user privacy. Failure to address these concerns could slow adoption and damage the reputation of the entire D2D ecosystem.

Competitive Analysis

The AI‑Powered Direct‑to‑Device Market is dominated by leading chipmakers and platform providers such as Apple Inc., Nvidia Corporation, Intel Corporation, Advanced Micro Devices, Inc. (AMD), and Google. These firms supply AI‑accelerator hardware, neural processing units (NPUs), and optimized software frameworks embedded directly in consumer devices (smartphones, tablets, wearable, IoT) to enable local inference, low‑latency AI tasks, and offline intelligence.

Additionally, emerging connectivity and direct‑to‑device infrastructure providers such as AST & Science, LLC, Lynk Global, and Starlink are expanding the notion of AI‑powered interactions where devices communicate directly via satellite or low‑Earth orbit networks. Their platforms facilitate real‑time data exchange, remote AI services, and global reach. These technologies support device deployments in remote locations, emerging markets and global IoT ecosystems.

Specialist component and AI software vendors including MediaTek Inc., Arm Limited, Synaptics, Inc., Edge Impulse, Inc., BrainChip, and Syntiant Corp., along with other market players, provide ultra‑low‑power AI chips, embedded edge AI toolchains and device SDKs. Their technologies enable AI models to run efficiently on constrained devices, supporting use‑cases like smart sensors, audio assistants, gesture recognition and industrial IoT.

Top Key Players in the Market

- Apple Inc.

- MediaTek Inc.

- Nvidia Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- AST & Science, LLC

- Lynk Global

- Starlink

- Arm Limited

- Synaptics, Inc.

- Edgeimpulse, Inc.

- BrainChip

- Syntiant Corp.

- Other

Recent Developments

- October 2025, Apple launched its M5 chip, marking a major leap in on-device AI performance for iPhones, iPads, and Macs. The new Apple Intelligence suite now includes Live Translation, enhanced Visual Intelligence, and AI-powered Shortcuts, all running directly on the device for privacy and offline use. Apple also opened up Apple Intelligence to third-party developers, allowing deeper integration into apps.

- October 2025, Nvidia partnered with Nokia to pioneer AI-powered 6G-ready networks, introducing the Aerial RAN Computer Pro (ARC-Pro) platform. This collaboration will enable seamless AI-native 5G-Advanced and 6G networks, supporting next-gen D2D devices like drones and AR/VR glasses. Nvidia also invested $1 billion in Nokia to accelerate the rollout

Report Scope

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 100.4 Bn CAGR(2025-2034) 40.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Application(Healthcare Devices, Consumer Electronics, Industrial IoT (IIoT), Smart Home Devices, Automotive Systems, Satellite Communication, Security & Surveillance, Others), By Device Type(Smartphones & Tablets, Wearables, Edge Computing Devices, AR/VR Headsets, Connected Consumer Devices, Others), By Technology Type(Machine Learning (ML), Natural Language Processing (NLP), Computer Vision, Edge AI, Others), By Industry Vertical (Healthcare, IT & Telecom, Consumer Electronics, Manufacturing, Automotive, Retail & E-Commerce, Defense & Aerospace, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., MediaTek Inc., Nvidia Corporation, Advanced Micro Devices, Inc., Google, Intel Corporation, AST & Science, LLC, Lynk Global, Starlink, Arm Limited, Synaptics, Inc., Edgeimpulse, Inc., BrainChip, Syntiant Corp., Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI In Powered Direct-to-Device MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

AI In Powered Direct-to-Device MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Apple Inc.

- MediaTek Inc.

- Nvidia Corporation

- Advanced Micro Devices, Inc.

- Intel Corporation

- AST & Science, LLC

- Lynk Global

- Starlink

- Arm Limited

- Synaptics, Inc.

- Edgeimpulse, Inc.

- BrainChip

- Syntiant Corp.

- Other