Global AI in Music Market Size, Share, Industry Analysis Report By Component (Software, and Services), By Deployment (Cloud, and On-premises), By Application (Automated Music Composition, Music Arrangement and Orchestration, Music Style Transfer and Remixing, Sound Synthesis and Design, Music Personalization and Recommendation, and Others), By End Use (Music Production and Recording, Film and Television, Video Games and Interactive Entertainment, Advertising and Marketing, Music Education and Training, Streaming Services and Music Platforms, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 120117

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- AI Adoption Rates in Music (%)

- Creator Use of Creation & Production

- U.S. AI in Music Market Size

- By Software Analysis

- By Cloud Deployment Analysis

- By Application Analysis

- By End Use Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Latest Trends

- Growth factors

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

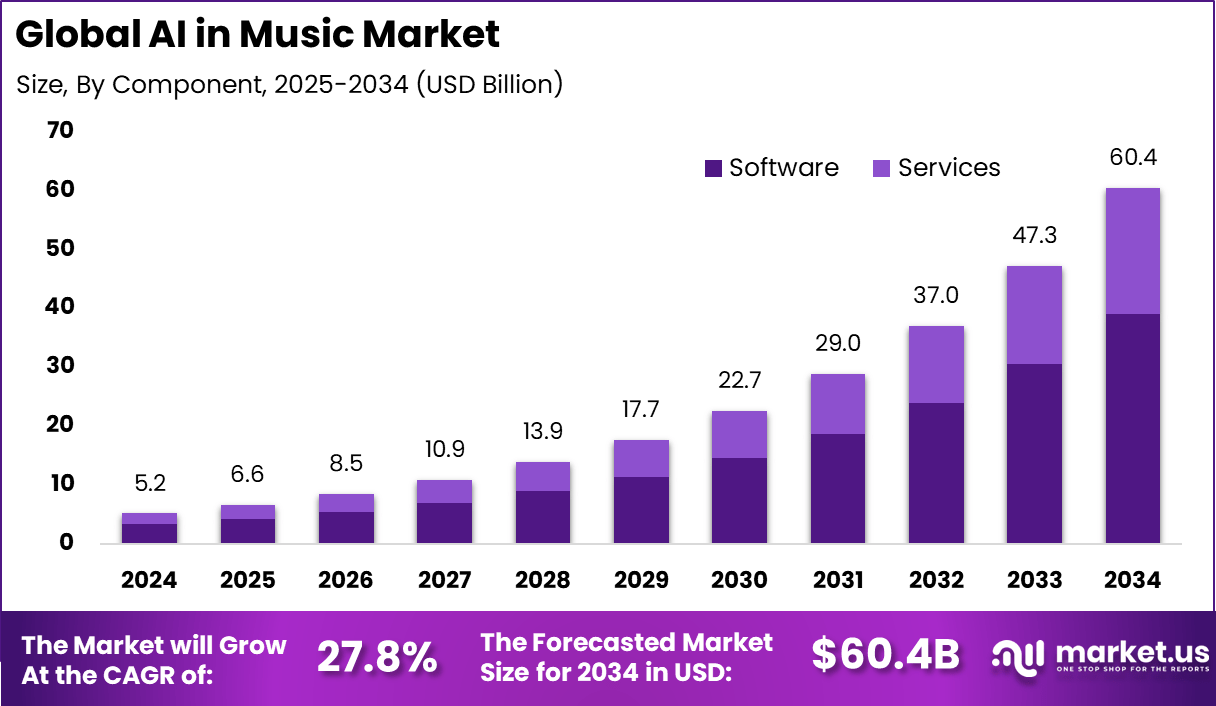

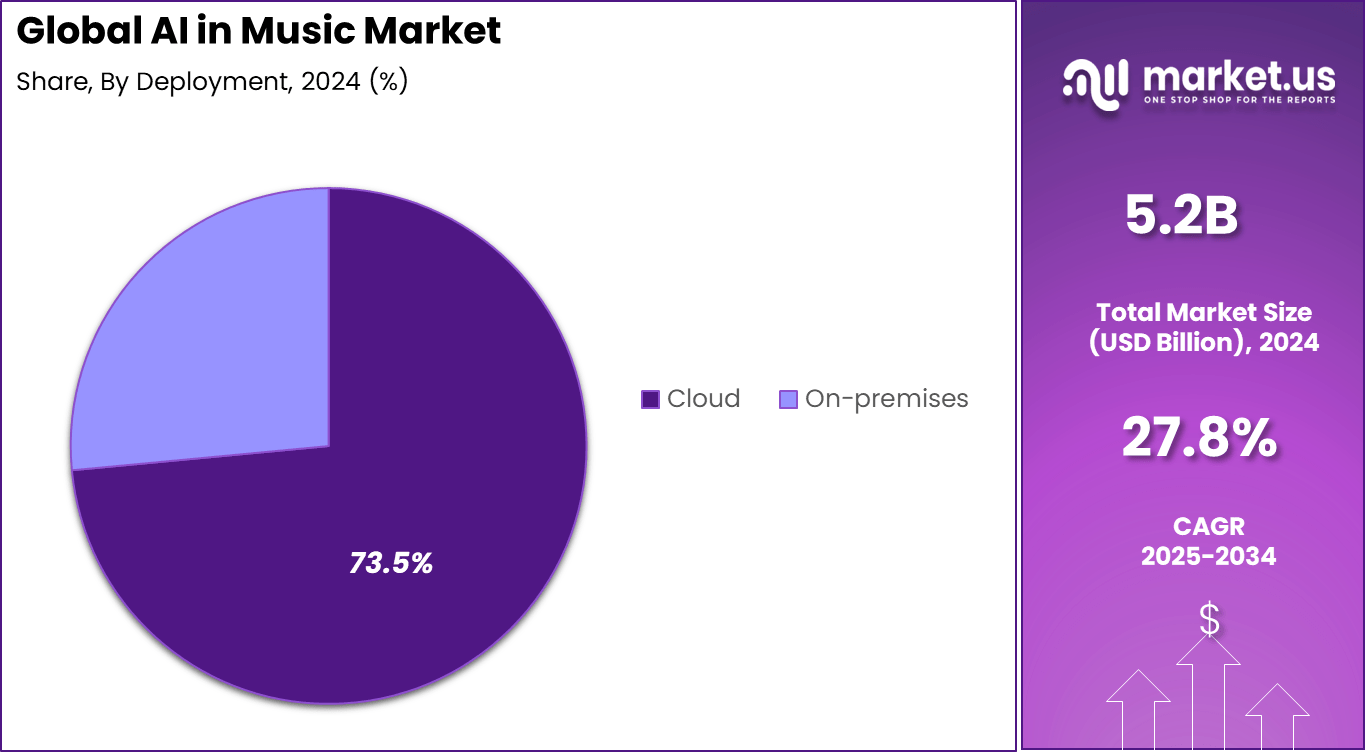

The global AI in Music market size accounted for USD 5.20 billion in 2024 and is predicted to increase from USD 6.65 billion in 2025 to approximately USD 60.44 billion by 2034, expanding at a CAGR of 27.80% from 2025 to 2034.

The AI in Music Market refers to the application of artificial intelligence technologies in music composition, production, recommendation, distribution, and performance. These solutions use machine learning, deep learning, and natural language processing to create original music, assist musicians, and personalize user experiences on streaming platforms. The market includes AI-powered composition tools, recommendation engines, mastering platforms, and interactive music systems

The market is driven by the rising demand for personalized music consumption and the increasing use of AI tools in music production. Streaming platforms rely heavily on AI to provide recommendations tailored to individual preferences. Musicians and producers are adopting AI software to automate mixing, mastering, and even composition tasks, reducing production time and costs. The expansion of virtual reality and augmented reality experiences, where AI-generated soundtracks are critical, also contributes to growth.

Based on data from dittomusic.com, 60% of musicians are embracing AI for music creation and production. On the other hand, a survey by ukmusic.org shows that 77% of people are concerned that AI-generated music often overlooks the need to credit the original artists, thereby leading to potential copyright issues.

Accordindg to market.us, the Generative AI in the Music Market is projected to experience remarkable growth in the coming years, reaching a value of approximately USD 2,660 Million by 2032. This signifies a significant increase from its valuation of USD 294 Million in 2023, with a noteworthy compound annual growth rate (CAGR) of 28.6% during the forecast period from 2024 to 2033.

The speed at which AI can create music is truly impressive, as it can generate musical compositions 20 times faster than humans. This efficiency is driving its adoption among artists and musicians, with 20.3% of them having utilized AI for music production. Moreover, AI technology is being employed by 30.6% of artists for mastering tracks and 38% for creating artwork associated with their music.

The overall perception of AI in the music industry is largely positive, with 40% of artists expressing a favorable view, and 39% believing that AI aligns well with their goals and aspirations. However, despite its potential, AI-written songs currently make up only a modest 1.5% of the music played on the top music stations in the UK.

Streaming platforms like Spotify are leveraging AI capabilities to analyze the mood of songs, leading to accurate predictions of listener preferences with an impressive 86% accuracy rate. Additionally, AI recommendations play a significant role in music content consumption, as approximately 30% of music consumption on platforms such as YouTube occurs through AI-driven suggestions.

Key Takeaways

- In 2024, the Software segment held a dominant market position, capturing 64.7% share.

- In 2024, the Cloud segment dominated, securing 73.5% share.

- In 2024, the Automated Music Composition segment led the market with 37.2% share.

- In 2024, the Music Production and Recording segment accounted for 33.9% share.

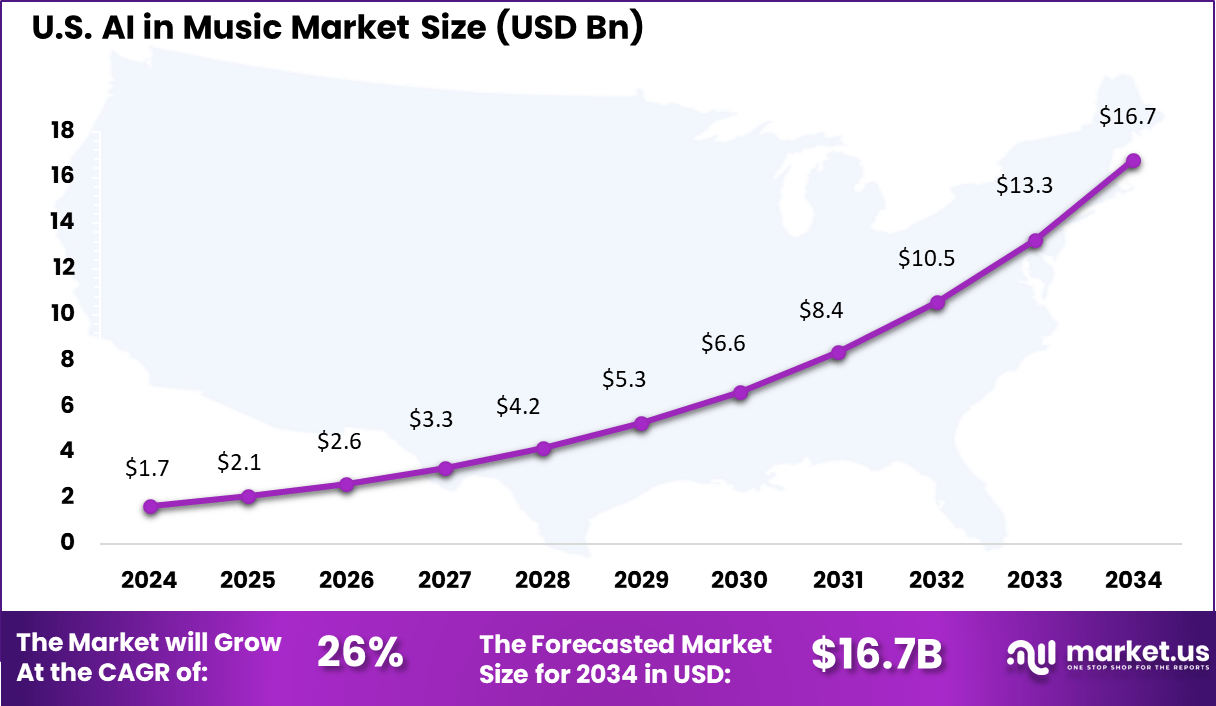

- The U.S. AI in Music Market was valued at USD 1.66 Billion in 2024, with a strong CAGR of 26.0%.

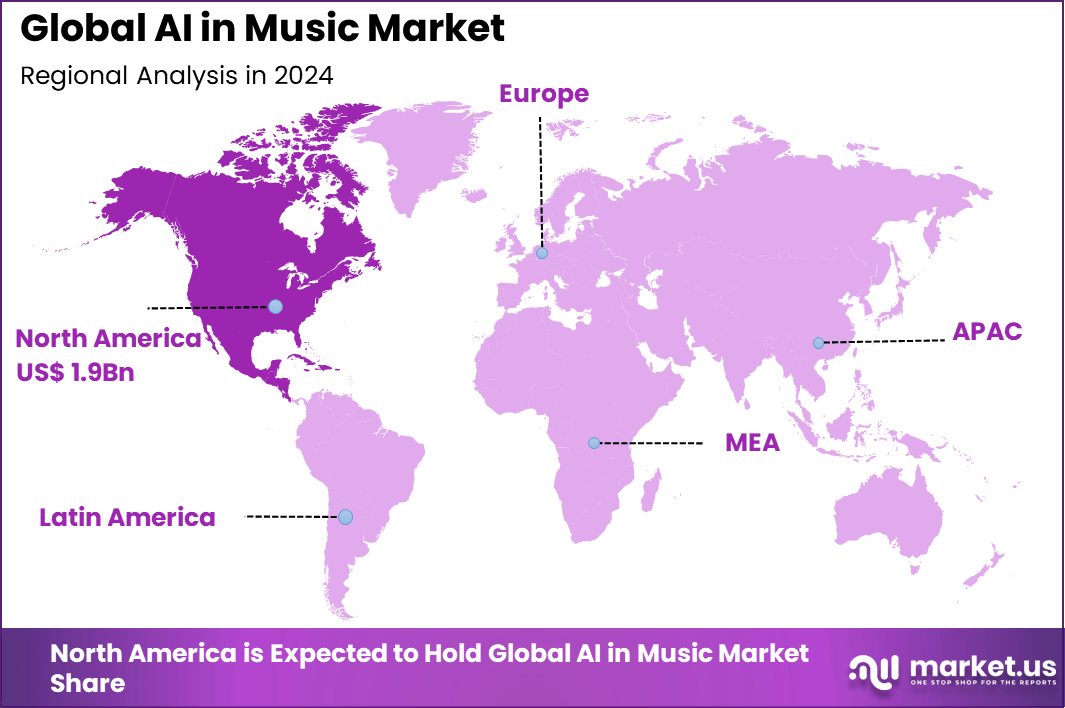

- In 2024, North America captured more than 37.6% share of the global market.

- 74% of internet users have utilized AI in some capacity for discovering or sharing music.

- By 2025, revenue from AI-generated music is expected to exceed $6 billion.

- AI is capable of generating a basic melody in less than 2 seconds.

- 82% of listeners report being unable to distinguish between music composed by humans and music composed by AI.

- AI music platform Amper Music has successfully secured $4 million in seed funding to further its development in AI-generated music.

- Over 50% of the top 20 global hits on music streaming platforms are influenced by AI recommendations.

- AI-generated music is anticipated to contribute to a 17.2% increase in revenue in the music industry by 2025.

Analysts’ Viewpoint

Demand for AI in music is strong among streaming platforms and digital distribution services, where recommendation systems play a central role in user engagement. Independent musicians and small studios are increasingly adopting AI-based tools for mastering, lyric generation, and beat creation to reduce reliance on expensive production facilities.

Technological innovations are expanding the capabilities of AI in music. Generative AI models are being used to compose new songs in various styles, while advanced deep learning algorithms are improving the quality of audio mastering and remixing. Natural language processing is allowing AI systems to generate lyrics based on user prompts. AI-powered voice synthesis is creating opportunities for realistic vocal generation.

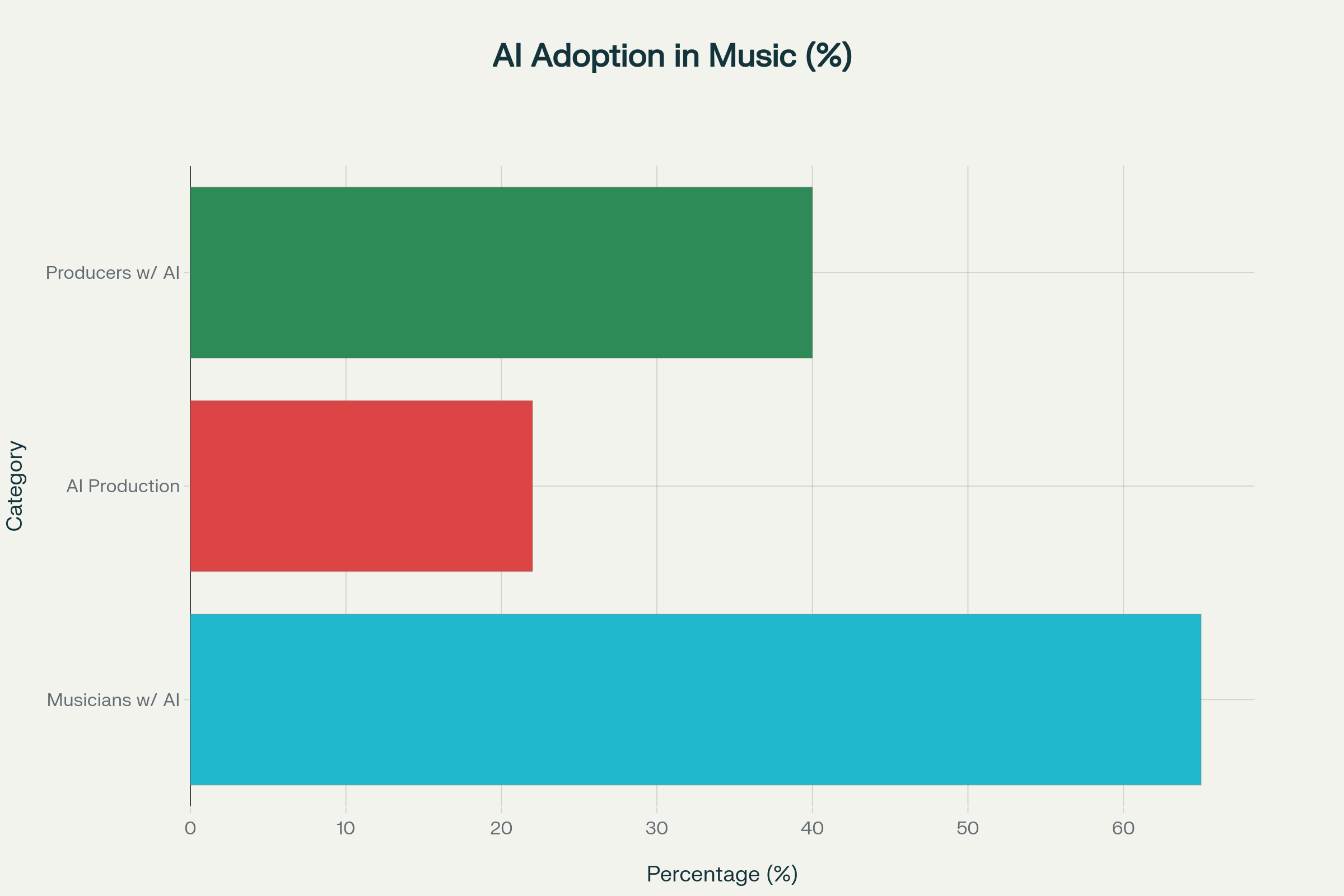

AI Adoption Rates in Music (%)

Musician Using AI Tools (65%), Musician Using AI in Production (22%), and Producers Integrating AI (40%).

Creator Use of Creation & Production

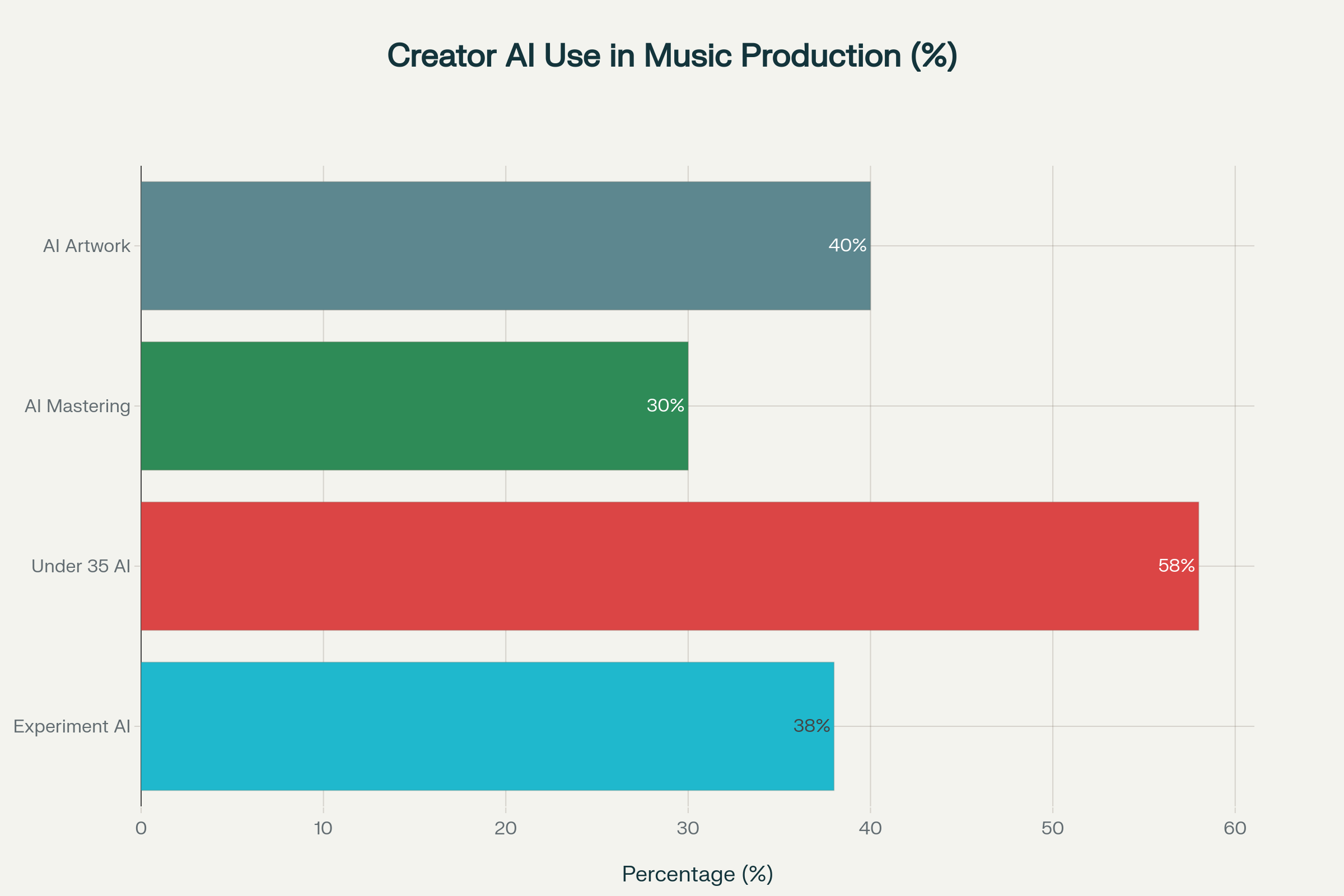

The adoption of AI among music creators continues to rise. Creators under 35 are the most active, with nearly 58% using AI in their workflows. Approximately 38% of creators experiment with AI, exploring new possibilities for sound and composition.

AI tools are also popular for visual content, as about 40% of artists use AI to create artwork. Meanwhile, around 30% of artists use AI specifically for mastering tracks, highlighting broader integration of AI into technical aspects of production.

U.S. AI in Music Market Size

The US AI in Music Market was valued at USD 1.66 Billion in 2024, with a robust CAGR of 25.0%. The U.S. AI in music market is rapidly growing, driven by advancements in artificial intelligence technologies that revolutionize music creation, production, and distribution.

AI is used for music composition, sound design, mastering, and personalization of playlists, enhancing user experiences across streaming platforms. Tools like AI-powered music generators and smart recommendation systems are gaining popularity among both professionals and consumers.

The market is fuelled by the increasing demand for personalized music content and the efficiency AI brings to music production. Leading companies in this space are leveraging machine learning algorithms to optimize music discovery, while artists explore AI for creative inspiration. With investments in AI startups and growing consumer adoption, the U.S. AI music market is expected to expand significantly in the coming years.

In 2024, North America held a dominant market position in the global AI in Music Market, capturing more than a 37.6% share. There are several important reasons why the AI recommendation business in North America dominates the music industry. The music industry in North America is booming and has a long history of creativity and technological improvement.

The demand for AI in Music in North America was valued at USD 1.4 billion in 2023 and is anticipated to grow significantly in the forecast period. The region’s leading music streaming services and IT firms have been early adopters of AI-based recommendation systems, using their substantial user bases and abundant resources to create algorithms.

A customized music experience is provided via sophisticated math. Furthermore, the population of North America is very tech-savvy and diversified, with a great desire for digital music and a willingness to accept new technology. Due to the region’s advantageous market conditions, high internet penetration, and widespread smartphone use, AI-based music recommendation services are being quickly adopted by consumers.

Furthermore, North America’s thriving ecosystem of AI startups, research facilities, and technology hubs has aided in the creation of cutting-edge music discovery apps and sophisticated recommendation algorithms. North American corporations can maintain a competitive advantage and dominate the music industry due to the region’s collaborative ecosystem and vibrant start-up culture, which have fostered AI innovation.

By Software Analysis

In 2024, the Software segment held a dominant market position, capturing more than a 64.7% share of the Global AI in Music Market. The needs and preferences of professionals in the music industry are well-matched by several important variables that contribute to the AI software segment’s supremacy in the market.

With the unmatched versatility and customization choices provided by AI software solutions, users may adapt their tools and workflows to suit a variety of creative approaches, musical tastes, and genres. This degree of personalization is crucial in a field that values originality and artistic expression, enabling producers, composers, and musicians to craft distinctive sounds and works.

Furthermore, compared to other hardware platforms, software AI platforms are frequently easier to use and more accessible, which makes them perfect for a variety of users, including artists and aspiring musicians. Users don’t need to have a lot of technical knowledge or training to use the software solutions as they have user-friendly interfaces, in-depth tutorials, and robust customer support.

Furthermore, the software industry gains from the quick development of AI algorithms and machine learning methods, which enables developers to enhance and broaden their product offerings with additional features and functionalities. This never-ending cycle of invention guarantees that AI software solutions remain at the forefront of technological development, propelling market dominance and adoption in the AI space in the music industry.

By Cloud Deployment Analysis

In 2024, the Cloud segment held a dominant market position, capturing more than a 73.5% share of the Global AI in Music Market. Endpoint security solutions are designed to protect devices such as laptops, smartphones, desktops, and servers from cyber threats. This segment is rapidly growing due to the increasing use of remote work, the proliferation of mobile devices, and the rise in endpoint-targeted attacks like malware and ransomware.

As organizations adopt digital transformation strategies, the attack surface expands, making endpoint devices prime targets for cybercriminals. The dominance of endpoint security is driven by its effectiveness in preventing unauthorized access, malware infections, and data breaches. With the rise of the Internet of Things (IoT) and BYOD (Bring Your Own Device) policies, businesses face a higher volume of devices needing protection.

Additionally, advanced endpoint protection technologies, such as AI-driven threat detection, behavioral analysis, and real-time monitoring, are making endpoint security solutions more essential for businesses to mitigate risks and ensure comprehensive defense.

By Application Analysis

In 2024, the Automated Music Composition segment held a dominant market position, capturing more than a 37.2% share of the Global AI in Music Market due to its innovative applications and growing demand for AI-generated music. This segment leverages machine learning algorithms and deep neural networks to create original compositions, revolutionizing the music industry by reducing the time and effort required for music production.

Artists, producers, and even non-professional creators are increasingly adopting automated composition tools to generate unique melodies, harmonies, and lyrics. These AI systems can analyze vast amounts of music data, learning patterns, and styles to create music that mimics human creativity.

The versatility of automated music composition is also extending its application across various sectors, including film, video games, and advertising, where custom soundtracks are in high demand. The ease of use and efficiency of these AI tools is driving adoption, making it the leading segment in the AI-powered music landscape.

By End Use Analysis

In 2024, the Music Production and Recording segment held a dominant market position, capturing more than a 33.9% share of the Global AI in Music Market. AI’s impact on music production and recording has been transformative, enhancing the creative process and improving production efficiency.

AI-powered tools are being increasingly used by producers and artists for tasks like mastering tracks, generating unique soundscapes, and even composing music. Machine learning algorithms help in automating repetitive tasks such as mixing and sound editing, allowing professionals to focus on more creative aspects.

The rise of AI-driven platforms that analyze music trends, preferences, and sound designs is empowering producers to create more personalized and engaging music. Additionally, the integration of AI tools in recording studios has streamlined workflows, reducing time and costs, and has enabled independent artists to produce high-quality tracks without extensive technical knowledge or resources.

Key Market Segments

By Component

- Software

- Services

By Deployment

- Cloud

- On-premises

By Application

- Automated Music Composition

- Music Arrangement and Orchestration

- Music Style Transfer and Remixing

- Sound Synthesis and Design

- Music Personalization and Recommendation

- Others

By End Use

- Music Production and Recording

- Film and Television

- Video Games and Interactive Entertainment

- Advertising and Marketing

- Music Education and Training

- Streaming Services and Music Platforms

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Increased Adoption of AI Tools by Musicians

One of the main drivers of AI in music is how more musicians and producers are using AI-powered tools. These tools help with writing songs, mixing, mastering, and sound design. They reduce the time and cost it takes to create music, making professional-level production more accessible even for independent artists who have limited resources. The ease of use encourages musicians to experiment with new sounds and quickly produce high-quality tracks, expanding creativity.

This broad usage of AI technology in daily music production workflows drives market growth. Musicians and producers appreciate how AI streamlines complex technical tasks, enabling them to focus on the creative side. As the technology gets more advanced and affordable, adoption is expected to rise sharply, pushing the AI in music market higher in value and influence in the coming years.

Restraint

Copyright and Intellectual Property Concerns

A significant restraint for AI in music is the growing concern over copyrights. AI systems often learn from large datasets of existing music, sometimes without clear permission from original creators. This creates legal uncertainty around who owns the rights to AI-generated music. Many artists and industry experts worry that current copyright laws do not adequately protect their work or properly recognize AI contributions.

This issue slows down the adoption and investment in AI music technologies. The unclear ownership and royalty distribution have led to disputes and caution among musicians and companies alike. Without clear legal frameworks, the potential for misuse or unfair compensation remains a challenge that holds the market back from reaching its full potential.

Opportunity

Personalized Music and User Experience

A major opportunity within AI in music lies in personalization. Streaming platforms use AI to create music recommendations and mood-based playlists tailored specifically for individual listeners. This personalization improves listener satisfaction and keeps users engaged longer. AI can also generate customized music on demand for videos, games, or ads, offering new revenue streams.

AI’s ability to analyze listening habits and create unique experiences opens fresh avenues for the music industry. Artists can reach wider audiences and companies can develop new services around personalized content. The growing consumer demand for tailored musical experiences offers a significant growth opportunity for AI-driven platforms and tools.

Challenge

Ethical Use and Fair Compensation

One of the biggest challenges facing AI in music is ensuring ethical use and fair compensation for artists. The rise of AI-generated music raises questions about ghost artists and voice cloning, which can replicate human performances without permission. This creates difficult ethical dilemmas related to consent and authenticity.

Additionally, the music industry struggles to develop fair royalty models that include AI’s role while protecting human creators’ livelihoods. Without clear rules and ethical standards, there is a risk of artists losing income and control over their work. Addressing these issues is crucial to balance innovation with fairness and maintain trust in the industry’s future.

Latest Trends

Emerging trends in AI music in 2025 include the rise of AI-generated songs that gain traction on platforms like TikTok, where users create AI-powered covers, remixes, and virtual duets. AI tools not only help generate entire tracks from simple text prompts but also enable interactive music creation, such as AI karaoke with vocal cloning and harmonization.

Streaming platforms are increasingly using AI to curate hyper-personalized playlists and even provide AI-generated commentary on music, significantly enhancing listener engagement. Data reveals that about 75% of music streaming services apply AI algorithms to enhance personalization, increasing listener retention by 40% over traditional playlist methods.

Growth factors

Growth factors driving AI adoption in music include the accessibility of advanced AI tools that reduce music production time by up to 50%, allowing musicians to experiment with more ideas faster. The technology empowers both professional and amateur creators by offering sophisticated composition and sound design assistance.

Additionally, AI’s ability to analyze large music databases to identify lyrical and rhythmic patterns fosters innovation. Despite some concerns around copyrights and potential impacts on musicians’ traditional roles, the creative possibilities offered by generative AI continue to propel its adoption. Market insights note that about 30% of AI-generated songs achieve commercial success, reflecting growing acceptance of AI content by listeners.

Key Players Analysis

In the AI in music market, iZotope, LANDR, Amper Music (Shutterstock), and Aiva Technologies are recognized as major innovators. These companies focus on AI-driven music creation, mastering, and production tools that serve both professionals and independent artists. Their solutions enhance efficiency in composing, mixing, and sound design while lowering costs for users.

Emerging players such as Boomy Corporation, BRAINFM, SOUNDRAW, Amadeus Code, Klangio, and Mubert are expanding the market with applications in personalized music generation, wellness, and consumer-focused platforms. Their offerings emphasize accessibility and real-time music creation, allowing users without formal training to produce customized tracks.

Technology-focused firms including Magenta (Google), Musimap, and OpenAI contribute by integrating advanced AI models, deep learning, and data-driven composition systems. Their work supports both experimental music creation and practical applications for streaming, advertising, and entertainment platforms.

Top Key Players in the Market

- iZotope

- Aiva Technologies

- Amper Music (Shutterstock Inc)

- BRAINFM Inc

- LANDR

- Boomy Corporation

- Magenta (Google Inc)

- SOUNDRAW Inc.

- Amadeus Code

- Klangio GmbH

- Mubert

- Musimap

- OpenAI

- Other Key Players

Recent Developments

- In Sep 2025, STIM launched the AI License for Music. The license covers a selection of works by creators who have explicitly given their consent and ensure fair compensation when their music is used in AI contexts.

- In Sept 2025, Sweden’s music rights organisation has introduced a licence that allows artificial intelligence companies to legally use copyrighted songs for training their models, while ensuring that songwriters and composers are paid.

- In August 2025, ElevenLabs launched Eleven Music, an AI-powered music generation platform. The platform includes safeguards to protect rights holders and prevent copyright infringement.

- In April 2024, Saregama, one of the well-known music brands launched AI AI-based music learning app named Padhanisa.

- In April 2024, Udio launched an AI music creation app that is backed by Will.i.am that creates professional quality tracks in 40 seconds.

Report Scope

Report Features Description Market Value (2024) USD 5.2 Bn Forecast Revenue (2034) USD 60.4 Bn CAGR (2025-2034) 27.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, and Services), By Deployment (Cloud, and On-premises), By Application (Automated Music Composition, Music Arrangement and Orchestration, Music Style Transfer and Remixing, Sound Synthesis and Design, Music Personalization and Recommendation, and Others), By End Use (Music Production and Recording, Film and Television, Video Games and Interactive Entertainment, Advertising and Marketing, Music Education and Training, Streaming Services and Music Platforms, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape iZotope, Aiva Technologies, Amper Music (Shutterstock Inc.), BRAINFM Inc, LANDR, Boomy Corporation, Magenta (Google Inc), SOUNDRAW Inc., Amadeus Code, Klangio GmbH, Mubert, Musimap, OpenAI, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- iZotope

- Aiva Technologies

- Amper Music (Shutterstock Inc)

- BRAINFM Inc

- LANDR

- Boomy Corporation

- Magenta (Google Inc)

- SOUNDRAW Inc.

- Amadeus Code

- Klangio GmbH

- Mubert

- Musimap

- OpenAI

- Other Key Players