Global AI In Fintech Market By Component (Solution, Services), Deployment Mode (Cloud-Based, On-Premise), By Application (Fraud Detection, Analytics & Reporting, Customer Service & Engagement, Risk Assessment, Customer Behavioural Analytics, Other Applications), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 115628

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

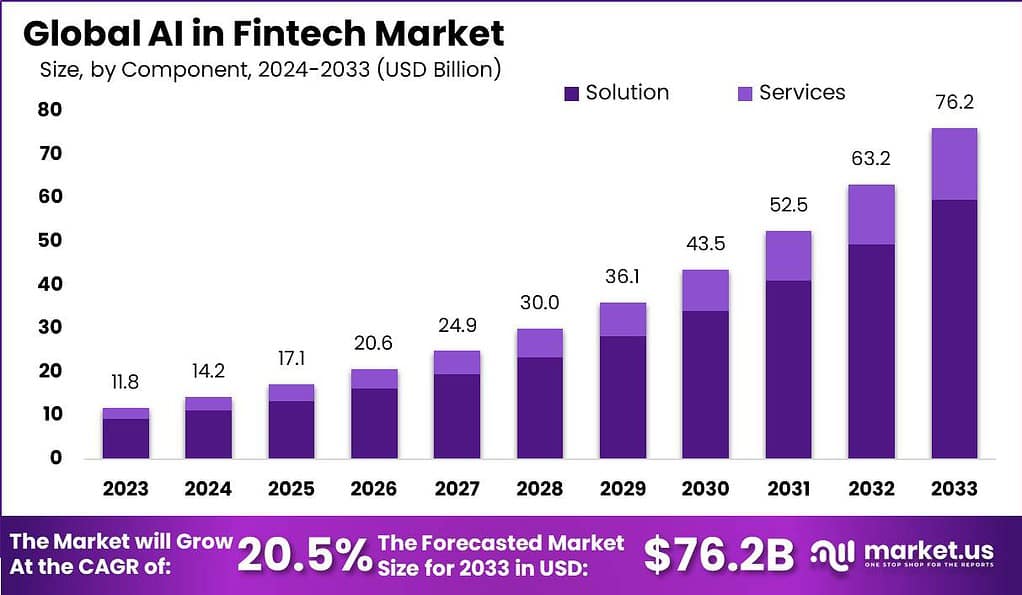

The Global AI In Fintech Market size is expected to be worth around USD 76.2 Billion by 2033, from USD 11.8 Billion in 2023, growing at a CAGR of 20.5% during the forecast period from 2024 to 2033.

AI (Artificial Intelligence) in fintech refers to the application of AI technologies and techniques in the financial technology industry to enhance financial services, improve decision-making, and drive innovation. AI is used in various aspects of fintech, including customer service, fraud detection, risk assessment, investment management, and compliance.

The AI in fintech market is experiencing substantial growth as the financial industry recognizes the transformative potential of AI. Factors driving this growth include the increasing digitalization of financial services, the need for advanced analytics and data-driven decision-making, the rise of fintech startups, and advancements in AI technologies such as machine learning and natural language processing.

The adoption of Artificial Intelligence (AI) and machine learning in the financial services sector has gained significant momentum. According to a 2022 survey conducted by Finastra, an overwhelming 92% of financial services firms are currently investing in AI and machine learning technologies. This indicates a strong interest and commitment to leverage AI for various applications within the industry.

The top use cases for AI in financial services, as identified by the survey, include risk analytics, predictive modeling, and trade analytics. These applications are seen as crucial for improving decision-making, managing risks effectively, and optimizing business processes. The findings of a report by Cognizant further support this, with 86% of bankers stating that AI helps them make better decisions, and 83% affirming that AI improves business processes.

The adoption of specific AI applications within the banking sector is also highlighted in a survey conducted by the American Bankers Association (ABA). The survey reveals that chatbots, utilized by 78% of banks, are the most widely adopted AI application. Other prominent applications include fraud analysis (67%) and anti-money laundering (63%). These AI-driven solutions are instrumental in enhancing customer service, detecting and preventing fraudulent activities, and ensuring regulatory compliance.

The impact of AI is not limited to traditional financial institutions. Fintech startups are actively integrating AI into their offerings. According to Accenture, 28% of fintech startups consider AI a core component of their business, compared to only 12% of non-fintech startups. This indicates that AI is seen as a crucial competitive advantage within the fintech industry, enabling startups to deliver innovative and efficient financial services.

Investment in AI-focused fintech companies demonstrates the market’s confidence and support for these technologies. In 2023 alone, more than $10 billion was invested in AI-focused fintech companies, as reported by industry sources. This substantial investment highlights the industry’s recognition of the potential and value that AI brings to the financial services sector.

The year 2024 witnessed noteworthy funding rounds in the AI fintech space. For instance, MANTL, an AI-powered insurance platform, raised $100 million in funding, demonstrating investor confidence in AI-driven solutions for the insurance sector. Similarly, Pontera, a provider of AI-driven wealth management solutions, secured $70 million in funding. These funding rounds signify continued investor interest and support for AI in the financial services industry.

Key Takeaways

- The AI in Fintech market is poised for significant expansion, estimated to reach USD 76.2 billion by 2033.

- Investments in AI-focused fintech companies exceeded $10 billion in 2023 alone, underscoring market confidence and support for AI technologies.

- In 2023, the Solution segment emerged as the dominant player in the AI in Fintech market, capturing a significant market share of over 78.3%.

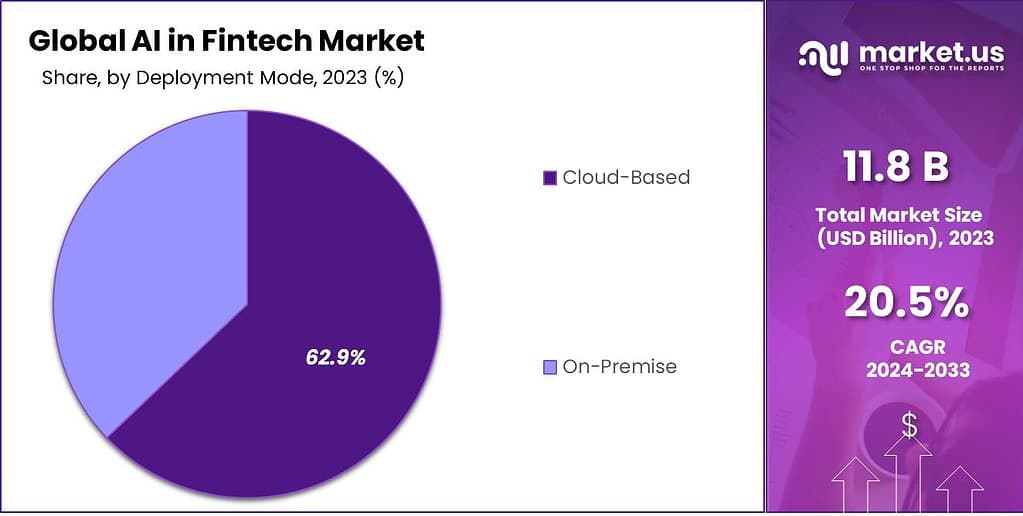

- In 2023, the Cloud-Based segment established a dominant market position in the AI in Fintech market, capturing a significant share of over 62.9%.

- In 2023, the Analytics & Reporting segment emerged as the dominant player in the AI in Fintech market, capturing a significant market share of over 30.7%.

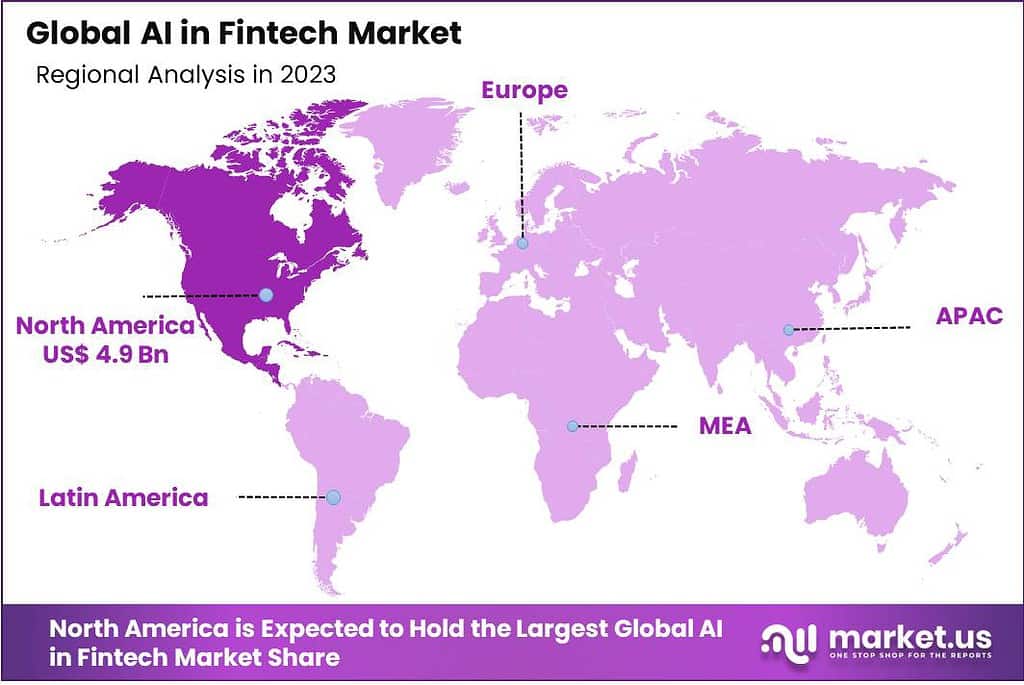

- North America leads the AI in fintech market, capturing over 41.5% of the global market share in 2023.

Component Analysis

In 2023, the Solution segment emerged as the dominant player in the AI in Fintech market, capturing a significant market share of over 78.3%. This segment encompasses a wide range of AI-based software and platforms specifically designed to address the unique needs and challenges of the financial industry.

The Solution segment’s leadership can be attributed to several key factors. Firstly, AI-powered solutions offer advanced data analytics capabilities, enabling financial institutions to analyze vast amounts of data quickly and accurately. This helps them uncover valuable insights, identify patterns, and make data-driven decisions, thereby enhancing operational efficiency and risk management.

Additionally, AI solutions in Fintech assist in automating manual processes, streamlining workflows, and reducing human errors. The integration of machine learning algorithms and natural language processing enables automated document processing, fraud detection, and customer support, resulting in improved customer experiences and reduced operational costs.

Furthermore, the Solution segment’s growth is fueled by the increasing demand for personalized financial services. AI-powered solutions can analyze customer data, predict individual preferences, and offer tailored recommendations, such as personalized investment advice, customized insurance plans, or targeted marketing campaigns. This level of personalization enhances customer engagement, satisfaction, and loyalty.

Moreover, the Solution segment is expected to maintain its leading position in the coming years due to ongoing advancements in AI technologies, including deep learning, natural language processing, and predictive analytics. These advancements will further empower financial institutions to optimize their decision-making processes, develop innovative products and services, and stay ahead in a highly competitive market.

Deployment Mode Analysis

In 2023, the Cloud-Based segment established a dominant market position in the AI in Fintech market, capturing a significant share of over 62.9%. This segment refers to the deployment of AI solutions on cloud platforms, where the software and data are hosted and managed remotely by third-party providers.

The Cloud-Based segment’s leadership can be attributed to several key factors. Firstly, cloud-based deployment offers scalability and flexibility, allowing financial institutions to easily access and deploy AI solutions as per their requirements. This eliminates the need for extensive infrastructure investments, hardware maintenance, and software updates, resulting in cost savings and operational efficiency.

Furthermore, cloud-based AI solutions enable real-time data processing and analysis, which is crucial in the fast-paced financial industry. Financial institutions can leverage the power of cloud computing to handle large volumes of data, perform complex computations, and generate actionable insights more quickly and efficiently. This empowers them to make data-driven decisions promptly, respond to market trends, and gain a competitive edge.

Additionally, the Cloud-Based segment offers enhanced collaboration and accessibility. Cloud platforms enable seamless integration with existing systems, facilitating data sharing and communication across different departments and locations. This promotes collaboration, improves workflow efficiency, and supports remote work capabilities, which have become increasingly important in today’s digital and remote-oriented business environment.

Moreover, the Cloud-Based segment’s growth is driven by the increasing adoption of Software-as-a-Service (SaaS) models in the financial industry. SaaS-based AI solutions provided through the cloud offer affordability, ease of implementation, and continuous updates, making them attractive options for financial institutions of all sizes.

Application Analysis

In 2023, the Analytics & Reporting segment emerged as the dominant player in the AI in Fintech market, capturing a significant market share of over 30.7%. This segment focuses on leveraging AI technologies to analyze financial data, generate accurate reports, and extract valuable insights for financial institutions.

The leading position of the Analytics & Reporting segment can be attributed to several key factors. Firstly, AI-powered analytics and reporting solutions enable financial institutions to process vast amounts of data quickly and accurately. Machine learning algorithms and data mining techniques can identify patterns, trends, and anomalies in financial data, providing valuable insights for decision-making and risk management.

Moreover, advanced reporting capabilities offered by AI solutions allow financial institutions to generate comprehensive and customized reports in real-time. These reports provide a holistic view of financial data, helping stakeholders gain a deeper understanding of the market, performance metrics, and customer behaviors. This enables more informed decision-making, improved strategic planning, and enhanced regulatory compliance.

Furthermore, the Analytics & Reporting segment addresses the growing need for data-driven insights in the financial industry. Financial institutions are increasingly relying on AI-powered analytics to identify potential risks, detect fraud, and optimize operational processes. By leveraging AI algorithms, financial institutions can uncover hidden patterns and anomalies in data, enabling proactive risk mitigation and fraud prevention.

Additionally, the Analytics & Reporting segment’s leadership is driven by the increasing demand for regulatory compliance and transparency in the financial industry. AI-powered reporting solutions can automate compliance reporting, ensure accuracy, and facilitate adherence to regulatory standards. This helps financial institutions meet regulatory requirements more efficiently, reducing manual efforts and potential errors.

Key Market Segments

Component

- Solution

- Services

Deployment Mode

- Cloud-Based

- On-Premise

Application

- Fraud Detection

- Analytics & Reporting

- Customer Service & Engagement

- Risk Assessment

- Customer Behavioural Analytics

- Other Applications

Driver

Advancements in Machine Learning Algorithms

Advancements in machine learning algorithms have been a significant driver in the AI in Fintech market. These advancements have revolutionized data processing and analysis, enabling financial institutions to extract valuable insights from vast amounts of data.

Machine learning algorithms can identify patterns, trends, and anomalies in financial data with greater accuracy and speed, empowering financial institutions to make data-driven decisions, optimize operational processes, and enhance risk management strategies. The continuous development and refinement of machine learning algorithms are driving innovation and pushing the boundaries of what AI can accomplish in the financial industry.

Restraint

Regulatory Compliance and Security Concerns

While AI presents numerous opportunities, regulatory compliance and security concerns act as restraints in the AI in Fintech market. Financial institutions operate in a highly regulated environment, and integrating AI solutions requires adherence to stringent regulatory frameworks. Ensuring compliance with regulations such as data privacy laws, anti-money laundering (AML) regulations, and consumer protection laws can be complex and time-consuming.

Additionally, security concerns related to data breaches and cyber threats raise skepticism and caution among financial institutions, impeding the rapid adoption of AI in the industry. Addressing these compliance and security challenges is crucial to build trust, foster widespread adoption, and unlock the full potential of AI in Fintech.

Opportunity

Enhanced Personalization and Customer Experience

One of the significant opportunities in the AI in Fintech market is the ability to deliver enhanced personalization and customer experiences. AI-powered solutions can analyze vast amounts of customer data, including transaction history, preferences, and behaviors, to generate personalized recommendations and tailored financial products.

This level of personalization enables financial institutions to offer customized investment advice, personalized insurance plans, and targeted marketing campaigns. By leveraging AI, financial institutions can exceed customer expectations, improve customer satisfaction, and foster long-term customer loyalty. The opportunity to create personalized experiences that cater to individual customer needs is a key driver for the adoption of AI in the financial industry.

Challenge

Data Privacy and Ethical Considerations

A significant challenge in the AI in Fintech market revolves around data privacy and ethical considerations. The collection and processing of large amounts of personal and financial data raise concerns about data privacy and protection. Financial institutions must navigate stringent data privacy regulations and ensure that customer data is handled securely and ethically. Transparency in data usage, obtaining informed consent, and implementing robust security measures are crucial to address these challenges.

Additionally, ethical considerations such as algorithmic bias and the responsible use of AI in decision-making processes pose challenges that need to be carefully addressed. Striking the right balance between innovation and ethical practices is a critical challenge for the AI in Fintech market to gain widespread acceptance and trust from customers and regulators alike.

Regional Analysis

In 2023, North America held a dominant market position in the AI in fintech sector, capturing more than a 41.5% share of the global market. The demand for AI In Fintech in North America was valued at US$ 4.9 billion in 2023 and is anticipated to grow significantly in the forecast period.

Several factors contribute to North America’s dominant position in this market. Firstly, North America is home to several prominent financial institutions and technology companies that are at the forefront of AI adoption in the financial industry. The region boasts a mature fintech ecosystem, with established players and a strong focus on innovation. North American financial institutions have been early adopters of AI technologies, leveraging machine learning, natural language processing, and predictive analytics to drive operational efficiency, enhance risk management, and improve customer experiences.

Moreover, North America has a robust technological infrastructure and advanced research capabilities, providing a conducive environment for AI development. The region has a significant pool of AI talent, including researchers, data scientists, and developers, who contribute to the advancement of AI applications in fintech. The presence of leading academic institutions, research centers, and technology hubs further fosters innovation and collaboration in the AI in Fintech market.

Additionally, North America benefits from favorable regulatory frameworks and supportive government initiatives that encourage AI adoption in the financial industry. Regulatory bodies in the region have been proactive in addressing the challenges associated with AI, promoting responsible AI practices, and ensuring consumer protection. This regulatory environment provides financial institutions with clarity and confidence in deploying AI solutions, further driving market growth.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In analyzing the key players in the AI in fintech market, several prominent companies stand out for their innovative contributions and market influence. IBM Corporation, a longstanding leader in technology solutions, offers a comprehensive suite of AI-powered tools and platforms tailored for the financial services industry. With a focus on cognitive computing and data analytics, IBM empowers financial institutions to enhance customer experiences, mitigate risks, and drive operational efficiency through AI-driven insights.

Microsoft Corporation is another major player leveraging its Azure cloud platform and AI capabilities to deliver scalable and secure solutions for fintech applications. Through offerings such as Azure Machine Learning and Azure Cognitive Services, Microsoft enables financial organizations to harness the power of AI for predictive analytics, fraud detection, and personalized customer experiences.

Top Market Leaders

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Nuance Communications, Inc.

- Axyon AI

- ForwardLane

- Salesforce, Inc.

- SAS Institute Inc.

- Mastercard Inc

- Inbenta Technologies Inc.

- Amelia.ai

- Other Key Players

Recent Developments

1. Amazon Web Services (AWS):

- February 2023: Launched Amazon Fraud Detector, a machine learning-based service for fraud prevention in financial transactions.

- June 2023: Announced a partnership with Visa to leverage AI and cloud computing for risk management and fraud detection solutions.

2. Nuance Communications, Inc.:

- March 2023: Acquired Cerence, a leading provider of AI-powered voice and language solutions, aiming to strengthen its AI capabilities for financial institutions.

- July 2023: Launched Dragon Voice Banking, an AI-powered conversational platform for personalized banking experiences.

3. Axyon AI:

- May 2023: Secured $20 million in Series A funding to expand its AI-driven platform for regulatory compliance and risk management in financial services.

- October 2023: Partnered with HSBC to utilize Axyon’s AI for anti-money laundering (AML) compliance and fraud detection.

Report Scope

Report Features Description Market Value (2023) US$ 11.8 Bn Forecast Revenue (2033) US$ 76.2 Bn CAGR (2024-2033) 20.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), Deployment Mode (Cloud-Based, On-Premise), By Application (Fraud Detection, Analytics & Reporting, Customer Service & Engagement, Risk Assessment, Customer Behavioural Analytics, Other Applications) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services Inc., Nuance Communications Inc., Axyon AI, ForwardLane, Salesforce Inc., SAS Institute Inc., Mastercard Inc, Inbenta Technologies Inc., Amelia.ai, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the AI in Fintech Market?The AI in Fintech Market refers to the integration of artificial intelligence technologies within the financial technology sector to enhance efficiency, accuracy, and customer experience in financial services.

How big is AI In Fintech Market?The Global AI In Fintech Market size is expected to be worth around USD 76.2 Billion by 2033, from USD 11.8 Billion in 2023, growing at a CAGR of 20.5% during the forecast period from 2024 to 2033.

Who are the key players in AI in Fintech Market?IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services Inc., Nuance Communications Inc., Axyon AI, ForwardLane, Salesforce Inc., SAS Institute Inc., Mastercard Inc, Inbenta Technologies Inc., Amelia.ai, Other Key Players

Which region has the biggest share in AI in Fintech Market?In 2023, North America held a dominant market position in the AI in fintech sector, capturing more than a 41.5% share of the global market.

What are the key drivers of growth in the AI in Fintech Market?Key drivers include the increasing demand for automation, the need for improved fraud detection and prevention, the rise of digital banking, and the growing adoption of AI-powered chatbots and virtual assistants.

What are the major challenges facing the AI in Fintech Market?Challenges include data privacy concerns, regulatory compliance, the need for skilled AI talent, and the potential for algorithmic biases.

What are some notable AI technologies used in Fintech?Notable technologies include machine learning, natural language processing, robotic process automation, predictive analytics, and blockchain.

-

-

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services, Inc.

- Nuance Communications, Inc.

- Axyon AI

- ForwardLane

- Salesforce, Inc.

- SAS Institute Inc.

- Mastercard Inc

- Inbenta Technologies Inc.

- Amelia.ai

- Other Key Players