Global AI in Enterprise Accounting Market By Component (Software, Services), By Deployment (Cloud-Based, On-premise), By Enterprise Size (Large Enterprise, Small and Medium Enterprise (SME)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 130470

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

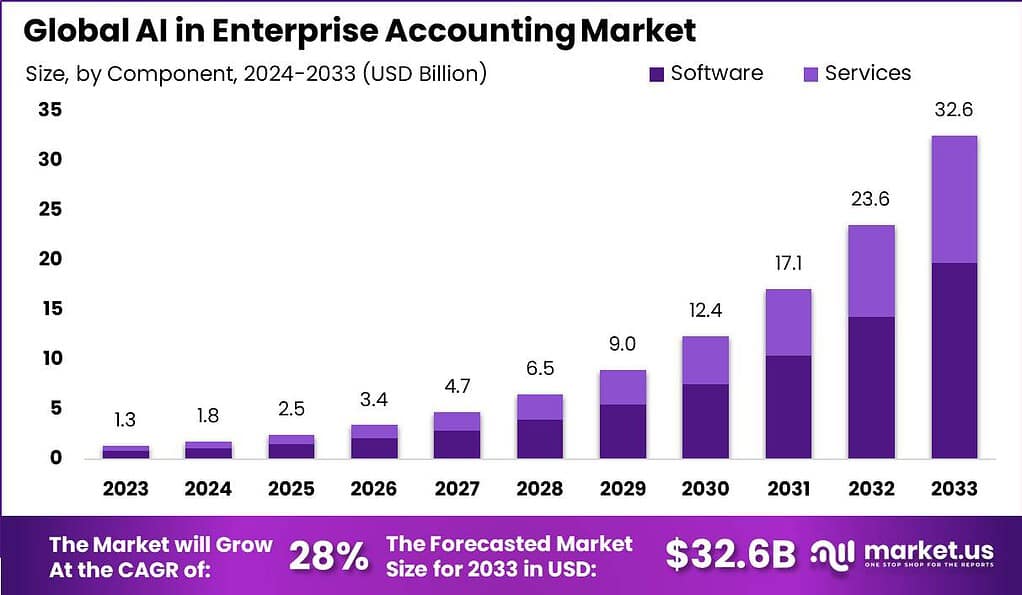

The Global AI in Enterprise Accounting Market size is expected to be worth around USD 32.6 Billion By 2033, from USD 1.3 Billion in 2023, growing at a CAGR of 28% during the forecast period from 2024 to 2033.

AI in enterprise accounting refers to the integration of artificial intelligence technologies into accounting systems to streamline and enhance financial processes within businesses. AI tools in accounting help automate repetitive tasks such as data entry, invoice processing, and reconciliations. They also provide advanced analytics capabilities, enabling companies to generate insights from their financial data more quickly and accurately.

The market for AI in enterprise accounting is growing rapidly as businesses seek to improve efficiency and accuracy in their financial operations. This market expansion is driven by the increasing demand for automated financial processes and the need for enhanced data accuracy, which AI technologies can provide. Companies across various sectors are adopting AI accounting solutions to reduce human error and make real-time decisions based on accurate financial insights.

The growth of AI in enterprise accounting is propelled by several factors. First, there’s an increasing need for automation to handle high volumes of data and complex transactions efficiently. Additionally, as regulatory requirements become more stringent, AI helps ensure compliance and accuracy in financial reporting. Companies are also looking for ways to reduce operational costs, and AI provides an effective solution by automating routine tasks and freeing up employees for higher-value work.

There’s a significant demand in the market for AI-driven accounting solutions. This demand stems from businesses of all sizes seeking ways to improve the speed and accuracy of their financial operations. With AI, companies can quickly analyze vast amounts of financial data to make informed decisions, predict future trends, and maintain competitiveness in their respective industries. This ability to enhance decision-making and operational efficiency is a major draw for many enterprises.

AI in enterprise accounting has become increasingly popular among companies seeking to gain a competitive edge. Its ability to streamline financial processes and provide detailed analytics has made it a favored choice in the tech-forward business environment. The technology’s popularity is further fueled by its success stories and case studies that demonstrate significant cost savings and improved financial management.

The market for AI in enterprise accounting is ripe with opportunities. There’s a growing trend towards cloud-based solutions, which are more scalable and accessible to businesses without the infrastructure for on-premise systems. Innovations in AI are also creating opportunities for deeper integrations into various accounting software, offering more tailored solutions that meet specific industry needs. Additionally, as more businesses recognize the benefits of AI, there is an expanding market for consulting and managed services to help implement and manage these AI solutions.

The market is set to expand as AI technology advances and becomes more integrated into general business practices. Expansion is also expected as AI solutions become more user-friendly and less expensive, making them accessible to a broader range of businesses, including small and medium-sized enterprises. Moreover, as industries worldwide increasingly digitize their operations, the demand for intelligent accounting solutions is likely to surge, pushing the market to new heights.

According to Market.us, the Global AI in Accounting Market size is expected to reach USD 88.2 billion by 2033, up from USD 2.8 billion in 2023, growing at a CAGR of 41.2% during the forecast period from 2024 to 2033. This significant growth reflects the increasing adoption of AI technologies to streamline accounting processes, enhance financial accuracy, and mitigate risks.

Based on data from Virtasant, the average cost of an accounting data breach has surged to $4.45 million, making security a pressing concern. However, AI-driven solutions are playing a pivotal role in strengthening security measures and preventing such breaches.

AI automation enables finance teams to shift more than 40% of their efforts toward value-driven activities, including financial analysis and strategic planning. Notable companies have already benefited from AI: Danske Bank saw a 60% reduction in false fraud alerts, Ernst & Young achieved 70-80% automation in lease reviews, and Legendary Entertainment improved accuracy in financial management.

Further insights from zipdo reveal that 75% of finance leaders believe automation in accounting can save at least 240 hours per year, with 67% of accounting professionals recognizing AI’s potential to significantly impact the profession within the next five years. By 2025, the financial services sector could save up to $1 trillion through AI adoption.

Additionally, more than 50% of finance professionals believe that AI will enhance financial insights and improve reporting accuracy, while over 80% of accounting tasks could be automated using AI. AI-powered tools are expected to reduce the time spent on data entry by up to 76%.

Key Takeaways

- The Global AI in Enterprise Accounting Market is projected to reach USD 32.6 billion by 2033, growing significantly from USD 1.3 billion in 2023. This reflects a robust CAGR of 28% during the forecast period from 2024 to 2033, driven by increasing demand for automation in financial processes and enhanced data analytics in accounting functions.

- In terms of components, the software segment held a dominant position, accounting for 60.7% of the market share in 2023. This leadership is attributed to the growing need for sophisticated AI-powered accounting software solutions that streamline financial management.

- When considering deployment types, the cloud-based segment led the market with a significant 75% share in 2023, due to the rising preference for cloud solutions that offer flexibility, scalability, and cost-effectiveness for businesses of all sizes.

- Based on enterprise size, large enterprises captured 70.4% of the market in 2023, as these organizations are investing heavily in AI-driven technologies to optimize their accounting operations and improve decision-making processes.

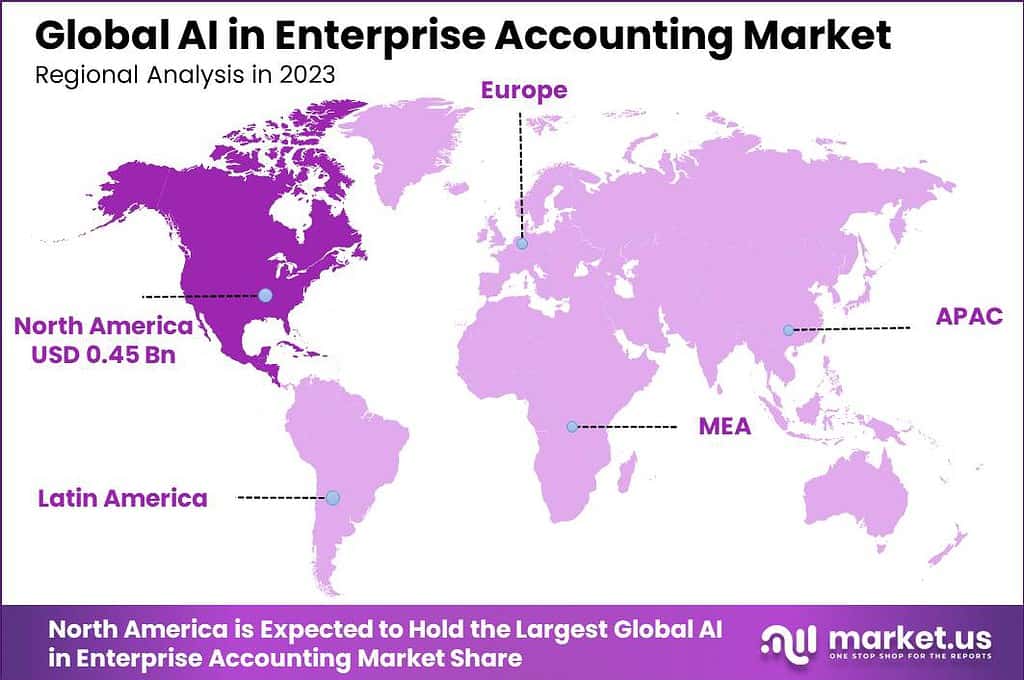

- Regionally, North America emerged as the leading market, holding a 35.3% share in 2023, driven by early adoption of AI technologies and the presence of key market players in the region.

Component Analysis

In 2023, the Software segment held a dominant market position within the AI in Enterprise Accounting Market, capturing more than a 60.7% share. This leadership is primarily attributed to the growing recognition of the advantages that AI-powered software brings to financial operations.

Enterprises are increasingly relying on AI software to streamline their accounting processes, reduce errors, and enhance accuracy. The adoption of these tools allows companies to automate routine tasks such as data entry, invoicing, and compliance checks, which significantly frees up valuable human resources for more strategic activities.

Moreover, AI software in accounting has evolved to offer predictive analytics and insights that go beyond traditional accounting functions. These capabilities enable businesses to forecast financial trends, optimize budgets, and make informed decisions that contribute to long-term profitability and stability. The ability of AI software to provide real-time financial data and analytics is a game-changer for businesses seeking agility in a competitive market landscape.

Another factor contributing to the dominance of the software segment is the integration of AI with cloud-based accounting solutions. This combination offers scalability and accessibility, allowing businesses of all sizes to implement advanced accounting solutions without substantial upfront investment. Cloud-based AI accounting software also offers enhanced security features, which is critical given the sensitivity of financial data. This aspect is particularly appealing to enterprises that prioritize data security amidst rising cyber threats.

The trend towards digital transformation in finance further boosts the software segment’s lead. As companies modernize their operations, the shift from manual accounting practices to automated, AI-driven processes is seen as essential for staying relevant and competitive. This digital shift is not just a matter of operational efficiency but also a strategic alignment with evolving technological landscapes, where agility and data-driven decision-making are key to success.

Deployment Analysis

In 2023, the cloud-based segment held a dominant market position within the AI in Enterprise Accounting Market, capturing more than a 75% share. This prominence is largely due to the segment’s ability to provide scalable and flexible financial solutions that can adapt to varying business needs. Cloud-based AI accounting solutions allow enterprises to manage their financial tasks more efficiently without the need for significant hardware investments, which appeals to businesses looking to minimize costs while maximizing functionality.

Additionally, the cloud-based approach offers superior accessibility compared to on-premise solutions. With financial data and systems accessible from anywhere at any time, businesses can ensure continuous operations and real-time financial monitoring, which is vital for making quick and informed decisions. This level of accessibility is particularly beneficial for organizations with remote teams or multiple locations, ensuring that all units can access consistent information and tools regardless of their physical location.

Security enhancements provided by cloud vendors are another key factor contributing to the dominance of this segment. As financial data security remains a top priority for enterprises, cloud vendors have strengthened their platforms with advanced security measures like encryption, multi-factor authentication, and regular security audits. These features help mitigate risks associated with data breaches and unauthorized access, making cloud-based solutions an attractive choice for enterprises concerned about data integrity.

The shift towards digital transformation in accounting practices also plays a crucial role in the popularity of cloud-based AI solutions. As enterprises seek to leverage new technologies to enhance their competitive edge, cloud-based platforms offer an agile and innovative environment that supports continuous improvement and integration with other business functions.

Enterprise size Analysis

In 2023, the Large Enterprises segment held a dominant market position within the AI in Enterprise Accounting Market, capturing more than a 70.4% share. This leadership is primarily due to large enterprises’ capacity to invest in advanced AI technologies, which are often cost-prohibitive for smaller businesses.

These larger organizations typically possess the necessary financial resources to implement sophisticated AI solutions that streamline complex accounting processes, enhance accuracy, and improve financial reporting and compliance. Moreover, large enterprises tend to have more complex financial operations and transactions, necessitating robust accounting solutions that can handle large volumes of data with precision.

AI enhances these capabilities by enabling real-time data processing and analysis, which is crucial for large organizations seeking to maintain agility and compliance in a dynamic business environment. The ability of AI to integrate with other enterprise systems, such as ERP and CRM, also makes it particularly valuable for large enterprises that rely on a seamless flow of information across departments.

The scalability of AI solutions further explains their popularity among large enterprises. As these organizations grow, their accounting needs become more intricate, requiring scalable solutions that can adapt without significant additional investments. AI-driven systems offer this scalability, allowing large enterprises to expand their operations while maintaining control over their financial processes without the need for extensive system overhauls.

Additionally, large enterprises are often leaders in adopting new technologies, setting trends within their industries. By integrating AI into their accounting practices, they not only enhance their operational efficiency but also drive innovation, establishing new benchmarks for industry practices. This trend-setting role often encourages other market players to adopt similar technologies, reinforcing the dominant position of large enterprises in the AI-driven market landscape.

Key Market Segments

By Component

- Software

- Services

By Deployment

- Cloud-Based

- On-Premise

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Driver

Adoption of Natural Language Processing (NLP)

One significant driver in the AI in Enterprise Accounting market is the adoption of Natural Language Processing (NLP). NLP technology enhances the interaction between computers and human language, making it easier to handle large volumes of unstructured data typical in accounting, such as invoices and financial reports.

The integration of NLP allows for more effective automation of routine tasks and improved accuracy in data interpretation, which is essential for timely and informed financial decision-making. NLP enables systems to perform complex tasks such as semantic text interpretation and sentiment analysis, which can significantly benefit areas like compliance monitoring and fraud detection by identifying subtle patterns and anomalies that might indicate potential risks..

Restraint

Skill Gap and Integration Challenges

A major restraint in the AI in Enterprise Accounting market is the skill gap present in the workforce. Despite the powerful capabilities of AI, there is often a lack of professionals trained to integrate and leverage these technologies effectively within existing accounting frameworks. Additionally, many organizations face challenges when trying to incorporate AI systems with their legacy systems.

This integration can be fraught with technical difficulties, potentially leading to data silos and operational inefficiencies. The disparity between the advanced nature of AI technologies and the readiness of accounting infrastructures to support them can hinder the widespread adoption and optimal utilization of AI in accounting.

Opportunity

Enhanced Fraud Detection and Risk Management

AI technologies, particularly through the use of machine learning and NLP, offer significant opportunities to enhance fraud detection and risk management capabilities within the accounting sector. AI systems can analyze vast datasets quickly and with a high degree of accuracy, identifying irregularities and patterns indicative of fraudulent activities.

This capability is crucial for financial institutions and businesses that require high standards of compliance and oversight. By automating the detection of potential financial discrepancies and risks, AI reduces the workload on human auditors and increases the overall reliability of financial reporting.

Challenge

Data Security and Ethical Concerns

A primary challenge in the implementation of AI in accounting is ensuring the security and privacy of sensitive financial data. As AI systems often require access to large datasets containing personal and financial information, there is an inherent risk of data breaches and unauthorized access.

Moreover, there are ethical considerations to address, such as the potential biases in AI algorithms that may affect financial decision-making processes. Ensuring that AI systems operate transparently and fairly is crucial to maintain trust and integrity in financial reporting and compliance. Thus, organizations must invest in robust security measures and develop ethical guidelines to govern the use of AI in accounting practices.

Growth Factors

The AI in Enterprise Accounting market is on a robust growth trajectory, driven by several compelling factors. Primarily, the demand for efficiency and accuracy in accounting processes is pushing enterprises towards AI adoption. AI significantly enhances the capability to process large volumes of transactions while reducing errors and providing timely insights, which are critical for financial decision-making.

Additionally, as businesses expand globally, the complexity of managing finances increases, making AI an attractive solution for automating and managing complex accounting tasks across multiple currencies and regulations. The integration of AI with existing financial systems is also fueling market growth.

This integration allows for seamless data flow and real-time analytics, providing businesses with up-to-date financial information crucial for strategic planning. Furthermore, the advent of cloud-based solutions has democratized access to advanced AI tools, enabling even small and medium-sized enterprises to leverage AI for accounting, thereby expanding the market base.

Moreover, regulatory compliance and the need for transparent financial reporting are other significant growth drivers. AI helps ensure compliance by automatically updating systems in line with changing regulations and providing detailed audit trails that aid in forensic accounting and compliance reviews.

Emerging Trends

In the realm of AI in Enterprise Accounting, several emerging trends are reshaping the landscape. One of the most significant trends is the use of Machine Learning and Deep Learning technologies to predict financial outcomes and identify anomalies in financial statements, which can indicate errors or fraud. This predictive capability is becoming increasingly sophisticated, offering businesses not just insights into their current financial health but also foresight into potential future scenarios.

Another trend is the growing emphasis on Natural Language Processing (NLP) to make financial data more accessible. NLP is being used to transform complex financial reports into simpler, conversational outputs that non-experts can easily understand, thus improving decision-making across various levels of an organization.

Blockchain technology is also making inroads into the accounting sector. By facilitating secure, transparent transactions, blockchain is ideal for handling multi-party transactions and contracts, ensuring integrity and traceability of financial records, which is a boon for auditability and compliance.

Business Benefits

The adoption of AI in enterprise accounting offers a multitude of business benefits. Firstly, AI dramatically increases operational efficiency by automating routine tasks such as data entry, invoice processing, and reconciliation. This automation frees up valuable human resources to focus on more strategic tasks that require human insight.

AI also enhances accuracy in financial reporting, reducing the incidence of errors and the time and expense associated with correcting them. By improving the reliability of financial data, AI supports better business decisions and helps maintain compliance with accounting standards and regulations.

Furthermore, AI-driven analytics provide deep insights into financial data, enabling businesses to identify trends, forecast future financial conditions, and make informed strategic decisions. These insights can be used to optimize expenses, improve revenue forecasts, and enhance overall financial management.

Lastly, AI improves risk management by providing tools to detect and prevent fraud. AI systems can analyze patterns in data to identify anomalies that may indicate fraudulent activities, providing an early warning system that can help prevent significant financial losses and reputational damage.

Regional Analysis

In 2023, North America held a dominant market position in the AI in Enterprise Accounting Market, capturing more than a 35.3% share with revenues amounting to USD 0.45 billion. This leadership can be attributed primarily to the high penetration of advanced technological infrastructures and the early adoption of AI solutions across enterprises.

The region’s robust financial sector, coupled with stringent regulatory requirements for financial reporting and a high focus on enterprise operational efficiencies, has propelled the demand for AI-driven accounting solutions. Notably, the presence of major technology players and startups focused on AI and machine learning innovations has also contributed significantly to the dynamic growth of this market in North America.

The region’s market dominance is further reinforced by substantial investments in R&D activities related to AI and its application in accounting. These investments are driven by the need to enhance decision-making processes and automate repetitive tasks, which are abundant in the accounting sector. For instance, AI helps in real-time data processing and anomaly detection, which are critical for accuracy in financial reporting.

Moreover, North America shows a strong trend towards cloud-based accounting solutions, which offer scalability, reduced costs, and enhanced accessibility. These solutions are particularly favorable for the vast number of small and medium-sized enterprises (SMEs) in the region, which form a significant part of the customer base for AI in enterprise accounting technologies.

Lastly, the ongoing push towards digital transformation, especially post-pandemic, has urged companies to adopt secure, reliable, and efficient technologies. AI plays a crucial role here by providing these businesses with sophisticated tools for financial management and fraud detection, further cementing North America’s leading position in the global AI in enterprise accounting market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The AI in enterprise accounting market is highly fragmented and consists of various key players operating in the market. These players are continuously developing various strategies to sustain themselves in the competitive market. These strategies could be mergers, acquisitions, strategic alliances, and others. Businesses are also investing in research and development to bring innovations to the market.

Top Key Players in the Market

- Microsoft

- Kore.ai

- Intuit

- AWS

- UiPath

- Xero

- YayPay

- Bill.com

- Sage

- AppZen

- PwC

- OneUp

- IBM

- Hyper Anna

- KPMG

- Deloitte

- Vic.ai

- SMACC

- MindBridge Analytics

- Botkeeper

- Other Key Players

Recent Developments

- Microsoft: In July 2023, Microsoft expanded its partnership with KPMG to further integrate AI into professional services. This collaboration utilizes tools like Microsoft 365 Copilot and Azure OpenAI services to enhance audit, tax, and advisory capabilities. The alliance also focuses on ESG data analysis and AI-driven tax transparency reports.

- Kore.ai: In early 2023, Kore.ai launched new AI-powered accounting bots designed to automate and streamline financial workflows. This release is part of their broader AI-first platform, focusing on enhancing productivity for enterprise users.

- Intuit: In February 2023, Intuit introduced new AI-driven features within QuickBooks, aimed at automating tasks such as invoice processing and fraud detection. These enhancements are expected to reduce manual bookkeeping efforts significantly.

- AWS: Amazon Web Services (AWS) continued to enhance its AI services for enterprise accounting in 2023, focusing on machine learning (ML) and natural language processing (NLP) applications to automate financial processes like risk management and auditing.

- UiPath: In March 2023, UiPath launched new AI automation tools specifically targeted at finance and accounting departments, improving the efficiency of tasks like invoice processing and reporting.

- Xero: Xero, a cloud-based accounting platform, released an AI-powered tool for automated reconciliation of transactions in mid-2023, improving accuracy and saving time for accountants.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Bn Forecast Revenue (2033) USD 32.6 Bn CAGR (2024-2033) 28% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Services), By Deployment (Cloud-Based, On-premise), By Enterprise Size (Large Enterprise, Small and Medium Enterprise (SME)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft, Kore.ai, Intuit, AWS, UiPath, Xero, YayPay, Bill.com, Sage, AppZen, PwC, OneUp, IBM, Hyper Anna, KPMG, Deloitte, Google, Vic.ai, SMACC, MindBridge Analytics, Botkeeper, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Enterprise Accounting MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

AI in Enterprise Accounting MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft

- Kore.ai

- Intuit

- AWS

- UiPath

- Xero

- YayPay

- Bill.com

- Sage

- AppZen

- PwC

- OneUp

- IBM

- Hyper Anna

- KPMG

- Deloitte

- Vic.ai

- SMACC

- MindBridge Analytics

- Botkeeper

- Other Key Players