Global AI in Freight Transportation Market Report By Type (Hardware, Software), By Mode of Transportation (Road, Rail, Air, Ocean), By Application (Route Optimization, Predictive Maintenance, Fleet Management, Safety and Security, Supply Chain Management), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 125634

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

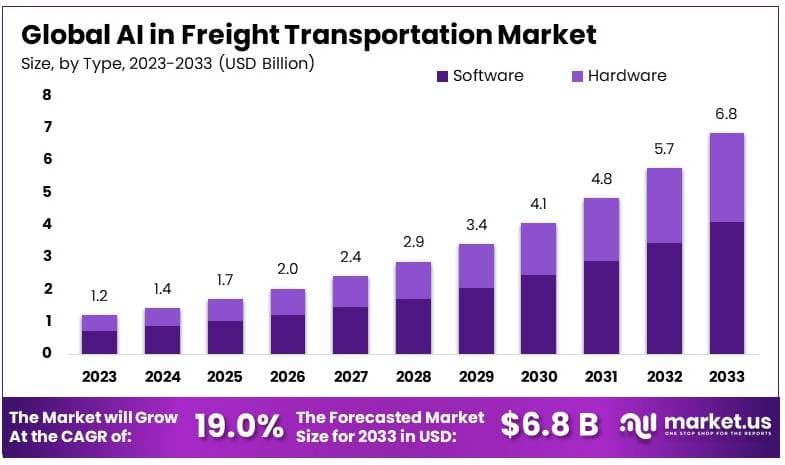

The Global AI in the Freight Transportation Market size is expected to be worth around USD 6.8 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 19.0% during the forecast period from 2024 to 2033.

The AI in Freight Transportation Market focuses on the use of artificial intelligence to optimize logistics and transportation operations. AI technologies improve route planning, fleet management, and cargo tracking. This market is growing as companies seek to reduce costs, improve efficiency, and enhance delivery accuracy.

Key applications of AI in freight transportation include real-time route optimization, predictive maintenance for vehicles, and automated warehousing. AI-driven analytics provide insights into transportation patterns, helping companies optimize their logistics networks. The market serves industries such as e-commerce, manufacturing, and retail.

As global supply chains become more complex, the adoption of AI in freight transportation is crucial. Companies that integrate AI into their logistics operations can achieve significant cost savings, reduce delays, and improve customer satisfaction. The focus should be on leveraging AI to create more resilient and efficient supply chains.

The AI in Freight Transportation market is rapidly evolving as companies increasingly recognize the transformative potential of artificial intelligence in logistics and supply chain management. A global survey reveals that 20% of freight and logistics companies plan to implement AI for business-to-business sales within the next year, highlighting the growing role of AI in driving operational efficiency and customer engagement in the industry.

Companies like Girteka, which operates a fleet of over 6,400 trucks, are leading the way in AI adoption. They are expanding the use of AI tools to optimize their operations, including TRAVIS, an online marketplace that helps truck drivers find parking spots, saving time and reducing inefficiencies.

Additionally, fleet optimization tools developed by Nexogen are being utilized to adapt to ever-changing road conditions, considering factors like arrival time, distance, and emissions. These innovations underscore the practical benefits of AI in improving logistical efficiency and reducing operational costs.

The logistics industry is increasingly embracing AI, with 65% of transportation and logistics firms believing that AI will significantly influence their operations by 2023. This sentiment is echoed by the fact that 80% of advanced logistics providers plan to integrate AI into their workflows, indicating a strong industry-wide commitment to adopting this technology. AI’s potential to optimize routes, manage fleets, and improve overall supply chain visibility is driving this adoption.

The financial impact of AI in logistics is substantial, with projections suggesting that the industry could save approximately USD 1.5 trillion by 2025 through the implementation of AI technologies. Moreover, AI is expected to enhance customer satisfaction by 10-15%, reflecting its ability to improve service delivery and responsiveness in the logistics sector.

As artificial intelligence continues to reshape freight transportation, companies that invest in these technologies are likely to gain a competitive advantage through improved efficiency, cost savings, and enhanced customer experiences. The AI in Freight Transportation market is set to expand significantly as the industry increasingly relies on AI to meet the growing demands of global trade and supply chain complexity.

Key Takeaways

- The AI in the Freight Transportation Market was valued at USD 1.2 billion in 2023 and is expected to reach USD 6.8 billion by 2033, with a CAGR of 19.0%.

- Software dominates the type segment with 60% owing to its essential role in optimizing logistics and transportation management systems.

- Road leads the mode of transportation segment with 53%, driven by the widespread use of AI in road freight operations for route optimization and fleet management.

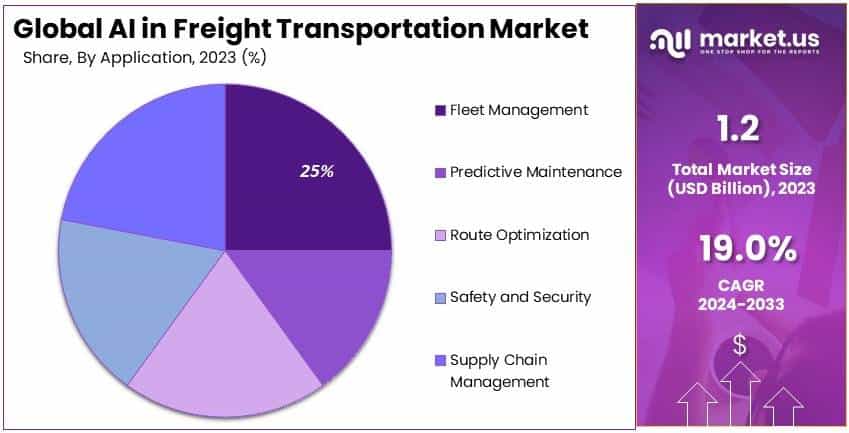

- Fleet Management dominates the application segment with 25% due to the need for efficient vehicle monitoring and maintenance.

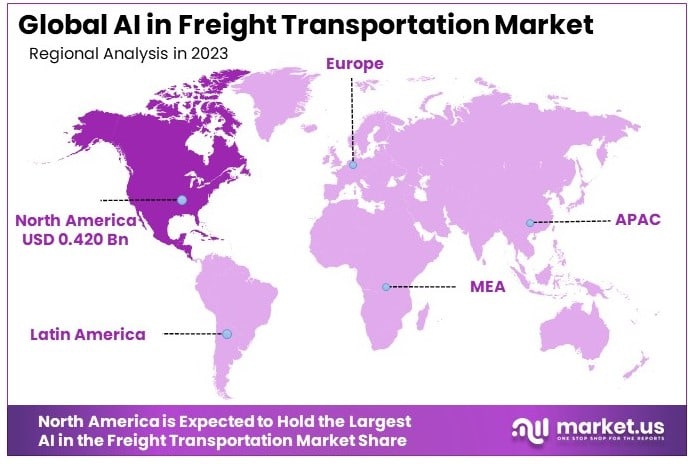

- North America leads with 35% due to the region’s strong logistics infrastructure and early adoption of AI in transportation.

Type Analysis

The Software sub-segment dominates with 60% due to its crucial role in enabling advanced AI functionalities that optimize freight transportation operations.

In the AI in Freight Transportation Market, the Type segment is clearly dominated by Software, holding a 60% share. This substantial market dominance stems from the software’s critical role in integrating and operationalizing AI within the transportation sector. AI-powered software solutions facilitate numerous functions, such as data collection, analysis, and real-time decision-making, which are vital for enhancing efficiency and reducing operational costs in freight transportation.

AI software applications in this market are primarily designed to optimize route planning, manage fleets efficiently, predict maintenance needs, and ensure the safety and security of cargo and transportation assets. The flexibility and scalability of these software solutions allow them to be customized to meet the specific needs of different freight transportation modes, such as road, rail, air, and ocean, further broadening their applicability and market penetration.

Despite the dominance of Software, Hardware also plays a critical role, particularly in terms of sensors and on-board devices that collect real-time data essential for AI operations. These hardware components are integral to the effective deployment of AI in software, providing the necessary data infrastructure to support advanced analytics and machine learning algorithms.

As AI technology advances and integrates deeper into freight transportation systems, the synergy between Hardware and Software will remain pivotal in driving further market growth and innovation.

Mode of Transportation Analysis

The Road sub-segment dominates with 53% due to its extensive infrastructure and pivotal role in intra-country transport logistics.

In the Mode of Transportation segment, Road transportation commands a leading position with a 53% share in the AI in Freight Transportation Market. This dominance is attributed to the extensive road network infrastructure that facilitates the majority of intra-country transport of goods. Road transportation’s flexibility and ubiquity make it a critical component of the logistics and supply chain network, offering direct routes and door-to-door service that other modes cannot provide.

AI enhances road freight operations by optimizing route planning to avoid congestion and reduce fuel consumption, thus saving costs and minimizing environmental impact. AI-driven systems also enhance load planning and vehicle maintenance schedules, which improve operational efficiency and prolong the lifespan of transportation assets.

While Road leads this segment, Rail, Air, and Ocean also significantly benefit from AI applications. Rail freight benefits from AI in scheduling and network optimization, Air freight utilizes AI for cargo space optimization and predictive maintenance, and Ocean freight uses AI to navigate complex international logistics and compliance requirements. Each of these transportation modes contributes to the overall efficiency of the freight sector, leveraging AI to meet specific operational challenges and market demands.

Application Analysis

The Fleet Management sub-segment dominates with 25% due to its essential role in optimizing the performance.

Within the Application segment of the AI in Freight Transportation Market, Fleet Management is the most influential, holding a 25% share. This dominance is largely due to the critical importance of fleet operations in ensuring efficient, cost-effective, and reliable freight transportation. AI-powered fleet management solutions offer comprehensive capabilities that include vehicle surveillance system, fuel management, vehicle maintenance, and driver performance analysis.

The integration of AI in fleet management not only helps companies reduce operational costs but also improves safety by monitoring driver behavior and vehicle conditions. Predictive analytics used in AI applications can foresee potential breakdowns or maintenance issues, allowing for preemptive actions that minimize downtime and enhance service reliability.

Other applications such as Route Optimization, Predictive Maintenance, Safety and Security, and Supply Chain Management also play vital roles in the AI in Freight Transportation Market. Route Optimization improves delivery times and reduces costs, Predictive Maintenance prevents unexpected equipment failures.

Moreover Safety and Security enhance the protection of assets, and Supply Chain Management improves the visibility and coordination of goods movement. Each of these applications leverages AI to address specific challenges within freight transportation, contributing to the overall growth and efficiency of the industry.

Key Market Segments

By Type

- Hardware

- Software

By Mode of Transportation

- Road

- Rail

- Air

- Ocean

By Application

- Route Optimization

- Predictive Maintenance

- Fleet Management

- Safety and Security

- Supply Chain Management

Driver

Government Initiatives and Technological Advancements Drive Market Growth

The growth of artificial intelligence (AI) in the freight transportation market is being driven by several key factors. First, government initiatives and regulations are significantly shaping the industry. For instance, efforts to modernize transportation infrastructure and policies supporting AI adoption are becoming more prevalent.

The U.S. government’s push for fleet electrification and the expansion of smart logistics infrastructure demonstrates a commitment to integrating AI-driven technologies into the national transportation system. In 2022, the U.S. federal government owned 1,100 charging stations but recognized the need for 100,000 to support its electrification goals. This illustrates the substantial public investment required to facilitate AI in transportation.

Additionally, technological advancements are revolutionizing freight logistics. Companies are increasingly adopting AI and machine learning to improve efficiency and reduce human intervention. For example, RFID chips and other AI-driven technologies enable real-time tracking and predictive analytics, significantly enhancing operational efficiency. This has led to innovations like automated drone deliveries and AI-powered transportation management systems, which are transforming the logistics landscape.

Restraint

Regulatory, Technological, and Infrastructural Barriers Restraint Market Growth

The growth of AI in the Freight Transportation Market is significantly restrained by a combination of regulatory, technological, and infrastructural challenges. One of the primary restraints is the complex regulatory environment governing the freight and logistics sector.

Regulations such as the Federal Motor Carrier Safety Administration (FMCSA) rules in the United States and similar frameworks globally impose stringent requirements on the use of AI in autonomous vehicles, data privacy, and transportation safety. These regulations are necessary for ensuring safety and compliance but can slow down the deployment of AI technologies by adding layers of approval and compliance costs.

Technological limitations also play a critical role in restraining the adoption of AI in freight transportation. The successful implementation of AI in this sector relies on the availability of robust and reliable data from IoT devices, GPS tracking devices, and other sensors embedded in vehicles and infrastructure.

However, many freight companies still operate with outdated technologies and fragmented data systems, making it difficult to collect and integrate the data necessary for AI to function effectively. Moreover, the high costs associated with upgrading these systems or investing in new AI-compatible infrastructure can be prohibitive, particularly for small to medium-sized enterprises (SMEs) that dominate the freight transportation market.

Opportunity

Efficiency, Route Optimization, and Predictive Maintenance Provide Opportunities

The AI in the Freight Transportation Market offers significant opportunities for industry players, driven by the need for enhanced efficiency, optimized routing, and predictive maintenance. Efficiency presents a key opportunity as freight companies seek to reduce operational costs and improve delivery times.

AI can streamline processes such as load planning, scheduling, and fleet management, allowing companies to make better use of their resources and minimize downtime. This not only cuts costs but also enhances service quality, leading to higher customer satisfaction.

Route optimization is another critical opportunity. AI-powered systems can analyze traffic patterns, weather conditions, and fuel consumption to determine the most efficient routes for freight transportation. By optimizing routes, companies can reduce fuel costs, minimize delays, and ensure timely deliveries.

Predictive maintenance also provides substantial growth potential. AI can monitor the condition of vehicles and equipment in real-time, predicting when maintenance is needed before a breakdown occurs. This proactive approach to maintenance reduces unexpected downtime, extends the lifespan of assets, and lowers repair costs.

Challenge

Infrastructure Limitations Challenge Market Growth

Infrastructure limitations significantly challenge the growth of AI in the freight transportation market. As AI technologies become more integral to optimizing logistics, they require robust infrastructure to function effectively. However, the existing infrastructure in many regions is outdated or insufficient to support the advanced needs of AI-driven systems.

In many parts of the world, transportation networks are not fully equipped to handle the sophisticated data processing and real-time analytics that AI demands. For example, poor road conditions, limited connectivity in rural areas, and outdated communication networks can hinder the seamless integration of AI into freight operations. These limitations slow down the adoption of AI, as companies must either invest in upgrading infrastructure or accept reduced efficiency in their AI systems.

Moreover, the lack of standardized infrastructure across regions creates inconsistencies in AI implementation. Freight companies operating in multiple locations may face challenges in scaling their AI solutions due to varying levels of infrastructure readiness. This inconsistency can lead to inefficiencies and increased operational costs, as companies need to adapt their AI systems to fit different environments.

The cost of upgrading infrastructure to meet AI requirements is another significant barrier. Many companies, particularly smaller ones, may find it financially unfeasible to invest in the necessary technology upgrades. This financial strain can delay the adoption of AI in the freight transportation sector, limiting its growth potential.

Growth Factors

- Route Optimization: AI analyzes traffic patterns, weather conditions, and other variables to determine the most efficient routes. This reduces fuel consumption, delivery times, and operational costs, making freight transportation more efficient and cost-effective.

- Predictive Maintenance: AI monitors the condition of vehicles and equipment in real-time, predicting potential failures before they happen. This proactive maintenance approach minimizes downtime, extends the life of assets, and reduces repair costs.

- Enhanced Safety: AI improves safety by assisting drivers with real-time alerts and automated driving features. This reduces the likelihood of accidents, ensuring safer transportation of goods and improving overall reliability in freight operations.

- Automated Warehousing: AI-powered systems optimize warehouse operations by automating inventory management, sorting, and loading processes. This increases efficiency, reduces errors, and speeds up the supply chain, contributing to smoother freight operations.

- Demand Forecasting: AI analyzes historical data and market trends to predict future demand for freight services. This helps companies plan capacity, manage resources better, and respond quickly to market changes, driving more effective operations.

- Cost Reduction: AI streamlines various aspects of freight transportation, from route planning to load optimization, reducing operational costs. This cost efficiency enables companies to offer competitive pricing, attract more clients, and expand their market presence.

Emerging Trends

- Route Optimization: AI is being used to optimize routes by analyzing traffic patterns, weather conditions, and road infrastructure. This trend reduces fuel consumption, lowers delivery times, and decreases operational costs, making freight transportation more efficient and reliable.

- Autonomous Vehicles: The development of AI-powered autonomous trucks is transforming the freight transportation industry. This trend has the potential to reduce labor costs, increase safety, and improve delivery speed, offering significant growth opportunities for logistics companies.

- Predictive Maintenance: AI is being utilized to predict when vehicles and equipment will need maintenance, based on data from sensors and historical performance. This trend minimizes downtime, reduces repair costs, and ensures that fleets operate at peak efficiency.

- Enhanced Supply Chain Visibility: AI-driven analytics provide real-time insights into the entire supply chain, from warehouse operations to final delivery. This trend helps companies identify bottlenecks, optimize inventory management, and improve overall supply chain efficiency.

- Sustainability and Green Logistics: AI is enabling more sustainable practices in freight transportation by optimizing fuel usage and reducing carbon emissions. This trend aligns with the growing demand for eco-friendly logistics solutions, offering a competitive edge for companies that adopt green practices.

- Real-Time Shipment Tracking: AI is improving real-time tracking of shipments, allowing companies and customers to monitor the exact location of goods. This trend enhances transparency, improves customer satisfaction, and reduces the risk of lost or delayed shipments.

Regional Analysis

North America Dominates with 35% Market Share in the AI in Freight Transportation Market

North America’s 35% market share with valuation of USD 0.420 Bn in the AI in freight transportation is largely due to its advanced logistics and transportation infrastructure. The region is home to some of the world’s largest freight companies, which are quick to adopt new technologies like AI to optimize routes, improve delivery times, and reduce costs. Additionally, a strong focus on innovation and technology-driven competitive strategies supports this high adoption rate.

The dynamics of the North American market are shaped by the widespread implementation of AI technologies in logistics. These technologies include automated routing, predictive maintenance, and real-time freight tracking. This adoption is driven by the need to manage vast geographical distances efficiently and the demand for quick, cost-effective deliveries amid growing e-commerce.

The influence of North America in the AI in freight transportation sector is expected to remain strong and potentially grow. With ongoing advancements in AI and machine learning, coupled with investments in autonomous vehicle technologies, North America is well-positioned to further enhance operational efficiencies and sustainability in freight transportation. This will likely solidify and possibly extend its market dominance.

Regional Analysis for Other Markets:

- Europe: Europe is also a significant player in the AI in freight transportation market, with a focus on sustainability and efficiency. The region’s stringent environmental regulations drive the adoption of AI to optimize fuel usage and reduce emissions. European freight companies are increasingly investing in AI to maintain compliance and improve logistical operations.

- Asia Pacific: The Asia Pacific region is experiencing rapid growth in this sector due to increasing industrial activities and infrastructure development. Countries like China and Japan are leading in adopting AI technologies for freight management, driven by the need to handle large volumes of goods and complex supply chains efficiently.

- Middle East & Africa: In the Middle East and Africa, the market for AI in freight transportation is emerging. Investments in infrastructure and an increasing focus on diversifying economies are driving interest in technology solutions to enhance the efficiency and reliability of freight operations.

- Latin America: Latin America’s AI in freight transportation market is growing as the region seeks to improve its logistics capabilities. Increasing trade volumes and the need for cost-effective transportation solutions are driving the adoption of AI technologies, with a focus on improving supply chain visibility and reducing operational costs.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The AI in Freight Transportation market is being shaped by technological advancements and the need for efficient logistics. IBM Corporation, Microsoft Corporation, and Google LLC are the leading companies driving innovation in this space.

IBM Corporation plays a crucial role with its AI-powered logistics solutions. Through its Watson platform, IBM offers predictive analytics and automation tools that help freight companies optimize routes, reduce costs, and improve delivery times. IBM’s long-standing expertise in AI and its focus on enterprise solutions make it a key player in the market.

Microsoft Corporation is another significant influencer, providing AI and cloud solutions through its Azure platform. Microsoft enables freight companies to leverage big data, machine learning, and IoT to enhance operational efficiency and decision-making. Its strong cloud infrastructure and AI capabilities position Microsoft as a leader in the market.

Google LLC contributes through its advanced AI technologies and vast data resources. Google’s AI-driven tools and cloud services help freight companies manage and analyze large volumes of data, improving logistics and supply chain management. Google’s innovative approach and global reach give it a strategic edge in the market.

These companies are leading the AI in Freight Transportation market by offering cutting-edge solutions, strategic positioning, and significant market influence. Their impact is expected to grow as AI becomes increasingly integral to the logistics and transportation industry.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Google LLC

- Amazon Web Services Inc.

- Siemens AG

- Intel Corporation

- NVIDIA Corporation

- Uber Technologies Inc.

- C.H. Robinson Worldwide Inc.

- Other Key Players

Recent Developments

- July 2023: AWS and Siemens announced a strategic partnership to develop AI-powered logistics solutions. This collaboration aims to integrate AWS’s cloud and AI capabilities with Siemens’ extensive experience in industrial automation and transportation.

- August 2023: Uber Freight expanded its AI-powered logistics platform to better serve shippers and carriers. The platform now includes enhanced predictive analytics tools that help optimize routes, reduce empty miles, and improve load matching efficiency. Uber Freight reported a 20% increase in shipment volumes and a corresponding rise in revenue due to these AI enhancements.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 6.8 Billion CAGR (2024-2033) 19.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hardware, Software), By Mode of Transportation (Road, Rail, Air, Ocean), By Application (Route Optimization, Predictive Maintenance, Fleet Management, Safety and Security, Supply Chain Management) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, SAP SE, Google LLC, Amazon Web Services Inc., Siemens AG, Intel Corporation, NVIDIA Corporation, Uber Technologies Inc., C.H. Robinson Worldwide Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the AI in Freight Transportation Market?The AI in Freight Transportation Market involves the application of artificial intelligence technologies in the transportation of goods, including route optimization, predictive maintenance, fleet management, and supply chain management.

How big is the AI in Freight Transportation Market?The AI in Freight Transportation Market is valued at $1.2 billion and is projected to reach $6.8 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 19.0%.

What are the key factors driving the growth of the AI in Freight Transportation Market?The growth is driven by the increasing need for efficient logistics and supply chain management, the adoption of AI for predictive maintenance, and the demand for enhanced safety and security measures in transportation.

What are the current trends and advancements in the AI in Freight Transportation Market?Current trends include the use of AI for route optimization, the integration of AI in fleet management systems, and the development of AI-powered solutions for real-time tracking and monitoring of goods.

What are the major challenges and opportunities in the AI in Freight Transportation Market?Major challenges include the high cost of AI implementation, the complexity of integrating AI with existing logistics systems, and data privacy concerns. Opportunities exist in expanding AI applications to multimodal transportation, enhancing AI's role in sustainability, and developing AI solutions for emerging markets.

Who are the leading players in the AI in Freight Transportation Market?Leading players include IBM Corporation, Microsoft Corporation, SAP SE, Google LLC, Amazon Web Services Inc., Siemens AG, Intel Corporation, NVIDIA Corporation, Uber Technologies Inc., C.H. Robinson Worldwide Inc., and other key players.

AI in Freight Transportation MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

AI in Freight Transportation MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Google LLC

- Amazon Web Services Inc.

- Siemens AG

- Intel Corporation

- NVIDIA Corporation

- Uber Technologies Inc.

- C.H. Robinson Worldwide Inc.

- Other Key Players