Global AI In Foodtech Market By Component (Solution, Services), By Application (Food Production & Processing, Product Development and Innovation, Supply Chain Management, Food Safety and Compliance, Other Applications), By End-User (Food & Beverage Manufacturers, Restaurants & Food Service Providers, Other End-Users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122328

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

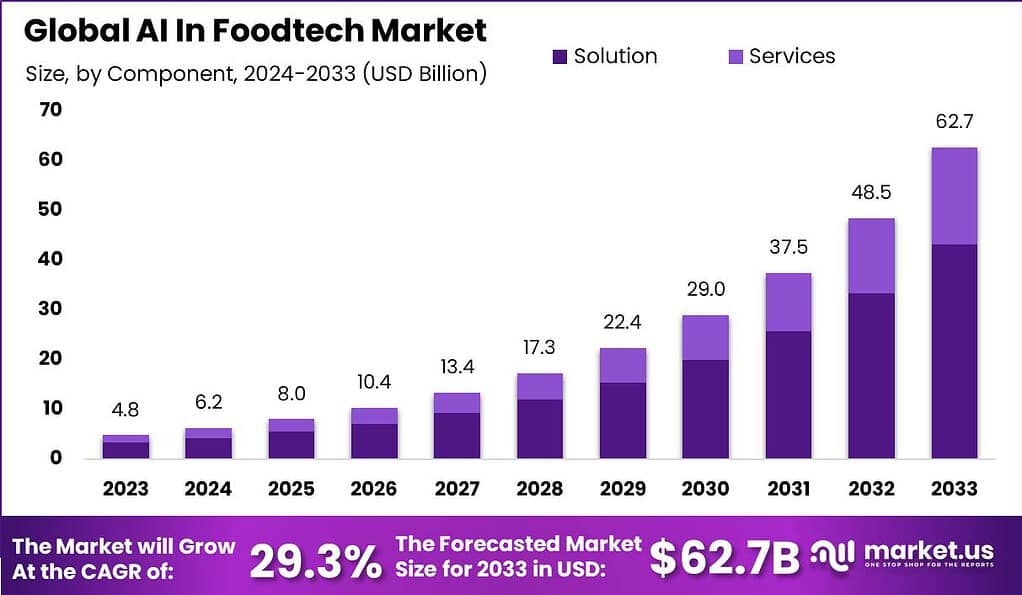

The Global AI In Foodtech Market size is expected to be worth around USD 62.7 Billion By 2033, from USD 4.8 Billion in 2023, growing at a CAGR of 29.3% during the forecast period from 2024 to 2033.

The AI in Foodtech market is poised for substantial growth, driven by the increasing demand for innovative solutions to enhance food production, safety, and customer experience. AI technologies are transforming the food industry by optimizing supply chains, improving food safety standards, and enabling personalized nutrition.

The integration of AI in Foodtech facilitates predictive analytics for demand forecasting, reducing food waste, and ensuring efficient inventory management. Additionally, AI-driven automation in food processing and packaging enhances operational efficiency and product quality.

Consumer preferences are increasingly shifting towards transparency and sustainability, and AI enables food companies to trace the origin of ingredients, monitor production processes, and ensure compliance with safety standards. Personalized nutrition is another burgeoning area where AI is making significant strides, offering tailored dietary recommendations based on individual health data and preferences, thus driving consumer engagement and satisfaction.

However, the AI in Foodtech market also faces challenges. One of the challenges is the availability and quality of data. AI algorithms rely on extensive and accurate datasets for effective analysis and predictions. Ensuring the availability and accessibility of high-quality data can be a hurdle for organizations entering the market.

Ethical considerations are also important challenges in the AI in Foodtech market. Issues such as privacy, data security, and transparency in AI algorithms need to be addressed to build trust among consumers and stakeholders. Responsible AI practices and adherence to ethical guidelines are crucial for the sustainable growth of the market.

Developing AI-powered solutions that address specific challenges in the food industry, such as efficient crop management, food safety monitoring, or personalized nutrition, can help new players carve out a niche in the market. Collaborations with existing foodtech companies and partnerships with research institutions can also provide avenues for new entrants to establish themselves in the market.

According to Worldmetrics, the integration of Artificial Intelligence (AI) within the food industry is producing significant efficiency gains and sustainability improvements. Notably, AI has enabled certain food companies to reduce their carbon footprint by 10-15%, underscoring its potential for environmental impact management.

In operational efficiencies, the implementation of AI has led to a remarkable increase in order accuracy for food delivery services, achieving a precision of 95%. Furthermore, AI-driven logistics platforms are reported to decrease delivery costs by 25%, optimizing supply chain operations across the sector.

From a safety perspective, AI significantly enhances food inspection processes by identifying contaminants with 98% accuracy. This advancement is crucial for maintaining food safety standards and consumer trust.

Market penetration of AI technologies is rapidly increasing, with 50% of food manufacturers anticipated to have adopted AI-driven automation by 2023. This adoption is largely driven by AI’s capacity to boost energy efficiency, with the industry aiming for up to 20% enhanced efficiency in energy consumption.

Investment trends also indicate a strong commitment to AI in the food industry, with 68% of companies planning to augment their AI investments within the next two years. This trend is complemented by a 15% annual growth in AI applications for food personalization, demonstrating a shift towards more tailored consumer experiences.

Additionally, AI-powered robotic systems are revolutionizing packaging processes, delivering speeds 30% faster than traditional methods. Such improvements not only increase productivity but also reduce labor costs and workplace hazards.

Lastly, AI-based demand forecasting is playing a critical role in inventory management for food retailers, potentially reducing overstocking issues by 20%. This capability assists in minimizing waste and optimizing stock levels, aligning with broader sustainability goals within the industry.

Key Takeaways

- The Global AI in Foodtech Market size is estimated to reach USD 62.6 billion in the year 2033 with a CAGR of 29.3% during the forecast period and was valued at USD 4.8 billion in the year 2023.

- In 2023, the solution segment held a dominant market position in the AI in Foodtech market, capturing more than a 68.9% share.

- In 2023, the food production and processing segment held a dominant market position in the AI in Foodtech market, capturing more than a 29.1% share.

- In 2023, the Food & Beverage Manufacturers segment held a dominant market position in the AI in Foodtech market, capturing more than a 55.4% share.

- In 2023, North America held a dominant market position in the AI in Foodtech market, capturing more than a 38.5% share.

Component Analysis

In 2023, the Solution segment held a dominant market position within the AI in Foodtech market, capturing more than a 68.9% share. This substantial market share can be attributed primarily to the increasing adoption of AI-driven solutions by food and beverage companies aiming to enhance operational efficiencies and customer experiences.

AI solutions, including predictive analytics, machine learning, and AI-driven automation, are being integrated across various stages of the food supply chain, from production to customer delivery. These technologies help in optimizing processes such as inventory management, demand forecasting, and quality control, thereby reducing waste and improving profitability.

The leadership of the Solution segment is further reinforced by the growing necessity for food businesses to comply with stringent regulatory standards and to adapt to rapidly changing consumer preferences. AI solutions facilitate real-time data gathering and analysis, enabling businesses to make informed decisions quickly and maintain a competitive edge.

Additionally, the advancements in AI technology have made these solutions more accessible and cost-effective, encouraging even small and medium-sized enterprises to implement them. Moreover, the development of more sophisticated AI applications, such as computer vision for quality assurance and natural language processing for customer service, continues to drive the expansion of the Solution segment.

As AI technology evolves, these solutions are expected to become even more integral to the foodtech industry, potentially increasing their market share further. Companies are investing heavily in R&D to innovate and develop tailored AI solutions that meet the specific needs of the food industry, signifying a promising growth trajectory for this market segment.

Application Analysis

In 2023, the Food Production & Processing segment held a dominant market position in the AI in Foodtech market, capturing more than a 29.1% share. This segment’s leading position can be attributed to several factors. Food Production & Processing companies are increasingly adopting AI technology to improve operational efficiency, enhance quality control, and optimize the production process.

AI algorithms play a crucial role in optimizing farming practices and crop management. By analyzing data on weather patterns, soil conditions, and crop health, AI systems can provide insights and recommendations for improving yields, reducing resource wastage, and enhancing sustainability in food production. This application of AI technology enables food producers to increase productivity, reduce costs, and ensure a more efficient supply chain.

Furthermore, AI in Food Production & Processing facilitates quality control and food safety. AI-powered systems can quickly detect contaminants, such as bacteria or foreign objects, in food products, ensuring compliance with safety standards and reducing the risk of product recalls. By utilizing AI for real-time monitoring and analysis of production processes, companies can identify and resolve quality issues promptly, ensuring consistent and safe food products for consumers.

Additionally, AI technology contributes to process automation and optimization in food production. AI algorithms can analyze data from sensors, machines, and production lines to identify bottlenecks, optimize workflow, and minimize downtime. By automating repetitive tasks and streamlining production processes, food producers can improve efficiency, reduce errors, and increase overall productivity.

End User Analysis

In 2023, the Food & Beverage Manufacturers segment held a dominant market position in the AI in Foodtech market, capturing more than a 55.4% share. This segment’s leading position can be attributed to several factors. Food & Beverage Manufacturers are increasingly adopting AI technology to improve their production processes, enhance product quality, and optimize resource allocation.

AI algorithms help in analyzing large volumes of data related to ingredients, recipes, and production techniques to identify opportunities for process optimization, reduce waste, and ensure consistent quality standards. By leveraging AI in areas such as predictive maintenance, inventory management, and quality control, Food & Beverage Manufacturers can streamline their operations, reduce costs, and deliver food products that meet consumer expectations.

Moreover, the Food & Beverage Manufacturers segment benefits from the growing consumer demand for transparency and traceability in the food supply chain. AI technology allows manufacturers to track and monitor the movement of ingredients and products throughout the production process, ensuring compliance with safety and regulatory standards. This transparency builds trust among consumers and helps manufacturers meet the increasing need for food safety and quality assurance.

Additionally, the Food & Beverage Manufacturers segment leverages AI in product development and innovation. AI-powered systems can analyze consumer preferences, market trends, and nutritional data to identify new product opportunities. This enables manufacturers to develop tailored and innovative food products that cater to specific consumer segments. AI algorithms can also assist in recipe optimization, suggesting ingredient substitutions or modifications to meet dietary preferences or regulatory requirements.

Key Market Segments

By Component

- Solution

- Services

By Application

- Food Production & Processing

- Product Development and Innovation

- Supply Chain Management

- Food Safety and Compliance

- Other Applications

By End-User

- Food & Beverage Manufacturers

- Restaurants & Food Service Providers

- Other End-Users

Driver

Improved Operational Efficiency and Cost Reduction

The integration of AI in the foodtech industry has significantly enhanced operational efficiency and reduced costs. AI technologies enable automation of repetitive tasks, optimization of production processes, and improved supply chain management. For instance, AI-driven predictive analytics helps in accurate demand forecasting, reducing overproduction and minimizing waste.

Quality control systems powered by AI ensure consistent product quality, further enhancing efficiency. These advancements are crucial for maintaining competitiveness in the food and beverage industry, driving the adoption of AI technologies.

Restraint

High Initial Investment Costs

One of the major barriers to the widespread adoption of AI in the foodtech sector is the high initial investment required. Implementing AI solutions involves substantial costs related to hardware, software, and infrastructure.

Additionally, there are expenses associated with training personnel and integrating these advanced systems into existing operations. These high costs can be particularly prohibitive for small and medium-sized enterprises (SMEs), which may lack the financial resources to invest in such technologies. The economic feasibility of large-scale deployment remains a significant challenge.

Opportunity

Increasing Demand for Personalized Food Products

The rising demand for personalized food products presents a significant opportunity for the AI in foodtech market. Consumers are increasingly seeking customized food options that cater to their specific dietary preferences and health needs.

AI technologies can analyze consumer data to develop personalized meal plans, recommend products, and even create bespoke recipes. This level of personalization not only enhances customer satisfaction but also opens new revenue streams for food manufacturers and service providers. As consumer preferences continue to evolve, leveraging AI for personalization will become increasingly important.

Challenge

Data Privacy and Cybersecurity Concerns

The implementation of AI in foodtech involves handling vast amounts of sensitive data, raising concerns about data privacy and cybersecurity. Ensuring the protection of consumer data and safeguarding against cyber threats is a significant challenge. AI systems must comply with stringent data protection regulations, and any breach can lead to severe legal and financial repercussions.

Additionally, the complexity of AI algorithms and the need for skilled professionals to manage these systems add to the challenge. Addressing these concerns is crucial for the successful adoption and trust in AI technologies within the foodtech industry.

Growth Factors

- Increasing Demand for Automation and Efficiency: AI technologies streamline food production, processing, and distribution, reducing labour costs and minimizing human error while enhancing overall operational efficiency.

- Rising Consumer Demand for Personalized Nutrition: AI enables the analysis of individual health data and dietary preferences, allowing for the development of customized nutrition plans and products tailored to specific consumer needs.

- Advancements in AI and Machine Learning: Continuous improvements in AI algorithms and machine learning models enhance the capabilities of AI solutions, making them more effective and accessible for various Foodtech applications.

- Growing Focus on Food Safety and Compliance: AI-driven quality control systems and predictive analytics ensure higher standards of food safety and compliance with regulatory requirements, reducing the risk of contamination and recalls.

- Expansion of Cloud-Based AI Solutions: Cloud-based AI platforms offer scalable, flexible, and cost-effective solutions that make advanced AI technologies accessible to small and medium-sized enterprises (SMEs) in the food industry.

- Enhanced Supply Chain Management: AI optimizes supply chain operations by predicting demand, managing inventory, and improving logistics, leading to reduced waste and increased efficiency.

Latest Trends

- AI-Powered Food Safety and Quality Control: Adoption of AI for real-time monitoring and inspection to ensure food safety and quality, reducing contamination risks and product recalls.

- Personalized Nutrition and Meal Planning: Increasing use of AI to provide tailored dietary recommendations and meal plans based on individual health data, lifestyle, and preferences.

- Smart Farming and Precision Agriculture: Utilization of AI and IoT for precision agriculture, optimizing crop yields, reducing waste, and improving resource management in farming.

- Predictive Analytics for Demand Forecasting: AI-driven predictive analytics to accurately forecast consumer demand, streamline inventory management, and minimize food waste.

- AI-Enhanced Supply Chain Optimization: Implementation of AI to improve supply chain efficiency, from sourcing and logistics to delivery, ensuring timely and cost-effective operations.

- Robotics and Automation in Food Processing: Increased use of AI-powered robots and automation in food processing and packaging to enhance efficiency and reduce labor costs.

- AI in Product Development and Innovation: Leveraging AI to analyze consumer trends and preferences, facilitating the development of innovative food products that meet market demands.

Regional Analysis

In 2023, North America held a dominant market position in the AI in Foodtech market, capturing more than a 38.5% share with revenue reaching approximately USD 1.8 billion. This leadership can be attributed to several pivotal factors. Firstly, the region boasts a robust technological infrastructure, which facilitates the adoption and integration of advanced AI solutions across the food technology sector.

Furthermore, North America is home to a significant number of leading AI technology developers and foodtech startups, which drive innovation and implementation in this field. The presence of global tech giants and innovative startups in Silicon Valley and other tech hubs across the U.S. and Canada accelerates the regional advancements in AI applications within the food industry.

These companies are at the forefront of developing AI solutions that enhance food processing, supply chain management, and consumer engagement through personalized experiences. Moreover, the regulatory environment in North America generally supports technological innovation, with policies that encourage digital transformation in various industries, including food and beverages.

Additionally, the high consumer demand for convenience, efficiency, and sustainability in food consumption further propels the adoption of AI technologies. North American consumers are increasingly favoring tech-driven solutions for food delivery, dietary planning, and sustainable eating practices, which are well-supported by AI-driven platforms.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI in Foodtech market is marked by the presence of several key players who are driving innovation and technological advancements within the industry. Leading the charge is IBM Corporation, known for its robust AI solutions that enhance food safety, quality, and supply chain efficiency.

Similarly, Microsoft Corporation leverages its Azure platform to offer AI-powered tools for food production and distribution, fostering a more sustainable and efficient food supply chain. Oracle Corporation’s AI-driven applications streamline food inventory management and predictive analytics, enabling better decision-making in food businesses.

TOMRA Systems ASA stands out with its AI-integrated sorting and processing technologies, significantly reducing food waste and improving quality control. SAP SE, with its extensive ERP systems, incorporates AI to optimize food production processes and supply chain logistics.

NVIDIA Corporation, a leader in AI hardware and software, provides advanced computational capabilities that are crucial for developing AI models in foodtech applications. Blue Yonder Group, Inc. offers AI-driven supply chain management solutions that enhance forecasting accuracy and inventory management in the food industry.

Agilent Technologies, Inc. is notable for its AI applications in food safety testing and quality assurance, while Analytical Flavor Systems, Inc. uses AI to predict and optimize flavor profiles, ensuring consistent product quality and consumer satisfaction. These companies, along with other key players, are at the forefront of integrating AI into various aspects of the foodtech industry, driving efficiencies, reducing waste, and improving overall food safety and quality.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- TOMRA Systems ASA

- SAP SE

- NVIDIA Corporation

- ai, Inc.

- Blue Yonder Group, Inc.

- Agilent Technologies, Inc.

- Analytical Flavor Systems, Inc.

- Other Key Players

Recent Developments

- In March 2023, Microsoft completed its acquisition of Nuance Communications, enhancing its AI capabilities in healthcare, a significant development for its AI applications in Foodtech, particularly in dietary and nutritional analysis.

- Oracle introduced several AI-driven applications in their cloud infrastructure, focusing on improving supply chain management and operational efficiencies in the food and beverage sector throughout 2023.

- TOMRA Systems has been advancing its AI technologies in food sorting and recycling. In October 2023, they launched an upgraded AI-driven sorting system aimed at reducing food waste and improving recycling efficiency.

- NVIDIA has been actively promoting its AI platforms for accelerating computing tasks. In August 2023, they introduced the NVIDIA AI Enterprise suite, which includes tools for enhancing AI capabilities in food production and safety monitoring.

- Agilent has integrated AI into its laboratory instruments for food testing, launched in September 2023, to improve accuracy and efficiency in detecting food contaminants.

Report Scope

Report Features Description Market Value (2023) USD 4.8 Bn Forecast Revenue (2033) USD 62.7 Bn CAGR (2024-2033) 29% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered by Component (Solution, Services), by Application (Food Production & Processing, Product Development and Innovation, Supply Chain Management, Food Safety and Compliance, Other Applications), by End-User (Food & Beverage Manufacturers, Restaurants & Food Service Providers, Other End-Users) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Oracle Corporation, TOMRA Systems ASA, SAP SE, NVIDIA Corporation, C3.ai, Inc., Blue Yonder Group, Inc., Agilent Technologies, Inc., Analytical Flavor Systems, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is AI In Foodtech Market?The Global AI In Foodtech Market size is expected to be worth around USD 62.7 Billion By 2033, from USD 4.8 Billion in 2023, growing at a CAGR of 29.3% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the AI in Foodtech market?The AI in Foodtech market is driven by increased automation demand, improved food safety, supply chain optimization, personalized nutrition, and advancements in machine learning and data analytics.

What are the current trends and advancements in AI In Foodtech Market?Current trends include AI integration with IoT, AI for inventory management, AI-powered customer service chatbots, AI in food sorting and grading, and advancements in AI algorithms for safety and quality control.

What are the major challenges and opportunities in the AI In Foodtech Market?Major challenges include high initial costs, data privacy concerns, and the need for skilled personnel. Opportunities lie in sustainable food production, reducing food waste, and increasing demand for supply chain transparency.

Who are the leading players in the AI in Foodtech market?Leading players include IBM Corporation, Microsoft Corporation, Oracle Corporation, TOMRA Systems ASA, SAP SE, NVIDIA Corporation, C3.ai, Inc., Blue Yonder Group, Inc., Agilent Technologies, Inc., Analytical Flavor Systems, Inc., Other Key Players

-

-

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- TOMRA Systems ASA

- SAP SE

- NVIDIA Corporation

- ai, Inc.

- Blue Yonder Group, Inc.

- Agilent Technologies, Inc.

- Analytical Flavor Systems, Inc.

- Other Key Players