Global AI in Mobile Apps Market Size, Share, Statistics Analysis Report By Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Other Technologies), By Application (Chat Automation, Digital Assistance, Security, Object Detection, Personalization, Others (Data Analytics, Optimization, etc.)), By Operating System (Android, iOS), By End Use Apps (Social Media, Communication and Connectivity (Voice and Video Communication Apps, Text Messaging Apps, Email Apps, Social Media Apps)), Information and Utility (Mobile Browser, Navigation Apps, Others), Entertainment (Video Streaming Apps, Music Streaming Apps, Mobile Gaming Apps, E-books/audiobooks, Educational Apps, Others), Productivity (Document Editing, Collaboration Tools, Calendar Scheduling and Reminders, Others), Photo and Video Capturing and Editing Apps, Mobile Wallets, E-commerce Shopping Apps, Travel and Tourism Apps, Health and Wellness Apps), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2025

- Report ID: 122606

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The AI in Mobile Apps Market size is expected to be worth around USD 354.09 Billion By 2034, from USD 21.23 billion in 2024, growing at a CAGR of 32.5% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 55.34% share, holding USD 11.73 Billion revenue.

Artificial Intelligence (AI) in mobile apps refers to the integration of machine learning and data analysis technologies to create smarter, more adaptive applications. These applications can learn from user interactions and make data-driven predictions or decisions, enhancing the user experience through personalization and automation.

The market for AI in mobile apps is experiencing rapid growth, driven by the increasing demand for advanced mobile applications that offer enhanced user engagement and personalized experiences. This growth is further propelled by technological advancements in AI and the widespread availability of smartphones with high processing power.

Major tech companies and startups alike are investing in AI capabilities to capture a significant share of this expanding market. The AI in mobile apps market encompasses a range of applications including virtual personal assistants, customer support via chatbots, enhanced security features, and more, all aimed at improving convenience and efficiency for users.

The primary drivers of the AI in mobile apps market include the need for personalized user experiences, the efficiency of automated processes, and the demand for enhanced data security. AI’s ability to analyze large sets of user data and adapt functionalities to individual users is a significant attraction for businesses aiming to improve customer satisfaction and retention rates.

Based on data from MindInventory, The adoption of AI in mobile applications is expanding rapidly, with an estimated 230 million people worldwide actively using AI-powered apps. Among AI-driven voice assistants, Siri holds a 36% market share, serving over 660 million users per month.

The widespread use of Siri reflects the growing reliance on voice-based AI interfaces for hands-free interaction, smart home control, and on-the-go assistance. Additionally, around 66% of businesses plan to invest in AI, aiming to enhance their mobile app functionality, user engagement, and overall efficiency. AI-powered mobile applications are improving customer experience through chatbots, predictive analytics, and advanced image recognition technologies.

There is a high demand for AI-enabled mobile apps in sectors such as e-commerce, finance, healthcare, and entertainment, where personalized customer service and operational efficiency are crucial. These apps utilize AI to offer tailored recommendations, improve security measures, and facilitate seamless user interactions, which are critical factors in driving user engagement and loyalty.

Key Takeaways

- The AI in Mobile Apps Market is projected to grow from USD 21.23 billion in 2024 to USD 354.09 billion by 2034.

- The market is expected to expand at a CAGR of 32.5% from 2025 to 2034.

- APAC dominated in 2024, holding a 55.34% share and generating USD 11.73 billion in revenue.

- The Natural Language Processing (NLP) segment led the market, capturing a 39.7% share.

- The Personalization segment held a 31.4% market share.

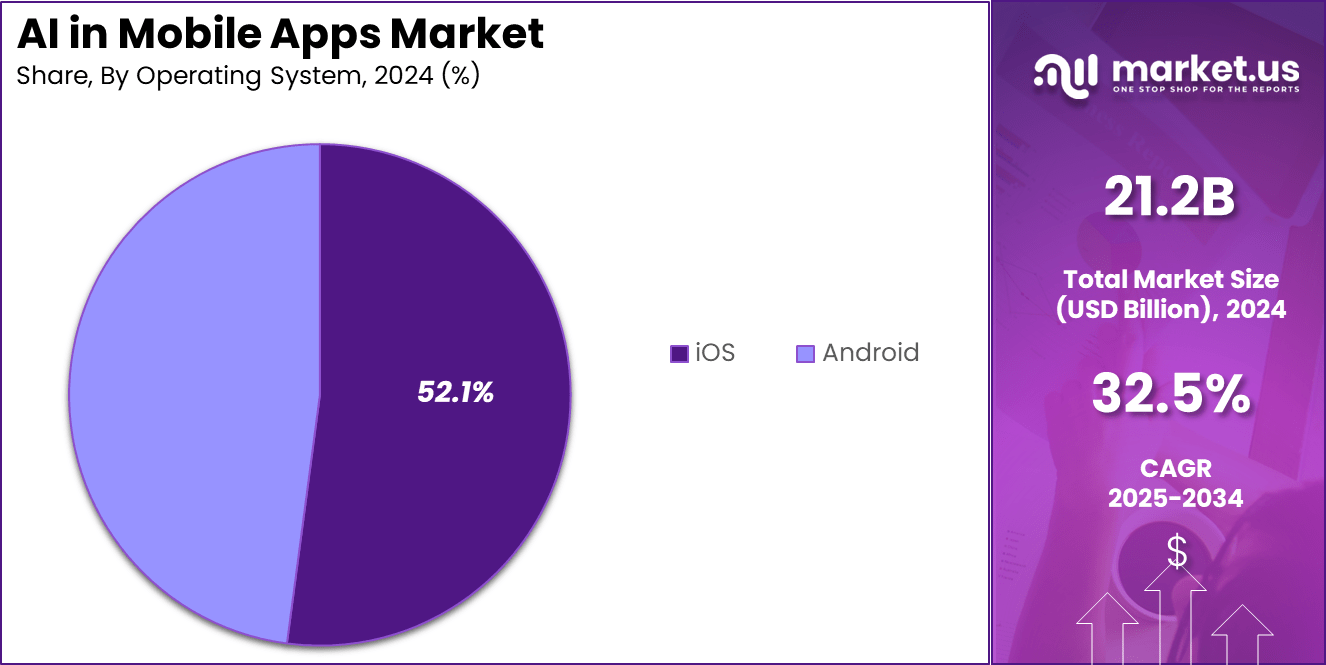

- The iOS segment dominated, accounting for 52.1% of the market.

- The Entertainment segment was the largest, securing a 53.6% share

Analysts’ Viewpoint

Investment in AI-driven mobile app development is seen as highly lucrative due to the transformative impact of these technologies on app functionalities and business models. Investors are particularly interested in applications that leverage AI for predictive analytics, natural language processing, and intelligent automation, offering substantial returns through enhanced user engagement and operational scalability.

The integration of AI into mobile apps provides significant business benefits, including improved customer insights, higher engagement rates, and reduced operational costs. AI enables businesses to automate customer service, optimize marketing strategies, and enhance security protocols, leading to increased productivity and profitability

Recent advancements in AI technology, such as deep learning, computer vision, and voice recognition, have expanded the capabilities of mobile apps. These technologies allow for more sophisticated features like real-time language translation, augmented reality experiences, and proactive health monitoring, further enhancing the utility and appeal of mobile applications.

The regulatory environment for AI in mobile apps is increasingly focused on ensuring user privacy and ethical AI usage. Regulations such as GDPR in Europe and various state laws in the U.S. mandate stringent data protection measures and transparency in how AI algorithms use consumer data. Compliance with these regulations is essential for app developers to build trust and ensure a wider acceptance of AI technologies.

Technology Analysis

In 2024, the Natural Language Processing (NLP) segment held a dominant position within the AI in mobile apps market, capturing more than a 39.7% share. This considerable market share can primarily be attributed to the widespread integration of NLP technologies in mobile applications, which enhances user engagement through sophisticated voice and text interactions.

NLP technologies facilitate a more intuitive and seamless user experience by enabling apps to understand human language in a way that closely mimics natural human dialogue. The surge in demand for NLP in mobile apps is driven by the increasing consumer preference for voice-based services, such as virtual assistants and chatbots, which are now prevalent in sectors ranging from e-commerce to customer service.

The ability of NLP to process and analyze large volumes of natural language data efficiently allows mobile applications to offer personalized experiences, recommendations, and support. This capability is crucial in retaining user engagement and improving service delivery in a competitive market.

AI in Mobile Apps Market Share, By Technology Analysis, 2019-2024 (%)

By Technology 2019 2020 2021 2022 2023 2024 Machine Learning 31.6% 32.0% 32.3% 32.6% 32.9% 33.2% Natural Language Processing (NLP) 39.6% 39.6% 39.6% 39.7% 39.7% 39.7% Computer Vision 12.7% 12.6% 12.5% 12.4% 12.3% 12.1% Other Technologies 16.01% 15.80% 15.59% 15.38% 15.18% 14.97% Moreover, advancements in machine learning models that underpin NLP technologies have significantly improved their accuracy and efficiency. These enhancements enable mobile applications to offer real-time language translation, sentiment analysis, and contextual responses, which are vital for apps operating on a global scale. The continuous evolution of NLP models also supports the development of applications that can cater to a diverse range of languages and dialects, further expanding their market reach.

Application Analysis

In 2024, the Personalization segment held a dominant market position in the AI in mobile apps market, capturing more than a 31.4% share. This prominence is largely due to the growing consumer demand for tailored experiences across mobile platforms.

Personalization technologies leverage AI to analyze user behaviors, preferences, and interactions, enabling apps to deliver content, recommendations, and features that are specifically aligned with individual user needs. The increasing sophistication of AI algorithms has allowed for deeper insights into user data, which in turn has enhanced the ability of apps to offer highly customized experiences.

This capability is crucial for user retention and satisfaction, as it significantly enhances the user’s interaction with the app. Personalized user experiences are particularly valuable in industries such as e-commerce, media, and entertainment, where they contribute to increased consumer engagement and sales.

Additionally, the integration of personalization within mobile applications has been supported by advances in data processing and AI-driven analytics. These technologies allow for real-time personalization, adapting to user interactions as they occur, which further refines the user experience. The capability to dynamically adjust content and services to meet the expectations of users at any given moment is a key factor driving the expansion of this market segment.

AI in Mobile Apps Market Share, By Application Analysis, 2019-2024 (%)

By Application 2019 2020 2021 2022 2023 2024 Chat Automation 7.8% 7.8% 7.8% 7.8% 7.8% 7.8% Digital Assistance 23.3% 23.0% 22.8% 22.6% 22.4% 22.2% Security 13.0% 13.0% 12.9% 12.9% 12.8% 12.8% Object Detection 9.4% 9.5% 9.5% 9.6% 9.7% 9.7% Personalization 29.3% 29.7% 30.1% 30.6% 31.0% 31.4% Others (Data Analytics, Optimization, etc.) 17.26% 17.03% 16.80% 16.57% 16.34% 16.12% Overall, the leadership of the Personalization segment in the AI in mobile apps market can be attributed to its ability to significantly enhance the user experience by providing bespoke services and content. As businesses continue to recognize the value of personalized user engagement, this segment is expected to maintain its growth trajectory and pivotal role in the development of mobile applications.

Operating System Analysis

In 2024, the iOS segment held a dominant market position in the AI in mobile apps market, capturing more than a 52.1% share. This substantial market share can be attributed to several factors, including the high adoption rate of iOS devices among affluent consumers and the robust ecosystem that Apple has developed around its hardware and software products.

iOS devices are known for their advanced hardware capabilities, which are highly optimized for sophisticated AI applications, from augmented reality to machine learning-driven functionalities. The preference for iOS in the AI mobile apps market is also driven by Apple’s strict control over its ecosystem, which ensures a high standard of app quality and security.

This control extends to the incorporation of AI capabilities, where Apple provides developers with advanced tools and frameworks like Core ML and ARKit, simplifying the integration of AI into apps. These tools help developers create more effective and efficient applications, enhancing user engagement and satisfaction.

AI in Mobile Apps Market Share, By Operating System Analysis, 2019-2024 (%)

By Operating System 2019 2020 2021 2022 2023 2024 Android 46.0% 46.4% 46.8% 47.1% 47.5% 47.9% iOS 54.0% 53.6% 53.2% 52.9% 52.5% 52.1% Moreover, the demographic of iOS users, typically characterized by higher spending power, makes this platform more attractive to developers aiming to monetize their AI-driven applications. This economic advantage is significant, promoting more investments in innovative applications that cater to the expectations of iOS users.

End Use Apps Analysis

In 2024, the Entertainment segment held a dominant market position in the AI in mobile apps market, capturing more than a 53.6% share. This significant market share is driven by the escalating consumer demand for entertainment apps, which include video streaming, mobile gaming, and music streaming applications, all enhanced by AI technologies.

The integration of AI not only improves content recommendations but also enhances user interfaces and interactive features, leading to more engaging and personalized user experiences. The surge in the segment’s dominance is also bolstered by the increasing sophistication of AI algorithms that enable features such as adaptive streaming and predictive playback, optimizing the experience for variable network conditions.

Furthermore, AI is instrumental in analyzing user behavior to tailor content offerings and notifications, which keeps users engaged and increases the time spent on these apps. These technological enhancements are vital in maintaining user interest in a highly competitive market.

Additionally, the Entertainment segment benefits from the broad demographic appeal of its applications, encompassing a wide age range and varied interests, from casual games to educational and immersive AR/VR experiences. The universal appeal is significantly supported by advancements in AI that make these applications more accessible and enjoyable for diverse audiences.

AI in Mobile Apps Market Share, By End Use Apps Analysis, 2019-2024 (%)

By End Use Apps 2019 2020 2021 2022 2023 2024 Social Media, Communication & Connectivity 6.4% 6.4% 6.3% 6.3% 6.3% 6.3% Voice & Video Communication Apps 22.6% 22.4% 22.1% 21.9% 21.6% 21.4% Text Messaging Apps 9.9% 10.1% 10.3% 10.5% 10.7% 10.9% Email Apps 2.7% 2.7% 2.7% 2.7% 2.7% 2.7% Social Media Apps 64.7% 64.8% 64.9% 64.9% 65.0% 65.1% Information & Utility 0.6% 0.6% 0.6% 0.6% 0.5% 0.5% Mobile Browser 27.0% 27.0% 27.0% 27.0% 26.9% 26.9% Navigation Apps 58.2% 58.4% 58.7% 59.0% 59.2% 59.5% Others 14.8% 14.5% 14.3% 14.1% 13.9% 13.6% Entertainment 55.2% 54.9% 54.5% 54.2% 53.9% 53.6% Video Streaming Apps 9.6% 9.7% 9.8% 10.0% 10.1% 10.2% Music Streaming Apps 3.3% 3.3% 3.3% 3.3% 3.4% 3.4% Mobile Gaming Apps 81.0% 80.8% 80.5% 80.3% 80.0% 79.7% E-books/Audiobooks 0.7% 0.7% 0.6% 0.6% 0.6% 0.6% Educational Apps 4.1% 4.2% 4.4% 4.5% 4.7% 4.8% Others 1.3% 1.3% 1.3% 1.3% 1.2% 1.2% Productivity 16.2% 16.3% 16.4% 16.6% 16.7% 16.8% Document Editing 3.1% 3.1% 3.1% 3.0% 3.0% 3.0% Collaboration Tools 1.6% 1.6% 1.5% 1.5% 1.5% 1.5% Calendar Scheduling & Reminders 0.5% 0.5% 0.5% 0.5% 0.5% 0.5% Photo & Video Apps 15.0% 15.3% 15.5% 15.8% 16.1% 16.3% Mobile Wallets 0.2% 0.2% 0.2% 0.2% 0.2% 0.2% E-commerce Shopping Apps 3.6% 3.6% 3.7% 3.7% 3.7% 3.7% Travel & Tourism Apps 0.1% 0.1% 0.1% 0.1% 0.1% 0.1% Health & Wellness Apps 0.6% 0.6% 0.6% 0.6% 0.6% 0.6% Others 2.1% 2.1% 2.0% 2.0% 2.0% 2.0% Key Market Segments

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Computer Vision

- Other Technologies

By Application

- Chat Automation

- Digital Assistance

- Security

- Object Detection

- Personalization

- Others (Data Analytics, Optimization, etc.)

By Operating System

- Android

- iOS

By End Use Apps

- Social Media, Communication and Connectivity

- Voice and Video Communication Apps

- Text Messaging Apps

- Email Apps

- Social Media Apps

- Information and Utility

- Mobile Browser

- Navigation Apps

- Others

- Entertainment

- Video Streaming Apps

- Music Streaming Apps

- Mobile Gaming Apps

- E-books/audiobooks

- Educational Apps

- Others

- Productivity

- Document Editing

- Collaboration Tools

- Calendar Scheduling and Reminders

Others

- Photo and Video Capturing and Editing Apps

- Mobile Wallets

- E-commerce Shopping Apps

- Travel and Tourism Apps

- Health and Wellness Apps

Driver

Increasing Demand for Personalized User Experiences

One of the primary drivers for integrating AI into mobile apps is the escalating demand for personalized user experiences. AI enables apps to deliver customized content and functionalities tailored to individual preferences and behaviors.

This personalization is achieved through machine learning algorithms that analyze user data and predict preferences, significantly enhancing user engagement and satisfaction. For instance, AI-powered apps can suggest products, optimize user interfaces, or adjust features in real-time, making each interaction more relevant and engaging for the user.

The capability of AI to learn from user interactions and refine its predictions and responses continuously leads to more intuitive and adaptive apps, which are highly valued in competitive markets like e-commerce, entertainment, and social media.

Restraint

Data Privacy and Security Concerns

Despite the advantages, a significant restraint in the adoption of AI within mobile apps is the concern for data privacy and security. AI systems often require access to large volumes of personal data to function effectively, raising issues about the security of user information and compliance with data protection laws like GDPR.

The integration of AI necessitates robust encryption and stringent data handling protocols to prevent breaches and maintain user trust. Ensuring transparency in AI operations and giving users control over their data are essential steps in addressing these privacy concerns.

Opportunity

Enhancement of App Functionality and Performance

The integration of AI in mobile apps presents substantial opportunities for enhancing app functionality and performance. AI technologies like NLP, ML and computer vision enable features such as voice commands, real-time language translation, personalized recommendations, and augmented reality, all of which significantly improve the utility and appeal of apps.

For businesses, this means better customer engagement, increased sales through personalized marketing, and improved customer service through AI-driven chatbots and automated support. Furthermore, AI can optimize app operations, reduce load times, and manage resources more efficiently, leading to better overall performance and user satisfaction.

Challenge

Complexity in Implementation

Implementing AI in mobile apps comes with its set of challenges, primarily related to the complexity of AI technologies and the need for specialized skills. Developing, integrating, and maintaining AI-powered features requires expertise in machine learning, data science, and software engineering.

The complexity increases with the need to ensure that the AI components work seamlessly within the app’s ecosystem without compromising performance. Additionally, AI models are resource-intensive, necessitating advanced hardware and optimized algorithms to function effectively on mobile devices.

Growth Factors

- Increasing Demand for Personalized Experiences: Consumers are seeking more tailored interactions, driving the integration of AI to deliver customized content, recommendations, and services.

- The proliferation of Smartphones: The widespread adoption of smartphones enhances the reach and potential impact of AI-driven mobile apps across various demographics and regions.

- Advancements in AI Technologies: Innovations in machine learning, natural language processing, and computer vision are enabling more sophisticated and functional AI applications in mobile apps.

- Rising Popularity of Virtual Assistants: The growing use of AI-powered virtual assistants and chatbots in mobile apps is improving customer service and user engagement.

- Improved User Engagement and Retention: AI enhances user experiences by making apps more intuitive and responsive, leading to higher engagement and retention rates.

Latest Trends

- Voice Recognition and Virtual Assistants: Increasing integration of voice recognition technologies and AI-powered virtual assistants like Siri, Google Assistant, and Alexa for hands-free user interaction.

- AI-driven Personalization: Enhanced user experiences through AI-driven personalized content, recommendations, and services based on user behavior and preferences.

- Natural Language Processing (NLP): Advancements in NLP are enabling more intuitive and accurate language understanding in chatbots, translation apps, and virtual assistants.

- AI-powered Predictive Analytics: Use of predictive analytics for user behavior forecasting, churn prediction, and personalized marketing strategies to enhance user engagement and retention.

- Real-time Data Processing: Implementation of AI algorithms that process data in real-time, improving responsiveness and user experiences in mobile apps.

- AI in Healthcare Apps: Increasing adoption of AI in healthcare mobile apps for telemedicine, remote monitoring, personalized treatment plans, and health data analysis.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a dominant market position in the AI in mobile apps market, capturing more than a 55.34% share and generating revenue of USD 11.7 billion. This leading status can be attributed to several key factors, including the rapid expansion of mobile connectivity and smartphone penetration in populous countries such as China and India.

The region’s massive consumer base provides a fertile ground for the adoption of AI-driven mobile applications, spanning from e-commerce and entertainment to fintech and health-related services. Another significant driver for the APAC region’s dominance in this market is the strong local development ecosystem, supported by governments actively promoting technology advancements and digital transformation.

AI in Mobile Apps Market Share, Regional Analysis, 2019-2024 (%)

By Region 2019 2020 2021 2022 2023 2024 North America 23.70% 23.68% 23.66% 23.64% 23.62% 23.60% Europe 15.70% 15.49% 15.28% 15.08% 14.87% 14.66% Asia Pacific 53.78% 54.09% 54.40% 54.72% 55.03% 55.34% Latin America 4.34% 4.32% 4.29% 4.27% 4.24% 4.22% Middle East & Africa 2.48% 2.42% 2.36% 2.30% 2.24% 2.18% Moreover, the increasing digital literacy among the population and the growing middle class in APAC countries contribute to the higher demand for sophisticated AI-enabled applications. This demand is further propelled by the cultural affinity for technology and innovation, making consumers in the APAC region more receptive to adopting new technologies integrated into mobile apps.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia

-Pacific - China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East

& Africa - South Africa

- Saudi Arabia

- United Arab Emirates

- Rest of Middle East & Africa

Key Players Analysis

In analyzing the key players in the AI in Mobile Apps market, it’s evident that the sector is driven by rapid advancements in AI technologies and an increasing demand for enhanced mobile user experiences. Here’s a brief overview of three leading companies that are significantly impacting this market through innovations, mergers, acquisitions, and product launches:

Apple Inc.: Apple remains a dominant force, particularly in the iOS market segment, which has a substantial share due to its advanced hardware that supports sophisticated AI applications. Apple’s integration of AI into its devices, facilitated by its comprehensive ecosystem and tools like Core ML for developers, continues to enhance user engagement through features such as augmented reality and machine learning functionalities.

Samsung Electronics: As a leading competitor in both the hardware and software aspects of mobile AI, Samsung has been instrumental in pushing the boundaries of what mobile devices can do with AI. The company’s investments in next-generation AI chips in collaboration with companies like Naver and the launch of new mobile processors demonstrate its commitment to enhancing AI capabilities on mobile devices.

Qualcomm: Known for its significant contributions to mobile processing technology, Qualcomm is pivotal in driving AI adoption across mobile devices. Their development of AI-enhanced chips has facilitated superior processing capabilities in smartphones, making advanced AI features like real-time voice processing and image recognition more accessible.

Top Key Players in the Market

- Microsoft

- Google LLC (Alphabet Inc.)

- Open AI

- Amazon Inc.

- Apple Inc.

- Facebook (Meta Platforms, Inc.)

- Adobe

- Snap Inc.

- Photoroom

- Grammarly Inc.

- BigML

- Luka Inc. (Replika)

- BrainCo Inc.

- Others

Recent Developments

- Apple Inc.: In November 2024, Apple acquired Pixelmator, a popular image editing application available on Mac and iOS platforms. This acquisition aims to enhance Apple’s suite of creative tools and strengthen its position in mobile image editing.

- Amazon Inc.: In December 2024, Amazon introduced a new suite of AI platforms, known as foundation models, at its annual AWS conference. These models are designed to handle text, image, and video processing, positioning Amazon to compete with other tech giants in the AI domain.

- OpenAI and T-Mobile US: In October 2024, T-Mobile US partnered with OpenAI to develop an AI platform named IntentCX. This platform leverages customer interaction data to automate customer service tasks and proactively address issues, aiming to reduce the need for direct customer service interventions.

Report Scope

Report Features Description Market Value (2024) USD 21.23 Bn Forecast Revenue (2034) USD 354.09 Bn CAGR (2025-2034) 32.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine Learning, Natural Language Processing (NLP), Computer Vision, Other Technologies), By Application (Chat Automation, Digital Assistance, Security, Object Detection, Personalization, Others (Data Analytics, Optimization, etc.)), By Operating System (Android, iOS), By End Use Apps (Social Media, Communication and Connectivity (Voice and Video Communication Apps, Text Messaging Apps, Email Apps, Social Media Apps)), Information and Utility (Mobile Browser, Navigation Apps, Others), Entertainment (Video Streaming Apps, Music Streaming Apps, Mobile Gaming Apps, E-books/audiobooks, Educational Apps, Others), Productivity (Document Editing, Collaboration Tools, Calendar Scheduling and Reminders, Others), Photo and Video Capturing and Editing Apps, Mobile Wallets, E-commerce Shopping Apps, Travel and Tourism Apps, Health and Wellness Apps) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, Google LLC (Alphabet Inc.), Open AI, Amazon Inc., Apple Inc., Facebook (Meta Platforms, Inc.), Adobe, Snap Inc., Photoroom, Grammarly Inc., BigML, Luka Inc. (Replika), BrainCo Inc., Others, Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Microsoft

- Google LLC (Alphabet Inc.)

- Open AI

- Amazon Inc.

- Apple Inc.

- Facebook (Meta Platforms, Inc.)

- Adobe

- Snap Inc.

- Photoroom

- Grammarly Inc.

- BigML

- Luka Inc. (Replika)

- BrainCo Inc.

- Others