Global AI in Corporate Banking Market Report By Component (Hardware, Software, Services), By Application (Payments, Regulatory, Call Center, Trade Desk, IT, Legal), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: August 2024

- Report ID: 125632

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

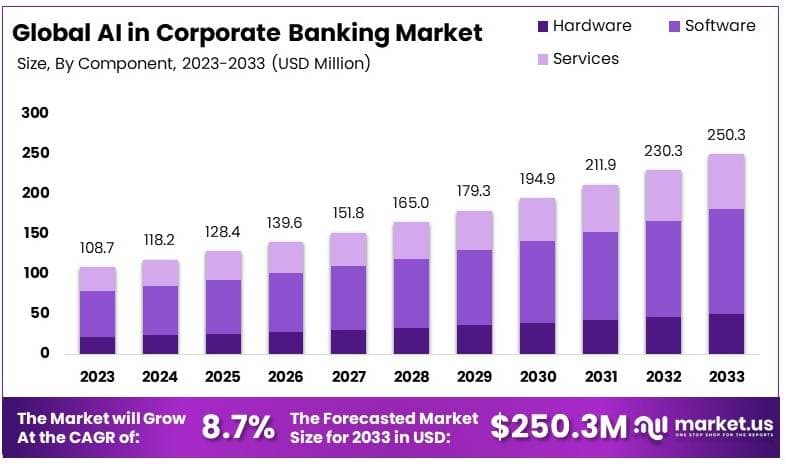

The Global AI in Corporate Banking Market size is expected to be worth around USD 250.3 Million by 2033, from USD 108.7 Million in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033

The AI in Corporate Banking Market involves the application of artificial intelligence to optimize corporate banking services. AI technologies improve efficiency in areas such as risk assessment, customer relationship management, and transaction processing. This market is growing as banks seek to enhance customer experiences and reduce operational costs.

Key applications of AI in corporate banking include automated credit scoring, fraud detection, and personalized financial services. AI-driven analytics provide deep insights into customer behavior, enabling banks to offer tailored solutions. Additionally, AI enhances compliance by ensuring adherence to regulatory standards.

As competition in corporate banking intensifies, the adoption of AI technologies is becoming essential. Banks that leverage AI can gain a competitive edge by offering faster, more personalized services and reducing risks. The focus should be on integrating AI seamlessly into existing banking operations to maximize benefits.

The AI in Corporate Banking market is on the cusp of significant growth, driven by the potential for substantial economic value and enhanced operational efficiency. By 2030, AI is expected to generate USD 1 trillion in annual economic value for the banking and financial services industry. This projection underscores the transformative impact AI can have on the sector, particularly in corporate banking, where the ability to analyze large volumes of data and generate actionable insights is crucial.

Currently, 77% of financial institutions are planning to deploy AI as a key tool to drive customer insight and profitability over the next three years. This widespread adoption reflects a growing recognition of AI’s potential to improve decision-making, optimize processes, and enhance customer experiences. AI’s ability to predict customer behavior, automate routine tasks, and identify new revenue opportunities is particularly valuable in the highly competitive corporate banking environment.

Artificial Intelligence adoption in the banking sector is anticipated to grow by 66% by 2022, signaling a rapid shift towards more technology-driven operations. This trend is supported by different strategic approaches to AI integration within financial institutions.

Key Takeaways

- The AI in Corporate Banking Market was valued at USD 108.7 million in 2023 and is expected to reach USD 250.3 million by 2033, with a CAGR of 8.7%.

- Software is the dominant component with 52.3% owing to its essential role in automating and optimizing banking processes.

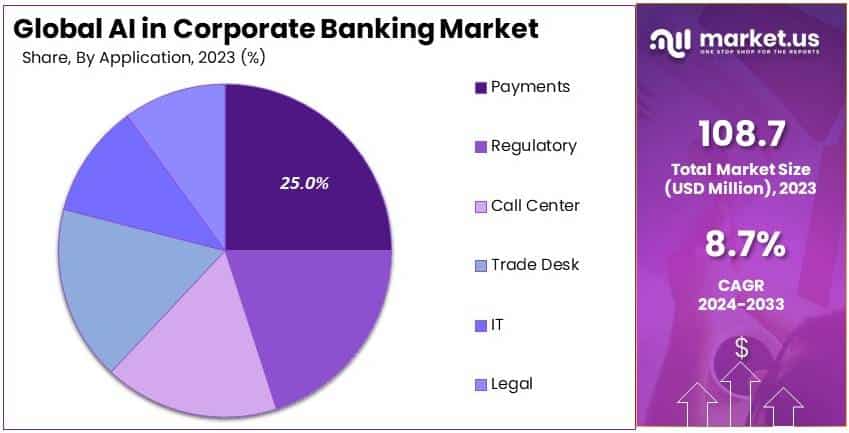

- Payments dominates the application segment with 25%, driven by the need for AI to enhance the security and efficiency of banking transactions.

- North America leads with 31% due to the region’s early adoption of AI technologies in the corporate banking sector.

Component Analysis

The Software sub-segment dominates with 52.3% due to its essential role in implementing AI capabilities across corporate banking functions.

In the AI in Corporate Banking Market, the Component segment is categorized into Hardware, Software, and Services. Software leads with a substantial market share of 52.3%, underscoring its critical role in enabling AI functionalities within the banking sector. AI software provides the algorithms and computational power needed to analyze vast amounts of financial data, automate decision-making processes, and enhance customer service offerings.

The dominance of the Software sub-segment is driven by its ability to integrate seamlessly with existing banking systems, enabling banks to leverage AI for various applications such as fraud detection, customer relationship management, and financial advisory services. Software solutions in corporate banking often include machine learning in financial services models that can predict customer behavior, personalize financial products, and optimize risk management strategies.

These AI capabilities are crucial for banks as they seek to improve operational efficiencies and provide more tailored services to clients in a highly competitive market. Additionally, AI software supports regulatory compliance efforts by providing tools that can monitor and analyze transactions in real time to detect and report suspicious activities, thereby reducing the risk of financial crimes.

While the Software sub-segment leads in market share, Hardware and Services also play significant roles within the AI in Corporate Banking ecosystem. Hardware components, such as servers and GPUs, are fundamental for supporting the intensive computational tasks required by AI applications. Meanwhile, Services are critical for the deployment, maintenance, and continuous improvement of AI solutions, offering expertise that banks may not internally possess, especially in areas like AI training and custom development.

Application Analysis

The Payments sub-segment dominates with 25% due to its significant role in automating and securing transaction processes.

In the Application segment of the AI in Corporate Banking Market, Payments emerge as the leading sub-segment with a 25% market share. This dominance is primarily due to AI’s ability to transform smart payment systems, making transactions faster, more secure, and less susceptible to fraud. AI enhances payment technologies by automating processes such as transaction verification, risk assessment, and anti-fraud checks, which are crucial for maintaining the integrity and efficiency of banking operations.

AI applications in payments are particularly valued for their real-time processing capabilities, which enable corporate banks to handle a high volume of transactions quickly and with reduced error rates. These capabilities are essential in today’s fast-paced business environment, where delays in processing can lead to significant operational disruptions and customer dissatisfaction.

Furthermore, AI-driven payment solutions often incorporate advanced security features, such as predictive analytics and behavioral biometrics, which help detect and prevent fraudulent activities before they can affect the bank’s operations. This proactive approach to security is critical in an era where cyber threats are becoming more sophisticated and frequent.

Other applications in corporate banking, such as Regulatory compliance, Call Center operations, Trade Desk support, IT, and Legal, also significantly benefit from AI integration. These areas utilize AI to streamline workflows, enhance decision-making, and ensure compliance with ever-changing financial regulations. Each of these applications contributes to the robust growth and increasing sophistication of AI technologies in the banking sector, addressing both operational challenges and customer needs.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Payments

- Regulatory

- Call Center

- Trade Desk

- IT

- Legal

Driver

Automation, Data Analytics, and Risk Management Drive Market Growth

The growth of AI in corporate banking is significantly influenced by automation, advanced data analytics, and enhanced risk management. Automation plays a crucial role, as AI systems are increasingly used to handle repetitive tasks such as loan processing and customer inquiries, reducing processing times by up to 70%. This automation not only increases efficiency but also allows human resources to focus on more complex, value-added activities.

Advanced data analytics is another key driver, enabling banks to analyze vast amounts of financial data in real time. AI-powered analytics can identify trends and patterns that help in making informed decisions, such as optimizing credit scoring models, which have been shown to increase accuracy by a significant percentage. This capability allows banks to better understand their clients, tailor services, and enhance customer satisfaction.

Risk management has also seen significant improvements through AI. AI systems can monitor transactions in real-time, identifying potential risks and fraudulent activities much faster than traditional methods. For instance, AI-driven risk models can detect anomalies in large datasets, reducing the likelihood of financial fraud by up to 50%. This not only safeguards the bank’s assets but also builds greater trust with clients.

Restraint

Regulatory, Technological, and Organizational Barriers Restraint Market Growth

The AI in Corporate Banking Market faces several significant restraining factors that collectively limit its growth, particularly due to regulatory challenges, technological limitations, and organizational resistance. Regulatory complexities are a major restraint, as corporate banking operates within a highly regulated environment. Financial institutions must comply with numerous regulations such as the Basel III framework, Anti-Money Laundering (AML) laws, and the General Data Protection Regulation (GDPR).

Technological limitations further exacerbate these challenges. AI systems in corporate banking require access to vast amounts of high-quality, real-time data to provide accurate insights and predictions. However, many banks still rely on legacy systems that are not equipped to handle the data-intensive demands of AI.

These outdated systems lack the integration capabilities needed to support AI, leading to fragmented data silos and inefficiencies in data processing. The high costs associated with upgrading these systems or developing new AI-ready infrastructures are a significant barrier, particularly for smaller banks or those operating in emerging markets.

Organizational resistance to change also plays a critical role in restraining the adoption of AI in corporate banking. The sector is traditionally conservative, with a strong reliance on established processes and human expertise. There is often skepticism about the reliability of AI-driven solutions, particularly in areas like risk assessment, credit analysis, and regulatory compliance.

Opportunity

Automation, Customer Insights, and Risk Management Provide Opportunities

The AI in Corporate Banking Market offers significant opportunities for players, driven by the demand for automation, enhanced customer insights, and improved risk management. Automation presents a key opportunity as corporate banks seek to streamline complex processes like loan approvals, compliance checks, and transaction monitoring. AI-powered systems can automate these time-consuming tasks, reducing operational costs and increasing efficiency.

Customer insights provide another critical growth opportunity. AI can analyze vast amounts of customer data to generate insights that help banks tailor their services to meet the specific needs of corporate clients. By leveraging AI as a financal planning software, banks can enhance customer satisfaction and loyalty, leading to stronger client relationships and increased revenue opportunities.

Risk management is also a significant area of opportunity. AI tools can assess risks more accurately by analyzing patterns in large datasets, identifying potential issues before they become major problems. This proactive approach to risk management is especially valuable in the corporate banking sector, where managing financial risks is crucial. By implementing AI-driven risk management solutions, banks can reduce the likelihood of defaults, fraud, and compliance breaches, thereby protecting their assets and reputation.

Challenge

Compliance Requirements Challenge Market Growth

Compliance with evolving regulations is a significant challenge impacting the growth of AI in the corporate banking market. Banks must navigate a complex regulatory landscape, which often varies by region and jurisdiction. This need to comply with various laws, such as data protection regulations, anti-money laundering directives, and cybersecurity standards, creates substantial operational challenges.

These regulations require constant updates to AI algorithms and processes, making it costly and time-consuming for banks to maintain compliance. As a result, banks may experience delays in AI adoption, slowing down the overall market growth. Additionally, the fear of non-compliance penalties can discourage investment in AI technologies, particularly for smaller institutions with limited resources.

Furthermore, stringent regulations can stifle innovation, as companies might be hesitant to experiment with new AI applications that could potentially breach compliance standards. In turn, this cautious approach can lead to slower AI deployment across the industry.

As AI technology advances, regulations continue to evolve, creating a moving target for compliance. This constant change requires banks to invest in ongoing training, technology upgrades, and legal consultations, further adding to the cost and complexity of AI implementation.

Consequently, while compliance ensures the responsible use of AI in financial wellness, it also poses a significant barrier to rapid market expansion. Overcoming these challenges requires a strategic approach, where banks balance regulatory demands with innovation, ensuring that AI can be both compliant and a driver of growth.

Growth Factors

- Enhanced Risk Management: AI helps banks analyze vast amounts of data to identify potential risks and fraud. This proactive approach to risk management allows banks to mitigate threats more effectively, ensuring financial stability and security.

- Automated Decision-Making: AI automates complex decision-making processes, such as credit assessments and loan approvals. This speeds up operations, reduces human error, and improves the accuracy of financial decisions, leading to better customer service.

- Personalized Customer Experience: AI enables banks to offer personalized services by analyzing customer data and preferences. Tailored product recommendations and customized financial advice improve customer satisfaction and loyalty, driving growth in corporate banking.

- Cost Efficiency: By automating routine tasks like data processing and customer inquiries, AI reduces operational costs for banks. This cost efficiency allows banks to allocate resources more effectively and invest in other growth areas.

- Regulatory Compliance: AI helps banks stay compliant with evolving regulations by continuously monitoring transactions and reporting requirements. This ensures that banks avoid costly penalties and maintain trust with regulators and customers.

- Improved Data Analysis: AI enhances the ability of banks to analyze large datasets, uncovering valuable insights that inform strategic decisions. This data-driven approach supports better financial planning and forecasting, contributing to the overall growth of the banking sector.

Emerging Trends

- Personalized Financial Services: AI is enabling banks to offer personalized financial products and services by analyzing customer data and behavior. This trend enhances customer satisfaction and loyalty, leading to increased adoption of AI-driven solutions in corporate banking.

- AI-Powered Risk Management: AI is revolutionizing risk management by providing real-time analysis of financial data and predicting potential risks. This trend helps banks mitigate risks more effectively, ensuring financial stability and regulatory compliance.

- Automated Loan Processing: AI is streamlining the loan approval process by automating credit assessments and document verification. This trend reduces processing time, improves accuracy, and allows banks to serve more clients efficiently, driving growth in the market.

- Enhanced Fraud Detection: AI-driven fraud detection systems are becoming more sophisticated, capable of identifying fraudulent activities in real-time. This trend strengthens security, reduces financial losses, and builds trust among corporate clients, making AI essential in banking operations.

- Predictive Analytics for Business Insights: AI is providing banks with predictive analytics that help in understanding market trends, customer behavior, and financial risks. This trend allows banks to make data-driven decisions, improving business strategies and outcomes.

- Integration with Blockchain Technology: The combination of AI and blockchain is emerging as a powerful tool in corporate banking, offering enhanced security, transparency, and efficiency in financial transactions. This trend is particularly important for cross-border payments and AI in trade finance.

Regional Analysis

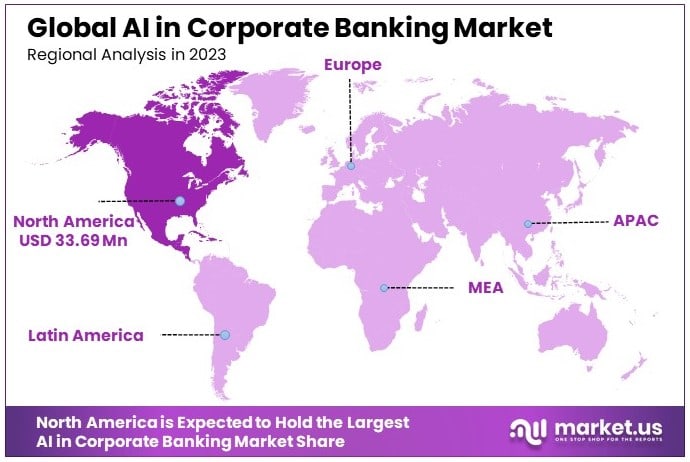

North America Dominates with 31% Market Share in the AI in Corporate Banking Market

North America’s commanding 31% market share with valuation of USD 33.69 Mn in the AI in corporate banking market stems from its advanced financial infrastructure and high concentration of technological innovation. The region’s financial institutions heavily invest in AI to enhance customer experience, risk management, and operational efficiency. This investment is driven by a competitive market that demands constant improvement in service delivery and regulatory compliance.

In North America, the adoption of AI in corporate banking is facilitated by the availability of high-tech resources and skilled professionals. Financial institutions leverage AI for data-driven insights, predictive analytics, and automated customer service solutions, which significantly improve efficiency and accuracy. The presence of major global banks and tech firms in this region further accelerates the deployment and innovation of AI technologies in banking.

The future influence of North America in the AI in corporate banking sector is expected to remain strong. As AI technologies evolve and integrate deeper into the banking ecosystem, North American banks are likely to continue leading in developing and adopting new AI applications. This trend will help maintain the region’s dominance by offering more sophisticated, personalized banking services and improved compliance and risk management solutions.

Regional Analysis for Other Markets:

- Europe: Europe’s market share in AI in corporate banking is significant due to its robust regulatory frameworks and emphasis on innovation and security. European banks are adopting AI to navigate complex regulatory environments and to offer enhanced customer services, indicating steady growth prospects in the region.

- Asia Pacific: Asia Pacific is rapidly advancing in AI adoption within corporate banking, driven by the digital transformation of economies and the rise of fintech companies. The region’s large population and increasing technological deployment make it a fast-growing market with significant potential for expansion.

- Middle East & Africa: The Middle East and Africa are witnessing gradual adoption of AI in corporate banking, spurred by efforts to diversify economies and enhance financial services sectors. As infrastructure develops and regulatory environments mature, the adoption of AI is expected to increase, fueling market growth.

- Latin America: Latin America’s adoption of AI in corporate banking is on the rise, facilitated by increasing financial sector modernization and digital banking initiatives. The region is focused on improving financial inclusivity and service efficiency, which supports the gradual expansion of AI in banking systems.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The AI in Corporate Banking market is driven by advancements in technology and increasing adoption across financial institutions. Among the key players, Amazon, American Express, and AI Corporation hold significant influence.

Amazon is at the forefront due to its extensive AI capabilities, especially through Amazon Web Services (AWS). It provides scalable AI solutions that enable corporate banks to enhance customer service, risk management, and fraud detection. Amazon’s broad market reach and innovation in AI technologies position it as a critical player in the market.

American Express leverages AI to personalize customer experiences and optimize its financial services. Its use of AI in credit scoring, fraud prevention, and customer service enhances its strategic position. The company’s strong brand and integration of AI across its services allow it to maintain a competitive edge in corporate banking.

AI Corporation focuses on payment solutions and fraud prevention powered by AI. Its specialized offerings help corporate banks streamline operations and improve security. By continuously innovating in AI-driven payment technologies, AI Corporation plays a crucial role in the market.

Together, these companies shape the AI in Corporate Banking market through their innovative solutions, strong market presence, and strategic use of AI technology. Their influence is expected to grow as AI continues to transform the industry.

Top Key Players in the Market

- 5Analytics

- Active Intelligence

- Active.ai

- Acuity

- AI Corporation

- Alphasense

- Amazon

- Amenity Analytics

- American Express

- Applied Data Finance

- AppZen

- AutomationEdge

- Ayasdi

- Other Key Players

Recent Developments

- August 2023: American Express has continued to leverage AI for enhancing risk management and fraud detection. The company reported a 15% increase in the accuracy of fraud detection through the use of AI-powered predictive analytics. This has allowed American Express to reduce false positives and improve customer satisfaction, contributing to a 12% increase in quarterly revenue from its corporate banking division.

- July 2023: AWS expanded its partnership with Alphasense to provide advanced AI capabilities to corporate banks. Alphasense’s AI platform, which is integrated with AWS’s cloud infrastructure, helps financial institutions analyze large volumes of unstructured data, providing insights into market trends and customer behavior. This collaboration is aimed at helping corporate banks make more informed decisions, thus enhancing their competitive edge in the market.

- June 2023: AppZen, known for its AI-driven expense management solutions, introduced new AI features tailored for corporate banking clients. These features help automate the auditing of corporate expenses, ensuring compliance and reducing the risk of financial fraud. Since its launch, AppZen has reported a 20% growth in its client base, particularly among large financial institutions.

Report Scope

Report Features Description Market Value (2023) USD 108.7 Million Forecast Revenue (2033) USD 250.3 Million CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Application (Payments, Regulatory, Call Center, Trade Desk, IT, Legal) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 5Analytics, Active Intelligence, Active.ai, Acuity, AI Corporation, Alphasense, Amazon, Amenity Analytics, American Express, Applied Data Finance, AppZen, AutomationEdge, Ayasdi, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the AI in Corporate Banking ?The AI in Corporate Banking involves the integration of artificial intelligence technologies into corporate banking services, including payments, regulatory compliance, IT operations, and customer support, to enhance efficiency and decision-making.

How big is the AI in Corporate Banking Market?The AI in Corporate Banking Market is valued at $108.7 million and is projected to reach $250.3 million by 2033, growing at a Compound Annual Growth Rate (CAGR) of 8.7%.

What are the key factors driving the growth of the AI in Corporate Banking Market?The growth is driven by the increasing need for automated financial services, the demand for improved regulatory compliance, the rise in digital payments, and the adoption of AI for customer service enhancement.

What are the current trends and advancements in the AI in Corporate Banking Market?Current trends include the use of AI for fraud detection and prevention, the integration of AI in regulatory compliance and legal services, and the development of AI-powered trade desks and call centers.

What are the major challenges and opportunities in the AI in Corporate Banking Market?Major challenges include data security concerns, the complexity of AI integration, and regulatory hurdles. Opportunities exist in expanding AI applications to smaller banks, developing AI solutions for emerging markets, and enhancing AI's role in payment processing.

Who are the leading players in the AI in Corporate Banking Market?Leading players include 5Analytics, Active Intelligence, Active.ai, Acuity, AI Corporation, Alphasense, Amazon, Amenity Analytics, American Express, Applied Data Finance, AppZen, AutomationEdge, Ayasdi, and other key players.

AI in Corporate Banking MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample

AI in Corporate Banking MarketPublished date: August 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 5Analytics

- Active Intelligence

- Active.ai

- Acuity

- AI Corporation

- Alphasense

- Amazon

- Amenity Analytics

- American Express

- Applied Data Finance

- AppZen

- AutomationEdge

- Ayasdi

- Other Key Players