Global AI in Lending Market By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Technology (Machine Learning (ML) and Predictive Analysis, Natural Language Processing (NLP), Robotic Process Automation (RPA), Other AI Technologies), By End-User (Banks and Financial Institutions, Credit Unions, Peer-to-Peer (P2P) Lending Platforms, Other Lenders), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122210

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

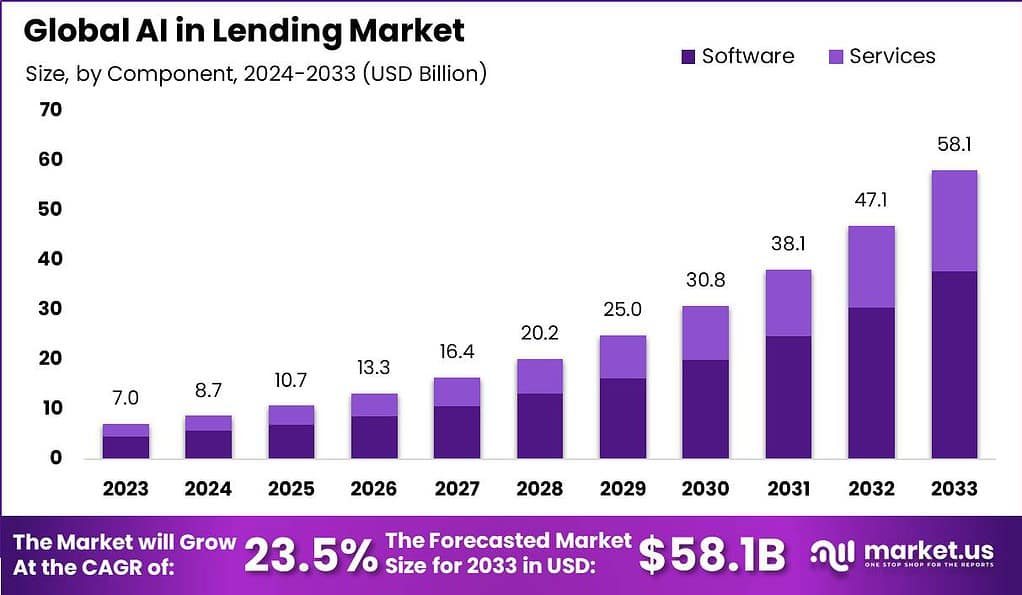

The Global AI in Lending Market size is expected to be worth around USD 58.1 Billion By 2033, from USD 7.0 Billion in 2023, growing at a CAGR of 23.5% during the forecast period from 2024 to 2033.

The AI in Lending market has witnessed significant growth driven by the increasing adoption of artificial intelligence technologies in financial services. This sector has experienced a robust expansion, attributed to the demand for efficient and accurate credit risk assessment, fraud detection, and personalized customer services. The integration of AI in lending processes enhances decision-making capabilities, reduces operational costs, and improves customer satisfaction through automated and streamlined processes.

One of the primary growth factors for the AI in lending market is the increasing availability of data. Lenders now have access to vast amounts of structured and unstructured data, including financial records, transaction history, social media activity, and alternative data sources. AI algorithms can analyze this data, extract meaningful insights, and make predictions or assessments based on patterns and correlations. This data-driven approach enables lenders to make more informed lending decisions and assess creditworthiness with greater accuracy.

The automation of lending processes is another significant growth driver. AI-powered systems can automate repetitive tasks, such as data entry, document verification, and loan application processing. This automation not only improves operational efficiency but also reduces the likelihood of errors and enables faster turnaround times for loan approvals. By streamlining workflows, lenders can provide a seamless and efficient borrowing experience to customers.

However, the AI in lending market is not without its challenges. Data privacy and security concerns are paramount, as the use of sensitive customer data is inherent in AI-driven lending processes. Lenders must prioritize data protection, comply with regulations such as GDPR, and establish robust security measures to maintain customer trust and confidentiality.

Interpretability and explainability of AI algorithms are also challenges in the lending industry. As AI models become more complex and sophisticated, it can be difficult to explain how specific lending decisions are made. This lack of transparency may lead to concerns about bias, discrimination, or unfair practices. Addressing these challenges requires developing AI models that are explainable and ensuring ethical and responsible use of AI in lending.

A report by Deloitte predicts that by 2025, AI will increase access to credit for borrowers by approximately 10%. This can be attributed to AI-powered lending platforms that utilize a broader range of data, including non-financial data like social media activity and spending patterns, to assess creditworthiness. This expanded data analysis capability allows lenders to reach a larger pool of potential borrowers.

Another study conducted by Accenture highlights the potential of AI in increasing cross-selling rates in the lending industry. The report reveals that AI can help lenders achieve up to a 20% increase in cross-selling rates. Banking executives surveyed in the report expressed their belief that AI will revolutionize the way they gather information from and interact with customers, indicating the transformative potential of AI in customer engagement.

However, while the benefits of AI in lending are evident, there are challenges to overcome. A survey by Deloitte in 2022 found that the cost of implementing AI in lending was a major challenge for 40% of lenders. Implementing AI technology can require significant financial investment, which may pose a barrier to some lenders looking to adopt these advanced solutions.

Nevertheless, the cost savings achievable through AI implementation are noteworthy. AI can reduce the cost of loan processing by as much as 40% by automating tasks such as data entry and document verification. This automation not only improves efficiency but also reduces the likelihood of errors, leading to significant cost savings for lenders.

Furthermore, the transition from human data processing to AI-driven processes brings a remarkable increase in accuracy. Reports suggest that lenders experience a 99% increase in accuracy after adopting AI technology for data processing. This improvement in accuracy has a direct impact on decision-making processes, leading to more reliable lending decisions and reduced risk.

Key Takeaways

- The Global AI in Lending Market size is estimated to reach USD 58.1 billion in the year 2033 with a CAGR of 23.5% during the forecast period and was valued at USD 7.0 billion in the year 2023.

- In 2023, the software segment held a leading market position in the AI Lending market, capturing more than a 65% share.

- In 2023, the cloud-based segment held a dominant market position in the AI Lending market, capturing more than a 70% share.

- In 2023, the Machine Learning (ML) and Predictive Analytics segment held a dominant market position in the AI Lending market, capturing more than a 51% share.

- In 2023, the Banks and Financial Institutions (BFSI) segment held a dominant market position in the AI Lending market, capturing more than a 45% share.

- In 2023, North America held a dominant market position in the AI Lending market, capturing more than a 40% share.

Component Analysis

In 2023, the software segment held a leading market position in the AI Lending market, capturing more than a 65% share. This leadership can be accredited to several factors driving the adoption of AI-driven software solutions within the financial services industry. AI software enhances the competence and correctness of lending processes by automating tasks such as credit risk assessment, fraud detection, and loan underwriting.

These software solutions leverage advanced algorithms and machine learning models to analyze vast amounts of data, enabling lenders to make informed and timely decisions. The ability to process real-time data and provide personalized loan offerings significantly advances customer experience and satisfaction. Additionally, the scalability and flexibility of AI software make it an attractive investment for financial institutions aiming to stay competitive in a rapidly evolving market.

Furthermore, the software segment’s dominance is bolstered by continuous technological advancements and the integration of AI with other emerging technologies. For instance, predictive analytics and natural language processing (NLP) are increasingly being incorporated into lending software, enhancing the ability to forecast borrower behavior and streamline customer interactions.

The growing availability of cloud-based AI solutions also subsidizes the segment’s growth, as it allows financial institutions of all sizes to access sophisticated AI tools without the need for extensive on-premises infrastructure. This accessibility is particularly beneficial for smaller banks and credit unions, which can now leverage AI to compete with larger players.

Deployment Mode Analysis

In 2023, the cloud-based segment held a dominant market position in the AI Lending market, capturing more than a 70% share. This substantial lead can be attributed to the numerous advantages that cloud-based solutions offer over on-premise alternatives. Cloud-based AI in lending platforms provides unparalleled scalability, allowing financial institutions to effortlessly adjust their operations based on demand.

This flexibility is particularly beneficial for lenders facing fluctuating loan volumes and seasonal spikes in applications. Furthermore, cloud solutions eliminate the need for extensive on-site infrastructure, significantly reducing upfront capital expenditure and ongoing maintenance costs.

Another critical factor driving the dominance of the cloud-based segment is the enhanced accessibility and collaboration it offers. Cloud-based platforms enable real-time data access and analytics, allowing lending teams to work seamlessly from different locations.

This capability is essential in the current era of remote work and global operations. Additionally, cloud-based AI solutions facilitate rapid deployment and updates, ensuring that financial institutions can quickly adapt to regulatory changes and technological advancements. According to market analysis, cloud-based AI in lending solutions is projected to grow further, driven by increasing investments in digital transformation and the need for more efficient and responsive lending processes.

Technology Analysis

In 2023, the Machine Learning (ML) and Predictive Analytics segment held a dominant market position in the AI Lending market, capturing more than a 51% share. This dominance can be attributed to the transformative impact of these technologies on the lending process. Machine learning algorithms and predictive analytics enable lenders to analyze vast amounts of data, providing deep insights into borrower behavior and creditworthiness.

These tools enhance the accuracy of credit risk assessments and fraud detection, reducing default rates and improving loan approval processes. The capability to predict future borrower behavior based on historical data allows for more informed lending decisions, which enhances overall financial performance.

Furthermore, the integration of ML and predictive analytics into lending platforms has streamlined operations and reduced costs. These technologies automate complex tasks such as data processing, risk modeling, and loan underwriting, freeing up resources and allowing financial institutions to focus on strategic activities. The continuous learning capabilities of ML models mean they improve over time, adapting to new data and trends, which ensures that lenders stay ahead in a competitive market.

Moreover, the use of predictive analytics funds dynamic pricing strategies, enabling lenders to offer personalized loan products with competitive interest rates based on real-time risk assessments. This adaptability and precision make ML and predictive analytics essential components of modern lending solutions.

End-User Analysis

In 2023, the Banks and Financial Institutions (BFSI) segment held a dominant market position in the AI Lending market, capturing more than a 45% share. The BFSI segment’s leading position can be attributed to the extensive adoption of AI technologies by traditional banks and financial institutions to enhance their lending operations.

AI-driven solutions enable these institutions to streamline loan processing, improve risk assessment accuracy, and enhance customer service. By leveraging AI, banks can analyze vast amounts of data to identify creditworthy borrowers, detect fraud, and provide personalized loan offerings. This capability significantly reduces default rates and enhances operational efficiency, making AI a critical component of modern lending strategies for BFSI players.

Additionally, the BFSI segment’s dominance is driven by the significant resources and infrastructure that established banks and financial institutions possess. These organizations have the financial capacity to invest in advanced AI technologies and integrate them into their existing systems. The integration of machine learning, predictive analytics, and natural language processing (NLP) tools has allowed banks to offer seamless digital lending experiences, which are crucial in today’s competitive market.

For instance, AI-powered chatbots and virtual assistants enhance customer interactions, providing instant responses and personalized loan recommendations. Furthermore, the regulatory environment favoring the adoption of AI in financial services has also played a role in the BFSI segment’s leadership. Regulatory bodies are increasingly recognizing the benefits of AI in enhancing compliance, risk management, and overall financial stability.

Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Technology

- Machine Learning and Predictive Analytics

- Natural Language Processing (NLP)

- Robotic Process Automation (RPA)

- Other AI Technologies

By End-User

- Banks and Financial Institutions

- Credit Unions

- Peer-to-peer (P2P) Lending Platforms

- Other Lenders

Driver

Growing Implementation of AI in Different Financial Services

The growing implementation of AI in various financial services is a significant driver for the AI in Lending market. Financial institutions are increasingly adopting AI technologies to enhance their operations, improve customer experience, and stay competitive. AI enables banks and financial services providers to analyze vast amounts of data with precision and speed, leading to more accurate credit risk assessments, fraud detection, and personalized loan offerings.

For instance, AI-driven credit scoring models can evaluate non-traditional data sources such as social media activity and transaction history, providing a more comprehensive picture of a borrower’s creditworthiness. This capability not only reduces the risk of defaults but also allows lenders to offer tailored loan products that meet individual needs, thereby increasing customer satisfaction and loyalty.

Moreover, the automation of repetitive tasks through AI, such as data entry and document verification, significantly reduces operational costs and processing times. This efficiency enables financial institutions to process a higher volume of loan applications, ultimately boosting profitability.

This widespread adoption is driven by the need for financial institutions to enhance their digital capabilities and provide seamless, real-time services to customers. The integration of AI in lending processes is a key part of this digital transformation, offering substantial benefits in terms of accuracy, efficiency, and customer engagement.

Restraint

Issues regarding Data Privacy and Security

Issues regarding data privacy and security are significant restraints for the AI in Lending market. The integration of AI in lending processes involves handling vast amounts of sensitive customer data, including personal identification details, financial histories, and credit scores. This extensive data collection and processing raise concerns about the potential for data breaches, unauthorized access, and misuse of personal information.

Financial institutions must ensure robust data protection measures to safeguard this information, which can be a complex and costly endeavor. Compliance with stringent data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, adds another layer of complexity and expense. Any lapse in data security can lead to significant financial penalties, reputational damage, and loss of customer trust.

According to a recent survey, over 70% of consumers expressed concerns about data privacy when using AI-driven financial services. Moreover, the increasing sophistication of cyberattacks poses a constant threat to the security of AI-driven lending platforms. Hackers and malicious actors continually develop new methods to exploit vulnerabilities in AI systems, making it essential for financial institutions to stay ahead with the latest cybersecurity technologies and protocols.

Implementing advanced security measures, such as encryption, multi-factor authentication, and regular security audits, requires substantial investment and ongoing effort. Smaller financial institutions and fintech start-ups, in particular, may struggle to allocate the necessary resources to effectively protect their data, potentially limiting their ability to adopt AI technologies at the same pace as larger players.

Opportunity

Growth in Machine Learning and Predictive Analysis Trend

The growth in machine learning and predictive analytics presents a significant opportunity for the AI in Lending market. Machine learning algorithms and predictive analytics tools enable lenders to process vast amounts of data with unprecedented accuracy and speed, transforming how credit risk is assessed and loans are underwritten.

By analyzing historical data and classifying patterns, these technologies can predict borrower behavior, detect possible defaults, and assess solvency more accurately than traditional methods. This capability allows financial institutions to make informed lending decisions, reducing the risk of defaults and improving the overall quality of their loan portfolios.

Additionally, predictive analytics facilitates the development of personalized loan products tailored to individual customer needs. By leveraging data from various sources, including social media activity, transaction history, and even non-traditional data points, lenders can offer customized loan terms and interest rates that match the borrower’s financial profile and risk level.

This level of personalization improves customer satisfaction and loyalty, as borrowers receive loan offers that are suited to their specific circumstances. The use of predictive analytics also supports dynamic pricing models, allowing lenders to regulate interest rates in real time based on market conditions and borrower behavior.

Challenge

Higher Cost of Implementation and Lack of Skilled Workforce

The higher cost of implementation and the lack of a skilled workforce pose significant challenges for the AI in Lending market. Deploying AI solutions in lending processes requires substantial investments in advanced technology infrastructure, software development, and system integration.

These costs can be prohibitive, particularly for smaller financial institutions and fintech start-ups with limited budgets. The initial setup expenses, coupled with ongoing maintenance and updates, create a significant financial burden. Additionally, investing in high-quality AI solutions often involves purchasing sophisticated algorithms, data analytics tools, and cloud computing services, further escalating costs.

Moreover, the successful implementation of AI in lending necessitates a workforce proficient in data science, machine learning, and AI technologies. The demand for skilled professionals who can develop, manage, and optimize AI algorithms is rapidly increasing. However, there is a notable shortage of such talent in the market, leading to intense competition among financial institutions to attract and retain qualified personnel.

According to recent industry reports, there is a projected shortage of over 250,000 data scientists and AI specialists in the U.S. alone by 2025. This talent gap poses a significant challenge, as financial institutions may struggle to find and afford the necessary expertise to implement and maintain AI systems effectively.

Growth Factors

- Enhanced Credit Risk Assessment: AI enables more accurate and efficient credit risk assessment by analyzing vast amounts of data, including non-traditional data sources, leading to better lending decisions and reduced default rates.

- Fraud Detection and Prevention: AI technologies such as machine learning and predictive analytics help detect and prevent fraud by identifying unusual patterns and behaviors in real time, enhancing the security of lending processes.

- Operational Efficiency: AI automates repetitive tasks, such as data entry and document verification, reducing operational costs and processing times, thereby increasing the overall efficiency of lending operations.

- Personalized Loan Offerings: AI allows lenders to offer personalized loan products tailored to individual borrowers’ needs and financial profiles, improving customer satisfaction and loyalty.

- Regulatory Compliance: AI helps financial institutions ensure compliance with stringent regulatory requirements by automating compliance checks and risk management processes, reducing the risk of regulatory penalties.

- Real-time Data Processing: AI enables real-time data processing and analysis, allowing lenders to make timely and informed lending decisions, which is crucial in a fast-paced market environment.

- Digital Transformation: The growing emphasis on digital transformation in the financial services industry drives the adoption of AI technologies, as institutions seek to enhance their digital capabilities and offer seamless, real-time services to customers.

Latest Trends

- Increased Use of Machine Learning and Predictive Analytics: Machine learning algorithms and predictive analytics are being increasingly adopted to enhance credit risk assessment, automate loan underwriting, and provide personalized lending solutions.

- Adoption of Natural Language Processing (NLP): NLP technologies are being used to improve customer interactions through AI-powered chatbots and virtual assistants, streamlining communication and enhancing customer service.

- Rise of Cloud-Based AI Solutions: Cloud-based AI solutions are gaining traction due to their scalability, flexibility, and cost-effectiveness, allowing financial institutions to deploy AI technologies without significant on-premise infrastructure investments.

- Integration with Blockchain Technology: The integration of AI with Blockchain is emerging as a trend to enhance transparency, security, and efficiency in lending transactions.

- Focus on Regulatory Compliance: AI is being leveraged to automate compliance checks and ensure adherence to regulatory requirements, reducing the risk of non-compliance and associated penalties.

- Development of Real-Time Data Processing Capabilities: Financial institutions are adopting AI to process and analyze real-time data, enabling timely and informed lending decisions.

- Expansion of AI in Small and Medium-Sized Enterprises (SMEs): SMEs are increasingly adopting AI-driven lending solutions to access credit more efficiently and improve their financial management.

- Growing Importance of Explainable AI (XAI): There is a rising emphasis on explainable AI to ensure transparency and build trust with stakeholders by making AI decision-making processes more understandable.

Regional Analysis

In 2023, North America held a dominant market position in the AI Lending market, capturing more than a 40% share. The demand for AI in Lending in North America was valued at US$ 2.8 billion in 2023 and is anticipated tgrow significantly in the forecast period.

This leadership can be attributed to several factors driving the adoption of AI technologies within the financial services sector in the region. The United States, in particular, is home to a large number of advanced financial institutions and fintech companies that are at the forefront of integrating AI into their lending processes. These institutions leverage AI to enhance credit risk assessment, fraud detection, and customer service, leading to improved operational efficiency and customer satisfaction.

Moreover, the region benefits from a robust technological infrastructure and a high level of investment in AI research and development. North America is a hub for some of the world’s leading AI technology providers, which accelerates the adoption of innovative AI solutions in the lending market.

The presence of major tech companies and a strong startup ecosystem fosters continuous innovation and collaboration, further driving the growth of the AI in Lending market. Additionally, the regulatory environment in North America is increasingly supportive of AI adoption in financial services, with regulators recognizing the potential of AI to enhance compliance, risk management, and overall financial stability.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the AI in lending market, several key players are leading innovations and shaping industry dynamics. Upstart Holdings, Inc. and LendingClub Corporation are prominent for leveraging AI to offer improved credit decisions and customized lending experiences. Upstart’s platform uses sophisticated machine learning algorithms to predict risk and approve loans, demonstrating higher approval rates and lower loss rates compared to traditional models.

Kabbage, Inc., a subsidiary of American Express, provides automated funding solutions to small businesses, utilizing AI to streamline the lending process. Their technology quickly assesses the financial health of businesses using various data points, improving the speed and accessibility of funding.

Zest AI focuses on making fair and transparent credit available to everyone, using AI to help lenders achieve better risk management and increase inclusivity. Their tools are designed to enhance the accuracy of credit scoring models while ensuring compliance with regulatory standards.

OnDeck Capital Inc. and Avant LLC specialize in providing credit solutions to small businesses and consumers, respectively, using AI to facilitate quick and reliable loan approval processes. OnDeck utilizes predictive analytics to gauge business performance rapidly, whereas Avant uses AI to personalize loan options and repayment plans.

SoFi Technologies Inc. and Enova International Inc. have significantly impacted the personal finance and small business lending spaces. SoFi uses AI to refine financial services ranging from loan refinancing to investment management, while Enova deploys AI to analyze vast amounts of non-traditional data for real-time credit decisions.

Top Key Players in the Market

- Upstart Holdings, Inc.

- LendingClub Corporation

- Kabbage (a subsidiary of American Express)

- Zest AI

- OnDeck Capital Inc.

- Avant LLC

- SoFi Technologies Inc.

- Enova International Inc.

- OakNorth Bank

- Prosper Marketplace Inc.

- PayPal Holdings Inc.

- Better Mortgage Corporation

- Figure Technologies Inc.

- Funding Circle Holdings PLC

- LenddoEFL

- Other Key Players

Recent Developments

- May 2024: Upstart Holdings Inc., Launched the first AI certification program for financial services, providing industry leaders with the knowledge to leverage AI in lending practices

- February 2024: Zest AI unveiled LuLu, a generative AI model designed to provide strategic insights and optimize performance for lending organizations. This tool aims to simplify access to industry data and enhance decision-making processes, making it a significant innovation in AI-driven lending solutions.

Report Scope

Report Features Description Market Value (2023) USD 7.0 Bn Forecast Revenue (2033) USD 58.1 Bn CAGR (2024-2033) 23.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered by Component (Software, Services), by Deployment Mode (On-Premises, Cloud-Based), by Technology (Machine Learning (ML), Natural Language Processing (NLP), Robotic Process Automation (RPA), Other AI Technologies), by End-User (Banks and Financial Institutions. Credit Unions, Peer-to-Peer (P2P) Lending Platforms, Other Lenders) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Upstart Holdings, Inc., LendingClub Corporation, Kabbage (a subsidiary of American Express), Zest AI, OnDeck Capital Inc., Avant LLC, SoFi Technologies Inc., Enova International Inc., OakNorth Bank, Prosper Marketplace Inc., PayPal Holdings Inc., Better Mortgage Corporation, Figure Technologies Inc., Funding Circle Holdings PLC, LenddoEFL, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI lending?AI lending refers to the use of artificial intelligence technologies, such as machine learning algorithms, to automate and enhance the lending process. It involves using data analysis to assess creditworthiness, manage risk, and personalize loan offerings.

How big is AI in Lending Market?The Global AI in Lending Market size is expected to be worth around USD 58.1 Billion By 2033, from USD 7.0 Billion in 2023, growing at a CAGR of 23.5% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the AI in Lending Market?Advances in data analytics, machine learning algorithms for credit risk assessment, automation of loan processes, and increasing demand for personalized financial services.

What are the current trends and advancements in AI in Lending Market?Adoption of AI-driven chatbots for customer service, predictive analytics for credit scoring, use of natural language processing (NLP) for document processing, and integration of blockchain for secure transactions.

What are the major challenges and opportunities in the AI in Lending Market?Challenges include regulatory compliance, ethical use of AI in decision-making, data privacy concerns, and potential bias in algorithms. Opportunities lie in enhancing customer experience, improving operational efficiency, and expanding financial inclusion.

Who are the leading players in the AI in Lending Market?Major companies include Upstart Holdings, Inc., LendingClub Corporation, Kabbage (a subsidiary of American Express), Zest AI, OnDeck Capital Inc., Avant LLC, SoFi Technologies Inc., Enova International Inc., OakNorth Bank, Prosper Marketplace Inc., PayPal Holdings Inc., Better Mortgage Corporation, Figure Technologies Inc., Funding Circle Holdings PLC, LenddoEFL, Other Key Players

-

-

- Upstart Holdings, Inc.

- LendingClub Corporation

- Kabbage (a subsidiary of American Express)

- Zest AI

- OnDeck Capital Inc.

- Avant LLC

- SoFi Technologies Inc.

- Enova International Inc.

- OakNorth Bank

- Prosper Marketplace Inc.

- PayPal Holdings Inc.

- Better Mortgage Corporation

- Figure Technologies Inc.

- Funding Circle Holdings PLC

- LenddoEFL

- Other Key Players